Bioresorbable Medical Material Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433490 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Bioresorbable Medical Material Market Size

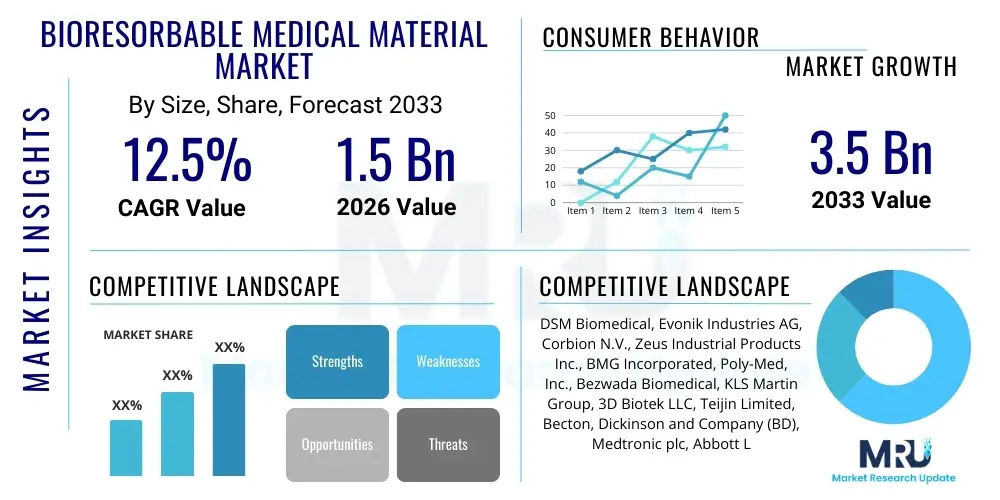

The Bioresorbable Medical Material Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 3.5 Billion by the end of the forecast period in 2033.

Bioresorbable Medical Material Market introduction

Bioresorbable medical materials, also termed biodegradable or bioabsorbable materials, are specifically engineered substances designed to perform a temporary structural or functional role within the human body before degrading safely and being metabolized or eliminated naturally, precluding the necessity for subsequent surgical removal. These materials, primarily synthetic aliphatic polyesters like Poly-L-lactic acid (PLLA), Poly-glycolic acid (PGA), and their co-polymer Poly(lactic-co-glycolic acid) (PLGA), represent a paradigm shift in medical device manufacturing, moving away from permanent metal or ceramic implants towards transient biological scaffolds. The fundamental advantage lies in their capacity to provide mechanical support or drug delivery capability while the native tissue heals, subsequently dissolving completely once their purpose is fulfilled, thereby minimizing chronic foreign body reactions and reducing patient morbidity associated with secondary retrieval procedures.

Major applications of bioresorbable materials span critical medical domains, notably orthopedics (sutures, screws, plates, bone fixation devices), cardiovascular surgery (stents, grafts), and general surgery (wound closure devices and meshes). These materials are instrumental in minimally invasive surgery techniques where precision and temporary structural integrity are paramount. The market is propelled by the intrinsic benefits offered to both patients and healthcare systems, including reduced recovery times, lower lifetime healthcare costs associated with device removal, and superior cosmetic outcomes. Furthermore, the inherent biocompatibility and tunable degradation profiles of these materials enable their use in sophisticated drug-eluting systems, broadening their clinical utility beyond mere mechanical support.

The primary driving factor for market expansion is the global increase in age-related degenerative diseases, coupled with a surging preference for advanced, high-performance medical devices that support faster patient rehabilitation. Regulatory approvals for novel polymer formulations and the integration of these materials into complex scaffolding technologies, particularly in tissue engineering and regenerative medicine, further catalyze market growth. Product development is heavily focused on achieving optimal mechanical properties that match the load-bearing requirements of the application, alongside precise control over the hydrolysis rate to ensure the device maintains structural integrity throughout the critical healing phase, a technical challenge that drives continuous innovation within the sector.

Bioresorbable Medical Material Market Executive Summary

The Bioresorbable Medical Material Market is characterized by robust growth, driven primarily by the global shift towards minimally invasive surgical procedures and the increasing incidence of orthopedic and cardiovascular diseases requiring implantable devices. Key business trends include substantial investment in R&D focused on next-generation composite materials that combine bioresorbability with enhanced strength and flexibility, particularly those enabling additive manufacturing techniques such as 3D printing. Strategic partnerships between material manufacturers and medical device OEMs are accelerating the commercialization timeline for new applications, particularly within the niche areas of bio-inks for bioprinting and advanced wound care matrices. Regulatory landscapes, while stringent, are becoming more streamlined for novel biodegradable platforms, encouraging innovation and market entry.

Regionally, North America maintains market dominance due to high healthcare expenditure, sophisticated technological adoption, and the presence of major industry players and leading research institutions, particularly focusing on PLLA and PLGA applications in high-value orthopedic devices. However, the Asia Pacific region is anticipated to demonstrate the fastest growth rate, fueled by improving healthcare infrastructure, massive patient populations, increasing disposable incomes, and governments promoting domestic manufacturing of medical devices. Europe remains a significant market, emphasizing adherence to strict quality standards imposed by entities like the European Medicines Agency (EMA) and focusing on incorporating bioresorbable elements into drug-eluting stents and complex surgical meshes, reflecting a mature and highly regulated environment.

Analysis of market segments reveals that the polymers category, particularly PLGA, holds the largest market share owing to its versatile tunability regarding degradation rates, making it suitable for a wide range of short-to-medium-term applications. Conversely, the market for metallic bioresorbable materials, though smaller, is gaining traction, especially magnesium-based alloys, due to their superior initial mechanical strength suitable for load-bearing applications like certain coronary stents and trauma fixation. By application, orthopedic fixation devices currently dominate, but the cardiovascular sector, specifically bioresorbable scaffolds (BRS), represents a high-growth segment, poised to revolutionize interventional cardiology by offering temporary scaffolding that resolves completely, theoretically reducing long-term adverse events associated with permanent implants.

AI Impact Analysis on Bioresorbable Medical Material Market

Users frequently inquire about AI's potential to accelerate the development cycle of novel bioresorbable polymers, seeking confirmation on whether machine learning algorithms can predict material performance, degradation kinetics, and biocompatibility before extensive wet-lab testing. Common concerns revolve around how AI can handle the complexity of predicting long-term in vivo behavior, particularly toxicity and immune response, which are critical variables for bioresorbable materials. The prevailing expectation is that AI will significantly shorten the time from discovery to commercialization by optimizing synthesis parameters, identifying ideal co-polymer ratios, and customizing implant designs to match specific patient anatomies and disease states, effectively ushering in an era of data-driven material science and personalized implantology within the bioresorbable domain.

- AI-driven material informatics identifies novel bioresorbable polymer structures with desired mechanical properties and degradation profiles.

- Machine learning algorithms predict in vivo biocompatibility and hydrolytic degradation rates, significantly reducing traditional trial-and-error R&D costs.

- Computational modeling optimizes the geometric design of scaffolds and implants (e.g., orthopedic screws, stents) for enhanced performance and personalized patient fit.

- AI improves quality control in the manufacturing process by analyzing high-throughput sensor data to detect subtle material defects or variations in polymerization.

- Predictive analytics optimizes the supply chain management for precursor chemicals, ensuring timely availability for specialty polymer synthesis.

DRO & Impact Forces Of Bioresorbable Medical Material Market

The bioresorbable medical material market is shaped by a strong interplay between clinical necessity, technological feasibility, and economic viability. Key drivers include the global aging population, which necessitates an increasing number of surgical interventions, particularly joint replacements and cardiovascular procedures, where the temporary support offered by bioresorbable materials is highly beneficial. The continuous advancements in polymer science, allowing for the fine-tuning of mechanical strength and degradation kinetics, further accelerates adoption. However, market restraints are significant, primarily relating to the high cost of raw material synthesis, complex purification processes required for medical-grade polymers, and the lengthy, rigorous regulatory approval pathways necessary for implantable devices, which often delay market entry and increase upfront investment.

Opportunities for market growth primarily reside in the integration of bioresorbable polymers with advanced manufacturing techniques such as 3D printing (additive manufacturing), enabling the creation of highly complex, porous scaffolds customized for tissue engineering applications, including nerve guides and complex bone defect fillers. Furthermore, the immense potential of utilizing bioresorbable matrices in controlled drug delivery systems, particularly for localized cancer therapy or antibiotic release at surgical sites, offers substantial market expansion. The impact forces acting on this market include the increasing pressure from healthcare systems globally to reduce long-term patient complications associated with permanent implants, pushing device manufacturers toward bioresorbable solutions, alongside the competitive force generated by continuous innovation in traditional metallic and ceramic implant technologies.

The market also faces internal pressure from the need for standardization in material testing methodologies, particularly concerning long-term degradation products and their systemic impact. While the demand for temporary implants is rising, concerns regarding potential acute inflammatory responses during the degradation phase remain a limiting factor that research must actively address. Successful market players are those that can navigate these complex regulatory and technical hurdles by offering materials with predictable, non-toxic degradation profiles and superior initial mechanical performance, thereby overcoming the perception that bioresorbable devices are inherently weaker or less reliable than their permanent counterparts.

Segmentation Analysis

The Bioresorbable Medical Material Market is comprehensively segmented based on material type, application, and end-user, providing a granular view of demand dynamics across the global medical landscape. Material segmentation is crucial as it dictates the physical and chemical properties, influencing the suitability for various clinical uses; synthetic polymers dominate this category due to the extensive control over their properties achieved through chemical synthesis. Application-based segmentation reflects the primary clinical areas where these materials are utilized, with orthopedics being the historically dominant segment due to early adoption in fracture fixation and suture materials. End-user segmentation highlights the primary purchasers and centers of usage for these materials, confirming the critical role of hospitals and specialized surgical centers in driving volume demand globally.

Within the materials landscape, Poly(lactic-co-glycolic acid) (PLGA) exhibits a high growth trajectory, favored for its adjustable degradation time which makes it ideal for drug delivery vehicles and tissue engineering scaffolds that require synchronization between material loss and tissue regeneration. The market for bioresorbable metals, specifically magnesium and iron alloys, is experiencing revitalization; these materials offer the high initial mechanical strength of traditional metals but eventually dissolve, mitigating long-term risks associated with permanent metallic implants. This shift toward high-performance, temporary metallic materials is expected to gain significant traction in load-bearing applications where polymer strength is currently insufficient.

The orthopedic segment remains foundational, encompassing a vast array of products such as resorbable screws, pins, and plates used in trauma and sports medicine. However, the cardiovascular application segment is poised for transformative growth, primarily fueled by the potential of fully bioresorbable vascular scaffolds (BVS) to provide temporary vessel support followed by complete dissolution, allowing the vessel to return to its natural physiological state, thus avoiding the complications associated with permanent metallic stents. This continuous diversification across applications underscores the versatility and increasing clinical confidence in bioresorbable technology as a superior alternative in various demanding medical scenarios.

- By Material Type:

- Polymers:

- Polylactic Acid (PLA)/Poly-L-lactic acid (PLLA)

- Polyglycolic Acid (PGA)

- Poly(lactic-co-glycolic acid) (PLGA)

- Polycaprolactone (PCL)

- Polyurethanes (PUs)

- Others (e.g., Polyhydroxyalkanoates (PHAs))

- Metals:

- Magnesium Alloys

- Iron Alloys

- Zinc Alloys

- Ceramics:

- Tricalcium Phosphate (TCP)

- Calcium Sulfate

- Bioactive Glass

- Polymers:

- By Application:

- Orthopedics:

- Suture Anchors

- Screws, Pins, and Rods

- Plates and Meshes

- Bone Grafts and Substitutes

- Cardiovascular:

- Vascular Scaffolds/Stents (BVS)

- Grafts

- Vascular Closure Devices

- Drug Delivery:

- Microparticles and Nanoparticles

- Implants and Wafers

- Wound Management:

- Sutures and Staples

- Wound Dressings and Scaffolds

- General Surgery:

- Hernia Repair Meshes

- Adhesion Barriers

- Orthopedics:

- By End User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Research and Academic Institutions

Value Chain Analysis For Bioresorbable Medical Material Market

The value chain for bioresorbable medical materials is complex, beginning with the upstream synthesis and purification of high-purity monomer precursors, which is a highly specialized and capital-intensive process often dictating the final cost and quality of the finished polymer. Specialized chemical suppliers focus on synthesizing medical-grade materials such as lactide and glycolide monomers. This is followed by the core polymerization process, where material manufacturers convert these monomers into proprietary polymers (e.g., specific molecular weights of PLGA or PLLA). Rigorous quality control at this stage is mandatory to ensure appropriate intrinsic viscosity, molecular weight distribution, and purity, all of which directly influence the material's performance and degradation profile in vivo. Material producers then supply these raw or semi-finished polymers to downstream device manufacturers.

The downstream segment involves highly specialized medical device manufacturing, encompassing processes like extrusion, injection molding, and increasingly, additive manufacturing (3D printing) to create finished products such as orthopedic screws, cardiovascular stents, or drug-eluting wafers. Device OEMs must not only master precision engineering but also manage the sterilization and packaging of these materials, which can be sensitive to heat and moisture. Furthermore, the intellectual property surrounding unique device designs, material formulations, and manufacturing methods is a significant component of value creation in this stage. The distribution channel is subsequently engaged for market reach, involving a mix of direct and indirect sales strategies depending on the geographical market and the specialization of the product.

Distribution for bioresorbable medical devices is typically structured through specialized medical distributors and direct sales forces targeting hospitals and ambulatory surgical centers. Direct distribution is common for high-value, complex devices, allowing manufacturers close contact with key opinion leaders (KOLs) and surgeons, facilitating training and personalized support. Indirect channels utilize regional distributors that manage warehousing and logistics, offering wider market penetration, especially in emerging markets. The final link in the chain involves hospitals and surgical centers, which are the end-users, where purchasing decisions are driven by clinical efficacy, pricing agreements, and established vendor relationships. The entire value chain is characterized by strict regulatory oversight at every stage, requiring significant investment in compliance, clinical trials, and post-market surveillance to ensure product safety and efficacy.

Bioresorbable Medical Material Market Potential Customers

The primary consumers and end-users of bioresorbable medical materials are institutions and professionals that perform surgical interventions and require high-quality, temporary implantable devices. Hospitals, particularly those with large surgical volumes in orthopedic, cardiovascular, and trauma departments, represent the largest customer base. These large institutions require substantial quantities of resorbable sutures, fixation devices, and meshes, driven by the increasing complexity and frequency of surgical procedures performed globally. Purchasing decisions within hospitals are often influenced by value analysis committees who weigh the clinical benefits of bioresorbable materials—such as reduced secondary surgery rates—against their potentially higher procurement cost compared to traditional permanent materials.

Ambulatory Surgical Centers (ASCs) constitute a rapidly growing customer segment, particularly in North America, focusing on outpatient procedures that often benefit significantly from the reduced recovery time and simplified post-operative management associated with bioresorbable implants. ASCs prioritize efficiency and streamlined processes, making devices that eliminate the need for device removal highly attractive. Furthermore, specialty clinics focusing on sports medicine, orthopedics, and interventional cardiology are key niche customers, requiring state-of-the-art bioresorbable anchors and scaffolds for minimally invasive repair techniques.

Beyond clinical settings, research and academic institutions, along with pharmaceutical and biotechnology companies, are significant purchasers of specific types of bioresorbable materials, especially polymers like PLGA and PCL, for use in advanced research. These materials serve as critical components in drug delivery research, tissue engineering, and regenerative medicine experiments, where the goal is often to create sophisticated, temporary matrices that facilitate targeted cellular growth or controlled release of therapeutic agents. This research segment drives demand for highly specialized, often customized, batches of medical-grade bioresorbable polymers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 3.5 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DSM Biomedical, Evonik Industries AG, Corbion N.V., Zeus Industrial Products Inc., BMG Incorporated, Poly-Med, Inc., Bezwada Biomedical, KLS Martin Group, 3D Biotek LLC, Teijin Limited, Becton, Dickinson and Company (BD), Medtronic plc, Abbott Laboratories, Boston Scientific Corporation, Stryker Corporation, Johnson & Johnson (DePuy Synthes), Zimmer Biomet Holdings, Inc., Smith & Nephew plc, Sekisui Chemical Co., Ltd., Foster Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bioresorbable Medical Material Market Key Technology Landscape

The technological landscape of the bioresorbable medical material market is dominated by advancements in polymer synthesis and fabrication methods designed to achieve precise control over mechanical integrity and biological interaction. Novel polymerization techniques, such as ring-opening polymerization and condensation polymerization, are continuously being refined to produce ultra-high purity, high molecular weight polymers with narrow polydispersity indices, crucial for predictable in vivo performance. A critical area of focus is the development of composite materials, combining polymers with bioceramics (like hydroxyapatite or tricalcium phosphate) or specialized fillers to enhance radiopacity, initial mechanical stiffness, and osteoconductivity, making them suitable for demanding orthopedic applications.

Advanced manufacturing technologies are fundamentally changing how these materials are utilized. Additive manufacturing (3D printing), including selective laser sintering (SLS) and fused deposition modeling (FDM), is enabling the creation of patient-specific, complex lattice structures for bone scaffolds and porous drug delivery devices, optimizing the surface area for cell adhesion and nutrient diffusion while ensuring controlled degradation. Furthermore, electrospinning is widely employed to produce nanofiber meshes for advanced wound dressings and nerve regeneration conduits, mimicking the extracellular matrix structure and enhancing biological signaling. These fabrication methods allow for the customization of pore size and fiber diameter, offering unprecedented control over the material's interaction with host tissues.

Another crucial technological frontier is surface engineering and coating technologies. Researchers are employing techniques like plasma treatment, covalent immobilization, and layer-by-layer assembly to modify the surface of bioresorbable implants. These modifications aim to enhance biocompatibility, reduce the risk of infection by incorporating antimicrobial agents, or facilitate the localized delivery of growth factors to accelerate tissue healing. For bioresorbable metals, the key technological challenge involves controlling the corrosion rate precisely through alloying strategies and protective surface layers, ensuring that the metallic structure provides adequate mechanical support throughout the critical healing phase before gradually and safely dissolving without toxic byproduct accumulation.

Regional Highlights

- North America: North America, particularly the United States, represents the largest market share holder, driven by substantial R&D expenditure, the rapid adoption of advanced medical devices, and favorable reimbursement policies for sophisticated surgical procedures. The region boasts a dense presence of leading medical device manufacturers and highly specialized centers of excellence, ensuring continuous innovation in orthopedic and cardiovascular bioresorbable applications, including the development and clinical translation of bioresorbable vascular scaffolds (BVS). Stringent, but clear, regulatory frameworks established by the FDA provide a strong foundation for clinical trials and market entry, attracting significant investment in polymer science and additive manufacturing for customized implants.

- Europe: Europe maintains a mature and significant market position, primarily driven by strong healthcare systems in countries like Germany, France, and the UK, focusing heavily on quality and efficacy. The market is characterized by strict regulatory requirements, particularly under the Medical Device Regulation (MDR), which mandates extensive clinical data for bioresorbable products. European research institutions are at the forefront of developing novel bioresorbable composite materials, particularly those for personalized drug delivery systems and dental applications. Germany, in particular, leads in the adoption of bioresorbable fixation devices in trauma surgery and sports medicine.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region during the forecast period. This exponential growth is attributed to the increasing burden of chronic diseases, the rapid expansion and modernization of healthcare infrastructure in populous nations like China and India, and rising medical tourism. Local governments are actively promoting domestic manufacturing and offering incentives for R&D in biomaterials, aiming to reduce dependence on imported devices. While pricing remains a sensitive factor, the sheer volume of surgical procedures performed in countries like China and Japan provides immense market potential, particularly for lower-cost, high-volume products such as resorbable sutures and wound care matrices.

- Latin America: The Latin American market exhibits moderate growth potential, characterized by improving economic conditions and increased public and private investment in healthcare facilities, notably in Brazil and Mexico. Market growth is constrained by fluctuating currency values and disparities in healthcare access, but the increasing demand for advanced cosmetic and minimally invasive orthopedic surgeries creates pockets of opportunity. Adoption rates are steadily increasing as international manufacturers expand their distribution networks and increase educational efforts regarding the long-term benefits of bioresorbable solutions over permanent implants.

- Middle East and Africa (MEA): The MEA region is currently a smaller market but offers promising future growth, particularly in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia, Qatar) due to high government healthcare spending and investment in world-class medical cities. The focus here is on establishing specialized centers for cardiovascular and orthopedic care, driving demand for premium bioresorbable stents and fixation devices. Conversely, the African sub-region faces challenges related to infrastructure limitations and lower purchasing power, concentrating demand primarily on essential bioresorbable materials like surgical sutures and high-quality wound care products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bioresorbable Medical Material Market.- DSM Biomedical

- Evonik Industries AG

- Corbion N.V.

- Zeus Industrial Products Inc.

- BMG Incorporated

- Poly-Med, Inc.

- Bezwada Biomedical

- KLS Martin Group

- 3D Biotek LLC

- Teijin Limited

- Becton, Dickinson and Company (BD)

- Medtronic plc

- Abbott Laboratories

- Boston Scientific Corporation

- Stryker Corporation

- Johnson & Johnson (DePuy Synthes)

- Zimmer Biomet Holdings, Inc.

- Smith & Nephew plc

- Sekisui Chemical Co., Ltd.

- Foster Corporation

Frequently Asked Questions

Analyze common user questions about the Bioresorbable Medical Material market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using bioresorbable materials over permanent implants?

Bioresorbable materials dissolve safely into the body after their temporary function is complete, eliminating the need for a second surgical procedure for device removal. This reduces long-term risks such as chronic inflammation, stress shielding on adjacent bones, and potential device failure associated with permanent implants, leading to improved patient recovery and overall cost savings.

Which types of bioresorbable materials are currently dominant in the medical device sector?

Synthetic polymers, particularly Poly(lactic-co-glycolic acid) (PLGA) and Poly-L-lactic acid (PLLA), dominate the market due to their proven biocompatibility and the ability to finely tune their mechanical strength and degradation kinetics for diverse applications, ranging from sutures and drug carriers to complex orthopedic fixation devices.

How does the degradation of bioresorbable implants occur, and is it safe?

Degradation typically occurs through hydrolysis, where water molecules break down the polymer chains into non-toxic, naturally occurring compounds (such as lactic acid and glycolic acid). These breakdown products are safely metabolized and eliminated by the body. The safety of the degradation process is rigorously tested through extensive preclinical and clinical studies, ensuring no harmful systemic or localized toxicity.

What role does 3D printing play in the future development of bioresorbable medical devices?

3D printing (additive manufacturing) is crucial as it allows for the fabrication of complex, patient-specific geometries, such as porous bone scaffolds or customized drug implants, which cannot be achieved using conventional methods. This technology accelerates personalized medicine by enabling devices tailored precisely to the patient's anatomy and specific therapeutic requirements.

What are the major challenges facing the commercialization of bioresorbable vascular scaffolds (BVS)?

Major challenges include achieving sufficient radial strength to prevent vessel recoil before full degradation, managing the complex long-term regulatory requirements, and addressing the technical difficulty of manufacturing ultra-thin, highly robust scaffolds with predictable degradation profiles to ensure optimal clinical outcomes and minimize late scaffold thrombosis.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager