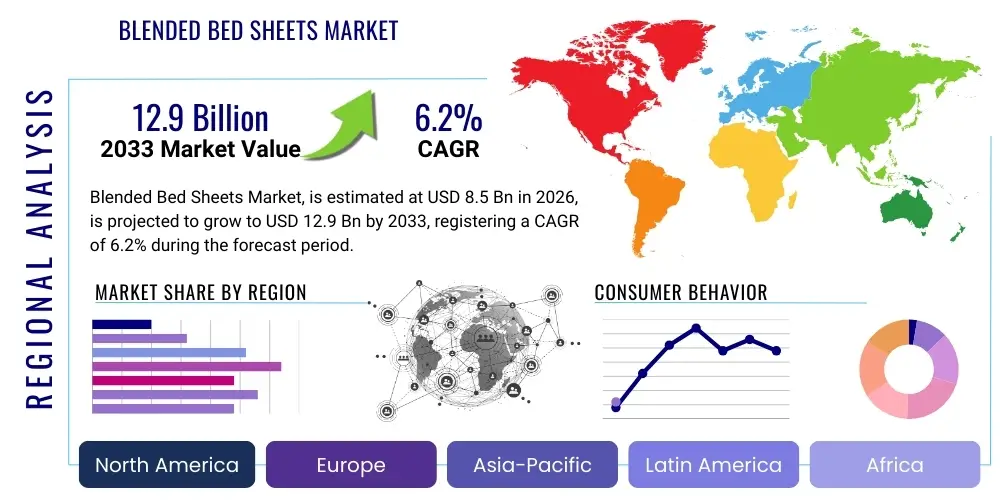

Blended Bed Sheets Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439160 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Blended Bed Sheets Market Size

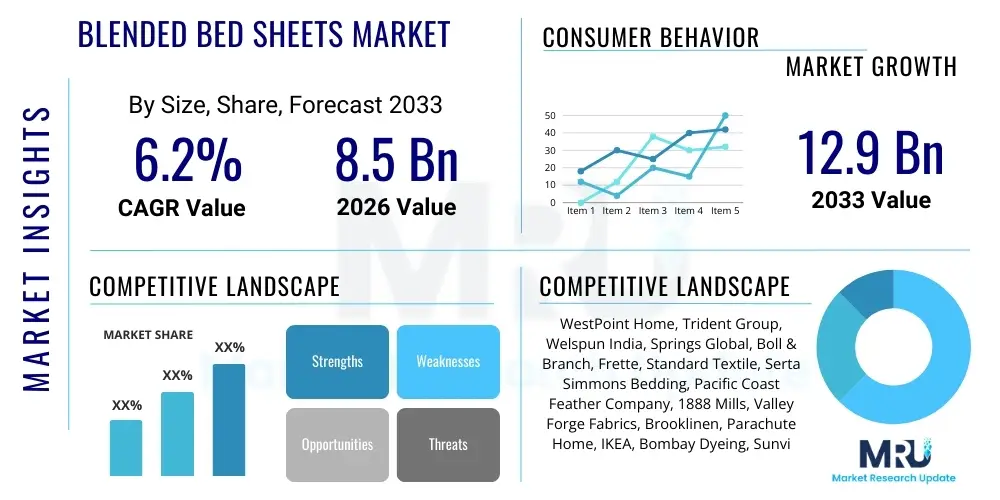

The Blended Bed Sheets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 12.9 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the increasing consumer preference for bedding solutions that offer an optimal balance between natural fiber comfort and synthetic fiber durability and ease of maintenance, particularly the resistance to wrinkling and improved color retention characteristic of blended fabrics.

Blended Bed Sheets Market introduction

The Blended Bed Sheets Market encompasses the production and distribution of bedding materials manufactured from a mixture of two or more distinct fiber types, such as cotton mixed with polyester, or linen blended with rayon or bamboo fiber. These products are specifically designed to leverage the advantageous properties of each component fiber, resulting in a textile that often surpasses single-fiber alternatives in terms of performance metrics like tensile strength, pilling resistance, thermal regulation, and overall cost-effectiveness. The fundamental appeal of blended sheets lies in their ability to provide the soft, breathable feel of natural fibers while incorporating the resilience and easy-care properties associated with synthetic counterparts, thereby catering to a broad spectrum of consumer needs and budgetary constraints.

Major applications of blended bed sheets span residential use, encompassing standard consumer bedrooms, guest rooms, and specialized children's bedding, extending significantly into the commercial and institutional sectors. These commercial applications include high-volume procurement by the hospitality industry, particularly hotels and resorts, which require durable, frequently laundered, and stain-resistant linens. Healthcare facilities, including hospitals and long-term care centers, also constitute a vital market segment, prioritizing blends that offer antimicrobial properties and withstand harsh industrial washing processes. The inherent benefits, such as enhanced longevity, reduced wrinkling, quick drying times, and improved colorfastness compared to 100% natural fibers, solidify their dominant position in these rigorous commercial environments.

Driving factors for market expansion include accelerating urbanization in developing economies, leading to increased disposable income allocated towards home décor and comfort products, coupled with rising global occupancy rates in the travel and tourism sector, which directly boosts demand from the hospitality supply chain. Furthermore, manufacturers are continually innovating fiber ratios and incorporating specialty materials, such as Tencel or modal, into blends to enhance specific performance attributes like moisture-wicking and luxurious hand feel. The sustained focus on blending materials to achieve cost optimization without significant compromise on tactile quality remains a primary catalyst for market penetration across all socio-economic strata, positioning blended bed sheets as a cornerstone of the global textiles industry.

Blended Bed Sheets Market Executive Summary

The Blended Bed Sheets Market is experiencing dynamic shifts, driven by evolving consumer preferences for sustainable, yet highly durable, textile products and significant advancements in textile manufacturing processes. Business trends indicate a strong move towards vertical integration among key manufacturers, aiming to control raw material quality and reduce production lead times, particularly in sourcing sustainable synthetic components like recycled polyester. E-commerce channels have profoundly disrupted traditional distribution models, facilitating direct-to-consumer (DTC) sales which allow brands to offer personalized blended options and gather immediate feedback on fabric performance. Furthermore, strategic partnerships between fiber producers and bedding brands are focusing on developing proprietary, high-performance blends that offer distinct competitive advantages, such as superior temperature regulation or enhanced hypoallergenic qualities, catering to wellness-focused consumers.

Regionally, Asia Pacific (APAC) stands out as the primary engine of market growth, attributed to the immense manufacturing capacity, rapidly expanding middle-class population, and booming domestic consumption in countries like China and India. North America and Europe, while mature, demonstrate strong demand for premium and specialty blends, with a pronounced focus on sustainability certification (e.g., Oeko-Tex, GOTS for blended components). These developed regions exhibit higher average selling prices and are early adopters of innovative materials like recycled PET blends and technical blends designed for specific sleep health benefits. The market dynamics in Latin America and the Middle East & Africa (MEA) are accelerating, supported by expanding tourism infrastructure and increasing foreign investment in localized textile production facilities, leading to a diversified regional consumption profile favoring cost-effective cotton-polyester blends.

Segmentation trends highlight the enduring dominance of the cotton-polyester blend due to its unmatched balance of affordability, comfort, and performance, particularly in institutional procurement. However, segments focusing on luxury and specialized functions, such as bamboo-cotton or microfiber-Tencel blends, are exhibiting the fastest growth rates, signaling a premiumization trend within the consumer segment willing to pay for enhanced tactile properties and eco-friendliness. The size segment also reveals robust growth in non-standard sizes, such as deep-pocket sheets, adapting to the increasing prevalence of thicker mattresses. Overall, the market trajectory suggests sustained innovation in blending techniques, aiming to reduce the environmental footprint while maximizing the functional longevity and consumer satisfaction derived from these versatile textile products.

AI Impact Analysis on Blended Bed Sheets Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the Blended Bed Sheets Market predominantly revolve around three critical areas: supply chain optimization, personalized product development, and manufacturing efficiency. Users seek to understand how AI-driven predictive analytics can forecast demand spikes for specific blend ratios (e.g., 60/40 cotton/poly versus 80/20), thereby minimizing inventory holding costs and reducing textile waste. A major concern is AI’s role in automating textile quality control, especially identifying subtle defects in weave density or color consistency across various blend types. Furthermore, consumers and retailers are keenly interested in AI tools that can analyze individual sleep data (temperature, movement) to recommend the optimal blend composition and thread count for enhanced sleep performance, reflecting a shift from mass production towards hyper-personalized textile solutions.

- AI optimizes raw material procurement by predicting global fiber price fluctuations and securing optimal blend components.

- Generative AI models accelerate new product development by simulating millions of blend ratio combinations and analyzing potential performance characteristics before physical prototyping.

- Machine Vision systems, powered by AI, provide real-time, high-precision quality inspection during the weaving, dyeing, and finishing stages, significantly reducing defect rates.

- Predictive maintenance algorithms minimize downtime on large-scale textile machinery, ensuring continuous and efficient production cycles.

- AI-driven demand forecasting enhances inventory management, tailoring stock levels of specific colors and sizes to regional consumer purchasing patterns, minimizing overproduction.

- Chatbots and virtual assistants utilize AI to guide consumers through complex blend options (e.g., microfibers vs. natural blends), improving the online purchase experience.

- Automated logistics routing and warehousing management, utilizing AI algorithms, ensure faster and more cost-effective distribution of finished blended sheets globally.

- AI aids in tracking the sustainability footprint of the supply chain, verifying claims related to recycled fiber content and ethical sourcing across complex textile origins.

DRO & Impact Forces Of Blended Bed Sheets Market

The Blended Bed Sheets Market is shaped by a confluence of accelerating drivers (D), significant restraints (R), compelling opportunities (O), and resulting impact forces. A primary driver is the widespread consumer demand for convenience, where easy-care attributes such as wrinkle resistance and quick-drying capabilities—hallmarks of blends, particularly those incorporating synthetic fibers—outweigh the desire for 100% natural fiber luxury. This demand is further amplified by the growth of the global rental and hospitality sectors, which require durable, low-maintenance linens capable of frequent commercial laundering. The second major driver involves cost efficiency; blending high-cost natural fibers (like Pima cotton or linen) with less expensive synthetic fibers (like polyester) allows manufacturers to offer competitively priced products that still retain desirable comfort features, appealing directly to mass-market and budget-conscious consumers globally.

However, the market faces notable restraints, chiefly concerning growing consumer scrutiny over sustainability and environmental impact. The use of traditional polyester, a petroleum-derived fiber, is increasingly viewed negatively due to microplastic shedding during laundering and its non-biodegradability, prompting regulatory pressure and shifting consumer sentiment towards eco-friendly alternatives. Furthermore, while blends offer performance, lower-quality blends can sometimes suffer from pilling, reduced breathability, or a less luxurious hand feel compared to premium 100% natural fibers, leading to perceived value erosion among high-end consumers. Overcoming these restraints requires substantial investment in sustainable synthetic alternatives, such as certified recycled polyester or bio-based polymers, adding complexity and initial cost to the manufacturing process.

Opportunities for growth are abundant, particularly through technological innovation and market segmentation. The development and integration of high-performance blends, such as those featuring antimicrobial properties, thermal regulation capabilities (phase change materials), or advanced moisture-wicking technology, open specialized market niches like athletic bedding or medical textiles. Furthermore, the rising awareness and acceptance of plant-based cellulosic blends (e.g., Tencel, Modal) combined with organic cotton present a lucrative pathway to satisfying the demand for both performance and sustainability. The final impact force is the intensification of competition among key players, leading to rapid product innovation, competitive pricing strategies, and aggressive marketing centered on the unique performance attributes derived from specific fiber combinations, ultimately benefiting the end consumer through enhanced product variety and quality at various price points.

Segmentation Analysis

The Blended Bed Sheets Market is meticulously segmented based on material type, thread count, application, size, distribution channel, and geographic region, reflecting the diverse consumer base and varying product performance requirements across sectors. Material segmentation is crucial, determining the sheet’s primary characteristics, such as feel, durability, and cost, with cotton-polyester being the foundational category, while newer, higher-growth segments involve sophisticated blends incorporating regenerative fibers. Thread count, traditionally a measure of quality, segment the market based on perceived luxury and durability, influencing pricing structure significantly. Application segmentation differentiates between high-traffic commercial use (requiring institutional-grade durability) and residential use (prioritizing comfort and aesthetic appeal), driving distinct manufacturing specifications.

- By Material Type:

- Cotton and Polyester Blend (CVC and Poly-Cotton)

- Cotton and Rayon/Viscose Blend

- Bamboo and Cotton Blend

- Linen and Cotton Blend

- Tencel and Microfiber Blend (Specialty/Performance)

- Recycled Fiber Blends (Sustainable Options)

- By Thread Count:

- 100-200 Thread Count (Institutional/Budget)

- 201-400 Thread Count (Standard Residential)

- 401-600 Thread Count (Premium/Luxury)

- Above 600 Thread Count (Ultra-Premium)

- By Application:

- Residential

- Commercial (Hotels, Resorts, Serviced Apartments)

- Healthcare/Institutional (Hospitals, Care Centers)

- By Size:

- Twin/Single

- Full/Double

- Queen

- King/California King

- Custom/Specialty Sizes (e.g., Deep Pocket)

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Brand Websites)

- Offline Retail (Supermarkets, Hypermarkets, Specialty Stores)

Value Chain Analysis For Blended Bed Sheets Market

The value chain for the Blended Bed Sheets Market begins with the upstream activities centered on raw material procurement, which involves the sourcing of natural fibers such as raw cotton and synthetic or manufactured cellulosic fibers like polyester pellets, rayon, or Tencel pulp. Success in the upstream segment hinges on maintaining stable, high-quality sourcing agreements, especially for organic or recycled materials, ensuring compliance with global textile standards. Following fiber procurement, processing involves spinning the distinct fibers into blended yarns at precise ratios, followed by weaving or knitting to create the base fabric. Dyeing, printing, and specialized finishing treatments (e.g., wrinkle-free application, antimicrobial treatment) are critical stages where blending expertise is essential to ensure consistent color uptake and performance across disparate fiber types, greatly influencing the final product quality and consumer perception.

The midstream operations transition into the cut-and-sew manufacturing process, where the finished fabric rolls are transformed into standardized bed sheet sets (flat sheets, fitted sheets, pillowcases). This stage benefits heavily from automation and efficiency in pattern cutting to minimize material waste, a key consideration for cost-competitive blends. Downstream activities involve inventory management, packaging, and the complex distribution network, which is categorized into direct and indirect channels. Direct channels include brand-owned physical stores and, more importantly, proprietary e-commerce platforms, allowing for better margin control and direct consumer feedback loops.

Indirect distribution remains essential for market penetration, relying heavily on large-scale retail partners, including mass merchandisers (Target, Walmart), department stores (Macy's), and online marketplaces (Amazon). Furthermore, specialized B2B distribution channels handle bulk orders for the hospitality and healthcare sectors, often requiring tailored product specifications and institutional packaging. The effectiveness of the overall value chain relies on seamless logistical integration, particularly the efficient flow of information regarding demand forecasts, which prevents overstocking of specific blend variations and ensures rapid delivery to geographically dispersed end-users, stabilizing retail shelf presence and maximizing market reach.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 12.9 Billion |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | WestPoint Home, Trident Group, Welspun India, Springs Global, Boll & Branch, Frette, Standard Textile, Serta Simmons Bedding, Pacific Coast Feather Company, 1888 Mills, Valley Forge Fabrics, Brooklinen, Parachute Home, IKEA, Bombay Dyeing, Sunvim Group, GHCL Limited, Himatsingka Seide, Vartest Laboratories, Peacock Alley. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blended Bed Sheets Market Key Technology Landscape

The manufacturing of high-quality blended bed sheets relies extensively on advanced textile technology to ensure fiber integrity, consistent blending ratios, and superior finishing. In the upstream stage, sophisticated blending machinery utilizes gravimetric and volumetric feeding systems to precisely combine different staple fibers (e.g., natural cotton and synthetic polyester) before spinning, guaranteeing a uniform yarn structure critical for quality performance, especially wrinkle resistance. Modern air-jet and rapier looms are employed for high-speed, precision weaving, allowing manufacturers to achieve complex weave structures like sateen or twill, which dramatically influence the sheet's final luster, feel, and durability, ensuring that the finished blend textile maintains a luxurious hand despite the inclusion of synthetic components.

In the finishing segment, technological advancements are paramount, particularly the application of specialized treatments. Digital textile printing technology has revolutionized the market by allowing for intricate, multi-color patterns on blended fabrics, offering flexibility and reduced environmental impact compared to traditional screen printing methods. Crucially, chemical finishing technologies, such as formaldehyde-free durable press finishes, are applied to enhance wrinkle recovery and minimize the need for ironing, a key selling point for polyester-cotton blends. Furthermore, microencapsulation technology is being integrated to embed functional properties, such as permanent antimicrobial agents, insect repellents, or thermal phase change materials (PCMs) directly into the fibers, providing value-added benefits that differentiate premium blended products in competitive markets.

Beyond core manufacturing, the integration of Industry 4.0 principles, including sensor technology and Internet of Things (IoT) devices, is optimizing entire production facilities. Smart factories utilize automated monitoring systems throughout the dyeing process to ensure consistent shade matching across large production batches, which is historically challenging when handling multiple fiber types with varying dye affinities. These systems provide real-time data on energy consumption, reducing operational waste, and significantly improving traceability, which is vital for verifying sustainability claims related to the blended materials. The ongoing focus is on developing closed-loop manufacturing systems, especially for the recovery and recycling of textile waste from synthetic blends, furthering the circular economy objectives within the bedding sector.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global blended bed sheets market both in terms of production volume and rapidly increasing consumption. Countries like China, India, and Pakistan are global manufacturing hubs, benefiting from low labor costs, readily available raw materials (cotton and petrochemical derivatives for polyester), and advanced textile infrastructure. Domestic market growth is fueled by strong middle-class expansion, urbanization, and a burgeoning hospitality sector, with local brands focusing on cost-effective, durable blends to meet high-volume demand. Investment in sustainable textile technology is also accelerating in Southeast Asia.

- North America: Characterized by high consumer disposable income and a strong preference for branded, high-quality products. North American demand is concentrated on premium blends (e.g., Tencel/cotton, specialized microfiber blends) and products offering enhanced functional benefits (e.g., cooling, antimicrobial). The region is a significant importer of finished goods, and retailers prioritize transparency regarding fiber sourcing and sustainability certifications (Oeko-Tex Standard 100) for blended products, driving market innovation towards eco-friendly synthetics.

- Europe: Europe exhibits a mature market focused intensely on regulatory compliance, ethical sourcing, and environmental standards (e.g., EU Ecolabel). Consumers demonstrate a strong preference for natural-feel blends, such as linen-cotton or organic cotton blends, even when synthetics are included for durability. The region experiences robust demand from both the residential sector and the premium hospitality segment, where perceived luxury and longevity of blended textiles are prioritized. Eastern European countries are emerging as important manufacturing centers due to lower operational costs.

- Latin America (LATAM): Growth in LATAM is closely linked to economic stability and the expansion of the regional tourism industry. Countries like Brazil and Mexico are important manufacturing and consumption centers, prioritizing value-for-money products. Demand is primarily for standard cotton-polyester blends, balancing affordability and maintenance ease, serving a large base of budget-conscious consumers and expanding mid-range hotels.

- Middle East and Africa (MEA): The MEA market growth is propelled by massive infrastructure development, particularly in the Gulf Cooperation Council (GCC) countries, supporting a booming luxury tourism and healthcare market. This necessitates high-volume procurement of durable, visually appealing, and often fire-retardant specialized blends for high-end hotels and resorts. Africa represents an emerging consumption market, increasingly demanding durable, climate-appropriate blends.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blended Bed Sheets Market, encompassing manufacturers, distributors, and specialized fiber suppliers who drive innovation and market competition.- Welspun India Ltd.

- Trident Group

- Springs Global S.A.

- WestPoint Home LLC

- Standard Textile Co. Inc.

- Boll & Branch

- Frette S.r.l.

- Serta Simmons Bedding, LLC

- Pacific Coast Feather Company

- 1888 Mills LLC

- Valley Forge Fabrics Inc.

- Brooklinen

- Parachute Home

- IKEA Systems B.V.

- Bombay Dyeing and Manufacturing Company Ltd.

- GHCL Limited

- Himatsingka Seide Ltd.

- Sunvim Group Co., Ltd.

- Vartest Laboratories

- Culp, Inc.

Frequently Asked Questions

Analyze common user questions about the Blended Bed Sheets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of purchasing blended bed sheets over 100% natural fiber sheets?

Blended bed sheets, particularly cotton-polyester blends, offer superior durability, enhanced wrinkle resistance, reduced shrinking after washing, and significantly lower maintenance requirements compared to 100% natural fibers like cotton or linen. The blending process provides optimal cost-effectiveness and increased longevity, making them ideal for high-frequency washing environments like hotels.

How does thread count impact the quality and performance of blended fabrics?

While often marketed as a primary quality indicator, thread count in blended sheets represents the density of the weave. For blends, a moderate thread count (250–400 TC) often provides the best balance of breathability, softness, and durability. Extremely high thread counts in blends may indicate multi-ply yarns, which can decrease breathability and potentially increase pilling over time, depending on the fiber ratio.

Are sustainable blended bed sheets commercially available, and what materials are used?

Yes, sustainability is a key market driver. Manufacturers increasingly use sustainable blends such as recycled polyester (made from post-consumer plastic bottles) combined with organic cotton or Tencel (a cellulosic fiber derived from sustainable wood sources). These options minimize the environmental footprint while retaining the functional benefits of blended textiles, catering to eco-conscious consumers.

Which fiber blend is most suitable for high-humidity or warm sleeping environments?

For high-humidity or warm environments, blends that prioritize moisture-wicking and breathability are recommended. These often include natural fibers like cotton or bamboo combined with performance synthetics such as specialized microfiber or Tencel/Modal. These combinations effectively manage moisture and enhance thermal regulation, leading to a cooler, drier sleep experience compared to standard high-polyester content sheets.

What is the current industry standard regarding the optimal cotton-to-polyester ratio for residential use?

The industry commonly recognizes a 60% cotton and 40% polyester (60/40) or 50% cotton and 50% polyester (50/50) ratio as providing the best combination for general residential use. Ratios with higher cotton content (60%+) prioritize softness and breathability, while ratios leaning toward higher polyester content (50%+) emphasize extreme wrinkle resistance and increased robustness against wear and tear, typically preferred in institutional settings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager