Biostorage Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431977 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Biostorage Service Market Size

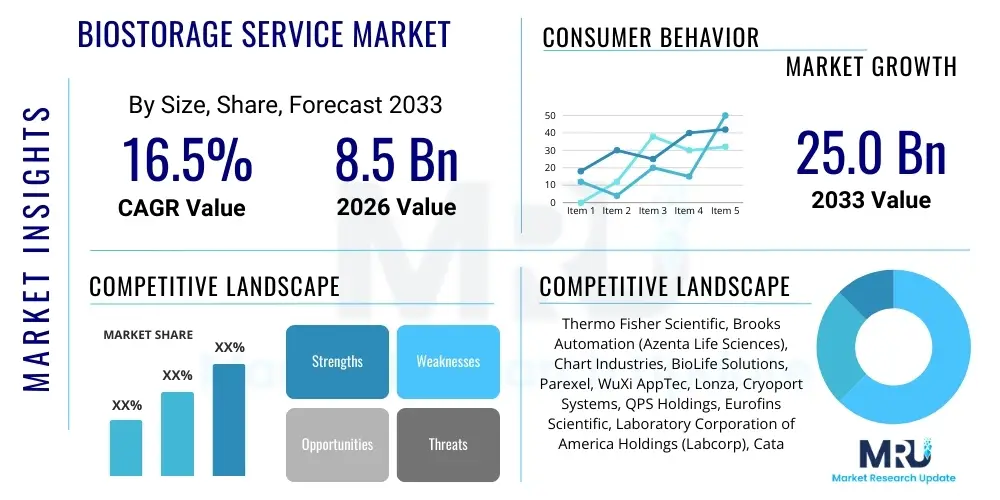

The Biostorage Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.5% between 2026 and 2033. The market is estimated at USD 8.5 billion in 2026 and is projected to reach USD 25.0 billion by the end of the forecast period in 2033. This significant expansion is primarily driven by the escalating demand for outsourced biological sample management, rigorous regulatory requirements for sample integrity, and the booming fields of biopharmaceuticals and personalized medicine.

Biostorage Service Market introduction

The Biostorage Service Market encompasses the specialized facilities and logistical operations dedicated to the preservation, inventory management, and retrieval of biological materials such as human tissues, blood components, nucleic acids, cell lines, and other crucial biospecimens. These services are vital for maintaining the viability and integrity of samples over extended periods, often requiring ultra-low or cryogenic temperatures to ensure scientific validity for future research, clinical trials, and therapeutic development. Outsourced biostorage provides specialized infrastructure, sophisticated monitoring systems, and expertise that many research institutions and small biotech firms cannot sustain internally, thereby ensuring regulatory compliance (like FDA and EMA guidelines) and minimizing the risk of sample degradation or loss.

The core product delivered by this market is the reliable, long-term preservation of high-value biological assets, categorized by temperature ranges (ambient, refrigerated, frozen, and cryogenic, including liquid nitrogen storage). Major applications span across academic and government research, pharmaceutical and biotechnology companies utilizing samples for drug discovery and biomarker identification, and clinical trials requiring secure long-term archival of patient specimens. The benefit of utilizing third-party biostorage services includes capital expenditure avoidance, access to validated quality management systems, enhanced security against environmental hazards, and improved tracking capabilities, which accelerate the pace of scientific discovery and clinical validation processes.

Driving factors propelling market growth include the explosive increase in complex biological research, particularly in genomics, proteomics, and cell and gene therapies, which rely heavily on high-quality, traceable biospecimens. Furthermore, the global proliferation of clinical trials, coupled with mandated archival periods for regulatory evidence, continuously necessitates professional, high-capacity storage solutions. The shift towards personalized medicine, requiring extensive biobanking of patient cohorts, further solidifies the essential role of specialized biostorage services in the modern biomedical ecosystem. The market’s evolution is characterized by continuous advancements in automation and monitoring technologies to ensure maximum sample safety and traceability.

Biostorage Service Market Executive Summary

The Biostorage Service Market is experiencing robust acceleration fueled by transformative business trends, particularly the increasing preference for fully outsourced biobanking models over in-house operations to manage specialized logistics and regulatory burdens. Key business trends indicate a move toward integrated service offerings, where storage is bundled with sample processing, quality control, and advanced data management systems (LIMS), providing end-to-end solutions for pharmaceutical and biotech clients. Mergers and acquisitions among service providers are also consolidating the market, allowing larger entities to offer geographically diverse and harmonized global storage networks, critical for international clinical trials and research consortia requiring standardized handling protocols.

Regionally, North America maintains market dominance due to its highly concentrated pharmaceutical R&D spending, extensive network of large academic research institutions, and early adoption of advanced cryopreservation technologies. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, driven by significant government investments in genomic research, burgeoning clinical trial activity in countries like China and India, and the establishment of large-scale population biobanks. Europe remains a strong market, characterized by mature national biobanking infrastructures and strict regulatory environments that necessitate high-compliance storage solutions, thereby favoring professional third-party services.

Segment trends reveal that the human biospecimen segment, encompassing clinical trial and diagnostic samples, continues to hold the largest market share due to the persistent demand from oncology and immunology research. Services centered on cryogenic storage (sub-zero temperatures, often liquid nitrogen based) are experiencing the highest growth rate, necessitated by the storage requirements of sensitive cell and gene therapy components and advanced biological materials. Furthermore, the trend among end-users shows that pharmaceutical and biotechnology companies are the primary revenue generators, although academic and governmental biobanks are rapidly professionalizing their operations, increasingly seeking external specialized support for large-scale, long-term archival projects.

AI Impact Analysis on Biostorage Service Market

User inquiries regarding the influence of Artificial Intelligence (AI) on biostorage services overwhelmingly center on how AI can enhance efficiency, mitigate human error, and ensure sample integrity at an unprecedented scale. Common questions revolve around AI’s role in predicting equipment failure, optimizing sample placement for energy efficiency and rapid retrieval, and augmenting quality control processes to detect potential degradation before it occurs. The market consensus summarized through these queries is that AI's primary value proposition lies in transforming passive storage facilities into intelligent, predictive ecosystems. AI integration is expected to drastically reduce operational risks associated with temperature excursions, improve inventory accuracy through advanced image recognition and robotics, and streamline the logistical complexity inherent in managing millions of distinct biological assets across global networks. This shift allows biostorage providers to offer higher reliability and significantly reduced turnaround times, positioning AI as a crucial differentiator in competitive service delivery.

- AI-driven Predictive Maintenance: Utilizing sensor data to anticipate failures in ultra-low temperature freezers or monitoring equipment, minimizing sample loss risk.

- Automated Sample Inventory Management: Implementing machine vision and deep learning algorithms for real-time tracking, verifying sample locations, and ensuring audit compliance without manual checks.

- Logistical Route Optimization: AI algorithms optimize retrieval pathways for robotic systems, minimizing door-open time and maintaining thermal stability during sample handling.

- Enhanced Quality Control (QC): Analyzing cryopreservation data and thaw records to identify best practices and flag samples exhibiting potential viability issues based on stored environmental parameters.

- Resource and Energy Efficiency: Optimizing freezer mapping and power consumption by analyzing usage patterns and minimizing required cooling cycles based on sample stability profiles.

- Advanced Data Integration: AI facilitates seamless integration between LIMS, environmental monitoring systems, and client data portals, improving traceability and reporting complexity.

DRO & Impact Forces Of Biostorage Service Market

The Biostorage Service Market is shaped by powerful Drivers that promote outsourcing and specialized care, counterbalanced by inherent Restraints tied to cost and complexity, while substantial Opportunities emerge from new therapeutic modalities. The primary driver is the exponential growth of biological research, particularly in areas requiring extensive sample sets, such as personalized medicine and complex clinical trials that necessitate standardized, high-quality archival systems. Simultaneously, the strict regulatory landscape imposed by global health authorities mandates robust audit trails and impeccable sample integrity, compelling institutions to turn to specialized providers capable of meeting these stringent compliance requirements efficiently. These drivers create an upward pressure on market expansion, solidifying the need for professional third-party management.

However, the market faces significant restraints, including the inherently high capital investment required for establishing and maintaining specialized, highly reliable cryogenic infrastructure, which increases operational costs and consequently raises service pricing for end-users. Regulatory heterogeneity across different geographical regions presents a logistical challenge, requiring providers to manage varied legal requirements concerning sample ownership, transfer, and destruction, which complicates international service delivery. Furthermore, concerns regarding the security and confidentiality of highly sensitive patient data linked to biological samples (HIPAA/GDPR compliance) represent a persistent barrier that service providers must constantly address through rigorous security protocols.

Opportunities for growth are abundant, primarily stemming from the rapid development of cell and gene therapies, which require extremely specialized and high-volume cryogenic storage capabilities that exceed standard biobanking practices. Emerging markets, especially in APAC and Latin America, present untapped potential as R&D activities and outsourced clinical trials escalate in these regions, creating demand for localized, compliant storage facilities. Furthermore, the increasing adoption of automated biostorage solutions (robotic freezers and automated tracking) offers a pathway for providers to improve efficiency and scalability, ultimately lowering the long-term cost of service delivery and enhancing competitiveness within the market structure.

Segmentation Analysis

The Biostorage Service Market is comprehensively segmented based on the type of sample being stored, the storage temperature regime required, the service offering model, and the primary end-user industry. Analyzing these segments provides critical insights into specific demand drivers and high-growth areas. The segmentation based on sample type reveals that human biospecimens dominate the market due to their central role in clinical diagnostics and drug development, though microbial and animal cell lines also constitute significant portions necessary for vaccine production and veterinary medicine. Temperature-based segmentation highlights the growing significance of cryogenic storage as cell and gene therapy components, which demand ultra-low preservation temperatures (below -130°C), gain regulatory approval and commercial traction globally.

Service-wise, the market is categorized into physical storage, sample processing, and comprehensive logistics services. While physical storage remains the foundational service, the trend is moving towards integrated offerings, where companies seek providers who can manage everything from initial sample collection and processing (e.g., nucleic acid extraction) to final logistical delivery for downstream analysis. End-user analysis clearly shows that the pharmaceutical and biotechnology sector is the largest revenue contributor, consistently requiring vast storage capacity and sophisticated handling for R&D pipelines and clinical trial materials. This complex segmentation underscores the market's specialization and the requirement for providers to offer highly customized solutions tailored to specific biological and regulatory needs of diverse clientele.

- By Sample Type:

- Human Biospecimens (Tissues, Blood, Urine, DNA/RNA)

- Cell Lines and Cell Banks (Mammalian, Microbial)

- Vaccines and Therapeutics

- Animal Samples

- Pathogens and Microorganisms

- By Temperature Range:

- Cryogenic Storage (<-130°C, Liquid Nitrogen)

- Ultra-Low Temperature Freezing (-80°C to -130°C)

- Refrigerated Storage (2°C to 8°C)

- Ambient Storage

- By Service Offering:

- Storage and Archival

- Sample Processing and Handling

- Retrieval, Packaging, and Logistics

- Quality Control and Assurance

- By End-User:

- Pharmaceutical and Biotechnology Companies

- Academic Research Institutes and Universities

- Biobanks and Clinical Laboratories

- Government Agencies and Public Health Organizations

Value Chain Analysis For Biostorage Service Market

The Biostorage Service Market value chain is structured around the integrity and reliable transfer of high-value biological assets, commencing with upstream activities focused on preparation and procurement of raw materials, and extending through specialized processing and distribution. Upstream analysis involves the procurement and maintenance of highly specialized equipment, including validated ultra-low temperature freezers, cryogenic tanks, advanced temperature monitoring systems, and robust power backup infrastructure. This phase also includes the essential development and validation of Standard Operating Procedures (SOPs) for collection, receipt, and initial processing of diverse biological samples, requiring significant expertise in biology and engineering to ensure compliance with quality standards like ISO certification and Good Manufacturing Practice (GMP) guidelines.

The core of the value chain is the midstream service delivery, characterized by the meticulous long-term storage, inventory management (utilizing Laboratory Information Management Systems or LIMS), and continuous environmental monitoring to guarantee sample viability. Downstream analysis focuses on the final delivery and distribution channel, which is crucial for maintaining the cold chain during transfer to the end-user for research or clinical analysis. Distribution channels are predominantly direct, involving specialized, temperature-controlled logistics networks (cold chain shipping) managed internally or through dedicated third-party logistics (3PL) providers experienced in handling high-risk biological materials. The indirect channel is less common but can involve partnerships with broader clinical trial service organizations that subcontract the physical storage components.

Effective management across this chain requires seamless coordination between logistics, IT infrastructure, and scientific personnel. Direct interaction with end-users ensures that customized storage conditions and retrieval protocols are met, which is particularly vital for highly sensitive materials like advanced cell therapies. The integrity of the data linking the physical sample to its clinical context is as critical as the physical preservation itself; thus, the integration of validated LIMS with client interfaces represents a major value addition, ensuring transparency, traceability, and regulatory readiness throughout the entire lifecycle of the biospecimen.

Biostorage Service Market Potential Customers

Potential customers for the Biostorage Service Market are diverse, highly regulated entities that generate or utilize high-value biological samples critical for health outcomes and scientific advancement. The primary end-users are pharmaceutical and biotechnology companies, which require extensive archival of samples generated during preclinical development and global clinical trials for drug efficacy, safety assessment, and biomarker discovery. These firms necessitate outsourced services to manage the sheer volume and the mandatory long archival periods stipulated by regulatory bodies like the FDA, allowing them to focus internal resources on core drug development activities rather than infrastructure management.

Another crucial segment comprises academic research institutions and government-funded biobanks, which manage large-scale population cohorts or disease-specific specimen collections essential for public health research and collaborative scientific endeavors. While historically these entities managed storage in-house, resource constraints, increasing sample complexity (e.g., massive genomic datasets), and the need for standardized quality management are driving them towards professional external providers. Clinical laboratories, particularly those involved in diagnostic testing and personalized medicine initiatives, also represent a rapidly growing customer base, requiring secure, traceable storage for residual patient samples needed for future retrospective studies or quality assurance.

Furthermore, specialized segments such as regenerative medicine companies, contract research organizations (CROs), and firms developing advanced cell and gene therapies are increasingly reliant on high-compliance biostorage providers. These customers often require GMP-compliant facilities and highly specialized cryogenic handling expertise, placing high value on providers who can demonstrate impeccable quality systems and customized logistical capabilities for transporting and storing extremely temperature-sensitive therapeutic products and starting materials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 25.0 Billion |

| Growth Rate | 16.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Brooks Automation (Azenta Life Sciences), Chart Industries, BioLife Solutions, Parexel, WuXi AppTec, Lonza, Cryoport Systems, QPS Holdings, Eurofins Scientific, Laboratory Corporation of America Holdings (Labcorp), Catalent, SGS SA, Precision Bioservices, Biorepository Outsourcing Solutions (BOSS), Tecan Group, DNA Genotek, VWR International (Avantor), Charles River Laboratories, TTP Labtech. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Biostorage Service Market Key Technology Landscape

The technological evolution within the Biostorage Service Market is centered on three core principles: maintaining consistent temperature stability, ensuring high-throughput automation, and guaranteeing meticulous data traceability. Modern biostorage facilities heavily rely on advanced cryogenic systems, primarily utilizing liquid nitrogen vapor phase storage to achieve temperatures below -150°C, which is critical for preserving cell viability without the risk of immersion contamination often associated with liquid phase storage. This infrastructure is underpinned by highly redundant power systems, often incorporating complex diesel generator backups and uninterruptible power supplies (UPS), ensuring thermal integrity even during prolonged power outages, which is a major technological requirement for regulatory compliance and risk mitigation.

Automation and robotics constitute another foundational technological pillar. Automated ultra-low temperature storage systems (AUTS), like robotic biobanks, are increasingly employed to handle massive volumes of samples (millions of vials) without manual intervention. These systems utilize robotic arms for sample retrieval and placement, minimizing the exposure of samples to warmer ambient air (door-open events) and drastically reducing human error in inventory management. The integration of high-density storage formats, such as 2D-barcoded tubes and microplates, coupled with sophisticated barcoding and optical reading technology, enables rapid, error-free identification and tracking necessary for efficient large-scale operations.

Finally, the entire process is managed by sophisticated Laboratory Information Management Systems (LIMS), which serve as the central nervous system of the biostorage facility. Modern LIMS are cloud-enabled, providing real-time data access for clients and integrating seamlessly with environmental monitoring devices (sensors tracking temperature, humidity, and CO2). These integrated IT platforms not only manage inventory location and chain of custody but also perform complex data analytics, offering crucial insights into sample usage patterns, regulatory compliance reporting, and predictive maintenance alerts. The synergy between physical infrastructure, automation, and advanced IT guarantees the required level of security and efficiency demanded by the contemporary biomedical sector.

Regional Highlights

Regional dynamics play a significant role in shaping the demand and operational models within the Biostorage Service Market, dictated primarily by research intensity, regulatory maturity, and investment levels in biotech infrastructure.

- North America (USA and Canada): This region holds the largest market share due to unparalleled spending on pharmaceutical research and development, a robust and mature biotech ecosystem, and a high concentration of sophisticated biobanks and academic medical centers. Strict regulatory requirements set by the FDA necessitate high-compliance storage solutions, driving widespread adoption of outsourced services, particularly for complex and high-volume clinical trial archival.

- Europe (Germany, UK, France): Characterized by strong national biobanking initiatives and collaborative European research networks, Europe is a major consumer of biostorage services. Stringent data privacy regulations (GDPR) alongside high standards for sample traceability and quality (EMA guidelines) mandate advanced LIMS integration and validated service providers. The UK and Germany, specifically, exhibit strong demand fueled by leading pharmaceutical hubs and cell/gene therapy development.

- Asia Pacific (APAC) (China, India, Japan, South Korea): APAC is projected to be the fastest-growing region. This growth is driven by massive governmental investments in genomics and personalized medicine, increasing outsourcing of clinical trials to the region due to lower costs, and rapid infrastructural development establishing state-of-the-art biobanks. China and India are emerging as critical centers for high-volume storage demand, although the regulatory landscape is still maturing compared to Western markets.

- Latin America (LATAM): The market here is emerging, primarily focused on supporting regional clinical trials and public health initiatives. Growth is steady but constrained by lower R&D expenditure relative to North America and Europe. Key demand centers include Brazil and Mexico, where providers often focus on tailored, cost-effective cold chain logistics and storage solutions.

- Middle East and Africa (MEA): This region represents the smallest market share, but growth is accelerating, particularly in the Gulf Cooperation Council (GCC) countries, driven by ambitious healthcare modernization projects and localized genomic research initiatives. Challenges include extreme environmental conditions necessitating highly robust cold chain infrastructure and nascent regulatory frameworks, often requiring service providers to operate under European or American compliance standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Biostorage Service Market.- Thermo Fisher Scientific Inc.

- Brooks Automation (Azenta Life Sciences)

- BioLife Solutions Inc.

- Chart Industries Inc.

- Laboratory Corporation of America Holdings (Labcorp)

- Eurofins Scientific SE

- Catalent Inc.

- WuXi AppTec Co. Ltd.

- Parexel International Corporation

- Lonza Group AG

- QPS Holdings LLC

- Cryoport Systems LLC

- SGS SA

- Precision Bioservices Inc.

- Biorepository Outsourcing Solutions (BOSS)

- Tecan Group Ltd.

- DNA Genotek Inc.

- VWR International LLC (Avantor)

- Charles River Laboratories International Inc.

- TTP Labtech Ltd.

Frequently Asked Questions

Analyze common user questions about the Biostorage Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of growth in the Biostorage Service Market?

The primary growth driver is the escalating demand from the pharmaceutical and biotechnology sectors, specifically due to the proliferation of complex clinical trials and the development of advanced therapies, such as cell and gene therapies, which require high-compliance, ultra-low temperature cryogenic storage and rigorous chain-of-custody management.

How is Artificial Intelligence (AI) being utilized to enhance biostorage security?

AI enhances biostorage security by implementing predictive maintenance algorithms that monitor environmental sensors to anticipate equipment failures (like ultra-low freezer malfunctions), thereby drastically reducing the risk of catastrophic temperature excursions and subsequent sample loss.

Which geographical region is currently leading the global Biostorage Service Market?

North America currently leads the global market due to its mature pharmaceutical and biotechnology R&D infrastructure, high level of capital investment in healthcare, and strict adherence to regulatory standards (FDA) that favor outsourced, specialized sample management solutions.

What is the difference between cryogenic and ultra-low temperature storage in this market?

Ultra-low temperature storage typically refers to mechanical freezing between -80°C and -130°C, suitable for many standard tissue and plasma samples. Cryogenic storage involves temperatures below -130°C, usually achieved using liquid nitrogen vapor phase, which is essential for preserving highly sensitive materials like viable cells and specialized therapeutic components.

What are the main regulatory concerns impacting biostorage service providers?

Main regulatory concerns include adherence to Good Laboratory Practice (GLP) and Good Manufacturing Practice (GMP) standards, maintaining complete and accurate Chain of Custody documentation, ensuring compliance with global data privacy laws (like HIPAA and GDPR), and meeting mandated archival periods for clinical trial materials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager