Black Pellets Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433025 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Black Pellets Market Size

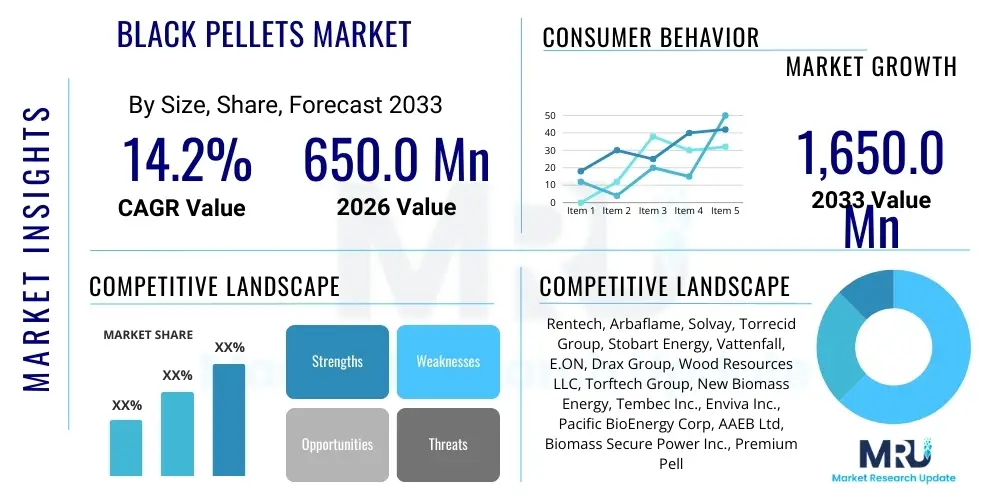

The Black Pellets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.2% between 2026 and 2033. The market is estimated at USD 650.0 Million in 2026 and is projected to reach USD 1,650.0 Million by the end of the forecast period in 2033.

Black Pellets Market introduction

The Black Pellets Market encompasses the production and trade of torrefied biomass pellets, a high-energy density, water-resistant solid biofuel designed to replace or co-fire with coal in existing energy infrastructure. These pellets undergo a process called torrefaction, which is mild pyrolysis resulting in a product with superior fuel characteristics compared to conventional white wood pellets. Black pellets are crucial for decarbonizing sectors like power generation, cement, and steel production, offering a sustainable, carbon-neutral alternative that enhances logistical efficiency and reduces storage risks associated with raw biomass. Their ability to be ground into powder and handled similarly to coal makes them a direct drop-in fuel solution, driving significant industrial adoption.

The product description highlights key benefits, including increased energy density (up to 20 GJ/m³) and improved grindability, crucial for effective co-firing operations. Major applications focus on thermal power plants transitioning away from fossil fuels, where black pellets significantly lower capital expenditure by utilizing existing coal handling and milling equipment. Furthermore, the hydrophobicity of black pellets allows for outdoor storage and marine transport without degradation, resolving a major logistical constraint faced by the conventional biomass supply chain. This technological advantage positions black pellets as a critical enabler for global sustainable energy trading.

Driving factors for market growth include stringent global emissions reduction targets, favorable government mandates supporting biomass utilization, and rising fossil fuel prices, making sustainable alternatives economically competitive. The push towards achieving net-zero goals by major industrial economies is accelerating the demand for solid biofuels that can provide reliable, baseload power and heat. The ongoing advancement in torrefaction technology, coupled with increasing investor confidence in biomass conversion projects, ensures a steady supply chain development necessary to meet the escalating industrial requirements across Europe, Asia Pacific, and North America.

Black Pellets Market Executive Summary

The Black Pellets Market is experiencing rapid expansion, fueled primarily by the global shift towards industrial decarbonization and the necessity for robust, storable, and transportable renewable energy sources. Key business trends indicate substantial investment in large-scale torrefaction facilities, moving production capacity closer to biomass feedstock sources, often in forestry-rich regions. Strategic partnerships between pellet producers, logistics providers, and major utilities are defining the competitive landscape, aiming to secure long-term supply contracts essential for financing new infrastructure. Technological advancements are focused on improving the efficiency and cost-effectiveness of the torrefaction process itself, ensuring a standardized, high-quality product that meets stringent utility specifications regarding calorific value and particle size distribution.

Regionally, Europe, particularly Northwestern Europe, remains the largest consumer due to well-established biomass co-firing policies and early retirement schedules for coal power plants. However, the Asia Pacific region, led by Japan and South Korea, is emerging as the fastest-growing market, driven by national Renewable Portfolio Standards (RPS) and increasing regulatory support for coal-to-biomass conversion projects. North America, rich in sustainable forest resources, is transitioning from being primarily an exporter of raw biomass to developing its own black pellet manufacturing capabilities, targeting both domestic industrial use and lucrative export markets. The stability and predictability offered by black pellets make them highly attractive in markets prioritizing energy security alongside sustainability.

Segmentation trends highlight the dominance of the power generation sector, where co-firing applications account for the majority of current consumption. However, the industrial heat and combined heat and power (CHP) sectors are projected to show significant growth as industries such as cement and lime, which require extremely high temperatures, integrate black pellets to reduce their carbon footprint without compromising operational efficiency. Furthermore, demand is segmented by feedstock, with wood residuals and agricultural residues being the primary sources, but there is growing interest in utilizing unconventional biomass sources like dedicated energy crops, diversifying the input base and enhancing market resilience.

AI Impact Analysis on Black Pellets Market

User queries regarding the impact of Artificial Intelligence (AI) on the Black Pellets Market frequently revolve around optimizing complex supply chains, predicting feedstock availability, and enhancing the efficiency of the torrefaction process. Users are keen to understand how AI can manage the variability inherent in biomass quality and logistics, which traditionally presents challenges for consistent pellet production. Concerns also focus on the integration of AI-driven sensor technologies to monitor and control temperature and residence time in torrefaction reactors in real-time, thus maximizing energy yield and maintaining product standardization necessary for large industrial consumers. The core expectation is that AI will unlock significant operational efficiencies, reduce waste, and lower the overall cost of black pellet production and delivery, accelerating its cost competitiveness against fossil fuels.

- AI-Powered Process Optimization: Utilizing machine learning algorithms to fine-tune torrefaction parameters (temperature, pressure, duration) based on real-time feedstock moisture and density inputs, maximizing energy content (LHV) and hydrophobicity.

- Predictive Maintenance: Deployment of AI in manufacturing plants to anticipate equipment failure in high-stress components like reactors and mills, reducing unplanned downtime and maintenance costs.

- Logistics and Supply Chain Forecasting: Employing AI models to predict biomass availability, optimize transportation routes from forest sources to production facilities, and manage inventory levels effectively, minimizing spoilage and ensuring just-in-time delivery to end-users.

- Quality Control Automation: Integrating AI vision systems to automatically assess and sort raw biomass and finished pellets, ensuring stringent quality specifications are met consistently before shipment.

- Market Demand Modeling: Using AI to analyze global energy market trends, policy shifts, and customer consumption patterns to provide highly accurate demand forecasts, informing capacity expansion strategies.

DRO & Impact Forces Of Black Pellets Market

The Black Pellets Market is fundamentally driven by global mandates for decarbonization and the increasing economic viability of biomass fuels, yet it faces significant hurdles related to initial capital expenditure and supply chain scaling. Drivers encompass favorable regulatory frameworks, such as carbon pricing mechanisms and government subsidies for sustainable power generation. However, the market growth is restrained by the high upfront costs associated with constructing advanced torrefaction facilities and concerns over sustainable sourcing certification, particularly when utilizing imported biomass. Opportunities arise from technological improvements that lower production costs, coupled with the expanding application scope into hard-to-abate sectors like steel and hydrogen production, creating new, high-value demand centers. These forces collectively shape the market trajectory, making reliable, scalable, and verifiable sustainable sourcing the most critical success factor.

The primary drivers are rooted in policy instruments designed to expedite the energy transition. For instance, countries committed to phasing out coal require a dispatchable, low-carbon substitute that can utilize existing power plant infrastructure, which black pellets perfectly accommodate. This legislative support provides long-term demand certainty, attracting the substantial capital required for infrastructure development. Additionally, the inherent physical advantages of black pellets—their high energy density (reducing shipping costs) and resistance to water (enabling cheaper outdoor storage)—significantly lower the operational expenses for end-users compared to handling conventional white pellets, thereby enhancing market penetration.

Conversely, restraints largely center on market maturity and perceived risk. While torrefaction technology is established, scaling it up globally requires standardization of equipment and processes, which is still evolving. Furthermore, competition from other renewable energy sources, especially solar and wind, poses a continual challenge, although black pellets often serve a complementary role in providing baseload stability. Impact forces include intense pressure from environmental NGOs concerning the true sustainability of large-scale biomass harvesting, necessitating robust and transparent certification schemes (e.g., SBP) and verifiable traceability systems to maintain social license to operate and ensure consumer confidence in the biomass supply chain.

Segmentation Analysis

The Black Pellets Market is segmented primarily based on the type of feedstock utilized, the specific applications where the pellets are consumed, and the end-use industrial sector. Feedstock segmentation differentiates between woody biomass, agricultural residues, and dedicated energy crops, reflecting variations in input costs, energy content, and regional availability. Application segmentation is crucial as it dictates the required specifications, with co-firing in thermal power plants demanding specific grindability and ash characteristics, contrasting with the requirements for industrial heating. Understanding these segments is vital for producers to tailor product offerings and optimize logistics, especially given the geographical disparity between biomass supply areas and industrial demand centers across continents.

Segmentation by end-use industry highlights the energy transition imperative. The Power Generation segment dominates, driven by large utilities seeking immediate decarbonization solutions for coal infrastructure. However, the fastest growth is anticipated in heavy industrial sectors, including Cement, Lime, Steel, and Chemical manufacturing, which are increasingly replacing high-carbon fuels with black pellets to meet corporate and regulatory sustainability targets. The final segmentation, by production technology (e.g., rotary drum torrefaction, moving bed torrefaction), reflects the ongoing technological evolution aimed at achieving greater thermal efficiency and lower operating costs, influencing the competitiveness and scalability of new market entrants.

- By Feedstock:

- Woody Biomass (Forest Residues, Sawmill Waste)

- Agricultural Residues (Bagasse, Straw, Husk)

- Dedicated Energy Crops (Miscanthus, Switchgrass)

- By Application:

- Co-firing in Thermal Power Plants

- Dedicated Biomass Power Generation

- Industrial Heating (Cement, Lime, Chemicals)

- Combined Heat and Power (CHP)

- By End-Use Industry:

- Power Generation Utilities

- Cement and Lime Manufacturing

- Metallurgical Industries (Steel, Aluminum)

- Chemical and Petrochemical Processing

- By Production Technology:

- Rotary Drum Torrefaction

- Moving Bed Torrefaction

- Screw Reactor Torrefaction

Value Chain Analysis For Black Pellets Market

The Black Pellets value chain is characterized by high levels of integration, extending from sustainable forest management or agricultural sourcing through to final energy conversion. Upstream analysis involves the procurement and pre-treatment of diverse biomass feedstocks, where sustainability certification and consistent supply volume are paramount. This stage often includes chipping, drying, and basic quality checks. The core transformation stage is torrefaction and pelletizing, where technology efficiency (e.g., heat recovery, material handling) dictates the final production cost and product quality, converting low-density, moisture-heavy biomass into energy-dense, hydrophobic black pellets. Operational excellence in this midstream segment is crucial for market competitiveness.

The downstream analysis focuses on logistics, storage, and distribution, which are significantly simplified for black pellets compared to white pellets due to their water-resistant nature. Distribution channels rely heavily on bulk shipping (ocean freight, rail) for intercontinental trade, especially moving supply from North America and Southeast Asia to demand centers in Europe and Northeast Asia. Direct distribution involves long-term contracts between large-scale producers and utilities, ensuring dedicated supply lines. Indirect distribution may involve commodity traders or specialized logistics firms facilitating smaller or spot-market sales to various industrial users, thereby broadening market access.

The effectiveness of the value chain is heavily reliant on integrated logistics planning. Since biomass sources are often remote from industrial consumption sites, the cost of transportation remains a major component of the final delivered price. The hydrophobicity of black pellets allows for greater resilience in the supply chain, facilitating the use of open storage and existing coal logistics infrastructure (ports, silos), which provides a significant economic advantage and operational flexibility. Successful players often own or control critical steps in the chain, from sustainable forest certification to long-term charter agreements for bulk carriers, ensuring cost control and supply integrity.

Black Pellets Market Potential Customers

The primary buyers and end-users of black pellets are large industrial entities seeking reliable, scalable, and low-carbon heat or power sources to meet environmental compliance obligations and corporate sustainability mandates. The largest segment of potential customers comprises major thermal power generation utilities, particularly those operating converted or co-firing plants in Europe and APAC, where government regulations necessitate substantial reductions in fossil fuel dependency. These customers require massive, continuous volumes of fuel with highly specific technical properties, such as high bulk density and low ash content, and prioritize suppliers with robust sustainability certification.

A rapidly expanding customer base includes manufacturers in energy-intensive, heavy industries such as cement, lime, and steel production. These sectors utilize black pellets to displace coal or petcoke in high-temperature processes, allowing them to lower their Scope 1 emissions without significant capital expenditure on plant retrofits. These industrial buyers value the consistent energy release and the capability of black pellets to be ground into a fine powder, compatible with existing burners and feed systems, making the transition seamless and less disruptive to continuous operations.

Furthermore, smaller but growing segments include district heating networks and specialized chemical processing facilities. These customers often seek smaller, tailored supply volumes but place a premium on reliability and localized sustainable sourcing. The overall market demand is shifting from early adopters (European utilities) to broad industrial users globally, driven by the increasing cost of carbon emissions and the maturity of the black pellet supply chain, which now offers credible, long-term supply assurances.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650.0 Million |

| Market Forecast in 2033 | USD 1,650.0 Million |

| Growth Rate | CAGR 14.2% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rentech, Arbaflame, Solvay, Torrecid Group, Stobart Energy, Vattenfall, E.ON, Drax Group, Wood Resources LLC, Torftech Group, New Biomass Energy, Tembec Inc., Enviva Inc., Pacific BioEnergy Corp, AAEB Ltd, Biomass Secure Power Inc., Premium Pellet Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Black Pellets Market Key Technology Landscape

The technology landscape of the Black Pellets Market is dominated by the torrefaction process, a thermochemical conversion technique performed at temperatures typically ranging from 250°C to 350°C in an oxygen-limited environment. The core aim of this technology is to mimic the natural process of coal formation, resulting in a solid fuel that is hydrophobic, brittle, and possesses high energy density. Key technological advancements center on reactor design—including rotary drum, moving bed, and screw reactors—each offering different advantages in terms of throughput, heat transfer efficiency, and ability to handle various feedstock sizes. The continuous refinement of these systems is crucial for scaling production capacity and reducing the overall energy consumption of the conversion process itself, making black pellets economically feasible.

Secondary technological areas focus on pre-treatment and post-processing steps. Pre-treatment involves sophisticated drying technologies to reduce the high moisture content of raw biomass before torrefaction, significantly impacting process efficiency. Post-processing involves advanced grinding and pelletizing systems specifically designed to handle the brittle nature of torrefied material, ensuring the final pellet product meets strict industrial specifications regarding durability and size uniformity. Furthermore, process integration, particularly the utilization of torrefaction off-gases (syngas) for drying and heating purposes within the plant, is becoming standard practice, enhancing the overall energy self-sufficiency and sustainability profile of the production facility.

Innovation is increasingly driven by incorporating digitalization and advanced controls. Modern plants utilize sophisticated sensor technology and Supervisory Control and Data Acquisition (SCADA) systems to monitor temperature profiles, mass flow rates, and product quality in real-time. This level of control ensures product consistency, minimizes variations in energy content, and maximizes safety during the highly exothermic stages of torrefaction. The emphasis is on developing modular, scalable reactor designs that can be rapidly deployed in various geographical locations, adapting efficiently to localized biomass feedstock availability and varying quality characteristics, thereby accelerating global market penetration.

Regional Highlights

- Europe: Europe, particularly the UK, Netherlands, Belgium, and Germany, stands as the most mature market for black pellets, driven by aggressive coal phase-out timelines and established subsidy mechanisms for co-firing technologies. The region imports significant volumes, primarily from North America and the Baltic states, due to limited domestic feedstock availability. Demand is heavily concentrated in large utility-scale power plants undergoing conversion, requiring stable, high-volume supply contracts and rigorous sustainability certifications (e.g., Sustainable Biomass Program – SBP).

- Asia Pacific (APAC): APAC represents the fastest-growing regional market, propelled by decarbonization goals in industrial power generation, notably in Japan and South Korea. These countries rely heavily on imported biomass, viewing black pellets as a superior, weather-resistant fuel for meeting national Renewable Portfolio Standards (RPS). The rapid industrialization and high energy demand in emerging economies like China and India present substantial long-term growth potential for black pellet adoption in the cement and thermal power sectors.

- North America: North America is a critical region, serving as both a major producer (driven by vast, sustainable forest resources in the Southeast US and Canada) and an emerging consumer. The region possesses the feedstock capacity necessary to supply global demand. While domestic consumption is currently lower than exports, increasing regulatory pressure and corporate sustainability commitments are driving utilities and industrial manufacturers to explore black pellets as a viable domestic biofuel option, especially in areas with available rail and port infrastructure.

- Latin America (LATAM): The LATAM market is nascent but holds high potential, particularly in countries like Brazil and Chile, which have abundant agricultural and forestry residues (e.g., sugarcane bagasse, eucalyptus plantations). Growth will be contingent on developing localized torrefaction technology and establishing reliable logistics infrastructure to serve domestic industrial demand and potential export routes to Europe, leveraging the existing commodity trading networks.

- Middle East and Africa (MEA): The MEA market for black pellets is minimal due to high reliance on oil and gas, and logistical challenges. However, localized opportunities exist in industrial clusters (e.g., cement production in North Africa) seeking to diversify energy sources and lower carbon intensity for internationally exported products. Future growth is likely tied to large-scale, sustainability-focused infrastructure projects and specialized industrial applications where sustainable heat is mandatory.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Black Pellets Market.- Rentech

- Arbaflame

- Solvay

- Torrecid Group

- Stobart Energy

- Vattenfall

- E.ON

- Drax Group

- Wood Resources LLC

- Torftech Group

- New Biomass Energy

- Tembec Inc.

- Enviva Inc.

- Pacific BioEnergy Corp

- AAEB Ltd

- Biomass Secure Power Inc.

- Premium Pellet Ltd.

- Advanced Biofuels Canada

- Sustained Energy Solutions

- Global Bio-Energy Group

Frequently Asked Questions

Analyze common user questions about the Black Pellets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of black pellets over traditional white wood pellets?

The primary advantage of black pellets is their enhanced physical properties resulting from torrefaction, specifically increased energy density and superior hydrophobicity (water resistance). This allows for easier, cheaper outdoor storage and enables the use of existing coal handling and milling equipment, minimizing the need for costly utility retrofits.

Which industry accounts for the largest demand share in the Black Pellets Market?

The Power Generation Utility sector holds the largest demand share. Black pellets are predominantly consumed in large-scale thermal power plants, utilized either for direct co-firing with coal or in dedicated biomass boilers as part of strategic decarbonization and coal phase-out initiatives.

How does the sustainability of black pellet production ensure compliance with global environmental standards?

Sustainability is ensured through rigorous third-party certification schemes like the Sustainable Biomass Program (SBP). These schemes verify that the biomass feedstock is sourced from sustainably managed forests, ensuring carbon neutrality and ecological responsibility throughout the entire value chain, from harvesting to consumption.

What are the main geographical drivers of future market growth for black pellets?

Future growth will be significantly driven by the Asia Pacific (APAC) region, specifically Japan and South Korea, due to their ambitious renewable energy mandates and reliance on imported solid biofuels to replace fossil fuels. Europe will remain a strong market, while North America will increase its role as a key exporter and domestic consumer.

What are the key technological challenges currently facing black pellet manufacturers?

Key challenges include achieving uniform quality and consistency across large production batches, reducing the high capital investment required for torrefaction equipment, and optimizing the thermal efficiency of the reactors to lower the overall operating cost of converting diverse, variable biomass feedstocks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager