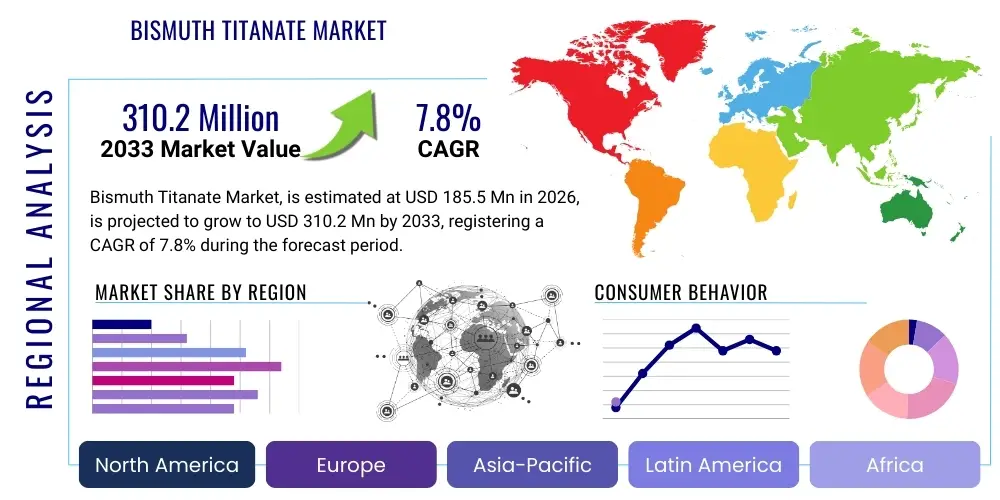

Bismuth Titanate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435686 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Bismuth Titanate Market Size

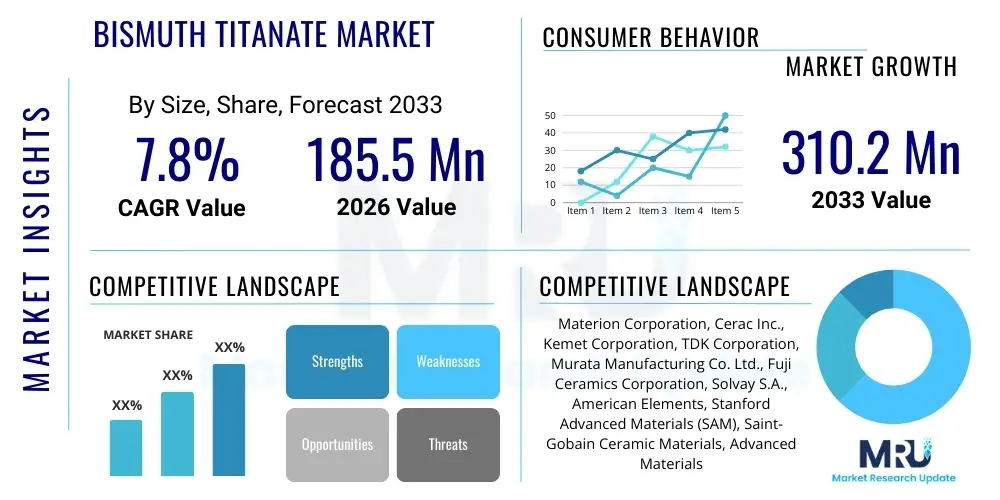

The Bismuth Titanate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 185.5 Million in 2026 and is projected to reach USD 310.2 Million by the end of the forecast period in 2033.

Bismuth Titanate Market introduction

Bismuth Titanate (Bi4Ti3O12, often abbreviated as BIT) is a complex, layered perovskite-like ferroelectric ceramic material highly valued for its unique dielectric, piezoelectric, and ferroelectric properties, particularly its fatigue-free nature. This advanced material finds critical application across various high-technology sectors, serving as a cornerstone for next-generation electronic components. Its crystal structure, characterized by bismuth oxide layers intergrowing with perovskite blocks, grants it superior anisotropic characteristics, making it distinct from traditional ferroelectric materials like PZT. The material's high Curie temperature and robust ferroelectric polarization retention capabilities ensure reliable performance under stringent operating conditions, facilitating its use in high-temperature environments and long-life electronic systems. The market landscape is predominantly shaped by the increasing demand for miniaturized, high-performance passive components capable of operating efficiently in demanding electronic circuitry, particularly within the burgeoning fields of IoT, 5G infrastructure, and advanced automotive electronics.

The primary applications of Bismuth Titanate span across non-volatile memory devices, high-k dielectric layers in capacitors, advanced sensors (pressure, acceleration, humidity), and high-frequency piezoelectric actuators. In memory technology, Bismuth Titanate is sought after for its potential in Ferroelectric Random Access Memory (FeRAM) due to its excellent fatigue resistance, which significantly extends the operational lifespan compared to conventional materials. Furthermore, its integration into Multilayer Ceramic Capacitors (MLCCs) allows for higher energy density and improved thermal stability, crucial factors for power electronics and hybrid vehicle systems. The material's utility is further extended into catalytic applications, where its semiconductor properties and structured lattice enable enhanced photochemical reactions, opening avenues in environmental remediation and sustainable energy generation.

Driving the expansion of the Bismuth Titanate market are several crucial factors, notably the global proliferation of sophisticated consumer electronics requiring compact, high-reliability components, and the significant governmental and private investments channeled into smart infrastructure development. The intrinsic benefits of Bismuth Titanate, such as its relatively low toxicity compared to lead-based ceramics, also align well with tightening global environmental regulations, positioning it as an eco-friendly substitute in various piezoelectric and ferroelectric applications. Its unique combination of stability, high polarization, and fatigue resistance makes it indispensable for creating sensors and actuators deployed in critical safety systems within aerospace and medical devices, thereby solidifying its market position as a key enabling material for advanced technological progress.

Bismuth Titanate Market Executive Summary

The Bismuth Titanate market demonstrates robust growth, primarily propelled by dynamic shifts in the electronics and automotive industries focusing on enhanced reliability and performance. Key business trends include substantial research and development efforts directed towards doping Bismuth Titanate with elements like Lanthanum or Vanadium to further optimize its ferroelectric and piezoelectric properties, enabling commercial viability in high-volume manufacturing processes. Strategic partnerships between material suppliers and electronic device manufacturers are becoming prevalent, aimed at scaling up production of thin films for FeRAM and micro-electromechanical systems (MEMS). Furthermore, the trend toward non-toxic materials is favoring Bismuth Titanate over PZT, especially in regions with strict environmental directives such as the European Union and specific parts of Asia Pacific. Manufacturers are also heavily investing in advanced synthesis techniques, such as hydrothermal and sol-gel methods, to produce ultra-fine, uniform powders required for advanced ceramic processing.

Regionally, the Asia Pacific (APAC) region dominates the Bismuth Titanate market, driven by the colossal presence of the electronics manufacturing base, particularly in countries like China, South Korea, and Japan. These countries are not only major consumers of Bismuth Titanate in capacitor and sensor manufacturing but are also centers for pioneering research in ferroelectric materials. North America and Europe follow, characterized by high adoption rates in aerospace, defense, and specialized automotive applications, where performance and reliability take precedence over cost optimization. The ongoing migration of manufacturing facilities and the establishment of new R&D centers in emerging economies within APAC ensure that this region maintains its leading market share, fueled by strong government support for semiconductor and advanced materials industries. Meanwhile, the Middle East and Africa (MEA) and Latin America are anticipated to exhibit steady, albeit slower, growth, linked primarily to infrastructure modernization and increasing penetration of consumer electronics.

Segment trends indicate that the application segment is heavily tilted towards piezoelectric devices and advanced capacitors. Within piezoelectric devices, the demand for highly sensitive pressure and strain sensors in industrial monitoring and healthcare wearables is significant. The capacitor segment is witnessing growth due to the integration of Bismuth Titanate thin films into high-density MLCCs required for 5G telecommunication infrastructure and electric vehicles (EVs). By type, modified Bismuth Titanate, which often incorporates dopants to enhance specific properties (e.g., fatigue resistance or coercive field), is gaining traction over pure, high-purity Bismuth Titanate, reflecting the industry's focus on tailored material solutions. End-use segment analysis highlights the electronics sector as the largest consumer, but the automotive segment is poised for the fastest expansion, driven by the electrification trend and the consequent requirement for robust, high-temperature dielectric and sensor components in EV battery management systems and autonomous driving platforms.

AI Impact Analysis on Bismuth Titanate Market

User inquiries regarding AI's impact on the Bismuth Titanate market typically center on how artificial intelligence and machine learning (ML) are accelerating material discovery, optimizing synthesis processes, and enhancing quality control. Common concerns revolve around whether AI can help overcome the intrinsic challenges of large-scale, cost-effective production, and if AI-driven simulations can replace extensive physical experimentation in the development of new Bismuth Titanate-based composites. Users frequently ask about the role of AI in predicting the long-term performance and fatigue characteristics of Bismuth Titanate thin films under operational stress, seeking affirmation that AI tools can reduce time-to-market for novel ferroelectric devices. The prevailing expectation is that AI will primarily serve as a powerful tool for predictive modeling, structure-property correlation analysis, and process optimization, ultimately reducing raw material waste and improving overall manufacturing consistency in this highly specialized material domain.

AI's application in materials informatics is revolutionizing the development cycle for Bismuth Titanate and related compounds. Machine learning algorithms are being trained on vast datasets of crystallographic structures, thermal properties, and electrical performance characteristics to predict optimal doping concentrations and processing parameters necessary to achieve desired ferroelectric or dielectric responses. This predictive capability dramatically narrows the experimental search space, saving immense time and resources typically spent on trial-and-error synthesis. Furthermore, AI models are essential in simulating device performance, particularly in complex architectures like FeRAM or sophisticated sensor arrays, allowing researchers to virtually test stability and reliability before expensive prototype fabrication, thereby accelerating innovation and commercial viability.

Beyond material discovery, AI and ML are playing a critical role in optimizing the industrial production of Bismuth Titanate powders and thin films. Advanced manufacturing facilities are implementing AI-driven control systems that monitor parameters such as temperature uniformity, reaction pressure, and precursor flow rates in real-time during synthesis methods like sol-gel or chemical vapor deposition (CVD). These systems use anomaly detection and predictive maintenance to ensure batch-to-batch consistency and high yield rates, which is crucial for cost management in high-purity ceramic manufacturing. The integration of AI for automated visual inspection during thin-film deposition also enhances quality assurance, identifying minute structural defects that could compromise the electrical integrity of the final device, ensuring that Bismuth Titanate components meet the stringent reliability requirements of aerospace and medical applications.

- AI accelerates the identification of optimal dopants and structural modifications for enhanced ferroelectricity.

- Machine learning optimizes synthesis parameters (e.g., temperature, pressure) to ensure high purity and consistency in batch production.

- Predictive modeling shortens the development cycle for Bismuth Titanate thin-film devices, reducing R&D costs.

- Automated visual inspection using AI improves quality control and defect detection in deposited films for FeRAM and sensors.

- AI simulations predict the long-term fatigue life and reliability of Bismuth Titanate components under various operational conditions.

DRO & Impact Forces Of Bismuth Titanate Market

The Bismuth Titanate market is influenced by a powerful interplay of Drivers, Restraints, and Opportunities (DRO). The primary Drivers stem from the escalating global demand for lead-free piezoelectric and ferroelectric materials driven by environmental regulations (such as RoHS and REACH) and the rapid expansion of high-reliability sectors, particularly electric vehicle manufacturing and 5G communication infrastructure, which require high-frequency, stable dielectric materials. Opportunities reside in leveraging advanced nano-synthesis techniques to produce high-surface-area Bismuth Titanate for catalytic applications and exploring its use in emerging fields like spintronics and advanced flexible electronics, where its unique anisotropic properties can be exploited. Conversely, the market faces significant Restraints, including the high cost and complexity associated with synthesizing high-purity, phase-pure Bismuth Titanate, especially in thin-film format, and the competitive presence of mature, albeit lead-containing, alternatives like PZT, which currently offer superior piezoelectric coefficients in certain low-voltage applications. Managing these forces requires manufacturers to focus on cost-effective, scalable production methods and aggressive R&D into enhanced material derivatives.

The core Impact Forces shaping the market trajectory are multifaceted. Technological innovation acts as a significant accelerating force; ongoing research into Lanthanum-doped Bismuth Titanate (BLT) and other modified variants has successfully addressed historical issues of high coercive fields and lower remnant polarization, making the material increasingly competitive. Economic factors, particularly capital expenditure on semiconductor fabrication plants (Fabs), directly influence demand for advanced dielectric materials. Simultaneously, regulatory pressures demanding lead-free solutions exert a strong push factor, forcing the electronic component industry to transition to materials like Bismuth Titanate. Finally, market competition from alternative materials (e.g., barium titanate derivatives or other non-lead ceramics) acts as a constraining force, mandating continuous improvement in Bismuth Titanate's performance profile to maintain market relevance, particularly in cost-sensitive commercial applications.

The long-term sustainability and growth of the market hinge on successfully converting the Opportunities into scalable commercial reality while mitigating the major Restraints. A key Opportunity is the application in high-temperature sensors (up to 600°C), where Bismuth Titanate's high Curie temperature provides a critical performance advantage over many polymers and lower-temperature ceramics. Furthermore, its potential use as a photocathode or photoanode in solar fuel production represents a significant, untapped market segment. Overcoming the restraint of synthesis complexity is paramount; achieving precise stoichiometric control during large-scale production of thin films remains a technical bottleneck that requires collaborative efforts between material scientists and engineering specialists to lower production costs and standardize quality across the supply chain, thereby unlocking its full commercial potential across diverse industries.

Segmentation Analysis

The Bismuth Titanate market segmentation provides a granular view of its structure based on Type, Application, and End-User Industry, reflecting the varied requirements of different technological domains. Segmentation by Type differentiates between pure, high-purity Bismuth Titanate, typically used in fundamental research and highly specialized, low-volume applications, and Modified Bismuth Titanate, which dominates commercial usage due to enhanced properties achieved through doping with elements like Lanthanum (BLT) or other rare earths to improve fatigue resistance, dielectric constant, or switching speed for high-volume manufacturing of memory and capacitor devices. Application analysis highlights the material's versatility, stretching across traditional ceramic applications like capacitors and high-precision fields such as advanced sensors and non-volatile memory. End-user classification reveals the primary consumption sectors, led by the pervasive electronics industry, followed closely by high-reliability sectors like automotive and aerospace & defense, where the material’s stability under extreme conditions is non-negotiable.

- By Type:

- High-Purity Bismuth Titanate

- Modified Bismuth Titanate (e.g., Lanthanum-doped Bismuth Titanate - BLT)

- By Application:

- Piezoelectric Devices (Sensors, Actuators)

- Capacitors (MLCCs, High-K Dielectrics)

- Non-Volatile Memory (FeRAM)

- Photocatalysts

- Electro-optic Devices

- By End-User Industry:

- Electronics and Semiconductor

- Automotive (EVs, ADAS)

- Aerospace and Defense

- Energy and Industrial

- Medical Devices

Value Chain Analysis For Bismuth Titanate Market

The Bismuth Titanate value chain begins with the upstream procurement of highly refined raw materials, primarily high-purity Bismuth Oxide (Bi2O3) and Titanium Dioxide (TiO2). These precursors must meet stringent purity specifications, as contaminants can severely degrade the resulting ceramic’s ferroelectric performance. The complexity of the synthesis process, including solid-state reaction, hydrothermal methods, or sol-gel techniques, constitutes the core manufacturing stage, converting raw materials into Bismuth Titanate powders or targets suitable for thin-film deposition. This stage requires significant technological expertise and high capital investment in specialized furnaces and cleanroom environments. Ensuring phase purity and uniform particle size during synthesis is critical for determining the final quality and application suitability, particularly for high-frequency electronics.

The midstream involves the fabrication of intermediate components, such as sputtering targets, ceramic substrates, or thick-film pastes, which are then supplied to device manufacturers. These component manufacturers specialize in precision engineering necessary for handling advanced ceramic materials. Downstream operations focus on integrating the Bismuth Titanate material into final products, such as embedding thin films into semiconductor chips for FeRAM, layering it within MLCC stacks, or incorporating it into piezoelectric sensor assemblies. This phase is dominated by major semiconductor and electronics Original Equipment Manufacturers (OEMs).

Distribution channels for Bismuth Titanate are predominantly characterized by a mix of direct and indirect engagement. For highly specialized applications, often involving custom material specifications or proprietary doping schemes, a direct distribution model is utilized, where material producers supply directly to tier-one aerospace or semiconductor manufacturers. Conversely, standard Bismuth Titanate products, particularly powders and standard targets, often move through indirect channels involving specialized chemical distributors or regional agents who manage logistics, inventory, and smaller volume orders for academic research and smaller industrial consumers. The overall structure emphasizes technological collaboration between material scientists and end-product engineers to ensure optimal material utilization and performance across the highly regulated and rapidly evolving electronics supply chain.

Bismuth Titanate Market Potential Customers

The potential customer base for Bismuth Titanate is highly concentrated within industries demanding high-performance, stable, and often lead-free electronic components. Primary end-users include major global semiconductor companies who require fatigue-resistant ferroelectric materials for integrating FeRAM technology into microcontrollers and embedded systems, seeking to capitalize on non-volatility and high-speed operation. Capacitor manufacturers, particularly those focusing on high-reliability multilayer ceramic capacitors (MLCCs) for power electronics in harsh environments (such as engine compartments or deep-sea equipment), are crucial buyers. The unique dielectric properties of Bismuth Titanate make it an attractive material for high-temperature and high-voltage applications, expanding its relevance beyond consumer electronics.

Secondary, yet rapidly growing, customer segments include automotive component suppliers responsible for developing sensors for Advanced Driver-Assistance Systems (ADAS) and battery management systems (BMS) in Electric Vehicles (EVs). These applications require highly stable piezoelectric sensors capable of maintaining accuracy across wide temperature fluctuations and mechanical stresses. Furthermore, the aerospace and defense sector represents a key customer group, utilizing Bismuth Titanate in specialized high-G sensors and robust electronic systems that must operate reliably in extreme thermal and radiation environments, favoring the material's inherent resistance to degradation compared to many organic compounds. Lastly, research institutions and specialized catalysis companies represent ongoing customers, driving demand for high-surface-area Bismuth Titanate powders for photocatalytic water splitting and environmental purification applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185.5 Million |

| Market Forecast in 2033 | USD 310.2 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Materion Corporation, Cerac Inc., Kemet Corporation, TDK Corporation, Murata Manufacturing Co. Ltd., Fuji Ceramics Corporation, Solvay S.A., American Elements, Stanford Advanced Materials (SAM), Saint-Gobain Ceramic Materials, Advanced Materials Technology (AMT), Praxair Surface Technologies, CoorsTek Inc., Ferro Corporation, Hitachi Metals Ltd., NGK Spark Plug Co. Ltd., Sigma-Aldrich (Merck KGaA), Reade Advanced Materials, ALD Vacuum Technologies, Nanocs Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bismuth Titanate Market Key Technology Landscape

The technology landscape for the Bismuth Titanate market is defined by sophisticated material synthesis techniques and advanced film deposition methods necessary to exploit its inherent ferroelectric properties. The primary synthesis methods for producing high-quality Bismuth Titanate powder include solid-state reaction (SSR), which is cost-effective for large volumes but often yields coarser particles; hydrothermal synthesis, which allows for precise control over particle size and morphology at lower temperatures; and sol-gel processing, which is crucial for achieving high purity and homogeneity, particularly for preparing thin-film precursors. The choice of synthesis method directly impacts the crystallinity and phase purity of the resulting material, which are paramount for achieving optimal electrical performance in devices like FeRAMs and piezoelectric sensors. Ongoing technological focus is dedicated to scaling up these precise synthesis methods while reducing energy consumption and precursor costs, moving towards continuous rather than batch processing.

For device integration, the key technological focus is on thin-film deposition, which is essential for creating miniaturized and high-density electronic components. Techniques such as Pulsed Laser Deposition (PLD), Metal-Organic Chemical Vapor Deposition (MOCVD), and Radio Frequency (RF) Sputtering are widely employed. PLD is often favored in R&D environments for its precise control over stoichiometry transfer from target to substrate, which is vital for maintaining the complex layered structure of Bismuth Titanate. MOCVD, while more complex to set up, offers better scalability and conformality for industrial manufacturing of memory devices. A critical technological challenge remains the prevention of Bismuth volatility during high-temperature annealing steps necessary to crystallize the ferroelectric phase, necessitating specialized controlled atmosphere furnaces and optimized temperature ramp profiles. Innovation in buffer layers and electrode materials (e.g., use of noble metals or conductive oxides) is also integral to mitigating interfacial degradation and ensuring robust device operation.

Furthermore, research into Bismuth Titanate's role in photocatalysis utilizes nanotechnology and surface engineering. Creating mesoporous structures or composite materials, such as combining Bismuth Titanate with graphene or carbon nanotubes, enhances the surface area and charge separation efficiency, boosting its catalytic activity under visible light irradiation. This technological segment focuses on optimizing the band gap structure through tailored synthesis to maximize photon absorption and charge carrier lifetime, making the material effective for environmental applications like pollutant degradation and hydrogen generation. The confluence of material science, nanotechnology, and advanced manufacturing processes underscores the technological complexity and high entry barriers within the specialized Bismuth Titanate market, driving continuous investment in next-generation processing and integration tools.

Regional Highlights

Regional dynamics heavily influence the consumption and production patterns of Bismuth Titanate, driven by the geographic concentration of electronics manufacturing, automotive production, and government R&D investment.

- Asia Pacific (APAC): APAC is the global leader in Bismuth Titanate consumption and production, spearheaded by industrial heavyweights like China, Japan, South Korea, and Taiwan. This region hosts the largest proportion of semiconductor fabrication plants and consumer electronics manufacturing facilities globally. The robust demand is generated by the mass production of MLCCs, advanced sensors for smartphones and 5G base stations, and a strong domestic focus on non-volatile memory development (FeRAM). Favorable government policies supporting advanced materials research and semiconductor independence further solidify APAC’s market dominance, making it the highest growth region.

- North America: Characterized by high-value, specialized applications, North America is a significant market, particularly within the aerospace, defense, and high-reliability automotive sectors. Demand is driven by strict quality standards and the need for components resilient to extreme conditions. The presence of major research universities and advanced materials companies leads to continuous innovation in Bismuth Titanate derivatives, focusing on high-temperature stability and sensor integration for military and commercial avionics.

- Europe: Europe is driven by strict environmental mandates (REACH, RoHS), positioning Bismuth Titanate as a crucial lead-free alternative in piezoelectric and dielectric components. The automotive industry, especially in Germany and France, is a major end-user, utilizing the material in advanced driver assistance systems (ADAS) and powertrain electronics for EVs. European manufacturers emphasize precision engineering and long-term reliability, fostering demand for high-grade, modified Bismuth Titanate compositions.

- Latin America (LATAM): The LATAM market exhibits nascent growth, primarily linked to the expansion of consumer electronics imports and foundational infrastructure projects. Market consumption is smaller relative to APAC or Europe, but steady modernization efforts in telecommunications and energy sectors offer niche opportunities for Bismuth Titanate components requiring robust dielectric performance.

- Middle East and Africa (MEA): Growth in MEA is moderate, fueled by increasing investment in renewable energy projects and regional defense spending. Bismuth Titanate sees applications in specialized sensor technology for oil and gas infrastructure monitoring and advanced communication systems, where component durability in harsh desert climates is a major requirement.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bismuth Titanate Market.- Materion Corporation

- Cerac Inc.

- Kemet Corporation

- TDK Corporation

- Murata Manufacturing Co. Ltd.

- Fuji Ceramics Corporation

- Solvay S.A.

- American Elements

- Stanford Advanced Materials (SAM)

- Saint-Gobain Ceramic Materials

- Advanced Materials Technology (AMT)

- Praxair Surface Technologies

- CoorsTek Inc.

- Ferro Corporation

- Hitachi Metals Ltd.

- NGK Spark Plug Co. Ltd.

- Sigma-Aldrich (Merck KGaA)

- Reade Advanced Materials

- ALD Vacuum Technologies

- Nanocs Inc.

Frequently Asked Questions

Analyze common user questions about the Bismuth Titanate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Bismuth Titanate over traditional ferroelectrics like PZT?

Bismuth Titanate (BIT) offers significant advantages over lead zirconate titanate (PZT), primarily due to its non-toxicity (lead-free composition), excellent fatigue resistance, and higher Curie temperature, which allows for stable operation in high-temperature environments, particularly crucial for automotive and aerospace electronics.

How does doping influence the performance of Bismuth Titanate in commercial applications?

Doping, typically with Lanthanum (forming BLT), is crucial for commercial Bismuth Titanate applications as it significantly reduces the coercive field and enhances ferroelectric polarization retention, thereby improving switching reliability and enabling its practical use in non-volatile memory (FeRAM) devices.

Which end-user segment drives the largest demand for Bismuth Titanate globally?

The Electronics and Semiconductor industry is the largest end-user segment, driven by the pervasive need for high-reliability, lead-free components such as multilayer ceramic capacitors (MLCCs) and ferroelectric thin films for next-generation memory and high-frequency communication systems.

What are the main technological challenges limiting the large-scale adoption of Bismuth Titanate?

The primary technological challenges include the complexity and high cost of synthesizing highly pure, phase-stable material, particularly in uniform thin-film formats, and the need to mitigate Bismuth volatility during high-temperature processing steps required for achieving optimal crystallinity.

What role does Bismuth Titanate play in the electric vehicle (EV) sector?

In the EV sector, Bismuth Titanate is critical for manufacturing robust, high-temperature dielectric capacitors and sensors used in battery management systems (BMS) and power inversion units, where its thermal stability ensures reliable operation under the stringent conditions of EV powertrains.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager