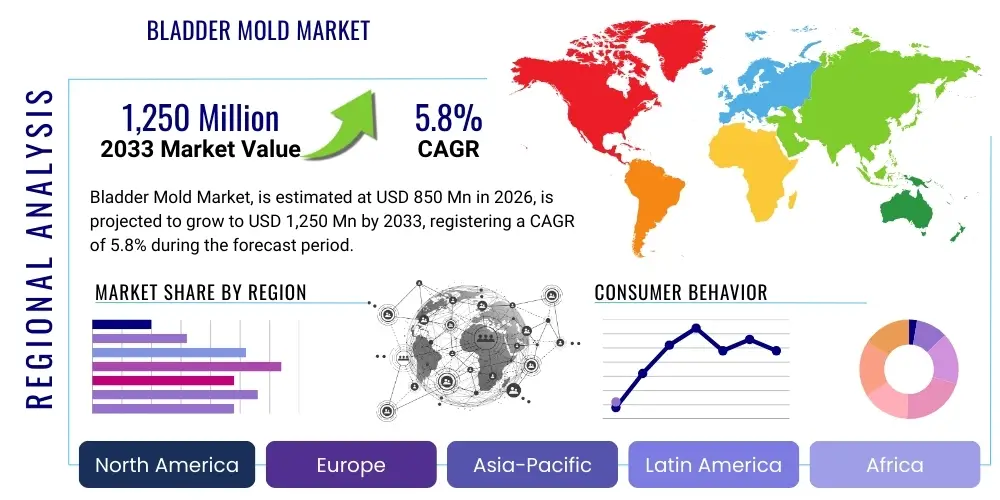

Bladder Mold Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435981 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Bladder Mold Market Size

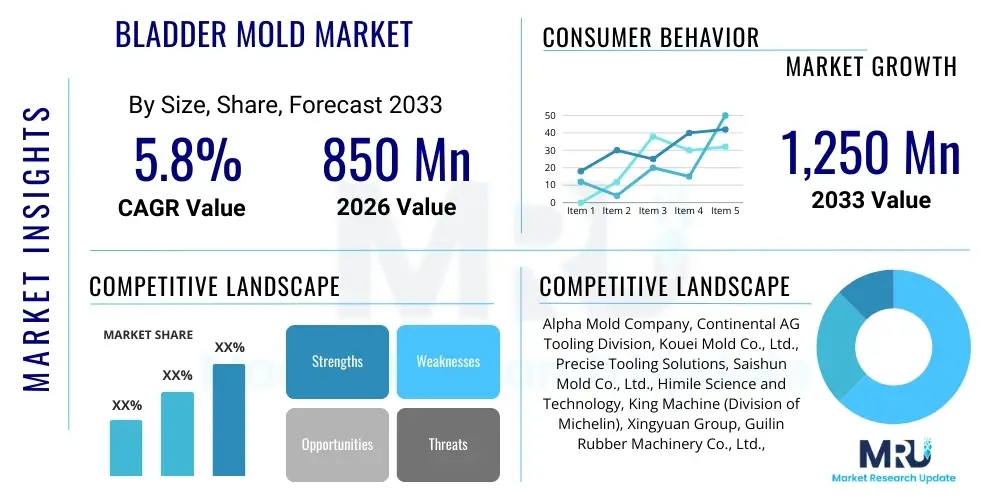

The Bladder Mold Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,250 Million by the end of the forecast period in 2033.

Bladder Mold Market introduction

The Bladder Mold Market centers on specialized tooling essential for manufacturing high-quality pneumatic components, predominantly industrial tires and various elastomeric products. Bladder molds are critical components in the tire curing press, utilized to shape the green tire and provide the necessary pressure and heat during the vulcanization process. The durability, thermal stability, and precise dimensional accuracy of these molds directly influence the quality, uniformity, and performance characteristics of the final tire product. As the global automotive and transportation sectors continue to expand, coupled with stringent safety standards requiring superior tire construction, the demand for advanced bladder molding technology remains robust. Furthermore, the complexity in manufacturing radial tires, requiring multi-stage curing, has driven innovation in mold materials and design, focusing on achieving longer service life and reduced maintenance downtime.

Major applications of bladder molds extend beyond passenger car tires to encompass truck and bus radial (TBR) tires, off-the-road (OTR) tires, and specialized aerospace and industrial rubber components. The fundamental benefits of using optimized bladder molds include enhanced energy efficiency during the curing cycle, reduced scrap rates due to consistent pressure distribution, and the ability to handle complex tread patterns and sidewall designs. Product descriptions typically highlight the use of advanced tool steels, specialized coatings (such as chrome plating or nickel-based alloys), and sophisticated heating channel designs necessary for rapid and uniform heat transfer. The performance requirements dictate that these molds must withstand extremely high temperatures and pressures over extended operational periods, necessitating precision engineering and robust material science.

Key driving factors underpinning market growth include the global recovery and expansion of the automobile production industry, particularly in emerging economies such as China and India, which are rapidly increasing vehicle ownership and replacement tire demand. Additionally, technological advancements in tire manufacturing, such as the adoption of high-performance tires (HPTs) and ultra-high-performance tires (UHP), require correspondingly precise and resilient bladder molds. Regulatory frameworks mandating tire labeling for fuel efficiency and wet grip further push manufacturers to invest in state-of-the-art curing equipment. The shift toward sustainable manufacturing processes also influences mold design, encouraging the use of materials that promote energy savings and reduce the environmental footprint associated with tire curing.

Bladder Mold Market Executive Summary

The Bladder Mold Market is characterized by steady technological evolution driven by the demanding requirements of the global tire industry. Current business trends indicate a strong move toward automation in mold manufacturing, leveraging five-axis CNC machining and additive manufacturing techniques (3D printing) for prototyping complex internal geometries, significantly reducing lead times and improving mold precision. Strategic mergers and acquisitions among key mold manufacturers and tooling suppliers are consolidating market expertise and facilitating cross-regional expansion. Furthermore, there is a distinct trend towards offering "smart molds" integrated with sensors to monitor temperature, pressure, and wear in real-time, providing predictive maintenance capabilities that minimize unexpected production stoppages for end-users, thereby increasing operational efficiency and reducing total cost of ownership.

Regional trends reveal Asia Pacific as the dominant market, primarily due to the concentration of major global tire manufacturing hubs, particularly in China, Thailand, and Indonesia, which serve both local automotive production and export markets. North America and Europe, while slower in new capacity expansion, demonstrate high demand for premium and specialized bladder molds catering to high-performance tires and electric vehicle (EV) specific tires, which often require unique compounding and curing profiles. Emerging markets in Latin America and the Middle East and Africa (MEA) are experiencing growth driven by infrastructure development and increasing commercial vehicle fleets, stimulating moderate but consistent demand for truck and bus tire molds.

Segment trends highlight the dominance of the Passenger Car Radial (PCR) tire segment in terms of volume, although the Truck and Bus Radial (TBR) segment generates higher revenue per unit due to the larger size and complexity of the molds required. Material segment analysis indicates a sustained preference for high-strength alloy steels due to their proven reliability, but specialized materials and surface treatments designed for extended life and improved heat transfer are gaining traction. The replacement market remains a stable revenue stream, dictated by the typical wear life of bladders, while the original equipment manufacturer (OEM) market sees growth directly correlated with new tire plant installations and capacity expansions worldwide, reflecting continuous capital expenditure in the tire industry.

AI Impact Analysis on Bladder Mold Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Bladder Mold Market frequently center on predictive maintenance, optimization of the curing cycle, and autonomous mold design. Users are concerned about how AI can extend the service life of expensive molds, reduce energy consumption during vulcanization, and accelerate the initial design and iteration phases. Key expectations revolve around using machine learning algorithms to analyze historical production data (pressure, temperature, cycle time) to identify patterns correlating to mold wear or potential failure points, thereby transitioning from scheduled maintenance to condition-based maintenance. Furthermore, there is significant interest in Generative Design, where AI tools assist engineers in designing optimal internal cooling channels and pressure distribution surfaces that traditional CAD methods might overlook, leading to molds that are both lighter and more thermally efficient.

The integration of AI into the bladder mold ecosystem is primarily realized through the manufacturing process and the post-production usage phase. In manufacturing, AI-driven quality control systems using computer vision can inspect finished molds for micro-cracks or surface defects with greater speed and accuracy than human inspection, ensuring only perfect tools enter the curing process. This improves the overall quality benchmark for mold suppliers. During the tire curing operation itself, AI is utilized to tune the process parameters in real-time. By connecting sensor data from the smart molds (temperature gradients, strain gauges) to a centralized AI platform, manufacturers can dynamically adjust steam pressure or heating element intensity to achieve perfect vulcanization uniformity across every tire, irrespective of minor variations in the green tire or environmental conditions.

Despite the promise, users also express concerns regarding the initial investment cost for implementing AI infrastructure, the need for specialized data scientists and engineers to manage these systems, and data privacy issues surrounding proprietary curing recipes and mold designs. The implementation of AI is expected to revolutionize mold lifecycle management, shifting the focus from simply supplying the mold to providing a complete, data-optimized tooling solution. This transformation elevates the competitive landscape, rewarding suppliers who can offer robust, digitally integrated products that minimize operational risk and maximize throughput for global tire manufacturers.

- AI-driven predictive maintenance scheduling for molds, minimizing unscheduled downtime.

- Generative Design utilization to optimize mold geometry for improved heat transfer and reduced material use.

- Real-time process optimization during tire curing using machine learning on sensor data (Smart Molds).

- Automated defect detection and quality control systems in mold manufacturing leveraging computer vision.

- Supply chain optimization using AI to manage raw material inventory and production forecasting for mold manufacturers.

- Enhanced energy efficiency in vulcanization through AI-guided thermal profile management.

DRO & Impact Forces Of Bladder Mold Market

The Bladder Mold Market is significantly shaped by a confluence of accelerating demand drivers and inherent operational restraints, balanced by substantial technological opportunities. The primary driver is the inexorable growth of the global vehicle parc and the continuous demand for replacement tires, coupled with regulatory pressure for safer, more durable, and fuel-efficient tires. Restraints often center on the high capital expenditure required for mold manufacturing facilities, the dependency on volatile raw material prices (especially specialized tool steels), and the extended lead times required for highly customized, large-format molds. Opportunities reside mainly in the proliferation of electric vehicles (EVs), which require specialized, low-rolling-resistance tires cured using optimized bladder molds, and the rising adoption of advanced manufacturing technologies like precision casting and hybrid additive manufacturing techniques, which can significantly enhance mold complexity and performance.

Impact forces stemming from macro-economic trends exert considerable pressure on the market. For instance, global trade tariffs and supply chain disruptions can heavily impact the cost and availability of critical materials, affecting mold manufacturer profit margins. Conversely, increased focus on sustainability acts as a positive force, compelling mold designers to create products that support curing processes with lower energy consumption, aligning with tire manufacturers' ESG (Environmental, Social, and Governance) goals. Technological obsolescence is also an impact force; as tire designs evolve rapidly (e.g., introduction of airless concepts), the necessity for traditional bladder molds might eventually diminish, though this remains a long-term risk. The bargaining power of large, global tire manufacturers is high, demanding strict quality specifications and competitive pricing, forcing mold suppliers to continuously innovate their offerings and operational efficiency to remain viable.

The market faces significant cyclicality tied to global automotive sales and economic stability, which influences tire production volumes. However, the consistent need for mold replacement due to wear ensures a baseline demand that mitigates extreme volatility. The transition to higher-quality tooling, often specified by Tier 1 tire companies, reflects a strategic shift towards reducing overall maintenance costs over the mold's lifespan, favoring suppliers who prioritize material science and surface engineering. This dynamic interplay between cost sensitivity and performance demands defines the competitive environment, where the ability to deliver highly precise, durable, and thermally efficient molds dictates market share dominance.

Segmentation Analysis

The Bladder Mold Market is segmented primarily based on the type of tire cured (application), the type of mold material used, and the geographical region. Segmentation by application allows the industry to categorize the specific demands and engineering requirements for different vehicle categories, recognizing that molds for passenger cars differ vastly from those used for large off-the-road vehicles in terms of size, pressure tolerance, and surface finish. Material segmentation highlights the trade-offs between cost, longevity, and thermal conductivity, driving innovation towards high-performance alloys and specialized coatings.

- By Mold Type:

- Segmented Molds

- Two-Piece Molds (or Full Molds)

- Venting Molds

- By Application (Tire Type):

- Passenger Car Radial (PCR) Tires

- Truck and Bus Radial (TBR) Tires

- Off-the-Road (OTR) Tires

- Aircraft Tires

- Industrial and Agricultural Tires

- By Material:

- High-Strength Alloy Steel Molds

- Aluminum Molds (Limited use, primarily for prototypes or low volume)

- Specialty Coated Molds (Chrome, Nickel, Ceramic)

- By End-User:

- Original Equipment Manufacturers (OEM)

- Aftermarket/Replacement Tire Manufacturers

Value Chain Analysis For Bladder Mold Market

The value chain for the Bladder Mold Market begins with upstream activities, focusing heavily on the procurement and processing of specialized raw materials. This includes high-grade tool steel (often customized alloys resistant to high temperatures and abrasive wear) and specialized coating materials. Upstream analysis involves assessing the stability and pricing of key metal suppliers, as the quality of the raw material fundamentally determines the mold's lifespan and performance. Key processes here include precision casting, forging, and initial heat treatments necessary to prepare the base metal for complex machining. Supply chain resilience in this phase is paramount, requiring strong, long-term relationships with reputable metal processors and metallurgical experts.

The core manufacturing stage involves sophisticated mold design (CAD/CAM), high-precision CNC machining (often 5-axis), and critical finishing processes like surface grinding, polishing, and specialized coating applications (e.g., chrome plating or PVD/CVD coatings for anti-stick properties and wear resistance). Distribution channels are predominantly direct, given the highly customized and technically demanding nature of the product. Bladder molds are rarely off-the-shelf items; they are tailored to specific tire specifications and curing press dimensions. Direct sales teams work closely with tire manufacturers' engineering departments to finalize designs, oversee manufacturing, and manage installation and commissioning.

Downstream analysis focuses on the end-users: the global network of tire manufacturing plants. The molds are integrated into sophisticated tire curing presses where they undergo intensive operation. The indirect distribution channel is minimal, primarily involving specialized local maintenance and repair services (tooling refurbishers) that handle mold lifecycle management rather than initial sales. The value chain culminates in aftermarket services, including refurbishment, modification, and replacement of molds and their segments. Successful participants in this market provide comprehensive post-sale technical support, critical for maximizing mold utilization and ensuring continuous high-quality tire output for the end-user.

Bladder Mold Market Potential Customers

The primary consumers and buyers of bladder molds are global tire manufacturers, ranging from multinational conglomerates to regional specialty tire producers. These organizations constantly require high-precision molds for both their mass-market product lines and their specialized, high-performance offerings. Key purchasing decisions are driven by mold longevity, dimensional accuracy, thermal uniformity, and the supplier's capacity to deliver within aggressive timelines, especially during new plant construction or capacity upgrade projects. The relationship between mold suppliers and tire manufacturers is highly technical and often contractual, involving proprietary specifications and stringent non-disclosure agreements.

Within these manufacturing entities, the key decision-makers typically reside in procurement, tooling engineering, and research and development departments. R&D teams determine the required specifications based on new tire designs (e.g., EV tires or run-flat technology), while tooling engineers evaluate the mold supplier's technical capabilities, material science expertise, and quality control processes. Procurement teams focus on total cost of ownership (TCO), factoring in the initial purchase price, expected lifespan, and potential refurbishment costs. The strategic importance of the bladder mold means that purchasing often involves high-level internal consensus, reflecting its direct impact on product quality and manufacturing uptime.

Furthermore, specialized segments such as aerospace rubber component manufacturers and heavy machinery tire producers (OTR tires) represent niche, high-value potential customers. These buyers demand molds built to extremely high performance standards, often utilizing exotic materials and complex geometries to withstand unique environmental and operational stresses. The trend towards vertical integration in some larger tire companies, where internal tooling shops are maintained, poses a competitive challenge to external mold suppliers, forcing the latter to demonstrate superior technological advantages and cost efficiencies that cannot be matched internally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,250 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Alpha Mold Company, Continental AG Tooling Division, Kouei Mold Co., Ltd., Precise Tooling Solutions, Saishun Mold Co., Ltd., Himile Science and Technology, King Machine (Division of Michelin), Xingyuan Group, Guilin Rubber Machinery Co., Ltd., Sanli Mold Co., Ltd., Herbert Group, Quality Mold Inc., KWT Group, M.T.H. Mold, Heins-Mellinger Inc., Qingdao Mesnac Co., Ltd., Giti Tire Tooling, Sumitomo Heavy Industries, Cima Manufacturing, VMI Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bladder Mold Market Key Technology Landscape

The core technology underpinning the bladder mold market is high-precision computer numerical control (CNC) machining, particularly utilizing 5-axis milling centers to achieve the intricate, complex geometries required for modern tire treads and sidewalls. This technology ensures extremely tight tolerances (often measured in micrometers), which is critical for tire uniformity and balance. Beyond basic machining, specialized surface treatments represent a significant technological frontier. Techniques like chrome plating, nickel plating, and specialized thermal spray coatings are employed to enhance the mold's release characteristics, prevent rubber sticking, improve wear resistance, and maintain uniform heat distribution across the mold cavity, significantly extending the time between necessary cleaning and refurbishment cycles.

A burgeoning technological area is the integration of advanced metallurgy and additive manufacturing (AM), specifically for creating molds with complex internal structures. Additive manufacturing, or 3D printing of metal alloys, allows for the creation of conformal cooling channels. Unlike traditional molds where cooling channels are straight-drilled and less effective, conformal channels follow the exact contour of the tire surface, leading to much faster and more uniform heat dissipation. This reduces curing time, saves energy, and minimizes thermal stress on the mold, leading to longer service life. While full production molds via AM are still niche due to cost, hybrid approaches—combining subtractive CNC manufacturing with AM inserts for critical heat zones—are becoming increasingly common, especially for high-performance tire molds.

Furthermore, sensor integration and digitalization constitute a vital technology trend. The development of "smart molds" incorporates embedded thermocouples and pressure transducers capable of transmitting real-time operational data wirelessly. This data enables sophisticated process control systems and AI algorithms to optimize the vulcanization process dynamically. The ability to monitor critical parameters like temperature uniformity and pressure distribution inside the mold cavity during the curing cycle is transforming quality assurance, allowing manufacturers to identify and correct process deviations instantly. This technological advancement moves mold manufacturing from a pure mechanical process to a high-tech, integrated hardware and software solution, offering substantial competitive advantages to suppliers who embrace digital tooling.

Regional Highlights

The Asia Pacific (APAC) region stands as the undisputed leader in the Bladder Mold Market, driven by the massive scale of tire production concentrated in nations like China, India, Japan, and South Korea. China, in particular, dominates both global automotive manufacturing and tire output, necessitating continuous investment in high-volume, cost-effective bladder molds. The rapid expansion of middle-class vehicle ownership and significant governmental infrastructure projects requiring commercial vehicles further fuel demand. The APAC region is also a key hub for innovation in mold manufacturing, with several local companies investing heavily in advanced CNC technology and metallurgical R&D to compete with established Western suppliers.

North America and Europe represent mature markets characterized by stringent quality demands and a strong focus on high-performance and specialty tires, including those designed specifically for electric vehicles (EVs). While capacity expansion is slower compared to APAC, the demand for replacement and technologically advanced molds remains high. European manufacturers prioritize automation, precision engineering, and adherence to environmental standards in mold construction. In North America, the market is driven by the large truck and bus radial (TBR) sector and the demand for OTR tires used in mining and construction, necessitating the supply of large, highly durable, and complex bladder molds.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging as high-growth potential regions. LATAM's market expansion is tied to economic stabilization and renewed foreign direct investment in automotive assembly plants, particularly in Mexico and Brazil. The MEA region's growth is predominantly linked to infrastructure development in the Gulf Cooperation Council (GCC) nations and increasing logistics requirements across Africa, driving up the need for commercial and industrial vehicle tires and, consequently, their associated molds. While these regions currently rely heavily on imports, local manufacturing capabilities are slowly being developed, presenting opportunities for mold technology transfer and localized production.

- Asia Pacific (APAC): Dominant market share due to large-scale tire manufacturing base (China, India, ASEAN countries). Focus on high volume and cost efficiency.

- North America: High demand for specialized OTR and TBR molds, driven by stringent quality standards and mining/logistics sectors.

- Europe: Emphasis on high-precision molds for high-performance passenger tires and EV-specific applications. Strong adoption of advanced materials and automation.

- Latin America (LATAM): Growth driven by recovering automotive production in Brazil and Mexico; increasing need for local mold sourcing.

- Middle East and Africa (MEA): Emerging market growth linked to infrastructure development, heavy logistics requirements, and imported mold technology.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bladder Mold Market.- Himile Science and Technology

- Kouei Mold Co., Ltd.

- Herbert Group

- Guilin Rubber Machinery Co., Ltd.

- Xingyuan Group

- Saishun Mold Co., Ltd.

- Continental AG Tooling Division

- VMI Group

- Alpha Mold Company

- Qingdao Mesnac Co., Ltd.

- Precise Tooling Solutions

- King Machine (Division of Michelin)

- Sanli Mold Co., Ltd.

- KWT Group

- M.T.H. Mold

- Giti Tire Tooling

- Sumitomo Heavy Industries

- Heins-Mellinger Inc.

- Cima Manufacturing

- Quality Mold Inc.

Frequently Asked Questions

Analyze common user questions about the Bladder Mold market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary material is used for bladder molds and why is material science critical?

High-strength alloy steel is the primary material due to its exceptional resistance to the high temperatures (up to 200°C) and extreme pressures involved in the tire curing process. Material science is critical because specialized coatings (like chrome or nickel) and precise alloy composition determine the mold's lifespan, thermal uniformity, and resistance to wear, directly impacting tire quality and production efficiency.

How does the shift to electric vehicles (EVs) impact the demand for bladder molds?

The shift to EVs drives demand for specialized bladder molds used to produce low-rolling-resistance tires. These EV-specific tires have unique tread patterns and require highly precise curing to meet stricter requirements for weight, noise reduction, and extended battery range, necessitating investments in advanced mold designs and manufacturing precision.

What is a "smart mold" and how does it benefit tire manufacturers?

A smart mold is a bladder mold integrated with sensors (thermocouples, pressure sensors) that monitor real-time conditions inside the mold cavity during vulcanization. This technology benefits manufacturers by enabling dynamic process adjustments, improving quality control, reducing scrap rates, and facilitating predictive maintenance based on actual operational data, maximizing uptime.

What are the key differences between segmented molds and two-piece molds?

Segmented molds consist of multiple radial segments that open outwards, providing easier and quicker tire removal, often used for high-volume Passenger Car Radial (PCR) and Truck and Bus Radial (TBR) tires. Two-piece molds (or full molds) are generally used for simpler or smaller tires and require specialized mechanisms for demolding, often offering higher rigidity but less flexible handling.

Which geographical region exhibits the highest growth potential in the Bladder Mold Market?

Asia Pacific (APAC), particularly driven by China, India, and Southeast Asia, exhibits the highest growth potential. This is attributed to continuous capacity expansion in the tire manufacturing sector, rapid motorization rates, and the establishment of numerous global tire production bases to serve domestic and international export markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager