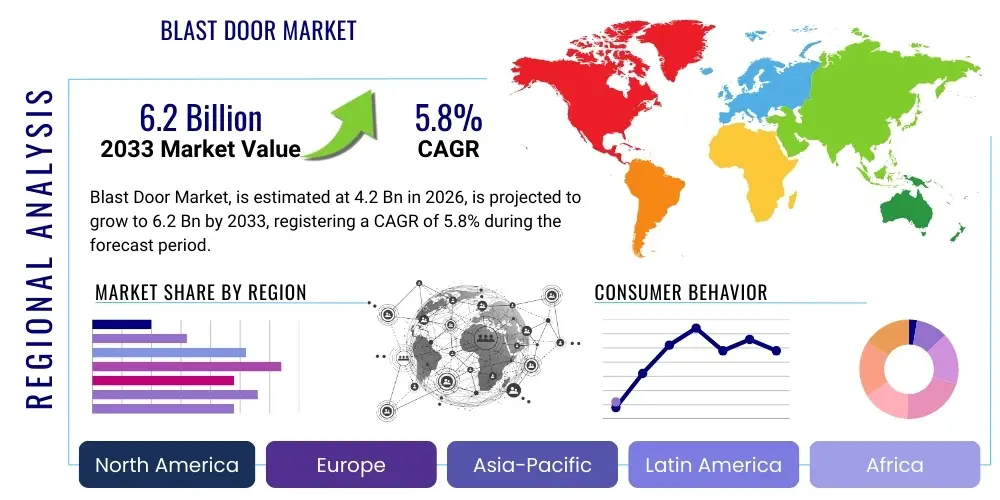

Blast Door Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439396 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Blast Door Market Size

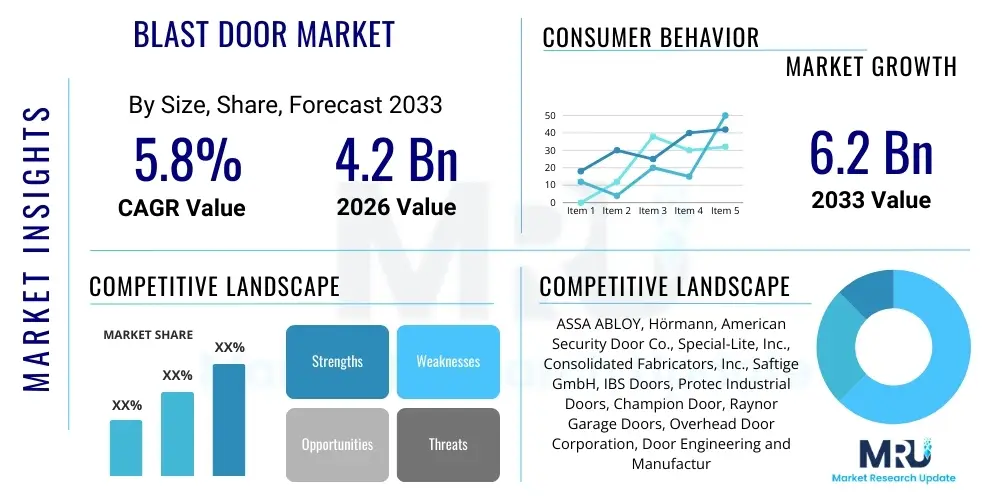

The Blast Door Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

Blast Door Market introduction

The blast door market encompasses the design, manufacturing, and installation of specialized door systems engineered to withstand significant overpressure events such as explosions, ballistic impacts, and severe environmental forces. These robust security solutions are critical for protecting lives, sensitive equipment, and vital infrastructure in high-risk environments where conventional doors would fail. Product descriptions often highlight advanced material compositions, intricate locking mechanisms, and the rigorous testing standards they meet, including compliance with international safety and security regulations like those from ASTM, UFC, and specific national defense standards. These doors are not merely strong; they are engineered for precise failure modes that mitigate damage to surrounding structures while maintaining occupant safety and operational integrity.

Major applications for blast doors span a wide array of sectors, including government and defense facilities, such as military bases, ammunition depots, and command centers, where protection against hostile threats is paramount. The oil and gas industry utilizes blast doors extensively in refineries, offshore platforms, and petrochemical plants to safeguard control rooms and personnel from accidental explosions or industrial incidents. Similarly, nuclear power plants, chemical processing facilities, and data centers rely on these doors to ensure the continuity of critical operations and the containment of hazardous materials. The benefits of deploying blast doors are multi-faceted, ranging from enhanced physical security and asset protection to regulatory compliance and reduced risk of catastrophic failure. They significantly bolster business continuity plans by protecting essential control systems and personnel from unexpected external or internal threats, thus minimizing potential downtime and financial losses. Furthermore, the psychological reassurance provided to personnel working in high-risk zones is an invaluable, though often unquantified, benefit.

Driving factors propelling the growth of the blast door market include increasing geopolitical instability and a heightened global awareness of terrorism threats, necessitating robust protective measures for critical national infrastructure. Rapid industrialization in emerging economies, particularly in energy-intensive sectors like oil, gas, and chemicals, is fueling demand for advanced safety solutions. Moreover, stricter regulatory frameworks and enhanced safety standards imposed by governmental bodies and international organizations are compelling industries to invest in superior blast protection. Technological advancements in material science, such as the development of ultra-high-performance concrete, advanced alloys, and composite materials, are enabling the creation of lighter, more durable, and more effective blast door solutions. The growing trend towards smart infrastructure and integrated security systems also presents new opportunities for blast doors to be incorporated into broader security architectures, offering enhanced monitoring and control capabilities.

Blast Door Market Executive Summary

The Blast Door Market is currently experiencing robust growth, driven by an intricate interplay of global business trends, evolving regional demands, and significant segmentation shifts. From a business trends perspective, there's a clear move towards higher integration of blast protection into broader physical security systems, often involving intelligent access control, biometric verification, and centralized monitoring platforms. Manufacturers are increasingly focusing on modular designs and customized solutions to meet the specific threat profiles and architectural requirements of diverse end-users, moving away from a one-size-fits-all approach. Furthermore, strategic partnerships and collaborations between blast door manufacturers and general construction firms or defense contractors are becoming more prevalent, streamlining the procurement and installation processes for large-scale projects. Sustainability is also emerging as a subtle but growing factor, with interest in materials and manufacturing processes that reduce environmental impact, without compromising on critical protective capabilities.

Regional trends highlight significant disparities and growth opportunities across different geographies. North America and Europe, with their established critical infrastructure and stringent safety regulations, represent mature markets characterized by replacement demand, retrofitting projects, and a continuous upgrade cycle to address evolving threats and technological advancements. These regions also lead in adopting integrated smart security solutions. In contrast, the Asia Pacific (APAC) region is demonstrating exponential growth, fueled by rapid industrial expansion, particularly in China, India, and Southeast Asian nations, alongside increasing investments in defense and energy infrastructure. Latin America and the Middle East & Africa (MEA) are emerging as high-potential markets, driven by new infrastructure development, expanding oil and gas operations, and a growing emphasis on national security, despite facing economic volatilities that can influence investment cycles. Each region presents unique challenges and opportunities, demanding tailored market entry strategies and localized product offerings.

Segmentation trends are significantly influencing market dynamics, with a notable shift towards advanced materials and automated operating mechanisms. While traditional steel and concrete doors remain foundational, there is an increasing demand for composite materials that offer superior strength-to-weight ratios and enhanced performance against multi-hazard threats. In terms of operating mechanisms, electric and hydraulic systems are gaining traction over purely manual systems, driven by the need for faster response times, easier operation, and seamless integration with automated security protocols. The end-use industry segmentation indicates that government and defense, along with the oil and gas sectors, continue to be primary demand drivers, but there's an accelerating penetration into sectors like data centers, financial institutions, and even high-security residential applications as the scope of perceived threats broadens. This diversification across end-user industries underscores the market's adaptability and expanding relevance beyond its traditional strongholds.

AI Impact Analysis on Blast Door Market

User questions regarding AI's impact on the blast door market frequently revolve around how artificial intelligence can enhance security, optimize performance, and predict maintenance needs. Key themes include the integration of AI for smarter threat detection, leading to automated and faster response mechanisms, and the potential for AI-driven analytics to predict structural integrity issues or wear and tear, thereby extending the lifespan and reliability of blast doors. Users are also concerned about the cybersecurity implications of connecting blast doors to intelligent networks, questioning the vulnerability of such advanced systems to sophisticated cyber threats. Expectations often center on AI transforming blast doors from passive barriers into active, responsive components of a holistic security system, capable of adaptive behavior and real-time threat assessment. There is also significant interest in how AI can contribute to more efficient design and testing phases, potentially reducing costs and development timelines through simulation and predictive modeling.

- AI-powered predictive maintenance algorithms for monitoring door health and scheduling preventative repairs.

- Integration of AI with threat detection systems for automated blast door activation or lockdown procedures.

- Enhanced access control through AI-driven facial recognition and behavioral analytics, preventing unauthorized entry.

- Optimization of blast door designs using AI-driven simulation for material strength and structural integrity analysis.

- Real-time threat assessment and adaptive response mechanisms, enabling doors to adjust protective states based on dynamic risks.

- AI-supported manufacturing processes for increased precision and quality control in complex blast door fabrication.

- Improved post-event analysis using AI to assess damage and recommend immediate recovery actions.

- Smart monitoring of environmental conditions impacting door performance, such as temperature and pressure variations.

- Autonomous patrolling robots integrated with smart blast doors for perimeter security and incident reporting.

- Data aggregation and analysis from multiple blast doors across a facility to identify systemic vulnerabilities and optimize overall security posture.

DRO & Impact Forces Of Blast Door Market

The Blast Door Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities, collectively shaping its growth trajectory and strategic direction. Drivers primarily stem from an intensifying global threat landscape, encompassing geopolitical instability, the rising prevalence of terrorism, and the increasing sophistication of industrial accidents, all of which necessitate heightened protective measures for critical infrastructure and personnel. The continuous expansion of essential industries, such as oil and gas, nuclear energy, and defense, particularly in developing economies, further fuels demand for robust blast protection solutions. Moreover, the increasing stringency of international safety regulations and building codes, mandating superior protection for high-risk facilities, acts as a significant catalyst for market growth. These regulations often specify performance criteria and testing standards that only specialized blast doors can meet, driving compliance-driven investments across various sectors.

Conversely, several formidable restraints temper the market's otherwise upward trajectory. The most prominent restraint is the exceptionally high initial investment cost associated with blast doors, attributed to the specialized materials, complex engineering, and rigorous testing required for their certification. This high upfront expenditure can deter smaller organizations or projects with limited budgets, especially in developing regions where cost-effectiveness often takes precedence. Furthermore, the specialized and often intricate installation processes, requiring highly skilled labor and specific site preparations, add to the overall project cost and timeline. The limited awareness of the critical necessity and long-term value of blast protection in certain emerging markets, coupled with a preference for less expensive, conventional security measures, also poses a significant challenge. Supply chain complexities for specialized components and raw materials can also lead to delays and increased production costs, further impacting market accessibility and competitive pricing.

Despite these restraints, the market is rife with compelling opportunities that promise future expansion and innovation. The most significant opportunities lie in the continuous technological advancements in materials science, leading to the development of lighter, more durable, and multi-threat-resistant composites and alloys that can offer superior protection at potentially reduced weights. The burgeoning trend towards integrating blast doors with smart building systems, leveraging IoT, AI, and advanced access control technologies, opens avenues for enhanced functionality, remote monitoring, and automated response capabilities. Furthermore, the expanding application scope beyond traditional defense and heavy industry sectors, into areas like high-security commercial buildings, data centers, financial institutions, and even high-net-worth residential properties, represents a significant untapped market. The potential for retrofitting existing facilities with upgraded blast protection solutions, driven by evolving threat perceptions and updated safety standards, also presents a substantial growth opportunity, allowing older infrastructure to meet modern security requirements without complete overhauls. Customization and modularity in design further cater to diverse client needs, enhancing market penetration across various segments.

Segmentation Analysis

The blast door market is intricately segmented across various dimensions, providing a granular view of its diverse landscape and enabling targeted strategies for manufacturers and suppliers. These segmentations allow for a detailed analysis of demand patterns, technological preferences, and end-user requirements, highlighting the nuanced interplay between product characteristics and market dynamics. Understanding these divisions is crucial for identifying growth hotspots, optimizing product portfolios, and tailoring marketing efforts to specific client needs. The market can be broadly categorized by the materials used in construction, the operational mechanisms employed, the specific design types, the diverse range of end-use industries, and critically, the blast rating or level of protection offered, each representing distinct value propositions and market segments.

- Material

- Steel: Traditional and widely used, offering high strength and proven blast resistance.

- Concrete: Often used in heavy-duty applications requiring extreme protection and mass.

- Composites: Emerging materials offering high strength-to-weight ratios and multi-threat capabilities.

- Others: Includes specialized alloys, combinations of materials, and advanced engineered solutions.

- Operating Mechanism

- Manual: Hand-operated, typically for less frequent use or backup systems.

- Hydraulic: Power-assisted, offering robust and reliable operation for heavy doors.

- Electric: Motorized systems providing ease of use and integration with access control.

- Pneumatic: Air-powered systems, often used in specific industrial environments.

- Design Type

- Swinging: Most common type, similar to conventional doors but heavily reinforced.

- Sliding: Space-saving solution, often used for larger openings or limited swing areas.

- Overhead: Typically for larger industrial openings, providing vertical clearance.

- Bi-fold: Consisting of multiple panels that fold, suitable for wide openings.

- End-Use Industry

- Government & Defense: Military installations, command centers, government buildings.

- Oil & Gas: Refineries, offshore platforms, pipelines, control rooms.

- Petrochemical: Chemical processing plants, storage facilities.

- Nuclear Power Plants: Reactor buildings, critical control areas, waste storage.

- Mining: Underground facilities, explosive storage, control rooms.

- Data Centers: Server rooms, critical infrastructure protection.

- Financial Institutions: Vaults, secure data storage, high-security areas.

- Research Facilities: Laboratories handling hazardous materials, experimental sites.

- Commercial & Industrial: High-security zones in commercial complexes, manufacturing plants.

- Residential (High-Security): Safe rooms, panic rooms in high-net-worth residences.

- Blast Rating

- Low Blast: Designed for minor overpressure events, offering basic protection.

- Medium Blast: Capable of withstanding moderate explosive forces.

- High Blast: Engineered for significant overpressure loads, robust protection.

- Ultra-High Blast: Specialized for extreme explosive events, maximum protection.

Value Chain Analysis For Blast Door Market

The value chain for the blast door market is a complex ecosystem, starting from raw material sourcing and extending through manufacturing, distribution, and end-user installation and maintenance. The upstream segment of this chain involves the procurement of specialized raw materials such as high-strength steel alloys, ballistic-grade concrete components, and advanced composite fibers. These materials must meet stringent quality and performance specifications, often requiring certified suppliers capable of delivering materials with consistent properties essential for blast resistance. Research and development activities, including material science innovations and structural engineering simulations, are also crucial upstream components, dictating the ultimate performance and cost-effectiveness of the final product. Suppliers in this segment often specialize in highly durable and specific industrial materials, forming a critical foundation for blast door construction.

The midstream section, which constitutes the core manufacturing process, is highly specialized and capital-intensive. It involves precision engineering, cutting, welding, and assembly of complex door systems, including the integration of locking mechanisms, hinges, and sealing systems that can withstand extreme forces. Manufacturers in this stage typically possess advanced fabrication capabilities, state-of-the-art machinery, and highly skilled labor trained in specialty welding and composite manufacturing. Quality control and testing are paramount, with doors often undergoing rigorous blast testing simulations or actual explosive tests to ensure compliance with performance standards and safety regulations. Customization is a key aspect, as many blast doors are engineered to specific project requirements, integrating seamlessly with existing building architectures and security protocols. This phase is characterized by a high degree of technical expertise and strict adherence to design specifications to guarantee the protective capabilities of the doors.

The downstream segment focuses on distribution channels and the ultimate delivery and installation of the blast doors to end-users. Distribution can occur through both direct and indirect channels. Direct channels involve manufacturers selling directly to large institutional clients like government agencies, defense contractors, or major industrial operators, often including installation and post-sales support as part of the contract. This direct engagement allows for close collaboration and custom solutions tailored to specific project needs. Indirect channels typically involve a network of specialized distributors, value-added resellers, or construction contractors who integrate blast doors into larger construction projects. These partners often provide localized installation services, technical support, and sometimes even initial consultation. The choice of distribution channel often depends on the project's scale, complexity, and geographical location. Effective logistics for transporting these often heavy and oversized doors are also a critical component of the downstream value chain, requiring specialized transport solutions and careful handling to prevent damage.

Blast Door Market Potential Customers

The potential customers for blast doors are diverse and extend across a wide spectrum of industries and governmental entities, all united by a critical need for superior protection against explosive forces, ballistic threats, or extreme environmental hazards. These end-users are typically characterized by operating environments where the consequences of a breach or catastrophic failure are exceptionally high, involving risks to human life, sensitive data, national security, or expensive critical infrastructure. Primarily, these customers are responsible for managing assets and personnel that are either high-value targets or are situated in inherently dangerous operational zones. Their buying decisions are driven not merely by cost, but by an overriding imperative for safety, regulatory compliance, and business continuity, making them highly discerning and demanding clients who prioritize performance and reliability above all else.

Government and defense organizations represent a foundational customer segment, including military bases, government administrative buildings, intelligence agencies, command and control centers, ammunition depots, and secure diplomatic facilities. Their demand is driven by the need to protect national assets, classified information, and personnel from both conventional and asymmetric threats. Similarly, critical infrastructure operators, such as those in the energy sector—including nuclear power plants, oil and gas refineries, petrochemical facilities, and electricity substations—constitute a major client base. These entities require blast doors for control rooms, equipment shelters, and emergency exits to mitigate risks from accidental explosions, industrial sabotage, or natural disasters, ensuring operational continuity and public safety. The mining industry, particularly for explosive storage and underground operations, also relies heavily on specialized blast doors for safety and containment.

Beyond these traditional heavy industries and government sectors, the customer base is expanding into more specialized and commercial applications. Data centers and financial institutions, for instance, increasingly invest in blast doors to protect their servers, vital data, and monetary assets from physical attacks or deliberate acts of sabotage, recognizing the immense financial and reputational losses associated with a security breach. Research and development facilities, especially those handling hazardous biological, chemical, or radiological materials, require blast doors for containment and safety. Even the commercial and industrial sectors are seeing increased adoption in high-security zones within factories, laboratories, and corporate headquarters. Furthermore, there is a niche but growing market in high-net-worth residential properties for safe rooms and panic rooms, driven by individual security concerns, showcasing the broadening appeal and necessity of blast door technology in safeguarding diverse assets and populations against an evolving threat landscape.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ASSA ABLOY, Hörmann, American Security Door Co., Special-Lite, Inc., Consolidated Fabricators, Inc., Saftige GmbH, IBS Doors, Protec Industrial Doors, Champion Door, Raynor Garage Doors, Overhead Door Corporation, Door Engineering and Manufacturing, ETS-Lindgren, Nystrom, Shielding Solutions, Inc., Amco Barriers, Armortex, Safezone UK, Blast Protection Systems, Inc., Norco Universal Doors |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blast Door Market Key Technology Landscape

The technology landscape of the blast door market is continuously evolving, driven by advancements in materials science, engineering methodologies, and the integration of smart systems. At its core, the primary technology revolves around the selection and application of ultra-high-strength materials capable of absorbing and dissipating immense energy from explosive forces. This includes specialized steel alloys, such as ballistic and armor-grade steels, which offer superior tensile strength and ductility. Beyond traditional metals, there is a growing trend towards advanced composite materials, incorporating layers of various fibers like carbon fiber, fiberglass, and aramid, often embedded in polymer matrices. These composites provide excellent strength-to-weight ratios, corrosion resistance, and multi-threat protection against blast, ballistic, and even chemical hazards, pushing the boundaries of what was previously achievable with monolithic materials. Furthermore, specialized concrete formulations, including ultra-high-performance concrete (UHPC) and fiber-reinforced concrete (FRC), are being engineered to provide extreme mass and structural integrity for critical applications, offering unparalleled resistance to both blast and impact forces.

Beyond material composition, the engineering and design technologies play a crucial role. This includes sophisticated finite element analysis (FEA) and computational fluid dynamics (CFD) simulations used during the design phase to accurately model how different door configurations and materials will react under specific blast loads. These simulation tools allow manufacturers to optimize designs for maximum energy absorption, structural integrity, and minimal deformation, reducing the need for extensive physical prototyping and testing. Innovative hinge systems, locking mechanisms, and sealing technologies are also integral components, designed not only for robust security but also to maintain airtight or watertight seals even after being subjected to significant pressure waves. Multi-point locking systems, often integrated with complex mechanical or hydraulic actuators, ensure uniform closure and enhanced resistance across the entire door frame. The design emphasis is not just on preventing penetration but also on ensuring the door remains functional for emergency egress post-event, adding another layer of engineering complexity.

The integration of intelligent technologies is rapidly transforming blast doors from passive barriers into active, responsive security components. This includes advanced sensor arrays that can detect overpressure waves, seismic activity, or even chemical threats, triggering automated lockdown sequences or protective responses. Access control systems are becoming increasingly sophisticated, incorporating biometric authentication (fingerprint, facial recognition, iris scan), RFID, and advanced credential verification, often managed by centralized security platforms. Networked communication capabilities allow blast doors to be remotely monitored and controlled, providing real-time status updates and diagnostic information. Furthermore, predictive maintenance technologies, leveraging IoT sensors and AI-driven analytics, are being developed to monitor the wear and tear of critical components, anticipate potential failures, and schedule proactive maintenance, thereby enhancing reliability and extending the operational lifespan of these essential security assets. These technological convergences are elevating blast doors to a new level of integrated and intelligent protection, aligning them with the broader trend of smart infrastructure and comprehensive security solutions.

Regional Highlights

- North America: This region stands as a mature and significant market for blast doors, driven by stringent government regulations, continuous investments in defense infrastructure, and a robust oil and gas sector. The United States, in particular, demonstrates consistent demand from military facilities, national laboratories, and critical civilian infrastructure. The market here is characterized by a strong emphasis on technological innovation, integration with smart building management systems, and a focus on high-performance solutions that meet specific threat mitigation standards. Demand is also sustained by ongoing modernization projects for aging infrastructure and the increasing protection needs of data centers and financial institutions against both physical and cyber threats. Canadian demand mirrors this trend, albeit on a smaller scale, with strong requirements from industrial sectors and government facilities.

- Europe: The European market is defined by a combination of strict safety and security standards, a well-established industrial base, and evolving geopolitical risks. Countries like Germany, the UK, and France are major contributors, with demand stemming from nuclear power plants, chemical processing facilities, and national security installations. There is a strong focus on compliance with EU directives and national safety regulations, which often mandate advanced protective measures. The European market also sees significant activity in the retrofitting of older industrial and governmental facilities to meet contemporary security requirements. Innovation in lightweight and highly efficient blast-resistant materials is a notable trend, alongside the integration of doors into comprehensive European security frameworks.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market, propelled by rapid industrialization, massive infrastructure development, and increasing defense expenditures across the region. China and India are at the forefront of this growth, with substantial investments in energy, petrochemical, and manufacturing sectors requiring advanced safety solutions. Countries in Southeast Asia are also contributing to demand as they enhance their industrial capabilities and focus on critical infrastructure protection. The market here is price-sensitive but increasingly recognizing the long-term value of high-quality blast protection. Expansion of smart cities and sophisticated defense procurement initiatives are also key drivers for advanced blast door solutions in this dynamic region.

- Latin America: The Latin American blast door market is emerging, driven by expanding oil and gas exploration activities, mining projects, and a growing focus on critical national infrastructure development. Countries like Brazil, Mexico, and Colombia are key markets, investing in security solutions for their energy assets and government facilities. Economic stability and foreign direct investment play a crucial role in shaping market demand, with fluctuating political landscapes sometimes influencing investment cycles. There is a gradual shift towards higher quality and more technologically advanced solutions, moving away from basic security measures, as regional threats and safety awareness evolve.

- Middle East and Africa (MEA): The MEA region presents a significant and expanding market, primarily fueled by massive investments in the oil and gas sector, large-scale infrastructure projects, and heightened security concerns. Countries in the Gulf Cooperation Council (GCC) such as Saudi Arabia, UAE, and Qatar are major consumers, driven by their extensive energy infrastructure and defense modernization programs. The region also faces elevated geopolitical risks, necessitating robust protective measures for government buildings, critical national assets, and expatriate facilities. Africa’s emerging economies are showing increasing demand, particularly in mining, energy, and secure government installations, as industrial development and security awareness grow.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blast Door Market.- ASSA ABLOY

- Hörmann

- American Security Door Co.

- Special-Lite, Inc.

- Consolidated Fabricators, Inc.

- Saftige GmbH

- IBS Doors

- Protec Industrial Doors

- Champion Door

- Raynor Garage Doors

- Overhead Door Corporation

- Door Engineering and Manufacturing

- ETS-Lindgren

- Nystrom

- Shielding Solutions, Inc.

- Amco Barriers

- Armortex

- Safezone UK

- Blast Protection Systems, Inc.

- Norco Universal Doors

Frequently Asked Questions

What is a blast door and its primary purpose?

A blast door is a specialized, heavily reinforced door designed to withstand extreme overpressure events such as explosions, ballistic impacts, and severe environmental forces, primarily to protect personnel, critical assets, and sensitive infrastructure from damage or destruction.

Which industries are the main adopters of blast doors?

The primary adopters include government and defense, oil and gas, petrochemical, nuclear power plants, data centers, and critical research facilities, all requiring robust protection against high-threat scenarios.

What are the key factors driving the growth of the blast door market?

Market growth is driven by increasing geopolitical instability, rising terrorism threats, expansion of critical infrastructure projects, stringent safety regulations, and technological advancements in materials and integrated security systems.

How does AI impact the future of blast door technology?

AI is expected to enhance blast door functionality through predictive maintenance, integration with smart threat detection systems for automated response, improved access control via biometrics, and optimized design and testing processes.

What are the main types of blast doors available based on material and operation?

Blast doors are primarily made from steel, concrete, or advanced composites. They operate via manual, hydraulic, electric, or pneumatic mechanisms, selected based on the required speed, power, and integration with overall security systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager