Bioresorbable Implants Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431784 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Bioresorbable Implants Market Size

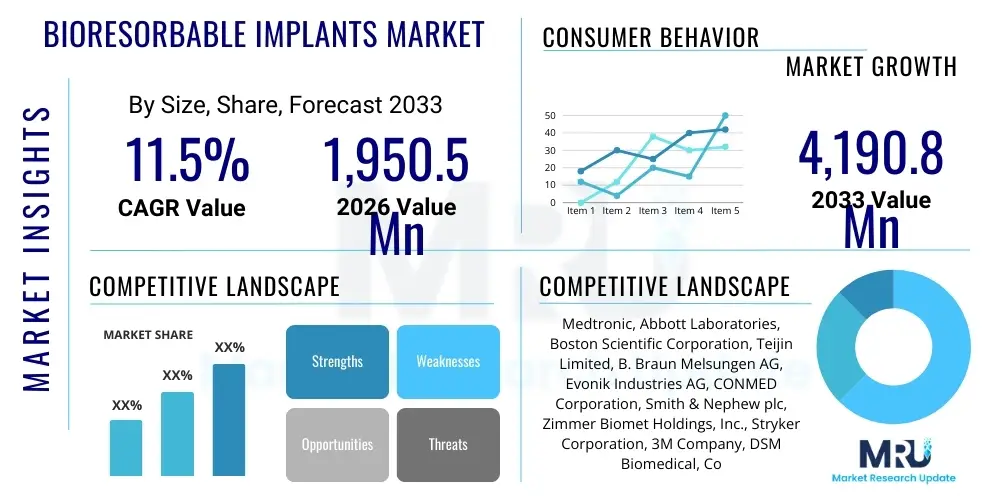

The Bioresorbable Implants Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $1,950.5 Million in 2026 and is projected to reach $4,190.8 Million by the end of the forecast period in 2033.

Bioresorbable Implants Market introduction

Bioresorbable implants, also known as biodegradable or dissolvable implants, represent a revolutionary class of medical devices designed to provide temporary mechanical support or function within the body before gradually degrading and being absorbed or excreted without requiring a secondary removal surgery. Unlike traditional metallic implants, bioresorbable materials eliminate the risks associated with long-term foreign body presence, such as chronic inflammation, stress shielding, or the necessity for follow-up procedures. These implants are crucial across various surgical disciplines, particularly in orthopedic fixation, cardiovascular stenting, and drug delivery systems, driving significant interest from both clinicians and manufacturers globally due to their inherent patient benefits.

The core mechanism behind bioresorbable implants relies on specific polymer chemistry, predominantly involving polylactic acid (PLA), polyglycolic acid (PGA), and their copolymers (PLGA), although metallic alloys like magnesium are gaining traction in specific applications such as coronary stents. The choice of material dictates the resorption rate, mechanical strength profile, and biological compatibility, allowing for customization based on the healing kinetics of the targeted tissue. Major applications span reconstructive surgery, where they facilitate bone fracture healing; cardiovascular procedures, offering scaffolding that dissolves once vessel wall integrity is restored; and in regenerative medicine, acting as temporary matrices for tissue growth.

The market expansion is fundamentally driven by the rising global incidence of orthopedic injuries and chronic cardiovascular diseases, coupled with an increasing demand for minimally invasive surgeries and improved patient outcomes. The primary benefits include reduced morbidity, minimized pain, and cost savings associated with avoiding subsequent removal operations. Furthermore, ongoing research focusing on optimizing degradation kinetics and enhancing the mechanical performance of these materials is expanding their clinical utility into complex surgical areas, thereby cementing their role as a preferred technology in modern medical practice.

Bioresorbable Implants Market Executive Summary

The Bioresorbable Implants Market is undergoing robust expansion, characterized by significant innovation in material science and increasing clinical adoption across high-volume surgical specialties, notably orthopedics and cardiology. Business trends show a strategic shift among leading medical device companies toward acquiring or partnering with specialized biomaterials firms to secure intellectual property in advanced polymer and metallic resorbable technologies. This strategic maneuver is aimed at overcoming key challenges, such as optimizing strength retention during the critical healing phase and ensuring consistent, non-toxic degradation products. Furthermore, pricing pressures in established healthcare markets are balanced by the demonstrable long-term cost-effectiveness provided by these implants, which eliminate costly secondary procedures, positioning them favorably in value-based healthcare models.

Regional trends indicate North America currently holds the dominant market share, attributed to high healthcare expenditure, sophisticated surgical infrastructure, and rapid adoption of advanced medical technologies. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid growth in APAC is fueled by expanding medical tourism, massive governmental investments in healthcare infrastructure development, and a burgeoning elderly population susceptible to orthopedic and cardiovascular conditions. Europe remains a strong market, driven by favorable regulatory pathways (e.g., MDR compliance) and high acceptance rates of innovative biomaterials in clinical settings.

Segment trends reveal that the Orthopedic segment, encompassing screws, plates, and fixation devices, retains the largest market share due to the sheer volume of trauma and reconstructive surgeries globally. Concurrently, the Cardiovascular segment, dominated by bioresorbable stents, is demonstrating the fastest growth rate, propelled by the urgent clinical need to replace permanent metallic stents, which often pose long-term risks such as late thrombosis. Material segmentation indicates that polymer-based implants (PLA, PLGA) are mainstream, yet magnesium-based metallic bioresorbable implants are gaining critical momentum, particularly where high initial mechanical strength is required before resorption commences, necessitating continuous R&D investment across all material categories.

AI Impact Analysis on Bioresorbable Implants Market

User queries regarding the impact of Artificial Intelligence (AI) on the Bioresorbable Implants Market predominantly revolve around three critical areas: enhanced material discovery and design, optimization of personalized implant characteristics, and prediction of in-vivo performance and degradation kinetics. Users are keenly interested in how machine learning algorithms can expedite the screening of novel biodegradable polymers or alloys, a process traditionally characterized by lengthy and expensive experimental trials. Furthermore, there is significant anticipation regarding AI's role in tailoring implant geometry and mechanical properties based on individual patient anatomy and predicted biological stresses, moving away from standardized sizes toward truly personalized medicine. Concerns also focus on using predictive models (Digital Twins) to simulate the precise degradation timeline of an implant within a specific patient environment, ensuring the implant maintains structural integrity exactly until the tissue healing process is complete, thus reducing failure rates and improving surgical precision.

- AI accelerates the discovery and synthesis of novel bioresorbable polymers and metallic alloys by simulating molecular interactions and predicting material characteristics, dramatically reducing R&D cycles.

- Machine learning models analyze patient-specific data (imaging, biomechanics) to optimize implant design, size, and porosity, enabling personalized bioresorbable devices for complex orthopedic or cardiovascular defects.

- AI algorithms are employed to predict the precise in-vivo degradation rate and mechanical load-bearing capacity of implants over time, allowing surgeons to select the ideal material composition for targeted healing kinetics.

- Generative Design capabilities, powered by AI, create complex scaffold architectures for tissue engineering applications, maximizing cellular infiltration and subsequent tissue regeneration before the scaffold fully dissolves.

- AI-driven image analysis improves quality control during the manufacturing process, identifying microscopic defects or inconsistencies in polymer structures that could affect resorption uniformity or mechanical strength.

- Predictive maintenance analytics, leveraging sensor data integration, could theoretically monitor the performance and early signs of material fatigue in complex functional bioresorbable devices post-implantation.

DRO & Impact Forces Of Bioresorbable Implants Market

The Bioresorbable Implants Market is influenced by a dynamic interplay of factors that both propel growth and impose limitations, creating a complex force structure shaping its trajectory. The primary drivers include the clinical benefits of eliminating secondary surgeries, the global rise in geriatric populations leading to higher instances of musculoskeletal and cardiovascular disorders, and continuous technological advancements resulting in materials with improved mechanical properties and predictable degradation profiles. These positive factors create a strong pull from the medical community seeking devices that minimize long-term patient complications and reduce overall healthcare costs. This demand for improved patient outcomes is the foundational force stimulating market investment and innovation across all application sectors.

However, significant restraints temper this expansion. High manufacturing costs associated with complex biomaterial synthesis, stringent regulatory approval processes requiring extensive long-term clinical data on degradation products, and current limitations regarding the load-bearing capacity and strength retention of some polymer-based implants restrict their use in high-stress orthopedic applications. Furthermore, the inherent variability in individual biological responses means that predicting the exact in-vivo degradation rate remains challenging, occasionally leading to premature failure or overly prolonged presence in some patients. These technical and regulatory hurdles necessitate substantial capital investment and prolonged development timelines, acting as frictional forces against rapid market entry.

Opportunities for growth are concentrated in the development of next-generation materials, specifically bioresorbable metallic implants (Magnesium, Iron-based alloys) that offer superior initial strength for fracture fixation, and the integration of these materials into drug-eluting scaffolds, combining therapeutic release with temporary mechanical support. Expanding applications in spinal fusion and neurosurgery, currently nascent fields for bioresorbable materials, represent significant untapped potential. The overall impact forces are strongly positive, driven by the clinical advantage of temporary implants, but the adoption rate is moderated by the necessary scientific rigor required to ensure long-term safety and efficacy, keeping research and development intensity high and concentrated on addressing mechanical and degradation challenges.

Segmentation Analysis

The Bioresorbable Implants Market is comprehensively segmented based on material type, application, and end-use, reflecting the diversity of clinical needs and the technological landscape. Segmentation allows stakeholders to accurately gauge market penetration and identify specific areas of unmet need where specialized material science can offer superior clinical solutions. Material segmentation highlights the dominance of polymers, but also tracks the increasing viability of metallic and composite materials, crucial for high-stress environments. Application segmentation clearly delineates the market’s primary focus areas, with orthopedics driving volume and cardiovascular driving high-value innovation, while end-use segmentation indicates the primary purchasing entities responsible for device adoption.

The detailed market breakdown helps in strategic planning, identifying the fastest-growing niches such as bioresorbable drug-eluting vascular scaffolds, which command premium pricing due to their complex functionality. Moreover, analyzing end-use segments, particularly the shift toward Ambulatory Surgical Centers (ASCs), underscores the preference for procedures utilizing devices that support rapid recovery and simplified post-operative management, perfectly aligning with the benefits offered by bioresorbable technology. The strategic relevance of segmentation lies in understanding where material innovation intersects with clinical necessity, providing a roadmap for future product development and geographical expansion strategies across different healthcare systems.

- Material Type:

- Polymer-based Implants (Polylactic Acid (PLA), Polyglycolic Acid (PGA), Poly-L-lactide (PLLA), Poly-Lactic-co-Glycolic Acid (PLGA), Polydioxanone (PDO), Polycaprolactone (PCL))

- Metallic Implants (Magnesium, Iron-based Alloys)

- Composite Implants

- Application:

- Orthopedics (Screws, Pins, Plates, Tacks, Interference Screws, Spinal Fusion Devices)

- Cardiovascular (Vascular Scaffolds/Stents, Closure Devices)

- Drug Delivery Systems (Drug-Eluting Coatings, Reservoirs)

- Dental Implants (Membranes, Fixation Devices)

- Craniofacial and Maxillofacial Surgery

- Other Applications (Soft Tissue Repair, Neurosurgery)

- End-Use:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics and Trauma Centers

Value Chain Analysis For Bioresorbable Implants Market

The value chain for the Bioresorbable Implants Market is complex and highly specialized, beginning with the meticulous procurement and synthesis of high-purity raw materials. Upstream activities are dominated by specialized chemical and material science companies responsible for manufacturing the medical-grade polymers (like PLLA or PLGA) or refining the biocompatible resorbable metallic alloys (like high-ppurity magnesium). Quality control and ensuring batch consistency at this stage are paramount, as the final implant's mechanical integrity and resorption profile are entirely dependent on the purity and molecular weight of these input materials. Few major chemical suppliers control the supply of these highly specific biomaterials, creating potential bottlenecks and influencing overall market dynamics and pricing structures.

Moving downstream, the core activity involves implant design, prototyping, advanced manufacturing (often using injection molding, extrusion, or additive manufacturing techniques for complex geometries), sterilization, and final packaging. This stage is dominated by large medical device original equipment manufacturers (OEMs) who possess the necessary regulatory expertise and intellectual property relating to device geometry and performance. Distribution channels are highly regulated, relying primarily on direct sales forces for large hospital systems and specialized distributors for smaller clinics or regional markets. Direct distribution allows OEMs to provide highly specialized technical support and training to surgeons, which is critical for complex implants like bioresorbable vascular scaffolds.

The direct buyers (Hospitals, ASCs, and Specialty Clinics) exert considerable influence on the market through procurement committees focused on balancing clinical efficacy, long-term cost of care, and upfront device price. Indirect influences include academic research institutions driving material innovation and regulatory bodies determining market access. The success of the value chain is ultimately measured by clinical acceptance and patient outcomes, positioning the relationship between manufacturers and clinical end-users as the most critical link in ensuring widespread adoption and sustained growth of bioresorbable technology.

Bioresorbable Implants Market Potential Customers

The primary end-users and potential customers of bioresorbable implants are diverse clinical settings that perform high volumes of surgical procedures requiring temporary fixation or scaffolding. Hospitals, particularly those with specialized departments in Orthopedic Surgery, Traumatology, Cardiology, and Neurosurgery, represent the largest customer segment due to their capacity for complex procedures and high patient turnover. These institutions seek products that reduce the need for subsequent surgical interventions, thereby freeing up operating room capacity and enhancing patient throughput. The procurement decisions in large hospital systems are often complex, involving clinical directors, supply chain management, and financial administrators focused on long-term cost optimization, making clinical evidence of cost-effectiveness a crucial sales factor.

Ambulatory Surgical Centers (ASCs) constitute a rapidly expanding segment of potential customers. ASCs specialize in outpatient procedures, and bioresorbable implants are highly attractive to them because they align perfectly with the need for streamlined, same-day surgical protocols and minimized recovery times. Devices that facilitate rapid, stable healing without the long-term presence of a foreign body are preferred in this setting, supporting faster discharge and lower infection risk profiles compared to traditional hospital stays. The focus here is on efficiency and patient satisfaction in non-emergency, elective procedures, such as ACL reconstruction or minor dental surgeries.

Furthermore, specialty clinics focused on specific treatments, such as sports medicine practices, dental clinics performing complex restorative work, and specialized trauma centers, form a significant niche market. These customers value the advanced technical specifications and patient-centric benefits offered by premium bioresorbable devices. Research institutions and academic centers also serve as influential customers, often utilizing these cutting-edge materials in clinical trials and regenerative medicine studies, ultimately driving demand for the most technologically advanced and novel bioresorbable materials available in the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1,950.5 Million |

| Market Forecast in 2033 | $4,190.8 Million |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, Abbott Laboratories, Boston Scientific Corporation, Teijin Limited, B. Braun Melsungen AG, Evonik Industries AG, CONMED Corporation, Smith & Nephew plc, Zimmer Biomet Holdings, Inc., Stryker Corporation, 3M Company, DSM Biomedical, Corbion N.V., Polyganics B.V., Sekisui Chemical Co., Ltd., REVA Medical, Inc., Bioretec Ltd., BioMers Pte Ltd., X-Spine Systems, Inc., Integra LifeSciences Holdings Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bioresorbable Implants Market Key Technology Landscape

The technology landscape governing the bioresorbable implants market is highly sophisticated, focusing intensely on material synthesis, device fabrication, and surface modification techniques designed to control degradation and enhance biological integration. The core technology lies in polymer chemistry, particularly the ability to precisely control the molecular weight, crystallinity, and stereochemistry of polyesters like PLA and PGA. Advanced polymerization techniques are utilized to create materials that maintain high mechanical strength for the required initial period (typically 6-12 weeks) before beginning the hydrolytic breakdown process, ensuring non-toxic, biocompatible metabolites are absorbed by the body. Innovations in this area include co-polymer blends (PLGA) tailored to adjust resorption rates for diverse clinical scenarios, from rapid dental membranes to slow-resorbing orthopedic screws.

Beyond traditional polymer manufacturing, additive manufacturing (3D printing) technologies are revolutionizing the fabrication of complex bioresorbable scaffolds. Selective Laser Sintering (SLS) and Fused Deposition Modeling (FDM) allow for the creation of intricate, porous internal structures that promote tissue ingrowth and vascularization, particularly important in regenerative medicine and complex craniofacial reconstruction. These methods enable patient-specific, geometry-optimized implants, a technological step change from standardized off-the-shelf devices. Furthermore, the increasing prominence of metallic bioresorbable technologies, primarily magnesium alloys, necessitates specialized metallurgical processes, including sophisticated surface treatments and alloying to manage corrosion rates and prevent rapid hydrogen gas evolution in vivo, ensuring safe degradation profiles.

Another crucial technological frontier involves surface modification and drug loading techniques. Many modern bioresorbable implants are designed as multi-functional devices, incorporating localized drug delivery capabilities. Technologies such as encapsulation, coating, or direct integration of pharmaceutical agents (e.g., anti-restenotic drugs in vascular stents or antibiotics in orthopedic fixations) are achieved through advanced plasma deposition or controlled immersion techniques. This fusion of mechanical support and therapeutic action represents the pinnacle of current material science in the sector, maximizing both mechanical stability and improved biological response at the implant site, thereby validating the high investment in these specialized manufacturing platforms.

Regional Highlights

The Bioresorbable Implants Market exhibits distinct regional dynamics, influenced heavily by healthcare infrastructure, regulatory environments, and prevalence of target diseases. North America, comprising the United States and Canada, stands as the global leader in terms of market size and technological innovation adoption. This dominance is underpinned by high healthcare expenditure, established clinical guidelines that favor advanced implant technologies, and the presence of major industry players and extensive R&D facilities. The region benefits from a high volume of orthopedic and cardiovascular surgeries, coupled with a proactive approach to adopting next-generation bioresorbable stents and fixation devices, ensuring consistent market penetration and growth.

Europe represents the second-largest market, characterized by a sophisticated public and private healthcare system and stringent, but harmonized, regulatory processes (EU Medical Device Regulation - MDR). Countries like Germany, France, and the UK are major contributors, demonstrating high clinical acceptance of polymer-based implants. Growth in Europe is sustained by an aging population and focused governmental funding into biomedical research and personalized medicine. While the regulatory transition to MDR created temporary hurdles, it ultimately promotes higher standards of safety and efficacy, which benefits innovative bioresorbable products demonstrating superior long-term clinical data.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This rapid expansion is driven by massive populations, improving economic conditions leading to increased disposable income for healthcare, and substantial government investments aimed at modernizing healthcare facilities in countries such as China, India, and Japan. The rising prevalence of lifestyle-related diseases (e.g., cardiovascular disease) combined with growing medical tourism initiatives creates significant untapped demand. Although local manufacturing capacity is increasing, the region still relies heavily on imports of high-end bioresorbable materials and sophisticated implantation technologies from North America and Europe, indicating massive future potential for localization and technology transfer.

- North America: Market leader; driven by advanced R&D, high expenditure on orthopedic and cardiovascular care, and rapid adoption of novel technologies.

- Europe: Mature market; sustained by high geriatric population base, strong clinical acceptance, and adherence to stringent EU MDR standards promoting quality and safety.

- Asia Pacific (APAC): Highest projected CAGR; fueled by economic development, rising prevalence of chronic diseases, increasing access to modern medical facilities, and expanding domestic manufacturing capabilities.

- Latin America (LATAM): Emerging growth market; characterized by improving healthcare access and infrastructure modernization in key economies like Brazil and Mexico, focusing on affordable and accessible implant solutions.

- Middle East and Africa (MEA): Niche market; growth concentrated in Gulf Cooperation Council (GCC) countries due to high healthcare spending and medical tourism, primarily importing high-end products for complex procedures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bioresorbable Implants Market.- Medtronic plc

- Abbott Laboratories

- Boston Scientific Corporation

- Teijin Limited

- B. Braun Melsungen AG

- Evonik Industries AG

- CONMED Corporation

- Smith & Nephew plc

- Zimmer Biomet Holdings, Inc.

- Stryker Corporation

- 3M Company

- DSM Biomedical

- Corbion N.V.

- Polyganics B.V.

- Sekisui Chemical Co., Ltd.

- REVA Medical, Inc.

- Bioretec Ltd.

- BioMers Pte Ltd.

- X-Spine Systems, Inc.

- Integra LifeSciences Holdings Corporation

Frequently Asked Questions

Analyze common user questions about the Bioresorbable Implants market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of using a bioresorbable implant over a traditional permanent metallic implant?

The primary advantage is the elimination of the need for secondary surgery to remove the implant once healing is complete. Bioresorbable implants gradually dissolve and are safely absorbed by the body, reducing patient morbidity, avoiding complications like stress shielding, and minimizing overall healthcare costs associated with revision surgeries.

In which medical application segment are bioresorbable implants most commonly used?

Bioresorbable implants are most extensively used in the Orthopedics segment, primarily for trauma fixation (screws, pins, tacks, and plates) and sports medicine procedures like anterior cruciate ligament (ACL) reconstruction, where temporary support is required for fracture or soft tissue healing.

What are the main materials utilized in manufacturing bioresorbable implants?

The main materials include biodegradable polymers such as Polylactic Acid (PLA), Polyglycolic Acid (PGA), and their copolymer PLGA. Increasingly, bioresorbable metallic alloys, particularly magnesium-based alloys, are being utilized where higher initial mechanical strength is required, especially in cardiovascular stenting and load-bearing orthopedic applications.

What is the anticipated growth rate (CAGR) for the Bioresorbable Implants Market?

The Bioresorbable Implants Market is projected to grow robustly at a Compound Annual Growth Rate (CAGR) of 11.5% between the forecast period of 2026 and 2033, driven by continuous innovation and increasing adoption in cardiology and orthopedic surgery globally.

What challenges limit the widespread adoption of bioresorbable implants in critical applications?

The key challenges include ensuring adequate mechanical strength retention throughout the entire healing period, managing the relatively high manufacturing complexity and cost compared to standard metallic devices, and navigating strict regulatory requirements regarding the long-term safety and biocompatibility of degradation products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager