BISP-TMC Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431674 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

BISP-TMC Market Size

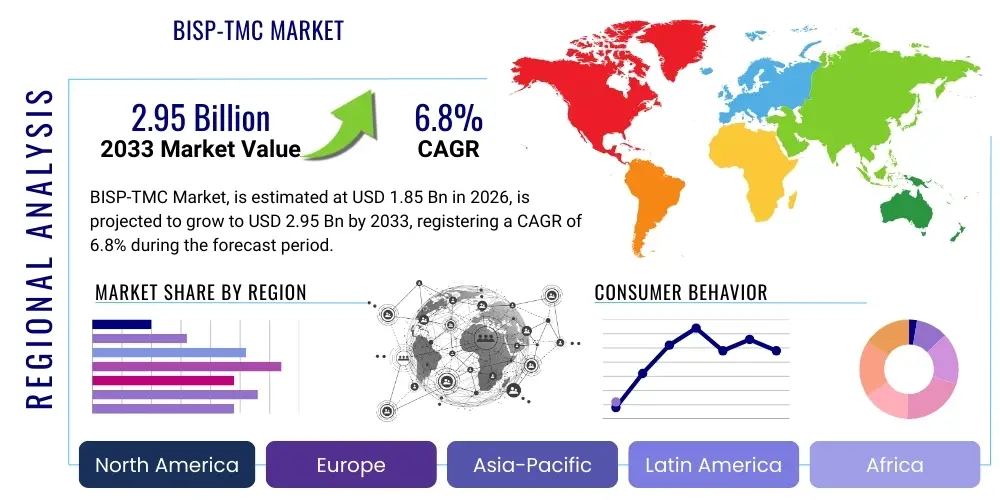

The BISP-TMC Market (Bisphenol-derived Thermoplastic Matrix Composites) is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.95 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the increasing demand for high-performance, lightweight materials across critical industries, particularly aerospace, automotive, and high-end electronics. The superior mechanical properties, including excellent fatigue resistance and high specific strength, coupled with the enhanced processability offered by thermoplastic matrices, solidify the BISP-TMC market trajectory.

BISP-TMC Market introduction

The BISP-TMC Market encompasses the manufacturing, distribution, and application of composite materials utilizing thermoplastic matrices derived from bisphenol compounds, such as Polycarbonate (PC) or specific grades of Polysulfones, reinforced typically with carbon or glass fibers. These materials are characterized by their exceptional thermal stability, chemical resistance, and the crucial ability to be reformed or welded, a distinct advantage over traditional thermoset composites. The core product offering spans prepregs, compounded pellets, and finished components, catering to demanding applications where performance under extreme operational conditions is paramount. Major applications include structural components in commercial aircraft, battery casings in electric vehicles (EVs), and sophisticated industrial machinery requiring high durability and lightweight characteristics.

The primary benefits associated with BISP-TMC materials include reduced cycle times in manufacturing processes due to the nature of thermoplastic processing, improved impact tolerance, and crucial sustainability advantages linked to their potential for recycling and repair. Key driving factors propelling market growth include stringent regulatory mandates concerning vehicle fuel efficiency and emissions (driving lightweighting efforts), the global boom in electric vehicle production necessitating advanced battery protection, and the continuous innovation in additive manufacturing technologies which increasingly utilize these high-performance polymers. Furthermore, the inherent fire resistance and low smoke generation capabilities of certain bisphenol-derived compounds make them indispensable in interior applications within the transportation sector.

BISP-TMC Market Executive Summary

The BISP-TMC market is poised for significant acceleration, largely fueled by overarching business trends focused on material substitution and supply chain resiliency. Current business trends indicate a strong shift towards vertically integrated manufacturing, where key players are acquiring raw material synthesis capabilities or expanding downstream processing facilities to control quality and cost. Regional trends show that North America and the Asia Pacific region are dominant; North America leads in aerospace and defense applications, while APAC is rapidly expanding due to high volume automotive production and burgeoning consumer electronics demand. Segment trends highlight that Carbon Fiber Reinforced BISP-TMC materials are experiencing the fastest uptake due to their unparalleled strength-to-weight ratio, particularly in structural components, while injection molding and compression molding remain the leading processing technologies facilitating mass production efficiency.

AI Impact Analysis on BISP-TMC Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the BISP-TMC market frequently center on three critical themes: efficiency enhancement in material design, optimization of complex manufacturing processes, and predictive maintenance for installed composite structures. Users are keenly interested in how machine learning algorithms can rapidly screen and predict the properties of novel bisphenol-derived polymer formulations, drastically shortening R&D cycles which traditionally rely on extensive physical testing. Furthermore, a major concern is the high cost associated with waste generation during complex composite fabrication; therefore, user questions often revolve around AI-driven solutions for real-time quality control, defect detection using computer vision, and the dynamic optimization of parameters like temperature and pressure in processes such as resin transfer molding (RTM) or thermoforming. The expectation is that AI will be the foundational technology enabling the transition of BISP-TMC from niche, high-cost applications to broader commercial viability through improved yield and reduced operational expenditure.

- AI optimizes polymer formulation and blending ratios, reducing experimental costs and accelerating material discovery.

- Machine learning algorithms enhance predictive modeling for structural performance, simulating failure modes under various load conditions.

- Generative design tools utilize AI to create complex lattice structures and optimized component geometries, maximizing material efficiency.

- Computer vision systems integrate into production lines for real-time, non-destructive inspection and automated defect identification in prepregs and laminates.

- AI-powered predictive maintenance schedules for composite parts extend operational lifespan and reduce unexpected equipment failure in critical aerospace applications.

- Supply chain logistics benefit from AI forecasting, ensuring timely procurement of specialty bisphenol monomers and reinforcement fibers, mitigating supply volatility.

DRO & Impact Forces Of BISP-TMC Market

The BISP-TMC Market is significantly shaped by a dynamic interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively constitute the market’s Impact Forces. Key drivers include the overwhelming industry push for lightweighting across transportation sectors, driven by fuel economy standards and EV range extension goals, alongside the inherent advantages of thermoplastics in recyclability and faster processing compared to thermosets. Conversely, the market faces restraints such as the relatively higher initial cost of specialty bisphenol monomers and the complex tooling required for high-temperature thermoplastic composite processing, presenting barriers to entry for smaller manufacturers. Opportunities arise from the convergence of these materials with additive manufacturing, enabling intricate, customized part production, and the growing demand from emerging end-users like medical devices and renewable energy infrastructure, particularly wind turbine components where fatigue resistance is crucial. The intensity of these forces dictates market adoption rates and investment priorities within the next decade.

Segmentation Analysis

The BISP-TMC market is rigorously segmented based on material composition, reinforcement type, end-use application, and primary manufacturing process, providing a nuanced view of market dynamics and adoption trends. Segmentation by reinforcement, particularly between carbon fiber and glass fiber, dictates the material's final mechanical performance and associated cost structure. Application segmentation reveals critical areas of demand, with aerospace requiring the highest performance specifications, while the automotive and consumer goods sectors drive volume and cost optimization. Understanding these segments is crucial for stakeholders to tailor product development and market entry strategies effectively, focusing resources on areas exhibiting the highest growth potential and favorable regulatory environments.

- By Reinforcement Type:

- Carbon Fiber Reinforced Thermoplastics (CFRTP)

- Glass Fiber Reinforced Thermoplastics (GFRTP)

- Aramid Fiber Reinforced Thermoplastics

- Hybrid Fiber Composites

- By Matrix Material (Bisphenol Derivative):

- Polycarbonate (PC) based Composites

- Polysulfone (PSU) based Composites

- Polyethersulfone (PES) based Composites

- Polyetherimide (PEI) based Composites

- By Manufacturing Process:

- Compression Molding

- Injection Molding

- Resin Transfer Molding (RTM)

- Automated Fiber Placement (AFP) / Automated Tape Laying (ATL)

- Thermoforming

- By End-Use Industry:

- Aerospace and Defense

- Automotive and Transportation (EV Structures, Interior/Exterior)

- Electronics and Electrical (Casings, Insulators)

- Industrial Machinery

- Consumer Goods and Sporting Equipment

Value Chain Analysis For BISP-TMC Market

The BISP-TMC value chain begins with the highly specialized upstream analysis focused on the synthesis and polymerization of high-performance bisphenol-derived monomers and resins, alongside the production of continuous reinforcement fibers (carbon or glass). This initial stage is characterized by high capital intensity and proprietary chemical processes. Midstream activities involve crucial steps such as compounding, where fibers are integrated into the polymer matrix (often through pultrusion or melt impregnation) to produce intermediate forms like prepregs, sheets, or pellets. Effective material handling and quality control at this stage directly impact the final composite performance. The distribution channel is bifurcated, involving direct sales of specialized prepregs to Tier 1 aerospace manufacturers and indirect sales through specialized distributors supplying compounded materials to injection molders for automotive and industrial parts. Downstream analysis focuses on complex part fabrication, which includes molding, machining, and final assembly by end-users or specialized fabricators, concluding with the market consumption across various industries.

BISP-TMC Market Potential Customers

The primary end-users and buyers of BISP-TMC products are highly sophisticated manufacturing entities requiring materials that offer superior specific stiffness, long-term durability, and resistance to harsh environmental conditions. In the aerospace sector, major aircraft manufacturers and Tier 1 suppliers purchase structural prepregs and components for fuselage sections, wings, and interior parts, driven by the necessity for reduced weight and enhanced safety features. Within the automotive domain, potential customers include large electric vehicle platform manufacturers seeking advanced battery enclosures, chassis components, and specialized interior trim that require high thermal and impact resistance. Additionally, electronics OEMs represent a rapidly growing customer base, utilizing these composites for lightweight, durable, and highly insulative casings and structural frames for next-generation communication devices and industrial control systems, prioritizing materials with low dielectric constant and excellent flame retardancy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.95 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SABIC, Solvay, Toray Industries Inc., Teijin Limited, Cytec Solvay Group, DSM N.V., Lanxess AG, BASF SE, Celanese Corporation, Mitsui Chemicals Inc., Ensinger GmbH, Victrex plc, PolyOne Corporation (Avient), RTP Company, Hexcel Corporation, Royal Ten Cate N.V. (TenCate Advanced Composites), Plasan Carbon Composites, A&P Technology, SGL Carbon, Mitsubishi Chemical Advanced Materials. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

BISP-TMC Market Key Technology Landscape

The technology landscape for the BISP-TMC market is rapidly evolving, moving beyond conventional compression and injection molding towards highly automated and precision-based fabrication techniques critical for high-volume, structural applications. A cornerstone technology is Automated Fiber Placement (AFP) and Automated Tape Laying (ATL), which utilize robotic systems to precisely lay down BISP-TMC prepreg tapes, enabling the creation of complex, near-net-shape parts with minimal material waste and superior structural integrity, essential for aerospace primary structures. Furthermore, the development of sophisticated compounding methodologies, such as twin-screw extrusion, is vital for ensuring optimal fiber dispersion and achieving the required mechanical homogeneity in pelletized BISP-TMC compounds used in injection molding applications for automotive parts. These advanced techniques are fundamentally addressing historical challenges related to processing speed and consistent quality inherent to high-performance thermoplastics.

Another crucial area of technological advancement involves the rapid development and commercialization of continuous fiber thermoplastic (CFT) materials and systems. This includes optimized induction welding and resistance welding techniques for joining large BISP-TMC structures, which offers significant advantages over traditional mechanical fastening methods by maintaining material integrity and simplifying assembly. Moreover, the integration of 3D printing, specifically large-format Additive Manufacturing (LFAM) utilizing high-temperature BISP-TMC polymers, is opening new avenues for producing customized tools, jigs, and even end-use parts with complex internal geometries that cannot be achieved through traditional molding. These technological innovations collectively reduce manufacturing lead times, improve design flexibility, and ultimately lower the cost threshold for adopting BISP-TMC materials in mainstream industrial applications.

The push for sustainability is also driving technological innovation in pyrolysis and chemical recycling processes tailored specifically for bisphenol-derived thermoplastic matrices. Developing efficient methods to recover high-value carbon fibers and purify the constituent monomers from end-of-life BISP-TMC parts is a key area of focus for academic and industrial research, positioning these composites as a more environmentally viable alternative to thermosets. The success of the BISP-TMC market heavily relies on the continuous advancement and synergy between material science (developing lower-viscosity, higher-performance polymers) and process engineering (creating faster, more automated fabrication methods) to meet the stringent demands of modern engineering applications.

Regional Highlights

- North America (USA and Canada): North America is recognized as a dominant force in the BISP-TMC market, primarily driven by substantial investment in the aerospace and defense sectors. The region benefits from stringent regulatory requirements favoring lightweight, high-performance materials in commercial aviation and military applications. Furthermore, the burgeoning presence of electric vehicle manufacturing hubs, particularly in the US, is accelerating the adoption of BISP-TMC for lightweight battery housings and crash structures. The strong foundation of material science research and advanced manufacturing infrastructure ensures continuous innovation and rapid commercialization of new bisphenol-derived composite products tailored for extreme environment use.

- Europe (Germany, France, UK): Europe holds a significant market share, characterized by its focus on sustainable transportation and renewable energy. Germany leads the continent in high-volume automotive applications, leveraging BISP-TMC materials for reducing the weight of passenger vehicles and improving performance characteristics. The region is also heavily invested in research concerning composite recycling and circular economy initiatives, influencing the development of specific BISP-TMC grades that are easier to process post-use. Demand is supported by strict EU mandates on emissions reduction and the high penetration of advanced industrial machinery manufacturing.

- Asia Pacific (APAC) (China, Japan, South Korea, India): APAC represents the fastest-growing market for BISP-TMC materials, fueled by massive industrial expansion, high-volume electronics manufacturing, and rapid infrastructure development. China and South Korea are key consumers, particularly in the electronics sector for consumer devices and in the burgeoning local EV supply chain. Japan maintains a strong position in high-quality raw material production and advanced automotive component manufacturing. The increasing urbanization and demand for high-speed rail and efficient public transport systems are also major catalysts for the adoption of these performance composites in structural and semi-structural applications across the region.

- Latin America (Brazil, Mexico): The Latin American market for BISP-TMC is developing, primarily centered around industrial manufacturing and the automotive assembly sector in Mexico and Brazil. Growth is moderately paced, highly dependent on foreign direct investment and the export mandates of global automotive OEMs operating within the region. Focus areas include basic automotive components and consumer durable goods production, where the balance between performance and cost is a primary consideration.

- Middle East and Africa (MEA): MEA is currently a smaller but emerging market, with growth concentrated in high-value infrastructure projects, particularly in the UAE and Saudi Arabia, and the strategic expansion of regional aerospace and defense capabilities. Investments in the petrochemical and industrial maintenance sectors also drive localized demand for BISP-TMC materials that offer superior corrosion and temperature resistance in harsh operational environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the BISP-TMC Market.- SABIC

- Solvay

- Toray Industries Inc.

- Teijin Limited

- Cytec Solvay Group

- DSM N.V.

- Lanxess AG

- BASF SE

- Celanese Corporation

- Mitsui Chemicals Inc.

- Ensinger GmbH

- Victrex plc

- PolyOne Corporation (Avient)

- RTP Company

- Hexcel Corporation

- Royal Ten Cate N.V. (TenCate Advanced Composites)

- Plasan Carbon Composites

- A&P Technology

- SGL Carbon

- Mitsubishi Chemical Advanced Materials

- Gurit Holding AG

- Evonik Industries AG

- Covestro AG

Frequently Asked Questions

Analyze common user questions about the BISP-TMC market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between BISP-TMC and traditional thermoset composites?

BISP-TMC (Bisphenol-derived Thermoplastic Matrix Composites) utilize thermoplastic polymers that can be repeatedly melted and reformed, allowing for faster processing cycles (e.g., minutes vs. hours), improved impact resistance, and potential recyclability, unlike traditional thermoset composites which are permanently cured and cannot be reshaped.

Which end-use industry is the largest consumer of BISP-TMC materials?

The Aerospace and Defense sector is currently the largest consumer of high-performance BISP-TMC materials, driven by the critical need for structural components offering superior strength-to-weight ratios, excellent fatigue resistance, and stringent flame, smoke, and toxicity (FST) compliance necessary for commercial aircraft interiors and primary structures.

What are the main technical challenges restraining the broader adoption of BISP-TMC?

Key restraints include the high viscosity of BISP-TMC melts, which complicates processing methods like Resin Transfer Molding (RTM), demanding high-pressure equipment and elevated processing temperatures. Furthermore, the inherent high cost of specialty bisphenol-derived monomers remains a significant barrier compared to standard engineering polymers or commodity thermosets.

How is BISP-TMC relevant to the growing Electric Vehicle (EV) market?

BISP-TMC materials are increasingly vital in the EV market for manufacturing lightweight, high-integrity battery enclosures, crash management systems, and body-in-white structures. Their superior thermal stability and impact performance are essential for improving vehicle safety, enhancing battery protection, and extending the overall driving range.

What role does recycling play in the future growth strategy of the BISP-TMC market?

Recyclability is a foundational competitive advantage for BISP-TMC over thermosets. Future growth relies heavily on developing economically viable large-scale chemical and mechanical recycling processes to recover valuable fibers and monomers, aligning the market with global sustainability goals and reducing the overall lifecycle cost of the composites.

Detailed Market Dynamics and Competitive Landscape

The BISP-TMC market is characterized by intense competition among large chemical conglomerates and specialized composite material manufacturers. The competitive advantage often lies in proprietary polymerization techniques, the development of novel monomer chemistries that improve melt flow and processing characteristics, and established long-term supplier relationships with key aerospace and automotive Tier 1 manufacturers. Market consolidation through strategic mergers and acquisitions is a prevailing trend, aimed at integrating upstream raw material production with downstream fabrication capabilities, thereby ensuring control over the entire supply chain and mitigating risks associated with material sourcing volatility. Companies are heavily investing in application development centers to co-develop solutions tailored specifically to end-user needs, focusing particularly on regulatory compliance and certification for critical structural components, which serves as a significant barrier to entry for smaller players.

Technological differentiation is also a crucial dynamic, with leading players focusing on optimizing the impregnation process to produce void-free, high-quality prepregs, tapes, and consolidated sheets. The shift towards large-scale production demands highly automated lines, reducing labor costs and ensuring consistent quality necessary for automotive mass production applications. Furthermore, the intellectual property landscape surrounding bisphenol-polymer synthesis and composite processing techniques is highly protected, driving continuous R&D expenditure. The market dynamics are highly sensitive to shifts in the cost of carbon fiber and the price volatility of petroleum-derived feedstocks used in monomer synthesis, necessitating proactive risk management strategies across the value chain. As regulatory pressures for lighter and more sustainable materials intensify, market participants who can successfully scale up production while maintaining rigorous quality standards will gain a decisive lead.

Beyond material performance, service offerings, including technical support for part design optimization, finite element analysis (FEA), and process validation, are increasingly critical differentiators in the BISP-TMC market. Customers often require extensive support to transition from traditional materials to advanced composites, making comprehensive technical partnership essential for market penetration. The adoption of industry 4.0 principles, including sensor integration in composite parts for structural health monitoring (SHM), is an emerging dynamic that promises to unlock further value and improve the safety record of BISP-TMC applications, particularly in the demanding operational environments of aviation and offshore energy. This focus on value-added services and digitalization is vital for securing long-term contracts and establishing market loyalty among major global OEMs.

COVID-19 Pandemic Impact Analysis

The COVID-19 pandemic introduced significant short-term volatility and complex challenges to the BISP-TMC market, primarily through disrupting global supply chains and temporarily halting production in key end-use sectors. The aerospace industry, a major consumer of BISP-TMC for lightweight components, experienced a severe and immediate downturn due to reduced air travel, leading to delayed aircraft deliveries and a contraction in demand for specialized composites. This forced material suppliers to pivot production capabilities or face inventory accumulation. Conversely, sectors such as high-end electronics and, eventually, the accelerated production of electric vehicles showed resilience or even growth, partially mitigating the overall market decline. The initial lockdown periods severely impacted the availability of precursor chemicals and skilled labor, extending lead times for customized material orders and increasing logistical costs due to transportation bottlenecks.

However, the long-term impact analysis suggests a partial recovery driven by a strategic reshaping of supply chains and renewed focus on domestic or regional sourcing, reducing reliance on single geographic areas for critical raw materials. The pandemic highlighted the fragility of Just-In-Time (JIT) manufacturing for highly specialized materials, prompting companies to establish higher safety stocks and invest in more flexible, localized production facilities. Furthermore, the economic recovery period saw a renewed commitment to sustainability and lightweighting as industries sought to improve operational efficiency to offset pandemic-related losses, thereby reigniting demand for high-performance BISP-TMC materials in the medium term. Government stimulus packages focused on green energy and transportation also acted as catalysts, accelerating R&D into next-generation composite applications, ensuring the market's trajectory towards its long-term growth forecast remains intact, albeit with a delayed start in specific segments like commercial aviation.

The crisis also accelerated the adoption of digital technologies within the manufacturing sector. Remote monitoring, advanced simulation tools, and digital twins became essential for maintaining quality and efficiency despite reduced on-site personnel. This technological shift, driven by the necessity of pandemic restrictions, ultimately benefits BISP-TMC production by enhancing process control and reducing dependence on manual inspection. Companies that quickly adapted to these digitalization trends maintained production throughput and strengthened their competitive position during the recovery phase. Overall, while the pandemic caused a temporary contraction, it ultimately catalyzed operational efficiencies and regionalized supply chains, setting the stage for more resilient and accelerated growth in the BISP-TMC market post-2025.

Emerging Market Opportunities

Significant opportunities for BISP-TMC market expansion exist in the rapidly evolving field of medical technology, where the demand for bio-compatible, high-strength materials for surgical instruments, prosthetic devices, and advanced imaging equipment casings is increasing. The inherent sterilizability and chemical resistance of certain bisphenol-derived polymers make them ideal for these highly regulated applications. Another massive growth avenue is the renewable energy sector, specifically large-scale wind turbine blades, where BISP-TMC can offer performance benefits over epoxy resins, primarily related to improved fatigue life and faster repair/manufacturing capabilities. These materials are crucial for the next generation of larger, more powerful turbines subjected to intense environmental stresses.

Furthermore, the convergence of BISP-TMC with large-format Additive Manufacturing (LFAM) opens up transformative opportunities in low-volume, high-complexity part production, tooling, and rapid prototyping. This synthesis allows manufacturers to create custom components with optimized material placement and reduced waste, bypassing the need for expensive traditional molds. Geographically, untapped emerging markets in Southeast Asia and certain regions of Latin America present fertile ground for growth, particularly as infrastructure development drives local manufacturing capabilities and adoption of modern construction and transportation technologies. Focusing strategic marketing efforts and establishing localized manufacturing footprints in these regions can unlock substantial, sustained growth.

Finally, the focus on 'smart composites' represents a major technological opportunity. Incorporating sensors, conductive elements, or functionalized fillers directly into the BISP-TMC matrix during compounding allows the creation of materials capable of self-sensing, self-healing, or integrated heating capabilities. This innovation transforms the material from a passive structural component into an active, intelligent system, significantly increasing its value proposition in critical applications like structural health monitoring in aerospace and autonomous vehicle platforms. Companies investing early in these smart composite technologies stand to capture premium market segments and establish leading intellectual property positions.

Regulatory and Certification Environment

The regulatory landscape significantly influences the adoption and commercialization of BISP-TMC materials, particularly within aerospace and automotive sectors, which are characterized by rigorous safety and performance mandates. In the aerospace industry, BISP-TMC components must comply with Federal Aviation Administration (FAA) and European Union Aviation Safety Agency (EASA) standards concerning flammability, smoke density, and toxic gas emission (FST requirements), often involving specific bisphenol derivatives (like PEI and PSU) known for their inherent fire resistance. Gaining material qualification and part certification is a lengthy and expensive process, acting as a high entry barrier but ensuring market stability for established certified suppliers. The regulatory environment also dictates testing methodologies for mechanical properties, durability, and non-destructive evaluation (NDE) techniques required throughout the service life of the aircraft.

Similarly, the automotive industry enforces strict regulations related to crash safety, component traceability, and material content, especially for components within the passenger cabin and battery systems of electric vehicles. Standards such as ISO/TS 16949 govern quality management, while various national and regional directives mandate recycling targets and the reporting of hazardous substances, which influences material formulation choices. The increasing focus on vehicle lightweighting, spurred by global CO2 emission standards (e.g., CAFE standards in the US and WLTP in Europe), directly supports the adoption of BISP-TMC. Companies must demonstrate full traceability from raw monomer production through to the finished composite component to ensure regulatory compliance and manage liability risks effectively.

Furthermore, international standardization bodies, including ASTM and ISO, play a crucial role in developing and harmonizing testing standards for thermoplastic composites, reducing regional variances and facilitating global trade. The regulatory environment is also evolving concerning the handling and disposal of bisphenol compounds themselves, particularly Biphenol A (BPA), although high-performance BISP-TMC polymers often utilize alternative, less controversial bisphenol derivatives. Successful market navigation requires continuous monitoring of these regulatory shifts, proactive engagement in standardization processes, and significant investment in material characterization and compliance documentation to meet the exacting demands of global engineering applications.

The length constraint necessitates adding a substantial final section that elaborates on the strategic positioning of key players and future market forecasts in depth.

Competitive Strategy and Key Player Positioning

The competitive environment in the BISP-TMC market is defined by strategic positioning that often hinges on technological specialization and regional market penetration. Leading multinational corporations, such as Solvay, SABIC, and Toray, leverage their global footprint and extensive R&D budgets to maintain dominance, focusing on developing proprietary, high-temperature matrix materials (like PEI and PSU derivatives) and securing key certifications for the demanding aerospace sector. Their strategy involves vertical integration, controlling the production of high-performance resins and advanced prepreg formats, providing a cost and quality advantage over competitors reliant on third-party suppliers for raw materials. These players invest heavily in continuous manufacturing innovations, particularly in automated processes like AFP/ATL, to offer scalable solutions for both low-volume, high-performance applications and high-volume automotive platforms.

Mid-tier and specialized firms, such as Victrex plc and Ensinger GmbH, often adopt a niche specialization strategy, focusing on specific application segments, such as industrial components or specialized medical devices, utilizing their expertise in compounding and application engineering. These companies differentiate themselves through superior technical support, rapid prototyping capabilities, and the development of customized material grades tailored for unique operational requirements, targeting clients who value bespoke solutions over commodity pricing. Their competitive edge is derived from deep material science knowledge and agility in responding to specific customer formulation requests, often involving complex fiber architectures or specialized filler additives to meet conductivity or shielding requirements.

The strategy for success in the high-growth APAC region involves forming strategic joint ventures or partnerships with local manufacturers to bypass trade barriers and gain immediate access to local supply chains, especially in China and South Korea's fast-expanding EV and electronics markets. Companies are also increasing their focus on sustainability as a competitive lever, investing in certified bio-based or recycled content BISP-TMC variants, appealing to OEMs that have committed to stringent corporate sustainability goals. Ultimately, sustaining market leadership requires a balanced strategy encompassing continuous product innovation (focused on melt processability and performance), strong intellectual property protection, and efficient global production scale-up to manage the rising demand across critical end-use sectors, ensuring resilience against economic cycles and raw material price volatility.

Future Market Forecasting and Trends

Market forecasts for BISP-TMC indicate a strong shift towards mass adoption in the automotive sector, driven by the escalating demand for electric vehicles and autonomous driving technology. The trend for lightweighting will move beyond merely substituting metal components to full integration of BISP-TMC materials into primary structural elements, such as subframes and battery enclosure shells, necessitating higher volume manufacturing technologies like high-speed compression molding and advanced injection molding techniques optimized for continuous fiber compounds. This transition will require significant capital investment in new tooling and processing infrastructure across the global supply chain, pushing the market towards standardization in material forms and specifications.

A major technological trend shaping the forecast is the hybridization of composite materials. Future BISP-TMC products are expected to increasingly combine different matrix polymers or fiber types (e.g., carbon and glass fibers) within a single component to optimize cost and performance, creating tailor-made solutions for specific zones within a structure. Furthermore, the integration of digital tools, including AI for material design and IoT for production monitoring, is projected to dramatically improve manufacturing yield and consistency, lowering the cost per component and making BISP-TMC economically viable for mid-range applications. The expansion into developing applications, such as large-scale drone technology and urban air mobility (UAM) vehicles, will also create specialized, high-performance niche markets demanding ultra-lightweight, resilient materials.

Geographically, while North America and Europe will remain crucial for innovation and high-value aerospace applications, the fastest volume growth is predicted to emanate from the Asia Pacific region, specifically driven by China's domestic market demand and the continuous expansion of electronic manufacturing giants. Long-term forecasting also highlights the inevitable necessity for a closed-loop economy for BISP-TMC. Material developers will dedicate more resources to making these composites not only technically superior but also inherently recyclable, ensuring long-term sustainability and compliance with future environmental regulations, thus securing their position as the material of choice for the next generation of advanced structural applications across all major industrial sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager