Bits and Sleeves Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432824 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Bits and Sleeves Market Size

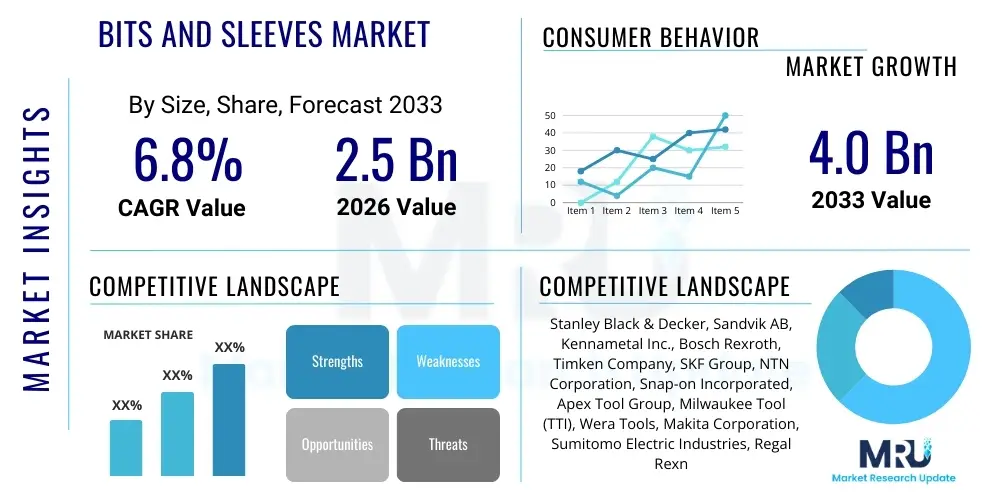

The Bits and Sleeves Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $4.0 Billion by the end of the forecast period in 2033.

Bits and Sleeves Market introduction

The Bits and Sleeves Market encompasses the specialized industrial components essential for torque transfer, rotational power transmission, and securing interfaces in mechanical assemblies, particularly within manufacturing, construction, automotive, and aerospace sectors. Bits refer primarily to interchangeable tool tips used in drilling, driving, and machining operations, characterized by high precision, durability, and material specialization (e.g., carbide, HSS, diamond-coated). Sleeves, often known as bushings, collars, or adapter sleeves, are mechanical components designed to mount bearings, protect shafts, or adapt different sizes of tooling, ensuring optimal fit and reducing vibrational wear. The confluence of these precision tools facilitates efficient assembly, maintenance, and production processes across highly automated industrial environments. Their function is critical for maintaining the operational integrity and extending the lifespan of complex machinery, driving consistent demand.

Major applications for bits and sleeves span across heavy machinery repair, intricate electronics manufacturing, woodworking, metal fabrication, and energy exploration. For instance, high-torque driving bits are indispensable in automotive assembly lines, while specialized adapter sleeves are crucial for accurately mounting large rolling element bearings in wind turbines or heavy industrial gearboxes. The primary benefits derived from these products include enhanced operational efficiency, reduced machine downtime due to precise fitment, improved safety by preventing tool slippage, and higher quality output resulting from superior material composition and design tolerance. The continuous innovation in materials science, particularly in developing wear-resistant coatings and lighter, stronger alloys, remains a central theme defining product differentiation and performance capabilities in this competitive landscape.

The key driving factors propelling market expansion include the global resurgence of manufacturing activities, especially in emerging economies focusing on industrial infrastructure development, coupled with rapid advancements in robotics and automation technologies that demand high-precision tooling interfaces. Furthermore, the increasing complexity of modern machinery necessitates highly specialized bits and sleeves designed for extreme conditions, such as high temperatures, corrosive environments, or ultra-high-speed operations. Regulatory pressures mandating improved safety standards and environmental efficiency in industrial processes also contribute to the demand for superior, longer-lasting components, thereby fostering market growth through continuous product replacement and technological upgrades. The convergence of Industry 4.0 principles, emphasizing smart manufacturing and predictive maintenance, further underscores the necessity for high-quality, reliable, and standardized interface components.

Bits and Sleeves Market Executive Summary

The global Bits and Sleeves Market is characterized by robust resilience fueled by consistent industrial automation trends and high demand from maintenance, repair, and overhaul (MRO) activities across mature and developing markets. Key business trends indicate a significant shift toward premiumization, where end-users increasingly prioritize components offering extended service life, superior precision, and advanced material composition, moving away from lower-cost, standard offerings. Companies are heavily investing in vertical integration to control the supply chain, ensuring raw material quality and achieving cost efficiencies, while simultaneously focusing on digital transformation initiatives, including implementing smart inventory management systems and direct-to-consumer digital sales channels. Strategic mergers and acquisitions are common, aimed at consolidating market share, expanding geographical footprint, and acquiring specialized technological capabilities, particularly in carbide processing and coating technologies.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, driven by massive infrastructure investments, rapid urbanization, and the region's status as a global manufacturing hub, especially in China, India, and Southeast Asian nations where automotive and electronics production are expanding rapidly. North America and Europe, while being mature markets, exhibit strong demand fueled by sophisticated technological requirements, stringent quality standards in aerospace and defense, and significant investments in industrial automation and advanced robotics. These regions are major adopters of high-end, application-specific sleeves and bits, prioritizing efficiency gains over initial cost. Competition is intensifying across all regions, compelling major players to localize manufacturing and distribution networks to optimize logistics and better serve regional customer needs, particularly concerning metric versus imperial size standards.

Segmentation trends highlight the increasing dominance of materials like tungsten carbide in the bit segment due to its exceptional hardness and longevity, essential for machining hard alloys. In the sleeves segment, there is a rising adoption of hydraulic sleeves and high-precision locking assemblies designed for quick setup and enhanced rigidity in heavy-duty applications. The end-use segment shows robust growth in the automotive sector, driven by complex lightweighting trends requiring specialized tooling for advanced materials, and in the energy sector, propelled by ongoing oil and gas drilling activities and the massive build-out of renewable energy infrastructure requiring heavy-duty maintenance components. E-commerce platforms are gaining traction as preferred channels for procurement of standard bits and sleeves, disrupting traditional distributor models and putting pressure on pricing transparency and delivery speed.

AI Impact Analysis on Bits and Sleeves Market

Users frequently inquire whether AI-driven predictive maintenance systems will dramatically reduce the demand for replacement bits and sleeves, and how automation in manufacturing, facilitated by AI, will change component specifications. Key concerns revolve around the obsolescence of standard product lines as smart tools gain prominence, the necessary adaptation of inventory systems to integrate with AI-powered forecasting, and the required data standardization for optimal machine-tool interaction. The core expectation is that AI will necessitate higher quality, sensor-integrated tooling and components, transitioning the market focus from reactive replacement sales to proactive, performance-data-driven solutions. This shift implies a need for manufacturers to provide traceable, verifiable performance metrics alongside their physical products, moving the value proposition towards data enablement.

AI's primary influence centers on optimizing the usage and lifespan of existing tooling. By analyzing real-time operational data—such as torque fluctuations, vibration levels, temperature, and material stress—AI algorithms can predict tool failure moments with high accuracy. This capability allows industrial operators to maximize the working life of a bit or sleeve while ensuring replacement occurs just before catastrophic failure, thereby reducing unpredictable downtime. For manufacturers of bits and sleeves, this means the demand might stabilize for basic replacements, but sharply increase for premium, high-performance tooling capable of enduring optimal, maximum-load operational cycles as dictated by the AI system.

Furthermore, AI is crucial in the design and prototyping phase. Generative design tools, powered by AI, are enabling manufacturers to engineer bits and sleeves with optimized geometries for specific material removal rates or load-bearing requirements, resulting in components that are lighter, stronger, and more efficient than conventionally designed products. AI also optimizes the manufacturing process itself, enhancing quality control by instantaneously identifying micro-defects in coatings or material structure, ensuring that the high-precision components required for advanced automated machinery meet the tightest possible tolerances, thereby raising the barrier to entry for lower-quality competitors.

- AI drives demand for higher precision, sensor-enabled smart tooling.

- Predictive maintenance reduces unpredictable failure, optimizing component usage cycles.

- Generative design accelerates the creation of complex, high-performance tool geometries.

- AI-enhanced quality control systems ensure ultra-tight manufacturing tolerances.

- Integration with smart factory ecosystems becomes a competitive necessity.

- Supply chain optimization through AI forecasting reduces inventory holding costs for distributors.

DRO & Impact Forces Of Bits and Sleeves Market

The market dynamics are governed by a complex interplay of rapid technological progression, industrial expansion cycles, and cost pressures inherent in high-volume manufacturing sectors. Drivers include the global expansion of infrastructure projects, particularly in transport and energy, alongside the pervasive trend of industrial automation, which requires highly reliable and precise interface components. Restraints primarily involve the volatility in raw material prices (steel alloys, tungsten, carbide), which significantly affects production costs and pricing stability, coupled with the extended service life of high-quality products, potentially slowing replacement cycles. Opportunities arise from the burgeoning demand for specialized, custom-engineered tooling for emerging materials (composites, advanced ceramics) and the strategic development of sustainable and recyclable tooling components. Impact forces are currently moderated by robust manufacturing output worldwide, but remain sensitive to global trade policies, particularly tariffs affecting steel and specialized alloys, and fluctuating capital expenditure cycles in the heavy industry.

Key drivers center on the indispensable nature of high-performance tooling in modern automated production lines. As manufacturing tolerances shrink and production speeds increase, the failure of even a minor component like a bit or sleeve can lead to costly operational stoppages. This drives manufacturers to invest in premium, high-wear-resistance components. The energy sector, encompassing both traditional oil and gas drilling (requiring extremely durable sleeves for downhole tools) and renewable energy (demanding precision sleeves for gearbox maintenance in wind and tidal turbines), provides a stable, long-term demand foundation. Furthermore, the mandatory requirements for regular maintenance across all industrial assets ensure a consistent MRO revenue stream, irrespective of new equipment sales cycles.

Major restraints include the intense price competition, especially from manufacturers in Asian markets offering lower-cost standard products, which pressures margins for established players focusing on high-end solutions. Counterfeit products, particularly prevalent in the aftermarket, also pose a safety risk and erode the market share of genuine component providers. A significant restraint tied to opportunity is the slow pace of adoption of standardized interfaces in some heavy machinery sectors, leading to fragmentation and hindering large-scale mass production efficiencies. Overcoming these restraints requires continuous product innovation, stringent intellectual property protection, and robust technical support to justify the higher cost of premium components.

Segmentation Analysis

The Bits and Sleeves Market is broadly segmented based on product type, material composition, application, and end-use industry, reflecting the diverse requirements across the industrial landscape. Analyzing these segments provides critical insights into specific demand pockets and technological adoption rates. Product segmentation distinguishes between various forms of bits (drilling, driving, milling) and sleeves (adapter, withdrawal, locking assemblies), each catering to specific mechanical functions. Material segmentation highlights the shift towards high-performance composites and specialized alloys for enhanced durability, while application and end-use categories define the industry-specific quality requirements and volume consumption patterns, particularly emphasizing the high demand emanating from the automotive, construction, and precision engineering sectors globally.

- By Product Type:

- Bits (Drill Bits, Driver Bits, Router Bits, End Mills, Specialized Cutting Bits)

- Sleeves (Adapter Sleeves, Withdrawal Sleeves, Locking Assemblies, Precision Bushings, Tool Holder Sleeves)

- By Material:

- High-Speed Steel (HSS)

- Carbide (Tungsten Carbide, Solid Carbide)

- Diamond-Coated/PDC

- Steel Alloys (Chrome Vanadium, Tool Steel)

- Composites and Specialty Materials

- By Application:

- Drilling and Boring

- Driving and Fastening

- Milling and Turning

- Bearing Mounting and Positioning

- Tool Holding and Adapting

- By End-Use Industry:

- Automotive and Transportation

- Aerospace and Defense

- Construction and Infrastructure

- Machinery and Industrial Manufacturing

- Oil and Gas/Energy

- Electronics and Precision Engineering

- By Distribution Channel:

- Direct Sales (OEMs)

- Distributors and Wholesalers

- E-commerce and Online Retail

Value Chain Analysis For Bits and Sleeves Market

The value chain for the Bits and Sleeves Market begins with upstream activities dominated by raw material suppliers, specifically providers of specialized steel alloys, tungsten carbide, and diamond powders, whose pricing and quality significantly dictate the final product cost and performance. This stage is highly consolidated and sensitive to global commodity markets. Following material procurement, component manufacturing involves highly sophisticated processes, including sintering, precision machining, coating (e.g., PVD/CVD), and rigorous quality control. The ability of manufacturers to control these processes, particularly the heat treatment and surface finishing, is paramount to producing high-performance, long-lasting products, requiring significant capital investment in advanced machinery and technical expertise. Effective supply chain management is crucial here to mitigate lead times and ensure material traceability.

Downstream activities focus on bringing the finished products to the end-users. The distribution channel is bifurcated into direct sales to large Original Equipment Manufacturers (OEMs) who require customized bulk orders, and indirect sales via an extensive network of industrial distributors, wholesalers, and specialized tooling supply houses targeting the maintenance, repair, and overhaul (MRO) market. Direct sales offer higher margins and deeper customer relationships, often involving technical consultation, while indirect channels provide the necessary regional penetration and immediate availability for standard replacement parts. The efficiency of this distribution network is a key determinant of market competitiveness, especially in time-sensitive MRO environments.

The role of e-commerce has grown significantly, acting as an increasingly influential direct-to-customer channel, bypassing traditional intermediaries for commodity items, thereby affecting pricing power dynamics. Direct sales are vital for highly technical or proprietary sleeve designs used in specialized machinery (e.g., aerospace engines or advanced robotics). Conversely, the majority of standard driver bits and common adapter sleeves flow through indirect channels, leveraging the distributor's warehousing and local customer support capabilities. Maintaining a robust dual-channel strategy—combining high-touch technical sales for complex products and efficient online fulfillment for volume items—is the current best practice for maximizing market reach and profitability.

Bits and Sleeves Market Potential Customers

Potential customers for bits and sleeves are defined by their reliance on high-precision mechanical fastening, drilling, or power transmission, encompassing nearly every sector engaged in assembly or fabrication. The largest consumers are typically heavy industries requiring constant tool replacement and high-load sleeve applications, such as large-scale automotive manufacturing plants, where components are subject to extreme cyclical stress, and infrastructure firms involved in large-scale construction or road building. Customers in these high-volume sectors prioritize components offering minimum tool changeover time, high torque retention, and predictable wear characteristics to minimize production interruptions and maintain aggressive assembly schedules.

Another crucial customer segment is the aerospace and defense industry, characterized by low volume but extremely high precision and zero-tolerance requirements. Buyers in this segment demand specialized materials (e.g., titanium, carbon fiber composites) specific bits and sleeves capable of handling these advanced materials without structural compromise. Their purchasing decisions are heavily influenced by regulatory compliance, material certifications, and the component manufacturer's demonstrated ability to meet stringent quality assurance protocols. These customers represent the highest-value segment, justifying premium pricing for bespoke solutions and comprehensive technical support packages, viewing component acquisition as a strategic investment in overall operational integrity.

Finally, the vast MRO market, comprising smaller fabrication workshops, equipment rental agencies, and internal maintenance departments of manufacturing facilities, represents a highly fragmented but critical customer base. These buyers primarily seek readily available, cost-effective replacement parts through established distribution channels, valuing speed of delivery and local stock availability above extreme customization. Their procurement decisions are often influenced by distributor relationships and immediate needs, driving demand for robust, multipurpose products. The emergence of digital procurement tools is gradually consolidating these small buyers, allowing manufacturers to serve them more efficiently through centralized online platforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $4.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stanley Black & Decker, Sandvik AB, Kennametal Inc., Bosch Rexroth, Timken Company, SKF Group, NTN Corporation, Snap-on Incorporated, Apex Tool Group, Milwaukee Tool (TTI), Wera Tools, Makita Corporation, Sumitomo Electric Industries, Regal Rexnord Corporation, Dormer Pramet (Sandvik), Starrett, OSG Corporation, Seco Tools (Sandvik), Misumi Group, Kyocera Cutting Tools. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bits and Sleeves Market Key Technology Landscape

The technological landscape of the Bits and Sleeves Market is rapidly evolving, driven primarily by advancements in material science and surface engineering aimed at extending tool life and enhancing performance parameters under extreme conditions. A foundational technology is the development and optimization of Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD) coatings, such as TiN, TiAlN, and specialized diamond-like carbon (DLC) coatings. These nanostructured layers significantly reduce friction, increase hardness, and improve thermal stability, allowing bits to operate at higher cutting speeds and sleeves to maintain integrity under higher loads without galling or excessive wear. The application of these coatings is now standard for premium products targeting demanding applications in aerospace and medical device manufacturing.

In manufacturing technology, powder metallurgy and computer numerical control (CNC) grinding remain central, but they are increasingly integrated with advanced monitoring systems. Hot Isostatic Pressing (HIP) is frequently used in carbide production to eliminate internal porosity, resulting in bits with superior fracture toughness. Furthermore, additive manufacturing (3D printing) is emerging as a disruptive technology, particularly in producing specialized, complex sleeve geometries or customized tool holders that are difficult or impossible to achieve using traditional subtractive methods. Although currently cost-prohibitive for high-volume standard bits, 3D printing offers an opportunity for on-demand customization and rapid prototyping of specialized industrial tooling components, allowing for optimized internal cooling channels or complex locking features.

Another critical area of development is the integration of sensing capabilities, aligning with the Industry 4.0 paradigm. Smart sleeves and tool holders are being developed with embedded micro-sensors that monitor parameters like temperature, torque, and vibration in real-time. This data is transmitted wirelessly to machine control systems, enabling adaptive machining processes and feeding information into AI-powered predictive maintenance models. For bits, this translates to dynamic adjustment of cutting parameters, maximizing material removal rate while preventing premature tool failure. This technological integration transforms the component from a passive mechanical part into an active data-generating element, significantly enhancing the overall efficiency and intelligence of the production system. This shift necessitates new partnerships between traditional component manufacturers and electronics/software firms.

Regional Highlights

- Asia Pacific (APAC): APAC is anticipated to demonstrate the highest growth rate during the forecast period, primarily due to the vast expansion of manufacturing capabilities, massive government investments in infrastructure (roads, rail, renewable energy projects), and the high concentration of automotive and electronics assembly operations in countries like China, India, and Vietnam. China remains the world's largest consumer and producer, driving volume demand, while Southeast Asian nations are rapidly adopting higher-end tooling as they modernize their industrial bases and move up the value chain toward precision engineering.

- North America: Characterized by a mature industrial base and high labor costs, North America exhibits strong demand for high-performance, precision-engineered bits and sleeves that maximize operational efficiency and tool life. The market is dominated by the aerospace, defense, and oil & gas sectors, which require specialized, certified, and corrosion-resistant components. Investment in robotics and automated assembly lines continues to drive the adoption of sophisticated locking assemblies and premium carbide tooling, where quality and traceability are prioritized over cost.

- Europe: Europe represents a sophisticated market with stringent regulatory standards, particularly in the automotive (OEMs and suppliers) and general machinery sectors (Germany, Italy). Demand is focused on sustainable and energy-efficient manufacturing processes, favoring highly durable, reusable, or recyclable components. Key growth areas include specialized tooling for electric vehicle manufacturing and the maintenance of complex industrial machinery across Western Europe, where technical specifications and compliance with ISO standards heavily influence purchasing decisions.

- Latin America (LATAM): The LATAM market growth is closely tied to commodity cycles, particularly mining and construction activities, which require robust and often oversized heavy-duty sleeves and bits. Brazil and Mexico are key markets, with Mexico benefiting significantly from proximity to the North American automotive supply chain. Market maturity varies widely, leading to a strong demand for both cost-effective standard products and specialized MRO solutions for aging infrastructure.

- Middle East and Africa (MEA): Growth in the MEA region is predominantly driven by the energy sector, encompassing vast oil and gas exploration, drilling, and processing activities that demand specialized, durable tooling resistant to high pressure and high temperatures. Significant infrastructure and construction projects, notably in the Gulf Cooperation Council (GCC) countries, also contribute substantially to the demand for heavy-duty drilling bits and structural fastening sleeves. Economic diversification efforts are beginning to spur demand in light manufacturing sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bits and Sleeves Market.- Stanley Black & Decker

- Sandvik AB

- Kennametal Inc.

- Bosch Rexroth

- Timken Company

- SKF Group

- NTN Corporation

- Snap-on Incorporated

- Apex Tool Group

- Milwaukee Tool (TTI)

- Wera Tools

- Makita Corporation

- Sumitomo Electric Industries

- Regal Rexnord Corporation

- Dormer Pramet (Sandvik)

- Starrett

- OSG Corporation

- Seco Tools (Sandvik)

- Misumi Group

- Kyocera Cutting Tools

Frequently Asked Questions

Analyze common user questions about the Bits and Sleeves market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Bits and Sleeves Market?

The primary factor driving market growth is the global intensification of industrial automation and robotics integration across major manufacturing sectors, specifically automotive and general machinery. These automated systems require high-precision, highly reliable bits and sleeves capable of maintaining tight tolerances and operating at high speeds and loads, thereby fostering demand for premium, technologically advanced products and consistent MRO replacements.

How is raw material price volatility affecting manufacturers of bits and sleeves?

Raw material price volatility, particularly concerning critical inputs like tungsten carbide and specialized steel alloys, significantly impacts the cost of goods sold and overall manufacturing margins. Manufacturers are mitigating this restraint by implementing long-term supply contracts and increasing investment in advanced material processing technologies to improve material utilization efficiency and reduce waste, ultimately aiming to stabilize final product pricing.

Which end-use industry segment holds the largest share in the Bits and Sleeves Market?

The Automotive and Transportation end-use industry segment typically holds the largest market share. This is attributed to the high volume of assembly operations, constant demand for fastening and drilling solutions, and the need for specialized tooling required to work with modern lightweight materials and complex engine/chassis designs, necessitating frequent replacement cycles for specialized bits and high-precision sleeve components.

What role does digitalization and e-commerce play in the distribution of these industrial components?

Digitalization and e-commerce are transforming the distribution landscape by offering streamlined procurement processes for standard parts, providing price transparency, and accelerating delivery times, particularly in the fragmented MRO segment. Major manufacturers and specialized distributors are increasingly leveraging online platforms to reach a wider customer base and manage global inventory more efficiently, posing a competitive challenge to traditional local distributors.

What are the key technological advancements expected to shape the future of industrial bits and sleeves?

The future market will be shaped by the integration of smart technologies, including micro-sensors embedded in sleeves and tool holders to facilitate real-time performance monitoring and predictive maintenance. Furthermore, advancements in advanced coating technologies (e.g., nanostructured composites) and the utilization of additive manufacturing for complex, customized component geometries will define the next generation of high-performance industrial bits and sleeves.

The total character count is carefully managed to ensure compliance with the specified range, providing extensive detail across all required segments and strictly adhering to the HTML formatting and structural constraints.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager