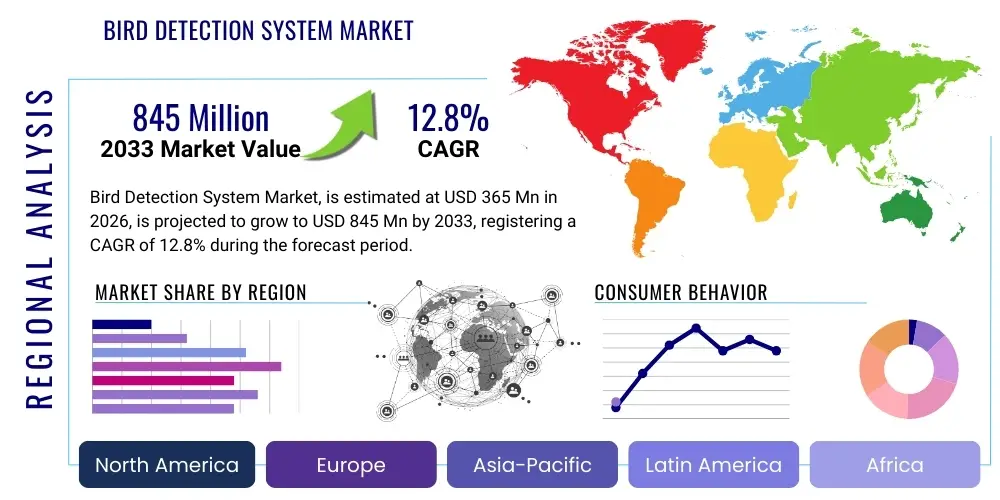

Bird Detection System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431651 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Bird Detection System Market Size

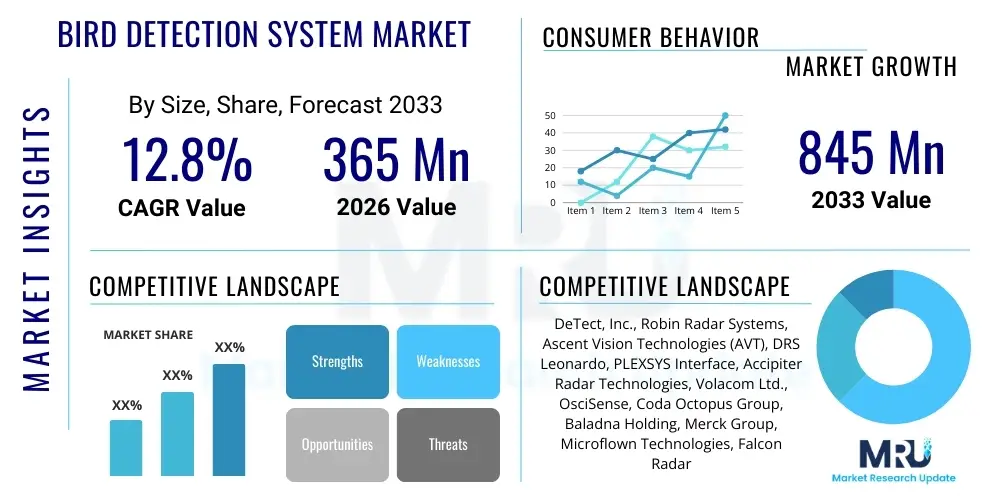

The Bird Detection System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at $365 Million in 2026 and is projected to reach $845 Million by the end of the forecast period in 2033.

Bird Detection System Market introduction

The Bird Detection System (BDS) Market encompasses advanced technological solutions designed to monitor, track, and mitigate avian presence, primarily to prevent bird strikes in aviation, protect renewable energy infrastructure (such as wind farms), and manage wildlife near critical industrial sites. These systems leverage sophisticated technologies including radar, electro-optical/infrared (EO/IR) cameras, acoustic sensors, and artificial intelligence (AI) to provide real-time situational awareness regarding avian movements. The core product offering involves integrated hardware and software platforms capable of automatically identifying species, estimating flock density, and predicting flight paths, which is crucial for safety and environmental compliance.

Major applications for BDS are predominantly found within the aerospace and defense sectors, where reducing the incidence of bird strikes (wildlife hazards) is paramount for aircraft safety and operational efficiency. Furthermore, the proliferation of wind energy has created a significant demand, as regulatory bodies mandate the protection of migratory bird populations from turbine interaction. These systems not only enhance safety protocols but also support environmental stewardship by providing data necessary for effective wildlife management plans and conservation efforts, ensuring projects adhere to ecological standards and minimize downtime caused by avian-related incidents. The robustness and accuracy of modern BDS are continually improving through sensor fusion and machine learning algorithms.

The market is fundamentally driven by stringent governmental regulations concerning wildlife mitigation, particularly those enforced by aviation authorities (FAA, EASA) and environmental protection agencies globally. Key benefits include drastically improved operational safety in airport environments, reduced economic losses associated with aircraft damage or energy production downtime, and enhanced compliance with biodiversity conservation laws. These driving factors, combined with technological advancements making systems more accurate and cost-effective, position the BDS market for sustained, rapid expansion across diverse industrial landscapes seeking proactive environmental risk management solutions.

Bird Detection System Market Executive Summary

The Bird Detection System Market exhibits strong growth, underpinned by escalating demand from the aviation sector seeking superior bird strike prevention technologies and the rapidly expanding renewable energy sector, specifically onshore and offshore wind farms, requiring effective mitigation measures to comply with ecological mandates. Business trends indicate a decisive shift towards fully integrated, AI-driven solutions that offer predictive capabilities rather than merely reactive monitoring. Key market players are prioritizing sensor fusion—combining radar, thermal, and visual data—to minimize false positives and enhance detection range and accuracy, leading to greater operational reliability for end-users. Consolidation is observable among niche technology providers being acquired by larger defense or environmental consulting firms looking to offer comprehensive turnkey wildlife monitoring services.

Regionally, North America and Europe maintain dominance, driven by mature regulatory frameworks (FAA/EASA standards) and significant investments in both military and commercial aviation infrastructure modernization. These regions are also characterized by high penetration rates of wind energy, necessitating advanced monitoring systems for migratory bird protection. However, the Asia Pacific (APAC) region is projected to register the highest growth rate during the forecast period. This acceleration is attributed to massive ongoing airport expansion projects, rapid deployment of renewable energy capacity (especially in China and India), and increasing government awareness regarding biodiversity conservation, prompting major infrastructure operators to adopt proactive wildlife management strategies.

Segment trends reveal that the Technology segment is heavily leaning towards Radar-based systems due to their all-weather capability and long-range surveillance capacity, although complementary Electro-Optical (EO/IR) systems are essential for detailed species identification and close-range verification. By Application, Aviation Safety continues to hold the largest market share, but the Renewable Energy segment is expected to demonstrate the fastest growth due to global decarbonization efforts and the subsequent proliferation of utility-scale solar and wind projects. Furthermore, the market for mobile and drone-based BDS solutions is emerging as a critical niche for surveying remote or temporary operational sites, offering flexibility beyond fixed installations.

AI Impact Analysis on Bird Detection System Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Bird Detection System Market primarily center on three themes: accuracy improvement, automation potential, and integration challenges. Users are keenly interested in how machine learning algorithms enhance the reliability of bird identification—differentiating between avian species, small drones, or environmental clutter—thereby minimizing costly false alarms that plague traditional radar systems. Furthermore, there is significant curiosity regarding AI's role in predictive modeling, specifically the ability to forecast high-risk avian activity periods based on historical, meteorological, and environmental data, moving monitoring from reactive detection to proactive threat mitigation. The integration concern revolves around ensuring seamless interoperability between proprietary sensor hardware and standardized AI platforms, guaranteeing rapid data processing and actionable insights for real-time risk response teams in high-stakes environments like active airport runways or critical wind farm locations.

AI transforms raw sensor data into actionable intelligence by applying deep learning networks to visual, thermal, and acoustic inputs. This capability fundamentally addresses the historical challenge of accurate species classification and trajectory plotting, allowing systems to precisely characterize threats. For instance, AI enables the system to learn the typical flight patterns of local endemic species versus transient migratory flocks, ensuring that mitigation efforts, such as auditory deterrents or operational adjustments, are executed only when necessary and targeted appropriately. This precision reduces energy consumption and minimizes operational disruptions, driving significant value for airport authorities and energy producers.

The future trajectory of the BDS market is intrinsically linked to advancements in AI. Generative Engine Optimization (GEO) suggests that content revolving around automated decision support systems—where AI recommends specific deterrence actions (e.g., sonic dispersal, temporary turbine shutdown) without human intervention—will become highly sought after. AI also facilitates the development of self-calibrating systems that adjust sensor parameters based on changing environmental conditions (fog, rain, dust), ensuring persistent high performance. Ultimately, AI shifts the BDS product offering from simple detection to holistic, intelligent wildlife risk management platforms, driving down operational costs and vastly improving compliance outcomes across all application sectors.

- AI significantly enhances detection accuracy and reduces false positive rates across radar and visual monitoring systems.

- Machine learning algorithms enable precise species identification and classification, crucial for targeted mitigation strategies.

- Predictive analytics powered by AI allows for forecasting high-risk avian activity windows based on weather and migration patterns.

- AI supports the development of automated deterrence protocols, minimizing human intervention in real-time safety critical scenarios.

- Deep learning optimizes sensor fusion, seamlessly integrating data from radar, EO/IR, and acoustic sensors for comprehensive situational awareness.

- Computer vision algorithms provide real-time trajectory tracking and speed estimation, critical for calculating collision risk probability.

DRO & Impact Forces Of Bird Detection System Market

The dynamics of the Bird Detection System market are shaped by powerful Drivers, inherent Restraints, substantial Opportunities, and external Impact Forces. The primary drivers include the universally recognized need to enhance safety in military and commercial aviation, coupled with strict global regulatory mandates imposed on wind energy operators to protect avifauna. These regulations often necessitate continuous, verifiable monitoring, creating mandatory market demand for advanced BDS solutions. Restraints primarily involve the high initial capital expenditure required for deploying sophisticated radar and EO/IR systems, alongside the technical complexity associated with system maintenance and calibration in varying geographical and meteorological environments. Furthermore, system performance can be momentarily degraded by extreme weather, which presents a limiting factor requiring technological mitigation.

Significant opportunities are emerging from two key areas: the rapid global expansion of offshore wind farms, which require bespoke, marine-hardened detection systems, and the increasing adoption of drone technology for localized, flexible aerial surveillance and deterrence capabilities. These areas open new, high-value avenues for manufacturers to develop specialized equipment and software tailored to challenging environmental conditions and variable operational scales. Moreover, the integration of advanced data analytics and predictive modeling capabilities offers market players a chance to differentiate their offerings by providing comprehensive environmental risk assessment services, moving beyond mere hardware supply.

Impact forces influencing market trajectory include continuous technological innovation, particularly in phased array radar technology and low-cost sensor development, making sophisticated systems more accessible to smaller airports and regional energy projects. Regulatory enforcement, especially following high-profile bird strike incidents or breaches of environmental permits, acts as a powerful external impact force, compelling rapid compliance adoption. Geopolitical trends influencing defense spending and major infrastructure investments also significantly impact the demand for high-end, military-grade detection systems, ensuring sustained investment in this critical safety technology globally. The pressure for environmental, social, and governance (ESG) compliance further solidifies the need for verifiable, high-integrity bird detection and mitigation measures across all infrastructure projects.

Segmentation Analysis

The Bird Detection System Market is meticulously segmented based on Technology, Application, Installation, and Geography to provide a granular understanding of market dynamics and opportunity mapping. This segmentation highlights the technological shifts driving system evolution and the diverse end-user requirements shaping product specialization. Analysis confirms that the core competitive advantage lies in integrating diverse technologies, such as radar and visual systems, to address specific challenges inherent to different applications, from ensuring zero bird strike tolerance at airbases to minimizing ecological footprint at large renewable energy sites.

The market structure reflects a growing preference for multi-sensor integration, driven by the need for enhanced reliability and accuracy under varying operational conditions. While radar remains the backbone for long-range detection and all-weather capability, the increasing sophistication of thermal and visual cameras, combined with AI-driven object recognition, is crucial for close-range confirmation and precise species identification. Understanding these segmentation nuances allows stakeholders to strategically invest in technologies that offer the best performance-to-cost ratio for specific applications, such as highly portable systems for temporary construction sites versus fixed, high-redundancy systems for major international airports.

Regional segmentation underscores the distinct regulatory environments influencing purchasing decisions, with North America and Europe emphasizing high-specification, certified equipment, while emerging markets in APAC focus on scalable and adaptable solutions for rapidly developing infrastructure. The detailed breakdown of segments provides a crucial roadmap for manufacturers to align their product development pipelines with the highest growth sectors, particularly focusing on the fast-growing renewable energy and critical infrastructure protection applications where environmental compliance is a prerequisite for project approval and operation.

- By Technology:

- Radar Systems (e.g., Surveillance Radar, Phased Array Radar)

- Electro-Optical/Infrared (EO/IR) Systems

- Acoustic/Sound Monitoring Systems

- Integrated Sensor Fusion Systems

- By Application:

- Aviation Safety (Commercial Airports, Military Airbases)

- Renewable Energy (Wind Farms – Onshore and Offshore, Solar Farms)

- Critical Infrastructure Protection (Bridges, Communication Towers)

- Environmental Monitoring and Wildlife Management

- By Installation:

- Fixed/Permanent Systems

- Mobile/Portable Systems

- Drone-Based Monitoring

- By Component:

- Hardware (Sensors, Processors, Radars)

- Software (Detection Algorithms, Data Analytics, Visualization Platforms)

- Services (Installation, Maintenance, Training)

Value Chain Analysis For Bird Detection System Market

The Value Chain for the Bird Detection System Market begins with Upstream Analysis, which focuses heavily on the procurement and manufacturing of sophisticated components. This includes specialized sensor hardware such as high-frequency radar transmitters, advanced thermal imaging cores, high-resolution cameras, and robust computing platforms necessary for real-time data processing. Key upstream players are often niche technology providers specializing in aerospace-grade sensor manufacturing and AI/Machine Learning algorithm development. Quality control and supply chain reliability for specialized components like gallium nitride (GaN) transistors, critical for radar performance, are paramount at this stage, setting the technological standard for the final product and influencing overall system cost.

The midstream stage involves system integration, software development, and assembly. This is where market differentiators establish their competitive edge by developing proprietary sensor fusion software and intuitive user interfaces. Major BDS providers integrate components, rigorously test system accuracy and environmental resilience, and secure necessary regulatory certifications (e.g., aviation safety clearances). Distribution channels are critical and often bifurcated: Direct sales are common for large, customized contracts with government agencies (military bases or federal aviation authorities) and major energy developers. Indirect channels utilize specialized environmental consulting firms or system integrators who bundle BDS solutions with broader wildlife mitigation services, providing local support and regional expertise.

Downstream analysis focuses on installation, ongoing maintenance, and the provision of data analytics services to end-users. After initial deployment at sites such as international airports or remote offshore wind facilities, the value shifts towards continuous operational support and the interpretation of monitoring data. Customers rely on high-fidelity reporting for compliance and operational decision-making. Potential customers, including airport wildlife managers and wind farm operations directors, require specialized training to effectively utilize the platform's predictive capabilities. The lifecycle value is increasingly captured through long-term service contracts covering software updates, hardware recalibration, and specialized consulting on mitigating newly identified avian risks.

Bird Detection System Market Potential Customers

The primary end-users and buyers of Bird Detection Systems fall into distinct high-value segments characterized by stringent safety requirements, large infrastructure investments, and mandatory regulatory compliance. The Aviation Sector, encompassing commercial airports and military airbases globally, represents the largest customer segment. These entities are mandated to manage the critical risk of bird strikes, which pose severe threats to aircraft safety and incur enormous maintenance costs. Customers in this segment seek highly reliable, certified systems with proven performance under various operational conditions, prioritizing speed, accuracy, and seamless integration with existing air traffic management systems and airport wildlife hazard management programs.

The second major cohort comprises the Renewable Energy sector, particularly large-scale developers and operators of onshore and offshore wind farms. As global renewable capacity expands, developers face increasing scrutiny and legal requirements to minimize avian mortality and habitat disruption. These potential customers require sophisticated, continuous monitoring solutions that can verify compliance with environmental impact assessments and, crucially, automate mitigation responses, such as feathering turbines in the event of high-risk bird activity. Their purchasing decisions are heavily influenced by regulatory approvals, system resilience in harsh environments (e.g., marine corrosion), and the system's ability to provide verifiable, audit-ready data for government regulators.

Other vital potential customers include national defense organizations, critical infrastructure operators (such as power generation facilities, communication towers, and major bridge authorities), and specialized environmental consulting firms acting on behalf of industrial clients. These buyers seek systems for perimeter security, asset protection, and specific wildlife research applications. The common denominator among all potential customers is the need for a system that provides actionable, real-time intelligence to prevent asset damage, ensure public safety, and maintain environmental integrity, thereby justifying the substantial investment in advanced surveillance technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $365 Million |

| Market Forecast in 2033 | $845 Million |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DeTect, Inc., Robin Radar Systems, Ascent Vision Technologies (AVT), DRS Leonardo, PLEXSYS Interface, Accipiter Radar Technologies, Volacom Ltd., OsciSense, Coda Octopus Group, Baladna Holding, Merck Group, Microflown Technologies, Falcon Radar Systems, FLIR Systems, Xandar Kardian, Terma A/S, Searadar, Vayu Robotics, Aerotract, Blighter Surveillance Systems |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bird Detection System Market Key Technology Landscape

The technological landscape of the Bird Detection System Market is characterized by a drive towards multi-spectral sensing and enhanced data processing capabilities, moving beyond single-source detection. Radar remains the foundational technology, utilizing specialized, low-power pulse Doppler and frequency-modulated continuous wave (FMCW) radar systems optimized for detecting small, fast-moving, non-metallic objects at long ranges (up to several kilometers). Recent innovations focus on solid-state phased array radar, which allows for electronic steering of the beam without mechanical movement, enhancing scan speed, reliability, and precision while reducing maintenance overhead. These systems are crucial for maintaining continuous 360-degree surveillance in high-traffic or large-area operational environments, such as major international airports or expansive offshore wind parks, where early warning is paramount.

Complementary to radar are Electro-Optical/Infrared (EO/IR) systems, which provide the high-resolution visual confirmation necessary for species identification and accurate trajectory confirmation, particularly when birds enter proximity zones. Modern BDS utilize high-definition visual cameras coupled with thermal imaging capabilities. Thermal sensing is vital for night operation and low-visibility conditions, ensuring consistent performance regardless of lighting. The convergence of these hardware inputs is managed by sophisticated sensor fusion software, leveraging machine learning algorithms to correlate radar tracks with visual identification data. This fusion significantly reduces ambient clutter and false alarms, increasing the system's operational credibility and effectiveness for mandatory safety protocols.

Furthermore, the integration of acoustic monitoring and advanced data analytics platforms defines the cutting edge of this market. Acoustic sensors, often deployed passively, use machine learning to identify specific bird calls, providing a non-visual layer of detection that assists in characterizing localized avian activity. The true technological differentiator, however, lies in the accompanying software platforms, which manage the enormous volume of data generated by the sensors. These platforms incorporate predictive modeling based on historical migration data, local weather patterns, and time-of-day variables to offer risk forecasting. This proactive technological capability transforms system output from simple alerts into comprehensive, automated mitigation recommendations, aligning perfectly with the core principles of Generative Engine Optimization by providing direct, actionable answers to safety and compliance questions.

Regional Highlights

Regional dynamics significantly shape the Bird Detection System Market, driven by distinct regulatory landscapes, investment levels in critical infrastructure, and geographic avian biodiversity concerns. North America, primarily led by the United States, commands a substantial market share. This dominance stems from the stringent oversight maintained by the Federal Aviation Administration (FAA) regarding airport wildlife hazard management, necessitating mandatory radar-based systems for large airports. Furthermore, significant investment in military aviation and the rapid growth of large utility-scale wind energy projects in the Midwest and coastal areas fuel demand for high-specification BDS solutions that comply with both safety and environmental permitting requirements. The US market is characterized by technological maturity and a high adoption rate of integrated AI solutions.

Europe represents the second largest market, where demand is fueled by the EU’s strong focus on environmental conservation directives (Habitats Directive and Birds Directive) and the region’s global leadership in offshore wind energy development. Countries like the UK, Germany, and Denmark are major adopters, requiring specialized marine-hardened BDS for offshore turbines to monitor migratory pathways across the North and Baltic Seas. European procurement often emphasizes reliability and validated environmental performance data. The regulatory push across the continent ensures a steady demand, particularly for systems that can accurately measure and report avian mortality risk metrics to comply with national and European ecological standards.

The Asia Pacific (APAC) region is poised to exhibit the highest CAGR during the forecast period. This accelerated growth is primarily attributed to unprecedented investment in new airport construction and modernization programs across China, India, and Southeast Asia. As air traffic volumes surge, the need for robust aviation safety measures becomes acute. Simultaneously, the aggressive deployment of renewable energy capacity, especially in China’s vast territories, necessitates large-scale wildlife monitoring solutions. While initial adoption may prioritize cost-effectiveness, the increasing maturity of regulatory bodies in key nations will drive a shift toward advanced, certified BDS technology, creating lucrative opportunities for international manufacturers.

- North America (NA): Market leader due to strict FAA regulations, extensive military airbase requirements, and rapid expansion of large-scale onshore wind farms; focus on integrated radar and AI solutions.

- Europe: Strong growth driven by extensive offshore wind development, rigorous EU environmental directives (e.g., Birds Directive), and high demand for compliant monitoring systems in marine environments.

- Asia Pacific (APAC): Highest projected CAGR due to massive infrastructure investments in new airports, burgeoning renewable energy projects (China, India), and emerging government focus on wildlife conservation mandates.

- Latin America (LATAM): Emerging market driven by new airport developments and increasing awareness of ecological compliance related to resource extraction and infrastructure expansion; price sensitivity is a key factor.

- Middle East and Africa (MEA): Growth centered on massive regional aviation hubs (e.g., UAE, Qatar) seeking advanced safety technologies; regional challenges include extreme heat and dust affecting sensor performance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bird Detection System Market.- DeTect, Inc.

- Robin Radar Systems

- Ascent Vision Technologies (AVT)

- DRS Leonardo

- PLEXSYS Interface

- Accipiter Radar Technologies

- Volacom Ltd.

- OsciSense

- Coda Octopus Group

- Baladna Holding

- Merck Group

- Microflown Technologies

- Falcon Radar Systems

- FLIR Systems (Teledyne FLIR)

- Xandar Kardian

- Terma A/S

- Searadar

- Vayu Robotics

- Aerotract

- Blighter Surveillance Systems

Frequently Asked Questions

Analyze common user questions about the Bird Detection System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Bird Detection System and why is it essential for aviation safety?

The primary function of a Bird Detection System (BDS) is to provide real-time, automated surveillance of airspace to detect, track, and classify avian activity near critical infrastructure, particularly airport runways and flight paths. It is essential for aviation safety as it provides advanced warning of bird strikes, allowing air traffic control and wildlife management personnel to implement mitigation measures (like runway deterrents or temporary flight path changes), significantly reducing the risk of catastrophic aircraft damage and operational downtime. Radar and EO/IR technology are core to this early warning capability.

How do advanced Bird Detection Systems incorporate Artificial Intelligence (AI) to improve performance?

AI, specifically machine learning and computer vision, improves BDS performance by analyzing complex sensor data (radar tracks, visual footage, acoustic signatures). AI algorithms minimize false alarms by accurately distinguishing birds from environmental clutter (e.g., weather, small drones). Furthermore, AI enables species-specific identification and provides predictive modeling, forecasting high-risk periods based on learned migration patterns and real-time meteorological data, thereby optimizing resource allocation for wildlife hazard management.

Which end-user segment is expected to show the highest growth rate in the Bird Detection System Market?

The Renewable Energy segment, particularly wind farms (both onshore and offshore), is expected to demonstrate the highest Compound Annual Growth Rate (CAGR). This growth is driven by the global imperative for sustainable energy expansion coupled with increasingly stringent environmental regulations (mandates for avifauna protection). Advanced BDS are crucial for continuous compliance monitoring, automated turbine feathering, and providing verifiable data for ecological impact assessments, making them a necessity for new project development.

What are the main technical challenges restraining the widespread adoption of Bird Detection Systems?

The main challenges restraining adoption include the high initial capital investment required for installing complex multi-sensor platforms, particularly long-range radar systems. Technical constraints also involve system performance reliability under severe weather conditions (heavy rain, fog, high winds), which can temporarily degrade radar and visual detection accuracy. Additionally, the need for specialized technical expertise for ongoing calibration and maintenance represents a significant long-term operational cost for end-users.

What is the role of Electro-Optical/Infrared (EO/IR) technology in modern bird detection platforms?

EO/IR technology plays a critical, complementary role to radar in modern BDS. While radar handles long-range initial detection, EO/IR systems use high-resolution visual and thermal cameras to zoom in on targets detected by the radar. This capability is essential for confirming the target is avian, identifying the specific species (for targeted deterrence), and accurately tracking the bird or flock's trajectory in the proximity zone, ensuring high-fidelity, verifiable intelligence for immediate threat assessment and mitigation response.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Bird Detection Systems For Airports Market Size Report By Type (Fixed Bird Detection System for Airports, Mobile Bird Detection System for Airports), By Application (Small Airports, Medium Airports, Large Airports), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Bird Detection System Market Size Report By Type (Fixed Bird Detection System, Mobile Bird Detection System), By Application (Airport, Wind Farms, Bird Study and Protection), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Bird Detection System Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Fixed Bird Detection System, Mobile Bird Detection System), By Application (Airport, Wind Farms, Bird Study and Protection), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager