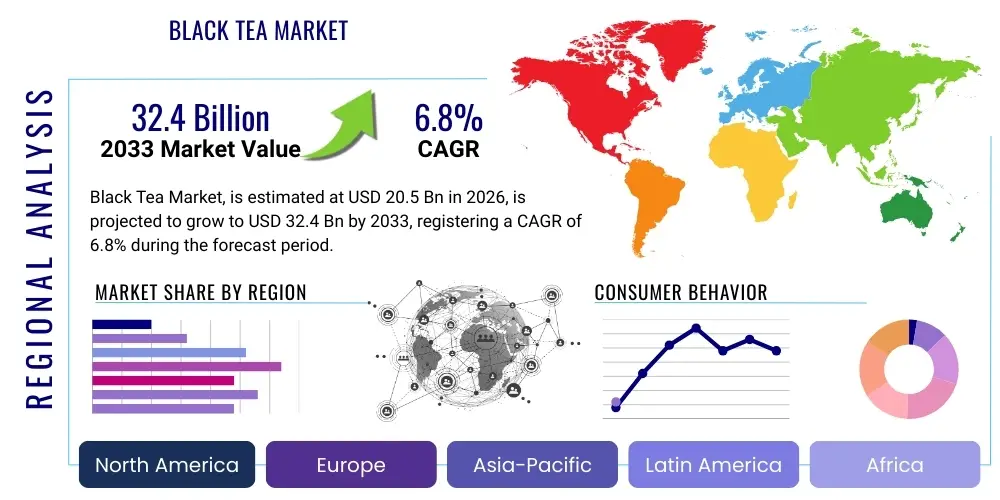

Black Tea Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437874 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Black Tea Market Size

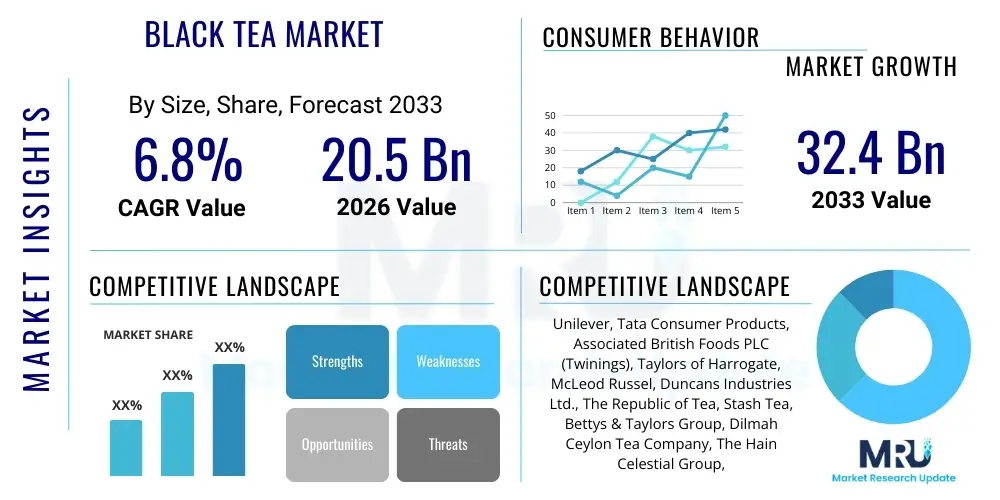

The Black Tea Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $20.5 Billion in 2026 and is projected to reach $32.4 Billion by the end of the forecast period in 2033.

Black Tea Market introduction

The Black Tea Market encompasses the global production, processing, distribution, and consumption of tea leaves that have been fully oxidized (fermented). Originating primarily from the Camellia sinensis plant, black tea is fundamentally distinguished by its strong flavor, dark amber color, and robust profile compared to lighter teas like green or white varieties. The crucial manufacturing step is complete oxidation, which transforms the leaf's catechins into theaflavins and thearubigins, compounds responsible for its color, flavor depth, and many of the scientifically recognized health benefits. Black tea remains the predominant type of tea consumed worldwide, especially prevalent in Western nations and core producing regions, establishing its pivotal role within the global functional beverage ecosystem. Major sourcing hubs, notably India (Assam, Darjeeling), China (Keemun, Lapsang Souchong), Sri Lanka (Ceylon), and Kenya, utilize both the traditional Orthodox method (focusing on whole leaf quality) and the high-volume Crush, Tear, Curl (CTC) method, catering to distinct consumer preferences and price points globally.

The product is utilized across an expansive array of applications, primarily as a traditional hot or chilled beverage. However, modern consumption patterns have dramatically expanded its use into the Ready-to-Drink (RTD) iced tea category, which has seen explosive growth due to convenience and flavor diversification. Beyond direct consumption, black tea extracts and brewed infusions serve as essential industrial ingredients. They are integrated into the functional food and beverage sector for natural coloring and flavoring in confectionery, baked goods, dairy products, and increasingly, in energy drinks and nutraceutical supplements, capitalizing on the high antioxidant load. This industrial application segment requires standardized extracts and consistent quality control, driving technological advancements in extraction and formulation science to ensure stability and efficacy in final products.

Market expansion is structurally supported by two main pillars: health motivation and demographic shifts. The confirmed association between black tea polyphenols and reduced risk factors for chronic diseases, coupled with its natural low-calorie profile (when consumed unsweetened), positions it favorably against carbonated soft drinks. Concurrently, rising urbanization and increasing disposable incomes in key emerging markets across Asia and Latin America translate directly into higher per capita expenditure on branded and premium tea products. Driving factors also include supply chain efficiencies that ensure year-round availability of specific regional teas (such as Darjeeling or Assam), continuous flavor innovation (e.g., enhanced Chai spices or seasonal fruit infusions), and successful brand positioning that links black tea consumption with moments of relaxation and well-being, reinforcing its therapeutic perception globally.

Black Tea Market Executive Summary

The Black Tea Market exhibits dynamic business trends dominated by a pronounced drive towards premiumization, ethical sourcing mandates, and digital transformation in retail. Leading global corporations are focusing strategic investments on acquiring specialty tea brands and enhancing their environmental, social, and governance (ESG) compliance, especially concerning ethical labor practices and sustainable farming. This commercial imperative is driven by consumer scrutiny, particularly from younger generations, who prioritize certified ethical and organic labels. Technological integration is high on the corporate agenda, with manufacturers deploying automation in blending and packaging processes to improve scale and consistency, while leveraging predictive analytics for more precise demand forecasting, mitigating the risk associated with perishable inventory and volatile raw material prices.

Regional market performance displays a duality: volume dominance resides in Asia Pacific (APAC), which serves as the central hub for production and mass consumption, particularly driven by robust demand in China and India. Conversely, the high-value growth engine is concentrated in North America and Western Europe. These Western markets are characterized by high price elasticity for premium, single-origin black teas and rapid adoption of convenient formats like Cold Brew and RTD iced tea, leading to superior revenue realization per unit. Emerging regions such as the Middle East and parts of Africa, while traditionally focusing on bulk imports, are gradually shifting towards branded and flavored teas, signaling future opportunities for specialized product penetration aided by improving retail infrastructure.

Segmentation analysis confirms the resilience of the tea bag format as the most convenient, mass-market solution globally, maintaining significant market share. However, the fastest growth is observed in the Loose Leaf segment, specifically within the specialty and gourmet sub-sector, reflecting a consumer desire for higher quality and traditional brewing experiences. By application, residential consumption remains the bedrock, but the recovery and expansion of the Foodservice (HORECA) segment post-global disruption are injecting renewed institutional demand for high-grade, reliable supply. The flavor segment indicates that while traditional unflavored varieties still command the largest market share, functionalized black teas infused with botanicals or health supplements are registering accelerated compound annual growth, capitalizing on the broader wellness movement.

AI Impact Analysis on Black Tea Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Black Tea Market frequently center on themes of supply chain optimization, predictive quality assurance, and hyper-personalized consumer personalization. Common questions address how AI can stabilize volatile crop yields through precision agriculture techniques, whether machine learning systems can achieve a more accurate and consistent classification of premium tea leaf quality compared to traditional human expertise, and how AI-driven recommendation engines dynamically influence purchasing behavior and loyalty in competitive online tea marketplaces. There are underlying concerns regarding data privacy related to consumer behavior tracking and the potential for technological displacement in labor-intensive agricultural roles. The consensus expectation is that AI will be transformative, introducing critical efficiencies in resource management, dramatically enhancing product authenticity verification to safeguard the reputation of high-value regional teas (such as Darjeeling and Ceylon), and enabling unprecedented levels of customized product offering through detailed flavor profile matching and dynamic inventory management based on real-time consumption trends.

The practical application of AI is profoundly reshaping the upstream cultivation phase. Machine learning models analyze vast datasets encompassing sensor readings (soil moisture, temperature), localized meteorological forecasts, satellite spectral imagery, and historical yield data to generate precise, actionable recommendations for tea garden management. This deployment of precision agriculture allows plantation managers to apply water, nutrients, and pest control agents only where and when necessary, fundamentally minimizing resource wastage and costs while boosting crop resilience against climate shocks. Furthermore, AI-powered image recognition systems are being trained to identify early signs of common tea diseases or pest infestations with exceptional accuracy, allowing for targeted biological or chemical intervention, which dramatically reduces overall pesticide load and ensures compliance with increasingly stringent global food safety standards required for key export destinations like the European Union and Japan.

In the processing, midstream, and consumer-facing sectors, AI and advanced automation are instrumental in quality consistency and commercial optimization. Sophisticated optical sorters equipped with deep learning algorithms rapidly analyze processed tea leaves, sorting them not only by physical characteristics (size, shape, color) but also by inferred chemical composition (linked to flavor precursors) to guarantee uniform quality across batches, a task impractical for manual inspection. Downstream, AI algorithms are vital for streamlining logistics and marketing efforts. They predict demand volatility influenced by seasonal shifts, global events, and promotional activities, allowing inventory levels to be optimized in real-time across regional warehouses, thereby minimizing spoilage and reducing complex cold chain management costs for RTD products. Moreover, Generative AI is being explored to create novel flavor pairings and blend recommendations, influencing future product development cycles and enabling unique, personalized offerings that drive significant consumer engagement and brand loyalty in crowded marketplaces.

- Precision agriculture deployment utilizing IoT and machine learning for optimized tea bush health, irrigation, and fertilization scheduling.

- AI-driven meteorological modeling for predicting regional crop volatility and proactive supply chain risk mitigation.

- Automated quality grading, optical sorting, and foreign material detection in processing plants using high-speed computer vision systems.

- Predictive demand forecasting based on social media trends, sales history, and external factors to minimize stockouts and optimize perishable inventory management.

- Blockchain integration coupled with AI analysis for robust authentication and traceability of single-origin and premium black teas.

- Enhanced flavor profile analysis and blend formulation facilitated by neural networks for accelerated product development.

- Optimization of complex international logistics networks and distribution routes using advanced AI algorithms to reduce transport time and associated carbon emissions.

- Implementation of sophisticated Natural Language Processing (NLP) solutions in customer service interfaces to efficiently handle complex product inquiries and generate deep consumer insights from feedback data.

DRO & Impact Forces Of Black Tea Market

The Black Tea Market is propelled by powerful macro-trends, primarily the sustained global shift toward natural and functional beverages, underpinning demand expansion across established and emerging consumer demographics (Drivers). However, the industry’s reliance on specific, delicate agricultural environments subjects it to severe restraints, notably the increasing impact of climate volatility on yield and raw material quality, coupled with structural price competition from highly marketed substitute beverages (Restraints). Substantial opportunities exist in leveraging advanced technology for supply chain transparency, accelerating the functionalization of tea into high-margin nutraceutical segments, and strategically penetrating underdeveloped geographic markets (Opportunity). These market forces collectively shape the competitive landscape (Impact Forces), where non-negotiable sustainability criteria and digital efficiency dictate long-term viability and profitability for both producers and global brand owners.

Drivers:

The most compelling driver remains the escalating global recognition of black tea’s significant intrinsic health benefits. Extensive research validates that the unique blend of flavonoids, especially theaflavins and thearubigins produced during oxidation, contributes substantially to cardiovascular health by improving blood vessel function and reducing oxidative stress. Furthermore, the moderate caffeine content, combined with the relaxing amino acid L-theanine, provides a sustained cognitive boost without the jitters often associated with coffee, appealing to the massive segment of consumers seeking sustained alertness and focus. This continuous flow of positive scientific validation allows marketers to position black tea effectively in the rapidly expanding functional beverage category, moving it beyond traditional consumption into wellness management tools. The shift is evident in the booming sales of black tea extracts and concentrates for use in health-focused formulations.

In addition to health trends, the robust growth in convenience formats, particularly Ready-To-Drink (RTD) iced black tea, is indispensable for market penetration in North America and Western Europe. Modern consumers demand speed and portability, and the RTD sector fulfills this need while simultaneously offering diverse and innovative flavor profiles, often incorporating fruit juices, sparkling water, or botanical extracts. This segment successfully attracts younger demographics who might otherwise opt for soda or packaged juices. Complementing this, the ongoing rise in disposable income across Asia’s emerging middle classes fuels demand for premium, branded black tea products. As consumers transition from unbranded, local consumption to high-quality, packaged international brands, the average unit price and overall market value experience sustained upward trajectory, particularly favoring orthodox and single-estate specialty teas.

- Increasing global consumer preference for natural, healthy, and antioxidant-rich beverages over artificially sweetened alternatives.

- Strong scientific backing for the cardiovascular, metabolic, and cognitive health benefits derived from black tea polyphenols.

- Exponential growth and diversification within the convenient Ready-To-Drink (RTD) black tea and cold brew segments.

- Sustained increase in disposable income and changing consumer lifestyles in APAC and LATAM, supporting premiumization.

- Successful adaptation of traditional black tea into customized, culturally relevant formats (e.g., modern Chai blends, specialty ice tea).

Restraints:

The foremost constraint severely challenging the stability of the black tea supply chain is the acute vulnerability of cultivation to climate change. Tea bushes thrive under specific, often narrow, climatic conditions. Extended droughts, sudden heavy rains, or frost events cause significant damage to tea flushes, leading to sharp declines in yield quantity and a noticeable degradation in leaf quality, which directly impacts the premium orthodox segment. This environmental volatility necessitates increased capital expenditure on adaptive measures like specialized shade netting and advanced irrigation systems, increasing the cost of production, particularly for smallholder farmers who lack the necessary financial buffers to absorb such systemic risks. Furthermore, political instability and labor disputes in major producing regions can exacerbate supply chain disruptions and introduce unexpected price spikes.

Furthermore, the market faces relentless, structural competition from well-established and aggressively marketed substitute beverages. Coffee, particularly specialty coffee and espresso-based beverages, maintains a dominant presence in the morning consumption routine globally, often perceived as offering a superior energy proposition. Additionally, the proliferation of functional herbal infusions (e.g., turmeric, ginger, rooibos) competes directly for the health-focused consumer segment, offering specific, targeted wellness benefits that sometimes overshadow the general health benefits of black tea. Within the mass market, the price elasticity of demand for bulk black tea remains high; consumers are often quick to switch brands or forms based on minor price differences, limiting margin expansion for high-volume producers and requiring perpetual cost management efforts to stay competitive against generic private labels.

- High agricultural risk and supply volatility induced by extreme weather events and long-term climate change impacts.

- Intense market substitution pressure from highly developed coffee, carbonated, and specialized herbal beverage industries.

- Significant reliance on manual labor in the delicate plucking stage, leading to rising labor costs and potential workforce shortages.

- Stringent and diverse regulatory standards in major importing regions concerning pesticide residues, aflatoxins, and ethical sourcing compliance.

Opportunity:

A compelling opportunity lies in the vigorous pursuit of functional ingredient integration and advanced nutraceutical applications derived from black tea. By isolating and standardizing the potent theaflavin compounds, manufacturers can create high-value extracts for use in dietary supplements targeting specific areas like weight management, metabolic support, and immune function. This strategy elevates black tea from a commodity beverage to a premium health ingredient, generating superior profit margins. Partnerships with pharmaceutical and supplement manufacturers are essential to unlock this vertical market potential, requiring investments in clinical trials to substantiate specific health claims, further bolstering consumer trust and willingness to pay premium prices.

Additionally, significant untapped market potential exists through focused geographic penetration into regions previously overlooked or dominated by non-tea beverages. Eastern European nations, Central Asian republics, and specific rapidly urbanizing African countries present environments where modern retail channels are expanding, and consumers are becoming more exposed to globalized beverage choices. Tailoring packaging, flavor profiles (e.g., incorporating local spices or fruit notes), and brewing instructions to local tastes is vital for successful entry. The expansion of e-commerce capabilities globally also provides a low-cost, high-reach mechanism for small-to-medium enterprises (SMEs) specializing in artisanal and niche black teas to directly access these growing international consumer bases, fostering greater market diversity and competition.

- Vertical market expansion through the creation and commercialization of black tea extracts in nutraceuticals, cosmetics, and functional ingredients sectors.

- Strategic geographic expansion into high-growth, underdeveloped consumer regions like Eastern Europe and urban centers in Africa and LATAM.

- Leveraging advanced digital platforms (e-commerce, D2C) to reach niche consumer segments and facilitate global sales of premium products.

- Developing climate-resilient tea varieties and cultivation techniques through biotechnology to ensure future supply stability.

Impact Forces:

The competitive environment is fundamentally shaped by several powerful forces. The Environmental Force dictates that sustainable and climate-resilient sourcing is no longer optional but a fundamental prerequisite for market access, especially in Western export markets. Major buyers now routinely demand proof of water stewardship, carbon footprint reduction, and biodiversity protection, requiring substantial investment in certifications and transparency tools. The Economic Force is characterized by fluctuating currency valuations and global inflation, which impact input costs (fertilizers, logistics) and consumer purchasing power, necessitating continuous cost optimization in processing while strategically segmenting products to capture both budget-conscious and premium segments.

The Social Force, driven by heightened ethical consumerism, places immense pressure on companies to ensure fair wages and safe working conditions throughout the supply chain, often prompting the adoption of Fair Trade or similar standards, which ultimately affects raw material pricing. The Technological Force, encompassing AI, IoT, and automation, rapidly transforms operational efficiency, from optimizing field yields to ensuring processing consistency, creating a competitive gap between technologically advanced large players and traditional small-scale producers. Finally, Regulatory Forces, particularly the increasingly strict standards set by the European Union and the U.S. FDA regarding maximum residue limits (MRLs) for pesticides, act as powerful trade barriers, steering production towards organic and compliant agricultural practices globally, creating distinct tiers of market accessibility based on quality compliance.

- Climate volatility compelling mandatory investment in environmental compliance and resilient farming practices.

- Ethical consumer demands driving supply chain transparency, traceability, and certified labor standards (Fair Trade).

- Technological advancements (AI/Automation) forcing rapid operational transformation to maintain cost competitiveness and quality consistency.

- Stringent Maximum Residue Limits (MRLs) regulations acting as non-tariff barriers to trade for export markets.

Segmentation Analysis

The Black Tea Market segmentation provides a granular view of consumer preferences, product forms, and channel dynamics critical for targeted marketing and strategic planning. Key segmentations focus on the form of the product (loose leaf, tea bags, instant mix, RTD), the type (flavored vs. unflavored), the distribution channel (supermarkets, convenience stores, online retail, foodservice), and the grade (orthodox vs. CTC). Understanding these segments allows market participants to align production capabilities with evolving demand patterns, particularly the rising preference for convenient formats like tea bags in Western markets and the enduring cultural significance of high-grade loose leaf tea in Asian markets, which drives premium pricing.

The distribution channel breakdown is particularly crucial in the modern retail environment. While traditional channels such as supermarkets and hypermarkets dominate volume sales, the e-commerce segment is witnessing the fastest growth rate, fueled by its ability to offer an extensive range of specialized and niche artisanal brands that cannot be accommodated in standard retail shelf space. The segmentation by form highlights a crucial divergence: tea bags serve the mass-market need for speed and convenience, appealing heavily to institutional buyers and large households, while the high-margin loose leaf segment captures the sophisticated gourmet consumer who seeks authenticity and a superior sensory brewing experience. This structural diversity necessitates highly tailored product development and marketing strategies across various geographic markets.

- By Type:

- Flavored Black Tea (e.g., Earl Grey, Chai, Fruit Infusions)

- Unflavored Black Tea (Traditional varieties like Assam, Darjeeling, Ceylon)

- By Form:

- Loose Leaf Black Tea

- Black Tea Bags

- Instant Black Tea Mixes

- Ready-to-Drink (RTD) Black Tea

- By Distribution Channel:

- Supermarkets and Hypermarkets (Mass Retail)

- Convenience Stores

- Specialty Stores (Tea Houses, Gourmet Shops)

- Online Retail/E-commerce

- Foodservice (HORECA)

- By Application:

- Residential Consumption

- Commercial/Institutional Consumption (Offices, Hotels)

Value Chain Analysis For Black Tea Market

The black tea value chain is an intricate network beginning with intensive agricultural activity and culminating in complex global retail distribution, characterized by multiple value-addition points. The upstream segment, crucial for determining foundational quality, involves detailed tea garden management, specialized cultivation methods (orthodox vs. CTC), and the high-skilled, labor-intensive process of plucking the 'two leaves and a bud.' Subsequent processing—including withering, rolling/crushing, full oxidation (fermentation), and firing/drying—is where the raw leaf transforms into saleable bulk tea. Upstream margins are highly exposed to uncontrollable variables such as climate variability, seasonal labor wages, and international commodity price fluctuations, necessitating efficient resource management and high yield quality to ensure profitability.

The midstream focuses on the integration, refinement, and final preparation for retail. This includes sophisticated blending operations, where raw teas from different estates or origins are combined to achieve a specific, consistent flavor profile (a trademark of major brands). Packaging is a critical value driver in this stage, moving from bulk shipment to consumer-ready formats (tea bags, canisters, RTD bottles). Quality assurance, including sophisticated testing for contaminants and adherence to international food safety certifications (ISO, HACCP), is paramount, serving as the necessary entry ticket to lucrative Western export markets. Furthermore, this stage often incorporates specialty value additions, such as organic or Fair Trade certification labeling, enabling premium price points and appealing to ethically motivated consumers.

The downstream sector manages the complex global logistics and market access, involving numerous intermediaries across both conventional and digital channels. Indirect distribution, dominated by large-scale retailers like supermarkets and hypermarkets, handles the majority of the high-volume CTC tea market, relying on robust wholesale and import infrastructure. Conversely, the direct distribution model, facilitated by e-commerce and specialized brick-and-mortar tea shops, caters specifically to the high-margin orthodox tea segment, offering curated customer experiences and fostering brand loyalty. The shift towards RTD formats also introduces the necessity of cold chain logistics management, significantly increasing the complexity and capital requirements for downstream participants in that growing segment.

Upstream Analysis: Focused on agricultural input and primary processing. Key activities include clonal research for disease-resistant, high-yield varieties, advanced soil management, and highly controlled, specific processes for withering and oxidation that define the final flavor profile. Profitability is highly sensitive to the cost of sustainable agricultural inputs and optimized mechanized harvesting to counter rising labor costs. Global climate impact mitigation is the primary strategic concern in this phase.

Downstream Analysis: Involves branding, global marketing, inventory management, and diverse distribution execution. Downstream players hold the majority of pricing power due to their brand equity and control over consumer touchpoints. Key challenges include maintaining brand differentiation in a crowded market, managing the rapid growth of the D2C channel, and ensuring compliance with varied international labeling and packaging regulations across diverse export destinations.

Distribution Channels:

- Direct Channels: Specialty online platforms, proprietary brand stores, and subscription services, enabling high margin capture and direct relationship management with premium customers.

- Indirect Channels: Large commodity traders, bulk importers, national wholesalers, and mass-market retail chains (supermarkets/convenience stores). This channel prioritizes efficiency, volume, and low per-unit cost.

- Foodservice/HORECA: Dedicated suppliers providing institutional grade bulk or portioned tea specifically for hotels, restaurants, cafes, and corporate catering, requiring high consistency and specialized packaging.

Black Tea Market Potential Customers

The black tea market's potential customers span a broad demographic, segmented primarily by consumption habits, income levels, and regional cultural affinity. Geographically, potential customers include the massive urban populations across Asia Pacific, particularly those in India and China who view tea as a daily staple, alongside affluent consumers in North America and Western Europe seeking premium, ethically sourced, and functional beverage options. The traditional customer base consumes tea for routine hydration and cultural familiarity, favoring high-volume, cost-effective options like CTC black tea bags, which are particularly relevant in price-sensitive emerging markets and institutional settings demanding high volume efficiency.

A rapidly growing segment of potential customers is the health-conscious urban population, typically Millennials and Gen Z, who are actively seeking alternatives to sugary sodas and artificial energy drinks. These consumers are driven by the perceived health benefits of antioxidants, demanding organic certifications, transparent sourcing information, and innovative flavor profiles, such as botanical blends or cold brew concentrates. This segment is willing to pay a premium for specialty single-estate teas (e.g., Darjeeling First Flush) and products marketed with specific functional attributes, making them ideal targets for high-value D2C strategies and sophisticated digital marketing campaigns focused on lifestyle and wellness narratives.

Furthermore, the institutional market, encompassing the HORECA (Hotels, Restaurants, Cafes) sector and corporate catering services, represents a key set of potential customers. As dining and hospitality standards rise globally, there is increasing demand for high-quality, diverse tea menus to complement food offerings and enhance the customer experience. This segment requires reliable, large-volume supply contracts, customized packaging solutions, and comprehensive staff training on brewing techniques, often preferring branded tea offerings that convey prestige and quality assurance to their end consumers. The industrial sector, including food and beverage processing, also constitutes a significant B2B customer base for concentrated extracts used in flavorings and nutraceuticals, demanding consistent quality and supply chain reliability for large-scale production.

Key Potential Customer Segments:

- Mass Market Consumers: Individuals seeking daily, affordable hydration, primarily consuming standard tea bags or bulk loose leaf tea. Strong emphasis on price sensitivity and convenience.

- Health and Wellness Enthusiasts: Focused on natural products, antioxidants, and low-sugar content. Primarily target RTD, organic, and functional black tea blends.

- Specialty and Gourmet Drinkers: Affluent customers interested in origin, processing methods (orthodox), single-estate sourcing, and exotic flavor combinations. They are the core buyers for specialty stores and high-end e-commerce.

- Foodservice and Hospitality (HORECA): Commercial entities requiring reliable bulk supply, premium quality for guest experience, and varied offerings (hot and iced options).

- B2B Ingredient Buyers: Food and beverage manufacturers utilizing black tea extracts as flavorings, colorants, or functional ingredients in dairy, confectionery, and pharmaceutical products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $20.5 Billion |

| Market Forecast in 2033 | $32.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Unilever, Tata Consumer Products, Associated British Foods PLC (Twinings), Taylors of Harrogate, McLeod Russel, Duncans Industries Ltd., The Republic of Tea, Stash Tea, Bettys & Taylors Group, Dilmah Ceylon Tea Company, The Hain Celestial Group, Teavana (Starbucks), Harney & Sons Fine Teas, Mighty Leaf Tea, Typhoo Tea, R. Twining and Company Limited, Yorkshire Tea, Akbar Brothers, Tetley. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Black Tea Market Key Technology Landscape

The technology landscape in the black tea market is evolving rapidly, driven by the need for enhanced agricultural efficiency, stringent quality control, and optimized supply chain transparency. Upstream, the focus is heavily on adopting Internet of Things (IoT) sensors and satellite imagery for precision farming. These technologies monitor soil moisture, nutrient levels, and leaf health in real-time, allowing for hyper-localized inputs, which is crucial for maximizing the yield and quality of high-value orthodox teas, while simultaneously reducing the environmental footprint associated with indiscriminate use of water and pesticides. Mechanization, particularly the advancement of mechanized tea plucking equipment guided by vision systems and GPS mapping, is reducing reliance on manual labor in mass-production CTC segments, addressing rising labor costs and efficiency deficits.

In the processing and manufacturing midstream, automation remains a key technological emphasis. Advanced sorting machines utilizing high-resolution cameras and AI algorithms are replacing traditional manual sorting, drastically improving the consistency of tea grade and removing foreign materials. This automated quality assurance is vital for meeting export standards. Furthermore, specialized drying and firing technologies (such as fluid-bed dryers and continuous vacuum driers) ensure optimal moisture content retention, which is critical for preserving volatile flavor compounds and extending shelf life of high-end teas. Innovations in packaging technology focus on minimizing oxygen exposure through nitrogen flushing and utilizing sustainable materials, including biodegradable filter paper for tea bags and compostable pouches, aligning packaging efficiency with consumer environmental demands and reducing plastic dependency.

Downstream, digital technologies are redefining consumer engagement and supply chain integrity. Blockchain technology is emerging as a critical tool for creating immutable records of origin, processing, and transportation for specialty teas, ensuring authenticity and combatting fraud, which is prevalent in high-demand origin teas like Darjeeling. E-commerce platforms leverage sophisticated data analytics and recommendation engines to personalize the consumer journey, predicting preferred flavors and optimal brewing methods based on purchasing history and demographic data. The integration of QR codes and Near Field Communication (NFC) tags on packaging links consumers directly to the product’s digital journey, enhancing transparency, providing sourcing narratives, and ultimately building greater brand trust and facilitating traceability for ethical consumers.

Regional Highlights

- Asia Pacific (APAC): APAC is the global powerhouse for the black tea market, dominating both production and consumption volume. Countries like India, China, Sri Lanka, and Kenya are crucial producers, influencing global commodity prices and supply stability. India and China represent massive consumer bases where black tea is deeply embedded in cultural practices. The market growth here is driven by population size, rising disposable incomes leading to a shift towards premium branded teas, and robust domestic consumption. However, the region also faces significant challenges related to land availability, climate change impacts on production, and the imperative need for modernization in processing facilities to consistently meet stringent Western export standards.

- Europe: Europe represents a mature but high-value market, characterized by strong consumer demand for specialty, ethically sourced, and certified organic black teas. The UK, historically a major tea consumer, alongside Germany, France, and Russia, drive the demand for flavored blends like Earl Grey, English Breakfast, and increasingly, functional teas infused with specific health benefits. Regulatory requirements regarding pesticide residues and maximum residue limits (MRLs) are extremely stringent, compelling global suppliers to adhere to the highest quality control standards to access this lucrative market. Growth is heavily concentrated in the premium segment and the expansion of the RTD iced tea category, particularly among younger, convenience-seeking demographics in Central and Western Europe.

- North America (NA): North America is a critical growth region, characterized by a dynamic shift from traditional hot tea to innovative iced and RTD black tea products, which now constitute a major revenue stream. The market here is highly responsive to health and wellness trends, favoring low-sugar, natural, and high-antioxidant formulations. Specialty tea houses and dedicated online retailers drive the premiumization trend, focusing on exotic single-origin teas and cold brew concentrates. Marketing strongly emphasizes wellness benefits, clean labels, and clear sourcing narratives. Innovation in product formats, particularly large-format bottled iced tea and rapid-infusion cold brew bags, is a primary growth engine, particularly within the competitive beverage landscape of the United States.

- Middle East and Africa (MEA): MEA is a region with high traditional tea consumption, particularly in countries like Turkey, Morocco, and Egypt, where strong, dark black tea is culturally central. The market is primarily driven by affordability and bulk consumption of high-grade CTC teas, though oil-rich nations are seeing a rise in demand for premium and imported luxury teas. Kenya is a crucial player as a major producer, exporting high volumes, primarily CTC grade, to the UK and other global markets. Growth opportunities lie in enhanced localized blending, packaging, and branding that meets the strong cultural preference for robust, dark, and often heavily sweetened or spiced black tea varieties tailored for local consumption rituals.

- Latin America (LATAM): The black tea market in LATAM is comparatively smaller than coffee consumption, but it is expanding steadily, driven by urbanization, rising middle-class disposable income, and increased exposure to international beverage trends. Countries like Brazil, Mexico, and Argentina show potential, particularly in the RTD, instant mix, and convenience segments, favored by the region’s fast-paced urban lifestyles. The increased penetration of international foodservice chains and global retail brands is facilitating broader acceptance of branded black tea, moving beyond traditional regional herbal infusions to standardized, globally recognized black tea blends, capitalizing on the perception of quality and modernity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Black Tea Market.- Unilever

- Tata Consumer Products

- Associated British Foods PLC (Twinings)

- Taylors of Harrogate

- McLeod Russel

- Duncans Industries Ltd.

- The Republic of Tea

- Stash Tea

- Bettys & Taylors Group

- Dilmah Ceylon Tea Company

- The Hain Celestial Group

- Teavana (Starbucks)

- Harney & Sons Fine Teas

- Mighty Leaf Tea

- Typhoo Tea

- R. Twining and Company Limited

- Yorkshire Tea

- Akbar Brothers

- Tetley

- ITO EN

Frequently Asked Questions

Analyze common user questions about the Black Tea market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Black Tea Market?

The Black Tea Market is officially projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period spanning 2026 to 2033. This growth momentum is substantially fueled by rising consumer interest in health-focused, functional beverages, coupled with the rapid expansion of the convenient Ready-To-Drink (RTD) formulations across North American and European consumer bases.

How is climate change influencing black tea production and supply chain stability?

Climate change poses a major structural restraint, leading to unpredictable weather patterns, including severe droughts and flash floods, which destabilize supply chain reliability and directly diminish tea leaf quality, particularly in high-altitude, premium-producing regions. Industry stakeholders are mitigating this through urgent investment in AI-driven precision agriculture and climate-resilient farming techniques to stabilize yields and ensure consistent supply.

Which geographical region holds the largest market share in the global black tea industry?

The Asia Pacific (APAC) region currently holds the largest volume share of the global Black Tea Market, underpinned by immense domestic consumption across densely populated producer nations such as India and China. However, North America and Europe contribute disproportionately to the overall market value, driven by high consumer willingness to pay a premium for certified organic, specialty, and ethically sourced black tea products.

What role does e-commerce play in the distribution of specialty black tea products?

E-commerce is critically important as it enables Direct-to-Consumer (D2C) models, allowing niche, specialty, and artisanal black tea brands to achieve global reach without relying on traditional mass-market retail gatekeepers. This channel offers curated consumer experiences, facilitates price transparency, and leverages digital technology for personalized marketing and efficient logistics management, accelerating the premiumization trend.

What are the key technological advancements being implemented in the black tea market?

The key technological shifts include the application of AI and computer vision for automated, high-speed quality grading and sorting during processing. Furthermore, blockchain technology is being adopted for comprehensive supply chain traceability, guaranteeing the authenticity and origin of premium teas, while IoT sensors support upstream precision farming to optimize agricultural resource use and yield efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Black Tea Extracts Market Size Report By Type (Hot Water Soluble, Cold Water Soluble), By Application (Functional Food, Beverages, Cosmetics, Beauty Supplements), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Tea Drinks Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Black tea drink, Green tea drink, Oolong tea drink, Tea beverage), By Application (Commercial, Homehold, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager