Blockchain Social Media Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431860 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Blockchain Social Media Market Size

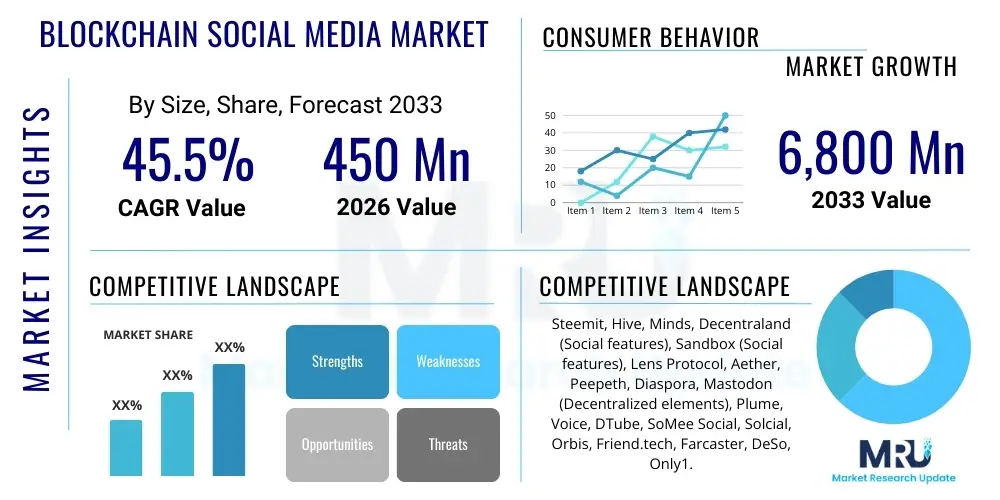

The Blockchain Social Media Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 45.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 6,800 Million by the end of the forecast period in 2033. This exponential growth trajectory is fundamentally driven by the increasing global demand for decentralized digital platforms that prioritize user privacy, data ownership, and transparent monetization schemes, contrasting sharply with the centralized models prevalent today. The nascent stage of the technology, coupled with massive influxes of venture capital and continuous innovation in Layer-1 and Layer-2 blockchain solutions tailored for high-throughput applications, facilitates this accelerated market expansion across key geographical regions, particularly in North America and Asia Pacific where digital engagement rates are highest.

Blockchain Social Media Market introduction

The Blockchain Social Media Market encompasses decentralized applications (dApps) built upon distributed ledger technology (DLT) designed to function as social networking platforms. These platforms aim to resolve critical issues plaguing traditional social media, such as arbitrary censorship, opaque algorithms, monopolistic data control, and inequitable revenue sharing. Key products range from microblogging sites and content creation hubs to decentralized communities and media sharing platforms, all leveraging blockchain's inherent properties of immutability, transparency, and pseudonymity. The underlying technology typically incorporates cryptographic security and smart contracts to automate platform governance and user reward mechanisms, transforming users from mere consumers into genuine stakeholders who participate in the network's value creation.

Major applications of blockchain social media include transparent content monetization for creators through native tokens, verifiable digital identity management (Self-Sovereign Identity or SSI), decentralized autonomous organization (DAO) based governance, and direct peer-to-peer interactions free from intermediary control. Benefits derived from these applications are significant: enhanced privacy through decentralized data storage, true data ownership by the user, reduction in malicious bots and fake accounts due to verifiable identity requirements, and fairer compensation models that distribute advertising or subscription revenue back to the content generators and community members. Furthermore, the inherent censorship resistance of DLT attracts users in regions facing strict governmental information control, positioning these platforms as vital tools for digital freedom.

Driving factors propelling this market include the growing global dissatisfaction with Big Tech's data handling practices, high-profile data breaches on centralized platforms, and the increasing mainstream adoption of cryptocurrencies and Web3 wallets, making onboarding onto decentralized applications easier than ever before. Regulatory uncertainty surrounding traditional platforms, coupled with consumer demand for alternative, ethical social networking environments, further accelerates adoption. Technological advancements in scalability solutions like sharding, state channels, and optimistic rollups are steadily overcoming the historical throughput limitations of blockchain, making these decentralized social experiences viable for mass market deployment and ensuring they can handle the high volume of traffic typically associated with major social media platforms.

Blockchain Social Media Market Executive Summary

The Blockchain Social Media Market is currently defined by robust business trends focusing on interoperability, token utility, and the integration of advanced Web3 functionalities such as Non-Fungible Tokens (NFTs) for digital content rights and decentralized finance (DeFi) components for creator funding and tipping. The primary business model pivot involves shifting from attention-based advertising to participatory ownership models, where platform success directly benefits token holders, including active users. Regional trends indicate North America and Europe leading in development and early adoption, driven by strong regulatory frameworks supporting digital innovation and high consumer awareness regarding data privacy. However, the Asia Pacific region, fueled by large digitally native populations and rapid crypto adoption in countries like India and Southeast Asia, is projected to exhibit the highest growth rates, becoming a crucial consumption hub by the mid-forecast period.

Segment trends highlight the dominance of content creation and sharing platforms built on high-speed blockchains, catering primarily to video content and micro-content creators seeking immediate, transparent rewards. Identity management solutions utilizing blockchain are gaining significant traction as foundational infrastructure required for mitigating Sybil attacks and ensuring accountability within decentralized environments. Furthermore, the market is segmenting along specific use cases, with professional networking and specialized community platforms (e.g., decentralized scholarly communication or open-source development forums) showing rapid, albeit niche, growth. The trend towards integrating AI tools for content moderation and personalized feeds within a decentralized framework poses a crucial technological challenge and opportunity, demanding innovative solutions that balance decentralization principles with operational efficiency.

Overall, the executive analysis indicates that the market is in a crucial scaling phase, moving past proof-of-concept toward mass usability. Key challenges remain centered on user experience (UX) simplification, reducing complexity associated with wallet management and gas fees, and achieving true viral network effects that can compete with established giants. Successful platforms are those that prioritize seamless onboarding, offer substantial token rewards, and maintain a commitment to community-driven development and governance, effectively leveraging the power of decentralized autonomous organizations (DAOs) to steer future product roadmaps and platform policy changes.

AI Impact Analysis on Blockchain Social Media Market

User inquiries frequently center on whether Artificial Intelligence (AI) can compromise the core decentralization and privacy promises of blockchain social media, or conversely, if AI can solve existing scalability and moderation challenges. Key themes include the potential for AI-driven deepfakes and sophisticated disinformation campaigns facilitated by decentralized, censorship-resistant networks; the application of AI for automated, yet fair and transparent content moderation (replacing centralized human moderation teams); and the ethical deployment of personalization algorithms that respect user data ownership rights held on the blockchain. Users are concerned about regulatory oversight applying to combined AI/Blockchain systems and the economic impact of AI-driven content generation flooding decentralized feeds, potentially diluting the value of human-created content and associated tokens.

The integration of AI represents a dual-edged sword for the Blockchain Social Media market. While generative AI models threaten to introduce unprecedented levels of synthetic, difficult-to-detect spam and propaganda onto immutable ledgers, AI also offers solutions vital for the market's survival and growth. Specifically, AI algorithms can be deployed locally or within secure enclaves (federated learning models) to analyze encrypted user data patterns without compromising underlying privacy, enabling personalized content recommendations or targeted advertising that respects user ownership. Moreover, AI is critical for scalable content filtering, using machine learning to identify and flag harmful content (e.g., illegal material) based on community-defined rules embedded within smart contracts, thereby achieving efficient moderation while maintaining transparency regarding algorithmic decisions, a stark improvement over current opaque systems.

Market expectation leans toward AI becoming an essential infrastructure layer, not a replacement for decentralization. Advanced AI-powered analytics will be necessary to manage massive data throughput and secure decentralized identity systems against bot attacks. Platforms are exploring zero-knowledge machine learning (ZKML) to verify AI-driven moderation decisions cryptographically, ensuring that the AI’s processes are auditable even if the underlying data remains private. This symbiotic relationship, where blockchain provides the trust and immutable ownership layer, and AI provides the intelligence and scaling capability, is projected to significantly accelerate platform adoption, addressing critical user experience and safety concerns necessary for mainstream acceptance.

- AI-driven content moderation frameworks providing transparent and auditable enforcement of community rules via smart contracts.

- Deployment of Zero-Knowledge Machine Learning (ZKML) to perform personalized data analytics while preserving user privacy and cryptographic verification.

- Enhanced security protocols utilizing AI for real-time detection and mitigation of sophisticated Sybil attacks and bot networks common in decentralized token ecosystems.

- The rise of decentralized AI marketplaces and oracles to fairly compensate users or DAOs for contributing proprietary data sets used to train AI models.

- Increased risk of AI-generated deepfake content and sophisticated disinformation campaigns leveraging the censorship resistance of DLT platforms.

- AI integration for optimizing blockchain transaction throughput and calculating dynamic, fair gas fees based on network congestion.

- Automation of token distribution and reward mechanisms based on AI evaluation of content quality, engagement value, and adherence to platform policies.

DRO & Impact Forces Of Blockchain Social Media Market

The market is predominantly driven by increasing consumer awareness regarding digital privacy abuses and the promise of transparent economic models for content creators. Technological restraints include the persistent challenges of blockchain scalability (transaction speed and cost) and the complexity associated with user onboarding (wallet management, seed phrases). Opportunities lie primarily in integrating the metaverse, NFTs, and DeFi services directly into social platforms, creating comprehensive Web3 ecosystems. The impact forces are characterized by high market rivalry among pioneering dApps and the constant threat of regulatory intervention, which could either legitimize the sector or impose restrictive compliance burdens, heavily influencing investor confidence and subsequent market velocity.

Drivers: Significant drivers include the global trend toward data sovereignty, where users demand control over their digital footprints, facilitated by decentralized identity solutions (DIDs). The allure of direct, equitable monetization models, eliminating exorbitant platform cuts seen in centralized environments, attracts a substantial influx of professional content creators and influencers seeking sustainable revenue streams via token economics. Furthermore, the global proliferation of Web3 infrastructure, including ubiquitous access to non-custodial wallets and the maturation of cross-chain communication protocols, lowers the technical barrier to entry for both developers and general users, stimulating application development and fostering network effects necessary for social platform success. Political and social factors, particularly censorship resistance, act as a powerful catalyst in jurisdictions where information freedom is restricted.

Restraints: The primary restraint remains the significant hurdle of achieving user experience parity with established centralized platforms. Decentralized applications often suffer from higher latency, complex multi-step onboarding processes, and the irreversible consequences of cryptographic errors (e.g., lost private keys). Scalability, despite recent layer-2 advancements, still presents a constraint, as platforms struggle to handle peak concurrent user traffic equivalent to major centralized competitors without incurring substantial transaction fees or slowing network finality. Furthermore, the lack of widespread regulatory clarity creates hesitancy among large institutional investors and corporate advertisers, limiting capital flow and hindering large-scale commercial partnerships crucial for long-term platform viability.

Opportunities: Major opportunities revolve around the synergy between social networking and the burgeoning metaverse ecosystem, enabling users to socialize, transact, and own virtual assets (NFTs) directly within the social interface. The expansion into decentralized finance (DeFi) offers platforms the chance to integrate micro-lending, staking, and yield generation features directly into user accounts, substantially increasing token utility and providing creators with sophisticated financial tools. Emerging markets, especially in Asia and Latin America, present fertile ground for rapid adoption, driven by high smartphone penetration and existing familiarity with mobile-first payment systems and token-based economies. Developing robust, user-friendly bridges between Web2 and Web3 interfaces remains a massive opportunity for platforms that can simplify the transition for millions of mainstream users.

Segmentation Analysis

The Blockchain Social Media Market is primarily segmented based on the type of application, the underlying blockchain infrastructure utilized, the business model adopted, and the end-user demographics. This multi-dimensional segmentation allows for a nuanced understanding of market dynamics, revealing specific high-growth niches like content monetization platforms and decentralized identity services. Analyzing these segments helps stakeholders tailor development strategies and investment decisions toward areas where blockchain technology offers the most pronounced comparative advantage over traditional social media models, such as eliminating intermediaries and ensuring cryptographic proof of content ownership.

By application type, the market splits into content sharing (video/images), microblogging, professional networking, and decentralized community building. By infrastructure, the market is differentiated by the type of blockchain (Layer-1 protocols such as Ethereum or Solana, or specialized Layer-2 solutions designed for high throughput). Business models are crucial, ranging from subscription-based token access, pay-per-engagement models, and direct token rewards for curation, distinguishing themselves from traditional ad-supported models. Geographic segmentation remains vital, contrasting regulatory environments and technological readiness across regions, impacting both adoption rates and platform feature sets.

Understanding these segments confirms that the immediate value proposition is strongest in use cases requiring high degrees of trust and transparency, such as verification of digital assets (NFTs) and secure, immutable record-keeping for reputation scores or intellectual property. The shift toward specialized niche communities, rather than broad general-purpose platforms, indicates that early adopters are seeking highly governed, purpose-built ecosystems that maximize token utility and governance participation, setting the stage for future mainstream consolidation once scalability challenges are fully resolved across all major segments.

- By Application:

- Content Sharing Platforms (Video, Image, Audio)

- Microblogging and Short-Form Content

- Professional Networking and Skill Verification

- Decentralized Community Forums and Messaging

- Decentralized Identity and Reputation Services

- By Blockchain Type:

- Layer-1 Protocols (e.g., Ethereum, Solana, Cosmos)

- Layer-2 Solutions (e.g., Polygon, Optimism, Arbitrum)

- Permissioned Blockchains (For Enterprise Social Applications)

- By Revenue Model:

- Token-Based Reward Systems (Proof-of-Stake, Proof-of-Brain)

- Subscription/Premium Feature Access

- Decentralized Advertising Protocols (Ad revenue shared with users)

- NFT and Digital Asset Sales Commission

- By End-User:

- Individual Content Creators and Influencers

- General Social Media Users

- Enterprises and Brands

- Decentralized Autonomous Organizations (DAOs)

Value Chain Analysis For Blockchain Social Media Market

The value chain for blockchain social media is highly distributed, significantly deviating from the linear, centralized chain of traditional platforms. The upstream segment involves core infrastructure providers, including blockchain protocol developers, node operators, decentralized storage solutions (like IPFS or Arweave), and smart contract auditors who ensure platform security and functionality. These foundational components are critical as they dictate the platform’s performance metrics, such as transaction speed, security guarantees, and data persistence. Innovation at this stage, particularly in gas optimization and cross-chain bridging, directly impacts the viability of the downstream social application layer, making infrastructure quality a key determinant of market success.

Midstream activities primarily encompass the development and deployment of the decentralized social applications (dApps) themselves, executed by platform builders, decentralized autonomous organizations (DAOs), and specialized Web3 development firms. This stage involves front-end development focused on enhancing user experience to match Web2 standards, integrating wallet solutions, and designing robust tokenomics models that align community incentives with platform growth. Effective community management and governance mechanism design are also midstream essentials, ensuring that the platform adheres to decentralized principles and evolves according to user consensus, thereby maintaining the platform's commitment to self-governance and censorship resistance.

Downstream activities involve end-user interaction, distribution, and monetization. Distribution channels are predominantly direct-to-consumer via mobile dApp stores (App Store, Google Play, though often censored), Web3 browser extensions, and dedicated decentralized application directories. Monetization flows directly from users (via tips, subscriptions, or token purchases) to content creators and the platform DAO, often bypassing traditional advertising intermediaries. Direct and indirect distribution channels are managed through partnerships with wallet providers, listing on major decentralized exchanges (DEXs), and cross-platform integrations using open-source APIs, fostering a highly collaborative and interoperable distribution ecosystem focused on attracting developers and liquidity providers as much as general users.

Blockchain Social Media Market Potential Customers

The primary customers and end-users of blockchain social media platforms span multiple demographics, ranging from digitally native content creators seeking fair compensation to privacy-conscious individuals disillusioned with traditional tech giants. Professional content creators, including video streamers, digital artists, and writers, represent a high-value customer segment due to their significant incentive to migrate to platforms offering higher revenue share and immutable intellectual property rights (often secured via NFTs). These buyers value transparent metrics and immediate, micro-payments facilitated by platform tokens.

A second major cohort consists of consumers located in regions susceptible to heavy internet censorship or political instability. For these users, the core feature is the assurance of censorship resistance and the ability to maintain a verifiable, pseudonymized digital identity that cannot be easily de-platformed or tracked by hostile entities. They prioritize security, anonymity, and the immutability of shared information, making platforms utilizing decentralized storage and robust encryption highly attractive. This demographic views blockchain social media as essential infrastructure for freedom of expression and secure communication, driving significant organic adoption.

A third segment comprises Decentralized Autonomous Organizations (DAOs) and Web3 native projects. These entities require platforms built on DLT for secure, transparent internal communication, voting, and community management, ensuring that their operational infrastructure aligns with their decentralized ethos. Furthermore, corporations and brands are emerging as potential customers, seeking to leverage transparent blockchain advertising protocols to engage with highly verified, non-bot traffic and execute targeted marketing campaigns where consumer data rights are explicitly respected and codified via smart contracts, ensuring ethical and auditable outreach practices.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 6,800 Million |

| Growth Rate | 45.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Steemit, Hive, Minds, Decentraland (Social features), Sandbox (Social features), Lens Protocol, Aether, Peepeth, Diaspora, Mastodon (Decentralized elements), Plume, Voice, DTube, SoMee Social, Solcial, Orbis, Friend.tech, Farcaster, DeSo, Only1. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blockchain Social Media Market Key Technology Landscape

The technological landscape of blockchain social media is rapidly evolving, driven by the necessity for high throughput and low latency to support real-time social interactions. Core technologies rely on decentralized infrastructure elements such as specialized Layer-1 and Layer-2 scaling solutions that move heavy transactional loads off the main chain, significantly reducing gas fees and increasing transaction finality speed. Examples include optimistic and ZK rollups (Zero-Knowledge) which bundle transactions efficiently. The choice of underlying protocol (e.g., Ethereum Virtual Machine compatible chains or high-speed Directed Acyclic Graph (DAG) protocols) critically determines the architecture's efficiency and developer accessibility, influencing market penetration rates and the overall quality of the user experience.

Another pivotal technology is decentralized storage systems, such as IPFS (InterPlanetary File System) or Arweave. These protocols ensure that user-generated content is stored redundurally and immutably across a distributed network, eliminating single points of failure and protecting content from centralized deletion or censorship. This decentralized storage is intrinsically linked to NFT technology, where content ownership is tokenized and verifiable on the blockchain. Furthermore, Self-Sovereign Identity (SSI) frameworks, often implemented using decentralized identifiers (DIDs), are foundational for ensuring user authenticity without requiring reliance on centralized logins, addressing the chronic problem of anonymity and accountability simultaneously.

Advanced cryptographic primitives like Zero-Knowledge Proofs (ZKPs) are increasingly being adopted to enhance privacy, allowing users to verify information (like account ownership or compliance with a policy) without revealing the underlying data itself. This is crucial for balancing the need for moderation and security with user privacy guarantees. The overarching shift is toward modular blockchain architectures that allow social platforms to customize their data availability layers and execution environments, optimizing for social specific requirements like fast indexing, low-cost micro-transactions (tipping), and complex social graph mapping. The successful integration of these technical components determines a platform’s ability to transition from a niche Web3 product to a scalable, mainstream social network capable of handling billions of interactions monthly.

Regional Highlights

Regional dynamics heavily influence the adoption and developmental focus of blockchain social media platforms. North America currently dominates the market in terms of venture capital investment, developer activity, and the headquarters of major foundational protocol projects. The region benefits from a robust technological infrastructure and a high level of consumer awareness regarding digital privacy concerns, which fuels demand for decentralized alternatives. Regulatory bodies in the US and Canada are closely monitoring the sector, but the general climate, while complex, supports innovation, positioning North America as the primary hub for intellectual property and protocol standardization, significantly influencing global market trends and setting precedents for decentralized governance structures.

Europe stands as a major secondary market, characterized by stringent data protection laws such as GDPR, which inherently align with the core privacy promises of decentralized social networks. European consumers are typically highly sensitized to data control issues, accelerating the search for platforms offering guaranteed data sovereignty. Development efforts in Europe often focus on legal compliance and interoperability, aiming to create ethical social ecosystems. Countries like Germany, Switzerland, and the UK are emerging as strong centers for Web3 investment and regulatory sandboxes, particularly favoring platforms that integrate verified decentralized identity solutions and offer robust, audited governance mechanisms.

Asia Pacific (APAC) is projected to be the fastest-growing region, driven by immense populations of digitally native users and high rates of cryptocurrency adoption, particularly in emerging economies like India, Southeast Asia, and South Korea. These markets often exhibit a leapfrog effect, readily adopting advanced digital technologies directly. The demand in APAC is often centered around monetization (creator economy) and seamless mobile integration. While regulatory frameworks vary significantly, the sheer scale and enthusiasm for token-based rewards and decentralized content ownership make this region crucial for achieving the necessary critical mass for network effects, serving as the largest potential consumption market for scaled blockchain social media applications.

Latin America (LATAM) and the Middle East & Africa (MEA) represent significant long-term growth opportunities, primarily due to economic instability and high rates of fiat currency devaluation, which incentivize crypto adoption and token-based economies. In LATAM, demand is driven by the need for censorship-resistant communication and alternative financial infrastructure integrated into social platforms. In MEA, particularly in areas with limited access to traditional banking services, token rewards and decentralized community platforms offer valuable avenues for economic participation and digital identity management. Adoption in these regions is heavily reliant on mobile accessibility and the development of robust, low-bandwidth dApp interfaces optimized for local conditions.

- North America: Leads in investment and protocol development; high awareness of data privacy issues drives consumer demand.

- Europe: Focused on GDPR-compliant, ethical platforms; strong regulatory environment supporting decentralized identity and governance models.

- Asia Pacific (APAC): Fastest growing region due to high mobile penetration and large crypto-native user bases; market demand centered on creator monetization and seamless UX.

- Latin America (LATAM): High demand for decentralized, censorship-resistant communication and integration with local crypto-economies driven by macroeconomic volatility.

- Middle East and Africa (MEA): Emerging markets leveraging blockchain social media for economic inclusion and accessing global digital communities under challenging banking conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blockchain Social Media Market, comprising foundational protocol developers, application layer providers, and associated infrastructure platforms.- Steemit

- Hive

- Minds

- Lens Protocol

- Farcaster

- Decentraland (Social features)

- Sandbox (Social features)

- Aether

- Peepeth

- Diaspora

- Mastodon (Federated architecture with blockchain elements)

- Plume

- Voice

- DTube

- SoMee Social

- Solcial

- Orbis

- Friend.tech

- DeSo (Decentralized Social)

- Only1

Frequently Asked Questions

Analyze common user questions about the Blockchain Social Media market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference between blockchain social media and traditional centralized platforms?

The key difference is ownership and control. Centralized platforms own user data, control moderation, and retain advertising revenue. Blockchain social media, conversely, utilizes distributed ledger technology (DLT) to ensure users own their data and identity, participate in platform governance (via DAOs), and receive transparent, equitable rewards for their content and engagement through token economics. This shift fundamentally removes the central intermediary.

How do blockchain social media platforms ensure content moderation without centralized authority?

Moderation in decentralized social media typically relies on community governance models or algorithmically defined smart contracts. These systems utilize token voting mechanisms (Proof-of-Stake or similar models) to determine content policy enforcement. Some platforms also implement advanced, auditable AI moderation tools that flag content based on transparent, community-voted rules, ensuring decisions are verifiable on the blockchain and resistant to unilateral censorship.

Are blockchain social media platforms truly scalable enough to compete with platforms like X or Facebook?

Scalability remains a primary technical challenge, though significant progress is being made through Layer-2 solutions (rollups, sidechains) and highly optimized Layer-1 protocols (like Solana or Polygon) built for high throughput. While currently few decentralized platforms handle billions of daily active users, advancements in modular blockchain design and transaction bundling are rapidly closing the performance gap, making mass adoption technically feasible within the forecast period (2026–2033).

How can users earn money on decentralized social media platforms?

Users primarily earn through native token rewards distributed via predefined tokenomics models, often based on engagement, content curation, or participation in governance (Proof-of-Brain mechanisms). Other methods include direct peer-to-peer tipping, selling Non-Fungible Tokens (NFTs) representing ownership of their content, and earning a share of decentralized advertising revenue generated on the platform.

What is the role of Self-Sovereign Identity (SSI) in the future of blockchain social media?

SSI is crucial for accountability and security. By granting users cryptographic control over their decentralized identifiers (DIDs), SSI eliminates the need for centralized logins while simultaneously making it significantly harder for malicious actors to execute Sybil attacks or impersonate others. SSI ensures that identity and reputation scores built on the platform are verifiably owned by the user and are portable across different decentralized applications, fostering a more trustworthy digital ecosystem.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager