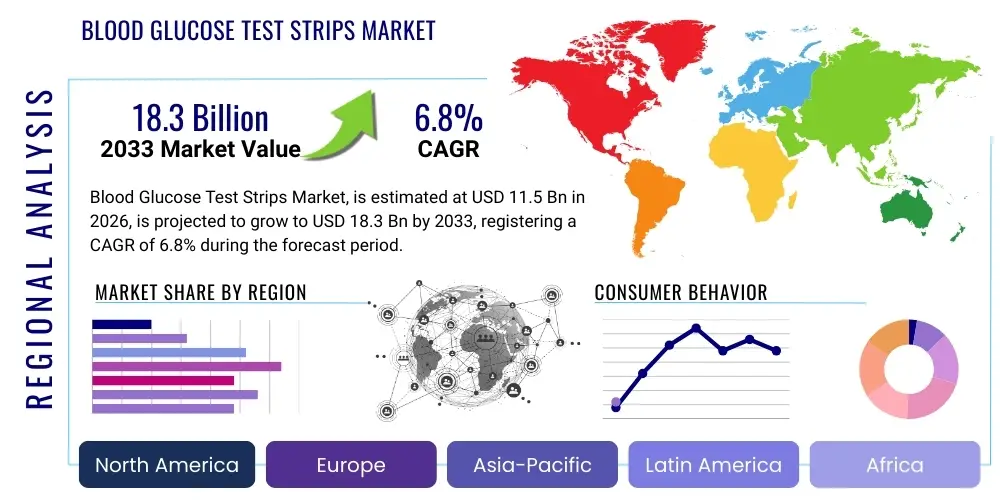

Blood Glucose Test Strips Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437896 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Blood Glucose Test Strips Market Size

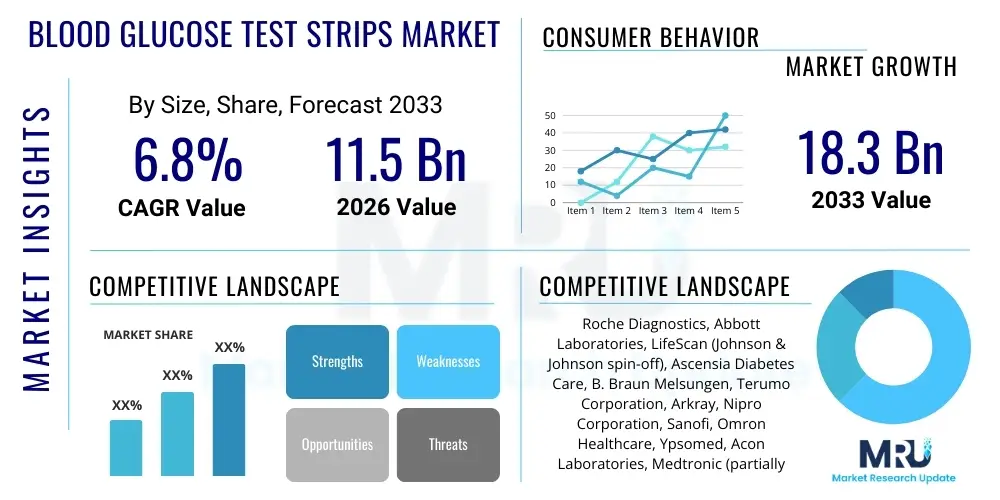

The Blood Glucose Test Strips Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 18.3 Billion by the end of the forecast period in 2033.

Blood Glucose Test Strips Market introduction

The Blood Glucose Test Strips Market forms the cornerstone of self-monitoring of blood glucose (SMBG) for individuals managing diabetes mellitus. These disposable strips, when used in conjunction with a specialized glucometer, allow patients to quickly and accurately measure the concentration of glucose in a small sample of capillary blood. The strips contain an enzymatic layer, typically utilizing glucose oxidase or glucose dehydrogenase, which reacts electrochemically with the glucose present in the blood sample. This reaction generates a measurable electrical current, which the meter converts into a glucose reading. Given the chronic nature of diabetes and the necessity of frequent testing to prevent severe complications such as hypoglycemia and hyperglycemia, test strips represent a high-volume, recurring revenue stream within the global diagnostics industry. Their efficacy and ease of use are crucial determinants of patient adherence to strict blood sugar management protocols, thereby directly impacting long-term health outcomes for the diabetic population.

Major applications of blood glucose test strips span across Type 1 diabetes management, Type 2 diabetes management, and gestational diabetes monitoring. For Type 1 diabetics, who require multiple daily insulin injections, SMBG is indispensable for dose calculation, often involving testing 4 to 10 times daily. Type 2 diabetics, depending on the severity and treatment regimen (oral medication vs. insulin), also rely on strips to track the effectiveness of their lifestyle interventions and pharmacological therapies. Furthermore, healthcare professionals utilize these strips in clinical settings, emergency rooms, and during critical care episodes for rapid metabolic assessment. The primary benefit of these strips lies in empowering patients with real-time data, enabling proactive adjustments to diet, exercise, and medication, which significantly reduces the risk of long-term microvascular and macrovascular complications associated with poorly controlled blood sugar levels.

The market is primarily driven by the escalating global prevalence of diabetes, propelled by aging populations, sedentary lifestyles, and rising obesity rates, particularly in emerging economies. Improvements in healthcare access and increasing awareness regarding the importance of proactive diabetes management are further stimulating demand. Technological advancements, such as the introduction of strips requiring smaller blood samples, providing faster results, and exhibiting improved accuracy (meeting ISO standards), continuously enhance the user experience and drive product adoption. Although the market faces competitive pressure from continuous glucose monitoring (CGM) systems, test strips remain the standard, cost-effective, and highly accessible method, particularly in resource-constrained settings or for individuals who do not require intensive, continuous monitoring, ensuring their sustained dominance in the immediate diagnostic landscape.

Blood Glucose Test Strips Market Executive Summary

The Blood Glucose Test Strips Market is characterized by robust growth underpinned by demographic shifts and the persistent increase in diabetes prevalence worldwide. Business trends indicate a strong focus among key manufacturers on developing highly accurate, affordable, and digitally-integrated strips that interface seamlessly with companion apps and telehealth services, optimizing data aggregation and patient-physician communication. While established companies maintain market dominance through extensive distribution networks and brand loyalty, competition is intensifying from private-label brands and low-cost manufacturers, particularly those based in the Asia Pacific region, leading to minor price erosion but expanding overall market access. Strategic acquisitions and partnerships focused on distribution enhancement in high-growth developing markets remain a critical approach for sustaining revenue growth amidst the rising adoption of alternative monitoring technologies like CGMs, which necessitate differentiation through enhanced strip technology, potentially focusing on multi-analyte testing capabilities.

Regionally, North America and Europe currently represent the largest revenue generators due to high diabetes awareness, well-established reimbursement frameworks, and high per capita healthcare spending. However, the Asia Pacific region is poised to exhibit the fastest growth over the forecast period, driven by the sheer scale of its diabetic population, rapid improvements in healthcare infrastructure, and increasing disposable incomes leading to greater access to essential diagnostic tools. Latin America and the Middle East & Africa also present significant untapped potential, though challenges related to fragmented distribution and varying regulatory standards necessitate localized market penetration strategies. Government initiatives aimed at diabetes prevention and subsidized access to monitoring supplies in countries like India and China are key factors influencing the demand trajectory across these emerging regional markets, making localized manufacturing and pricing critical success factors.

Segmentation trends highlight the enduring popularity of glucose oxidase-based strips, although glucose dehydrogenase-based technology is gaining traction due to its stability and reduced susceptibility to oxygen variations, which can enhance accuracy. Retail sales channels, particularly pharmacies and online platforms, command the largest share, reflecting the self-management nature of the product. The end-user segmentation is heavily skewed towards home care settings, emphasizing the consumer-facing characteristics of the market. Crucially, the growth rate within the hospital segment, while smaller, remains steady, driven by infection control protocols requiring disposable patient-specific supplies. Overall, the market is navigating a dynamic landscape where traditional SMBG must continually evolve its technology and cost profile to complement the growing sophistication and convenience offered by non-invasive and continuous monitoring technologies.

AI Impact Analysis on Blood Glucose Test Strips Market

User queries regarding the impact of Artificial Intelligence (AI) on the Blood Glucose Test Strips Market commonly revolve around the role of AI in interpreting the vast datasets generated by frequent testing, enhancing the diagnostic accuracy of the underlying technology, and managing logistics. Users frequently ask if AI can predict glucose fluctuations based on historical strip readings, diet inputs, and activity logs, thereby moving SMBG from reactive measurement to proactive risk management. Another major theme concerns how AI-driven analysis of strip readings can personalize treatment recommendations, optimizing insulin dosing or lifestyle adjustments, and reducing the burden of manual data interpretation for both patients and healthcare providers. Concerns are also raised about whether AI integration could lead to the obsolescence of test strips themselves by favoring continuous, non-invasive methods, or if AI primarily serves to augment the utility of traditional strip technology, providing better inventory management and supply chain optimization.

- AI-enhanced Predictive Modeling: AI algorithms analyze sequential strip data to forecast hypoglycemia or hyperglycemia episodes, enabling proactive patient intervention.

- Optimized Data Interpretation: AI integrates strip readings with lifestyle data (food logging, exercise) to offer precise, personalized dietary and medication recommendations.

- Supply Chain and Inventory Management: AI predicts patient usage rates and geographical demand fluctuations, optimizing distribution and reducing stock-outs of test strips in clinical and retail environments.

- Quality Control and Calibration: Machine learning models are used during manufacturing to analyze strip consistency and detect minute electrochemical anomalies, significantly improving overall batch quality and precision.

- Telehealth Integration: AI-powered platforms synthesize strip data for remote monitoring, flagging critical readings for physician review and streamlining follow-up care.

DRO & Impact Forces Of Blood Glucose Test Strips Market

The dynamics of the Blood Glucose Test Strips Market are dictated by powerful drivers, significant restraints, and emerging opportunities that collectively shape its trajectory. The primary driver is the pervasive and increasing global incidence of diabetes mellitus, necessitating lifelong monitoring. Coupled with this is the enhanced public awareness regarding diabetes management and the implementation of governmental mandates and public health campaigns promoting regular blood sugar checks, particularly in high-risk populations. Moreover, the inherent convenience, portability, and relatively low per-test cost compared to other diagnostic options ensure the strips maintain a critical market position. Technological advances focused on miniaturization, faster reaction times, and reduced sample volume requirements further enhance user acceptance and market penetration, solidifying the strip's role as the definitive diagnostic tool for intermittent monitoring.

However, the market faces considerable restraints, primarily the strong competitive pressure stemming from the rapid development and adoption of Continuous Glucose Monitoring (CGM) systems. CGM offers continuous, non-invasive, or minimally invasive real-time data, often preferred by Type 1 diabetics and intensive insulin users, potentially cannibalizing the high-frequency testing segment of the strip market. Furthermore, reimbursement challenges and variations in regulatory approval processes across different countries, especially regarding generic or private-label strips, can restrict market entry and growth. Patient non-adherence due to the perceived inconvenience, pain associated with finger pricking, and the high cumulative cost of strips for frequent testers also poses a structural constraint that innovators must continuously address through better design and pricing strategies.

Opportunities for growth are largely centered on penetrating high-growth emerging economies where access to healthcare is expanding and the diabetic population is booming, such as in India, China, and Southeast Asia. Developing strips that integrate multi-analyte testing (e.g., ketones alongside glucose) offers a crucial pathway for product differentiation, especially in critical care and for severe Type 1 management. Furthermore, leveraging digital connectivity—linking strip data to Electronic Health Records (EHRs) and patient portals—transforms the strip from a simple diagnostic tool into a vital component of a comprehensive, connected diabetes management ecosystem. The impact forces are characterized by high regulatory scrutiny, moderate rivalry from existing players, and a severe threat of substitution from alternative monitoring technologies, compelling manufacturers to focus rigorously on cost efficiency and technological enhancements to maintain relevance.

Segmentation Analysis

The Blood Glucose Test Strips Market is intricately segmented based on technology, usage setting, end-user type, and distribution channel, reflecting the diverse needs of the global diabetic population and the complexity of the healthcare supply chain. Technological segmentation differentiates strips based on the enzymes utilized, primarily glucose oxidase and glucose dehydrogenase (GDH), each offering distinct advantages in terms of stability, sensitivity, and susceptibility to interfering substances. The segmentation by usage environment typically separates the retail/home care setting, which dominates volume, from clinical/hospital use, which prioritizes speed and adherence to strict contamination protocols. Understanding these segment dynamics is crucial for manufacturers to tailor their product offerings, pricing strategies, and marketing campaigns to specific patient profiles and healthcare system requirements globally.

- Technology

- Glucose Oxidase Strips

- Glucose Dehydrogenase (GDH) Strips

- Other Enzyme-Based Strips (e.g., Hexokinase)

- End-User

- Hospitals and Clinics

- Home Care Settings (Self-Monitoring)

- Diagnostic Laboratories

- Distribution Channel

- Retail Pharmacies

- Online Sales Channels

- Institutional Sales (Direct Procurement)

- Usage Frequency

- High-Frequency Testing (Type 1 Diabetes, Intensive Insulin Users)

- Low-Frequency Testing (Type 2 Diabetes, Non-Insulin Dependent)

Value Chain Analysis For Blood Glucose Test Strips Market

The value chain for Blood Glucose Test Strips begins with sophisticated upstream activities involving the sourcing and refinement of specialized biochemical components and materials, particularly high-purity enzymes (glucose oxidase or GDH), electrode materials (often gold or carbon), and plastic substrates. Research and Development (R&D) at this stage is focused on optimizing enzyme stability, minimizing the required blood sample volume, and reducing interference from common drugs or physiological substances. Manufacturing involves precision processes such as printing the enzymatic and conductive layers onto the strip substrate and stringent calibration to meet ISO standards for accuracy. Due to the high-volume, low-margin nature of the product, minimizing manufacturing waste and automating production lines are critical success factors in maintaining cost competitiveness. The quality control process is exceptionally rigorous, as strip accuracy directly impacts patient safety and treatment efficacy.

Mid-chain activities focus on aggregation, regulatory compliance, and distribution. Manufacturers must navigate complex global regulatory approvals (FDA, CE Mark, etc.) to ensure product marketability. Distribution channels are bifurcated into direct sales to large institutions (hospitals, integrated delivery networks) and indirect sales through vast retail networks, including pharmaceutical wholesalers, pharmacies, and increasingly, e-commerce platforms. E-commerce has emerged as a particularly powerful indirect channel, offering convenience and often better pricing for repeat purchases by chronic patients. The efficiency of the logistics chain—ensuring strips are delivered and stored within required temperature and humidity specifications—is vital to maintaining product integrity up to the point of use.

Downstream activities center on the end-user interaction and post-market surveillance. For home care users, pharmacies and online retailers serve as the primary access points, often coupled with patient education and loyalty programs. Hospitals rely on streamlined institutional procurement processes. Post-market surveillance is crucial for tracking product performance, addressing accuracy concerns, and gathering user feedback to inform future R&D iterations. The integration of test strips with digital health platforms represents the final value-add, transforming raw data into actionable insights for patients and healthcare providers, thereby enhancing the overall utility and perceived value of the strip system. Transparency in pricing and effective communication of accuracy standards are essential for successful downstream engagement.

Blood Glucose Test Strips Market Potential Customers

The primary end-users and buyers of Blood Glucose Test Strips are individuals diagnosed with diabetes mellitus, constituting the largest consumer segment within the home care setting. This demographic includes both Type 1 and Type 2 diabetics, with Type 1 patients being high-frequency users due to their insulin dependence, and Type 2 patients representing a high-volume market segment that utilizes strips intermittently based on their treatment protocols. Secondary, yet vital, customer segments include healthcare institutions, specifically hospitals, specialized endocrinology clinics, primary care physician offices, and diagnostic laboratories. These institutional buyers procure strips in bulk for immediate patient testing, critical care monitoring, and diagnostic screening, often prioritizing institutional contracts, reliability, and ease of integration with hospital glucose monitoring policies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 18.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Roche Diagnostics, Abbott Laboratories, LifeScan (Johnson & Johnson spin-off), Ascensia Diabetes Care, B. Braun Melsungen, Terumo Corporation, Arkray, Nipro Corporation, Sanofi, Omron Healthcare, Ypsomed, Acon Laboratories, Medtronic (partially via integrated systems), Nova Biomedical, Rossmax International, i-Sens, Trividia Health (part of Sinocare). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blood Glucose Test Strips Market Key Technology Landscape

The technology landscape of the Blood Glucose Test Strips Market is dominated by electrochemical biosensors, which utilize enzyme-based reactions to determine glucose concentration. The two primary enzymatic technologies deployed are Glucose Oxidase (GOx) and Glucose Dehydrogenase (GDH). GOx strips, which historically dominated the market, use oxygen in the blood sample as a co-reactant, generating an electrical signal proportional to the glucose level. While mature and cost-effective, GOx is susceptible to oxygen interference, potentially leading to inaccurate readings in hypoxic conditions or high altitude environments. This limitation has driven innovation toward alternatives that are less oxygen-dependent, enhancing the reliability of readings across varied patient states and environments, particularly important in critical care settings.

The shift towards Glucose Dehydrogenase (GDH) strips, specifically those utilizing FAD-GDH (Flavin adenine dinucleotide-dependent glucose dehydrogenase) or PQQ-GDH (Pyrroloquinoline quinone-dependent glucose dehydrogenase), addresses many of the limitations associated with GOx. GDH strips use electrochemical mediators rather than oxygen, resulting in a system that is less prone to interference from oxygen partial pressure variations. However, certain GDH variants (PQQ-GDH) can react with sugars other than glucose (like maltose or xylose), which can lead to falsely high readings, particularly in patients undergoing certain medical procedures or utilizing specific medications. Consequently, the industry heavily favors FAD-GDH or GDH variants modified to ensure high specificity for beta-D-glucose, maximizing accuracy and patient safety. Furthermore, manufacturers are continually reducing the required sample size (microliters) and processing time (seconds) through advanced strip design and faster signal processing in the associated meters.

A crucial technological trend involves enhancing strip integration with digital health ecosystems, moving beyond simple measurement to comprehensive data management. This includes Near Field Communication (NFC) or Bluetooth integration in the accompanying meters to automatically transfer readings to smartphone applications and cloud-based platforms. These connected systems facilitate trend analysis, automated logging, and seamless data sharing with healthcare providers, significantly improving adherence and clinical management efficiency. Future innovation is focused on developing multi-analyte strips that simultaneously measure glucose and ketones, crucial for preventing diabetic ketoacidosis (DKA), and on enhancing the shelf stability of the enzymatic coating under varying climatic conditions, a key logistical challenge for global distribution, especially in tropical regions.

Regional Highlights

The global distribution and growth profile of the Blood Glucose Test Strips Market exhibit distinct regional variations driven by differing healthcare expenditure levels, diabetes prevalence rates, and regulatory environments.

- North America: This region holds a dominant market share, characterized by high diabetes prevalence, established government and private reimbursement structures, and a strong preference for branded, technologically advanced products. High per capita healthcare spending and early adoption of connected health devices propel the demand for premium strips and meters that integrate seamlessly with digital platforms. The market here is highly competitive, dominated by major multinational corporations focused on innovation in accuracy and usability.

- Europe: Western Europe maintains a mature, steady market, supported by comprehensive healthcare systems and strict quality standards (CE Mark). Growth is steady, focused on cost-effectiveness and standardization of care protocols. Central and Eastern Europe represent emerging growth areas, driven by increasing awareness and improving healthcare access.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, primarily due to the vast patient base in countries like China and India, which account for a significant portion of the world's diabetic population. Market expansion is fueled by rising disposable incomes, improving access to primary care, and aggressive market penetration strategies by both local and international companies, often focusing on affordable, high-volume products tailored for mass distribution.

- Latin America (LATAM): Growth in LATAM is promising but constrained by economic instability and variable reimbursement policies. Key markets like Brazil and Mexico demonstrate increasing demand driven by urbanization and dietary changes, demanding targeted strategies focused on affordability and local clinical validation.

- Middle East & Africa (MEA): The MEA region, particularly the Gulf Cooperation Council (GCC) countries, exhibits high rates of diabetes prevalence linked to lifestyle factors. High healthcare investments in wealthier nations drive demand for quality strips, while large parts of Africa face supply chain challenges and require low-cost, robust solutions for effective disease management.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blood Glucose Test Strips Market.- Roche Diagnostics

- Abbott Laboratories

- LifeScan (Johnson & Johnson spin-off)

- Ascensia Diabetes Care

- B. Braun Melsungen

- Terumo Corporation

- Arkray

- Nipro Corporation

- Sanofi

- Omron Healthcare

- Ypsomed

- Acon Laboratories

- Medtronic (partially via integrated systems)

- Nova Biomedical

- Rossmax International

- i-Sens

- Trividia Health (part of Sinocare)

- Bayer (Diabetes Care business now Ascensia)

- Dexcom (indirectly influences SMBG market)

Frequently Asked Questions

Analyze common user questions about the Blood Glucose Test Strips market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Blood Glucose Test Strips Market despite the rise of Continuous Glucose Monitors (CGMs)?

The market growth is primarily driven by the escalating global incidence of diabetes, the fundamental role of strips in clinical diagnostics and emergency care, and their inherent advantages in cost-effectiveness and accessibility, particularly for Type 2 diabetics and in emerging economies where CGMs are prohibitively expensive.

Which technology segment is expected to dominate the Blood Glucose Test Strips Market?

While Glucose Oxidase (GOx) remains prevalent, the Glucose Dehydrogenase (GDH) segment, particularly highly specific FAD-GDH technology, is expected to see faster growth due to its superior performance characteristics, including reduced susceptibility to oxygen interference, leading to enhanced accuracy and reliability across various patient conditions.

How is digital health integration influencing the utility and adoption of blood glucose test strips?

Digital integration, utilizing Bluetooth and cloud connectivity, transforms strip data from isolated measurements into actionable insights. This facilitates automatic logging, trend analysis, remote patient monitoring via telehealth, and improved adherence, significantly enhancing the overall value proposition of the traditional SMBG method.

What are the key constraints limiting the market potential of Blood Glucose Test Strips?

The primary constraint is the market substitution threat posed by Continuous Glucose Monitoring (CGM) systems, which offer continuous, real-time data without the need for repetitive finger pricking. Additionally, the high cumulative cost of frequent strip purchases and varying reimbursement policies act as limiting factors in certain global regions.

Which region holds the highest growth potential for Blood Glucose Test Strips manufacturers?

The Asia Pacific (APAC) region is projected to hold the highest growth potential, driven by the massive and expanding diabetic population base, increasing healthcare investments, and growing awareness regarding proactive diabetes management in major economies such as China and India, making it crucial for localized market expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Blood Glucose Test Strips Market Size Report By Type (Glucose Oxidase, Glucose Dehydrogenase), By Application (Hospital, Clinic, Household), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Blood Glucose Test Strips Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Thick Film Electrochemical, Thin Film Electrochemical, Optical), By Application (Hospital, Clinic, Household), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager