Blast Resistant Modular Buildings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436876 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Blast Resistant Modular Buildings Market Size

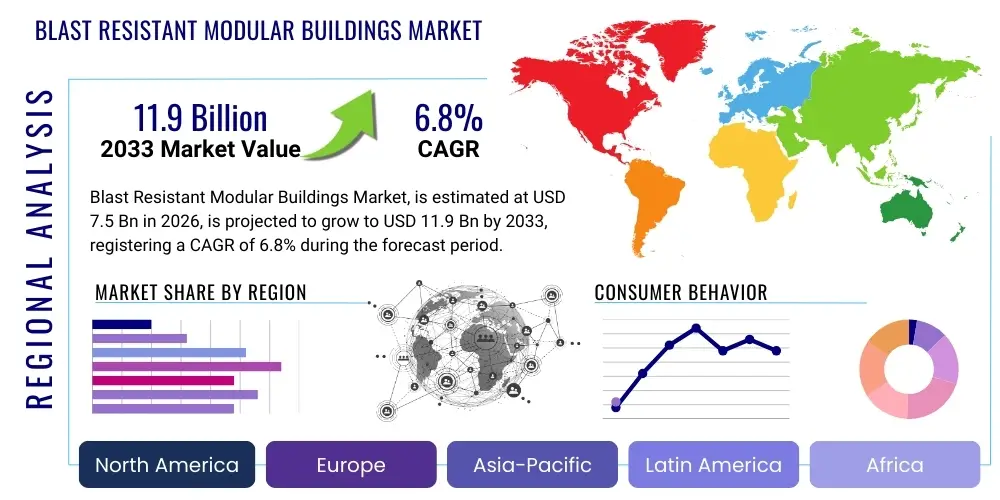

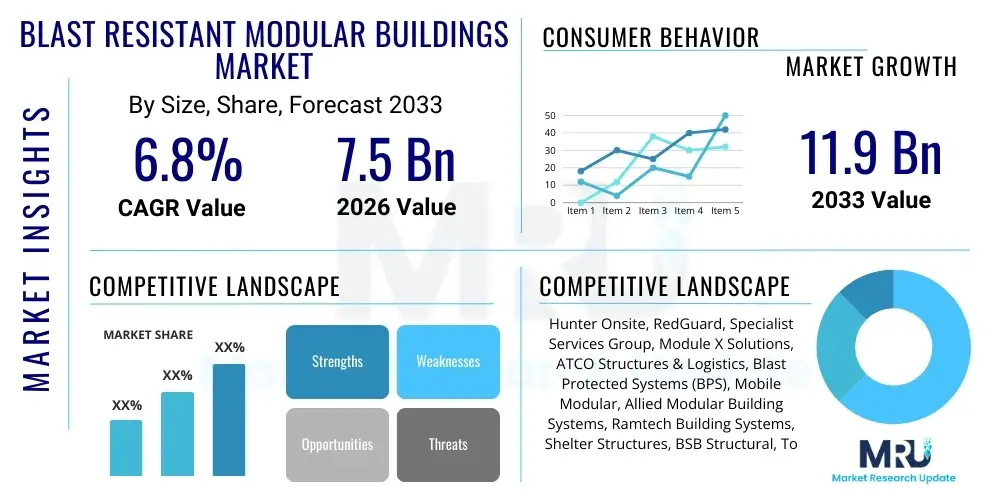

The Blast Resistant Modular Buildings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 7.5 Billion in 2026 and is projected to reach USD 11.9 Billion by the end of the forecast period in 2033.

Blast Resistant Modular Buildings Market introduction

The Blast Resistant Modular Buildings (BRMB) market encompasses the design, manufacturing, and installation of specialized prefabricated structures engineered to protect personnel, assets, and critical infrastructure from external explosive threats, accidental chemical explosions, or sudden pressure waves. These structures are essential safety components, particularly in high-risk environments such as petrochemical refineries, offshore drilling platforms, military installations, and manufacturing facilities handling volatile materials. BRMBs provide superior protection compared to conventional structures through advanced construction materials, specialized anchoring systems, and rigorous testing standards that adhere to international safety codes like API RP 752/753, ASCE standards, and relevant governmental regulations globally. The fundamental engineering challenge solved by BRMBs is designing a structure capable of absorbing and dissipating the extreme energy pulse of a blast wave—characterized by its peak overpressure and duration (impulse)—while minimizing structural deflection and preventing catastrophic failure that could injure occupants or damage interior equipment.

Key applications of BRMBs include centralized control rooms, emergency muster points and shelters, sophisticated analytical laboratories, and secure server data centers situated within high hazard zones (often defined as Zones 1 or 2 by facility risk assessments). The market demand is intrinsically linked to industrial safety mandates, driven by regulatory bodies enforcing strict occupational safety limits, and continuous global investment in critical infrastructure development, especially in volatile geopolitical or developing industrial regions. The primary benefits driving market adoption are rapid deployment, high mobility, which allows the structures to be shifted as operational layouts evolve, and cost-effectiveness relative to site-built, similarly rated blast structures. Crucially, these modules offer guaranteed life safety protection against specific blast overpressure ratings and impulses, having been independently tested and certified.

Driving factors propelling market expansion include increasingly stringent global safety regulations, particularly revisions to the API standards requiring risk reassessment of existing facilities, heightened operational risk awareness following major industrial accidents (such as petrochemical plant explosions), and the necessity for robust business continuity planning in sectors such as oil & gas, mining, and defense. Furthermore, the inherent flexibility of modular construction allows companies to quickly expand, modify, or relocate protective capacity based on evolving project needs or changing threat assessments. Manufacturers are continuously innovating the structural envelope, focusing on lighter, more efficient materials, advanced sealing mechanisms for toxic gas protection, and fully integrated blast-resistant door and window systems that contribute structurally to the overall unit rating, making BRMBs an agile and preferred solution for sophisticated safety requirements worldwide.

Blast Resistant Modular Buildings Market Executive Summary

The Blast Resistant Modular Buildings (BRMB) market is exhibiting robust expansion, sustained by mandatory safety capital expenditures across global hazardous industries and consistent technological refinement in material science and structural engineering. The core business trends reflect a shift towards highly engineered, customized solutions rather than mass-produced standards. This includes the increasing integration of high-performance materials such as composite panels utilizing ceramic or aramid fibers and specialized high-yield strength steel alloys, designed to enhance blast resistance while drastically reducing the overall unit weight. This focus on optimized weight and strength is crucial for manufacturers catering to the relocatable segment, where transport logistics and foundation requirements are primary cost considerations. Furthermore, manufacturers are establishing global service networks, moving beyond simple delivery to providing comprehensive lifecycle services, including re-certification, post-blast inspection, and structural repairs.

Regionally, the market dynamic showcases a duality: established maturity and stability in North America and Western Europe, contrasting sharply with explosive growth potential in the Asia Pacific (APAC) region. North America maintains market dominance due to its highly regulated environment and extensive existing infrastructure requiring ongoing upgrades and new construction, particularly within the massive midstream and downstream oil and gas sectors. The APAC growth trajectory is underpinned by massive government and private sector investment in building new mega-refineries, chemical processing hubs, and energy transport infrastructure, particularly in countries with less established domestic BRMB manufacturing capabilities, creating significant import opportunities for specialized international providers. The Middle East remains a critical hub for high-specification, permanent structure demand, often driven by government procurement related to high-value strategic assets.

Segmentation analysis reveals that while the Oil & Gas sector remains the largest consumer by volume and value, the Chemical and Petrochemical sector is demonstrating the fastest growth in new procurement, driven by regulatory pressure to protect control facilities handling highly volatile mixtures. The Medium Rating segment (5 PSI to 8 PSI) accounts for the largest share of new installations, striking a balance between adequate protection against credible accidental VCE threats and manageable construction costs. A key segmental trend is the increasing demand for combined protection features—structures that offer both blast resistance and robust defense against toxic substance release (gas ingress), necessitating specialized air filtration, sealing technologies, and positive pressure HVAC systems integrated seamlessly into the modular design envelope.

AI Impact Analysis on Blast Resistant Modular Buildings Market

Common user questions regarding AI's influence on the BRMB market typically center on optimizing structural design processes, predicting blast vulnerabilities in existing structures, and leveraging AI for dynamic threat assessment and response protocols. Users are keen to understand how AI can move the industry beyond static structural compliance to a more adaptive and predictive safety methodology. Key concerns revolve around the integration costs, the reliability of AI models trained on limited real-world blast data, and the regulatory acceptance of AI-optimized designs that might deviate from traditional, prescriptive engineering standards. Users anticipate that AI could significantly reduce engineering lead times, improve material utilization efficiency, and enhance the certainty of compliance prior to expensive physical testing.

Based on this analysis, AI’s primary influence is expected in the pre-construction and operational phases, focusing on computational fluid dynamics (CFD) optimization and predictive maintenance for structural integrity. AI algorithms are increasingly being used to run thousands of complex blast simulations (Virtual Testing) under varied parameters (e.g., charge size, standoff distance, terrain) far faster than traditional methods. This capability allows engineers to quickly iterate designs and identify optimal structural reinforcements, such as precise gauge thicknesses and specific joint configurations, with minimal material use, thus lowering manufacturing costs while maximizing safety performance. This technological shift transforms traditional design from iterative manual processes to highly efficient, data-driven optimization loops, leading to lighter, stronger, and more cost-effective modular units that meet specific performance criteria under dynamic threat scenarios.

Furthermore, AI-driven sensor technology integration within the deployed modular buildings is emerging as a critical operational enhancement. Smart BRMBs equipped with integrated structural health monitoring (SHM) sensors and AI processors can continuously analyze subtle changes in vibrations, structural strain, and thermal profiles. This enables facility operators to receive real-time, predictive alerts regarding potential structural degradation, preemptive maintenance needs, or immediate damage assessment post-incident, crucial for determining if the structure remains compliant and safe for re-occupancy. AI thus shifts the focus from purely passive protection to active, intelligent structural management, ensuring the long-term integrity, reliability, and continuous certification status of safety-critical assets in high-hazard operating environments, improving overall lifecycle management significantly.

- Design Optimization: AI-driven CFD and Finite Element Analysis (FEA) for optimal structural load distribution, minimizing material usage while maintaining superior blast ratings.

- Predictive Threat Modeling: Machine learning models predicting the probability and severity of potential explosive incidents based on historical operational data and environmental factors, informing optimal placement.

- Smart Monitoring Systems: Integration of structural health monitoring (SHM) sensors using AI to detect micro-cracks or material fatigue post-installation, extending the lifespan and reliability of the unit.

- Supply Chain Efficiency: Optimization of modular component procurement, inventory management, and manufacturing schedules using AI to shorten delivery lead times and manage material sourcing complexity.

- Automated Compliance Auditing: AI algorithms quickly verifying structural plans against complex international regulatory codes (e.g., API, OSHA, IBC) to ensure immediate compliance and minimize engineering review cycles.

- Post-Blast Assessment: Utilizing AI and sensor data to rapidly assess structural damage severity following an event, facilitating quicker determination of safety status and required repairs.

DRO & Impact Forces Of Blast Resistant Modular Buildings Market

The market environment for Blast Resistant Modular Buildings is significantly influenced by legislative urgency, economic volatility in core industries, and the continuous evolution of threat landscapes. A primary driver is the pervasive trend toward increasingly rigorous global industrial safety standards, exemplified by updated versions of API RP 752/753, which often necessitate the immediate commissioning or substantial retrofitting of control buildings situated within existing or expanded facility hazard radii. This regulatory pressure is amplified by corporate liability concerns and increasing scrutiny from stakeholders regarding workplace safety, compelling facility owners to invest proactively in certified life safety structures to protect high-value operational personnel and ensure legal compliance. Furthermore, the global shift towards complex, high-pressure chemical manufacturing processes inherently increases the likelihood and severity of potential explosive incidents, making advanced protective structures a foundational requirement rather than a discretionary investment.

A key restraint is the substantial initial capital expenditure required for certified BRMBs. These structures involve specialized, high-strength materials, complex engineering analysis (requiring independent third-party certification and testing), and often high transportation and specialized installation costs due to size, weight, and the necessity for specific anchoring systems, placing them at a premium compared to standard industrial enclosures. This cost factor can be particularly prohibitive for smaller independent operators or in environments where project financing is constrained or subject to rapid economic fluctuations, such as downturns in global commodity prices affecting the oil and gas sector’s capital budgets. Moreover, the difficulty in achieving mutual recognition of certification across different international jurisdictions adds complexity and expense, requiring customized re-engineering to meet local building codes and seismic requirements in addition to blast resistance mandates.

Opportunities within the market are highly concentrated in the retrofitting segment, addressing thousands of legacy industrial buildings worldwide that were constructed before modern blast standards were adopted and now fail to meet current risk thresholds, necessitating modular replacement. The integration of the BRMB concept into emerging energy sectors, particularly large-scale battery energy storage systems (BESS) and hydrogen production plants, which present new, complex explosion risks, represents a novel, high-growth avenue. The impact forces profoundly shaping the market include global macroeconomic stability, which enables large-scale, multi-year infrastructure investment; geopolitical conflicts, which elevate security concerns and drive military/defense procurement for hardened command posts; and sustained innovation in structural engineering software, allowing for faster, more accurate dynamic modeling and design optimization, thus slowly reducing the engineering lead time and associated design costs, making BRMBs more accessible.

Segmentation Analysis

The Blast Resistant Modular Buildings market is extensively segmented based on criteria such as the level of protection provided (Blast Rating), the mobility of the structure (Type), the size and function (Application), and the primary industries utilizing these safety assets (End-Use Industry). Understanding these segments is crucial for manufacturers to tailor their engineering solutions and for customers to select compliant and cost-effective protective assets. The segmentation reflects a highly specialized market where solutions must meet stringent technical specifications related to overpressure resistance, duration of the impulse, and post-blast serviceability criteria, catering specifically to the nuanced safety demands of volatile industrial environments globally.

The segmentation by Type, specifically dividing structures into Permanent and Relocatable, often dictates the materials used and the installation requirements, with relocatable units prioritizing lightweight design, standardization, and ease of disassembly and reassembly, facilitating rapid project scaling. In contrast, permanent structures focus on maximum durability, integrated systems (e.g., utility tunnels), and typically aim for higher blast resistance ratings (often 10 PSI and above) due to their long-term proximity to continuous high-hazard sources. The Application segment, including Control Rooms, Emergency Shelters, and Laboratories, represents varying levels of critical importance and required occupancy capacity, thus mandating different internal fit-outs, redundancy of life support systems, and fire suppression systems. Analyzing these dimensions provides clear insight into where safety capital is being prioritized across the global industrial landscape.

- By Blast Rating (Overpressure Resistance):

- Low Rating (Up to 5 PSI)

- Medium Rating (5 PSI to 8 PSI)

- High Rating (Above 8 PSI)

- By Type:

- Permanent/Stationary Modular Buildings (Requires permanent foundation)

- Relocatable/Temporary Modular Buildings (Designed for easy transport and redeployment)

- By Application/Function:

- Control Rooms and Substations (Mission Critical)

- Emergency Shelters and Safe Havens (Mustering Points)

- Laboratories and Analytical Facilities (High-value equipment protection)

- Guardhouses and Access Control Points (Perimeter Security)

- Offices and Living Quarters (Non-Essential Personnel)

- Data Centers and Server Modules

- By End-Use Industry:

- Oil & Gas (Upstream, Midstream, Downstream)

- Chemical and Petrochemical

- Defense and Military (Command and Control)

- Mining and Metals Processing

- Power Generation and Utilities (Nuclear, Fossil Fuel, Renewable Energy)

- Pharmaceutical and Biotechnology

Value Chain Analysis For Blast Resistant Modular Buildings Market

The upstream segment of the BRMB value chain is highly specialized, demanding robust material integrity and certified sourcing to meet structural performance requirements. This segment primarily involves suppliers of high-grade structural components: certified ASTM standard steel (often specific high-yield grades for maximum blast resistance), custom manufactured blast-resistant doors and windows that must withstand dynamic loads without catastrophic failure, and advanced material suppliers providing composite panels (e.g., carbon fiber or aramid reinforced polymer) used for lightweight, high-performance cladding. Quality assurance at this stage is paramount, as the integrity of the raw material directly correlates with the final PSI rating of the finished module, necessitating stringent documentation and traceable sourcing protocols throughout the supply network. Long-term partnerships with specialized material processors who understand the dynamic loading requirements are critical for manufacturers.

The midstream phase, focusing on manufacturing and fabrication, is where the greatest value addition occurs, rooted in proprietary engineering expertise. BRMB manufacturers employ sophisticated software tools, including Computational Fluid Dynamics (CFD) and sophisticated Finite Element Analysis (FEA), to accurately model blast scenarios and optimize the frame design, joint welding patterns, and anchorage points. Fabrication occurs in high-specification, factory-controlled environments, minimizing environmental variables and ensuring precision welding and assembly, which is non-negotiable for blast certification. This off-site construction methodology significantly accelerates project timelines compared to traditional construction. Quality control checks at this stage are exhaustive, often including non-destructive testing (NDT) of critical welds and dimensional surveys before shipment, ensuring the module meets the exact geometric and material standards required for its intended blast rating.

The downstream component of the value chain involves complex logistics, site preparation, and highly specialized installation services. Given the module's size, weight, and critical function, transportation requires specialized heavy-haul carriers and permits. On-site installation is critical, particularly the anchoring process, as the module must be precisely secured to its foundation to prevent uplift or movement during a blast event, which could compromise the entire structure. Distribution channels are predominantly direct, necessitated by the highly technical and custom nature of the sale. Direct engagement between the manufacturer’s engineering team and the end-user or EPC contractor ensures that all site-specific risks, integration requirements (HVAC, fire systems, security), and regulatory compliance details are meticulously managed, minimizing reliance on multi-layered distribution networks and ensuring technical specifications are correctly implemented from design through final deployment.

Blast Resistant Modular Buildings Market Potential Customers

The primary purchasers of Blast Resistant Modular Buildings are large multinational corporations and governmental entities operating in industries where accidental or intentional explosive hazards are inherent risks to personnel and critical operations. The key end-users, or buyers, are typically the facility owners, operators, or the Engineering, Procurement, and Construction (EPC) contractors managing major capital projects within these hazardous zones. These customers prioritize compliance with international safety standards (API RP 752/753, OSHA mandates, etc.), proven structural performance backed by third-party testing, and rapid deployment capabilities to minimize operational downtime and meet strict project deadlines, often viewing the purchase as a critical safety investment rather than a standard procurement item.

The largest and most consistent customer base resides within the hydrocarbon sector, including major integrated oil companies, national oil companies, and independent refining and chemical producers. These entities require continuous blast protection for centralized control rooms managing complex chemical processes, localized equipment shelters near high-pressure piping, and field offices in unstable or remote regions. Secondary, but rapidly expanding, customer segments include military and defense organizations requiring hardened command centers, utility providers needing protection for critical substations, and pharmaceutical firms utilizing volatile solvents in their manufacturing processes, all seeking high levels of physical security combined with blast mitigation capabilities.

Procurement decisions are typically centralized and made by high-level safety officers (HSE Directors), engineering department heads, and capital project managers who possess detailed technical knowledge of blast mechanics and regulatory requirements. These decisions are heavily influenced by independent third-party blast certification reports (e.g., witness testing documentation) and the manufacturer's established track record in delivering structures that consistently meet non-negotiable life safety criteria. Repeat business often centers around manufacturers who can offer scalable, standardized solutions, adhere strictly to challenging project schedules, and provide comprehensive post-installation re-certification and long-term maintenance programs necessary for satisfying insurance compliance and ensuring operational longevity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.5 Billion |

| Market Forecast in 2033 | USD 11.9 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hunter Onsite, RedGuard, Specialist Services Group, Module X Solutions, ATCO Structures & Logistics, Blast Protected Systems (BPS), Mobile Modular, Allied Modular Building Systems, Ramtech Building Systems, Shelter Structures, BSB Structural, Total Safety, Par-Kut International, O’Neill Service Group, KCI Construction, DropBox Inc., Tiger Industrial Rentals, Triumph Modular, Palace Modular, Sterling Structural. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blast Resistant Modular Buildings Market Key Technology Landscape

The technological evolution in the Blast Resistant Modular Buildings market centers on advanced materials science, specialized structural joint design, and integrated operational monitoring systems aimed at maximizing protection while minimizing unit weight and construction time. A core technological focus is the development and application of composite materials, such as Fiber Reinforced Polymer (FRP) panels and specialized honeycomb cores, which offer a superior strength-to-weight ratio compared to traditional heavy steel plating. These lightweight composites allow for easier transportation and erection of large modular units while meeting or exceeding high-pressure overpressure resistance requirements, which is a major advantage for relocatable structures used in remote locations and highly constrained urban industrial settings.

Another critical area of technological advancement involves the design and engineering of pressure relief and mitigation systems integrated into the structural envelope. This includes sophisticated blast valve systems integrated into high-redundancy HVAC units that automatically shut down airflow and seal vents upon detecting a pressure wave, effectively preventing internal overpressure damage and protecting occupants from toxic gas ingress, a common secondary hazard in chemical plant explosions. Furthermore, door and window technologies have significantly advanced, utilizing multi-layered polycarbonate or specialized laminate glass coupled with sacrificial cladding systems and complex, multi-point locking mechanisms designed to absorb and dissipate blast energy without compromising the structural integrity or sealing effectiveness, maintaining the life safety environment inside the module.

The manufacturing process itself is rapidly adopting digital technologies, including robotics and high-precision, automated welding techniques, ensuring that structural joints and seams meet the incredibly high tolerances and consistent material properties required for blast certification. Furthermore, Building Information Modeling (BIM) and virtual reality (VR) are used extensively during the design phase to conduct detailed clash detection, optimize internal equipment layouts, and ensure that all equipment within the module is securely anchored and positioned to withstand potential structural deflection and secondary projectile hazards. This digital precision minimizes engineering risk and significantly shortens the time required for third-party auditing and final certification before deployment, optimizing the delivery timeline for complex industrial projects.

Regional Highlights

North America holds the largest share in the Blast Resistant Modular Buildings Market, primarily driven by the colossal scale of its oil and gas infrastructure, especially the refining and petrochemical clusters along the U.S. Gulf Coast, where stringent API RP 752/753 safety mandates dictate the widespread use of certified blast-resistant control buildings. Continuous capital investment in LNG export terminals, crude oil pipelines, and chemical processing facilities necessitates rapid deployment of high-specification, temporary, and permanent protective structures across both the United States and Canada. The market here benefits from mature regulatory enforcement, a deep pool of experienced engineering firms, and high rates of capital expenditure allocated specifically to safety upgrades and new infrastructure compliance.

The Asia Pacific (APAC) region is forecasted to exhibit the fastest growth rate, fueled by unprecedented industrial expansion, particularly in high-growth economies like China, India, and Southeast Asia. Massive investments in new chemical plants, refinery expansions, and power generation infrastructure across the region are driving the demand for international standard safety solutions, particularly as foreign investors and EPC contractors import global safety protocols. While historically relying on localized or less stringent standards, increasing foreign direct investment and regulatory harmonization are compelling local operators to adopt advanced BRMB solutions adhering to global performance benchmarks, leading to high-volume procurement in new industrial zones across the region.

The Middle East and Africa (MEA) region represents a substantial, highly critical market, dominated by national oil companies (NOCs) and international energy majors. The procurement of BRMBs is highly centralized, focusing on high-specification, permanent structures for mission-critical command centers and central control buildings in expansive petrochemical complexes. Geopolitical risks significantly amplify the need for maximum protection (often demanding 10 PSI+ ratings), ensuring business continuity and the safety of high-value expatriate personnel, thereby stabilizing high-end demand despite fluctuating commodity prices. Europe maintains steady, specialized demand, primarily driven by maintenance, repair, and upgrade (MR&U) activities in its mature refinery and nuclear power sectors, focusing heavily on specialized environmental and toxic gas ingress protection alongside stringent blast resistance standards.

- North America: Dominant market share due to mandatory API RP 752/753 compliance, extensive oil & gas infrastructure, and high capital spending on LNG and petrochemical facilities in the Gulf Coast.

- Asia Pacific (APAC): Fastest-growing region, driven by new refinery and chemical plant capacity additions, infrastructure mega-projects, and increasing adoption of global safety standards in China, India, and Indonesia.

- Middle East & Africa (MEA): High demand for premium, high-specification (high PSI) permanent structures, linked to geopolitical risk mitigation and large-scale, strategic petrochemical projects managed by NOCs.

- Europe: Mature market characterized by steady demand for retrofitting existing facilities, stringent environmental regulations requiring toxic gas protection, and upgrades in the nuclear and chemical sectors.

- Latin America: Emerging market growth tied to offshore oil and gas exploration and development in countries like Brazil and Mexico, requiring standardized, certified, and easily relocatable protective units for remote operations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blast Resistant Modular Buildings Market.- Hunter Onsite

- RedGuard

- Specialist Services Group

- Module X Solutions

- ATCO Structures & Logistics

- Blast Protected Systems (BPS)

- Mobile Modular

- Allied Modular Building Systems

- Ramtech Building Systems

- Shelter Structures

- BSB Structural

- Total Safety

- Par-Kut International

- O’Neill Service Group

- KCI Construction

- DropBox Inc.

- Tiger Industrial Rentals

- Triumph Modular

- Palace Modular

- Sterling Structural

Frequently Asked Questions

Analyze common user questions about the Blast Resistant Modular Buildings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary industry standards governing Blast Resistant Modular Buildings (BRMBs)?

The primary governing standards are the American Petroleum Institute Recommended Practices (API RP) 752 and 753. These provide essential guidelines for the location, design, construction, and protection of permanent and portable buildings in existing or proposed petrochemical facilities, focusing specifically on mitigating the risks from vapor cloud explosions (VCEs).

How is the required Blast Rating (PSI) determined for a modular building?

The required Blast Rating, measured in Pounds per Square Inch (PSI) of overpressure, is determined through a detailed Quantitative Risk Assessment (QRA) specific to the industrial facility. This assessment considers factors such as the potential source of the explosion, maximum credible event size (charge weight), and the required minimum safety margin for continuous personnel protection.

Are Relocatable Blast Resistant Buildings as safe as Permanent Structures with the same PSI rating?

Yes, if both structure types are independently certified to the exact same performance criteria (e.g., 8 PSI, 100 ms impulse duration). Relocatable units utilize specialized lightweight materials and advanced anchoring systems to meet identical dynamic load requirements and structural deflection limits as permanent units upon certified installation.

What are the key benefits of using modular construction over traditional site-built methods for blast resistance?

Modular construction offers several distinct advantages including highly predictable quality control (due to controlled factory fabrication), significantly reduced on-site construction safety exposure, faster project timelines, and guaranteed cost control. Crucially, modular units provide high asset mobility, allowing the critical protective infrastructure to be relocated if operational needs change.

How does the integration of AI affect the long-term maintenance and structural integrity of BRMBs?

AI significantly enhances long-term maintenance by integrating Structural Health Monitoring (SHM) sensors that analyze real-time data on strain, vibration, and material fatigue. This enables precise, predictive maintenance scheduling, ensuring the blast integrity of the structure remains compliant and safe over decades without relying solely on disruptive periodic physical inspections and audits.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager