Blister Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435243 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Blister Machine Market Size

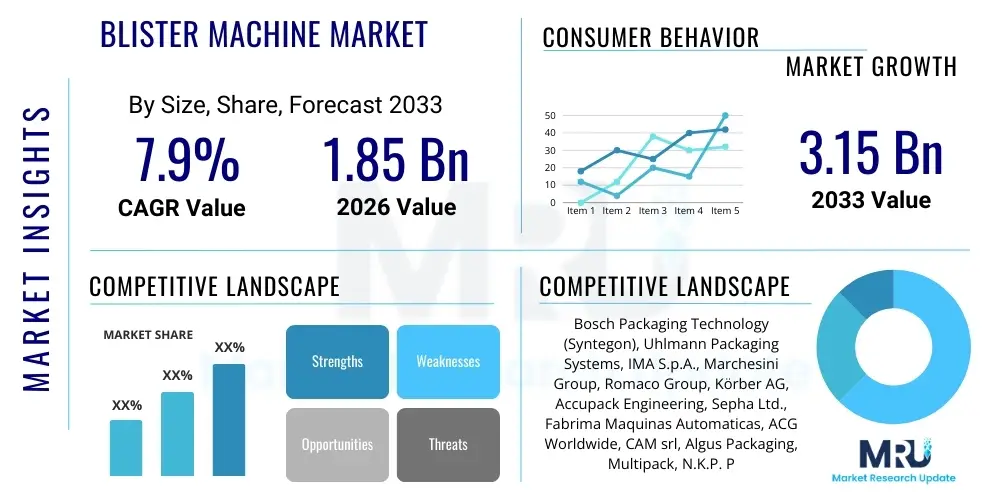

The Blister Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.9% CAGR between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 3.15 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the accelerating expansion of the global pharmaceutical and healthcare sectors, particularly the increasing demand for unit-dose packaging that ensures product integrity, enhances patient compliance, and offers superior protection against environmental factors such as moisture and light.

Blister Machine Market introduction

The Blister Machine Market encompasses the manufacturing, sales, and service of automated equipment designed to create pre-formed plastic packaging (blisters) commonly used for unit-dose pharmaceuticals, medical devices, and consumer goods. These machines utilize processes such as thermoforming (heating and shaping plastic film) or cold forming (pressing aluminum foil) to create cavities, which are then filled with the product and sealed with a lidding material, typically foil or paper-backed foil. Major applications span across highly regulated industries, including prescription drugs, over-the-counter (OTC) medications, vitamins, and specialized packaging for small electronics or cosmetic samples.

The primary benefits associated with modern blister packaging include improved product shelf life due to superior barrier properties, enhanced tamper evidence, and simplified inventory management owing to the standardized unit-dose format. Furthermore, for the end consumer, blister packs improve patient safety and compliance by clearly labeling the day or time for dosage. Driving factors include stringent regulatory requirements for pharmaceutical packaging integrity (such as those enforced by the FDA and EMA), the rapid rise in generic drug manufacturing, and increasing complexity in drug formulations requiring specialized moisture and oxygen barrier packaging solutions.

Technological advancements in the sector are centered around increasing operational efficiency, reducing material waste, and integrating sophisticated control systems. High-speed blister machines capable of running upwards of 600 blisters per minute are becoming standard in large manufacturing facilities. The trend towards sustainable packaging materials, including bio-plastics and thinner foils, is also reshaping the product description and development cycle within the market, necessitating continuous innovation in heating and sealing technologies to maintain package quality and security while meeting environmental sustainability goals.

Blister Machine Market Executive Summary

The Blister Machine Market Executive Summary highlights significant growth driven by favorable business trends in the global pharmaceutical industry, particularly the robust expansion in Asia Pacific (APAC). Business trends indicate a strong move toward high-speed, integrated packaging lines that incorporate serialization and track-and-trace capabilities to comply with global anti-counterfeiting legislation. Regional trends show APAC emerging as the fastest-growing region, fueled by massive investment in local drug production and expanding healthcare infrastructure in countries like China and India, while North America and Europe maintain dominance in terms of market value due to stringent quality standards and high adoption of advanced automated systems. Segment trends reveal that the rotary blister packaging technology segment is gaining traction due to its higher throughput efficiency compared to traditional flatbed systems, and the pharmaceutical application segment remains the undisputed primary revenue generator, emphasizing precision and validation protocols.

The market is characterized by intense competition and a focus on specialized machinery tailored for complex materials. Key stakeholders are prioritizing strategic mergers and acquisitions (M&A) to integrate advanced software and robotic capabilities into their offerings, thereby providing comprehensive, end-to-end packaging solutions. Furthermore, the persistent pressure from consumers and regulators for environmentally friendly packaging is necessitating substantial R&D expenditure in machinery capable of handling eco-friendly materials, which presents both a technical challenge and a significant market opportunity for specialized niche players.

Overall market stability is ensured by the non-cyclical nature of the pharmaceutical sector, providing a steady demand base for packaging equipment replacement and expansion. The high capital investment required for these complex machines creates significant entry barriers, allowing established companies with strong service and validation portfolios to maintain their market leadership. The integration of advanced diagnostics and remote monitoring capabilities, facilitated by the Industrial Internet of Things (IIoT), is streamlining maintenance and improving uptime, further strengthening the market position of suppliers offering digitally integrated solutions.

AI Impact Analysis on Blister Machine Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Blister Machine Market predominantly revolve around three key areas: predictive maintenance implementation to minimize unplanned downtime, enhanced quality control systems for detecting minute packaging defects, and optimization of machine parameters (speed, temperature, pressure) in real-time. Users are keen to understand how AI-driven vision systems can replace or significantly augment manual inspection processes, thereby improving accuracy and compliance with Good Manufacturing Practice (GMP) standards. A central theme is the expectation that AI will transition blister packaging operations from reactive maintenance models to proactive, highly efficient manufacturing environments, ultimately reducing waste and operating costs while ensuring 100% packaging integrity.

The application of machine learning algorithms in operational technology allows blister machine manufacturers to develop sophisticated software modules that analyze vast amounts of sensor data collected during packaging runs. This data includes information on sealing temperature uniformity, material tension, and cycle times. By identifying subtle correlations and anomalies that human operators might miss, AI systems can predict component failure (e.g., worn sealing rollers or heating element degradation) weeks in advance, enabling scheduled maintenance interventions rather than costly emergency repairs. This shift dramatically improves Overall Equipment Effectiveness (OEE).

Furthermore, AI-powered vision inspection systems are fundamentally transforming quality assurance. Traditional vision systems are programmed to look for specific, pre-defined flaws. In contrast, deep learning models can be trained on millions of images of both perfect and defective blisters, allowing the system to identify novel or complex defects, such as subtle delamination or incomplete thermoforming in challenging materials like Aclar, with unparalleled speed and accuracy. This AI-enhanced precision is critical for highly sensitive drug products where package failure could compromise efficacy or safety, ensuring that the blistering process maintains the highest level of regulatory compliance.

- AI-Driven Predictive Maintenance: Minimizes unplanned downtime by forecasting equipment failure based on sensor data analysis.

- Enhanced Quality Inspection: Utilizes deep learning vision systems for real-time, ultra-high-accuracy defect detection, surpassing human capability.

- Parameter Optimization: Automated adjustment of sealing temperature, pressure, and speed based on material feedback and environmental conditions.

- Supply Chain Integration: Improved traceability and serialization data management through intelligent data processing.

- Energy Efficiency: Optimization of machine operation cycles to reduce power consumption and material waste.

DRO & Impact Forces Of Blister Machine Market

The Blister Machine Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and growth potential, referred to as Impact Forces. Key drivers include the global expansion of the pharmaceutical industry, particularly in emerging markets, coupled with stricter regulatory requirements for tamper-evident and child-resistant unit-dose packaging. However, the market faces significant restraints, primarily the high initial capital investment required for high-speed, validated machinery and the technical complexities associated with handling increasingly sophisticated barrier materials and integrating highly regulated serialization technology.

Opportunities are abundant in the development of flexible machines capable of handling small batch production runs for personalized medicine and specialized clinical trials, alongside the persistent demand for sustainable packaging alternatives. The convergence of these factors creates powerful impact forces. For instance, the driver of regulatory compliance strongly impacts the opportunity for technological advancement in serialization equipment, while the restraint of high capital cost impacts market entry strategies, favoring established global suppliers who can provide comprehensive financing and long-term service contracts. Navigating these forces requires manufacturers to balance high efficiency with material flexibility and cost-effectiveness.

The impact forces also involve the growing trend towards outsourcing packaging operations (contract packaging organizations or CPOs), which drives demand for highly flexible and configurable blister lines that can quickly switch between different product formats and materials. The technical challenges inherent in achieving perfect seals across varying materials at high speeds represent an ongoing hurdle. Manufacturers must continuously invest in sealing technologies—such as induction sealing or ultrasonic bonding—to meet the exacting standards required, especially for moisture-sensitive products, cementing technology as a primary impact force dictating market success.

Segmentation Analysis

The Blister Machine Market is comprehensively segmented based on its structural components, operational technology, material handling capability, and end-use application. Understanding these segments is crucial for analyzing market dynamics, identifying specific high-growth niches, and formulating tailored business strategies. The key segmentation allows stakeholders to differentiate between high-throughput, standardized pharmaceutical machinery and lower-volume, flexible systems used in cosmetic or consumer goods packaging. Furthermore, segmentation by technology (Thermoforming vs. Cold Forming) highlights differing capital costs and material advantages, directly influencing end-user investment decisions based on required barrier properties and production volume.

The primary revenue stream continues to be dominated by fully automatic, high-speed blister packaging machines, necessary for large-scale production of OTC and generic pharmaceuticals. However, there is accelerating growth in the demand for semi-automatic and compact machinery, primarily catering to smaller pharmaceutical companies, research laboratories, and CPOs that require flexibility for small-to-medium batch sizes and complex product configurations. This granular segmentation provides critical insight into where capital expenditure is being directed across different geographical regions and operational scales.

Material type segmentation, often overlooked, is gaining importance as manufacturers seek optimal barrier protection. Machines optimized for PVC/PVDC (Polyvinyl Chloride/Polyvinylidene Chloride) or specialized materials like Aclar (PCTFE) command higher pricing due to the required precision in heating and forming. This dictates that equipment providers must offer specialized expertise not just in mechanics, but also in polymer science, linking machine design intrinsically to the chemistry of the packaging materials.

- By Technology:

- Thermoforming (PVC, PVDC, PET)

- Cold Forming (Aluminum/Aluminum)

- By Type of Operation:

- High-Speed (Fully Automatic)

- Medium-Speed (Automatic)

- Semi-Automatic/Manual

- By End-User Application:

- Pharmaceutical (Tablets, Capsules, Vials)

- Medical Devices (Syringes, Implants, Diagnostic Kits)

- Cosmetics & Personal Care

- Food & Confectionery

- By Machine Design:

- Rotary Blister Machines

- Flatbed Blister Machines

Value Chain Analysis For Blister Machine Market

The Blister Machine Market Value Chain begins with upstream suppliers providing critical raw materials and specialized components, progresses through the manufacturing and assembly phase, and culminates in downstream activities encompassing distribution, installation, and long-term after-sales service. Upstream analysis focuses heavily on precision engineering companies supplying high-quality stainless steel, sophisticated servo motors, highly accurate sensor technology, and programmable logic controllers (PLCs). The quality and reliability of these components are paramount, directly influencing the performance and longevity of the final blister machine, particularly concerning speed and positional accuracy during the sealing process.

The core manufacturing stage involves the complex integration of these components, requiring specialized expertise in metallurgy, advanced robotics, and software engineering for HMI (Human-Machine Interface) development. Downstream activities are heavily characterized by direct sales models for large, bespoke machinery, often involving extensive consultation and factory acceptance tests (FAT) before shipment. Distribution channels are frequently bifurcated: high-value, complex machines are sold directly to major pharmaceutical manufacturers, allowing for bespoke customization and comprehensive validation support. Conversely, lower-end or modular equipment may be distributed through regional agents or specialized industrial equipment distributors, especially in emerging markets where localized support is essential.

The post-sale value chain is critical in the blister machine market, centering on preventative maintenance contracts, spare parts supply, validation services (IQ/OQ/PQ – Installation Qualification, Operational Qualification, Performance Qualification), and software upgrades (especially for serialization compliance). The strength of a manufacturer’s service network often serves as a key competitive differentiator, ensuring rapid response times to minimize costly production interruptions. Indirect sales, though less common for flagship models, play a role in supplying consumables and standardized components, facilitating a robust secondary market for parts and minor upgrades.

Blister Machine Market Potential Customers

The primary Potential Customers (End-Users/Buyers) for Blister Machines are organizations requiring high-integrity, standardized unit packaging, dominated by the highly regulated global pharmaceutical industry. This includes major multinational pharmaceutical companies, generic drug manufacturers, and specialized biotech firms that demand precision, validated packaging solutions to comply with global regulatory bodies like the FDA, EMA, and corresponding national agencies. These customers prioritize machine speed, reliability, regulatory documentation support, and the capacity for seamless integration into existing production lines, especially concerning serialization hardware.

A rapidly growing segment of potential customers includes Contract Packaging Organizations (CPOs) and Contract Manufacturing Organizations (CMOs). These third-party service providers often require highly flexible blister machines capable of quickly switching between numerous product sizes, materials, and batch quantities to service diverse client portfolios. Their purchasing decisions hinge on machine versatility, rapid changeover times, and the ability to maintain multiple simultaneous validations for different regulatory standards worldwide. Their demand acts as an amplifier for market growth, as pharmaceutical companies increasingly outsource non-core manufacturing functions.

Beyond pharmaceuticals, significant customer demand originates from the nutraceutical, medical device, and specialized consumer goods sectors. Nutraceutical companies (vitamins and supplements) seek cost-effective, high-barrier packaging to preserve product potency. Medical device manufacturers require specialized, sterile blister packs, often incorporating Tyvek lidding, demanding machines capable of maintaining aseptic conditions. The cosmetics and food sectors utilize blister technology for sample distribution, chewing gum, or specialized portion control, where the focus shifts toward aesthetic quality and high production volume at optimized material costs, representing a diverse yet critical segment of potential buyers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 3.15 Billion |

| Growth Rate | 7.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch Packaging Technology (Syntegon), Uhlmann Packaging Systems, IMA S.p.A., Marchesini Group, Romaco Group, Körber AG, Accupack Engineering, Sepha Ltd., Fabrima Maquinas Automaticas, ACG Worldwide, CAM srl, Algus Packaging, Multipack, N.K.P. Pharma Pvt. Ltd., PennTech Machinery, Dott. Bonapace, Bausch + Ströbel, Zhejiang Hualian Pharmaceutical Machinery, Sainty International Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blister Machine Market Key Technology Landscape

The Blister Machine Market Key Technology Landscape is defined by advancements aimed at maximizing speed, enhancing material flexibility, and ensuring regulatory compliance, particularly serialization. The fundamental technologies remain thermoforming (using heat to shape plastics like PVC/PVDC) and cold forming (using high pressure to shape aluminum foil). Modern machines are characterized by modular designs, allowing end-users to quickly swap forming tools and integrate diverse feeders, crucial for handling complex product shapes or multiple product types on the same line. Furthermore, servo-motor technology has replaced traditional mechanical linkages, offering superior precision, faster changeover times, and reduced noise levels, dramatically improving overall equipment efficiency (OEE).

A significant technological focus is placed on sophisticated sealing techniques. While heat sealing remains standard for thermoforming, cold forming requires extremely accurate lidding placement and pressure application, often incorporating enhanced ultrasonic or inductive sealing processes to ensure a hermetic barrier crucial for highly hygroscopic drugs. The integration of high-resolution, smart vision systems utilizing industrial cameras and AI algorithms for quality control is now standard. These systems inspect for defects such as pinholes, incomplete fills, seal integrity failures, and printing errors, validating every single blister pack produced at high speeds before it moves to secondary packaging.

Another pivotal area is the integration of Industry 4.0 principles, including the use of Human-Machine Interfaces (HMI) with intuitive touchscreens, data logging capabilities, and connectivity for remote diagnostics. Manufacturers are increasingly offering machines fully capable of Level 3 and Level 4 serialization and aggregation, adhering to global standards such as the Drug Supply Chain Security Act (DSCSA) in the US and the Falsified Medicines Directive (FMD) in the EU. This technological requirement is mandatory and drives significant replacement cycles, ensuring that older, non-compliant machinery is phased out in favor of networked, data-rich systems.

Regional Highlights

The global Blister Machine Market exhibits distinct growth patterns and maturity levels across key geographical regions, with North America and Europe defining the quality and regulatory benchmark, while Asia Pacific (APAC) drives volume growth and expansionary trends.

- North America: This region holds a significant share of the global market value, primarily driven by the stringent regulatory environment (FDA regulations), high adoption rates of advanced automated packaging technologies, and the presence of numerous global pharmaceutical headquarters. The demand here is concentrated on high-speed, highly validated machinery capable of intricate serialization and aggregation. Furthermore, the increasing complexity of specialized biological and personalized medicines demands blister machines optimized for low-volume, high-value runs with maximum precision.

- Europe: The European market is mature, characterized by high spending on R&D and a strong focus on sustainability. Regulatory compliance, particularly the Falsified Medicines Directive (FMD) mandating end-to-end serialization, has been a major driver for machinery replacement and upgrades. European manufacturers emphasize energy efficiency, minimal material consumption, and robust automation, often leading the way in integrating robotic pick-and-place systems and advanced sensor technology into blister lines. Germany, Italy, and Switzerland are crucial manufacturing hubs and key consuming nations.

- Asia Pacific (APAC): APAC is the fastest-growing market, propelled by expanding healthcare access, booming generic drug manufacturing in countries like India and China, and significant government investment in pharmaceutical infrastructure. This region demands a blend of high-speed, cost-effective standard machinery for mass production (especially in generics) and high-quality validated equipment for export-oriented manufacturers. The shift from manual to fully automated packaging lines in China and Southeast Asia is the primary growth catalyst, providing massive opportunities for medium-speed and semi-automatic machine suppliers.

- Latin America (LATAM): Growth in LATAM is steady, driven by urbanization and improved health awareness, increasing the demand for packaged pharmaceuticals. Brazil and Mexico are the largest markets, focusing on upgrading existing facilities and importing proven European and North American technology. The primary purchasing factor is often a balance between validated performance and competitive pricing, favoring suppliers who offer localized service and support within a challenging logistics environment.

- Middle East and Africa (MEA): This region is experiencing nascent growth, spurred by initiatives to establish local pharmaceutical manufacturing capabilities to reduce dependence on imports, particularly in the UAE, Saudi Arabia, and South Africa. Investment is focused on establishing baseline manufacturing standards, leading to demand for reliable, versatile blister machines. Political stability and foreign direct investment remain critical factors influencing the pace of market expansion in MEA.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blister Machine Market.- Uhlmann Packaging Systems

- Bosch Packaging Technology (Syntegon)

- IMA S.p.A.

- Marchesini Group

- Romaco Group

- Körber AG

- ACG Worldwide

- Sepha Ltd.

- Fabrima Maquinas Automaticas

- Accupack Engineering

- CAM srl

- Algus Packaging

- Multipack

- N.K.P. Pharma Pvt. Ltd.

- PennTech Machinery

- Dott. Bonapace

- Bausch + Ströbel

- Zhejiang Hualian Pharmaceutical Machinery

- Sainty International Group

Frequently Asked Questions

Analyze common user questions about the Blister Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the key difference between thermoforming and cold forming blister technology?

Thermoforming heats plastic materials like PVC/PVDC to shape cavities, offering high visibility and lower material cost, but providing moderate barrier protection. Cold forming utilizes high pressure to shape aluminum foil, creating opaque blisters with superior barrier properties against moisture and light, essential for highly sensitive drugs, though at a higher material cost.

How does serialization impact the investment decisions for new blister machines?

Serialization mandates (e.g., DSCSA, FMD) require blister machines to integrate advanced vision systems, printing technology, and data management software capable of applying unique identifiers to individual packages. This significantly increases the capital cost and complexity of the machine, forcing manufacturers to prioritize networked, compliant systems.

Which regional market is exhibiting the highest growth rate for blister packaging machinery?

The Asia Pacific (APAC) region is demonstrating the highest Compound Annual Growth Rate (CAGR) due to rapid expansion in generic drug manufacturing, increased domestic healthcare spending, and widespread replacement of manual packaging processes with automated, high-speed blister lines, particularly in India and China.

What role does Artificial Intelligence (AI) play in modern blister packaging operations?

AI is primarily utilized to implement predictive maintenance, minimizing unexpected downtime by analyzing machine sensor data. Additionally, AI-driven deep learning vision systems are revolutionizing quality control, offering faster and more accurate detection of minute packaging defects than traditional methods.

What are the most critical factors driving the demand for high-barrier blister materials?

The primary driver is the increasing complexity of new drug formulations, particularly biologics and hygroscopic compounds, which require absolute protection from moisture and oxygen ingress to maintain stability and shelf life. Regulatory standards often mandate the use of materials like Aclar or aluminum/aluminum cold form foil to ensure product integrity.

The comprehensive analysis of the Blister Machine Market underscores its resilience and growth trajectory, fundamentally linked to the non-cyclical demand generated by the global healthcare sector. Investment is heavily concentrated in technologies that promise increased automation, superior quality assurance through AI, and compliance with increasingly rigorous global track-and-trace regulations. The future market success hinges on manufacturers' ability to deliver modular, high-speed, and validated systems that also address the growing industry pivot toward sustainable packaging solutions, maintaining the delicate balance between regulatory necessity, operational efficiency, and environmental responsibility.

The market structure is poised for further consolidation as key players seek to acquire specialized expertise in software integration and niche technologies, particularly those related to handling complex or non-standard dosage forms, such as inhalation capsules or transdermal patches. Strategic expansion into emerging markets, especially leveraging strong local partnerships in APAC, will define competitive market leadership over the forecast period. The increasing adoption of contract manufacturing services is expected to further democratize access to advanced blister packaging capabilities, driving continuous machine upgrades and expansion across the industry.

Technological differentiation through innovations in forming and sealing processes—such as moving from standard heat sealing to high-frequency or ultrasonic sealing—will be paramount for maintaining competitive edge. Furthermore, the total cost of ownership (TCO) remains a crucial purchasing factor for end-users, compelling manufacturers to design machines that are not only fast and reliable but also minimize utility consumption and material waste during operation. This focus on lifecycle cost management reinforces the preference for sophisticated, digitally integrated equipment that guarantees maximum uptime and lowest possible operational expenditure over its validated lifespan.

The transition toward eco-friendly packaging materials, including recycled PET (R-PET) or new cellulose-based films, presents a formidable yet essential R&D challenge. Current blister machinery often requires precise heating and cooling profiles that are optimized for traditional petroleum-based polymers. Adapting machine design to effectively process materials with different thermal properties without compromising barrier performance or production speed is a critical technological hurdle that must be overcome to meet evolving environmental mandates and consumer preferences, ensuring long-term market sustainability and growth alignment.

Finally, the long-term outlook for the Blister Machine Market is highly positive, bolstered by global demographic trends, including an aging population requiring more unit-dose medication, and the relentless pressure from regulatory bodies to ensure secure, traceable pharmaceutical distribution. These structural factors guarantee sustained demand for high-quality, validated packaging machinery, making the blister segment a cornerstone of the broader pharmaceutical packaging equipment industry and driving ongoing investment across all geographical segments, from mature industrialized nations to rapidly industrializing economies.

The detailed segmentation analysis confirms that investments are increasingly skewed towards automated solutions that can integrate seamlessly with upstream processing and downstream aggregation equipment, creating fully automated production islands. This high level of integration minimizes human intervention, reduces the risk of contamination, and accelerates batch release times, all critical metrics in pharmaceutical manufacturing. The robustness of the supply chain, particularly the reliable provision of validated spare parts and comprehensive training, serves as an invisible but highly impactful force multiplier for equipment sales, especially when dealing with mission-critical high-speed lines where downtime is measured in thousands of dollars per hour.

Focus on customization and flexibility is another defining trend. While standard high-volume machines address generic drug needs, the rise of personalized medicine and niche therapies necessitates equipment capable of running small, highly diverse batches efficiently. This shift has favored modular design concepts where change parts can be swiftly exchanged and validated for minimal downtime, driving demand for innovative tool-free changeover systems and sophisticated recipe management software embedded within the HMI. Suppliers who master both high-speed mass production and flexible small-batch capability are best positioned for comprehensive market penetration.

The competitive landscape is defined not only by machine specifications but also by service contracts and digital offerings. Leading companies are bundling equipment sales with subscription services for predictive analytics and remote diagnostics, effectively selling uptime reliability rather than just hardware. This service-centric model provides manufacturers with recurring revenue streams and solidifies customer loyalty, creating a substantial barrier to entry for smaller or less digitally mature competitors who cannot offer the same level of integrated operational support and data security features, which are vital for regulated environments.

Furthermore, global macroeconomic stability, while generally supportive of healthcare expenditure, presents localized challenges regarding currency fluctuation and trade tariffs, impacting the cost structure of imported machinery, especially in regions like LATAM and MEA. Manufacturers must strategically position their production and assembly operations to mitigate these risks, potentially increasing localized manufacturing or assembly processes to remain price competitive. This regionalized strategy becomes an increasingly important consideration for penetrating non-traditional growth markets where localized content requirements are often stipulated by government tenders, further complicating the global operations footprint.

In summary, the Blister Machine Market is characterized by a high degree of technological sophistication, driven by non-negotiable regulatory demands. The future trajectory is inextricably linked to digitalization (AI, IIoT, serialization) and sustainability, ensuring that only suppliers committed to continuous innovation across engineering, software, and service domains will secure long-term market leadership and realize the forecasted high-growth CAGR. This dynamic environment necessitates continuous market monitoring and strategic positioning across all segments and geographical regions analyzed in this report.

The pharmaceutical industry's persistent focus on reducing time-to-market for new drug entities further accelerates the demand for highly efficient blister packaging solutions. When a drug receives regulatory approval, the capacity to rapidly scale up production is crucial. This mandates that modern blister machines are not just fast, but also easily scalable and replicable across different manufacturing sites globally. Standardized machine platforms, coupled with centralized validation documentation packages, enable multinational corporations to deploy equipment consistently worldwide, minimizing the time required for site-specific qualification processes and achieving global harmonization of packaging standards. This strategic advantage offered by standardization strengthens the position of large, globally operational equipment vendors.

Addressing the restraint of high capital investment, market suppliers are increasingly offering flexible purchasing options, including long-term leasing agreements or pay-per-use models for specialized machinery components or software licenses. These financial strategies lower the initial barrier to entry for smaller or emerging pharmaceutical manufacturers and CPOs, thereby stimulating demand in otherwise underserved market segments. This transition from purely transactional sales to comprehensive financial and operational partnerships represents an evolving business model within the machinery market, reflecting a deeper commitment to customer success and shared risk management.

Finally, the growing awareness and subsequent investment in supply chain resilience globally following recent disruptions have emphasized the need for robust, domestic manufacturing capacity. Many countries are incentivizing local pharmaceutical production, which directly fuels the demand for new blister packaging facilities and equipment installation. This geopolitical factor acts as a powerful, non-market-based driver for sustained growth, providing regional manufacturers with secure, long-term procurement visibility and reducing reliance on vulnerable international supply chains for critical packaging operations, cementing the market’s positive growth forecast across various economic scenarios.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager