Blanking Presses Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436674 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Blanking Presses Market Size

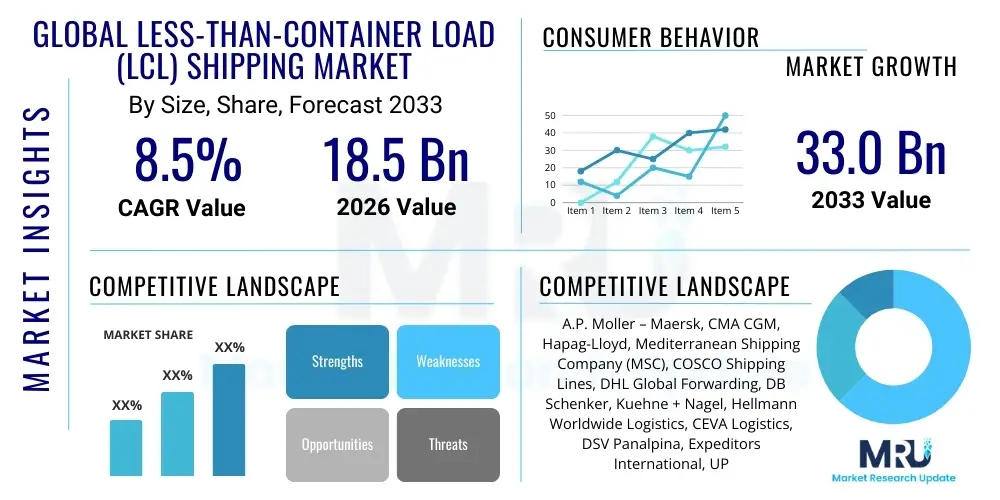

The Blanking Presses Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the accelerating demand for high-precision components across major industrial sectors, particularly automotive and electronics manufacturing, which require superior material processing capabilities provided by modern blanking press technology.

Blanking Presses Market introduction

The Blanking Presses Market encompasses industrial machinery designed specifically for the high-volume, precision cutting, and stamping of sheet materials, primarily metals, into specific component shapes known as blanks. These machines operate based on mechanical, hydraulic, or advanced servo-driven mechanisms, utilizing specialized tooling (dies and punches) to exert massive force, resulting in clean, accurate separation of material. Modern blanking presses are critical for mass production environments where dimensional accuracy and material integrity are paramount, offering significant throughput advantages over traditional cutting methods. The relentless pursuit of lightweighting in the automotive industry and miniaturization in the electronics sector have cemented the blanking press as an indispensable asset in modern fabrication lines.

Major applications of blanking presses span a broad range of industries, including the production of intricate internal components for engines and transmissions in the automotive sector, chassis components for consumer electronics, electrical laminations, and structural parts for domestic appliances. The primary benefits associated with adopting advanced blanking presses include superior production speed, repeatability, reduced material waste through optimized nesting patterns, and the ability to process high-strength, low-alloy (HSLA) steels and complex aluminum alloys. These benefits directly translate into reduced operational costs and improved product quality for manufacturers operating in highly competitive global markets. Furthermore, the integration of automation and smart monitoring systems is enhancing the efficiency profile of new press installations.

Driving factors supporting market growth include robust capital expenditure in developing economies focused on expanding their manufacturing bases, particularly in Asia Pacific, coupled with the global transition towards electric vehicles (EVs). The manufacturing of EV battery casings, specialized connectors, and thermal management components requires extremely precise blanking operations, creating sustained demand for high-tonnage and high-speed servo presses. Regulatory pressures requiring higher energy efficiency and safety standards in machinery also compel manufacturers to upgrade older hydraulic and mechanical systems with more precise, energy-efficient servo-electric counterparts, thereby stimulating market renewal and expansion.

Blanking Presses Market Executive Summary

The Blanking Presses Market is characterized by a strong shift toward digitalization and precision engineering, driven by demands from the automotive and electronics industries. Business trends show manufacturers prioritizing the development of advanced servo-driven presses, which offer greater control over stroke profile and speed, leading to reduced vibration and enhanced die life. Key strategic initiatives involve mergers, acquisitions, and technological partnerships focused on integrating Industry 4.0 capabilities, such as real-time performance monitoring and predictive maintenance. The competitive landscape is intensely focused on intellectual property related to stamping kinematics and material handling automation, ensuring operational flexibility for complex, multi-stage blanking processes. Sustainability is also emerging as a major trend, with manufacturers exploring material-efficient blanking techniques and presses designed for lower energy consumption per cycle.

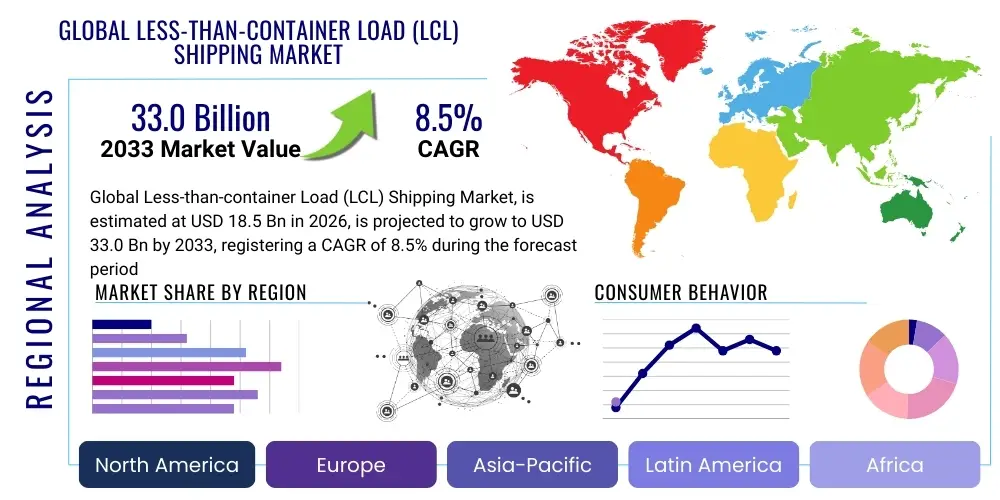

Regionally, Asia Pacific (APAC) dominates the market due to the enormous volume of manufacturing activity, particularly in China, India, and Southeast Asian nations, where massive investments are being channeled into automotive component production and consumer electronics assembly. North America and Europe, while representing mature markets, exhibit high demand for premium, technologically advanced servo presses for high-strength material processing required in specialized automotive and aerospace applications. These developed regions are the early adopters of highly automated, integrated stamping lines that minimize human intervention and maximize efficiency, driving value growth despite lower volume compared to APAC. Market penetration in Latin America and the Middle East & Africa (MEA) remains moderate but is accelerating, bolstered by infrastructure investments and localized vehicle manufacturing initiatives.

Segment trends highlight the dominance of the servo blanking presses segment due to their unparalleled versatility and efficiency, rapidly replacing conventional hydraulic and mechanical systems, particularly in the 300-600 Tons range, which is ideal for structural car parts and large electrical laminations. The automotive application segment remains the primary revenue driver, demanding presses capable of handling complex geometries and exotic materials crucial for vehicle safety and performance enhancement. Furthermore, there is a distinct trend within segmentation towards modular press designs that allow manufacturers to quickly retool and adapt their production lines for different component specifications, catering to the increasingly short product lifecycles prevalent in sectors like mobile device manufacturing and electric vehicle component production.

AI Impact Analysis on Blanking Presses Market

User queries regarding the impact of Artificial Intelligence (AI) on the Blanking Presses Market frequently center around three core themes: enhancing predictive maintenance capabilities, optimizing stamping process parameters for quality, and increasing automation levels in material handling and inspection. Users are particularly concerned with how AI can minimize expensive downtime caused by catastrophic die failure and how machine learning algorithms can analyze real-time vibration and acoustic data to predict tool wear before it impacts component accuracy. Furthermore, there is substantial interest in AI-driven vision systems for inline quality inspection, capable of detecting microscopic defects in stamped parts at high production speeds, ensuring zero-defect output. The consensus is that AI will transition blanking operations from reactive maintenance models to highly proactive, self-optimizing manufacturing cells, requiring new skill sets for operators and maintenance technicians.

AI's primary influence will be in transforming operational efficiency and minimizing resource consumption. By leveraging advanced data analytics, AI models can correlate variables such as tonnage force, material input quality, temperature, and lubrication rates with output quality and tool lifespan. This ability to instantly adjust press parameters based on predictive modeling allows for optimal stamping conditions across diverse production batches. For instance, an AI system can dynamically manage press speed and ram deceleration based on specific material thickness and hardness measurements, preventing material tearing or excessive burr formation, which traditionally required tedious manual adjustments by experienced technicians. This systemic optimization leads to significant reductions in scrap material and energy consumption, addressing both cost-efficiency and sustainability goals crucial for manufacturers.

The integration of AI also fundamentally changes how maintenance schedules are managed. Instead of relying on time-based or cycle-count maintenance, AI introduces condition-based monitoring. High-frequency sensors installed on critical press components (such as the main drive shaft, bolster, and clutch/brake system) feed data into machine learning models. These models learn the 'signature' of normal operation and flag anomalies that signify impending mechanical failure, often weeks in advance. This predictive capability allows maintenance teams to schedule repairs during planned downtime, eliminating unexpected production halts. Moreover, AI is crucial for training new generations of automated guided vehicles (AGVs) used for feeding blanks and removing stamped parts, further integrating the blanking cell into a fully automated, lights-out factory environment, thereby maximizing capital utilization.

- AI optimizes stamping parameters in real-time, reducing burr formation and ensuring higher dimensional accuracy.

- Predictive maintenance algorithms analyze sensor data (vibration, temperature, force) to forecast component failure, drastically reducing unplanned downtime.

- Machine vision systems utilize deep learning for high-speed, inline quality inspection, ensuring zero-defect production of intricate parts.

- AI enhances energy efficiency by dynamically adjusting servo motor control based on material type and required tonnage per stroke.

- Automation of material handling and tool changes is facilitated by AI-guided robotics, boosting overall production throughput.

- Data analytics platforms powered by AI provide comprehensive operational insights for strategic capacity planning and benchmarking.

DRO & Impact Forces Of Blanking Presses Market

The Blanking Presses Market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO). Major drivers include the rapid expansion and modernization of the global automotive manufacturing base, particularly the shift toward Electric Vehicle (EV) production, which necessitates high-precision blanking for battery casings and structural components using specialized high-strength materials. Technological advancements, notably the proliferation of highly accurate and flexible servo press technology, offer superior performance metrics (such as customizable ram movement profiles and improved energy efficiency) compared to traditional mechanical presses, compelling manufacturers to invest in upgrades. These drivers collectively exert a substantial upward pressure on market demand, particularly in regions undergoing industrial capacity expansion.

Conversely, significant restraints hinder market growth. The high initial capital investment required for modern, high-tonnage servo blanking presses and associated automated peripheral equipment (coil handling, scrap removal) often presents a barrier, particularly for small and medium-sized enterprises (SMEs). Additionally, the operational complexity and the stringent requirement for highly skilled maintenance and programming personnel can slow the adoption rate in emerging markets where specialized technical talent is scarce. Economic volatility and trade protectionism impacting global supply chains also introduce uncertainty in capital expenditure planning, forcing manufacturers to delay large-scale machinery procurements, thus acting as a mitigating force on the exponential growth potential.

Opportunities for market players are primarily concentrated in the ongoing digitalization of manufacturing (Industry 4.0). The ability to offer presses integrated with IoT sensors, cloud-based monitoring, and AI-driven diagnostics provides a significant competitive edge. Furthermore, the increasing use of advanced high-strength steels (AHSS) and non-ferrous alloys in high-stress applications opens a niche opportunity for specialized, high-rigidity presses capable of handling extreme blanking forces while maintaining die integrity and minimizing noise pollution. These opportunities encourage manufacturers to invest heavily in R&D, focusing on reducing the total cost of ownership (TCO) through improved machine lifespan, reduced energy usage, and simplified maintenance protocols, thereby generating long-term market expansion.

Segmentation Analysis

The Blanking Presses Market is comprehensively segmented based on Operation Type, Tonnage Capacity, and End-Use Application, providing a granular view of market dynamics and specialized demand pockets. The segmentation allows stakeholders to analyze specific technology adoption rates and capacity requirements across different industries. The trend toward customized manufacturing solutions necessitates a clear understanding of these segments, as, for example, the performance criteria for a press used in high-speed electrical lamination (low tonnage, high SPM) differ fundamentally from one used for large automotive body panels (high tonnage, deep draw capability).

Operation Type segmentation, consisting of Mechanical, Hydraulic, and Servo, reveals the ongoing technological transition, with servo technology rapidly gaining market share due to its flexibility and energy efficiency. Tonnage Capacity segments (e.g., up to 300 Tons, 300-600 Tons, and above 600 Tons) directly correlate with the size and complexity of the components manufactured, where higher tonnages are mandated for thick-gauge or high-strength material processing, predominantly within heavy industry and Tier 1 automotive suppliers. Analyzing these segments confirms that while high-tonnage machines drive high revenue per unit, mid-range and low-tonnage servo presses drive volume adoption across diversified manufacturing sectors, reflecting broad market utilization.

- By Operation Type:

- Mechanical Blanking Presses

- Hydraulic Blanking Presses

- Servo Blanking Presses

- By Tonnage Capacity:

- Up to 300 Tons

- 300 to 600 Tons

- Above 600 Tons

- By End-Use Application:

- Automotive and Transportation (Structural components, powertrain parts, EV casings)

- Electrical and Electronics (Laminations, connectors, heat sinks)

- Aerospace and Defense (Specialized, high-precision small parts)

- Industrial Machinery and Equipment (Gears, brackets, frames)

- Consumer Goods and Appliances (White goods components, hardware)

Value Chain Analysis For Blanking Presses Market

The value chain for the Blanking Presses Market starts with Upstream Analysis, involving the sourcing of high-quality raw materials, primarily specialized steel alloys for press frames and high-precision mechanical components (crankshafts, bearings, and servo motors). Key suppliers include major steel manufacturers and specialized component providers (e.g., German and Japanese motor and control system companies). The competitive dynamics at this stage are defined by material consistency and the reliability of advanced electronic components crucial for the precision control required in modern servo presses. Effective supply chain management and strong supplier relationships are critical to mitigating risks associated with commodity price fluctuations and ensuring timely delivery of complex sub-assemblies.

The midstream segment involves the core manufacturing process, where OEMs design, assemble, integrate, and test the presses. This stage is characterized by intense intellectual property competition regarding press design kinematics, automation integration, and software control systems. Manufacturers often specialize by press type (e.g., high-speed mechanical for canning, high-tonnage servo for auto body panels). The Distribution Channel analysis reveals a mix of direct sales channels, particularly for large, custom-engineered presses sold to Tier 1 automotive and aerospace clients, and indirect channels relying on regional distributors and technical agents. Indirect channels are crucial for reaching smaller enterprises and providing localized maintenance and aftermarket support, driving wider market penetration.

Downstream analysis focuses on the End-Users, encompassing various manufacturing sectors. The largest downstream consumer is the automotive industry, which dictates demand for high-tonnage, robust presses capable of handling new high-strength materials. The interaction between OEMs and end-users is often collaborative, with press manufacturers customizing features like tool-changing systems and scrap management conveyors to fit specific production line layouts. Aftermarket services—including tooling replacement, routine maintenance, parts supply, and retrofitting older presses with new controls—represent a significant and often high-margin component of the value chain, ensuring the long operational lifespan of capital equipment and strengthening manufacturer-client relationships.

Blanking Presses Market Potential Customers

Potential customers for Blanking Presses span the entirety of the metal fabrication and high-volume manufacturing landscape, making the market highly diversified but critically dependent on industrial capital expenditure cycles. The primary and most lucrative customer base consists of Tier 1 and Tier 2 Automotive Component Suppliers who utilize presses for producing structural chassis parts, powertrain components, and electrical connectors essential for traditional combustion engine vehicles and increasingly, for specialized components required in Electric Vehicles (EVs) such as battery tray frames and motor laminations. These customers prioritize high speed, high tonnage, and minimal tolerance deviation, often requiring fully automated press lines integrated with robotics and transfer systems. The massive volume and stringent quality requirements in this sector make them the backbone of demand for advanced servo press technology.

Another significant segment comprises Electrical and Electronics Manufacturing firms. These companies, particularly those involved in producing consumer devices, servers, and white goods, require lower tonnage but extremely high-speed mechanical or servo presses (High Strokes Per Minute - SPM) for crafting intricate components like terminals, heat sinks, and fine-pitch electrical laminations. For this customer group, precision and repeatability over billions of cycles are paramount, driving demand for advanced controls and superior die protection systems. The rapid obsolescence of consumer electronics means these customers frequently seek flexible presses that can quickly be retooled for new product specifications, favoring modular and programmable servo solutions.

Furthermore, General Industrial Manufacturers, including producers of heavy machinery, agricultural equipment, and construction components, form a stable customer base, particularly for durable hydraulic and large mechanical presses used for thick-gauge material processing and large-format component manufacturing. These customers prioritize durability, sheer force, and reliability, often seeking presses engineered for long service life under heavy loads. Specialized sectors like Aerospace and Defense, while lower volume, represent a high-value customer group demanding presses with absolute precision for specialized, high-integrity parts, often involving exotic materials, placing a premium on advanced sensing and quality assurance features integrated directly into the press design.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schuler AG, Komatsu Ltd., AIDA Engineering, Fagor Arrasate, Stamtec Inc., Chin Fong Machine Industrial Co., Ltd., JIER Machine-Tool Group, Mitsubishi Heavy Industries, Seyi Machinery, Nidec Minster Corporation, Qingdao Yiyou Electro-Mechanical, Macrodyne Technologies Inc., SEYI-AMADA, SANTOS S.A., Heilbronn Press GmbH, Formtek Group, Yangli Group, Xinchuang Machine Tool, PAMA S.p.A., Erfurt Umformtechnik GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blanking Presses Market Key Technology Landscape

The technological landscape of the Blanking Presses Market is undergoing a rapid transformation centered on digitalization and the adoption of advanced motion control. The most pivotal technology driving this change is the Servo Press system. Unlike traditional mechanical presses that rely on a fixed flywheel and linkage system, or hydraulic presses that utilize fluid pressure, servo presses use high-torque electric motors (servo motors) to control the slide motion precisely. This allows for fully programmable ram speed and stroke profile, enabling manufacturers to optimize stamping curves for challenging materials like High-Strength Low-Alloy (HSLA) steels, reducing material stress, minimizing heat generation, and dramatically extending tooling life. The energy efficiency of servo systems is also a key feature, as energy is only consumed during the working stroke and often recovered during deceleration, significantly lowering operational energy costs compared to continuously running flywheels in mechanical presses.

Another crucial technological development involves the integration of Industry 4.0 components, transforming blanking presses into smart, connected assets. This includes the deployment of numerous sensors for monitoring critical operational parameters such as bearing temperature, slide parallelism, tonnage peaks, and vibration analysis. This data is processed locally and often transmitted to cloud-based platforms for real-time diagnostics and condition monitoring. Predictive maintenance (PdM) systems, leveraging AI and machine learning, analyze this voluminous data to forecast component wear and schedule proactive interventions, maximizing machine uptime. Furthermore, automated quick die change (AQDC) systems are becoming standard, utilizing hydraulic clamps and automated die carts to reduce changeover times from hours to minutes, substantially improving manufacturing flexibility and supporting short-run production demanded by personalized or rapidly evolving product markets.

Advancements in peripheral technologies also significantly impact press performance. High-precision decoiling and feeding systems are essential for handling wide, thin, and difficult materials accurately at high speeds without causing surface damage or misalignment, which are prerequisites for high-speed blanking. Tooling technology is evolving concurrently, with the increased use of tungsten carbide and specialized coating materials (e.g., Physical Vapor Deposition coatings) designed to resist abrasive wear and high impact forces, further boosting production cycles between required tool maintenance. The confluence of precise servo motion control, enhanced structural rigidity in press frames (often utilizing finite element analysis for design optimization), and integrated software control systems ensures that modern blanking presses deliver unmatched precision and productivity, enabling manufacturers to meet the tight tolerances mandated by next-generation components in sectors like aerospace and micro-electronics.

Regional Highlights

- Asia Pacific (APAC): APAC is unequivocally the dominant global market, driven by its status as the world's primary manufacturing hub for automotive components, consumer electronics, and machinery. Countries such as China, India, Japan, and South Korea exhibit massive installed capacity and ongoing robust capital investment in new, high-speed press lines. The shift toward localized EV manufacturing across China and Southeast Asia is fueling explosive demand for high-tonnage servo presses necessary for battery casing production and motor laminations. Government initiatives promoting industrial automation and smart manufacturing further solidify APAC’s leadership, though competition among regional and international press manufacturers remains fierce, often leading to price sensitivity.

- North America: The North American market (primarily the US and Canada) is characterized by a high demand for premium, customized, and technologically advanced presses. While volume growth is slower than in APAC, the value of the market is high, driven by the stringent quality requirements of the domestic automotive sector, especially for complex stampings using advanced high-strength steels (AHSS) required by safety and fuel efficiency regulations. The focus here is less on sheer capacity expansion and more on press modernization, retrofitting older hydraulic and mechanical systems with servo drives, and integrating IoT capabilities to enhance operational efficiency and comply with high domestic environmental standards.

- Europe: The European market, led by Germany, Italy, and France, is defined by its expertise in high-precision engineering and the production of specialized, high-value components for the luxury automotive, industrial machinery, and aerospace sectors. European manufacturers are often at the forefront of implementing Industry 4.0 standards, prioritizing seamless integration with factory management systems (MES/ERP). Demand is strong for highly flexible servo presses and compact stamping cells that minimize physical footprint while maximizing output precision, reflecting the mature but technologically sophisticated nature of the region's industrial base and its emphasis on sustainable, resource-efficient production methods.

- Latin America (LATAM): The LATAM market, centered mainly in Brazil and Mexico (due to established automotive assembly operations), demonstrates moderate growth, fluctuating based on regional economic stability and trade policies. Demand here is primarily driven by the need to support localized component production for global OEMs with assembly plants in the region. There is a balanced requirement for both cost-effective mechanical presses for standard operations and mid-range hydraulic presses, although the adoption of servo technology is increasing, particularly in facilities catering to international quality standards and export markets.

- Middle East and Africa (MEA): The MEA market represents the smallest segment but possesses high long-term potential, especially in countries like Saudi Arabia and the UAE that are actively diversifying their economies away from hydrocarbon dependence through investments in infrastructure and light manufacturing. Growth is sporadic and project-based, heavily reliant on government-led industrialization programs. The current demand profile leans toward robust, reliable hydraulic and mechanical presses suitable for general fabrication and heavy construction-related component manufacturing, with high-end technology adoption still in nascent stages, pending further establishment of high-volume manufacturing ecosystems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blanking Presses Market.- Schuler AG

- Komatsu Ltd.

- AIDA Engineering

- Fagor Arrasate

- Stamtec Inc.

- Chin Fong Machine Industrial Co., Ltd.

- JIER Machine-Tool Group

- Mitsubishi Heavy Industries

- Seyi Machinery

- Nidec Minster Corporation

- Qingdao Yiyou Electro-Mechanical

- Macrodyne Technologies Inc.

- SEYI-AMADA

- SANTOS S.A.

- Heilbronn Press GmbH

- Formtek Group

- Yangli Group

- Xinchuang Machine Tool

- PAMA S.p.A.

- Erfurt Umformtechnik GmbH

Frequently Asked Questions

Analyze common user questions about the Blanking Presses market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Servo Blanking Presses segment?

The primary driver is the demand for superior control and flexibility in the stamping process, particularly for handling new lightweight, high-strength materials (like AHSS) used in EV and automotive manufacturing. Servo presses allow programmable ram motion profiles, reducing material stress and increasing tooling longevity and part precision.

How does Industry 4.0 integration benefit blanking press operation?

Industry 4.0 benefits operations through real-time data collection via IoT sensors, enabling predictive maintenance, remote diagnostics, and automated process optimization. This integration maximizes machine uptime, reduces energy consumption, and provides traceable data for quality assurance documentation.

Which regional market holds the highest growth potential for Blanking Presses?

Asia Pacific (APAC) holds the highest growth potential, primarily driven by massive capital investments in high-volume automotive (especially EV components) and consumer electronics manufacturing across China, India, and Southeast Asian countries, leading to significant capacity expansion.

What are the typical tonnage capacity requirements for automotive structural blanking?

Automotive structural blanking often requires high-tonnage presses, typically falling within the 300 to 600 Tons range, and frequently exceeding 600 Tons for stamping thick-gauge or specialized high-strength steel components crucial for vehicle safety and integrity.

What is the main restraint preventing the rapid adoption of advanced blanking presses by SMEs?

The main restraint is the high initial capital expenditure required for sophisticated servo blanking presses and associated automation equipment, coupled with the necessity for highly specialized technical skills required for their programming and advanced maintenance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager