Blood Chemistry Analysis Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438739 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Blood Chemistry Analysis Software Market Size

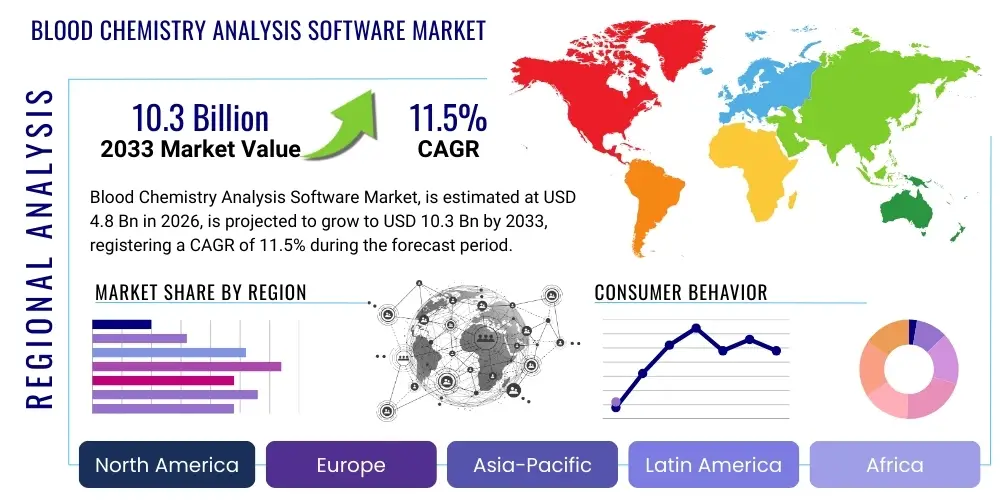

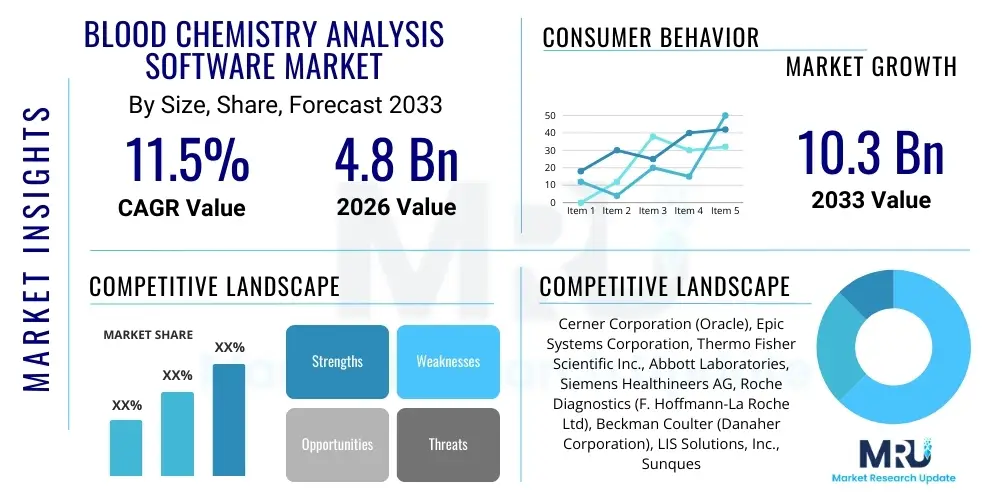

The Blood Chemistry Analysis Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 10.3 Billion by the end of the forecast period in 2033.

Blood Chemistry Analysis Software Market introduction

The Blood Chemistry Analysis Software Market encompasses advanced digital platforms and applications designed for the automated processing, interpretation, storage, and visualization of biochemical test results derived from blood samples. These sophisticated tools are crucial for modern diagnostic laboratories and healthcare providers, transforming raw data generated by automated clinical chemistry analyzers into actionable clinical insights. The software solutions offer features ranging from quality control management, normalization of data across different instruments, integration with Electronic Health Records (EHRs), and generation of comprehensive patient reports, thereby enhancing diagnostic accuracy and streamlining laboratory workflows globally. As healthcare systems increasingly rely on rapid and accurate diagnostics for chronic disease management and preventive care, the demand for robust and reliable blood chemistry analysis software continues to escalate, driven by the sheer volume of tests performed daily.

The primary applications of this software span clinical diagnostics, pharmaceutical research, toxicology screening, and academic research institutions. In clinical settings, the software facilitates the timely detection and monitoring of critical health indicators such as liver function, kidney function, electrolyte balance, and lipid profiles. The evolution of these platforms incorporates features like secure cloud-based deployment, allowing for remote access and collaborative diagnostics, which is especially important in distributed healthcare networks. Furthermore, the interoperability standards, such as Health Level Seven (HL7) and Fast Healthcare Interoperability Resources (FHIR), are central to the software's functionality, ensuring seamless data exchange between laboratory information systems (LIS) and hospital information systems (HIS), thereby improving efficiency and reducing manual transcription errors.

Key driving factors fueling market expansion include the increasing incidence of chronic diseases, which necessitates frequent and complex blood testing, and the global push toward digital health transformation and laboratory automation. The benefits offered by these solutions—such as reduced turnaround time for results, enhanced data security compliance (e.g., HIPAA and GDPR), improved quality assurance through automated flagging of critical values, and optimized resource utilization—make them indispensable tools for high-throughput laboratories. The integration of advanced analytical capabilities, particularly machine learning algorithms for predictive diagnostics and identification of subtle physiological changes, is poised to redefine the market landscape, offering greater value beyond mere data management.

- Product Description: Software platforms for automated processing, interpretation, storage, and reporting of clinical chemistry data.

- Major Applications: Clinical diagnostics, chronic disease monitoring, pharmaceutical R&D, toxicology screening, and forensic science.

- Benefits: Increased analytical accuracy, reduced laboratory turnaround time (TAT), enhanced data security and regulatory compliance, and improved integration with EHR systems.

- Driving Factors: Rising prevalence of chronic and metabolic disorders, technological advancements in laboratory automation, and demand for rapid, integrated diagnostic results.

Blood Chemistry Analysis Software Market Executive Summary

The global Blood Chemistry Analysis Software Market is experiencing significant momentum, characterized by a shift towards integrated, cloud-based solutions and the profound influence of artificial intelligence in enhancing diagnostic precision. Business trends indicate a strong focus on strategic partnerships between software vendors and major diagnostic equipment manufacturers to ensure seamless system compatibility and end-to-end solutions for laboratories. Consolidation among mid-sized vendors specializing in specific niche applications, such as quality control or specialized endocrinology analysis, is also a notable trend. The competitive environment is leaning heavily toward platforms that offer superior interoperability (FHIR compliance) and robust cybersecurity measures, addressing the growing concerns over protected health information (PHI) security in networked environments. Furthermore, subscription-based service models (SaaS) are becoming predominant, offering predictable expenditure models for healthcare institutions compared to traditional perpetual licensing.

Regionally, North America maintains its dominance, primarily due to high healthcare expenditure, early adoption of advanced laboratory technologies, and the presence of stringent regulatory frameworks that mandate high standards for data quality and management. However, the Asia Pacific (APAC) region is projected to register the highest growth rate, fueled by rapidly expanding healthcare infrastructure, increasing awareness of preventive diagnostics, and substantial government investments in digitalizing public health services, particularly in countries like China and India. European markets, while mature, are seeing robust growth driven by the need for cross-border data management solutions compliant with GDPR, pushing vendors to develop highly scalable and secure architectures.

Segmentation trends highlight the rapid expansion of the Cloud-Based deployment segment, favored for its flexibility, lower infrastructure costs, and scalability, especially beneficial for smaller or decentralized lab networks. Among application types, the Hospitals and Clinics segment remains the largest end-user due to the volume of tests conducted, though independent diagnostic laboratories are growing quickly through consolidation and optimization of their operations using advanced analytical software. The market also shows increasing polarization between standardized, high-volume platforms and specialized analytical tools tailored for complex biomarkers, reflecting a bifurcated demand structure based on the end-user’s operational scale and specialization requirements.

AI Impact Analysis on Blood Chemistry Analysis Software Market

Common user questions regarding AI's influence in the Blood Chemistry Analysis Software Market revolve primarily around three core themes: enhancement of diagnostic accuracy, implications for workflow automation and efficiency, and concerns regarding data privacy and regulatory validation. Users frequently inquire about how AI can move beyond simple threshold flagging to identify complex, subtle patterns indicative of early-stage diseases that human analysts might miss. There is also keen interest in AI's role in predictive maintenance for lab equipment and optimizing sample routing, directly impacting operational efficiency and cost savings. Furthermore, the necessity for robust validation frameworks for AI-driven diagnostic suggestions and the ethical implications of algorithmic bias in diverse patient populations are prominent concerns driving user research in this domain. Users expect AI to fundamentally change the interpretation phase of blood chemistry analysis, demanding clear, regulatory-compliant solutions that augment, rather than replace, clinical judgment.

The integration of Artificial Intelligence and Machine Learning (ML) is rapidly transitioning blood chemistry analysis software from basic data reporting tools into sophisticated predictive diagnostic engines. AI algorithms can process vast datasets of patient results, correlating current biochemical markers with historical outcomes, patient demographics, and co-morbidities to identify complex diagnostic signatures. This capability significantly improves the early detection of conditions such as acute kidney injury, subtle liver damage, and metabolic syndrome, offering clinicians a powerful tool for proactive intervention. For example, ML models are being developed to identify pre-analytical errors, ensuring sample integrity and minimizing the incidence of false positives or negatives, thereby raising the overall quality of laboratory output. This evolution is vital for handling the complexity arising from multi-panel testing and the sheer volume of data generated by modern high-throughput analyzers.

Beyond diagnostics, AI profoundly impacts the operational aspects of the laboratory. AI-driven software optimizes quality control (QC) procedures by intelligently predicting instrument drift or potential failures before they affect patient results, shifting QC from a reactive to a proactive process. Furthermore, natural language processing (NLP) is being utilized to analyze unstructured data within EHRs and correlate it with structured lab results, creating a richer contextual understanding for the software’s interpretive algorithms. This strategic implementation of AI promises not only enhanced clinical value but also substantial operational efficiencies, justifying the higher investment in these next-generation analytical platforms. However, successful adoption hinges on developing transparent, explainable AI (XAI) models that clinicians can trust, addressing the foundational concerns of regulatory bodies and end-users.

- AI-Driven Predictive Diagnostics: Identification of subtle biomarker patterns for early disease detection (e.g., pre-symptomatic sepsis or cardiovascular risk assessment).

- Automated Quality Control (QC): Use of ML to predict instrument failures and optimize calibration schedules, minimizing downtime and error rates.

- Enhanced Data Interpretation: Correlation of blood chemistry results with genetic data, imaging findings, and clinical notes for holistic patient assessment.

- Operational Efficiency: AI optimization of laboratory workflow, sample tracking, and resource allocation, reducing overall turnaround time.

- Regulatory and Trust Challenges: Need for explainable AI (XAI) and rigorous validation frameworks to ensure clinical acceptance and regulatory compliance.

DRO & Impact Forces Of Blood Chemistry Analysis Software Market

The Blood Chemistry Analysis Software Market is shaped by a powerful interplay of accelerating drivers and constraining factors, balanced by significant untapped opportunities that define its future trajectory. The primary drivers include the escalating global burden of chronic diseases, such as diabetes, cardiovascular conditions, and chronic kidney disease, which necessitate routine and detailed blood chemistry profiling. This high volume of testing inherently drives the need for automated, sophisticated analytical software to manage and interpret data efficiently. Furthermore, the global momentum toward healthcare digitization, spurred by governmental initiatives promoting EHR adoption and laboratory automation, provides a foundational technological substrate for market growth. The increasing complexity of diagnostic panels, including specialized biomarker testing, demands equally complex software capable of integrating disparate data sources and performing multi-parametric analysis, thereby bolstering demand for advanced solutions.

However, the market faces notable restraints, predominantly centered around high initial implementation costs and the substantial challenge of ensuring seamless interoperability across heterogeneous healthcare IT environments. Integrating new analytical software with legacy LIS and HIS systems can be technologically complex, time-consuming, and resource-intensive, particularly in older or public healthcare facilities. Data security and patient privacy remain critical concerns, as the software handles highly sensitive Protected Health Information (PHI). Compliance with diverse global and regional regulations, such as HIPAA in the US and GDPR in Europe, imposes significant developmental and operational constraints on software vendors. Additionally, a persistent shortage of highly specialized IT professionals skilled in managing and troubleshooting complex clinical informatics systems can hinder the effective deployment and utilization of these advanced tools.

The core opportunities in this market lie in the expansion of direct-to-consumer diagnostics and point-of-care testing (POCT), requiring software capable of handling distributed data generation and integrating results rapidly into centralized patient records. The development of AI-driven platforms that provide genuinely predictive and personalized medicine insights, moving beyond descriptive reporting, represents a major avenue for value creation. Furthermore, penetrating emerging markets, particularly in Latin America and Southeast Asia, presents substantial growth potential as these regions rapidly upgrade their laboratory infrastructure. The impact forces indicate that the continuous necessity for improved diagnostic accuracy and efficiency will outweigh the challenges posed by integration hurdles, ensuring sustained market expansion, particularly through SaaS models which mitigate the initial capital expenditure burden for end-users.

Segmentation Analysis

The Blood Chemistry Analysis Software Market is comprehensively segmented based on deployment type, application, end-user, and component, providing a granular view of market dynamics and adoption patterns. Analyzing these segments helps stakeholders tailor their strategies to specific market needs, focusing on either cost-effective, high-volume solutions or highly specialized, analytically intensive platforms. The fundamental shift towards cloud-based architectures is the most defining feature of current segmentation trends, driven by the desire for scalability, reduced infrastructure overhead, and enhanced collaborative diagnostic capabilities, contrasting sharply with traditional, secure but less flexible on-premise solutions. Understanding these segment dynamics is crucial for forecasting future investment priorities across the clinical informatics spectrum.

- By Deployment Type: On-Premise, Cloud-Based.

- By Application: Routine Clinical Chemistry, Specialized Clinical Chemistry (e.g., Endocrinology, Toxicology), Therapeutic Drug Monitoring (TDM), and Research Applications.

- By End-User: Hospitals and Clinics, Diagnostic Laboratories, Research and Academic Institutions, Pharmaceutical and Biotechnology Companies.

- By Component: Software/Platform (Core Processing, Interpretation, Reporting), Services (Implementation, Maintenance, Training).

Value Chain Analysis For Blood Chemistry Analysis Software Market

The value chain for Blood Chemistry Analysis Software is complex, beginning with upstream technology providers and extending through sophisticated integration services to the ultimate end-users—healthcare providers. Upstream activities involve software development and data infrastructure provision. This segment is dominated by specialized software firms and cloud service providers (CSPs) like Amazon Web Services or Microsoft Azure, which supply the foundational tools, operating systems, security protocols, and scalable hosting environments required for clinical data processing. Key activities here include ensuring regulatory compliance (e.g., medical device classification for diagnostic software) and adherence to data exchange standards (HL7/FHIR). Success at this stage relies heavily on intellectual property, cybersecurity resilience, and the ability to integrate advanced analytical modules, such as AI/ML algorithms.

Midstream activities encompass the actual development, customization, and distribution of the finalized software product. This phase includes integrating the analysis software with chemistry analyzers manufactured by companies like Roche, Siemens Healthineers, and Abbott, ensuring hardware-software synergy. Distribution channels are typically bifurcated into direct sales models, where large vendors sell high-value enterprise systems directly to major hospital networks, and indirect channels, utilizing distributors or value-added resellers (VARs) who specialize in regional deployment, system integration, and localized technical support. VARs are particularly critical in emerging markets where direct vendor presence is limited. The success of the distribution stage hinges on the strength of technical partnerships and the ability of channels to offer localized regulatory expertise and rapid maintenance services.

Downstream activities focus on deployment, end-user adoption, and ongoing service provision. End-users—hospitals, diagnostic labs, and research facilities—rely heavily on robust implementation services, including data migration, staff training, and continuous technical support. The long-term value generated comes from the software's ability to drive efficiency (reduced turnaround time), improve diagnostic quality, and maintain compliance. Feedback from downstream users often informs upstream development, creating a continuous improvement cycle. The movement toward subscription-based services in the downstream segment emphasizes the ongoing importance of maintenance, security updates, and feature upgrades as core value propositions, shifting the focus from product sale to continuous service delivery and client retention.

Blood Chemistry Analysis Software Market Potential Customers

The primary customers for Blood Chemistry Analysis Software are entities engaged in high-volume biochemical testing and clinical diagnostics, requiring structured data management and sophisticated interpretive capabilities. These include large hospital networks and associated clinics, which serve as the cornerstone of demand due to their expansive patient bases and requirement for integrating lab results seamlessly into Electronic Health Records (EHRs). Independent diagnostic laboratories, often functioning as commercial reference laboratories, are another crucial segment. These labs prioritize high-throughput capabilities, scalability, and the ability to handle complex test menus across geographically distributed sites, making them prime candidates for advanced, cloud-based analytical platforms optimized for logistical efficiency and rapid reporting.

Beyond traditional clinical settings, significant potential lies within specialized research institutions, including academic medical centers and university research labs. These customers require highly flexible software capable of managing clinical trial data, facilitating biomarker discovery, and supporting complex statistical analysis, often demanding specialized modules for toxicology or genetic correlation studies. Additionally, the pharmaceutical and biotechnology sector represents a growing customer base, utilizing blood chemistry analysis software during pre-clinical and clinical drug development phases for toxicity monitoring, efficacy evaluation, and regulatory submissions. The shift towards personalized medicine trials further emphasizes the need for sophisticated software capable of managing small, highly complex data sets.

Emerging potential customers include specialized toxicology screening centers (forensic and occupational health labs) and, increasingly, companies involved in direct-to-consumer health and wellness testing. Although smaller in volume individually, the cumulative growth of POCT sites and wellness clinics requiring simple, standardized reporting integrated with telemedicine platforms is creating a new segment of demand for lightweight, user-friendly, secure analytical software interfaces. For all customer types, the deciding factor in purchasing decisions is increasingly focused on interoperability standards (FHIR), regulatory compliance, and the quantifiable clinical utility derived from AI-enhanced interpretation features.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 10.3 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cerner Corporation (Oracle), Epic Systems Corporation, Thermo Fisher Scientific Inc., Abbott Laboratories, Siemens Healthineers AG, Roche Diagnostics (F. Hoffmann-La Roche Ltd), Beckman Coulter (Danaher Corporation), LIS Solutions, Inc., Sunquest Information Systems, LabVantage Solutions, Inc., Medical Information Technology, Inc. (Meditech), Data Innovations, Orchard Software Corporation, CompuGroup Medical, XIFIN, Inc., Alere (Abbott), Psyche Systems, CliniSys Group, Technidata, Merge Healthcare (IBM). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blood Chemistry Analysis Software Market Key Technology Landscape

The technological landscape of the Blood Chemistry Analysis Software Market is defined by a rapid evolution toward highly interconnected, intelligent, and scalable architectures. Central to this development is the robust implementation of cloud computing, particularly hybrid cloud models, which offer the flexibility of off-premise processing for large-scale analysis while maintaining critical data components securely on-premise or within private clouds. This enables rapid deployment, automatic scaling to manage fluctuating test volumes, and centralized data management across diverse geographic locations. Furthermore, the commitment to open standards is a non-negotiable technological requirement; the adoption of interoperability protocols like FHIR is critical for allowing seamless, standardized communication between the laboratory information system (LIS), hospital information system (HIS), and third-party AI analytical tools, moving the market away from proprietary, siloed platforms toward a unified digital ecosystem.

A second major technological trend is the embedded use of sophisticated Machine Learning (ML) and Deep Learning algorithms for enhanced data interpretation. These AI components are moving beyond simple trend analysis to perform differential diagnostics, identify latent disease markers, and predict patient outcomes based on historical blood chemistry profiles. Technologies such as Natural Language Processing (NLP) are also increasingly important for contextualizing laboratory results with unstructured patient notes and clinical histories within the EHR, ensuring a richer, more accurate interpretation. This push for advanced analytics demands high-performance data processing capabilities, often necessitating the use of specialized hardware accelerators and highly optimized database structures capable of handling petabytes of secure clinical data efficiently while ensuring auditability and traceability, essential for clinical use.

The third critical element involves cybersecurity and data integrity technologies. Given the sensitive nature of PHI handled by these systems, vendors are heavily investing in blockchain technology, though still nascent, for immutable record-keeping and enhanced data transparency, particularly in tracking chain-of-custody for samples and results. More immediate implementations include advanced encryption standards (e.g., end-to-end encryption for data in transit and at rest), multi-factor authentication, and continuous vulnerability monitoring compliant with ISO 27001 standards. The software must be designed with security by default (SecDevOps principles) to meet stringent regulatory requirements globally. The convergence of secure cloud infrastructure, advanced AI interpretation, and standardized interoperability protocols dictates the competitive edge for next-generation blood chemistry analysis solutions.

Regional Highlights

The regional analysis of the Blood Chemistry Analysis Software Market reveals differential growth and adoption patterns influenced by healthcare infrastructure, regulatory environment, and technological maturity levels across major geographic areas. North America, encompassing the United States and Canada, currently holds the largest market share. This dominance is attributed to high healthcare expenditure, the widespread presence of sophisticated diagnostic laboratory networks, and early, aggressive adoption of digital health technologies, including mandatory transitions to EHRs and LIS systems. The region benefits from significant investments in AI-driven diagnostics and a highly competitive vendor landscape pushing continuous innovation. Stringent regulatory compliance mandates, such as HIPAA, also drive demand for high-security, robust software platforms.

Europe represents the second-largest market, characterized by stable growth supported by well-established universal healthcare systems and a strong focus on interoperability standards across EU member states. Countries like Germany, the UK, and France are prominent adopters, driven by aging populations and the need to manage chronic diseases efficiently. The implementation of the General Data Protection Regulation (GDPR) has profoundly influenced software development in this region, forcing vendors to prioritize data residency and privacy features, which inadvertently raises the technological bar for all European-serving platforms. Investment is increasingly focused on cloud solutions that can handle cross-border data management securely while adhering to varying national clinical guidelines.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally throughout the forecast period. This rapid expansion is primarily fueled by improving healthcare access, increasing governmental spending on modernizing public healthcare infrastructure, and the immense population base leading to high testing volumes. China, India, Japan, and South Korea are key contributors, characterized by a rapid shift from manual processes to automation. While initial adoption favors cost-effective and scalable solutions, sophisticated centers in developed APAC nations are rapidly deploying AI and high-end analytical software. The major growth challenge remains adapting international software solutions to fragmented local regulatory landscapes and integrating them into diverse, often resource-constrained, local laboratory settings. Latin America and the Middle East & Africa (MEA) are emerging markets, showing steady, albeit slower, growth driven by urbanization and private investment in healthcare facilities.

- North America: Market leader due to high technology adoption, substantial healthcare IT budgets, and stringent data compliance requirements (HIPAA). Focus on predictive AI and sophisticated LIS integration.

- Europe: Mature market, driven by universal healthcare systems and strong emphasis on data privacy and security compliance (GDPR). Increasing demand for scalable cloud solutions supporting cross-border diagnostics.

- Asia Pacific (APAC): Fastest growing region, fueled by infrastructure modernization, rising prevalence of chronic diseases, and governmental investments in digital health. High potential in India and China for volume-based solutions.

- Latin America & MEA: Emerging growth centers, primarily driven by private sector investment in modernizing clinical laboratories and improving access to standardized diagnostic testing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blood Chemistry Analysis Software Market.- Cerner Corporation (Oracle)

- Epic Systems Corporation

- Thermo Fisher Scientific Inc.

- Abbott Laboratories

- Siemens Healthineers AG

- Roche Diagnostics (F. Hoffmann-La Roche Ltd)

- Beckman Coulter (Danaher Corporation)

- LIS Solutions, Inc.

- Sunquest Information Systems

- LabVantage Solutions, Inc.

- Medical Information Technology, Inc. (Meditech)

- Data Innovations

- Orchard Software Corporation

- CompuGroup Medical

- XIFIN, Inc.

- Alere (Abbott)

- Psyche Systems

- CliniSys Group

- Technidata

- Merge Healthcare (IBM)

Frequently Asked Questions

Analyze common user questions about the Blood Chemistry Analysis Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of Blood Chemistry Analysis Software?

The primary driver is the accelerating global prevalence of chronic diseases (like diabetes and cardiovascular conditions) which necessitates high volumes of frequent and accurate biochemical testing, coupled with the mandatory integration of lab results into centralized Electronic Health Records (EHRs) for comprehensive patient management.

How does Artificial Intelligence (AI) influence the accuracy of blood chemistry analysis?

AI improves accuracy by employing Machine Learning algorithms to analyze complex biomarker correlations, identifying subtle diagnostic patterns that may indicate early disease stages, optimizing quality control procedures to minimize instrument error, and integrating contextual patient data for better clinical interpretation.

What are the key technical challenges facing the Blood Chemistry Analysis Software Market?

The major technical challenge involves ensuring seamless interoperability between new software platforms and disparate, often proprietary, legacy Hospital Information Systems (HIS) and Laboratory Information Systems (LIS). This is further complicated by the need for strict compliance with diverse global data security and privacy regulations (e.g., GDPR, HIPAA).

Which deployment model is gaining the most traction in the current market?

The Cloud-Based deployment model, including Software as a Service (SaaS), is gaining the most traction. This model offers superior benefits in terms of scalability, reduced upfront capital expenditure, flexibility for distributed lab networks, and simplified maintenance and automated security updates compared to traditional on-premise solutions.

Which geographic region is expected to show the fastest growth rate?

The Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR). This is driven by significant governmental investments in modernizing healthcare infrastructure, expanding diagnostic access to large populations, and the growing demand for automated laboratory solutions in countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager