Blood Cancer Drugs Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433042 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Blood Cancer Drugs Market Size

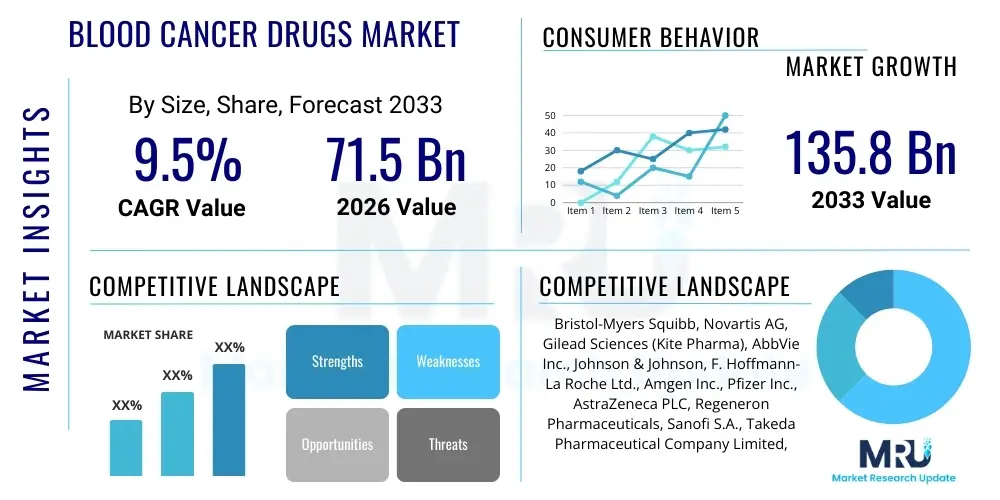

The Blood Cancer Drugs Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $71.5 Billion in 2026 and is projected to reach $135.8 Billion by the end of the forecast period in 2033.

Blood Cancer Drugs Market introduction

The Blood Cancer Drugs Market encompasses a comprehensive range of pharmaceutical agents specifically designed for the treatment of hematological malignancies, including leukemia, lymphoma, and multiple myeloma. These therapeutic modalities span traditional chemotherapy, highly effective targeted therapies, and cutting-edge immunotherapies such as CAR T-cell treatments and checkpoint inhibitors. The primary product description involves complex biological compounds and small molecules engineered to interrupt cancer cell proliferation, induce apoptosis, or harness the patient’s own immune system to identify and destroy cancerous cells. The evolution of treatment paradigms has shifted significantly towards precision medicine, emphasizing treatments that minimize systemic toxicity while maximizing efficacy against specific genetic markers.

Major applications for blood cancer drugs are predominantly categorized by the three main types of hematologic cancers. Leukemia treatments target abnormal white blood cell proliferation, with applications focusing on Acute Lymphocytic Leukemia (ALL), Acute Myeloid Leukemia (AML), Chronic Lymphocytic Leukemia (CLL), and Chronic Myeloid Leukemia (CML). Lymphoma treatments address cancers originating in the lymphatic system, encompassing Hodgkin’s Lymphoma and various non-Hodgkin’s Lymphomas (NHL). Multiple Myeloma drugs are essential for managing plasma cell proliferation in the bone marrow. The benefits derived from these drugs are profound, leading to significantly improved overall survival rates, better disease management, and, in many cases, durable remissions, especially through the adoption of novel targeted agents like Bruton's tyrosine kinase (BTK) inhibitors and proteasome inhibitors. Furthermore, modern therapeutic regimens are increasingly focused on outpatient administration and reduced side-effect profiles, enhancing the overall quality of life for patients undergoing treatment.

Driving factors propelling the expansion of the Blood Cancer Drugs Market include the rapidly aging global population, which correlates directly with an increased incidence of hematologic cancers, particularly multiple myeloma and certain lymphomas. Substantial advancements in molecular biology and genomic sequencing have led to the identification of novel drug targets, fueling robust research and development activities across both established pharmaceutical giants and emerging biotechnology firms. Furthermore, increasing regulatory approvals for breakthrough therapies, combined with greater patient awareness and improved diagnostic capabilities in developing economies, contribute significantly to market acceleration. The continuous innovation pipeline, particularly in cell and gene therapy—including the expansion of approved indications for CAR T-cell therapies—ensures sustained high growth rates, despite ongoing pricing pressures and the market entry of biosimilars for certain legacy biological treatments.

Blood Cancer Drugs Market Executive Summary

The Blood Cancer Drugs Market is experiencing dynamic shifts, characterized by intense competition driven by specialized biologics and personalized medicine approaches. Key business trends indicate a strong focus on strategic mergers and acquisitions (M&A) among major players aimed at acquiring promising drug candidates in late-stage clinical trials, especially within the B-cell malignancy space. Pharmaceutical companies are heavily investing in proprietary platform technologies to streamline the development and manufacturing of complex cell and gene therapies, which, while highly effective, pose significant logistical and cost challenges. The shift towards combination therapies, leveraging synergistic effects between targeted agents and immunotherapies, is becoming the standard of care, driving higher prescription values and necessitating comprehensive clinical trial design focused on efficacy in refractory and relapsed patient populations.

Regional trends highlight North America, particularly the United States, as the undisputed leader in market size, supported by high healthcare expenditure, advanced infrastructure for clinical trials, and rapid adoption of premium-priced novel therapies. Europe maintains a strong presence, driven by centralized healthcare systems that facilitate the uptake of approved treatments, though subject to stricter pricing negotiations, especially in countries like Germany and the UK. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR). This explosive growth is attributed to rising cancer incidence, improving healthcare access, increasing government focus on cancer care infrastructure development in nations such as China and India, and the growing urbanization leading to earlier diagnosis capabilities. The penetration of high-cost targeted drugs in these emerging markets, often supported by public or private insurance schemes, is a critical growth accelerator.

Segmentation trends reveal that the Targeted Therapy segment, encompassing agents like tyrosine kinase inhibitors (TKIs) and monoclonal antibodies (mAbs), remains the largest and fastest-growing segment, fundamentally altering treatment pathways for chronic leukemias and lymphomas. Within indications, Multiple Myeloma stands out due to the constant introduction of novel agents—including immunomodulatory drugs (IMiDs), proteasome inhibitors, and newer BCMA-targeted therapies—required for continuous disease management across multiple lines of treatment. Furthermore, the route of administration trend shows an increasing preference for oral formulations, where feasible, enhancing patient compliance and quality of life by allowing for easier, non-invasive administration outside of clinical settings. This demand is pressuring developers to reformulate or develop oral equivalents for traditional intravenous therapies, particularly for chronic blood cancers requiring long-term medication adherence. This transition is crucial for optimizing therapeutic continuity and reducing the burden on specialized infusion centers.

AI Impact Analysis on Blood Cancer Drugs Market

User queries regarding the impact of Artificial Intelligence (AI) on the Blood Cancer Drugs Market frequently center on AI's ability to revolutionize drug discovery timelines, personalize treatment regimens, and significantly enhance the efficiency of complex clinical trials. Users are keen to understand how AI-driven analysis of large genomic and clinical datasets can identify novel, previously overlooked therapeutic targets specific to rare hematologic malignancies. A core concern is the feasibility and regulatory acceptance of AI models for predicting patient response to highly specific treatments, such as CAR T-cell therapy, thereby enabling precise patient stratification and reducing treatment failures. Key themes revolve around the automation of molecular screening, predictive modeling for drug toxicity, and the use of natural language processing (NLP) to accelerate the synthesis of real-world evidence (RWE) from diverse electronic health records (EHRs), ultimately shortening the arduous journey from compound identification to market approval for new blood cancer therapies.

- AI accelerates the identification of novel drug targets by analyzing complex genomic, proteomic, and transcriptomic data sets related to hematopoiesis and malignant transformation.

- Predictive analytics driven by AI enhances clinical trial efficiency by optimizing patient selection, monitoring adverse events in real-time, and forecasting response rates across diverse cohorts.

- AI algorithms facilitate personalized medicine strategies by correlating individual patient molecular profiles with optimal therapeutic regimens, particularly for complex indications like Acute Myeloid Leukemia (AML).

- Machine learning models are employed for image analysis in pathology and hematology, improving diagnostic accuracy and speeding up the assessment of treatment efficacy (e.g., flow cytometry data analysis).

- Natural Language Processing (NLP) speeds up literature review and RWE extraction from unstructured clinical notes, aiding in pharmacovigilance and post-market surveillance for novel blood cancer treatments.

- Drug synthesis optimization, mediated by AI, improves the design and stability of small molecule inhibitors and complex biologics, reducing chemical development costs and timelines.

- AI supports the development of sophisticated companion diagnostics essential for the targeted therapy segment, ensuring drugs are administered only to patients most likely to benefit based on genetic markers.

- Enhanced safety and efficacy profiling through AI analysis of preclinical data reduces the risk of late-stage failures for highly potent but potentially toxic therapies.

DRO & Impact Forces Of Blood Cancer Drugs Market

The dynamics of the Blood Cancer Drugs Market are governed by a robust interplay between powerful drivers, significant restraints, and emerging opportunities, collectively shaping the competitive landscape. Key drivers include the dramatic surge in the global incidence of hematological cancers, the rapid commercialization and increasing approval of highly specialized cell and gene therapies (like CAR T-cells), and continuous investment in academic and industry research focusing on personalized oncology. Furthermore, the established shift from conventional chemotherapy towards targeted molecular therapies, which offer superior efficacy and reduced systemic toxicity, fundamentally accelerates market expansion. These drivers create a positive feedback loop, encouraging further R&D expenditure and facilitating the entry of innovative startup biotechnology firms specializing in niche therapeutic platforms, thus diversifying treatment options for patients with refractory or relapsed disease.

Conversely, the market faces stringent restraints primarily related to the exceptionally high cost associated with novel biological and cellular therapies, which often strains healthcare budgets globally and creates access equity challenges, particularly in lower-income regions. The complexity and specialized logistical requirements for manufacturing and administering treatments like CAR T-cell therapies—requiring specialized hospital centers, stringent cold chain management, and complex apheresis procedures—limit their widespread adoption and scalability. Additionally, intense regulatory scrutiny, particularly concerning the long-term safety and potential for severe adverse events associated with immunotherapies, poses significant hurdles to market entry and broad label expansion. The impending threat of patent expirations for blockbuster drugs and the subsequent market entry of biosimilars also act as a crucial restraint, applying downward pressure on overall pricing and revenue streams for foundational products in chronic disease management.

Opportunities within this market are centered on the development of novel bispecific and trispecific antibodies that can target multiple antigens simultaneously, enhancing immune response specificity and potency against malignant cells. Significant commercial potential exists in developing allogeneic (off-the-shelf) cell therapies, which promise to overcome the logistical and high-cost hurdles of autologous treatments, broadening patient access considerably. Moreover, focusing on treatments for rare or underserved indications, such as specific subtypes of T-cell lymphomas or high-risk AML, offers lucrative opportunities for expedited regulatory pathways and premium pricing, utilizing mechanisms like Orphan Drug Designation. Impact forces, therefore, include the fierce competitive rivalry among key pharmaceutical and biotech players vying for dominance in the cell therapy space, and the ongoing demand from payers and regulatory bodies for demonstration of cost-effectiveness relative to existing standard-of-care treatments. Technological innovation in drug delivery systems and enhanced diagnostic capabilities further intensify competition by enabling precise patient selection and driving market fragmentation towards specialized therapeutic niches.

Segmentation Analysis

The Blood Cancer Drugs Market is meticulously segmented based on Treatment Type, Indication, Route of Administration, and End-User, reflecting the specialized nature of hematologic oncology therapeutics. Segmentation analysis is critical for understanding market penetration and identifying high-growth sub-sectors, particularly the rapid adoption rate within targeted therapy and immunotherapy segments, which are rapidly replacing traditional cytotoxic agents as frontline treatments. This framework allows pharmaceutical companies to tailor their pipeline development and commercial strategies to specific disease areas and patient needs, optimizing resource allocation towards areas exhibiting the greatest clinical unmet need and commercial potential.

- By Treatment Type:

- Chemotherapy

- Targeted Therapy

- Tyrosine Kinase Inhibitors (TKIs)

- Proteasome Inhibitors

- Monoclonal Antibodies (mAbs)

- Immunomodulatory Drugs (IMiDs)

- Immunotherapy

- CAR T-Cell Therapy

- Checkpoint Inhibitors

- Bispecific Antibodies

- Radiation Therapy (Adjunctive)

- Stem Cell Transplantation (Preparatory Regimens)

- By Indication:

- Leukemia

- Acute Myeloid Leukemia (AML)

- Chronic Lymphocytic Leukemia (CLL)

- Acute Lymphocytic Leukemia (ALL)

- Chronic Myeloid Leukemia (CML)

- Lymphoma

- Non-Hodgkin’s Lymphoma (NHL)

- Hodgkin’s Lymphoma (HL)

- Multiple Myeloma (MM)

- Myelodysplastic Syndromes (MDS)

- Leukemia

- By Route of Administration:

- Oral

- Parenteral (Intravenous, Subcutaneous)

- By End-User:

- Hospitals & Clinics

- Specialty Cancer Centers

- Research & Academic Institutes

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Blood Cancer Drugs Market

The value chain for the Blood Cancer Drugs Market is intricate and highly regulated, beginning with exhaustive research and development, a phase critical for identifying and validating novel molecular targets specific to hematological malignancies. The upstream analysis focuses on the sourcing of high-quality active pharmaceutical ingredients (APIs), excipients, and, increasingly, complex biological materials such as viral vectors and specialized reagents required for cell therapy manufacturing. This initial phase demands significant capital investment in bioprocessing capabilities and adherence to stringent Good Manufacturing Practices (GMP) to ensure the purity and stability of the drug product. Strategic partnerships with specialized contract development and manufacturing organizations (CDMOs) are becoming prevalent, especially for emerging biotech firms that lack in-house capacity for large-scale, customized production runs for complex biologics like monoclonal antibodies and individualized cell therapies.

The midstream segment involves the meticulous manufacturing, quality control, packaging, and regulatory filing processes. For conventional drugs, manufacturing involves synthesizing and formulating small molecules or large biologicals. However, the value chain for CAR T-cell therapy introduces unique complexities, including patient-specific cell collection (apheresis), highly specialized logistics (cryopreservation and transport), and bespoke manufacturing processes in sterile, centralized facilities. Distribution channels are bifurcated into direct and indirect routes. Direct distribution is crucial for high-cost, specialized, and temperature-sensitive drugs, where manufacturers manage the supply chain to ensure immediate delivery to authorized specialty treatment centers and hospitals. This direct model is essential for therapies requiring complex handling and administration protocols, ensuring compliance and patient safety traceability.

Downstream analysis primarily involves distribution, market access, and patient administration. Indirect distribution utilizes specialized wholesalers and third-party logistics (3PL) providers capable of handling controlled substances and cold-chain requirements, facilitating market penetration into broader hospital networks and outpatient clinics. The end of the value chain involves the prescribing physicians, specialized oncologists, and pharmacists in hospitals and specialized cancer centers who administer the treatments. Market access and reimbursement are critical downstream functions, requiring extensive negotiation with payers (both governmental and private insurance) to secure favorable coverage decisions due to the high sticker price of most novel blood cancer drugs. Effective post-market surveillance and pharmacovigilance programs complete the cycle, ensuring patient safety and gathering real-world data crucial for label expansion and maintaining regulatory approval across diverse geographic regions.

Blood Cancer Drugs Market Potential Customers

The primary potential customers and end-users of Blood Cancer Drugs are institutions and professionals involved in the diagnosis, treatment, and long-term management of hematological cancers. The most substantial buyer segment consists of major specialized hospitals and large university medical centers, particularly those designated as comprehensive cancer centers. These institutions purchase large volumes of these drugs, ranging from established chemotherapies to newly approved targeted agents and high-value immunotherapies, often through institutional procurement contracts. Their purchasing decisions are heavily influenced by clinical guidelines, formulary status, and the institutional capability to manage the logistical and clinical requirements associated with complex treatments, such as having certified personnel and specialized infrastructure necessary for CAR T-cell infusion and monitoring for cytokine release syndrome (CRS).

Specialty cancer clinics and community oncology practices represent another significant customer base. While these settings typically handle a greater proportion of outpatient treatment and maintenance therapies, particularly for chronic conditions like CLL and CML utilizing oral TKIs, their demand for IV-administered monoclonal antibodies and supportive care medications remains high. As treatment paradigms shift towards outpatient care where feasible, these specialty clinics are expanding their capacity to administer complex infusion therapies, driving increased direct sales from pharmaceutical manufacturers. The focus in these settings is on convenience, patient adherence for oral drugs, and efficient reimbursement management, making simplified administration protocols and robust patient support programs highly valued components of the drug offering.

A smaller, yet strategically vital, customer segment includes contract research organizations (CROs) and academic research institutes engaged in preclinical and clinical trials. These entities procure specialized drugs, including investigational compounds and reference products, for use in sponsored research aimed at developing next-generation treatments or exploring new indications for existing therapies. Furthermore, national and regional government health agencies and procurement bodies act as key customers, particularly in countries with centralized health systems (e.g., UK, Canada, Australia). Their role is pivotal in bulk purchasing, determining essential drug lists, and setting price ceilings, making them critical stakeholders influencing market access and volume uptake across national populations. The procurement metrics for this segment heavily emphasize demonstrated clinical efficacy, overall survival benefit, and comparative cost-effectiveness data.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $71.5 Billion |

| Market Forecast in 2033 | $135.8 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bristol-Myers Squibb, Novartis AG, Gilead Sciences (Kite Pharma), AbbVie Inc., Johnson & Johnson, F. Hoffmann-La Roche Ltd., Amgen Inc., Pfizer Inc., AstraZeneca PLC, Regeneron Pharmaceuticals, Sanofi S.A., Takeda Pharmaceutical Company Limited, Daiichi Sankyo Company, Limited, BeiGene, Ltd., Seagen Inc., Celgene Corporation (Acquired by BMS), Merck & Co., Inc., Spectrum Pharmaceuticals, Inc., Servier Pharmaceuticals, Incyte Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blood Cancer Drugs Market Key Technology Landscape

The technological landscape of the Blood Cancer Drugs Market is undergoing rapid transformation, largely dominated by advancements in cellular and genetic engineering. The most impactful technology is Chimeric Antigen Receptor (CAR) T-cell therapy, which involves genetically modifying a patient’s T-cells to express a CAR that targets specific antigens (like CD19 or BCMA) found on cancer cells. This technology, while revolutionary for B-cell malignancies and multiple myeloma, requires sophisticated viral vector technology for T-cell modification and highly specialized cleanroom facilities for scalable manufacturing. Innovation is now focused on improving the safety profile of these therapies, such as developing ‘suicide switches’ or optimizing the CAR construct to reduce life-threatening toxicities like neurotoxicity and cytokine release syndrome (CRS), making it a technically demanding but clinically vital sector.

Beyond autologous cell therapies, the technological frontier is expanding rapidly into next-generation immunotherapies, specifically Bispecific T-cell Engagers (BiTEs) and similar formats. These technologies are engineered antibodies that simultaneously bind to a target antigen on the cancer cell (e.g., CD30, CD20) and a T-cell activation receptor (CD3), effectively bridging the immune cell and the tumor cell to induce targeted cytotoxicity. The technical challenge lies in optimizing the antibody structure to maximize half-life, reduce immunogenicity, and ensure effective tumor penetration and T-cell activation without systemic immunosuppression. Furthermore, high-throughput screening and computational chemistry play pivotal roles in designing and optimizing small molecule inhibitors, particularly next-generation Bruton's tyrosine kinase (BTK) inhibitors or novel proteasome inhibitors, ensuring high selectivity against malignant kinase targets while minimizing off-target effects crucial for chronic blood cancer management.

Gene editing tools, notably CRISPR/Cas9, are increasingly being adopted not only in research but also in the commercial pipeline to create allogeneic, or “off-the-shelf,” cell therapies. This technology allows for precise modifications of donor T-cells (e.g., knocking out TCR to prevent graft-versus-host disease or removing endogenous receptors) so they can be manufactured in advance and stored, solving the immense logistical challenge and time delays associated with autologous production. This transition requires overcoming significant regulatory hurdles related to gene editing safety and demonstrating clinical equivalence to approved autologous therapies. The integration of advanced computational biology and Artificial Intelligence (AI) to interpret complex genomic data and predict drug response phenotypes is also central to the technology landscape, driving the development of highly specialized companion diagnostics that are inextricably linked to the commercial success of many new targeted blood cancer drugs.

Regional Highlights

- North America (U.S. and Canada): This region dominates the Blood Cancer Drugs Market, primarily due to the presence of key pharmaceutical and biotechnology headquarters, high per capita healthcare spending, and sophisticated infrastructure capable of delivering complex, specialized treatments like CAR T-cell therapy. The United States market is characterized by rapid adoption of novel targeted agents, favorable reimbursement policies for high-cost oncology drugs, and a significant number of ongoing clinical trials for hematological malignancies. High prevalence rates of NHL and MM, combined with advanced diagnostic screening, ensure sustained demand. Regulatory pathways, especially the FDA's streamlined approval process for breakthrough therapies, accelerate market entry and innovation uptake.

- Europe (Germany, France, UK, Italy, Spain): Europe represents the second-largest market, driven by universal healthcare coverage which facilitates broad patient access to approved therapies, albeit often subject to stringent cost-effectiveness evaluations (e.g., NICE in the UK). Germany and France lead in terms of revenue, supported by established research institutions and high rates of adoption for targeted therapies. The region is seeing growth in the biosimilar market segment, which pressures the pricing of older monoclonal antibody therapies, necessitating strategic market shifts towards premium-priced innovation, particularly in the immunotherapy sector.

- Asia Pacific (APAC) (China, Japan, India, South Korea): APAC is projected to be the fastest-growing regional market due to an escalating patient population, substantial improvements in healthcare infrastructure, and rising disposable incomes that enable greater access to advanced treatments. Japan remains a mature market, adopting global innovations quickly. China, however, is emerging as a critical growth engine, driven by significant government investment in domestic biotech research and manufacturing capabilities, coupled with expanding reimbursement coverage for innovative oncology treatments. Market penetration is often focused on oral targeted drugs for chronic leukemias initially.

- Latin America (LATAM) (Brazil, Mexico, Argentina): This region presents moderate growth, constrained primarily by economic instability, fragmented healthcare systems, and challenges in securing consistent reimbursement for high-cost biologics. Market access is often slow and heavily reliant on government tenders and regional budget allocations. Brazil and Mexico are the largest contributors, where private insurance sectors play a crucial role in the adoption of premium blood cancer drugs, while public systems often prioritize generics and biosimilars.

- Middle East and Africa (MEA): The MEA market is highly heterogeneous. Growth is concentrated in the Gulf Cooperation Council (GCC) countries (Saudi Arabia, UAE) due to high state-funded healthcare expenditures, leading to rapid adoption of sophisticated oncology treatments, including targeted and immune therapies. Africa faces significant challenges related to underdeveloped infrastructure, poor diagnosis rates, and limited access to specialized drugs, making the market highly reliant on philanthropic initiatives and subsidized access programs for essential chemotherapy agents.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blood Cancer Drugs Market.- Bristol-Myers Squibb (BMS)

- Novartis AG

- Gilead Sciences (Kite Pharma)

- AbbVie Inc.

- Johnson & Johnson (Janssen Global Services, LLC)

- F. Hoffmann-La Roche Ltd.

- Amgen Inc.

- Pfizer Inc.

- AstraZeneca PLC

- Regeneron Pharmaceuticals

- Sanofi S.A.

- Takeda Pharmaceutical Company Limited

- Daiichi Sankyo Company, Limited

- BeiGene, Ltd.

- Seagen Inc.

- Merck & Co., Inc.

- Incyte Corporation

- Servier Pharmaceuticals

- Jazz Pharmaceuticals plc

- Kyowa Kirin Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Blood Cancer Drugs market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary growth driver for the Blood Cancer Drugs Market?

The primary growth driver is the rapid advancement and commercialization of specialized immunotherapies, particularly CAR T-cell treatments and next-generation targeted therapies like BTK inhibitors, coupled with the increasing prevalence of hematologic cancers in the aging global population. These innovative treatments offer superior efficacy, driving demand and higher revenue generation across established markets.

How does CAR T-cell therapy impact the overall market structure?

CAR T-cell therapy significantly increases the market valuation due to its high cost and curative potential for refractory diseases. It fundamentally shifts the structure towards personalized medicine, demanding specialized logistics, high infrastructural investment (specialty centers), and intensive physician training, thus raising the barriers to entry for new competitors in the advanced immunotherapy segment.

Which indication segment shows the strongest immediate growth potential?

The Multiple Myeloma (MM) indication segment demonstrates the strongest immediate growth potential. This is driven by the necessity for patients to cycle through multiple lines of treatment, requiring a continuous influx of novel mechanisms of action, including IMiDs, proteasome inhibitors, and newly approved BCMA-targeted drugs and cellular therapies.

What are the major restraints hindering the growth of blood cancer drug adoption?

Major restraints include the extremely high price points of novel therapies, leading to significant accessibility and reimbursement challenges globally. Additionally, the complexity and logistical constraints associated with the manufacturing and specialized administration of living cell therapies (CAR T-cells) limit their scalability and widespread availability outside of major medical centers.

What role does the Asia Pacific region play in future market growth?

The Asia Pacific (APAC) region is forecasted to achieve the highest CAGR, primarily driven by improving healthcare infrastructure, rising incidence of hematological cancers in populous countries like China and India, and increasing government initiatives to expand insurance coverage for advanced oncology treatments, fostering greater uptake of targeted and biological drugs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager