Blister Packaging Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432760 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Blister Packaging Machine Market Size

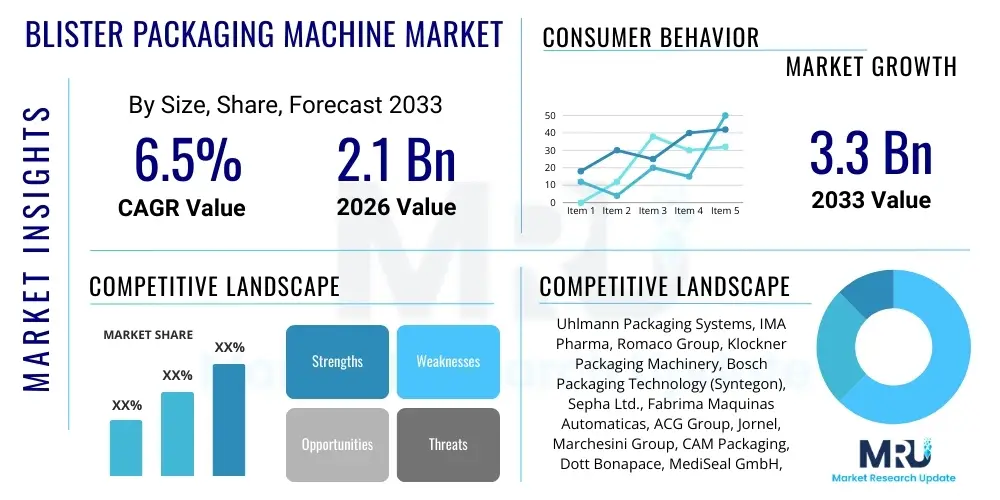

The Blister Packaging Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.3 Billion by the end of the forecast period in 2033.

Blister Packaging Machine Market introduction

The Blister Packaging Machine Market encompasses specialized equipment designed for creating unit-dose packaging, primarily used within the pharmaceutical, medical device, and consumer goods industries. Blister packaging involves forming a cavity or pocket, usually from a thermoformable plastic film or cold-forming aluminum, to hold the product securely, followed by a lidding material (often aluminum foil or paper board) sealed over the cavity. These machines are essential for ensuring product integrity, extended shelf life, preventing tampering, and crucially, maintaining dosage accuracy and traceability in highly regulated sectors like pharmaceuticals.

The core functions of these machines include forming, filling, and sealing operations, executed at high speed and precision. The robust growth in this market is intrinsically linked to the global expansion of the pharmaceutical sector, driven by increasing research and development activities, rising prevalence of chronic diseases, and the critical need for compliance packaging that improves patient adherence to medication schedules. Furthermore, blister packs offer superior barrier protection against moisture, oxygen, and light compared to traditional bottling methods, which is vital for chemically sensitive drugs.

Major applications span oral solids (tablets, capsules), injectable products, medical consumables (syringes, surgical kits), and certain consumer electronics. The benefits provided by these packaging formats—such as visibility, portability, and anti-counterfeiting features—serve as key driving factors. Technological advancements focusing on greater automation, faster changeover times, and integration of serialization capabilities are continuously reshaping the competitive landscape, making high-throughput, versatile machines the industry standard for modern manufacturing facilities globally.

Blister Packaging Machine Market Executive Summary

The Blister Packaging Machine Market is characterized by strong fundamental drivers rooted in stringent regulatory compliance and the sustained global expansion of healthcare access. Key business trends indicate a definitive shift toward fully automated, high-speed machinery equipped with advanced monitoring systems, primarily to meet the demanding production schedules of Contract Manufacturing Organizations (CMOs) and major pharmaceutical companies. Manufacturers are heavily investing in flexible machinery capable of handling various material types (PVC, PVDC, Aclar, Alu-Alu) and package designs, optimizing operational efficiency and minimizing downtime associated with product changeovers. Mergers, acquisitions, and strategic partnerships between equipment manufacturers and technology providers are common strategies employed to enhance integrated offerings and expand geographic footprints, particularly in high-growth emerging economies.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, propelled by massive investments in local pharmaceutical manufacturing capabilities in countries like China and India, aimed at serving both domestic demand and export markets. North America and Europe maintain market leadership in terms of technology adoption and established regulatory infrastructure, driving demand for premium, highly sophisticated machines featuring integrated robotics and serialization modules necessary for compliance with directives such as the Drug Supply Chain Security Act (DSCSA) and the Falsified Medicines Directive (FMD). These developed regions focus heavily on modernization and replacement cycles, favoring energy-efficient and highly precise equipment.

In terms of segmentation trends, the rotary blister packaging machine segment is gaining traction due to its superior speed and efficiency, making it ideal for large-scale, mass production environments. Furthermore, the pharmaceutical application segment dominates the market share, consistently driving innovation in precision engineering and quality assurance systems. There is a notable rising trend in sustainable packaging solutions, pushing machine manufacturers to adapt their equipment to process novel, eco-friendly blister materials, thereby addressing consumer preference and regulatory pressures related to plastics reduction.

AI Impact Analysis on Blister Packaging Machine Market

Users frequently inquire about how Artificial Intelligence (AI) can enhance quality control, optimize production scheduling, and minimize operational waste in blister packaging lines. The predominant user concern revolves around transitioning from reactive maintenance to predictive paradigms and improving the reliability of highly automated systems. AI integration specifically addresses these queries by processing massive datasets generated by sensors—including thermal, pressure, and vision systems—to identify anomalies and patterns indicative of future failure or quality issues, far surpassing the capabilities of traditional statistical process control (SPC) methods. This implementation ensures unparalleled levels of packaging integrity and regulatory adherence, which are non-negotiable in pharmaceutical production.

The influence of AI extends significantly into minimizing product rejection rates. Advanced computer vision systems powered by deep learning algorithms are deployed for real-time inspection of blister forming, filling accuracy (e.g., missing tablets, broken contents), and seal integrity. These AI-driven systems achieve near-zero defect rates by continuously learning and adapting to subtle variations in packaging materials and environmental conditions, thereby reducing material consumption and lowering the cost of non-compliance. This enhancement in quality assurance translates directly into tangible operational savings and improved brand reputation for end-users.

Furthermore, AI algorithms are becoming central to dynamic production planning and scheduling. By integrating data across the entire manufacturing supply chain—from raw material inventory levels and machine capacity to fluctuating market demand and regulatory batch requirements—AI can optimize machine utilization, schedule optimal material changeovers, and streamline the flow of products through the packaging line. This sophisticated level of operational intelligence enables manufacturers to achieve higher throughput with existing assets, thereby maximizing return on investment for high-cost packaging machinery and providing a competitive edge through agility.

- AI-driven Predictive Maintenance: Utilizing sensor data to forecast equipment failure, minimizing unplanned downtime and maximizing machine uptime.

- Enhanced Quality Control: Deep learning-based vision systems achieving near-perfect real-time detection of defects (e.g., missing product, seal imperfections).

- Optimized Production Scheduling: Dynamic algorithm adjustment of batch sizes and material handling based on live inventory and demand forecasting.

- Automated Serialization and Traceability: AI integration simplifying the complexity of track-and-trace requirements and ensuring accurate data logging.

- Reduced Waste and Energy Consumption: Machine learning fine-tuning operational parameters (heating, pressure, speed) for optimal material efficiency and energy usage.

DRO & Impact Forces Of Blister Packaging Machine Market

The Blister Packaging Machine Market is shaped by powerful forces encompassing robust drivers, significant restraints, and expansive opportunities. The primary driver is the rigorous global regulatory environment, particularly within the pharmaceutical sector, mandating secure, tamper-evident, and traceable packaging, which blister technology inherently provides. This mandatory compliance, combined with the exponential growth in the generic drug segment and specialty pharmaceuticals, creates a sustained demand cycle for high-speed, precision machinery. However, the market faces strong restraining forces, particularly the high initial capital investment required for automated blister lines, which poses a barrier to entry for smaller manufacturers, and the increasing complexity associated with integrating advanced software (serialization, robotics) into legacy systems. These dynamics compel manufacturers to seek out highly reliable, efficient, and flexible machines that justify the substantial initial outlay.

A significant impact force is the accelerating rate of technological change. Machine manufacturers are under continuous pressure to innovate, moving beyond basic thermoforming to offer advanced cold forming (Alu-Alu) capabilities and integrated end-of-line solutions (cartoning, palletizing). This continuous push for higher automation, faster speeds, and improved OEE (Overall Equipment Effectiveness) ensures that only technologically superior solutions remain competitive. The need for specialized materials, particularly high-barrier films like Aclar or PVDC, to protect sensitive drug formulations also drives demand for specialized machine configurations capable of handling these demanding materials accurately and efficiently.

Opportunities for market growth are abundant, chiefly centered on expanding into emerging markets where healthcare infrastructure is rapidly maturing and domestic drug production is scaling up. Another major avenue is the transition toward sustainable packaging solutions, which necessitates the development of machines capable of utilizing biodegradable, recyclable, or mono-material films, positioning manufacturers who lead in this area favorably. The increasing adoption of contract manufacturing services (CMOs and CDMOs) globally further fuels demand for versatile, highly utilized blister packaging lines, allowing machine providers to target a more consolidated, sophisticated customer base seeking scalable, turnkey solutions.

Segmentation Analysis

The Blister Packaging Machine Market segmentation provides a detailed view of machine type, material preference, automation level, and primary end-use application, reflecting the diverse operational needs across industries. Machines are primarily categorized by the type of forming process utilized, distinguishing between high-speed rotary systems, flexible flat-plate systems, and specialized thermoforming or cold-forming technologies. The analysis reveals that the pharmaceutical segment remains the dominant application area, setting the industry standard for precision and validation requirements, while medical devices and consumer goods segments contribute significantly, driven by demand for protective and attractive retail packaging.

The market is experiencing a notable trend towards higher levels of automation, driven by labor costs and the need for consistency and efficiency. Fully automatic blister packaging machines are witnessing the fastest growth due to their ability to integrate seamlessly into complete packaging lines, incorporating features such as automatic product loading, integrated quality inspection (vision systems), and serialization modules. Semi-automatic machines continue to find relevance in small-to-mid-sized companies or specialized batch production where versatility and lower throughput are acceptable tradeoffs for lower capital investment and operational complexity.

Material used for packaging is a crucial differentiator, affecting both machine design and market dynamics. Machines handling Alu-Alu (cold forming) command a premium due to the complexity of the process but are necessary for moisture-sensitive products, while PVC/PVDC thermoforming remains dominant for standard drug formulations due to cost-effectiveness and transparency. Machine manufacturers must increasingly offer multi-functional equipment capable of quick changeover between different forming technologies and materials to cater to the diverse needs of pharmaceutical CMOs and large-scale manufacturing sites.

- By Technology Type:

- Thermoforming Blister Packaging Machines

- Cold Forming Blister Packaging Machines (Alu-Alu)

- Pressure Forming Blister Packaging Machines

- By Automation Level:

- Automatic Blister Packaging Machines

- Semi-Automatic Blister Packaging Machines

- Manual Blister Packaging Machines

- By Machine Type/Speed:

- Rotary Blister Packaging Machines

- Flat-Plate Blister Packaging Machines

- By End-Use Application:

- Pharmaceuticals (Dominant)

- Medical Devices

- Consumer Products (e.g., Batteries, Electronics, Personal Care)

- Nutraceuticals and Supplements

- By Packaging Material:

- PVC (Polyvinyl Chloride)

- PVDC (Polyvinylidene Chloride)

- Aclar (PCTFE)

- Alu-Alu (Aluminum-Aluminum)

- PP (Polypropylene) and Sustainable Films

Value Chain Analysis For Blister Packaging Machine Market

The value chain for the Blister Packaging Machine Market begins with the upstream suppliers of critical components and raw materials. This includes specialized metals (stainless steel, aluminum), complex mechanical and electronic components (servo motors, programmable logic controllers or PLCs, sensors, human-machine interfaces or HMIs), and high-precision tooling necessary for the forming dies and sealing plates. Key challenges in the upstream segment involve managing global supply chain volatility, ensuring the quality and precision of customized parts, and integrating sophisticated control systems from specialized technology providers. Robust relationships with reliable component suppliers are crucial for maintaining the quality and operational speed of the final machinery.

Midstream activities involve the machine manufacturing, assembly, and rigorous testing phases. This core segment focuses on engineering design, integration of advanced automation technologies (robotics, vision systems, serialization units), and customization to meet specific client requirements regarding speed, changeover flexibility, and material handling capabilities. Effective operationalization requires expertise in precision engineering and compliance validation (e.g., FDA GAMP 5 standards). Manufacturers typically employ direct sales teams and highly trained technical staff for installation, validation (IQ, OQ, PQ), and ongoing technical support, forming a direct and high-touch distribution channel for complex, high-value capital equipment.

Downstream activities center on distribution, installation, and after-sales services, reaching the end-users—primarily pharmaceutical giants and contract packaging organizations. Distribution is largely direct due to the customized nature and high complexity of the equipment, although specialized industrial distributors or agents may be used in certain international markets. The revenue stream continues post-sale through highly profitable service contracts, providing preventative maintenance, spare parts, and technology upgrades (e.g., retrofitting existing lines with new serialization mandates). This focus on service ensures long-term customer relationships and maximizes the lifetime value of the installed machine base.

Blister Packaging Machine Market Potential Customers

The primary customers for Blister Packaging Machines are entities that require high-volume, precision, and highly compliant packaging for their products. The largest segment comprises pharmaceutical manufacturing companies, ranging from multinational corporations to specialized generic drug producers. These customers demand machines that can handle high throughputs (up to 600 blisters per minute), adhere strictly to cGMP (current Good Manufacturing Practices), and integrate advanced serialization features for global track-and-trace requirements. Their purchasing decisions are heavily influenced by OEE metrics, validation capabilities, and the machine's flexibility to handle multiple drug formulations and package sizes.

Contract Manufacturing Organizations (CMOs) and Contract Development and Manufacturing Organizations (CDMOs) represent a rapidly growing and influential customer base. As pharma companies increasingly outsource production and packaging, CMOs require highly flexible, versatile packaging lines capable of rapid changeovers between diverse client products, package formats, and regulatory standards (e.g., EU, US, Asian markets). Their emphasis is placed on maximum machine utilization, integration of end-of-line robotics, and comprehensive service support to minimize downtime across varying production demands.

Secondary, yet significant, customer groups include manufacturers of medical devices (e.g., catheters, sutures, diagnostic kits) and companies in the nutraceutical and specialized consumer goods sectors (e.g., batteries, electronics, personal care products). For medical devices, the requirement focuses intensely on sterile packaging (often using specialized materials and sealing techniques) and tamper evidence, while consumer goods companies prioritize attractive retail presentation, theft prevention, and cost-effective high-volume production. All these customer segments necessitate reliable, durable machinery that ensures product integrity throughout the supply chain.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.3 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Uhlmann Packaging Systems, IMA Pharma, Romaco Group, Klockner Packaging Machinery, Bosch Packaging Technology (Syntegon), Sepha Ltd., Fabrima Maquinas Automaticas, ACG Group, Jornel, Marchesini Group, CAM Packaging, Dott Bonapace, MediSeal GmbH, Zed Industries, SaintyCo, Accupack Engineering, Wenzhou Hualian Pharmaceutical Machinery, Ningbo Shengguang Pharmaceutical Machinery, O.M.A.R. S.R.L. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blister Packaging Machine Market Key Technology Landscape

The contemporary Blister Packaging Machine market is defined by several advanced technological integrations aimed at maximizing speed, precision, and compliance. Central to this landscape are servo-driven technology and advanced Human-Machine Interfaces (HMIs). Servo drives have replaced traditional mechanical linkages, offering unparalleled precision in indexing, forming, and sealing, resulting in faster machine cycles and significantly reduced material waste. HMIs now provide intuitive, standardized operating protocols, facilitating faster changeover times and easier diagnostics, critical for operations handling multiple Stock Keeping Units (SKUs) and requiring validation trail logs.

Another pivotal technological advancement is the integration of high-resolution vision systems and serialization modules. Vision systems, often leveraging AI, perform continuous quality checks, ensuring correct product placement and seal integrity, which is essential for regulated products. Serialization technology involves printing unique identifiers (2D data matrix codes) onto each blister card and aggregating this data, fulfilling stringent regulatory requirements in major markets (US DSCSA, EU FMD) aimed at combating counterfeiting. Machine manufacturers are focusing on offering seamless, integrated solutions that combine primary blister packaging with secondary cartoning and aggregation into a single, validated line.

Furthermore, there is increasing adoption of sophisticated temperature and pressure control systems, particularly crucial for cold-forming (Alu-Alu) processes which require immense pressure and controlled temperature application to maintain material integrity. Robotics are also playing a growing role, specifically in the automatic loading of oddly shaped products (e.g., vials, ampoules, complex medical devices) into the blister cavity, eliminating the potential for human contamination and boosting operational speed beyond manual capabilities. This reliance on integrated, automated systems highlights the market’s maturation toward Industry 4.0 principles.

Regional Highlights

- North America (US and Canada): North America is a mature market dominated by strict regulatory requirements, particularly concerning track-and-trace mandates (DSCSA) and product integrity. Demand is characterized by the need for high-end, fully automated blister packaging machines featuring integrated serialization, sophisticated vision inspection, and the capability to handle high-barrier materials (like Aclar) for specialty pharmaceuticals. The market growth here is driven less by capacity expansion and more by technology upgrades, replacement cycles, and investment in compliance-ready solutions by large pharmaceutical companies and advanced CMOs.

- Europe: Europe is highly influenced by the Falsified Medicines Directive (FMD), driving robust demand for machines with integrated serialization and aggregation capabilities. The European market exhibits strong demand for versatile machinery that accommodates complex, multi-layered packaging requirements and specialized patient-adherence formats. Germany, Switzerland, and Italy host significant manufacturing bases for both pharmaceutical companies and packaging machinery manufacturers, fostering continuous technological innovation, particularly concerning sustainability and energy efficiency in machine design.

- Asia Pacific (APAC): APAC represents the highest growth potential globally, driven by escalating healthcare expenditure, an aging population, and rapid infrastructure development in key countries like China, India, and Japan. India and China are major pharmaceutical manufacturing hubs for both generic drugs and APIs, fueling massive capacity expansion and the associated purchase of new blister packaging lines. While the demand for cost-effective semi-automatic machines remains strong in smaller operations, the shift towards compliance packaging for export markets increasingly drives the adoption of advanced, high-speed automated systems.

- Latin America (LATAM): The LATAM market, including Brazil and Mexico, is experiencing steady growth driven by the establishment of local production facilities and increasing government focus on expanding access to essential medicines. Market requirements often balance cost-efficiency with essential automation features. Demand focuses on reliable, mid-range automatic blister packaging machines capable of handling standard thermoforming materials, although international regulatory harmonization is gradually increasing the need for serialization readiness.

- Middle East and Africa (MEA): Growth in the MEA region is fragmented but accelerating, led by investments in localized pharmaceutical production in countries like Saudi Arabia, UAE, and South Africa, aiming for self-sufficiency and reduced reliance on imports. Blister packaging machinery demand is tied directly to these localization initiatives, focusing initially on standard, robust equipment, with higher-end purchases made by international pharma firms establishing regional hubs. Compliance with international standards is a major purchasing criteria.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blister Packaging Machine Market.- Uhlmann Packaging Systems

- IMA Pharma

- Romaco Group

- Klockner Packaging Machinery GmbH

- Syntegon Technology GmbH (formerly Bosch Packaging Technology)

- Marchesini Group

- ACG Group

- Sepha Ltd.

- Fabrima Maquinas Automaticas

- CAM Packaging Machinery

- Jornel S.A.

- Dott Bonapace & C. S.R.L.

- MediSeal GmbH (part of Korber AG)

- Zed Industries Inc.

- SaintyCo

- Accupack Engineering Pvt. Ltd.

- Wenzhou Hualian Pharmaceutical Machinery

- Ningbo Shengguang Pharmaceutical Machinery

- O.M.A.R. S.R.L.

- Hoong-A Corporation

Frequently Asked Questions

Analyze common user questions about the Blister Packaging Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between thermoforming and cold forming blister packaging?

Thermoforming (typically using PVC/PVDC) heats the plastic film to form the blister cavity and is used for less moisture-sensitive products. Cold forming (Alu-Alu) uses high pressure to stamp the aluminum foil cavity at room temperature, offering superior barrier protection for highly sensitive pharmaceuticals but operating at slower speeds.

How are serialization requirements impacting the blister packaging machine purchasing decisions?

Serialization mandates (such as DSCSA and FMD) necessitate that new machinery must have integrated printing and vision inspection systems to apply and verify unique 2D data matrix codes on each blister card. This drives demand toward highly automated machines that can seamlessly handle these track-and-trace functions without compromising production speed.

Which end-use segment drives the most technological innovation in blister packaging machines?

The pharmaceutical industry drives the most significant technological innovation. Requirements for cGMP compliance, high throughput, zero-defect quality control, and the need to handle complex drug formulations mandate continuous advancements in machine speed, material handling precision, and integration of AI-powered inspection systems.

What are the key operational challenges addressed by implementing AI in blister packaging lines?

AI implementation primarily addresses operational challenges related to unplanned downtime via predictive maintenance, and human error in quality assurance. AI vision systems ensure real-time, objective defect detection, while machine learning algorithms optimize scheduling and material consumption, increasing overall equipment effectiveness (OEE).

What is the current trend regarding sustainable materials in blister packaging?

The current trend focuses on developing and adopting sustainable, mono-material alternatives (e.g., PP or specialized recyclable films) to replace traditional multi-layer PVC/aluminum structures. This shift requires machine manufacturers to adapt their forming and sealing technologies to effectively process these novel, less rigid, or less heat-tolerant sustainable materials efficiently.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager