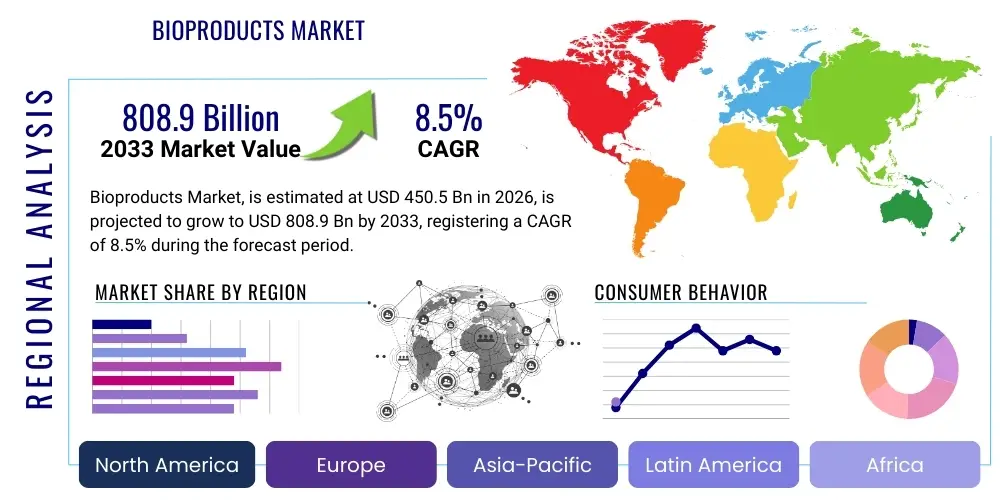

Bioproducts Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438978 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Bioproducts Market Size

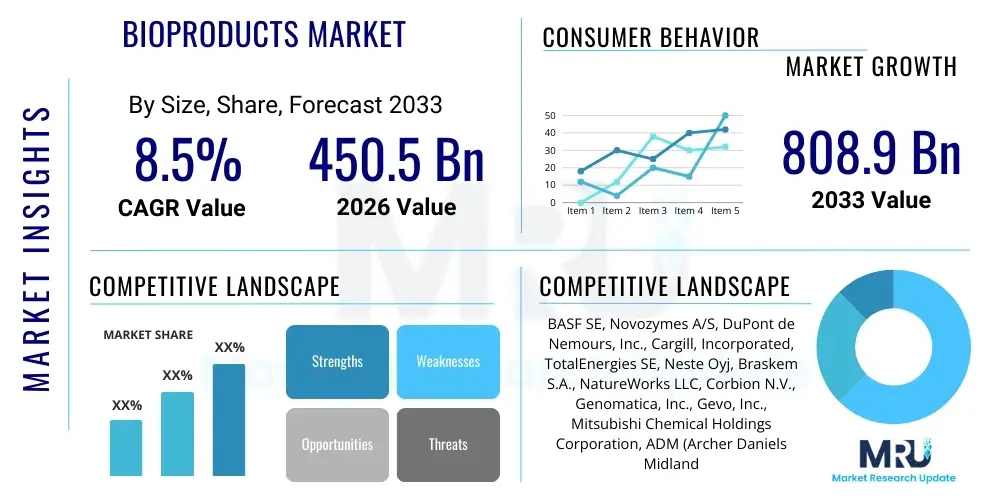

The Bioproducts Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $450.5 Billion in 2026 and is projected to reach $808.9 Billion by the end of the forecast period in 2033.

Bioproducts Market introduction

The Bioproducts Market encompasses a diverse and expanding portfolio of materials, chemicals, and energy carriers derived from renewable biological resources, collectively known as biomass, positioning them as essential substitutes for materials traditionally sourced from fossil fuels. This sector spans critical categories including advanced biofuels, high-performance bio-polymers, and versatile bio-based chemicals, utilized across key global industries such as packaging, automotive, pharmaceuticals, and agriculture. The fundamental shift towards bioproducts is profoundly driven by urgent global sustainability imperatives, including the ambitious mandates to achieve net-zero carbon emissions, coupled with burgeoning corporate commitments toward Environmental, Social, and Governance (ESG) criteria. Key market products, such as bio-succinic acid, polylactic acid (PLA), and Sustainable Aviation Fuel (SAF), are enabling manufacturers to develop products with significantly reduced environmental footprints, driving a paradigm shift in material science and industrial chemistry.

The inherent advantages of bioproducts extend beyond environmental benefits, offering unique functional properties in several applications, such as enhanced biocompatibility for medical devices and controlled biodegradability for specialized packaging. The market's growth trajectory is strongly influenced by technological breakthroughs, particularly in the fields of industrial biotechnology and synthetic biology, which are continually improving the efficiency of converting diverse, low-cost biomass feedstocks—ranging from agricultural waste and forestry residues to dedicated energy crops and algae—into viable commercial products. These advancements are crucial in bridging the traditional cost gap, often referred to as the 'green premium,' between bio-based materials and their conventional petrochemical equivalents. Successful market penetration relies heavily on the ability of biorefineries to achieve optimal yield, high purity, and economies of scale, making technological innovation the central determinant of competitive success in this rapidly maturing industry.

Major applications underscore the breadth of the market's impact. In the chemical sector, bio-based platform chemicals serve as foundational building blocks, displacing precursors in the synthesis of polymers, solvents, and specialized coatings. For the energy sector, advanced biofuels are critical for decarbonizing difficult-to-abate transportation segments, most notably aviation and marine shipping, where electrification remains impractical. The driving factors supporting this growth include favorable governmental policies such as tax incentives, blending mandates, and robust R&D funding for non-food biomass conversion technologies. Furthermore, increasing supply chain transparency and consumer demand for verified sustainable products are compelling brand owners to integrate certified bioproducts, solidifying their role as indispensable components of the emerging circular bioeconomy.

Bioproducts Market Executive Summary

The Bioproducts Market landscape is currently defined by dynamic business trends focusing on vertical integration and strategic diversification across the value chain. Leading chemical manufacturers are aggressively forming alliances with biotechnology firms and feedstock suppliers to secure reliable access to certified sustainable biomass and intellectual property surrounding high-yield microbial strains. A significant commercial trend involves the scaling up of integrated biorefinery concepts, which process multiple input streams (feedstocks) to produce various outputs (fuels, chemicals, materials) simultaneously, thereby maximizing resource utilization and enhancing economic resilience against fluctuating commodity prices. Financial investment is heavily skewed towards second and third-generation bioproduct technologies, ensuring production does not compete with global food security. Successful business models are leveraging digital integration and AI-driven process optimization to manage the complexities inherent in biological conversion processes, moving bioproducts from laboratory innovation toward industrial commodity status.

Regionally, market growth is bifurcated, showcasing distinct drivers across major continents. Asia Pacific (APAC) is emerging as the dominant growth engine, propelled by massive domestic consumption, rapid industrial capacity expansion, and proactive government efforts in countries like China and India to establish localized bio-refinery hubs utilizing abundant agricultural waste streams. North America maintains its leadership in technology and market capitalization, driven by robust private investment, established biofuel mandates (RFS), and a strong focus on generating sophisticated bio-based performance materials utilized in the aerospace and advanced manufacturing sectors. Europe, characterized by its strict regulatory framework promoting circularity and biodegradation, leads in consumer adoption rates for certified bioplastics and sustainability reporting, setting global benchmarks for eco-labeling and waste management policies, thereby ensuring consistent, long-term regional demand.

Analysis of segment trends confirms that Bio-polymers are exhibiting the fastest growth trajectory, predominantly catalyzed by global legislative crackdowns on single-use plastics and advancements in biodegradable polymers like polyhydroxyalkanoates (PHAs) that offer superior environmental fates. Within the Bio-based Chemicals segment, high-value platform molecules such as bio-monoethylene glycol (Bio-MEG) and bio-based lubricants are experiencing increased commercial adoption, facilitating the green transformation of supply chains across the textile and automotive industries. The Biofuels segment, while mature in volume, is undergoing a pivotal shift toward advanced and specialized fuels, particularly Sustainable Aviation Fuel (SAF), which is attracting unprecedented capital commitment to fulfill ambitious industry targets for aviation decarbonization. This targeted investment signifies the segmentation’s maturation and focus on high-impact, technologically complex solutions.

AI Impact Analysis on Bioproducts Market

User inquiries concerning the integration of Artificial Intelligence (AI) and Machine Learning (ML) in the Bioproducts Market center on optimizing the speed, efficiency, and cost-effectiveness of biological processes. Common questions explore how ML models can predict the optimal metabolic pathways for novel chemical synthesis, reducing the laborious effort of empirical testing. Users are particularly interested in AI's capability to enhance fermentation yields under industrial conditions, asking how algorithms manage the complex interplay of biological variability, substrate uptake rates, and environmental factors in real-time. The underlying expectation is that AI is the crucial technology required to make bioproducts economically competitive by minimizing production costs, accelerating time-to-market for bio-innovation, and ensuring scalable manufacturing consistency—a necessary step for mass-market adoption.

AI's influence is transformative in the initial research and development phases, enabling the high-throughput analysis of massive genomic and metabolomic datasets generated by modern sequencing and sensing technologies. Predictive modeling, leveraging deep learning architectures, allows researchers to accurately simulate the effect of genetic edits on microbial strains. This capability facilitates the rapid design of superior "cell factories" that efficiently convert inexpensive feedstocks into target bioproducts with unprecedented yields. By automating the design-build-test-learn cycle inherent to synthetic biology, AI significantly cuts down the experimental time and cost associated with optimizing biological routes, accelerating the pipeline from laboratory proof-of-concept to pilot-scale demonstration across chemicals, enzymes, and specialized proteins.

In the manufacturing domain, AI optimizes bioreactor performance, which is paramount for commercial viability. Production facilities employ advanced sensor arrays and IoT devices to gather continuous data on critical process parameters (CPPs). ML algorithms then analyze this data to establish "digital twins" of the bioreactor system. These digital models allow operators to predict deviations, forecast yield fluctuations, and implement dynamic process adjustments—such as precise nutrient feeding strategies or real-time temperature shifts—to maximize output while ensuring product purity and quality. This level of autonomous control, powered by reinforcement learning, minimizes human error, reduces energy consumption, and significantly enhances the overall operational expenditure efficiency required to produce bulk bioproducts at scale.

- AI-Driven Strain Engineering: Accelerated design and optimization of microbial cell factories using ML algorithms applied to genomic and metabolomic data, predicting optimal gene modifications for enhanced output.

- Bioreactor Process Optimization: Real-time, dynamic control of fermentation parameters (pH, temperature, feed rate, aeration) using predictive modeling and reinforcement learning to maximize yield, minimize resource waste, and maintain consistency.

- Novel Enzyme Discovery: Application of Generative AI to design and predict the efficacy, stability, and specificity of new enzymes required for efficient biomass deconstruction and highly targeted chemical conversion.

- Supply Chain and Feedstock Management: Utilizing advanced predictive analytics to forecast biomass availability, optimize logistics, manage the physical variability of agricultural or waste feedstocks, and ensure just-in-time delivery for biorefineries.

- Quality Control and Assurance: Implementing computer vision and sensor data analytics coupled with anomaly detection algorithms to monitor product quality, detect trace contaminants early in the production cycle, and ensure rapid compliance with pharmaceutical and food-grade standards.

- Process Modeling and Simulation: Creation of digital twins of entire biorefining complexes to simulate various production scenarios, optimize scheduling, predict equipment maintenance needs, and reduce commissioning time for new facilities.

- Data Integration and Knowledge Extraction: Centralized platforms using AI to integrate disparate data sources (R&D, pilot plant, commercial operation) to derive actionable insights, accelerate process transfer, and identify subtle correlations impacting long-term yield.

- Catalyst Screening and Optimization: Use of ML in chemocatalysis to predict the performance and longevity of heterogeneous catalysts used in thermochemical upgrading of bio-oils, reducing R&D cycles for fuel production.

DRO & Impact Forces Of Bioproducts Market

The Bioproducts Market expansion is principally driven by strong global environmental policies and profound corporate sustainability targets. Primary drivers include governmental regulations enforcing the reduction of plastic waste, leading to mandatory adoption of biodegradable or compostable packaging, and regulatory quotas for advanced biofuels designed to decarbonize the transport sector. These legislative actions create immediate, mandated demand, providing market certainty essential for large-scale infrastructure investment. Furthermore, the persistent volatility and geopolitical risks associated with conventional petroleum markets enhance the strategic value of biomass-derived materials, offering manufacturers enhanced supply chain resilience and cost stability. The increasing clarity of life cycle assessment (LCA) studies demonstrating the lower carbon footprint of bioproducts provides a critical evidence base, reinforcing their adoption by environmentally conscious corporations and consumers globally.

Growth is, however, constrained by significant economic and logistical hurdles. The most substantial restraint remains the high capital expenditure (CAPEX) required for constructing and commissioning commercial-scale biorefineries, often necessitating substantial initial investment relative to established petrochemical plants. Furthermore, the operational expenditure (OPEX) is often elevated due to the complexity of biomass pretreatment and conversion, leading to a lingering cost disadvantage for many commodity bioproducts. Logistical restraints involve securing a consistent, year-round supply of sustainable biomass feedstock, managing its inherent biological variability, and addressing concerns about the efficient utilization of land and water resources, often complicated by competing demands from food and animal feed production sectors. Technical challenges related to the separation and purification of target molecules from the biological broth also add to processing costs and complexity.

Significant opportunities are emerging from the convergence of advanced biotechnology and green chemistry, enabling the creation of novel, high-performance bioproducts that offer superior properties that petrochemicals cannot match, thereby commanding a premium price. The development of advanced fermentation routes for producing specialty ingredients, high-purity pharmaceutical precursors, and novel biopolymers with tailored end-of-life characteristics represents a major avenue for high-margin growth. The enduring impact forces driving this market include the irreversible global focus on mitigating climate change, the escalating necessity for supply chain decoupling from politically sensitive fossil fuels, and the continuous flow of technological breakthroughs, particularly in synthetic biology and AI-driven process engineering, which collectively work to chip away at the existing cost barriers and accelerate the functional competitiveness of bio-based alternatives.

Segmentation Analysis

Market segmentation provides a detailed map of the Bioproducts industry, enabling strategic analysis of growth pockets and competitive intensity across product types, feedstocks, and end-use applications. Segmentation by Product Type is essential for distinguishing between high-volume, cost-sensitive segments like Biofuels (e.g., bioethanol for gasoline blending) and high-value, specialized segments such as Bio-polymers (e.g., complex bio-nylons used in engineering plastics) and Bio-based Chemicals (platform chemicals like bio-BDO or bio-isobutanol). The profitability and required technology investment differ vastly across these segments, influencing corporate strategies toward either commodity scaling or niche innovation.

The segmentation based on Feedstock Source is critical, defining the sustainability profile and supply chain stability of the resulting products. The market is evolving rapidly from reliance on first-generation Plant-based materials (starches, sugars) toward second-generation Lignocellulosic Biomass (waste wood, agricultural residues), which alleviates the 'food vs. fuel' conflict. The emerging Microorganism/Algae segment, utilizing sophisticated fermentation processes or photobioreactors, is gaining traction for producing highly specialized chemicals and oils due to their rapid growth cycles and potential for non-arable land cultivation. Understanding feedstock economics and regional availability is key to determining optimal biorefinery locations and ensuring long-term raw material supply security.

Finally, segmentation by Application reveals where demand pressure is highest. The Packaging and Films sector remains the largest consumer by volume due to rapid regulatory changes and consumer preferences favoring compostable solutions. Simultaneously, the Automotive and Transportation segment is a crucial driver for advanced bio-composites and biofuels, fulfilling stringent industry requirements for weight reduction and carbon neutrality. This granular analysis of application demand, coupled with feedstock sustainability, enables market participants to effectively target investment, secure reliable procurement channels, and develop specialized products compliant with the specific regulatory and performance demands of diverse global end-use industries.

- By Product Type:

- Biofuels

- Bioethanol (First, Second, and Third Generation)

- Biodiesel and Renewable Diesel (HVO)

- Sustainable Aviation Fuel (SAF) and Bio-Jet Fuel

- Bio-based Chemicals

- Platform Chemicals (e.g., Bio-BDO, Bio-Succinic Acid, Bio-Ethanediol)

- Intermediate Chemicals and Solvents (e.g., Bio-Acetone, Bio-Isopropanol)

- Specialty Chemicals (e.g., Bio-Lubricants, Bio-Detergent Surfactants)

- Bio-polymers and Bioplastics

- Non-Biodegradable Bio-based Polymers (e.g., Bio-PE, Bio-PET, Bio-PA)

- Biodegradable Polymers (e.g., PLA, PHA, PBS)

- Other Bioproducts (Bio-adhesives, Bio-composites, Bio-pigments)

- Biofuels

- By Feedstock Source:

- Plant-based (Sugar Cane, Corn Starch, Vegetable Oils)

- Lignocellulosic Biomass (Agricultural Residues, Forestry Waste, Dedicated Energy Crops)

- Animal Fats and Waste Oils (UCO, Tallow)

- Microorganism/Algae (Fermentation Media, Algal Oil)

- By Application:

- Packaging and Films (Rigid, Flexible, Foams)

- Automotive and Transportation (Interior parts, Composites, Fueling)

- Pharmaceuticals and Medical Devices (Implants, Drug Delivery Systems, Disposables)

- Textiles and Fibers (Bio-nylon, Bio-Polyester)

- Construction and Infrastructure (Bio-adhesives, Bio-insulation)

- Agriculture and Fertilizers (Bio-based Pesticides, Slow-release Coatings)

- Consumer Goods and Personal Care (Cosmetics ingredients, Household Cleaners)

Value Chain Analysis For Bioproducts Market

The Bioproducts value chain initiates with the highly resource-intensive upstream activities focused on Feedstock Sourcing and Pretreatment. Upstream analysis involves rigorous management of sustainable biomass cultivation (e.g., optimized energy crop yield) or the efficient collection and segregation of waste streams (e.g., sorting municipal solid waste or industrial byproducts). Critical success factors at this stage include minimizing logistical costs associated with transporting bulky, low-energy-density biomass, and employing effective pretreatment techniques—such as milling, hydrolysis, or mechanical separation—to prepare complex materials for the subsequent conversion processes. Stakeholders in this segment must navigate complex certification systems, such as ISCC and RSB, to ensure verified sustainability and traceability, which is non-negotiable for market access in premium regulatory regions like Europe.

The midstream segment is dominated by Conversion Technology and Biorefining, where technological differentiation is most pronounced. This stage involves converting pretreated biomass into marketable intermediate or final bioproducts using either biochemical pathways (fermentation and enzymatic catalysis) or thermochemical routes (pyrolysis, gasification). Investment is heavily focused on integrated biorefineries that simultaneously produce multiple products—often a high-volume biofuel alongside a specialized, high-margin bio-chemical—to ensure cost efficiency and maximum carbon utilization. Operational success relies on relentless process optimization, highly efficient separation and purification steps, and advanced process control systems to manage biological and chemical variability, ensuring the bioproducts meet the stringent purity specifications required by downstream manufacturers.

The downstream segment encompasses Compounding, Distribution, and Final Market Integration. Intermediates like bio-polymers are often sent to specialized compounding firms to incorporate additives, fillers, or colorants to tailor specific mechanical properties before being sold to plastic molders or extruders. Distribution channels are varied, involving direct sales to large corporate buyers (e.g., petrochemical giants for blending or automotive Tier 1 suppliers) and indirect sales through specialized global chemical and material distributors. Effective downstream strategy requires rigorous AEO and marketing efforts to educate end-users on the performance capabilities, life-cycle benefits, and seamless processing integration of bioproducts, overcoming historical skepticism regarding quality and processing compatibility with existing infrastructure.

Bioproducts Market Potential Customers

The core potential customer base for the Bioproducts Market consists of multinational manufacturers across high-volume industrial sectors seeking to decarbonize their supply chains and comply with increasingly stringent environmental legislation. Major end-users include the global packaging industry, which rapidly consumes bio-polymers (PLA, PHA) for food containers, films, and bottles, driven by governmental mandates against single-use conventional plastics and escalating consumer preference for compostable solutions. Similarly, the automotive, aerospace, and construction sectors represent substantial buyers of bio-composites, bio-resins, and bio-adhesives, utilizing these materials to achieve weight reduction targets and integrate sustainable content into vehicles and infrastructure projects, thereby enhancing their corporate sustainability reporting (CSR).

A second critical customer segment is the specialized manufacturing industry, including pharmaceuticals, personal care, and high-performance coatings. These buyers prioritize purity, performance, and specific functional attributes over sheer volume. Pharmaceutical companies utilize bio-based intermediates for drug synthesis and specialized biocompatible polymers for medical devices, where material safety and low toxicity are paramount. The cosmetics and personal care industry is actively replacing petroleum-derived surfactants and emulsifiers with bio-based alternatives to market products as 'natural' or 'green,' responding directly to informed consumer demands and benefiting from favorable regulatory scrutiny regarding chemical components.

Furthermore, energy and logistics companies, particularly global airlines and maritime shipping firms, are becoming high-volume, mandated consumers of advanced biofuels, specifically Sustainable Aviation Fuel (SAF) and renewable marine diesel. These customers are driven primarily by mandatory blending targets imposed by international bodies (like ICAO) and regional governments (EU), compelling them to secure long-term, high-volume contracts with biorefinery operators. For these large buyers, the stability of supply, certification of sustainability (e.g., reduced lifecycle greenhouse gas emissions), and compatibility with existing infrastructure are the decisive procurement criteria, ensuring that bioproducts are viewed not merely as alternatives but as essential components of future operational compliance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450.5 Billion |

| Market Forecast in 2033 | $808.9 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Novozymes A/S, DuPont de Nemours, Inc., Cargill, Incorporated, TotalEnergies SE, Neste Oyj, Braskem S.A., NatureWorks LLC, Corbion N.V., Genomatica, Inc., Gevo, Inc., Mitsubishi Chemical Holdings Corporation, ADM (Archer Daniels Midland Company), Arkema S.A., Sappi Limited, Solvay S.A., BioAmber Inc., Avantium N.V., LanzaTech NZ, Inc., Shell plc |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bioproducts Market Key Technology Landscape

The technology landscape governing the Bioproducts Market is highly fragmented yet rapidly consolidating around core conversion efficiencies and digitalization. The prevailing technologies fall into two major categories: Biochemical Conversion and Thermochemical Processing. Biochemical routes, primarily industrial fermentation, utilize genetically engineered microorganisms to convert simple sugars or cellulosic material into target molecules. Key technological advancements here include continuous fermentation systems, which significantly increase volumetric productivity and reduce processing costs compared to traditional batch methods, and the application of CRISPR-Cas9 technology to rapidly screen and optimize high-performance microbial strains, moving product development at an unprecedented speed from concept to industrial scale.

Thermochemical processing, essential for maximizing the utilization of complex, recalcitrant biomass like wood waste and municipal solid waste, focuses on pyrolysis and gasification. Fast pyrolysis converts biomass into bio-oil, requiring subsequent catalytic upgrading to meet stringent fuel specifications. Technological emphasis is placed on developing robust, highly selective catalysts that can withstand impurities and efficiently remove oxygen (deoxygenation) from the bio-oil, ensuring the final fuel products are 'drop-in' ready and compatible with existing combustion engines and infrastructure. The optimization of gasification processes to efficiently yield synthesis gas (syngas) for subsequent Fischer-Tropsch synthesis into various hydrocarbon fuels or chemicals is also a critical area of ongoing industrial R&D and significant capital investment.

A crucial technological shift involves the integration and digitalization of these core processes within the framework of Biorefinery 4.0. This involves leveraging advanced analytics, digital twins, and the Industrial Internet of Things (IIoT) to monitor and optimize all stages of production in real-time. This technological capability is essential for managing the inherent variability of biomass feedstocks and optimizing multi-product output, allowing biorefineries to pivot production based on market demand or feedstock availability. Furthermore, breakthroughs in specialized downstream separation science, such as advanced membrane filtration and chromatography, are necessary to achieve the high purity levels demanded by the pharmaceutical and specialty chemical segments, thereby securing the premium market value for complex bio-derived molecules and positioning technological superiority as a key competitive differentiator.

Regional Highlights

North America maintains a position of technological and financial leadership in the Bioproducts Market, driven by a supportive regulatory environment and robust availability of agricultural feedstocks, particularly corn and soy, which underpin the region's strong biofuel production. The United States, through initiatives such as the Renewable Fuel Standard (RFS) and state-level mandates, ensures substantial demand and market stability for bioethanol and biodiesel. The region is also highly active in the R&D and commercialization of advanced bioproducts, focusing heavily on lignocellulosic conversion and next-generation bio-based chemicals and polymers, benefiting from high levels of venture capital investment in cleantech and synthetic biology startups clustered around technology hubs.

Europe stands out for its policy-driven market structure, prioritizing sustainability and circular economy principles. The European Union's ambitious targets for bio-based content in plastics, coupled with aggressive mandates for reducing carbon emissions in transportation, have established a mature and growing market for advanced bio-polymers (like certified compostable packaging) and Sustainable Aviation Fuel (SAF). European manufacturers benefit from stringent certification standards, which enhance consumer trust and provide a competitive advantage to certified sustainable producers. The region’s focus extends beyond simple substitution, actively pushing for bio-based solutions that offer superior environmental outcomes, such as marine degradability or enhanced resource efficiency.

Asia Pacific (APAC) represents the fastest-expanding market globally, characterized by unparalleled demand growth fueled by its vast population, rapid industrialization, and emerging middle-class consumers increasingly conscious of environmental issues. Countries like China, India, and Thailand are aggressively investing in domestic biorefinery capacity, leveraging abundant regional feedstocks such as sugarcane bagasse, rice husks, and palm oil residues. While environmental regulations are often less mature than in Western markets, governmental concern over air quality and energy independence is accelerating the adoption of biofuels and bio-based plastics, positioning APAC not only as a crucial production hub but also as the primary consumer base for future bioproduct volumes.

- North America: Market leader in terms of technological innovation, high capital investment in second-generation biofuels, and strong commercialization of high-value bio-based chemicals, supported by stable regulatory mandates.

- Europe: Policy powerhouse driving demand for certified bio-polymers and sustainable materials; leads in circular economy integration, waste-to-bioproduct technologies, and stringent sustainability certification.

- Asia Pacific (APAC): Expected to register the highest CAGR due to massive industrial expansion, governmental focus on localized feedstock utilization, and high volumetric demand for sustainable packaging materials.

- Latin America (LATAM): Dominant global producer of first-generation bioethanol (especially Brazil); shifting focus toward diversification into bio-based chemicals and advanced materials leveraging robust sugarcane and agricultural waste infrastructure.

- Middle East and Africa (MEA): Emerging market with potential concentrated in specific national economic diversification strategies; primary opportunity lies in utilizing marginal land for algae cultivation and capitalizing on local agricultural residues for regional self-sufficiency.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bioproducts Market.- BASF SE

- Novozymes A/S

- DuPont de Nemours, Inc.

- Cargill, Incorporated

- TotalEnergies SE

- Neste Oyj

- Braskem S.A.

- NatureWorks LLC

- Corbion N.V.

- Genomatica, Inc.

- Gevo, Inc.

- Mitsubishi Chemical Holdings Corporation

- ADM (Archer Daniels Midland Company)

- Arkema S.A.

- Sappi Limited

- Solvay S.A.

- BioAmber Inc.

- Avantium N.V.

- LanzaTech NZ, Inc.

- Shell plc

Frequently Asked Questions

Analyze common user questions about the Bioproducts market and generate a concise list of summarized FAQs reflecting key topics and concerns.What defines a bioproduct and how does its environmental benefit compare to traditional materials?

A bioproduct is derived from renewable biomass sources, such as plants, waste, or microorganisms. The core environmental benefit lies in its lower lifecycle carbon footprint, as biomass captures CO2 during growth, and in many cases, offers enhanced end-of-life options like industrial or home compostability, reducing reliance on fossil fuels.

What are the primary factors restraining the mass adoption of bio-polymers and bio-based chemicals?

The main restraints include the 'green premium' (higher production cost due to complex conversion and purification), high capital requirements for new biorefineries, and variability and potential competition in sourcing large, sustainable volumes of feedstock compared to established petrochemical supply chains.

Which feedstock source is projected to experience the highest growth rate and why is it important?

Lignocellulosic biomass (agricultural and forestry residues) is projected to exhibit the highest growth. This is crucial because using non-food-competing resources directly addresses ethical concerns surrounding land use and ensures the long-term scalability and sustainability necessary for commodity-level bioproducts.

How does the integration of Artificial Intelligence (AI) specifically enhance the bioproduct manufacturing process?

AI significantly enhances manufacturing by optimizing bioreactor performance through real-time dynamic control of fermentation parameters. It minimizes energy usage, increases product yield, and accelerates the R&D cycle by predicting optimal metabolic pathways in microbial strains, thereby making production economically viable at scale.

What role do global governmental mandates play in ensuring the long-term viability of the Bioproducts Market?

Government mandates, such as mandatory blending quotas for Sustainable Aviation Fuel (SAF), stringent plastic reduction directives, and carbon pricing mechanisms, provide the essential long-term market certainty and stable demand necessary to justify the high, long-term capital investments required for new biorefinery infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager