Blockchain Security Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432925 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Blockchain Security Market Size

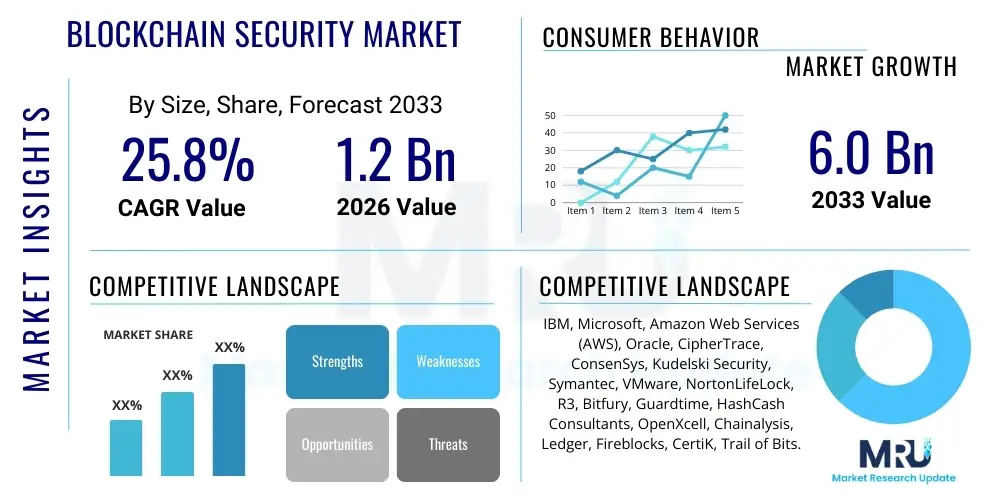

The Blockchain Security Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.8% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $6.0 Billion by the end of the forecast period in 2033.

Blockchain Security Market introduction

The Blockchain Security Market encompasses specialized solutions and services designed to protect decentralized applications, distributed ledgers, smart contracts, and associated digital assets from various cyber threats and vulnerabilities. As the adoption of blockchain technology expands across crucial industry verticals—including financial services, supply chain management, and healthcare—the necessity for robust security frameworks becomes paramount. These frameworks address unique challenges inherent to distributed systems, such as 51% attacks, double-spending vulnerabilities, node compromises, and potential flaws in cryptographic implementations or consensus mechanisms. The core objective of these security solutions is to ensure the integrity, confidentiality, and availability of data stored and transacted on blockchain networks, facilitating trustless environments for critical business operations.

Key products in this market range from application security tools and platform security mechanisms to advanced cryptographic solutions and identity management systems tailored for decentralized identities (DIDs). Major applications include securing cryptocurrency exchanges, managing enterprise private blockchains, auditing smart contracts for exploitable flaws, and protecting digital assets within decentralized finance (DeFi) protocols. The growing complexity of cross-chain interoperability and the rise of Layer 2 solutions further necessitate comprehensive security measures that can scale without compromising the foundational security guarantees of the underlying distributed ledger technology (DLT). Effective blockchain security also involves operational processes like incident response and continuous monitoring, ensuring rapid mitigation of evolving threat vectors.

The primary driving factors propelling market growth include the escalating frequency and sophistication of cyberattacks targeting decentralized autonomous organizations (DAOs) and DeFi platforms, coupled with increasing regulatory scrutiny demanding enhanced transparency and protection for digital assets. Furthermore, the substantial investments by large enterprises in private and consortium blockchain deployments for secure data sharing and process optimization mandate specialized security infrastructure that complies with industry standards. The benefits derived from implementing advanced blockchain security are manifold, providing enhanced data immutability, reduced operational risk, improved regulatory compliance posture, and ultimately, greater confidence in the adoption of blockchain as a foundational technology for future digital economies.

Blockchain Security Market Executive Summary

The Blockchain Security Market is undergoing rapid expansion, primarily driven by the exponential growth in Decentralized Finance (DeFi) adoption and the urgent need to secure complex smart contract environments. Business trends indicate a strong shift towards specialized security auditing services and the integration of advanced cryptographic techniques like zero-knowledge proofs (ZKPs) to enhance privacy without sacrificing verifiability. Enterprises are increasingly moving beyond perimeter security and focusing on securing the smart contract layer and associated APIs, viewing vulnerabilities at this level as the most critical risk. Strategic partnerships between established cybersecurity firms and blockchain development platforms are accelerating the development of integrated, end-to-end security solutions that address multi-chain environments, thereby creating significant market momentum.

Regionally, North America maintains market dominance due to high concentration of cryptocurrency innovation, early adoption of blockchain in BFSI, and substantial venture capital investment fueling security startups. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, fueled by government initiatives promoting DLT adoption in supply chain and digital identity sectors, notably in countries like Singapore, South Korea, and Japan. Europe is also a key growth area, particularly driven by rigorous regulatory frameworks such as GDPR, which necessitate privacy-preserving and secure blockchain implementations, pushing demand for robust cryptographic and identity solutions tailored for compliance.

Segment trends reveal that the Solutions component segment, particularly specialized platform security and key management systems, holds the largest market share, but the Services segment, encompassing managed security services, consulting, and smart contract auditing, is projected to exhibit the highest CAGR. Application-wise, securing exchanges and wallet infrastructure remains paramount, while the enterprise adoption of blockchain security in industry verticals like BFSI, retail, and government is growing significantly. The focus within segmentation is shifting toward proactive security measures, including automated vulnerability detection and decentralized insurance protocols, reflecting a maturity in understanding blockchain-specific risks beyond traditional network threats.

AI Impact Analysis on Blockchain Security Market

Users frequently inquire about how Artificial Intelligence (AI) can be leveraged to defend against sophisticated blockchain attacks, particularly those involving predictive analysis of transaction patterns or autonomous detection of anomalous smart contract behavior. Common concerns revolve around AI's ability to maintain decentralization principles while enhancing security, and whether AI itself could introduce new attack vectors if compromised. Expectations center on AI serving as a crucial layer for real-time threat detection, improving the efficiency of smart contract auditing, and enhancing forensic analysis post-incident. The integration of AI tools is largely seen as necessary to manage the complexity and sheer volume of data inherent in public blockchain networks, moving security from reactive patch management to proactive, predictive threat intelligence, thereby automating crucial defense mechanisms.

AI's influence is profound, transforming security methodologies from static code reviews to dynamic, pattern-based monitoring. Machine learning algorithms are now being trained on vast datasets of historical exploits and transaction data to identify subtle deviations indicative of potential attacks, such as flash loan exploits or manipulation of oracle data. This capability significantly reduces the window of vulnerability, providing rapid alerts that traditional signature-based security systems often miss. Furthermore, AI assists in optimizing consensus mechanisms by dynamically adjusting parameters based on network load and perceived threat level, enhancing overall resilience.

However, the application of AI in this domain is not without challenge. Ensuring the training data used for AI models is unbiased and representative of all potential threat landscapes is crucial. Security firms are developing specialized decentralized AI models (DeAI) to ensure that the security intelligence itself is distributed and resistant to single points of failure or centralized manipulation, aligning with the core ethos of blockchain technology. This synergy is leading to the development of next-generation security platforms that utilize AI for everything from enhancing private key security through behavioral biometrics to automatically generating protective wrapper contracts around vulnerable DeFi protocols.

- AI enhances real-time threat detection by analyzing vast blockchain transaction data for anomalous patterns.

- Machine Learning models improve the efficiency and accuracy of smart contract vulnerability auditing.

- AI facilitates predictive risk assessment, identifying emerging attack vectors (e.g., oracle manipulation, flash loans) before execution.

- Automated incident response systems powered by AI enable faster mitigation of active security breaches.

- AI-driven behavioral biometrics strengthen private key management and access control systems.

- Decentralized AI (DeAI) initiatives aim to provide distributed security intelligence, eliminating single points of failure.

- AI aids in forensic analysis and attribution following security incidents by correlating on-chain and off-chain data.

DRO & Impact Forces Of Blockchain Security Market

The Blockchain Security Market is primarily propelled by the exponential surge in the market capitalization of digital assets and the parallel increase in high-profile security breaches, which necessitate advanced defensive technologies. Key drivers include mandatory regulatory requirements demanding robust custodial solutions and compliance frameworks, alongside the critical enterprise need for trusted, secure platforms for sensitive data management in areas like supply chain and intellectual property. Restraints hindering market growth often center on the inherent complexity of integrating security solutions across disparate, permissioned, and permissionless blockchain architectures, coupled with the critical shortage of skilled security professionals possessing expertise in both cryptography and distributed systems engineering. This talent gap often leads organizations to rely on external consulting, slowing internal security maturation.

Opportunities abound, driven by emerging technological frontiers such as Layer 2 scaling solutions, which introduce new security challenges that require specialized monitoring and protection, and the proliferation of Non-Fungible Tokens (NFTs) and the Metaverse, which demand secure digital ownership verification and intellectual property protection frameworks. The impact forces acting on the market are substantial; the continuous evolution of attack techniques, especially those targeting cross-chain bridges and oracle systems, compels security providers to innovate rapidly. Furthermore, the rising awareness among retail and institutional investors regarding the risks associated with decentralized finance has dramatically increased demand for transparent and independently audited security assurances, pushing established cybersecurity giants to acquire or partner with specialized blockchain security firms to gain competency in this domain.

The macroeconomic environment, characterized by increased institutional participation in crypto assets, acts as a continuous accelerant for this market. As financial institutions integrate DLT into their core operations, the expectation for institutional-grade security, resiliency, and disaster recovery planning becomes non-negotiable. This high-stakes environment transforms the adoption of blockchain security from a desirable feature into a fundamental prerequisite for business continuity and regulatory acceptance. Consequently, the interplay between technological opportunity (new platforms requiring defense) and external pressure (high financial risk and regulatory demands) sustains the high growth trajectory projected for the forecast period, solidifying security as the backbone of decentralized innovation.

Segmentation Analysis

The Blockchain Security Market segmentation provides a detailed view of the various components, security types, applications, and end-use verticals driving market revenues. This segmentation is crucial for understanding market dynamics and identifying high-growth sub-segments, allowing both vendors and investors to align strategies with emerging needs. The market is primarily segmented based on the type of security mechanism deployed, the components purchased (solutions versus services), and the specific industry or application where the blockchain is implemented, reflecting the diverse security requirements across different DLT deployment models—public, private, or hybrid.

The Component segment clearly separates revenue streams derived from proprietary software and hardware solutions, such as hardware security modules (HSMs) and platform security tools, from those generated by crucial service offerings, including smart contract auditing, vulnerability assessments, and managed security services. Given the complexity and novelty of blockchain deployments, the services segment often demonstrates faster growth, as organizations rely on expert external consultation for initial deployment and continuous compliance maintenance. Furthermore, the segmentation by application highlights the shift in focus from merely securing basic transactions to protecting complex functionalities like cross-chain transfers, token issuance, and decentralized governance mechanisms.

By End-Use Vertical, the BFSI (Banking, Financial Services, and Insurance) sector remains the dominant adopter, driven by the massive capital involved in asset tokenization and custody. However, the increasing adoption by Government agencies for digital identity and land registry management, and by the Retail & Supply Chain sectors for provenance tracking and anti-counterfeiting, signifies diversification. Detailed analysis of these segments reveals that security needs vary significantly; BFSI requires high-performance, compliant cryptographic solutions, whereas Supply Chain demands robust application security and integrity checks across multiple nodes operated by different stakeholders.

- Component

- Solution

- Key Management Systems

- Platform Security

- Application Security

- Data Security

- Service

- Professional Services (Consulting, Integration)

- Managed Security Services

- Risk Assessment & Audit

- Incident Response

- Solution

- Type of Security

- Endpoint Security

- Application Security (Smart Contract Audit)

- Transaction Security

- Network Security

- Application

- Cryptocurrency Exchange Security

- Wallet Security Management

- Decentralized Finance (DeFi) Security

- Supply Chain Management

- Identity and Access Management (IAM)

- Deployment Model

- Cloud

- On-Premise

- Industry Vertical

- BFSI (Banking, Financial Services, and Insurance)

- Government

- Healthcare and Life Sciences

- Retail and E-Commerce

- IT and Telecommunication

- Energy and Utilities

Value Chain Analysis For Blockchain Security Market

The Value Chain for the Blockchain Security Market commences with the foundational layer—Upstream Analysis—involving technology providers specializing in core cryptographic algorithms, secure hardware (like HSMs), and low-level protocol development. This stage is characterized by high intellectual property intensity and deep research in areas such as post-quantum cryptography, zero-knowledge proofs, and secure multi-party computation (MPC). Key players at this stage include chip manufacturers, specialized cryptographic firms, and open-source foundation developers who provide the underlying, immutable security primitives upon which the entire ecosystem is built. Success at the upstream stage requires mastery of secure coding practices and peer review validation to ensure the integrity of the foundational security layer.

Moving downstream, the value chain progresses through solution development and integration. This stage involves companies that build complete security platforms, key management systems, and specialized auditing tools tailored for specific blockchain architectures (e.g., Ethereum, Hyperledger Fabric). Integrators and professional service firms then customize and deploy these solutions for end-users, ensuring seamless compatibility with existing IT infrastructure and compliance requirements. This middle layer adds substantial value by translating complex cryptographic security mechanisms into manageable, enterprise-ready solutions. Distribution channels are critical here, often relying on direct sales teams for large enterprise contracts and sophisticated partner ecosystems (System Integrators and Managed Security Service Providers or MSSPs) to reach small and medium enterprises (SMEs) and specialized DeFi projects.

The final layer involves the End-User (Downstream Analysis) and continuous operational security. Direct channels are utilized when major corporations procure bespoke platform security solutions from Tier 1 providers like IBM or Microsoft. Indirect channels, through specialized blockchain security consulting firms and auditing houses (e.g., ConsenSys, Chainalysis), provide ongoing monitoring, incident response, and compliance checks. The robustness of the distribution network determines market penetration, particularly in regions where DLT adoption is still nascent. Effective engagement across both direct and indirect models ensures that organizations, regardless of their internal security expertise, have access to necessary security assurances, thereby closing the loop on the end-to-end security delivery process.

Blockchain Security Market Potential Customers

Potential customers for blockchain security solutions span a broad spectrum, unified by the common need to protect high-value digital assets, sensitive transactional data, and the underlying infrastructure of decentralized applications. The primary end-users are financial institutions—including commercial banks, investment firms, and asset custodians—which utilize blockchain for cross-border payments, trade finance, and digital asset custody. These entities require highly secure, compliant, and scalable key management systems and transaction monitoring tools to meet stringent regulatory standards (e.g., MiCA, Basel III). The adoption in this vertical is mandatory, given the institutional risks associated with asset loss and systemic failure, positioning them as the largest revenue generators in the market.

The second major customer group includes technology and telecommunications firms that leverage DLT for secure data sharing, supply chain tracking, and digital identity solutions. These organizations require application security auditing for their smart contracts and robust platform security to protect consortium blockchains used by their business partners. Furthermore, the burgeoning decentralized ecosystem, comprised of Decentralized Autonomous Organizations (DAOs), cryptocurrency exchanges, and Decentralized Finance (DeFi) platforms, represents a high-growth segment. These DeFi protocols are constant targets for sophisticated exploits and urgently need specialized auditing services, bug bounty programs, and real-time behavioral monitoring tools to safeguard billions of dollars locked in smart contracts.

Government and Public Sector organizations are increasingly significant buyers, deploying blockchain for secure records management (land registries, voting systems) and digital identity management for citizens. Their focus is heavily weighted towards sovereign data integrity, requiring advanced network security and tamper-proof private blockchain implementations. Lastly, the Retail and Manufacturing sectors utilize security solutions to ensure the integrity of provenance data and prevent counterfeiting in complex global supply chains. Across all these segments, the purchasing decision is driven by risk mitigation, regulatory compliance, and the preservation of public trust in the immutability and reliability of their decentralized operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $6.0 Billion |

| Growth Rate | 25.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IBM, Microsoft, Amazon Web Services (AWS), Oracle, CipherTrace, ConsenSys, Kudelski Security, Symantec, VMware, NortonLifeLock, R3, Bitfury, Guardtime, HashCash Consultants, OpenXcell, Chainalysis, Ledger, Fireblocks, CertiK, Trail of Bits. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blockchain Security Market Key Technology Landscape

The Blockchain Security Market relies on a sophisticated technological landscape encompassing advanced cryptographic techniques, distributed system protocols, and specialized software tools designed to maintain the integrity and privacy of decentralized transactions. A fundamental technology is the utilization of Hardware Security Modules (HSMs), which are cryptographic processing devices used to securely store and manage the private keys essential for transaction signing and digital identity verification. HSMs provide a tamper-proof environment, isolating critical cryptographic material from software vulnerabilities, thereby mitigating risks associated with key compromise—a primary attack vector in decentralized environments. This hardware-based security approach is crucial for institutional investors and custodians.

Smart contract auditing tools and formal verification methods represent another vital component. As smart contracts automate high-value transactions, flaws in their coding logic can lead to catastrophic losses. Tools employing static analysis, dynamic analysis, and symbolic execution automatically scrutinize contract code for common vulnerabilities such as reentrancy, integer overflow, and access control issues. Furthermore, emerging technologies like Zero-Knowledge Proofs (ZKPs) are transforming privacy preservation. ZKPs allow one party to prove the validity of a statement or transaction without revealing the underlying data, offering a pathway to regulatory compliance (e.g., GDPR) while preserving the transparency of the blockchain network structure.

Beyond cryptographic and auditing solutions, the technological landscape includes specialized blockchain forensics and monitoring platforms. These platforms leverage graph database technology and machine learning algorithms to trace illegal transaction flows, identify suspicious wallet addresses, and comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. The growth of multi-chain and cross-chain environments has also propelled the development of secure inter-chain communication protocols and bridge monitoring solutions, recognizing that the connection points between disparate blockchain networks often represent new, high-risk attack surfaces that require continuous, specialized security protocols and dedicated operational monitoring infrastructure.

Regional Highlights

North America currently holds the largest share of the Blockchain Security Market, a dominance attributed to several factors including the high density of technological innovation hubs, significant government and private sector investment in DLT, and the presence of major cryptocurrency exchanges and DeFi pioneers. The United States, in particular, drives market demand due to the early establishment of comprehensive regulatory discussions around digital asset security and custody, forcing quick adoption of advanced security standards by financial institutions and tech giants. The region is characterized by a mature ecosystem of cybersecurity vendors that have successfully pivoted to specialize in blockchain-native security solutions, offering everything from sophisticated key management to regulatory compliance tools.

Europe represents a crucial growth region, driven primarily by regulatory clarity initiatives, such as the Markets in Crypto Assets (MiCA) framework, which impose rigorous operational and security requirements on digital asset service providers. Countries like the UK, Germany, and Switzerland are leaders in adopting secure private and consortium blockchains for trade finance and central bank digital currency (CBDC) experimentation, necessitating robust security infrastructure tailored to privacy preservation (GDPR compliance) and regulatory oversight. The focus in Europe tends toward governmental and enterprise adoption of permissioned blockchains, driving demand for specialized infrastructure security and identity management solutions over retail DeFi security.

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) during the projection period. This explosive growth is fueled by aggressive governmental support for DLT across countries such as China, Singapore, and South Korea, particularly in supply chain management, digital currency trials, and cross-border payments. The massive scale of emerging digital economies in India and Southeast Asia creates an enormous demand for scalable, low-cost security solutions for mobile-first blockchain applications. While North America focuses on high-security, high-cost enterprise solutions, APAC’s rapid growth is driven by sheer volume and the need for scalable, localized security services to protect rapidly expanding tokenized ecosystems.

Latin America and the Middle East & Africa (MEA) are emerging markets characterized by significant cryptocurrency adoption spurred by high inflation rates and the need for alternative financial mechanisms. In these regions, security demand is heavily concentrated in securing retail-facing cryptocurrency wallets and exchanges, as well as protecting remittance channels. Government and state-owned enterprises in the Gulf Cooperation Council (GCC) countries are also investing heavily in blockchain for energy, identity, and government services, driving specialized demand for secure private blockchain implementation consulting and operational management services, indicating a strong future growth potential as infrastructural readiness improves.

- North America: Market leader due to large presence of tech giants, significant venture capital, and early regulatory development regarding digital asset custody and compliance.

- Europe: High growth driven by strict regulatory mandates (e.g., MiCA, GDPR), focusing on secure enterprise and governmental use cases, especially CBDC exploration.

- Asia Pacific (APAC): Highest CAGR due to proactive government adoption (China, Singapore) in supply chain and digital identity, coupled with massive consumer market expansion.

- Latin America: Demand driven by high retail adoption of cryptocurrencies as inflation hedges, necessitating secure exchange and wallet solutions.

- Middle East & Africa (MEA): Emerging growth focused on government services, energy sector modernization using DLT, and institutional investment in secure digital identity solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blockchain Security Market.- IBM Corporation

- Microsoft Corporation

- Amazon Web Services (AWS)

- Oracle Corporation

- CipherTrace (a Mastercard company)

- ConsenSys

- Kudelski Security

- Symantec (now part of Broadcom)

- VMware Inc.

- NortonLifeLock (now Gen Digital)

- R3 (Corda)

- Bitfury Group

- Guardtime

- HashCash Consultants

- OpenXcell

- Chainalysis

- Ledger SAS

- Fireblocks

- CertiK

- Trail of Bits

Frequently Asked Questions

Analyze common user questions about the Blockchain Security market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary attack vectors currently threatening decentralized finance (DeFi) platforms?

The primary threats to DeFi include smart contract vulnerabilities (such as reentrancy or logic errors), oracle manipulation attacks (where price feeds are exploited), flash loan attacks (using uncollateralized loans to manipulate markets), and governance exploits. Security solutions must focus on rigorous code auditing and real-time transaction monitoring to detect these specific decentralized threats effectively.

How does key management technology ensure the security of digital assets in enterprise blockchain solutions?

Key management technology, primarily utilizing Hardware Security Modules (HSMs) and multi-party computation (MPC), provides a secure, tamper-proof environment for storing and processing private cryptographic keys. This prevents unauthorized access, isolates keys from software-based attacks, and ensures institutional-grade security and compliance for asset custody and transaction signing.

Is blockchain technology inherently secure, or does it still require external security solutions?

While blockchain's decentralized nature and cryptographic hashing provide high data integrity (immutability), the technology is not inherently immune to vulnerabilities. External security solutions are mandatory to protect peripheral components, including smart contract logic, user interfaces, key management, API integrations, and consensus mechanism integrity (e.g., preventing 51% attacks), addressing risks above the protocol layer.

What role does Artificial Intelligence (AI) play in enhancing blockchain transaction security and compliance?

AI plays a critical role in proactive security by employing machine learning models to analyze vast streams of on-chain data, identify anomalous transaction patterns indicative of fraud or money laundering, and conduct predictive risk scoring. This enhances Anti-Money Laundering (AML) compliance and facilitates real-time detection of sophisticated exploits that bypass traditional security rules.

Which industry vertical is projected to drive the highest demand for blockchain security services in the near future?

The Banking, Financial Services, and Insurance (BFSI) vertical is projected to drive the highest absolute demand for blockchain security due to mandatory regulatory requirements for digital asset custody and the high value of assets being tokenized. However, the Decentralized Finance (DeFi) application segment, crossing multiple verticals, is expected to see the highest growth rate in demand for auditing and continuous monitoring services.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager