Black Coffee Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433605 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Black Coffee Market Size

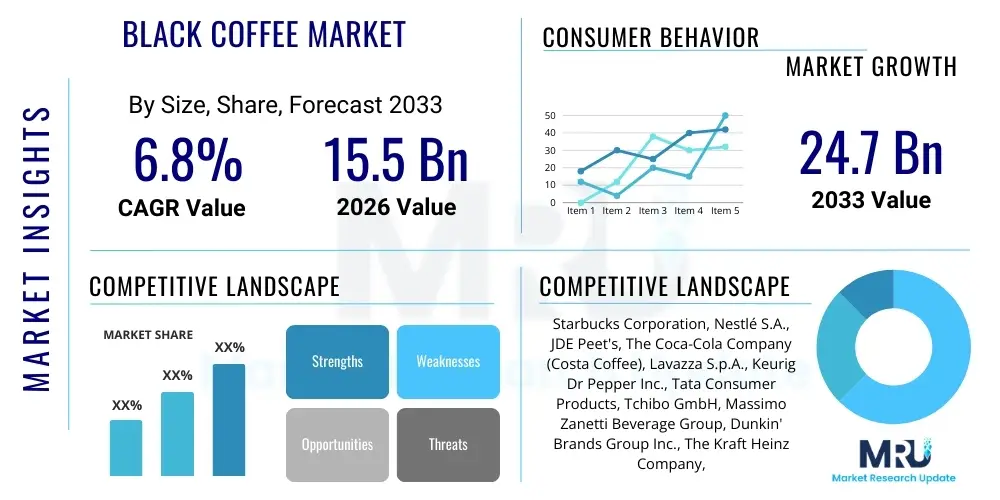

The Black Coffee Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $15.5 Billion in 2026 and is projected to reach $24.7 Billion by the end of the forecast period in 2033.

Black Coffee Market introduction

The Black Coffee Market encompasses the consumption and sale of coffee beverages prepared without the addition of milk, cream, or significant sweeteners. This segment is driven primarily by increasing consumer health consciousness, as black coffee is viewed as a zero-calorie, functional beverage offering natural energy and high antioxidant levels. The product spectrum ranges widely, including traditional brewed hot coffee, cold brew, nitro coffee, espresso, and various forms of instant black coffee. Geographic consumption patterns are diverse, with robust demand across established markets in North America and Europe, alongside rapidly accelerating uptake in Asia Pacific, particularly among younger demographics who appreciate its purity and versatile consumption methods.

Major applications of black coffee span both residential consumption, facilitated by readily available home brewing equipment and instant coffee options, and commercial channels, dominated by specialized coffee shops, cafés, and Quick Service Restaurants (QSRs). The appeal of black coffee is intrinsically linked to its perceived benefits, which extend beyond simple caffeine delivery. It is valued for enhancing cognitive function, boosting metabolism, and serving as a staple in various intermittent fasting and low-carb diets. These health and wellness attributes are significant driving factors, compelling manufacturers to invest heavily in sourcing high-quality, single-origin beans and developing advanced brewing technologies, such as specialty cold brew techniques, to enhance the flavor profile and overall consumer experience.

Driving factors propelling the market forward include the premiumization trend, where consumers are willing to pay more for ethically sourced, traceable, and specialty coffee beans (such as Arabica single-origin varieties). Furthermore, urbanization and the accelerating pace of modern life have cemented the role of convenient formats, like ready-to-drink (RTD) black coffee and high-quality instant powder, catering to on-the-go consumption. Marketing strategies emphasize the sophisticated flavor notes and the simplicity of the beverage, positioning it as a lifestyle choice reflective of discerning taste. Regulatory standards regarding quality control and labeling transparency are also evolving, ensuring consumer confidence in the sourcing and purity of the black coffee products available across global supply chains.

Black Coffee Market Executive Summary

The Black Coffee Market exhibits sustained growth underpinned by robust demand stemming from the global shift towards healthier beverage choices and the increasing adoption of specialty coffee culture. Business trends indicate a strong focus on sustainability, with major industry players committing to fair trade practices, responsible sourcing, and eco-friendly packaging solutions. This emphasis on ethical supply chains not only addresses consumer expectations but also enhances brand equity, particularly among Millennial and Gen Z consumers. Furthermore, the market is undergoing rapid innovation in preparation methods, characterized by the proliferation of nitrogen-infused black coffee and sophisticated cold extraction techniques that promise smoother, less acidic flavor profiles. Strategic mergers and acquisitions are common as large beverage conglomerates seek to integrate boutique specialty brands to capture niche, high-growth segments.

Regionally, North America and Europe currently represent the largest revenue bases, driven by high per capita consumption rates and deeply entrenched coffee-drinking habits. However, the Asia Pacific region is forecast to register the highest CAGR, primarily fueled by rapid economic expansion, rising disposable incomes, and the Westernization of consumer tastes in markets like China, India, and Southeast Asia. Regulatory environments across key regions are favorable, focusing on standardizing quality certifications and promoting transparency regarding bean origin and roasting process. This international harmonization aids cross-border trade and facilitates the expansion of global coffee chains. Competition remains fierce, centering on product differentiation, competitive pricing strategies for mass-market segments, and aggressive digital marketing campaigns targeting the health and wellness community.

Segmentation trends highlight the increasing dominance of the Cold Brew Black Coffee segment, catering to younger consumers who prefer chilled, year-round consumption options. In terms of distribution, online retail channels are experiencing disproportionate growth, driven by subscription models and direct-to-consumer (DTC) sales of specialty beans and RTD formats. The Instant Black Coffee segment is simultaneously being revitalized through technological improvements in freeze-drying and micro-grinding, offering convenience without compromising the quality previously associated with traditional instant products. Overall, the market trajectory is upward, dictated by a consumer base that is increasingly educated about coffee quality and highly receptive to functional, clean-label beverage options.

AI Impact Analysis on Black Coffee Market

Analysis of common user questions related to the intersection of Artificial Intelligence (AI) and the Black Coffee Market reveals primary themes revolving around supply chain optimization, personalized consumer experiences, and robotic automation in preparation and service. Users frequently inquire about how AI can predict bean price volatility, optimize farming practices (precision agriculture), and ensure traceability from farm to cup, addressing concerns about ethical sourcing and quality consistency. Furthermore, there is significant user interest in AI-driven recommendation engines used by online retailers to suggest specific roast levels or single-origin coffees tailored to individual taste profiles derived from past purchase data. Expectations also include the use of sophisticated robotics and computer vision in high-volume commercial settings to standardize brewing parameters, ensuring every cup of black coffee meets predefined quality metrics, thereby eliminating human error and variability.

The implementation of AI algorithms is fundamentally transforming the agricultural and logistics sectors underpinning the black coffee supply chain. Predictive analytics, utilizing machine learning, allows large-scale producers and distributors to forecast global demand fluctuations and proactively manage inventory levels, thereby reducing waste and enhancing capital efficiency. These systems analyze vast datasets related to climate patterns, disease prevalence, and socio-economic factors impacting key coffee-producing regions. By leveraging these insights, companies can make data-driven purchasing decisions, mitigating risks associated with commodity price volatility and ensuring a stable, high-quality supply of green coffee beans essential for black coffee production.

In the consumer-facing domain, AI is instrumental in developing advanced personalization and marketing strategies. Retailers and coffee subscription services deploy AI to categorize complex flavor data and match consumers with highly specific product offerings, leading to increased customer retention and basket size. Furthermore, within high-end café environments, AI-powered equipment monitors and adjusts espresso extraction parameters in real-time, focusing on factors like grind size, pressure, and temperature to achieve optimal flavor yield, which is critical for maximizing the purity and richness of black coffee served commercially. This integration of smart technology elevates the consistency and premium perception of black coffee products, directly enhancing the consumer value proposition.

- AI-driven precision agriculture optimizes coffee crop yields and reduces operational costs in cultivation.

- Machine learning algorithms enhance supply chain transparency and track provenance (traceability) of specialty beans.

- Predictive analytics aids in forecasting green bean commodity prices and managing inventory risks.

- AI-powered recommendation engines customize coffee bean suggestions for direct-to-consumer online sales.

- Robotics and computer vision automate commercial brewing and quality control, ensuring consistent flavor profiles.

- Natural Language Processing (NLP) analyzes customer feedback and sentiment, informing new product development strategies.

DRO & Impact Forces Of Black Coffee Market

The dynamics of the Black Coffee Market are fundamentally shaped by a complex interplay of Drivers, Restraints, Opportunities (DRO), and associated impact forces that dictate market expansion and competitive strategy. Key drivers include the relentless global focus on health and wellness, positioning black coffee as a natural, low-calorie, and highly functional energy source, perfectly aligning with dietary trends such as intermittent fasting and ketogenic lifestyles. The rapid proliferation of sophisticated home brewing equipment (e.g., single-serve machines, advanced pour-over systems) and the resulting premiumization of the at-home experience significantly boost consumption frequency. Furthermore, the cultural adoption of specialty coffee, emphasizing single-origin beans, unique roasting techniques, and complex flavor profiles, stimulates premium purchasing behavior and expands the market's high-value segment.

Conversely, the market faces notable restraints, predominantly centered around price volatility and supply chain vulnerabilities. Coffee bean cultivation is highly susceptible to climate change, pests, and political instability in major producing regions (the impact force being environmental risk), which can lead to unpredictable pricing and potential supply shortages for high-quality Arabica beans preferred for black coffee. Another restraint is the increasing consumer awareness regarding caffeine sensitivity and associated health risks, leading a minority segment to seek decaffeinated alternatives or avoid coffee entirely. Intense competition from other functional beverages, such as specialty teas, energy drinks, and enhanced waters, also dilutes potential market share, forcing companies to continuously innovate and differentiate their black coffee offerings.

Significant opportunities are present in emerging markets, particularly across Asia Pacific and Latin America, where coffee consumption habits are shifting away from traditional tea or carbonated beverages toward premium coffee. The burgeoning demand for ready-to-drink (RTD) black coffee formulations, which offer unparalleled convenience and consistency, represents a major avenue for expansion. Technological advancements, specifically in sustainable farming practices (e.g., biodynamic coffee) and innovative processing (e.g., advanced fermentation techniques), offer avenues to improve product quality, reduce environmental impact, and command higher price points. The development of robust direct-trade relationships also presents an opportunity for greater margin control and enhanced brand storytelling regarding ethical sourcing and farmer support.

Segmentation Analysis

The Black Coffee Market is segmented comprehensively based on key differentiators, primarily encompassing the product type, distribution channel, and end-user application. Product segmentation is crucial, as it reflects consumer preferences for convenience, preparation style, and flavor characteristics, spanning categories such as Hot Black Coffee (traditional brewed coffee and espresso), Cold Brew Black Coffee (slow-steeped concentrate and nitro infusions), and Instant Black Coffee (freeze-dried or granulated). The evolution of the market is strongly indicated by the rapid growth within the cold brew category, driven by younger demographics seeking less acidic and often higher-caffeine products that serve as year-round refreshments.

Distribution channel analysis highlights the relative importance of both traditional retail and modern digital commerce platforms. While Supermarkets/Hypermarkets and convenience stores remain vital for mass-market and instant products, the specialty segment heavily relies on Coffee Shops/Cafés for experience-driven consumption and education, and increasingly on Online Retail channels for subscription services and niche, specialty bean sales. End-user segmentation distinguishes between Residential consumption, driven by home brewing and convenience-focused formats, and Commercial consumption, driven by HoReCa (Hotel, Restaurant, and Café) sectors and institutional sales, where consistency and volume efficiency are paramount concerns.

- Product Type:

- Hot Black Coffee (Brewed Coffee, Espresso, Americano)

- Cold Brew Black Coffee (Standard Cold Brew, Nitro Cold Brew)

- Instant Black Coffee (Freeze-Dried Powder, Micro-Ground Coffee)

- Distribution Channel:

- Online Retail (E-commerce Platforms, Subscription Services)

- Supermarkets/Hypermarkets

- Convenience Stores

- Coffee Shops/Cafés (HoReCa)

- End-User:

- Residential (At-Home Consumption)

- Commercial (Cafés, Offices, Institutional Settings)

Value Chain Analysis For Black Coffee Market

The Black Coffee Market value chain is inherently complex, starting with agricultural production and extending through highly specialized processing and diverse distribution channels. The upstream segment involves the cultivation, harvesting, and initial processing (wet or dry milling) of green coffee beans, dominated by producing countries in Latin America, Africa, and Asia. Efficiency and sustainability in this initial stage are critical, as the quality of the green bean directly dictates the final flavor profile achievable in the black coffee product. Price stabilization and ethical sourcing agreements (such as Fair Trade and Direct Trade certifications) are crucial components of managing risk and ensuring consistent raw material supply for premium black coffee producers.

Midstream activities encompass the crucial steps of sourcing, warehousing, quality control, and, most importantly, roasting and grinding. Roasting is a highly technical process that determines the color, flavor notes, and acidity level, which are paramount for black coffee consumers. Major market players invest heavily in proprietary roasting technologies to ensure consistency across batches. Following roasting, packaging and branding become central. Downstream activities involve distribution through various channels. Direct distribution is common for high-end specialty roasters who sell via their own branded cafes or online platforms, offering higher margins and control over the brand experience. Indirect distribution utilizes large wholesale agreements, third-party logistics providers, and placement in supermarkets and convenience stores for widespread mass-market penetration.

Distribution channels are fragmented yet highly optimized. Direct channels, such as branded coffee shops (Starbucks, Costa Coffee), offer consumers the immediate consumption experience and reinforce brand loyalty, often serving as the primary touchpoint for black coffee introduction. Indirect channels, particularly e-commerce and large retailers, are critical for sales of packaged beans, ground coffee, and instant formats. The value chain's integrity relies heavily on logistics, requiring specialized handling to maintain the freshness and aromatic qualities of the roasted coffee, especially for international shipments. Effective value chain management, including transparent sourcing and minimizing carbon footprint, serves as a significant competitive advantage in the contemporary black coffee market.

Black Coffee Market Potential Customers

The primary customer base for the Black Coffee Market is diverse, segmented across various demographic and psychographic profiles, yet unified by a preference for functional beverages, flavor purity, and convenience. Potential customers include traditional coffee aficionados who prioritize the complex flavor profiles derived from specialty, single-origin beans and intricate brewing methods like pour-over or espresso. These consumers are typically affluent, educated, and seek an elevated sensory experience, often engaging with specialized cafes and subscribing to high-end bean delivery services. They are the driving force behind the premiumization trend, valuing information about provenance, roast date, and ethical sourcing over price sensitivity.

A second significant customer segment comprises health-conscious individuals and professionals. This group views black coffee not merely as a beverage but as a functional tool for boosting mental clarity, physical energy, and supporting specific dietary goals (e.g., intermittent fasting). These customers often gravitate towards clean-label, ready-to-drink (RTD) black coffee and instant formats that facilitate on-the-go consumption without added sugars or artificial ingredients. Their purchasing decisions are heavily influenced by nutritional transparency and the perceived benefits of antioxidants, driving demand for innovative products like enhanced cold brews and performance-focused blends.

The third major segment encompasses younger consumers (Millennials and Gen Z) who are increasingly adopting coffee culture, particularly the less traditional cold brew and nitro formats. For this segment, black coffee is a lifestyle accessory, often consumed socially or purchased from trendy, highly aesthetic independent cafes. Convenience and environmental responsibility are key decision factors. Instant black coffee consumers, who prioritize speed and affordability without compromising basic quality standards, represent another substantial segment, typically found in high-volume settings such as offices, educational institutions, and residential markets focused on daily efficiency and cost-effectiveness.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $15.5 Billion |

| Market Forecast in 2033 | $24.7 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Starbucks Corporation, Nestlé S.A., JDE Peet's, The Coca-Cola Company (Costa Coffee), Lavazza S.p.A., Keurig Dr Pepper Inc., Tata Consumer Products, Tchibo GmbH, Massimo Zanetti Beverage Group, Dunkin' Brands Group Inc., The Kraft Heinz Company, Melitta Group, Strauss Group, Illycaffè S.p.A., Death Wish Coffee Co., Blue Bottle Coffee (Nestlé), Peet's Coffee, Eight O'Clock Coffee, Luigi Lavazza S.p.A., Green Mountain Coffee Roasters |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Black Coffee Market Key Technology Landscape

The technological landscape of the Black Coffee Market is characterized by innovations that enhance both preparation precision and product format convenience. Key technologies driving the market include advanced roasting equipment, particularly fluid-bed roasters and sophisticated drum roasters equipped with real-time digital monitoring and profile control. These systems allow master roasters to precisely replicate complex roast curves, ensuring optimal flavor development and consistency, which is paramount for high-quality black coffee. Furthermore, grinding technology, including ceramic burr grinders and precision particle size analyzers, plays a crucial role in maximizing extraction efficiency, a critical factor whether the coffee is intended for espresso, drip, or pour-over methods, significantly impacting the final taste profile.

In the preparation and consumption sphere, technologies related to cold extraction and preservation are rapidly gaining prominence. Cold brew manufacturing leverages large-scale, controlled steeping systems designed to extract desirable compounds while minimizing acidity, leading to a smoother black coffee concentrate. Nitro infusion technology utilizes specialized equipment to inject inert nitrogen gas into cold brew, creating a cascading, creamy texture without the need for dairy, thereby enhancing the sensory appeal of black coffee. Additionally, the proliferation of single-serve pod technology, optimized for black coffee consumption, provides speed and consistency for residential and office environments, although manufacturers are constantly working on biodegradable and recyclable materials to address the environmental footprint of this format.

Supply chain technology, including blockchain implementation, is emerging as a critical tool for specialty black coffee companies. Blockchain ledger systems offer immutable records of the coffee bean's journey from the specific farm or lot to the final consumer, verifying claims related to origin, ethical sourcing, and organic status. This transparency capability is a direct response to consumer demand for traceability and authenticity, essential attributes in the high-value specialty black coffee segment. Furthermore, advanced packaging technologies, such as oxygen-scavenging barrier films and specialized one-way valves, extend the shelf life of roasted beans and ground coffee, ensuring maximum freshness is maintained until the point of consumption, thereby preserving the intrinsic quality of the black coffee.

Regional Highlights

North America remains a dominant force in the Black Coffee Market, driven by high consumption rates, particularly in the United States, where specialty coffee consumption is deeply integrated into daily culture. The region is characterized by advanced retail infrastructure, widespread penetration of coffee chains, and a highly competitive environment for specialty roasters. Consumers in North America show a strong preference for both traditional hot brewed black coffee and rapid adoption of cold brew and RTD formats, especially among younger, urban populations. Innovation in home brewing devices and the success of subscription models for premium, single-origin beans contribute significantly to the residential sector's growth. Regulatory standards regarding food safety and origin labeling are stringent, fostering consumer confidence in the quality of black coffee available.

Europe holds a substantial market share, marked by a historic appreciation for high-quality espresso and dark roasted coffee, particularly in Southern European countries like Italy and France. Northern European nations, known for high per capita consumption, are seeing increasing diversification, moving toward lighter roasts and filter coffee styles that emphasize the nuanced flavor of black coffee. The European market is highly sensitive to sustainability and ethical sourcing, with certifications like Fair Trade and Rainforest Alliance playing a crucial role in purchasing decisions. Market growth is stimulated by the expansion of large international coffee chains and a robust independent café culture focused on artisanal black coffee preparation.

The Asia Pacific (APAC) region is projected to be the fastest-growing market segment. This growth is primarily catalyzed by rapid urbanization, rising middle-class disposable income, and the adoption of Western dietary habits. Countries like China and India, traditionally tea-drinking nations, are experiencing a profound cultural shift toward coffee consumption. While instant black coffee remains popular due to convenience and affordability, there is burgeoning demand for specialty black coffee, particularly among younger consumers who view premium coffee as a status symbol. Investment by global chains and local players in establishing sophisticated retail and e-commerce networks is critical to capitalizing on the monumental growth potential within the APAC black coffee landscape.

- North America: Dominant market share; strong presence of specialty coffee culture; high demand for cold brew and RTD black coffee formats; innovation focused on home brewing and subscription services.

- Europe: Mature market; high preference for espresso and high-quality filter coffee; strong emphasis on ethical sourcing and sustainability certifications; robust independent café sector growth.

- Asia Pacific (APAC): Highest projected CAGR; rapid growth driven by changing demographics and urbanization in China, India, and Southeast Asia; increasing adoption of premium black coffee products; strong reliance on instant and RTD formats for mass market entry.

- Latin America: Important producing region; increasing domestic consumption; focus on local specialty coffee production and export; potential for brand premiumization within origin countries.

- Middle East and Africa (MEA): Growing market, particularly in urban hubs; historical coffee traditions (e.g., Arabic coffee); rising penetration of global coffee chain outlets; growth tied to expatriate communities and tourism.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Black Coffee Market.- Starbucks Corporation

- Nestlé S.A.

- JDE Peet's

- The Coca-Cola Company (Costa Coffee)

- Lavazza S.p.A.

- Keurig Dr Pepper Inc.

- Tata Consumer Products

- Tchibo GmbH

- Massimo Zanetti Beverage Group

- Dunkin' Brands Group Inc.

- The Kraft Heinz Company

- Melitta Group

- Strauss Group

- Illycaffè S.p.A.

- Death Wish Coffee Co.

- Blue Bottle Coffee (Nestlé)

- Peet's Coffee

- Eight O'Clock Coffee

- Luigi Lavazza S.p.A.

- Green Mountain Coffee Roasters

Frequently Asked Questions

Analyze common user questions about the Black Coffee market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the Black Coffee Market growth?

Market growth is predominantly driven by increasing consumer health awareness, positioning black coffee as a zero-calorie functional beverage rich in antioxidants. Additionally, the premiumization of the specialty coffee segment, innovation in convenient formats like cold brew and high-quality instant coffee, and the expansion of organized retail and e-commerce channels worldwide are key drivers.

Which product segment dominates the Black Coffee Market?

The Hot Black Coffee segment, including traditional brewed coffee and espresso, currently holds the largest market share globally due to its established consumption patterns. However, the Cold Brew Black Coffee segment is exhibiting the fastest growth rate, fueled by its smoother flavor profile and year-round popularity, especially among younger consumers seeking RTD options.

How does sustainability influence purchasing decisions in the Black Coffee Market?

Sustainability and ethical sourcing are major factors, particularly in developed markets like North America and Europe. Consumers increasingly prefer black coffee brands with transparent supply chains, Fair Trade or Direct Trade certifications, and commitments to reducing environmental impact through eco-friendly packaging, influencing brand loyalty and commanding premium pricing.

What impact does AI have on the black coffee supply chain?

AI is being used to optimize the supply chain through predictive analytics for commodity pricing and demand forecasting, minimizing volatility risk. Furthermore, AI-driven precision agriculture helps farmers improve yields and quality control, while blockchain technology enhances traceability and transparency from cultivation to consumer.

Which region is expected to show the highest CAGR for Black Coffee?

The Asia Pacific (APAC) region is anticipated to register the highest Compound Annual Growth Rate (CAGR). This acceleration is attributed to rapidly growing disposable incomes, extensive urbanization, and the adoption of Western coffee consumption culture in high-population markets such as China, India, and Southeast Asia.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager