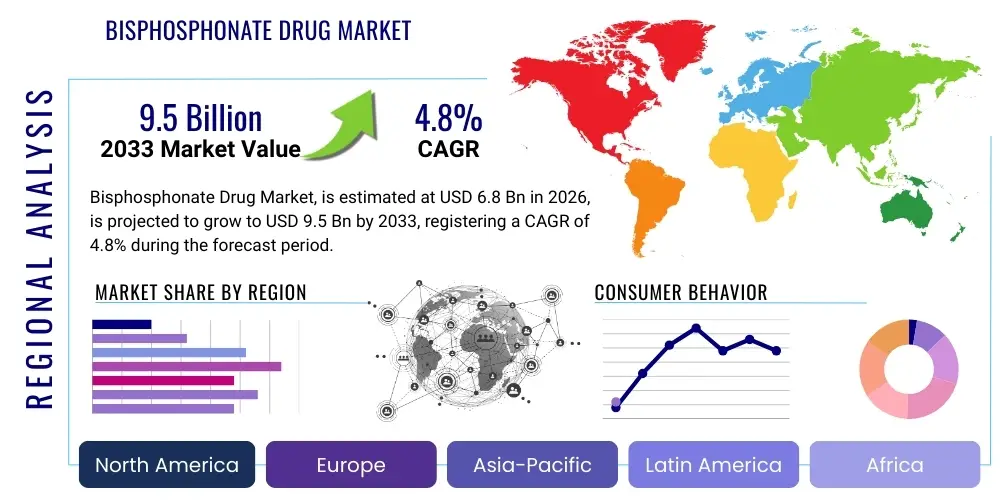

Bisphosphonate Drug Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436649 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Bisphosphonate Drug Market Size

The Bisphosphonate Drug Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 6.8 Billion in 2026 and is projected to reach USD 9.5 Billion by the end of the forecast period in 2033.

Bisphosphonate Drug Market introduction

The Bisphosphonate Drug Market encompasses therapeutic agents primarily utilized for managing bone disorders characterized by excessive bone resorption, notably osteoporosis, Paget's disease of bone, and malignant hypercalcemia. These compounds function by adhering strongly to hydroxyapatite crystals within the bone matrix, subsequently inhibiting osteoclast activity and proliferation. This mechanism effectively reduces bone turnover, increases bone mineral density (BMD), and significantly lowers the risk of fragility fractures, which represents a major global health burden, particularly among the aging population. The efficacy and long-established safety profile of bisphosphonates, including key drugs like Alendronate, Zoledronic Acid, and Ibandronate, have cemented their role as first-line treatments in postmenopausal women and men at high risk of osteoporotic fractures. The chronic nature of osteoporosis ensures sustained demand for these pharmacological interventions, driving consistent market expansion across developed and emerging economies.

Product descriptions within this category span various administration routes, including oral formulations (daily, weekly, or monthly dosing) offering convenience and cost-effectiveness, and intravenous injections (yearly or quarterly administration) which enhance patient compliance and bioavailability, particularly in severe cases or for patients with gastrointestinal intolerances. Major applications extend beyond osteoporosis management to include the palliative care of bone metastases associated with cancers like breast and prostate cancer, where bisphosphonates help manage pain and prevent skeletal-related events (SREs). The core benefit provided by these drugs is the reduction in morbidity and mortality associated with fractures, leading to improved quality of life for millions of elderly individuals worldwide. Furthermore, ongoing research into specialized delivery systems and combination therapies is maintaining the relevance of bisphosphonates despite the introduction of newer biologics.

Key driving factors supporting the market growth include the exponential increase in the geriatric population globally, which inherently elevates the prevalence of age-related bone diseases such as osteoporosis. Enhanced diagnostic capabilities, widespread public health initiatives promoting early screening for low bone mass, and improved awareness among healthcare professionals regarding fracture prevention protocols are also critical market accelerators. Furthermore, favorable reimbursement policies in major pharmaceutical markets like North America and Europe, coupled with the increasing availability of cost-effective generic bisphosphonate formulations, ensure broad patient access. The therapeutic versatility of these agents in oncology settings, particularly for mitigating tumor-induced osteolysis, provides an additional revenue stream and stabilizes market valuation against emerging competition.

Bisphosphonate Drug Market Executive Summary

The Bisphosphonate Drug Market is characterized by mature business trends focusing on compliance optimization, generic dominance, and strategic geographic expansion into high-growth emerging economies. Key business activities revolve around lifecycle management, where major pharmaceutical companies invest in new intravenous (IV) formulations, combination products, and patented drug delivery mechanisms to differentiate their offerings from generic oral staples. While patent expiries on blockbuster bisphosphonates have shifted significant market share toward generic manufacturers, creating intense price competition, the overall market value is sustained by the increasing volume of treated patients and the higher costs associated with long-acting IV formulations, which command premium pricing due to superior efficacy in complex patient cohorts and guaranteed adherence.

Regionally, North America maintains its dominance due to high disease prevalence, sophisticated healthcare infrastructure, and robust diagnostic and treatment uptake rates. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by rapid aging populations, increasing disposable incomes, and substantial improvements in healthcare access and infrastructure, particularly in countries like China and India. European trends emphasize established treatment protocols and stringent regulatory oversight, with a stable but moderate growth rate driven primarily by advanced osteoporosis treatments and specialized oncology applications. Latin America and the Middle East & Africa (MEA) represent significant opportunities for market penetration, relying on partnerships and low-cost generic availability to address the growing burden of musculoskeletal disorders.

In terms of segment trends, the intravenous route of administration is experiencing accelerated growth compared to oral dosage forms, primarily due to the established clinical benefits of high compliance, particularly with Zoledronic Acid (Reclast/Aclasta), which requires only annual dosing. Therapeutic segment trends highlight osteoporosis treatment as the largest application area, but the oncology segment, driven by managing skeletal-related events (SREs) in multiple myeloma and solid tumor metastases, is critical for future revenue generation, often commanding specialized pricing and utilization within hospital settings. Within the drug type segmentation, nitrogen-containing bisphosphonates (like Alendronate, Risedronate, Ibandronate, and Zoledronate) overwhelmingly dominate the landscape due to their superior potency in inhibiting farnesyl diphosphate synthase (FPPS), making them the gold standard for robust anti-resorptive therapy compared to older, non-nitrogenous variants.

AI Impact Analysis on Bisphosphonate Drug Market

Common user questions regarding AI's impact on the Bisphosphonate Drug Market frequently center on whether AI can improve personalized dosing, predict treatment non-response, and expedite the identification of novel anti-resorptive targets. Users are particularly keen to understand how machine learning models can sift through extensive electronic health records (EHRs) and imaging data (DEXA scans) to precisely identify patients at highest risk of fragility fractures, thereby optimizing the timing and type of bisphosphonate intervention. Concerns also revolve around the potential for AI-driven precision medicine to mitigate long-term adverse effects, such as osteonecrosis of the jaw (ONJ) or atypical femoral fractures (AFF), by providing predictive risk scores for individual patients, thus moving treatment protocols beyond generalized guidelines to highly individualized care plans. The expectation is that AI will enhance drug discovery efficiency, streamline clinical trials for new formulations, and ultimately improve overall adherence rates through smart monitoring systems.

- AI algorithms accelerate the discovery of novel non-bisphosphonate anti-resorptive agents by analyzing high-throughput screening data and complex genomic pathways related to bone metabolism.

- Machine learning enhances clinical trial efficiency by optimizing patient selection, predicting participant dropout rates, and accelerating data analysis for drug efficacy and safety monitoring.

- AI-powered diagnostic tools analyze quantitative computed tomography (QCT) and dual-energy X-ray absorptiometry (DEXA) scans with greater precision, identifying microarchitectural bone abnormalities earlier than traditional methods, leading to timely bisphosphonate initiation.

- Predictive modeling utilizes real-world evidence (RWE) from EHRs to calculate individual patient risk for adverse effects like Osteonecrosis of the Jaw (ONJ), allowing clinicians to adjust drug type or duration proactively.

- Artificial intelligence aids in optimizing personalized dosing strategies, particularly for intravenous bisphosphonates, based on patient-specific factors such as renal function, fracture history, and baseline bone turnover markers.

- AI-driven adherence programs use smart packaging or digital platforms to monitor patient compliance with oral bisphosphonate regimens, providing timely reminders and personalized educational content to improve treatment persistence.

- Natural Language Processing (NLP) is employed to analyze vast amounts of medical literature and regulatory documents, identifying patterns related to drug interactions and therapeutic outcomes to refine clinical practice guidelines for bisphosphonate use.

DRO & Impact Forces Of Bisphosphonate Drug Market

The market trajectory is significantly shaped by a confluence of accelerating drivers, persistent restraints, and compelling opportunities, all contributing to the overall impact forces. Key drivers include the overwhelming demographic shift towards an aging global population, directly inflating the incidence of osteoporosis and related skeletal disorders, ensuring a perpetually expanding patient base requiring anti-resorptive treatment. The availability of highly effective, low-cost generic versions of foundational bisphosphonates maintains the accessibility and affordability of treatment, particularly in resource-constrained settings, bolstering adoption rates globally. Furthermore, increasing awareness campaigns and government initiatives focusing on preventive healthcare and fracture risk assessment contribute substantially to early diagnosis and subsequent initiation of bisphosphonate therapy.

Conversely, significant restraints hinder optimal market growth. The most prominent challenges involve patient concerns regarding long-term safety issues associated with bisphosphonate use, specifically the risk, albeit low, of Osteonecrosis of the Jaw (ONJ) and Atypical Femoral Fractures (AFFs). These widely publicized side effects often lead to patient non-compliance or discontinuation, limiting the therapeutic success rate. Additionally, the emergence of newer, premium-priced biologic drugs, such as Denosumab (a RANKL inhibitor), presents strong competition, offering alternative mechanisms of action and often achieving superior short-term bone density gains, sometimes favored by specialists despite the higher cost. Regulatory complexities, particularly concerning long-term post-marketing surveillance required for these drugs, also impose operational hurdles for manufacturers.

Opportunities for expansion lie predominantly in geographical market penetration into underdeveloped or emerging nations where diagnostic infrastructure is rapidly improving and the treatment gap remains substantial. Strategic opportunities also exist in developing next-generation formulations, such as transdermal patches or extended-release oral capsules, aimed at improving patient compliance and overcoming gastrointestinal side effects associated with oral intake. Furthermore, integration of bisphosphonates into combined therapeutic regimens, utilizing them sequentially or concurrently with anabolic agents (e.g., Teriparatide) for severe osteoporosis, represents a high-value growth niche. The continuous research into their repurposing for non-skeletal indications, such as anti-inflammatory properties or potential use in cardiovascular calcification management, offers diversified future revenue streams. These drivers and opportunities collectively outweigh the restraints, resulting in a positive net impact force propelling the market forward moderately and consistently.

Segmentation Analysis

The Bisphosphonate Drug Market is strategically segmented based on several critical parameters including the type of drug, the route of administration, and the therapeutic application. Understanding these segmentations is vital for stakeholders to tailor marketing and distribution strategies effectively, recognizing that patient adherence, convenience, and clinical severity are central to product adoption. The market reflects a clear preference for nitrogen-containing bisphosphonates due to their enhanced potency, while the administration split reveals a strategic pivot towards intravenous options for complex patients and high-compliance regimens, contrasting with the cost-efficiency of oral drugs for standard chronic care. The application segmentation underscores the primary role of these drugs in osteoporosis, but also highlights the specialized, high-revenue niche provided by oncological supportive care.

- By Drug Type:

- Nitrogen-Containing Bisphosphonates (e.g., Alendronate, Risedronate, Ibandronate, Zoledronic Acid)

- Non-Nitrogen-Containing Bisphosphonates (e.g., Etidronate, Clodronate, Tiludronate)

- By Route of Administration:

- Oral

- Intravenous (IV)

- By Application:

- Osteoporosis (Postmenopausal, Male, Glucocorticoid-Induced)

- Paget’s Disease of Bone

- Malignant Hypercalcemia

- Bone Metastases (Oncology Supportive Care)

- Other Applications

- By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Value Chain Analysis For Bisphosphonate Drug Market

The value chain for the Bisphosphonate Drug Market initiates with upstream activities focused on active pharmaceutical ingredient (API) manufacturing and highly specialized chemical synthesis. This stage is complex due to the precise chemical structure required for high bone affinity and potent osteoclast inhibition, demanding stringent quality control measures. Raw material procurement, primarily encompassing complex organic chemicals and solvents, is a crucial upstream element, often centralized among specialized chemical vendors. Intellectual property surrounding novel formulations and synthetic processes provides significant competitive leverage for branded pharmaceutical companies in this phase. Cost efficiency in API production, particularly for generic manufacturers, dictates overall profitability in a heavily price-competitive environment.

Midstream activities involve formulation development, clinical trials, regulatory approval processes, and large-scale manufacturing of the final dosage forms (oral tablets, capsules, and sterile IV solutions). The transition from generic API to finished product requires robust quality assurance protocols and adherence to Good Manufacturing Practices (GMP). Logistics for both oral and IV products require specific handling, particularly the sterile conditions needed for injectable formulations. Marketing and sales efforts are intensified in this stage, targeting key prescribers such as endocrinologists, rheumatologists, orthopedic surgeons, and oncologists, alongside intensive professional education regarding appropriate usage and risk mitigation strategies for long-term therapy.

Downstream analysis focuses heavily on distribution channels and patient access. The distribution network is bifurcated: hospital pharmacies manage the supply of IV bisphosphonates, which are typically administered in clinical settings for high-risk patients or oncology indications; while retail and specialty pharmacies handle the high volume of oral prescriptions. Direct and indirect distribution channels are both vital; direct sales forces engage key opinion leaders and major medical centers, while indirect channels utilize large wholesalers and distributors to ensure widespread geographical reach. The final stage involves patient adherence and retention, where manufacturers and healthcare systems collaborate on education programs and compliance monitoring to ensure patients complete their prescribed therapeutic cycles, maximizing both clinical outcomes and return on investment for the pharmaceutical companies.

Bisphosphonate Drug Market Potential Customers

The primary customer base for the Bisphosphonate Drug Market consists of patient populations suffering from disorders of bone metabolism characterized by excessive bone resorption, predominantly including the geriatric demographic, specifically postmenopausal women and elderly men diagnosed with osteoporosis. These individuals represent the largest volume segment, requiring chronic, long-term pharmacological management to prevent debilitating fractures, which significantly increase mortality and healthcare costs. Healthcare providers, including general practitioners, specialists (endocrinologists, rheumatologists, geriatricians), and hospital systems, function as immediate buyers, procuring the drugs for patient administration and maintenance, and are key targets for marketing and educational efforts, influencing prescription patterns based on formulation preference (oral vs. IV) and clinical guidelines.

A specialized, high-value customer segment includes oncology departments and comprehensive cancer centers. These institutions purchase bisphosphonates (especially Zoledronic Acid and Pamidronate) for their application in mitigating skeletal-related events (SREs) in patients with multiple myeloma and solid tumors that have metastasized to the bone (such as breast and prostate cancer). In this context, the drugs serve a critical palliative role by reducing bone pain, hypercalcemia, and the need for radiation or surgery, positioning cancer centers as major volume consumers, often utilizing IV formulations that require specialized hospital administration protocols and generate substantial revenue for manufacturers due to the acute need and established therapeutic protocols.

Furthermore, managed care organizations (MCOs), insurance providers, and government health agencies (e.g., Medicare/Medicaid in the U.S.) act as indirect but extremely powerful customers by determining formulary inclusion, establishing reimbursement rates, and influencing the accessibility of both generic and branded bisphosphonates. Their purchasing decisions are driven by factors such as cost-effectiveness, clinical evidence, and compliance rates associated with various dosing regimens. For drug manufacturers, securing favorable formulary placement is paramount to ensuring widespread adoption and sustained market penetration across all demographics requiring long-term anti-resorptive therapy, thereby maximizing the total addressable market potential.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.8 Billion |

| Market Forecast in 2033 | USD 9.5 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amgen Inc., Novartis AG, Merck & Co., Inc., Eli Lilly and Company, Sanofi S.A., Takeda Pharmaceutical Company Limited, Teva Pharmaceutical Industries Ltd., Mylan N.V. (Viatris), Sun Pharmaceutical Industries Ltd., Cipla Limited, Hikma Pharmaceuticals PLC, Aurobindo Pharma Ltd., Abbott Laboratories, Fresenius Kabi AG, Accord Healthcare (Intas Pharmaceuticals) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bisphosphonate Drug Market Key Technology Landscape

The technological landscape of the Bisphosphonate Drug Market is centered less on entirely new compounds and more on enhancing formulation, delivery systems, and monitoring technologies to maximize therapeutic effectiveness and compliance while mitigating adverse effects. Key technological advancements focus on improving the bioavailability of oral bisphosphonates, which traditionally suffer from poor absorption, often below 1% of the administered dose. Microencapsulation and specialized pH-sensitive enteric coatings are being utilized to protect the drug from degradation in the stomach and ensure controlled release in the small intestine, thus improving absorption efficiency and reducing gastrointestinal side effects, which are a major cause of non-adherence. Furthermore, the development of effervescent tablets and liquid solutions aims to address the esophageal irritation issues associated with standard tablet ingestion, enhancing patient comfort and improving the overall experience of long-term therapy.

In the realm of injectable formulations, advancements are focused on creating highly potent, ultra-long-acting versions that can extend the dosing interval beyond the current annual injection of Zoledronic Acid. Research into liposomal drug delivery systems and nanoparticle carriers is exploring methods to ensure targeted delivery specifically to bone surfaces (hydroxyapatite binding sites), potentially reducing systemic exposure and minimizing non-skeletal side effects. This targeted delivery technology promises a higher concentration of the active ingredient at the site of action, allowing for lower overall systemic doses and potentially widening the therapeutic window. Such innovation is critical for branded manufacturers seeking to compete against the widespread generic availability of older IV formulations.

Beyond the drug itself, associated monitoring technology significantly impacts the market. The integration of high-resolution quantitative bone imaging techniques, such as High-Resolution Peripheral Quantitative Computed Tomography (HR-pQCT) and Trabecular Bone Score (TBS) analysis, allows for a more detailed, non-invasive assessment of bone microarchitecture in addition to standard Bone Mineral Density (BMD) measurement. This technological capability enables clinicians to better personalize treatment initiation and monitor the patient's response to bisphosphonate therapy. Furthermore, the use of wearable technology and connected health platforms for monitoring compliance and tracking bone turnover markers in real-time offers a data-driven approach to optimize treatment persistence, which is crucial for maximizing the fracture risk reduction achieved by long-term bisphosphonate usage. These technological improvements collectively solidify the clinical and commercial foundation of the market.

Regional Highlights

- North America (United States and Canada): North America holds the largest market share, characterized by high prevalence rates of osteoporosis, sophisticated diagnostic pathways (widespread DEXA screening), and well-established treatment guidelines. The market is highly influenced by advanced reimbursement mechanisms, particularly through Medicare, which covers most anti-resorptive drugs. Despite generic saturation in oral segments (Alendronate, Risedronate), the market value is sustained by premium IV products like Zoledronic Acid and Pamidronate, often utilized in specialized hospital and infusion centers. The U.S. remains the primary hub for clinical research, drug development, and key opinion leader influence, driving early adoption of new formulations and combination therapies. Strict compliance standards and high patient awareness contribute to consistent market demand.

- Europe (Germany, UK, France, Italy, Spain): The European market represents a mature and highly regulated environment. Growth is stable, driven by an accelerating aging population and robust national healthcare systems that prioritize cost-effective chronic disease management. Generic penetration is extremely high, particularly in Germany and the UK, placing significant downward pressure on pricing for oral bisphosphonates. However, clinical demand for IV bisphosphonates in hospital settings (for severe osteoporosis and bone metastases) maintains healthy revenue streams. Regulatory bodies, such as the European Medicines Agency (EMA), heavily influence post-marketing surveillance and risk management protocols concerning ONJ and AFFs, shaping prescribing behaviors across the continent.

- Asia Pacific (APAC) (China, Japan, India, South Korea): APAC is the fastest-growing region, presenting substantial untapped market potential. Key growth drivers include drastic demographic shifts resulting in an enormous geriatric population, rapid urbanization leading to lifestyle changes affecting bone health, and increasing governmental investments in public health infrastructure. Japan and South Korea have mature markets with established treatment protocols. China and India, however, are major growth engines, exhibiting explosive increases in both patient volume and pharmaceutical expenditure. Challenges include fragmented healthcare access in rural areas and the need for greater physician education regarding long-term osteoporosis management, yet the sheer size of the target population ensures robust future expansion.

- Latin America (LATAM) (Brazil, Mexico, Argentina): This region is characterized by moderate growth, driven by improvements in healthcare access and increasing medical literacy. Economic volatility and varying levels of healthcare spending across countries influence market penetration, with generics dominating the landscape due to stringent cost containment measures. Brazil and Mexico are the largest pharmaceutical markets, benefiting from expanding middle classes and government programs aimed at treating prevalent chronic diseases like osteoporosis. Adoption of IV formulations is gradually increasing, particularly in private healthcare sectors, driven by better patient compliance rates.

- Middle East and Africa (MEA): MEA remains the smallest market but offers specialized growth opportunities, particularly in the Gulf Cooperation Council (GCC) countries (Saudi Arabia, UAE) where high healthcare spending supports the adoption of branded and specialized IV treatments. The African segment is largely constrained by limited diagnostic capabilities and infrastructure, focusing predominantly on basic generic oral treatments. Growth is highly dependent on international aid programs and infrastructure development to address chronic diseases.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bisphosphonate Drug Market.- Novartis AG (Aclasta/Reclast - Zoledronic Acid)

- Merck & Co., Inc. (Fosamax - Alendronate)

- Amgen Inc. (Competitor in bone disease management with Prolia/Xgeva, influencing market strategies)

- Sanofi S.A. (Historical portfolio influence)

- Eli Lilly and Company (Significant player in overall bone health therapeutics)

- Teva Pharmaceutical Industries Ltd. (Major generic manufacturer of Alendronate and Risedronate)

- Mylan N.V. (Viatris) (Extensive generic portfolio, including Zoledronic Acid generics)

- Sun Pharmaceutical Industries Ltd. (Strong presence in APAC and emerging markets)

- Cipla Limited (Leading generic player in India and other developing regions)

- Aurobindo Pharma Ltd. (Key API and generic formulation supplier)

- Hikma Pharmaceuticals PLC (Focus on injectable generic bisphosphonates)

- Abbott Laboratories (Global generic division participation)

- Fresenius Kabi AG (Specialist in IV generic pharmaceuticals and hospital supply)

- Accord Healthcare (Intas Pharmaceuticals) (Growing generic footprint in Europe and North America)

- Bayer AG (Peripheral involvement through related products)

- Pfizer Inc. (Generic segment involvement post-acquisition)

- Shionogi & Co., Ltd. (Regional specialization)

- Daiichi Sankyo Company, Limited (Presence in Japan/APAC market)

- Sandoz International GmbH (Novartis generic division)

- Dr. Reddy's Laboratories Ltd. (Indian multinational generic firm)

Frequently Asked Questions

What is the projected Compound Annual Growth Rate (CAGR) for the Bisphosphonate Drug Market through 2033?

The Bisphosphonate Drug Market is forecasted to achieve a Compound Annual Growth Rate (CAGR) of 4.8% during the forecast period from 2026 to 2033, driven primarily by the global increase in the geriatric population and the sustained clinical demand for highly effective anti-resorptive agents.

Which bisphosphonate formulation type is dominating the market based on administration route?

While oral bisphosphonates (like Alendronate) represent the highest volume due to their low cost and broad accessibility, the intravenous (IV) route of administration, dominated by Zoledronic Acid, is experiencing the fastest revenue growth. This acceleration is due to IV formulations offering superior patient compliance, higher potency in severe cases, and preferred utilization in hospital settings for oncology and high-risk osteoporosis patients.

What are the primary factors restraining growth in the Bisphosphonate Drug Market?

Market growth is primarily restrained by long-term safety concerns, notably the rare but serious risks of Osteonecrosis of the Jaw (ONJ) and Atypical Femoral Fractures (AFFs), which lead to patient reluctance and high discontinuation rates. Furthermore, intense competition from high-efficacy biological alternatives, such as Denosumab, acts as a significant restraint, diverting key patient segments.

Which geographic region is expected to demonstrate the highest market growth rate?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) in the Bisphosphonate Drug Market. This growth is underpinned by rapid demographic aging, significant improvements in healthcare infrastructure, increasing disposable incomes, and the currently substantial gap between osteoporosis prevalence and treated population, particularly in China and India.

How is AI impacting the clinical use and development of bisphosphonates?

AI is transforming the clinical application of bisphosphonates by improving fracture risk assessment through advanced analysis of imaging data (DEXA/QCT) and refining personalized medicine strategies. AI models predict individual patient risk for long-term adverse effects like ONJ, enabling clinicians to optimize dosing schedules and improve patient selection, thereby maximizing therapeutic benefits while mitigating known side effects.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager