Blockchain in the Jewelry Supply Chain Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436341 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Blockchain in the Jewelry Supply Chain Market Size

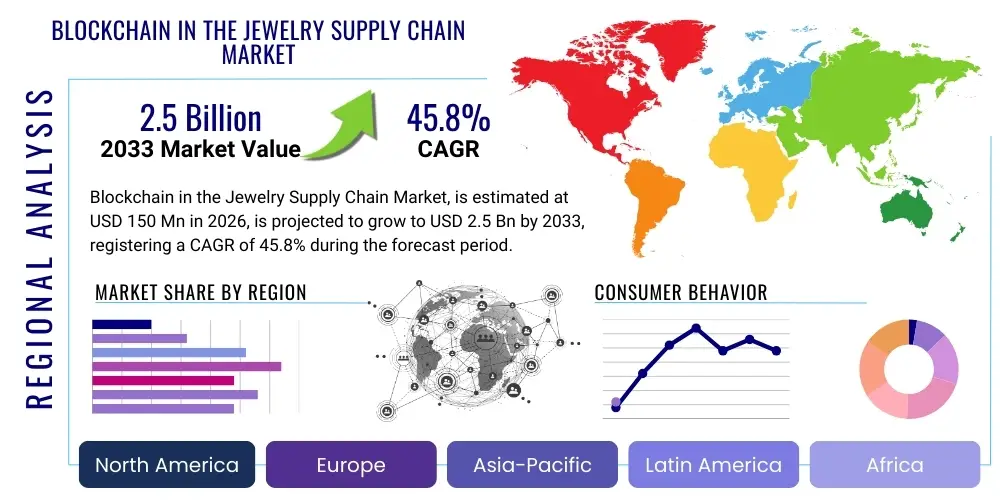

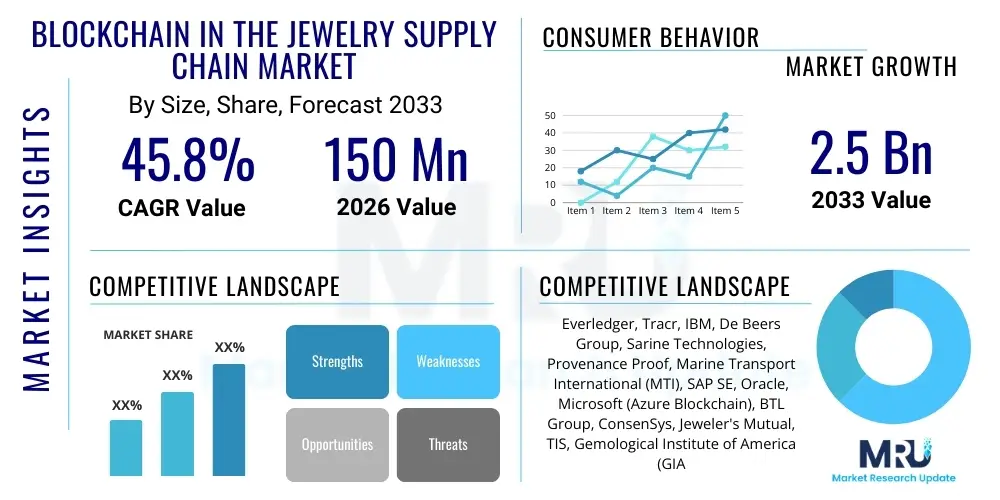

The Blockchain in the Jewelry Supply Chain Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 45.8% between 2026 and 2033. The market is estimated at USD 150 Million in 2026 and is projected to reach USD 2.5 Billion by the end of the forecast period in 2033.

Blockchain in the Jewelry Supply Chain Market introduction

The Blockchain in the Jewelry Supply Chain Market encompasses the integration of distributed ledger technology (DLT) to enhance transparency, traceability, and ethical sourcing practices across the entire jewelry value chain, from mining and cutting to retailing. This technology provides an immutable record of provenance, ensuring that precious materials like diamonds, gold, and gemstones are tracked accurately at every stage. This level of verification addresses long-standing industry challenges related to counterfeit goods, illicit trade, and 'blood diamond' concerns, fundamentally altering how trust is established between suppliers and consumers.

The core products and services within this market include blockchain platform development, integration services, digital certification systems, and specialized DLT solutions tailored for high-value asset tracking. Major applications span raw material sourcing (mining companies), manufacturing (cutters and polishers), wholesale distribution, and consumer retail, where final provenance certificates are issued. The primary benefits driving adoption are enhanced consumer confidence in ethical sourcing, reduced fraud and counterfeiting risks, optimized supply chain logistics through automated smart contracts, and improved compliance with international regulations concerning conflict minerals.

Driving factors propelling this market include rising consumer demand for sustainability and ethical jewelry, stringent regulatory pressures, the increasing need for anti-counterfeiting measures for luxury goods, and technological advancements making DLT platforms more scalable and affordable for industry participants. The adoption rate is accelerating, particularly among major luxury brands seeking to differentiate themselves through verifiable, transparent sourcing narratives, moving beyond traditional paper-based assurances to digital, unalterable proof of origin.

Blockchain in the Jewelry Supply Chain Market Executive Summary

The Blockchain in the Jewelry Supply Chain Market is characterized by rapid technological assimilation driven primarily by the luxury sector's imperative for verifiable ethical sourcing. Business trends indicate a strong move toward consortia-based blockchain platforms (permissioned ledgers) designed to pool resources and standardize tracking protocols across fragmented supply chains. Key market players are shifting from proprietary, closed systems to collaborative frameworks, emphasizing interoperability between different DLT solutions to facilitate seamless cross-border tracking. Furthermore, there is a distinct trend towards integrating blockchain with complementary technologies such as IoT sensors for real-time asset monitoring and AI for enhanced data validation and fraud detection, creating a robust digital twin for each valuable item.

Regionally, North America and Europe currently dominate the market due to the high concentration of affluent consumers demanding ethical jewelry and the presence of major luxury conglomerates driving early adoption. However, the Asia Pacific region, particularly India and China, is projected to exhibit the fastest growth, fueled by rapid urbanization, increasing luxury consumption, and critical roles as global centers for diamond cutting and polishing, necessitating enhanced transparency mechanisms. Latin America and MEA are emerging markets, primarily focusing on deploying blockchain solutions to certify origin and prevent the export of conflict materials, thereby boosting international trade credibility.

Segment-wise, the diamond sector remains the largest adopter, given the inherent high value and historical issues surrounding provenance; however, applications are rapidly expanding into colored gemstones and precious metals (gold and platinum). Solution segments are led by provenance tracking and tracing services, followed by digital asset management (tokenization of ownership). The retail application segment is showing exceptional growth as consumer-facing applications of blockchain technology—such as digital certificates accessible via QR codes—become standard practice for premium purchases.

AI Impact Analysis on Blockchain in the Jewelry Supply Chain Market

User inquiries concerning the synergy between AI and blockchain in the jewelry supply chain frequently revolve around automating complex verification processes, enhancing the security of provenance data, and predicting potential supply chain disruptions or fraudulent activities. Users seek to understand how AI can move beyond simple data storage (blockchain's core function) to intelligent data analysis, specifically regarding the authenticity of grading reports, the classification of complex inclusions in gemstones, and the predictive maintenance of logistics documentation. Common concerns center on the reliability of AI algorithms in handling subjective assessments (e.g., color and clarity grading) and the potential for malicious AI to attempt manipulating immutable blockchain records, although the latter is largely mitigated by blockchain's fundamental architecture.

The key themes emerging from this analysis highlight AI's role in augmenting the trust established by DLT. AI is expected to process the massive datasets generated by IoT and blockchain transactions, identifying anomalies that human auditors might miss, thereby strengthening anti-fraud efforts. Specifically, AI-driven machine vision is crucial for validating that the physical characteristics of a gemstone match its digital record throughout its journey. Furthermore, AI-powered smart contracts are enabling more complex, automated transactions based on real-time data input, significantly reducing operational friction and transaction times within the traditionally slow, manual jewelry trade.

Ultimately, the expectation is that AI will transform blockchain from a record-keeping system into an intelligent, autonomous supply chain manager. By analyzing historical transaction patterns, geological data, and logistics bottlenecks, AI can optimize inventory management, ensure compliance with evolving ethical standards, and provide dynamic risk scoring for suppliers. This convergence positions the market for 'Intelligent Traceability,' where both the record (blockchain) and the interpretation (AI) are highly robust, providing unparalleled confidence to high-end buyers and regulatory bodies.

- AI-driven anomaly detection enhances anti-fraud mechanisms by analyzing transaction patterns on the blockchain.

- Machine learning optimizes grading and certification processes by automating quality checks of diamonds and gemstones against digital records.

- Predictive analytics forecasts supply chain bottlenecks, improving inventory management and logistics efficiency.

- AI integration validates IoT sensor data (temperature, location) recorded on the blockchain, ensuring data integrity.

- AI-powered smart contracts facilitate complex, automated payments and ownership transfers upon verifiable milestones.

- Natural Language Processing (NLP) assists in standardizing disparate global documentation for seamless DLT integration.

DRO & Impact Forces Of Blockchain in the Jewelry Supply Chain Market

The Blockchain in the Jewelry Supply Chain Market is governed by a confluence of powerful drivers (D), significant restraints (R), and transformative opportunities (O), creating complex impact forces. The primary driver is the overwhelming consumer demand for ethical sourcing and transparency, particularly among younger generations who prioritize sustainability. This is coupled with the critical need for industry participants to combat the global rise of counterfeit luxury goods, making DLT a mandatory protective measure. Conversely, the market faces significant restraints, including the high initial cost of blockchain implementation and integration with legacy Enterprise Resource Planning (ERP) systems, alongside the challenge of achieving comprehensive consensus among thousands of small-scale miners and artisans globally, many of whom lack the necessary digital infrastructure.

Opportunities lie in the expansion of blockchain application beyond diamonds into colored gemstones and high-value precious metals, creating entirely new provenance certification standards. The ability to tokenize jewelry assets also presents a massive opportunity for fractional ownership and simplified collateralization of luxury items. Impact forces are currently centered on the pressure exerted by institutional investors and major regulatory bodies (especially in the EU and North America) pushing for mandatory digital provenance tracking. The collective impact of these forces is accelerating DLT adoption among Tier 1 and Tier 2 luxury brands, while simultaneously requiring platform providers to focus on developing highly scalable, user-friendly, and cost-effective solutions for the long tail of the supply chain.

The market faces structural friction due to the reluctance of established, less-transparent players to adopt verifiable systems, fearing exposure of past unethical practices. However, this restraint is gradually being neutralized by the economic necessity of participating in systems that confer trust and premium pricing. The overarching impact is a fundamental restructuring of the jewelry trade paradigm, shifting power from opaque intermediaries to transparent, verified suppliers, ultimately benefiting the ethically focused retailer and the conscious consumer.

Segmentation Analysis

The Blockchain in the Jewelry Supply Chain Market is highly fragmented but strategically segmentable based on the material being tracked, the technology deployed, the application scope within the supply chain, and the type of enterprise adopting the solution. Material segmentation (diamonds, gold, gemstones) is critical as tracking complexity and regulatory scrutiny differ significantly across these asset classes. Technology segmentation highlights the divide between public and permissioned blockchains, with most enterprise solutions favoring permissioned or hybrid models for enhanced control and data privacy. The application segments reveal where the value lies, dominated by verification and provenance services, followed closely by payments and smart contracts designed to automate settlements.

Enterprise segmentation underscores the adoption hierarchy, with large enterprises (luxury brands, major miners) leading investments, whereas SMEs, primarily consisting of independent retailers and artisanal workshops, require tailored, cost-effective SaaS-based solutions. Geographically, segmentation helps identify areas ripe for infrastructure investment and regulatory change. The granularity of this segmentation is vital for solution providers to tailor their DLT offerings—for instance, developing specific tokenization protocols for gold that differ from the high-security cryptographic mapping required for large diamonds.

This detailed segmentation allows market stakeholders to focus resources on the most receptive and high-value segments, such as applying complex cryptographic techniques to trace rare colored diamonds, or implementing simple, cheap QR code-based tracking for bulk precious metal shipments. Future growth is anticipated strongly in the technology segment related to integration services and the SME enterprise category as barrier-to-entry costs decrease due to platform maturation and standardization.

- By Material Type:

- Diamonds

- Gold and Precious Metals

- Colored Gemstones (Rubies, Sapphires, Emeralds)

- By Deployment Type:

- Private/Permissioned Blockchain

- Hybrid Blockchain

- By Application:

- Provenance Tracking and Tracing

- Supply Chain Financing and Payments

- Digital Certification and Grading Verification

- Counterfeit Prevention and Authentication

- By Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- By End User:

- Mining Companies and Producers

- Cutters and Polishers (Manufacturers)

- Jewelry Retailers and Designers

- Certification and Grading Laboratories

Value Chain Analysis For Blockchain in the Jewelry Supply Chain Market

The value chain for the jewelry supply chain is inherently complex, starting with upstream activities involving mining and rough material extraction. In this initial stage, blockchain is deployed to create the digital twin of the raw material, recording initial geolocation, weight, and ethical compliance data. This digital identity is critical, as any future verification relies on the integrity of this initial entry. Upstream analysis focuses heavily on integrating DLT with IoT devices at mine sites and ensuring adherence to international responsible sourcing standards, often dictated by entities like the Kimberley Process or the Responsible Jewellery Council (RJC).

Midstream activities involve cutting, polishing, and manufacturing, where the material undergoes significant transformation. Blockchain tracks this transformation process—the 'chain of custody'—recording details of the cutting yield, labor practices, and the final 4Cs (Carat, Color, Clarity, Cut) grading. Distribution channels, both direct and indirect, represent the point where ownership and physical custody frequently change hands. Direct distribution, involving major luxury brands, often leverages proprietary blockchain systems to maintain closed-loop traceability, whereas indirect channels (wholesalers, dealers) require inter-platform compatibility and standardized digital certification formats. The blockchain provides a single, verifiable ledger for all customs, shipping, and insurance documentation, drastically reducing transactional delays.

Downstream analysis focuses on retail and the end consumer. Retailers utilize blockchain-derived digital certificates to provide verifiable provenance stories, enhancing product differentiation and consumer trust. This transparency serves as a powerful marketing tool. Post-sale, the system supports secondary market activities, verifying authenticity for resale, insurance, and valuations. The primary value addition of blockchain across the entire chain is the introduction of immutable trust, transforming the fragmented, opaque legacy system into a digitally interconnected, transparent ecosystem. This shift significantly reduces the costs associated with dispute resolution and enhances asset liquidity.

Blockchain in the Jewelry Supply Chain Market Potential Customers

The primary potential customers and end-users of Blockchain in the Jewelry Supply Chain solutions are those entities with the highest risk exposure regarding provenance and counterfeiting, or those committed to leading the shift towards ethical consumerism. Mining companies are critical early adopters, requiring systems to legally certify the origin of rough materials to meet global import/export regulations. Similarly, large jewelry manufacturers and wholesale suppliers are key buyers, as they need scalable platforms to manage the massive influx and outflow of graded materials and comply with retailer demands for traceability documentation.

Crucially, high-end luxury jewelry brands (e.g., Cartier, Tiffany & Co., LVMH Group) represent the most valuable customer segment. These brands invest heavily in DLT solutions not only for compliance but as a core competitive differentiator, using verifiable provenance as a premium selling point to discerning customers. Grading laboratories (e.g., GIA, IGI) are also essential customers, leveraging blockchain to secure their grading certificates against forgery, thereby protecting their institutional credibility. Furthermore, financial institutions and insurance companies are emerging customers, utilizing the immutable records for more accurate valuation, collateral assessment, and fraud-risk mitigation when underwriting high-value jewelry assets.

The final and increasingly important customer group is the mid-market independent jeweler and SME retailer. While often price-sensitive, they are becoming essential as larger platforms offer accessible SaaS models, allowing them to compete with major brands by offering verifiable ethical sourcing narratives. This comprehensive customer base reflects a market-wide recognition that transparency is no longer optional but a fundamental requirement for operating in the modern luxury goods sector.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 150 Million |

| Market Forecast in 2033 | USD 2.5 Billion |

| Growth Rate | 45.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Everledger, Tracr, IBM, De Beers Group, Sarine Technologies, Provenance Proof, Marine Transport International (MTI), SAP SE, Oracle, Microsoft (Azure Blockchain), BTL Group, ConsenSys, Jeweler's Mutual, TIS, Gemological Institute of America (GIA), Kimberley Process Certification Scheme (KPCS) facilitators, Diacore, Rio Tinto, BHP Group, Richline Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blockchain in the Jewelry Supply Chain Market Key Technology Landscape

The technology landscape for blockchain in the jewelry supply chain is defined by the necessary combination of Distributed Ledger Technology (DLT) with physical tracking and cryptographic security tools. The primary underlying technology is typically a permissioned blockchain (like Hyperledger Fabric or customized Ethereum Enterprise) to ensure that only verified stakeholders can record data, which is crucial for maintaining the confidentiality and integrity required by high-value transactions. Complementing DLT, cryptographic hashing is employed to create unique, tamper-proof digital identities (tokens or NFTs) for individual items, linking the physical asset to its immutable digital record on the ledger.

Integral to capturing the physical journey are advanced identification technologies. Laser inscription and microscopic tagging, often combined with proprietary biometric scanning devices (especially for diamonds), are used to physically link the gem to its digital token. Internet of Things (IoT) sensors are increasingly utilized in logistics to record real-time environmental conditions (temperature, humidity, shock) and geolocation data, automatically feeding these data points as verified inputs into the blockchain via oracles. This IoT-blockchain synergy ensures that the digital record truly reflects the physical reality of the asset's handling and location at all times.

Furthermore, the development of sophisticated Application Programming Interfaces (APIs) and interoperability protocols is vital, allowing various proprietary blockchain platforms and legacy ERP systems used by miners, manufacturers, and retailers to communicate seamlessly. Smart contracts, automated legal agreements residing on the blockchain, govern ownership transfer, payments, and compliance checks, reducing the reliance on manual verification and legal intervention. The convergence of DLT, advanced cryptography, and sensor technology is establishing a 'trust layer' essential for the global scalability of ethical sourcing initiatives in the jewelry sector.

Regional Highlights

The regional dynamics of the Blockchain in the Jewelry Supply Chain Market reflect varying levels of regulatory pressure, consumer affluence, and the presence of critical industry hubs.

- North America: This region is a market leader, driven by high consumer awareness regarding ethical sourcing and the presence of major technology innovators and luxury headquarters. Regulatory frameworks, coupled with strong venture capital investment in DLT start-ups focused on traceability, ensure rapid adoption. Large US-based retailers are actively implementing blockchain systems to comply with consumer expectations and secure their premium supply chains against fraud.

- Europe: Europe is a key growth area, particularly France, Switzerland, and the UK, acting as global hubs for luxury goods manufacturing, trading, and retail. The stringent European Union regulations regarding conflict minerals and sustainable business practices heavily incentivize the adoption of verifiable digital provenance solutions. The concentration of high-end brands necessitates high-security, permissioned blockchain solutions.

- Asia Pacific (APAC): APAC represents the fastest-growing region, fueled by rising disposable incomes in China and Southeast Asia and the region's dominance in cutting, polishing, and manufacturing (especially India). As major processing hubs, APAC countries urgently need DLT to manage and certify the vast flow of materials accurately before export to Western markets. The emphasis here is on scalable, high-throughput solutions.

- Middle East and Africa (MEA): This region is critical due to its role in gold and diamond mining and trade (e.g., South Africa, UAE). Adoption is primarily driven by the need to secure international credibility for raw material exports and meet anti-money laundering (AML) standards. Blockchain implementation in MEA focuses heavily on linking mining output directly to global tracking systems (e.g., leveraging the Tracr platform).

- Latin America: This region is focused on leveraging blockchain to verify the origin of precious metals and gemstones to combat illegal mining and establish compliance with international environmental and labor standards. The market is smaller but growing steadily as governments and ethical trade associations push for DLT integration to formalize supply chains and boost trade confidence.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blockchain in the Jewelry Supply Chain Market.- Everledger

- Tracr (De Beers Group)

- IBM

- Sarine Technologies

- Provenance Proof (Gems & Jewelry)

- Marine Transport International (MTI)

- SAP SE

- Oracle

- Microsoft (Azure Blockchain Service)

- BTL Group

- ConsenSys

- Jeweler's Mutual

- Richline Group

- Diacore

- Rio Tinto

- BHP Group

- TrustChain Initiative (Led by Richline Group)

- Aether Diamonds

- Helzberg Diamonds

- Gemological Institute of America (GIA)

Frequently Asked Questions

Analyze common user questions about the Blockchain in the Jewelry Supply Chain market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using blockchain in the jewelry supply chain?

The primary benefit is establishing immutable provenance and verifiable ethical sourcing, which increases consumer trust and serves as a robust defense against counterfeiting and illicit trade by providing an unalterable digital record of origin and custody.

How does blockchain specifically track a diamond from mine to retailer?

A unique digital identity (token) is created at the mine site, linked to the rough diamond via laser inscription or biometric scanning. Every subsequent transaction, cut, polish, and grading report is recorded as an immutable block on the ledger, detailing the chain of ownership and transformation.

Are public or private blockchains predominantly used in this industry?

Permissioned or private blockchains (such as Hyperledger Fabric) are predominantly used. These offer the necessary security, confidentiality, and performance required by luxury stakeholders, allowing only authorized members to access and validate sensitive commercial data.

What are the main technical challenges to widespread adoption in the jewelry market?

Key technical challenges include integrating DLT with legacy supply chain management systems, ensuring universal standardization of data entry protocols across thousands of global participants, and managing the high initial capital investment required for comprehensive system deployment.

Beyond tracking, what future applications of blockchain are anticipated for jewelry?

Future applications include asset tokenization for fractional ownership and simplified investment, automated smart contracts for cross-border payments and insurance verification, and using DLT to manage complex regulatory compliance and ESG reporting automatically.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager