Blood Glucose Test Strip Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435728 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Blood Glucose Test Strip Market Size

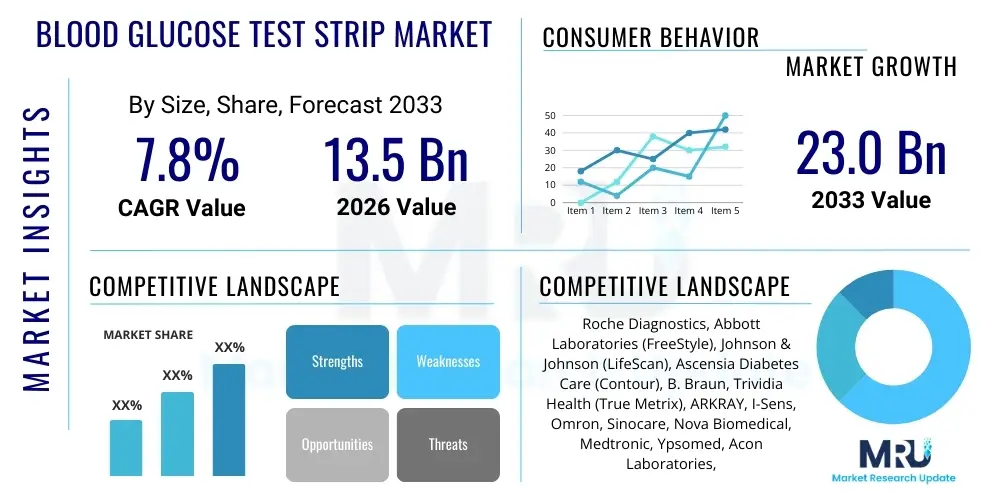

The Blood Glucose Test Strip Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 13.5 Billion in 2026 and is projected to reach USD 23.0 Billion by the end of the forecast period in 2033.

Blood Glucose Test Strip Market introduction

The Blood Glucose Test Strip Market encompasses the production and distribution of disposable strips used in conjunction with portable glucometers for self-monitoring of blood glucose (SMBG) levels, a crucial practice for managing diabetes mellitus. These strips primarily utilize enzymatic electrochemical sensing technology, where a small blood sample reacts with an immobilized enzyme, such as glucose oxidase (GO) or glucose dehydrogenase (GDH), to generate an electrical current proportional to the glucose concentration. This essential medical consumable allows patients, particularly those with Type 1 and Type 2 diabetes requiring insulin therapy, to track glycemic control, make informed decisions regarding diet, exercise, and medication dosage, thereby mitigating the risk of acute and long-term diabetic complications.

The primary applications of these strips are concentrated in homecare settings, facilitating frequent self-testing necessary for intensive diabetes management, although they are also extensively used in clinical environments, emergency departments, and long-term care facilities. The key benefits driving market demand include their portability, ease of use, rapid results delivery (typically within 5 to 10 seconds), and cost-effectiveness compared to laboratory-based testing. Furthermore, continuous technological refinement has resulted in strips requiring smaller blood volumes and offering greater accuracy and resistance to interferences like hematocrit variations or certain medications.

Major driving factors fueling the expansion of this market include the escalating global prevalence of diabetes, largely attributable to sedentary lifestyles, aging populations, and rising obesity rates. Simultaneously, increased awareness regarding proactive diabetes management, coupled with supportive governmental initiatives and reimbursement policies in developed economies, encourages greater frequency of SMBG. Although the market faces competition from Continuous Glucose Monitoring (CGM) systems, test strips remain indispensable due to their affordability, reliability for calibration and verification, and accessibility in resource-limited settings, ensuring their sustained importance in the diabetes care continuum.

Blood Glucose Test Strip Market Executive Summary

The Blood Glucose Test Strip Market demonstrates robust growth, primarily driven by the pandemic of diabetes worldwide and the increasing emphasis on preventative healthcare and patient-centric remote monitoring. Business trends indicate a strong focus on enhancing strip accuracy, reducing sample size requirements, and improving connectivity features within glucometers to facilitate data sharing with healthcare providers, thereby supporting telemedicine models. Furthermore, there is a strategic shift towards reducing manufacturing costs through automation and vertical integration to maintain competitive pricing against non-invasive or minimally invasive alternatives like CGM. Key manufacturers are also concentrating on emerging markets, recognizing the large, untapped diabetic population in Asia Pacific and Latin America, which presents significant growth potential despite lower average selling prices.

Regional trends show North America maintaining dominance due to high diabetes prevalence, established reimbursement structures, and rapid adoption of advanced testing technologies, while Europe follows closely, characterized by stringent regulatory standards and strong public healthcare procurement. However, the Asia Pacific region is poised for the highest growth rate, fueled by improving healthcare access, increasing disposable income, and a rapidly expanding diabetic base, particularly in populous countries such as China and India. This regional expansion is challenging manufacturers to develop localized distribution strategies and cost-optimized products tailored for varied economic strata.

Segment trends reveal that the Glucose Oxidase (GO) technology segment continues to hold a significant share due to its established reliability and standardization, though the Glucose Dehydrogenase (GDH)-based strips, particularly those less prone to maltose interference, are seeing adoption growth. The Homecare End-User segment remains the largest consumer, reflecting the fundamental purpose of SMBG. Crucially, the evolving competitive landscape is witnessing sustained price pressure, compelling companies to innovate not only in strip chemistry but also in packaging, logistics, and user experience to secure market share and brand loyalty among chronic disease patients requiring high-frequency testing.

AI Impact Analysis on Blood Glucose Test Strip Market

Common user questions regarding AI's impact on the Blood Glucose Test Strip Market often center on whether AI will ultimately replace traditional strips, how AI can improve strip reliability and manufacturing quality, and its potential role in optimizing supply chains to prevent shortages. Users are concerned about accuracy enhancements, desiring validation that AI-powered quality control systems can reduce batch variation and increase confidence in SMBG results. Furthermore, interest lies in how machine learning could integrate glucometer data with patient lifestyle information to offer truly personalized dosage recommendations, potentially reducing the frequency of necessary testing. The key themes revolve around automation, precision medicine integration, cost reduction, and enhancing the overall utility and efficiency of the existing test strip paradigm, rather than outright displacement, given the strip's current cost advantage and established reliability.

- AI enhances manufacturing precision by optimizing enzyme dispensing and layer deposition during strip production, leading to improved batch consistency and reduced waste.

- Machine learning algorithms are employed in Quality Control (QC) to analyze vast amounts of calibration data, quickly identifying and flagging outliers or defects that traditional statistical methods might miss.

- Predictive maintenance schedules for manufacturing equipment are optimized by AI, minimizing downtime and ensuring steady supply, addressing user concerns about strip availability.

- Integration of AI with glucometer data analysis enables advanced pattern recognition, helping users and clinicians adjust insulin regimens more effectively based on SMBG trends.

- AI-driven inventory and logistics management optimize distribution channels, ensuring efficient stocking levels in pharmacies and minimizing expiration waste, potentially stabilizing or reducing end-user costs.

- Development of AI-powered diagnostic software that interprets strip readings alongside clinical history, offering a secondary layer of validation and personalized health advice.

DRO & Impact Forces Of Blood Glucose Test Strip Market

The dynamics of the Blood Glucose Test Strip Market are governed by powerful forces encapsulated by Drivers, Restraints, and Opportunities (DRO). The primary drivers include the exponential increase in the global diabetic population and the rising global mandate for proactive self-management of chronic diseases. These are supported by technological advancements focusing on minimizing required blood volume and improving strip accuracy, thus enhancing user compliance. Conversely, the market faces significant restraints, most notably the intense price competition, leading to margin compression for manufacturers, and the escalating displacement threat posed by advanced Continuous Glucose Monitoring (CGM) and Flash Glucose Monitoring (FGM) systems, which offer greater convenience and continuous data streams.

Opportunities for growth are present through penetration into emerging markets where low-cost SMBG remains the most viable testing option, and through strategic partnerships integrating test strip data into broader digital health ecosystems. Developing highly specialized strips resistant to various chemical and biological interferences also presents a substantial opportunity to capture niche clinical segments. The interplay of these factors creates significant impact forces. Economic feasibility demands that test strip manufacturers achieve massive economies of scale to counter margin erosion from competition, while regulatory scrutiny ensures that new strips must meet stringent accuracy standards (such as ISO 15197:2013), directly influencing R&D expenditures.

The five major impact forces shaping the market trajectory include regulatory requirements (ensuring quality and patient safety), technological innovation (pushing for better accuracy and smaller samples), competitive intensity (driving down prices), threat of substitutes (CGM/FGM adoption), and macro-environmental factors (diabetes prevalence and healthcare expenditure). The market's future vitality depends heavily on the industry's ability to maintain high quality and accessibility while navigating the disruptive innovation of continuous monitoring technology. Manufacturers must emphasize the unique value proposition of strips—their affordability, calibration utility, and reliability in specific critical care scenarios—to secure their long-term relevance.

Segmentation Analysis

The Blood Glucose Test Strip Market is primarily segmented based on the technology utilized for enzymatic reaction, the end-user setting where the strips are consumed, and the distribution channels through which they reach the consumer. This segmentation provides clarity on the dominant product types and consumer behavior patterns that dictate demand dynamics. Technology segmentation is critical as it defines the strip’s performance characteristics, including potential interference from non-glucose sugars or oxygen. The dominant technologies, Glucose Oxidase and Glucose Dehydrogenase, reflect different trade-offs between cost, accuracy, and interference susceptibility, significantly influencing clinical preference and market adoption rates. Furthermore, the segmentation by end-user, differentiating between high-volume institutional use and consistent individual home use, dictates packaging, pricing, and specific feature requirements.

Segmentation by Distribution Channel, encompassing retail sales, hospital procurement, and increasingly important online platforms, highlights the changing accessibility and purchasing paradigms. The shift toward direct-to-consumer models, especially through e-commerce and subscription services, is impacting traditional pharmacy-centric sales structures. Each segment faces unique market challenges. For instance, the homecare segment is highly sensitive to price and convenience, necessitating innovative product designs, while the institutional segment places a premium on bulk purchasing capacity and integration with hospital information systems. Understanding these distinct segment needs is paramount for strategic market positioning and resource allocation among leading players.

The market structure is continually being refined by regulatory changes and patient preference shifts, demanding a flexible approach to product portfolio management. Manufacturers must carefully balance investment in established GO technology against the development of newer GDH variants that address known clinical limitations. The strategic imperative is to offer a differentiated product mix that caters simultaneously to the price-sensitive mass market through high-volume, cost-effective strips and to the premium segment seeking enhanced accuracy and technological integration, thereby maximizing overall market penetration across all key segments.

- By Technology

- Glucose Oxidase (GO)

- Glucose Dehydrogenase (GDH)

- Other (e.g., non-enzymatic)

- By End-User

- Hospitals and Clinics

- Homecare Settings/Self-Monitoring

- Diagnostic Laboratories

- By Distribution Channel

- Retail Pharmacies and Drug Stores

- Online Sales Channels

- Institutional Sales (Direct Procurement)

Value Chain Analysis For Blood Glucose Test Strip Market

The value chain for the Blood Glucose Test Strip Market begins with upstream activities focused on the sourcing and preparation of highly specialized biochemical components. This stage involves the procurement of high-purity enzymes (Glucose Oxidase, various GDH variants), electrochemical mediators, and substrate materials such as flexible polymer films and conductive inks. Efficiency and quality control at this stage are paramount, as the stability and accuracy of the final strip are directly dependent on the consistency and enzymatic activity of these raw materials. Major players often engage in rigorous vertical integration or establish long-term partnerships with specialized biochemical suppliers to ensure supply chain stability and protect proprietary enzyme formulations, which are critical differentiators in strip performance.

The middle segment of the value chain encompasses manufacturing and assembly, involving precision printing, lamination, cutting, and packaging of the test strips. This highly automated process requires advanced cleanroom environments and stringent quality checks, often leveraging AI and machine vision systems to detect minute defects. Cost optimization through high-volume production is crucial at this stage to maintain competitive pricing. Downstream activities focus on logistics and distribution, covering inventory management, warehousing, and transportation to regional distributors, institutional buyers, and retail points. Given the short shelf life of some biological components, efficient cold chain management, though less critical than for biologics, still plays a role in minimizing spoilage.

Distribution channels are categorized as direct and indirect. Direct distribution involves institutional sales to large hospitals, clinics, or government health programs, where manufacturers handle bulk logistics and often negotiate long-term contracts. Indirect channels rely on wholesale distributors, retail pharmacy chains (e.g., CVS, Walgreens), and increasingly, e-commerce platforms (Amazon, specialized medical suppliers). The rise of online sales is altering the traditional power balance, offering manufacturers direct access to consumers but increasing the complexity of managing pricing across diverse online and physical retail environments. Effective management across the entire chain, from enzyme stability (upstream) to timely retail availability (downstream), defines market leadership and profitability.

Blood Glucose Test Strip Market Potential Customers

The primary customer base for the Blood Glucose Test Strip Market is highly diversified but fundamentally anchored by individuals diagnosed with diabetes mellitus, necessitating frequent blood glucose monitoring for managing their condition. The largest segment comprises patients using insulin, particularly those with Type 1 diabetes and severe Type 2 diabetes, who require multiple daily tests (often 4 to 10 times a day) to adjust insulin doses effectively and prevent hypo- or hyperglycemia. These individuals, categorized as the high-volume/high-frequency end-user group, prioritize consistency, cost-effectiveness, and ease of use in their SMBG systems.

Secondary but crucial customer groups include healthcare institutions such as hospitals, diagnostic laboratories, and primary care clinics. Hospitals use test strips for point-of-care testing (POCT) in emergency rooms, intensive care units, and general wards, demanding fast, reliable results, often integrated with central patient data systems. Laboratories, though increasingly relying on automated analyzers, still use test strips for calibration verification and rapid near-patient testing. Additionally, geriatric care facilities and home healthcare agencies represent a growing customer base, focusing on monitoring elderly patients who may have difficulty managing complex devices.

A third group consists of non-diabetic individuals engaged in preventive health or those with pre-diabetes who monitor their glucose occasionally as part of a lifestyle modification program. While lower in usage frequency, this group represents a demographic growth opportunity for manufacturers focusing on wellness and early intervention. Ultimately, the market addresses the needs of anyone requiring rapid, quantitative assessment of blood glucose concentration outside of a formal laboratory setting, with procurement decisions often mediated by reimbursement policies, physician recommendations, and pharmacy availability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 13.5 Billion |

| Market Forecast in 2033 | USD 23.0 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Roche Diagnostics, Abbott Laboratories (FreeStyle), Johnson & Johnson (LifeScan), Ascensia Diabetes Care (Contour), B. Braun, Trividia Health (True Metrix), ARKRAY, I-Sens, Omron, Sinocare, Nova Biomedical, Medtronic, Ypsomed, Acon Laboratories, Sannuo, Bayer HealthCare. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blood Glucose Test Strip Market Key Technology Landscape

The technology landscape of the Blood Glucose Test Strip Market is predominantly defined by electrochemical biosensors, relying on the catalytic activity of specific enzymes to measure glucose levels. The two foundational technologies are Glucose Oxidase (GO) and Glucose Dehydrogenase (GDH). GO-based strips are historically prevalent, utilizing oxygen as an electron acceptor. While reliable, GO is susceptible to oxygen interference, and its reaction byproduct, hydrogen peroxide, can cause issues. Despite this, GO remains a major standard, especially in older glucometer models, due to its well-established manufacturing processes and cost efficiency. Innovation in GO strips focuses on improving electrode materials and mediator chemistry to stabilize the enzyme and enhance performance under varying hematocrit levels.

GDH-based technology is gaining significant traction, primarily because it does not require oxygen in the reaction, thus reducing interference issues often found in POCT environments. However, GDH itself has various cofactors (like PQQ, NAD, FAD), and early GDH-PQQ strips were prone to reacting with non-glucose sugars like maltose and xylose, leading to dangerously inaccurate readings in patients receiving certain medical treatments (e.g., peritoneal dialysis). Subsequent technological advances have focused on FAD-GDH or GDH-NAD variants that eliminate or significantly reduce this interference, positioning them as the preferred technology for newer, high-accuracy strip systems. Manufacturers are continually investing in enzyme engineering to enhance stability and specificity, crucial for meeting stringent new ISO standards.

Beyond the core enzymatic approach, the technological landscape includes advancements in strip structure and meter integration. Miniaturization allows for smaller blood sample sizes (often below 0.5 microliters), improving patient comfort and reducing the risk of insufficient sampling. Furthermore, smart strips are being developed that communicate more effectively with the glucometer, offering features like automatic calibration code recognition (no coding required) and checks for humidity or temperature issues that could compromise accuracy. The underlying trend is the development of highly integrated systems where the strip, the meter, and the digital application function seamlessly, providing validated, actionable data while maximizing user convenience and minimizing potential sources of error.

Regional Highlights

The global distribution of the Blood Glucose Test Strip Market exhibits distinct regional characteristics influenced by diabetes prevalence, healthcare expenditure, regulatory frameworks, and reimbursement policies. North America (NA) currently dominates the market, primarily due to the high incidence of both Type 1 and Type 2 diabetes, combined with sophisticated healthcare infrastructure that supports frequent SMBG and favorable reimbursement coverage by private and public payers (Medicare/Medicaid). The US market is characterized by high demand for premium, highly accurate strips and rapid adoption of new features like Bluetooth connectivity for data integration. Manufacturers in this region focus heavily on compliance with FDA regulations and maintaining competitive pricing strategies against intense local and international competition.

Europe represents the second largest market, marked by universal healthcare systems and centralized procurement policies, particularly in Western European countries like Germany, the UK, and France. While market penetration is high, the emphasis on cost-containment by national health services leads to greater price sensitivity and intense tendering processes, favoring high-volume, cost-effective solutions. The regulatory environment is governed by the European Medicines Agency (EMA) and local standards, which are highly focused on patient safety and device accuracy. Eastern Europe shows growth potential, driven by improving economic conditions and increased awareness, though access barriers remain higher than in the West.

The Asia Pacific (APAC) region is projected to register the fastest growth rate. This accelerated expansion is attributed to the sheer size of the diabetic population, particularly in China and India, rapidly increasing disposable incomes, and the modernization of healthcare infrastructure. Test strips are often the primary and most accessible monitoring tool in these regions due to the lower relative cost compared to CGMs. However, the APAC market is highly fragmented, characterized by a mix of multinational brands and strong local players, leading to fierce price competition. Market success relies on developing highly affordable, reliable products and navigating complex local regulatory approvals (e.g., NMPA in China). Latin America and the Middle East & Africa (MEA) are emerging regions, where growth is highly dependent on governmental health initiatives targeting diabetes control and the expansion of access to basic diagnostic tools in underserved rural areas.

- North America: Market leader driven by high prevalence, strong reimbursement coverage, demand for integrated digital solutions, and high acceptance of new technologies. The US remains the single largest consumer market globally.

- Europe: Mature market characterized by stringent regulatory standards, focus on cost efficiency due to state-managed healthcare procurement, and high utilization rates across all demographics.

- Asia Pacific (APAC): Highest growth potential fueled by massive diabetic population expansion, improving healthcare access, and the sustained affordability advantage of test strips over advanced substitutes. Local manufacturing is a significant competitive factor.

- Latin America: Emerging region with growth tied to urbanization and changing dietary habits; faces challenges related to inconsistent healthcare funding and reliance on imported products.

- Middle East & Africa (MEA): Growth driven by rapidly rising diabetes rates, particularly in Gulf nations, coupled with increasing governmental investments in chronic disease management and diagnostic infrastructure development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blood Glucose Test Strip Market.- Roche Diagnostics

- Abbott Laboratories (FreeStyle)

- Johnson & Johnson (LifeScan, now owned by Platinum Equity)

- Ascensia Diabetes Care (Contour)

- B. Braun Melsungen AG

- Trividia Health (True Metrix)

- ARKRAY, Inc.

- I-Sens, Inc.

- Omron Healthcare

- Sinocare Inc.

- Nova Biomedical

- Medtronic PLC (Specific to sensor integration and calibration)

- Ypsomed AG

- Acon Laboratories, Inc.

- Sannuo Biosensor Co., Ltd.

- HemoCue AB (Part of Danaher)

- Microlife Corporation

- Nipro Corporation

- Bayer HealthCare (Divested portfolio)

- Dexcom, Inc. (Indirectly, due to calibration needs)

Frequently Asked Questions

Analyze common user questions about the Blood Glucose Test Strip market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for blood glucose test strips?

The primary driver is the exponentially increasing global prevalence of diabetes mellitus (Type 1 and Type 2), which necessitates frequent self-monitoring of blood glucose (SMBG) for effective glycemic control and complication prevention.

How does the emergence of Continuous Glucose Monitoring (CGM) systems impact the test strip market?

CGM systems represent the largest restraint and substitute threat; however, test strips maintain crucial relevance due to their lower cost, widespread accessibility, utility for meter calibration, and essential role in critical care settings.

What is the difference between Glucose Oxidase (GO) and Glucose Dehydrogenase (GDH) test strip technology?

GO strips rely on oxygen, which can cause interference, whereas GDH strips are typically oxygen-independent, often providing better accuracy but requiring specific cofactor selection (FAD-GDH preferred) to prevent interference from non-glucose sugars like maltose.

Are test strip costs expected to rise or fall in the forecast period?

While manufacturing costs may stabilize due to automation, intense competition, especially from emerging APAC manufacturers and the threat of substitutes, is expected to continue exerting downward pressure on average selling prices, particularly in high-volume public procurement markets.

How can users ensure the maximum accuracy of their blood glucose test strip readings?

Users must strictly adhere to the manufacturer's instructions, check the strip expiration date, store strips correctly (avoiding humidity and extreme temperatures), use the correct coding (if required by the meter), and ensure adequate sample volume.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager