Bispecific T Cell Engager Therapeutics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433896 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Bispecific T Cell Engager Therapeutics Market Size

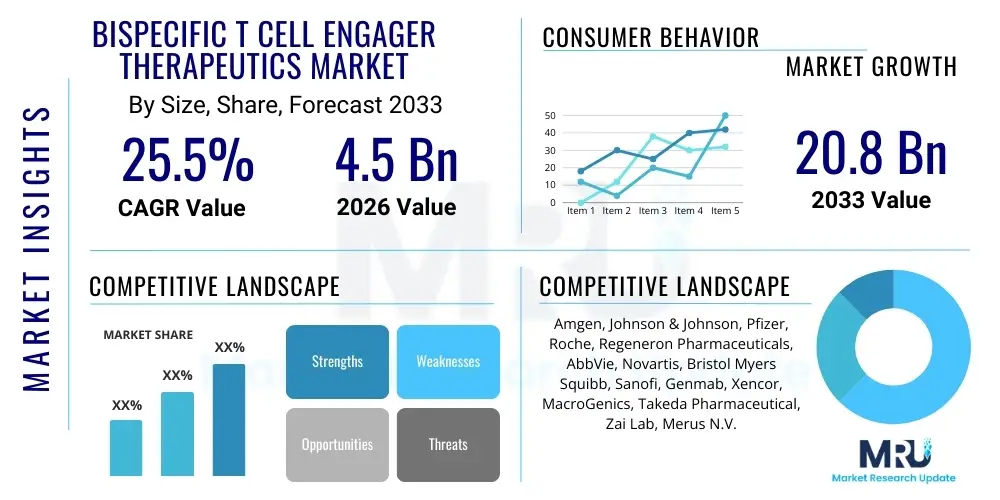

The Bispecific T Cell Engager Therapeutics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.5% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $20.8 Billion by the end of the forecast period in 2033.

Bispecific T Cell Engager Therapeutics Market introduction

The Bispecific T Cell Engager (BTCE) Therapeutics Market encompasses a revolutionary class of immunotherapies designed to bridge two different cells or molecules simultaneously, primarily targeting cancer cells by engaging the patient's cytotoxic T cells. BTCEs function by utilizing one binding arm to recognize a tumor-associated antigen (TAA) on the cancer cell and the other binding arm to recognize the CD3 complex on the surface of T lymphocytes. This strategic bridging mechanism activates the T cell, triggering a potent, localized immune response that results in the lysis of the cancer cell, regardless of the cancer cell's Major Histocompatibility Complex (MHC) presentation status.

Major applications of BTCEs are currently concentrated in hematologic malignancies, such as B-cell precursor acute lymphoblastic leukemia (ALL), non-Hodgkin lymphoma (NHL), and multiple myeloma, where initial products have demonstrated exceptional clinical efficacy, often in refractory settings. The descriptive term for these products involves specific protein engineering techniques that create novel antibody structures capable of simultaneous binding. The core benefits derived from BTCEs include their ability to redirect the immune system highly specifically, potentially overcoming immune evasion mechanisms common in traditional chemotherapies and monoclonal antibodies. This targeted approach minimizes systemic toxicity while maximizing cytotoxic effect at the tumor site, a significant advantage driving their adoption.

Driving factors propelling market expansion include the increasing prevalence of various cancers globally, particularly those resistant to standard treatments, coupled with robust investment in oncology research and development. Furthermore, advancements in protein engineering platforms, which enhance drug stability, reduce immunogenicity, and optimize pharmacokinetic profiles (e.g., extending half-life), are accelerating the pipeline progression. The shift toward personalized medicine and combination therapies, where BTCEs are leveraged alongside checkpoint inhibitors or conventional chemotherapies, further cements their critical role in the future oncology treatment landscape, pushing substantial market growth over the forecast period.

Bispecific T Cell Engager Therapeutics Market Executive Summary

The Bispecific T Cell Engager Therapeutics market is characterized by intense innovation and rapid commercialization, primarily driven by the clinical success of approved therapies like blinatumomab and teclistamab, which have set high benchmarks for efficacy in relapsed/refractory settings. Business trends indicate a strong focus on pipeline diversification, moving beyond CD19 and BCMA targets to explore novel tumor antigens, particularly within solid tumor indications, which represent a significantly larger patient pool and a major unmet medical need. Strategic partnerships between biotechnology firms possessing proprietary engineering platforms and large pharmaceutical companies capable of handling complex manufacturing and global distribution are defining the competitive landscape. Furthermore, significant investment is being channeled into developing next-generation BTCEs that incorporate features designed to mitigate common adverse events, such as Cytokine Release Syndrome (CRS), thereby improving the therapeutic index and patient compliance.

Regionally, North America, particularly the United States, maintains its dominance, attributable to substantial R&D expenditure, the presence of major pharmaceutical and biotech headquarters, favorable regulatory environments (e.g., FDA fast-track designations), and high rates of adoption for premium-priced innovative oncology drugs. Europe follows, buoyed by expanding access to advanced therapies through national health systems and active participation in global clinical trials. However, the Asia Pacific region is poised for the highest growth trajectory, fueled by rising cancer incidence, improving healthcare infrastructure, and the growing focus of multinational companies on establishing manufacturing and trial sites in countries like China and Japan to capitalize on emerging markets and local expertise in biological drug development.

Segmentation trends highlight the increasing sophistication of product design. While fragment-based BTCEs (like the BiTE platform) remain foundational, there is an accelerating shift toward full-length IgG-like bispecific antibodies which offer improved pharmacokinetics and easier dosing schedules. The application segmentation is witnessing a critical shift from exclusive dominance in hematologic malignancies toward extensive exploration of solid tumors (e.g., lung, breast, prostate cancer). This segment expansion is contingent upon identifying robust tumor-specific surface antigens in solid cancers and developing strategies to overcome the physical barriers and immunosuppressive environment inherent in these tumor types, making the solid tumor segment the primary driver of new product development and future market value expansion.

AI Impact Analysis on Bispecific T Cell Engager Therapeutics Market

User queries regarding the impact of Artificial Intelligence (AI) on the Bispecific T Cell Engager Therapeutics Market frequently center on accelerating the discovery phase, optimizing the complex protein engineering process, and predicting clinical outcomes. Key themes revolve around how AI can help identify novel, highly specific tumor-associated antigens (TAAs) that minimize off-target toxicity, a critical constraint in BTCE design. Users are keenly interested in AI’s ability to model the interaction kinetics between the bispecific construct, the T cell, and the tumor cell, thereby optimizing parameters such as binding affinity and linker length for maximal efficacy and minimal immunogenicity. Furthermore, there is significant focus on leveraging machine learning algorithms to analyze vast datasets from preclinical models and early clinical trials to better predict the likelihood and severity of adverse events like Cytokine Release Syndrome (CRS), facilitating proactive mitigation strategies and safer dosing regimens in personalized treatment protocols.

- AI optimizes target identification by analyzing genomic and proteomic data for highly selective TAAs.

- Machine learning models refine BTCE construct design, predicting optimal linker flexibility and domain orientation for better T cell engagement.

- AI-driven simulation predicts immunogenicity and toxicity profiles (e.g., risk of CRS) before clinical trials, enhancing drug safety.

- Automated high-throughput screening of millions of binder combinations accelerates the lead candidate selection process.

- AI supports personalized dosing strategies by analyzing patient-specific tumor characteristics and immune status.

DRO & Impact Forces Of Bispecific T Cell Engager Therapeutics Market

The dynamics of the Bispecific T Cell Engager Therapeutics market are governed by a robust interplay of drivers, significant restraints, and expansive opportunities, all contributing to profound impact forces shaping the competitive environment. The primary driver is the unparalleled clinical success demonstrated by approved BTCEs in overcoming resistance mechanisms in heavily pre-treated hematologic cancer patients, validating the mechanism of T cell redirection as a powerful therapeutic modality. Coupled with this, substantial venture capital and pharmaceutical R&D investment are pouring into next-generation platforms, especially those focusing on solid tumors, reflecting confidence in the long-term potential of this asset class. However, significant restraints include the high complexity and associated cost of manufacturing these biological constructs, stringent regulatory requirements, and the persistent challenge of managing severe immune-related adverse effects, particularly the life-threatening Cytokine Release Syndrome (CRS) and neurotoxicity, which necessitates specialized hospital settings and monitoring.

Opportunities for market penetration and expansion are vast, centering primarily on translating the efficacy seen in liquid tumors to solid tumor indications, which requires developing constructs capable of penetrating the dense tumor microenvironment (TME) and overcoming systemic immunosuppression. Furthermore, the development of combination therapies—integrating BTCEs with existing immunotherapies (like PD-1 inhibitors) or standard treatments—represents a major commercial avenue to enhance overall response rates and durability. The ongoing evolution of engineering platforms, focusing on half-life extension and novel formats (e.g., trispecific or tetra-specific antibodies), presents technological opportunities to create products with improved safety profiles and convenient outpatient administration, which would significantly expand their clinical reach.

The overall impact forces are high, characterized by disruptive innovation replacing older therapies and driving shifts in oncology treatment paradigms. The high initial capital requirements act as a strong barrier to entry, concentrating market share among established biopharma entities with advanced engineering and manufacturing capabilities. The market is also heavily influenced by reimbursement policies, as the premium pricing of these advanced biologics requires favorable coverage decisions to ensure broad patient access. Successfully navigating the challenge of reducing systemic toxicity while maintaining high on-target efficacy remains the crucial differential factor determining long-term market leadership and broad adoption.

Segmentation Analysis

The Bispecific T Cell Engager Therapeutics Market is strategically segmented based on factors reflecting the product’s structural complexity, the mechanism of action, the targeted application, and its geographic distribution. Segmentation by type primarily differentiates between IgG-like full-length antibodies, which offer advantages in stability and half-life, and non-IgG-like fragments (like BiTEs), which excel in potency due to their smaller size and flexibility. The application analysis is pivotal, distinguishing between the dominant hematological malignancies segment, which currently drives revenue, and the rapidly growing solid tumors segment, which represents future pipeline focus and long-term growth potential, addressing areas like non-small cell lung cancer, ovarian cancer, and colorectal cancer.

- By Technology Platform:

- BiTE Technology

- Duobody Technology

- DART Technology

- Tandem scFv (Single-Chain Variable Fragment)

- Others (e.g., XmAb, Triomab)

- By Application:

- Hematologic Malignancies (e.g., ALL, NHL, Multiple Myeloma)

- Solid Tumors (e.g., Lung Cancer, Breast Cancer, Prostate Cancer)

- By Product Type:

- Approved Products

- Pipeline Products (Phase I, II, III)

- By Structure:

- Symmetrical (IgG-like)

- Asymmetrical (Fragment-based/Non-IgG-like)

Value Chain Analysis For Bispecific T Cell Engager Therapeutics Market

The value chain for Bispecific T Cell Engager Therapeutics is intensely specialized and highly concentrated in the initial research and development phases due to the complex nature of protein engineering. Upstream analysis highlights the critical role of specialized technology platform providers and contract research organizations (CROs) that focus on target identification, antibody library screening, and complex construct design (e.g., optimizing linker sequences and variable domain pairings). This R&D phase requires substantial intellectual property protection and high-level scientific expertise, making it a major point of value addition and investment. Access to proprietary scaffolds and engineering platforms determines the quality and manufacturability of the final therapeutic candidate.

The midstream stage, encompassing manufacturing, is dominated by sophisticated bioprocessing, requiring specialized Good Manufacturing Practice (cGMP) facilities capable of handling large-scale production of complex biologics. The purification and quality control processes for bispecific antibodies are significantly more demanding than those for traditional monoclonal antibodies, necessitating rigorous standards to ensure drug homogeneity, stability, and purity. This phase often involves large Contract Development and Manufacturing Organizations (CDMOs) or internal production capabilities of large pharmaceutical companies, which represents a crucial bottleneck due to high capital investment and technical complexity.

Downstream analysis focuses on distribution and commercialization, characterized by a highly controlled and specialized distribution channel. BTCEs often require stringent cold chain management due to their biological nature. Distribution is primarily direct through specialized hospital pharmacies or oncology treatment centers, which are equipped to handle the unique administration requirements, including necessary monitoring for adverse events like CRS. Marketing efforts are targeted toward key opinion leaders (KOLs) and oncologists in academic medical centers, driving high-value sales despite smaller patient populations compared to mass-market drugs. The success in the downstream segment is highly reliant on securing favorable reimbursement from payers and effectively training healthcare professionals on safe product administration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $20.8 Billion |

| Growth Rate | 25.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amgen, Johnson & Johnson, Pfizer, Roche, Regeneron Pharmaceuticals, AbbVie, Novartis, Bristol Myers Squibb, Sanofi, Genmab, Xencor, MacroGenics, Takeda Pharmaceutical, Zai Lab, Merus N.V. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bispecific T Cell Engager Therapeutics Market Potential Customers

The primary potential customers and end-users of Bispecific T Cell Engager Therapeutics are specialized healthcare institutions and oncology practices treating advanced and refractory cancer patients. Academic medical centers (AMCs) and large, comprehensive cancer centers constitute the initial and most significant buyer base, as they possess the necessary infrastructure, trained personnel (specifically those experienced in managing severe immunotherapy-related toxicities like CRS), and financial capacity to adopt these cutting-edge therapies. These centers are often participants in clinical trials and are early adopters upon commercial approval.

Beyond specialized centers, community oncology clinics that handle significant patient volumes and are increasingly integrated into larger health systems represent a rapidly expanding customer segment. As next-generation BTCEs with improved safety profiles and reduced administration burden become available (e.g., subcutaneous formulations), the potential customer base expands beyond the highly specialized hospital setting. Furthermore, government agencies and national health systems (such as the NHS in the UK or relevant procurement bodies in Europe and APAC) are crucial indirect customers, as their purchasing and formulary decisions dictate market access and volume procurement.

The core patient profile targeted by these drugs typically involves individuals with late-stage or relapsed/refractory B-cell malignancies (like ALL or multiple myeloma) who have exhausted standard treatment protocols, thereby having a significant unmet medical need. Therefore, the purchasing decisions are heavily influenced by the treating oncologists and hematologists who evaluate the clinical data, safety profile, and quality of life benefits offered by BTCEs compared to alternative salvage therapies like CAR T-cell therapy, which often requires more complex logistics.

Bispecific T Cell Engager Therapeutics Market Key Technology Landscape

The technological evolution within the Bispecific T Cell Engager Therapeutics market is centered on overcoming structural limitations and enhancing drug properties to improve the therapeutic window. The foundational technology remains the single-chain variable fragment (scFv) based platforms, notably Amgen’s BiTE (Bispecific T cell Engager) platform, which uses two scFvs linked together. However, the limitation of short half-life inherent to these smaller fragments has spurred significant innovation towards engineering formats that mimic native IgG antibodies, providing superior pharmacokinetic profiles and once-weekly or less frequent dosing schedules, which are critical for patient compliance and outpatient management.

A key technological focus is on methods for stable heavy chain and light chain pairing to ensure accurate assembly of the two distinct binding domains, preventing mispairing which leads to non-functional or mono-specific byproducts. Technologies such as ‘Knobs-into-Holes’ (KiH), Duobody, and Electrostatic Steering are widely adopted to guide correct dimerization and improve manufacturing yields. Furthermore, advances in half-life extension utilize Fc domain engineering, incorporating silent Fc mutations that eliminate Fc gamma receptor binding to mitigate non-specific cell depletion, or utilizing albumin-binding domains, thereby extending circulation time without activating undesired immune pathways.

The emerging technological front involves the development of T-cell engagers with enhanced specificity or conditional activation mechanisms. This includes trispecific or tetra-specific constructs designed to target two tumor antigens simultaneously or incorporate a third binding site that modulates the T-cell activation signal (e.g., targeting co-stimulatory molecules like 4-1BB) only within the tumor microenvironment. This advanced engineering aims to significantly reduce off-target toxicities, making BTCEs viable for treating solid tumors where the expression difference between tumor and normal tissue antigens is often less pronounced. Novel high-throughput screening technologies, often accelerated by AI, are essential for identifying optimal dual-target combinations that exhibit high tumor selectivity.

Regional Highlights

- North America (United States and Canada): North America dominates the global BTCE market, driven by the highest concentration of leading biopharmaceutical companies (e.g., Amgen, J&J, AbbVie) with robust pipelines, significant government and private funding for oncology research, and high patient access rates to innovative and high-cost biologic therapies. Favorable reimbursement scenarios and a streamlined regulatory pathway (FDA approvals) facilitate rapid market penetration.

- Europe (Germany, France, UK, Italy, Spain): Europe represents the second-largest market, characterized by strong academic research in oncology and a high uptake of approved BTCEs, particularly in Germany and the UK. Market growth is moderately constrained by slower centralized EMA approval processes and price negotiations with national health authorities, although major countries are prioritizing funding for highly effective cancer immunotherapies.

- Asia Pacific (APAC) (China, Japan, South Korea, India): APAC is projected to be the fastest-growing region, fueled by rising cancer incidence, increasing healthcare expenditure, and a growing focus on localized clinical trials and manufacturing capacity, especially in China. Japan and South Korea, with their sophisticated biopharma industries and rapid adoption of advanced therapies, are key contributors, while China's domestic biopharma industry is heavily investing in BTCE analogues and novel designs.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions currently hold smaller market shares but offer significant long-term growth opportunities driven by expanding public health initiatives focused on cancer treatment access, improving clinical infrastructure, and growing partnerships between local distributors and multinational pharmaceutical companies to introduce next-generation therapeutics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bispecific T Cell Engager Therapeutics Market.- Amgen Inc.

- Johnson & Johnson (Janssen Biotech)

- Pfizer Inc.

- F. Hoffmann-La Roche Ltd.

- Bristol Myers Squibb Company (Celgene)

- Novartis AG

- Sanofi S.A.

- Regeneron Pharmaceuticals Inc.

- AbbVie Inc.

- Genmab A/S

- Xencor Inc.

- MacroGenics Inc.

- Merus N.V.

- Takeda Pharmaceutical Company Limited

- Zai Lab Limited

- Lilly (Loxo Oncology)

- BioNTech SE

- Roche (Genentech)

- Astellas Pharma Inc.

- Immunocore Holdings plc

Frequently Asked Questions

Analyze common user questions about the Bispecific T Cell Engager Therapeutics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental mechanism of action for Bispecific T Cell Engagers (BTCEs)?

BTCEs are engineered proteins that simultaneously bind a tumor-specific antigen on a cancer cell and the CD3 receptor complex on a T lymphocyte. This dual binding effectively bridges the immune cell and the cancer cell, leading to localized T cell activation, proliferation, and targeted tumor cell killing, independent of MHC presentation.

How do BTCEs compare to CAR T-cell therapy in cancer treatment?

BTCEs are "off-the-shelf" biological drugs requiring standard intravenous infusion, offering greater accessibility and immediate use compared to CAR T-cell therapy, which requires complex, time-consuming, and expensive ex vivo genetic modification of a patient's own T cells. While CAR T often offers curative potential, BTCEs provide a highly effective, scalable alternative with lower logistical hurdles.

What are the primary challenges limiting the widespread adoption of BTCEs?

The main challenges are managing severe adverse events, especially Cytokine Release Syndrome (CRS) and neurotoxicity, which require intensive monitoring in specialized settings. Additionally, high manufacturing complexity, the associated premium cost of therapy, and the difficulty in identifying suitable targets for solid tumors restrict broader market penetration and use.

Which cancer type currently generates the most revenue for the BTCE market?

The hematologic malignancies segment, including acute lymphoblastic leukemia (ALL), non-Hodgkin lymphoma (NHL), and multiple myeloma, currently drives the majority of market revenue due to the early clinical success and regulatory approvals of key products targeting CD19 and BCMA antigens in these liquid tumors.

What role does protein engineering play in enhancing next-generation BTCEs?

Protein engineering is crucial for improving pharmacokinetic profiles (e.g., using IgG-like structures or Fc modification for half-life extension), reducing immunogenicity, ensuring correct dimerization through techniques like 'Knobs-into-Holes,' and designing conditional or tumor microenvironment-activated bispecifics to enhance safety and solid tumor efficacy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager