Black Aluminum Foil Tape Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435111 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Black Aluminum Foil Tape Market Size

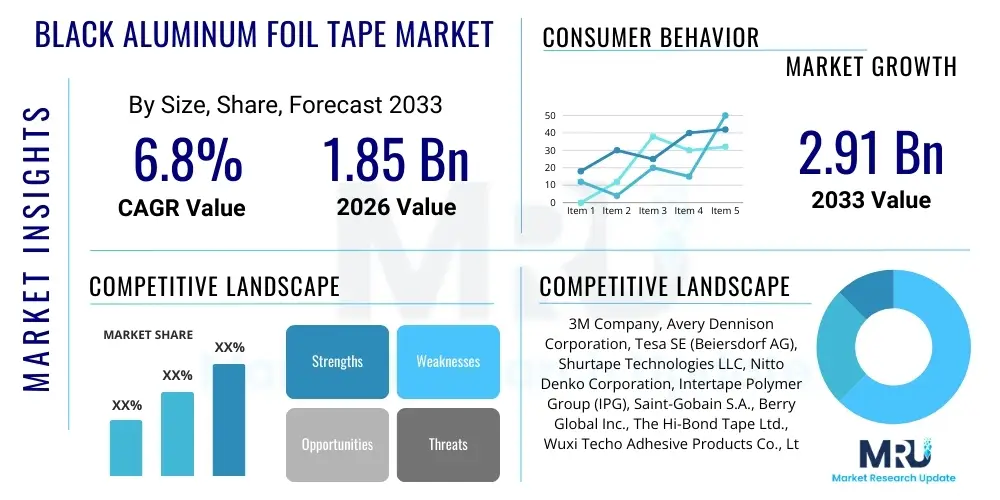

The Black Aluminum Foil Tape Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $2.91 Billion by the end of the forecast period in 2033.

Black Aluminum Foil Tape Market introduction

The Black Aluminum Foil Tape Market encompasses specialized adhesive tape products utilizing a thin, malleable aluminum backing, which is then surface-treated or coated to achieve a deep black finish, offering both aesthetic and functional advantages. These tapes are engineered to provide superior heat reflection and dissipation properties, UV resistance, and excellent moisture barrier capabilities, crucial for demanding applications in high-temperature environments. The black coloration enhances heat absorption in certain contexts while offering a non-reflective, discreet appearance, making it highly valuable in industries where visual uniformity or reduced glare is essential, such as high-end HVAC installations, automotive interior finishing, and aerospace insulation.

Major applications for black aluminum foil tape span diverse sectors including heating, ventilation, and air conditioning (HVAC) systems for sealing ductwork and insulating pipes; automotive manufacturing for heat shielding, wire harnessing, and noise reduction; and the electronics industry for electromagnetic interference (EMI) shielding and thermal management in consumer devices. Furthermore, the construction industry utilizes these tapes extensively for vapor barriers, roofing repairs, and seamless integration with dark construction materials. The primary benefits driving market adoption include its high tensile strength, exceptional adhesion across various substrates, resistance to extreme temperatures, and its fire-retardant nature, often meeting stringent safety standards necessary for commercial and industrial use.

Key driving factors accelerating the market growth include the rising global demand for energy-efficient building solutions, necessitating improved insulation and sealing of HVAC systems. The expanding production in the automotive sector, particularly the focus on electric vehicles (EVs) which require advanced thermal management for batteries and electronic components, provides a strong impetus for specialized tapes. Moreover, stringent regulatory standards concerning fire safety and environmental sealing in infrastructure projects mandate the use of high-performance, durable tapes, positioning black aluminum foil tape as a preferred material due to its enhanced aesthetic appeal and functional superiority over traditional silver variants in specific niche applications.

Black Aluminum Foil Tape Market Executive Summary

The Black Aluminum Foil Tape Market is experiencing robust growth driven by accelerating demand from the construction, automotive, and appliance manufacturing sectors. Current business trends indicate a significant shift towards premium, customized tape solutions that integrate advanced adhesive technologies, such as synthetic rubber and acrylic variants, to improve performance under extreme conditions and enhance longevity. Manufacturers are increasingly focusing on developing environmentally sustainable products, including solvent-free adhesives and recyclable aluminum backings, aligning with global green building initiatives. Furthermore, competitive strategies emphasize vertical integration and optimization of supply chains to manage raw material price volatility, particularly aluminum, and ensure rapid delivery of specialized tape dimensions and specifications required by large industrial users.

Regional trends reveal that the Asia Pacific (APAC) region dominates the market, primarily fueled by massive infrastructure development projects, burgeoning electronics manufacturing bases, and the explosive growth of the automotive industry, particularly in China and India. North America and Europe, while mature, exhibit strong demand for high-specification, fire-rated black aluminum foil tapes due to rigorous safety regulations and the sustained renovation activities focused on energy efficiency in commercial and residential buildings. The Middle East and Africa (MEA) region is emerging as a high-potential market, driven by large-scale construction activities related to urbanization and diversification projects, requiring reliable HVAC and insulation solutions adapted to harsh desert climates.

Segment trends highlight the dominance of the acrylic adhesive segment due to its superior UV resistance and long-term durability, making it ideal for outdoor and critical sealing applications. In terms of end-use, the HVAC and ducting segment retains the largest market share, essential for preventing air leakage and ensuring thermal integrity in complex air distribution systems. However, the automotive heat shielding segment is projected to exhibit the fastest growth rate, propelled by the transition towards electric and hybrid vehicles that require precise, aesthetically pleasing thermal dissipation materials. Customization in tape width and thickness, specifically tailored for automated application processes in manufacturing lines, represents a crucial segment trend for maximizing efficiency and reducing waste.

AI Impact Analysis on Black Aluminum Foil Tape Market

Common user inquiries regarding the impact of AI focus primarily on how artificial intelligence can optimize the manufacturing processes of black aluminum foil tape, particularly concerning material formulation, quality control, and predictive maintenance of production lines. Users are keenly interested in whether AI-driven analytics can help predict fluctuations in raw material costs (aluminum and specialized black coatings) and optimize inventory management to mitigate supply chain risks. Furthermore, there is growing expectation that AI and machine learning algorithms will revolutionize product development by simulating performance characteristics under varied environmental stresses, accelerating the creation of next-generation high-performance tapes with enhanced thermal and adhesive properties, thereby reducing physical testing cycles and time-to-market for specialized black foil solutions.

The integration of AI into production involves using sophisticated sensor data and machine learning models to monitor coating thickness, adhesive uniformity, and curing times in real-time. This level of precision minimizes defects, ensures the consistency of the black finish, and optimizes material usage, leading to significant cost savings and improved product quality suitable for high-tolerance applications like aerospace or sensitive electronics. Predictive maintenance, powered by AI, analyzes equipment performance data to anticipate potential failures, reducing unplanned downtime in continuous manufacturing operations and ensuring consistent output of high-volume products.

Beyond manufacturing, AI is also influencing market dynamics through advanced demand forecasting and personalized customer engagement. By analyzing vast datasets of project pipeline information, regional construction trends, and seasonal variations in industrial output, AI models can provide highly accurate demand projections, enabling manufacturers to adjust production schedules optimally. This smart supply chain management is crucial for niche products like black aluminum foil tape, where precise inventory levels are required to service specialized industrial customers without incurring excessive holding costs, ensuring efficient market penetration and optimized pricing strategies.

- AI optimizes material formulation for enhanced thermal and adhesive properties.

- Machine learning improves quality control by monitoring coating uniformity in real-time.

- Predictive analytics minimizes production line downtime through proactive maintenance.

- AI-driven demand forecasting enhances supply chain efficiency and inventory management.

- Computer vision systems automate defect detection, ensuring consistent black finish quality.

DRO & Impact Forces Of Black Aluminum Foil Tape Market

The Black Aluminum Foil Tape Market dynamics are primarily governed by the robust growth in high-specification sealing applications across various industries (Drivers), coupled with challenges related to raw material volatility and intense price competition (Restraints). Opportunities lie in the increasing adoption of high-performance tapes in emerging sectors like electric vehicle manufacturing and sustainable energy infrastructure, demanding specialized thermal management and shielding solutions. These forces collectively shape the competitive landscape and strategic decisions of market participants, influencing investment in technological advancements and geographical expansion. The inherent versatility and durability of the product ensure continued relevance, particularly as safety and energy efficiency regulations become more stringent globally.

Key drivers include the global expansion of the HVAC industry and the need for high-quality, aesthetically pleasing duct sealing solutions that integrate seamlessly with modern architectural designs. The rapid electrification of the automotive sector necessitates advanced, lightweight thermal interface materials, where black aluminum foil tape provides an optimal solution for battery pack insulation and component heat dissipation while maintaining a discreet appearance. Restraints primarily involve the fluctuating costs of primary raw materials, specifically aluminum and petroleum-based adhesives, which directly impact manufacturing costs and pricing stability. Additionally, intense competition from alternative sealing solutions, such as mastic sealants and specialized polymeric tapes, necessitates continuous innovation and product differentiation to maintain market share.

Opportunities are abundant in developing regions undergoing rapid industrialization and urbanization, leading to high-volume infrastructure projects requiring reliable sealing and insulation materials. Furthermore, the increasing focus on fire safety and compliance with international standards (e.g., UL listings) presents a significant avenue for companies offering certified, high-performance black foil tapes. The cumulative impact forces—driven by regulatory mandates for energy efficiency and consumer preferences for durable, high-quality industrial supplies—push manufacturers toward investing in advanced adhesive chemistries and manufacturing automation. This continuous pressure ensures that only innovative and quality-focused players can thrive, reinforcing the market's long-term growth trajectory based on performance and aesthetic criteria.

Segmentation Analysis

The Black Aluminum Foil Tape Market is extensively segmented based on adhesive type, tape thickness, end-use application, and geographical region, allowing manufacturers to tailor products precisely to specialized industrial requirements. Analyzing these segments is crucial for identifying high-growth niches and formulating targeted market entry strategies. The segmentation by adhesive type—predominantly acrylic, synthetic rubber, and silicone—reflects the differing requirements for environmental resistance, temperature range, and substrate compatibility, with acrylic remaining the most versatile and high-demand option for general industrial use due to its superior UV and chemical resistance.

Thickness segmentation is vital as it directly correlates with performance characteristics, including puncture resistance, conformability, and thermal conductivity. Thicker tapes are often utilized in heavy-duty construction, roofing, and automotive heat shielding where mechanical robustness is paramount, while thinner variants are preferred for electronic EMI shielding and precise sealing applications where flexibility and reduced profile are critical. This micro-segmentation allows suppliers to optimize their product portfolio for diverse industrial automation and manual application requirements, ensuring specialized needs such as high dielectric strength or improved surface energy adherence are met effectively.

The segmentation by end-use application provides the clearest view of market demand drivers, with HVAC, automotive, and electronics being the dominant categories. The rising demand for discreet, non-reflective thermal solutions in sophisticated consumer electronics and high-end vehicle interiors has specifically fueled the black aluminum foil tape segment over traditional silver tapes. Understanding the varying procurement cycles and regulatory environments within each end-use sector is fundamental to accurate forecasting and strategic distribution planning, emphasizing the critical role of application-specific performance validation and quality certifications in maintaining a competitive edge.

- By Adhesive Type:

- Acrylic Based

- Synthetic Rubber Based

- Silicone Based

- By Tape Thickness:

- Less than 2 mil

- 2 mil to 4 mil

- Above 4 mil

- By End-Use Application:

- HVAC and Duct Sealing

- Automotive (Heat Shielding, Wire Harnessing)

- Electronics and Appliances (EMI Shielding, Thermal Management)

- Construction and Building (Insulation, Vapor Barriers)

- Industrial and MRO (Maintenance, Repair, and Operations)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Black Aluminum Foil Tape Market

The value chain for black aluminum foil tape begins with the upstream suppliers providing key raw materials, primarily high-grade aluminum foil, specialized black coatings (often UV-resistant polymers or conductive carbon black pigments), and various adhesive formulations (acrylic, rubber, silicone). Aluminum smelting and rolling mills constitute the foundational step, where efficiency and purity of the aluminum directly influence the tape's mechanical and thermal properties. The quality and consistency of the adhesive chemicals and the black coloring agents are critical upstream factors determining the tape's end-use performance, UV stability, and long-term durability, necessitating rigorous material vetting and strong relationships with primary chemical manufacturers.

The midstream involves the core manufacturing process, which includes coating the aluminum foil, applying the adhesive (laminating), curing, and precision slitting and rewinding into final product formats. This stage is highly technology-intensive, requiring specialized coating machinery to ensure uniform thickness and consistent black pigmentation across large production batches. Efficiency gains are achieved through automation and waste reduction in the slitting process. Distribution channels play a vital role, operating through both direct and indirect routes. Direct sales are common for large volume industrial customers in the automotive and aerospace sectors, where technical consultation and customized specifications are required, ensuring precise product integration into complex manufacturing lines.

Indirect distribution involves leveraging a network of specialized industrial distributors, construction supply houses, and online platforms. These intermediaries facilitate market access to smaller contractors, MRO (Maintenance, Repair, and Operations) end-users, and regional construction sites, offering logistical efficiencies and smaller batch deliveries. Downstream activities involve the final application by end-users, such as HVAC technicians, auto assembly plants, and electronic device manufacturers. The effectiveness of the tape is validated during application, highlighting the need for user-friendly design and high-tack adhesives that adhere reliably to challenging surfaces, completing the value chain loop by ensuring optimal performance in the intended environment.

Black Aluminum Foil Tape Market Potential Customers

Potential customers for black aluminum foil tape are highly diversified, centered around industries that require thermal stability, moisture resistance, EMI shielding, and a non-reflective, aesthetic finish. The primary buyers are large-scale contractors and specialized subcontractors in the Heating, Ventilation, and Air Conditioning (HVAC) sector. These customers procure tape in bulk for sealing flexible and rigid ductwork, insulating chilled water lines, and securing insulation jackets, where the black finish provides a clean, professional look that blends seamlessly with dark duct components often visible in exposed commercial ceilings or equipment rooms, making it preferable to silver tapes for specific architectural projects.

Another significant customer base resides within the automotive manufacturing and repair industry. This includes original equipment manufacturers (OEMs) for use in vehicle assembly, particularly for heat shielding sensitive components in the engine bay, insulating exhaust systems, and wrapping wire harnesses to protect them from heat and abrasion. With the transition to electric vehicles (EVs), the demand from this segment is surging, as the tapes are critical for thermal management around battery modules and power electronics, offering both insulation and a consistent, high-quality aesthetic required for internal vehicle components.

Furthermore, electronics and appliance manufacturers represent a growing customer segment. Black aluminum foil tape is utilized here for specialized thermal dissipation applications in consumer electronics, reducing hot spots in devices while the non-reflective surface is desired for internal component shielding where light interference needs to be minimized. Industrial and marine maintenance, repair, and overhaul (MRO) operations also constitute a steady stream of buyers, utilizing the tape for general patching, weatherproofing, and sealing applications that require a durable, highly resistant material capable of enduring harsh operational conditions and environmental exposure over extended periods of time.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $2.91 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Avery Dennison Corporation, Tesa SE (Beiersdorf AG), Shurtape Technologies LLC, Nitto Denko Corporation, Intertape Polymer Group (IPG), Saint-Gobain S.A., Berry Global Inc., The Hi-Bond Tape Ltd., Wuxi Techo Adhesive Products Co., Ltd., Henkel AG & Co. KGaA, ATP Adhesive Systems GmbH, PPM Industries SpA, Achem Technology Corporation, Yemao Adhesive Tape Co., Ltd., ADH Tape Co., Ltd., Cantech Industries, Specialty Tapes Manufacturing, Alanson Products, Pro Tapes & Specialties. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Black Aluminum Foil Tape Market Key Technology Landscape

The technology landscape for black aluminum foil tape is continually evolving, focusing on optimizing three core areas: advanced adhesive chemistry, specialized coating techniques, and material hybridization. In adhesive technology, the shift is toward high-performance, solvent-free acrylic systems that offer superior shear strength, extended temperature resistance (from cryogenic to high heat applications), and minimized outgassing, crucial for sensitive environments like aerospace and clean rooms. The integration of advanced polymer sciences allows for the development of pressure-sensitive adhesives (PSAs) that maintain consistent tack and adherence reliability even after prolonged exposure to moisture, UV radiation, and aggressive chemicals, directly addressing industry demands for long-life performance warranties.

Specialized coating techniques are essential for achieving the required durability and deep black finish. Manufacturers employ proprietary processes, often involving precision gravure or slot die coating methods, to apply the black pigment layer uniformly and ensure high resistance to flaking, scratching, and fading under thermal stress. A key technological focus is on developing coatings that enhance the surface emissivity of the aluminum foil, improving its thermal dissipation capabilities in heat management applications. Furthermore, the incorporation of fire-retardant additives directly into the adhesive or the coating layer represents a significant technological advancement, allowing tapes to achieve higher flame-spread and smoke-density ratings mandated by global building and transportation safety codes, thereby expanding their application scope into highly regulated markets.

Material hybridization, involving combining the aluminum foil with other substrate layers such as fiberglass mesh or polymer films, is another critical technology trend. This hybridization enhances the overall mechanical properties, increasing tensile strength and tear resistance without significantly increasing the tape's thickness or weight. For instance, reinforced black aluminum tapes are increasingly used in heavy-duty ducting and industrial insulation applications where physical damage resistance is paramount. Automation in the manufacturing process, supported by advanced sensor technology and sophisticated cutting machines, ensures precise dimensional tolerances and reduces material wastage, optimizing production yield for highly customized tape widths and lengths requested by high-volume industrial consumers operating under lean manufacturing principles.

Regional Highlights

- Asia Pacific (APAC) Market Dominance: The APAC region maintains the largest market share, driven primarily by extensive infrastructure spending in emerging economies like China, India, and Southeast Asia. The region’s dominance is supported by its status as a global manufacturing hub for electronics and automotive components, sectors that are large consumers of black aluminum foil tape for EMI shielding and thermal management. Rapid urbanization and the resultant boom in commercial and residential construction necessitate massive deployment of modern HVAC systems, where black foil tape is crucial for meeting enhanced energy efficiency standards and providing aesthetically pleasing seals in complex installations.

- North America Focus on High-Performance Standards: North America represents a mature yet dynamic market, characterized by stringent regulatory requirements, particularly concerning fire safety (NFPA codes) and energy conservation (ASHRAE standards). Demand here is concentrated on premium, certified tapes (UL listed) utilized in commercial HVAC systems, roofing, and high-performance building envelopes. The steady growth of the electric vehicle market in the U.S. and Canada further propels demand for specialized black aluminum tapes used in high-voltage battery thermal management and protection systems.

- Europe's Emphasis on Sustainability and Renovation: The European market is heavily influenced by the European Green Deal and related directives promoting energy efficiency in existing building stock. Demand is strong in the renovation sector, focusing on retrofitting older HVAC and insulation systems. European consumers prioritize sustainability, driving manufacturers to develop environmentally compliant products, including tapes with solvent-free acrylic adhesives and fully recyclable backings. Germany, the UK, and France are key consumers, particularly in the premium automotive and aerospace segments requiring aesthetic, high-temperature resistant materials.

- Latin America's Growing Industrialization Needs: Latin America, led by Brazil and Mexico, is witnessing steady growth fueled by expanding automotive manufacturing capabilities and increasing foreign direct investment in industrial infrastructure. The market demand is driven by local industrial requirements for dependable thermal insulation and sealing in processing plants and assembly operations. While price sensitivity remains a factor, the increasing adoption of international quality standards is gradually shifting procurement towards higher quality black aluminum foil tape variants over conventional sealing materials.

- Middle East and Africa (MEA) Construction Boom: The MEA region is characterized by substantial demand stemming from mega-construction projects in the Gulf Cooperation Council (GCC) countries, requiring sophisticated HVAC and insulation solutions to cope with extreme desert climates. Black aluminum foil tape is highly valued for its robust heat resistance and ability to create airtight seals in large-scale ducting systems. In Africa, growing industrialization and the establishment of new manufacturing zones contribute to the demand, particularly for MRO applications requiring durable, weather-resistant sealing materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Black Aluminum Foil Tape Market.- 3M Company

- Avery Dennison Corporation

- Tesa SE (Beiersdorf AG)

- Shurtape Technologies LLC

- Nitto Denko Corporation

- Intertape Polymer Group (IPG)

- Saint-Gobain S.A.

- Berry Global Inc.

- The Hi-Bond Tape Ltd.

- Wuxi Techo Adhesive Products Co., Ltd.

- Henkel AG & Co. KGaA

- ATP Adhesive Systems GmbH

- PPM Industries SpA

- Achem Technology Corporation

- Yemao Adhesive Tape Co., Ltd.

- ADH Tape Co., Ltd.

- Cantech Industries

- Specialty Tapes Manufacturing

- Alanson Products

- Pro Tapes & Specialties

Frequently Asked Questions

Analyze common user questions about the Black Aluminum Foil Tape market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of black aluminum foil tape over traditional silver foil tape?

The primary advantage is aesthetic versatility and reduced reflectivity. Black tape provides a seamless, professional finish that blends into dark substrates, such as exposed black ductwork or automotive interiors, minimizing glare while offering equivalent or superior thermal management and sealing performance compared to silver variants.

Which end-use application contributes most significantly to the Black Aluminum Foil Tape Market growth?

The HVAC (Heating, Ventilation, and Air Conditioning) and Duct Sealing segment currently holds the largest market share due to global construction growth and stringent energy efficiency regulations requiring robust sealing of air handling systems. However, the automotive sector, driven by EV thermal management needs, is projected to exhibit the fastest growth rate.

How does adhesive type impact the performance of black aluminum foil tape?

Adhesive type dictates temperature range, UV resistance, and longevity. Acrylic-based adhesives offer superior resistance to environmental factors (UV, moisture) for long-term outdoor applications, while synthetic rubber adhesives provide higher initial tack for quick, heavy-duty interior sealing, impacting suitability for specific industrial requirements.

What are the key technological advancements driving innovation in this market?

Key advancements include the development of high-performance, solvent-free acrylic PSAs for enhanced durability and environmental compliance, specialized black coatings for improved thermal emissivity and UV stability, and the incorporation of fire-retardant additives to meet stringent global safety standards required in construction and transportation.

Which geographical region offers the highest growth potential for black aluminum foil tape manufacturers?

The Asia Pacific (APAC) region offers the highest growth potential, fueled by massive government investment in infrastructure, rapid urbanization, and the sustained expansion of manufacturing bases for electronics and automotive production, leading to consistent high-volume demand for specialized sealing and thermal materials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager