Blood Irradiation Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434864 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Blood Irradiation Market Size

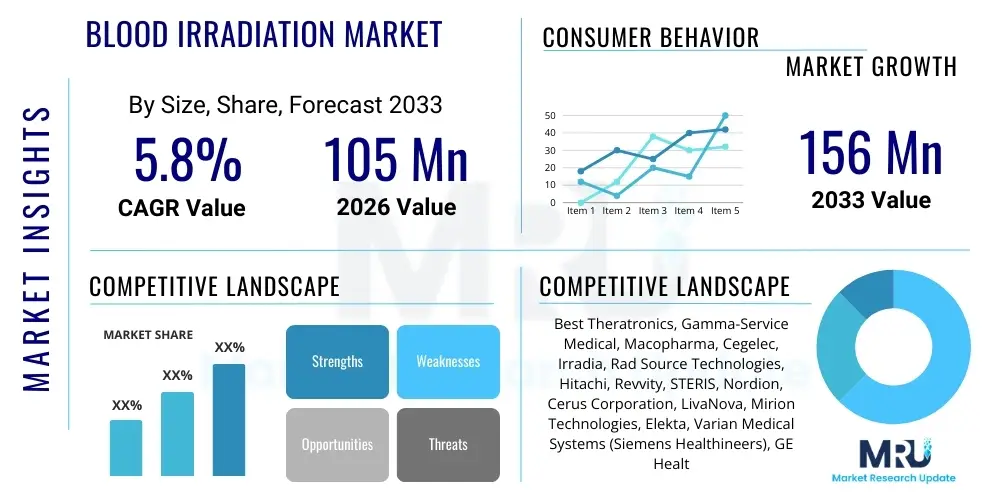

The Blood Irradiation Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $105 Million in 2026 and is projected to reach $156 Million by the end of the forecast period in 2033. This consistent expansion is fundamentally driven by the increasing necessity for safe blood transfusion practices globally, particularly to mitigate the risk of Transfusion-Associated Graft-versus-Host Disease (TA-GVHD) in immunocompromised patients, thereby ensuring patient safety and adherence to stringent regulatory standards in transfusion medicine.

Blood Irradiation Market introduction

The Blood Irradiation Market encompasses specialized medical devices designed to expose blood components, primarily packed red blood cells and platelets, to measured doses of radiation (typically gamma rays or X-rays) before transfusion. This process, known as blood product irradiation, effectively inactivates lymphocytes within the donated blood, preventing them from proliferating and attacking the recipient's tissues, which is the underlying cause of the often-fatal Transfusion-Associated Graft-versus-Host Disease (TA-GVHD). The primary application is in transfusion medicine, targeting patient populations such as premature neonates, recipients of hematopoietic stem cell transplants, patients undergoing specific chemotherapy regimens, and those with congenital immunodeficiencies.

The core product description includes both isotope-based irradiators, predominantly utilizing Cesium-137, and non-isotopic irradiators, primarily based on X-ray technology. While the traditional gamma irradiators offer high throughput and reliability, the growing preference, particularly in developed regions, is shifting towards non-radioactive X-ray systems due to heightened security concerns related to radioactive source management and associated regulatory complexities. Major applications extend beyond clinical transfusion to advanced research, including studying cellular responses to radiation and optimizing preservation techniques for blood products. The fundamental benefit is the marked reduction in morbidity and mortality associated with TA-GVHD, reinforcing the essential role of irradiation in modern hemovigilance protocols.

Driving factors propelling market growth include the rising global volume of complex surgical procedures and trauma cases requiring substantial blood transfusions, alongside the escalating awareness among clinicians and blood bank personnel regarding the critical importance of prophylactic irradiation. Furthermore, mandatory guidelines issued by major regulatory bodies, such as the American Association of Blood Banks (AABB), recommending irradiation for specific patient groups, significantly bolster market demand. Technological advancements focusing on efficiency, safety, and operational cost reduction, particularly within the X-ray irradiation segment, further solidify the market's positive trajectory, positioning blood irradiation as a non-negotiable step in ensuring safe blood supply chains worldwide.

Blood Irradiation Market Executive Summary

The global Blood Irradiation Market is characterized by a definitive transition from traditional gamma ray technology to advanced non-isotopic X-ray platforms, driven by operational safety, regulatory compliance, and a strategic move away from radioactive materials in clinical settings. Business trends indicate strong consolidation among leading equipment manufacturers who are actively innovating to enhance system portability, reduce cycle times, and integrate sophisticated quality control mechanisms into their devices. The market is witnessing increasing investment in automated blood handling systems compatible with irradiators, reflecting the drive toward efficiency and reduced human error in high-volume blood banks and regional transfusion centers. Key growth momentum is observed in emerging economies where expanding healthcare infrastructure and increasing adoption of Western clinical guidelines are fueling demand for new installations and regulatory compliant equipment upgrades, presenting significant commercial opportunities for international vendors.

Regionally, North America and Europe maintain dominance, attributed to well-established regulatory frameworks mandating blood safety standards, high awareness of TA-GVHD risk management, and the early adoption of X-ray irradiation technology as replacements for aging gamma units. The Asia Pacific (APAC) region is poised for the highest growth rate due to rapid modernization of blood banking systems, increasing prevalence of advanced medical treatments like organ transplantation and oncology care that necessitate irradiated blood, and supportive governmental initiatives aimed at improving national blood product safety. However, the Middle East and Africa (MEA) and Latin America still rely heavily on refurbished or older gamma irradiators, suggesting a potential future wave of replacements and technology upgrades once capital expenditure challenges are mitigated and specific local regulations evolve to favor non-radioactive solutions.

Segmentation trends highlight the enduring relevance of X-ray technology, which is expected to capture a larger market share over the forecast period owing to its superior safety profile and lower total cost of ownership over the lifecycle, despite higher initial purchase costs compared to gamma systems. In terms of application, Transfusion Medicine dominates the revenue landscape, driven by the prophylactic treatment of cellular components intended for immunocompromised patients. The end-user segment is led by Hospitals and Academic Blood Banks, which typically require high-throughput machines; however, standalone Diagnostic Centers are also increasing their adoption rates, reflecting decentralized blood product preparation needs and the growing necessity for irradiation capability across various points of care, thereby diversifying the market ecosystem.

AI Impact Analysis on Blood Irradiation Market

User inquiries regarding Artificial Intelligence (AI) in the Blood Irradiation Market frequently center on whether AI can optimize the irradiation process itself, reduce unnecessary irradiation, or enhance predictive modeling for TA-GVHD risk. Users often question if AI can replace manual dosimetry checks or if machine learning algorithms can manage inventory and scheduling more efficiently, especially concerning blood component expiration dates following irradiation. The key themes revolve around automation, precision, risk assessment, and optimizing operational throughput without compromising safety. Users expect AI to reduce operational costs associated with large-scale blood processing and seek assurance that AI integration adheres strictly to complex blood safety and regulatory protocols.

The integration of AI currently has minimal direct impact on the physical irradiation mechanics (dosing delivery) but offers transformative potential in peripheral operational domains. AI-driven predictive analytics can significantly improve blood inventory management by forecasting demand for irradiated products based on surgical schedules, disease prevalence, and demographic data, thereby minimizing wastage and ensuring prompt availability. Furthermore, machine learning models are beginning to assist in complex decision-making processes, such as identifying patients who are critically susceptible to TA-GVHD based on detailed clinical and genomic data, allowing for targeted and precise use of irradiated blood products, which can reduce overall operational expenditures in resource-constrained environments.

Looking forward, AI is expected to play a crucial role in enhancing the quality assurance and regulatory compliance aspects of blood irradiation. AI algorithms can analyze real-time data from irradiator sensors, including temperature, dosage distribution, and mechanical performance, to predict potential equipment failures or dosing irregularities before they occur, ensuring consistently accurate treatment of blood products. This shift toward preventive maintenance and enhanced compliance auditing through automated data logging and reporting is central to future operational excellence in sophisticated blood banking environments, reinforcing the market’s reliability and adherence to international safety guidelines.

- AI-powered Predictive Inventory Management: Optimizing stock levels of irradiated and non-irradiated blood components.

- Enhanced Patient Risk Stratification: Utilizing machine learning to precisely identify high-risk patients needing irradiated blood, minimizing unnecessary treatments.

- Automated Quality Assurance: Real-time monitoring of irradiator performance and dosage accuracy to prevent product non-conformance.

- Optimized Workflow and Scheduling: Improving the throughput and efficiency of blood component processing within centralized blood banks.

- Data Analytics for Hemovigilance: Identifying trends in irradiation efficacy and potential safety risks across patient populations.

DRO & Impact Forces Of Blood Irradiation Market

The Blood Irradiation Market is primarily driven by the mandatory clinical requirement to prevent Transfusion-Associated Graft-versus-Host Disease (TA-GVHD), coupled with the increasing volume of specialized medical procedures globally, such as organ transplants and intensive chemotherapy protocols, which inherently increase the patient pool requiring irradiated blood products. The move towards non-radioactive X-ray irradiation systems acts as a significant opportunity, mitigating regulatory hurdles and security risks associated with Cesium-137 units, making the technology more accessible and acceptable globally. However, the high initial capital investment required for installing advanced irradiation units, particularly the newer X-ray systems, acts as a primary restraint, especially impacting small or developing-country blood banks. These forces collectively shape the market's trajectory, mandating constant innovation in system affordability and usability while maintaining absolute commitment to safety protocols.

Impact forces on the market are multifaceted, stemming heavily from stringent regulatory updates and evolving clinical guidelines, such as those issued by the AABB and European directives, which often expand the scope of patient categories requiring irradiated blood, directly boosting demand. The increasing global focus on security and the safe handling of radioactive materials exerts significant pressure, accelerating the obsolescence of older gamma-based systems and strongly favoring non-radioactive alternatives. Furthermore, technological substitution risk is relatively low in the core process, as irradiation remains the gold standard for lymphocyte inactivation; however, innovations in pathogen reduction technologies (PRT) are being closely monitored as potential complementary or alternative methods in some niches, although PRT does not yet fully replace irradiation for TA-GVHD prevention.

Opportunities for market growth are abundant in geographical expansion, particularly in high-growth regions like APAC and Latin America, where rapid modernization and standardization of healthcare are underway. Market players focused on developing integrated, cost-effective solutions for mid-sized blood banks or mobile collection units are well-positioned to capitalize on this demand. The increasing collaboration between technology providers and major research institutions to establish standardized dosing protocols and improve device calibration further validates the market's long-term sustainability, ensuring that blood irradiation remains a foundational component of transfusion safety protocols for the foreseeable future, despite the capital constraints faced by end-users.

Segmentation Analysis

The Blood Irradiation Market is comprehensively segmented based on technology, application, and end-user, providing a granular view of market dynamics and adoption patterns across different healthcare environments. The technological segmentation is arguably the most critical dimension, reflecting the ongoing shift from historically dominant radioactive systems to safer, more operationally streamlined non-radioactive alternatives. Application segmentation clearly delineates the clinical focus (transfusion medicine) from research applications, with clinical use representing the overwhelming majority of market revenue due to regulatory mandates and established clinical necessity.

The dominance of the Transfusion Medicine segment underscores the mandatory nature of blood irradiation in patient safety protocols for immunocompromised individuals. Within the end-user segmentation, Hospitals and Centralized Blood Banks represent the largest buying power, driven by high patient throughput and the need for large-scale processing capabilities. However, the increasing number of specialized cancer centers and pediatric care units is creating niche demand for smaller, dedicated irradiation units. The segmentation analysis thus highlights key investment areas, emphasizing the need for manufacturers to develop systems that are scalable, easy to integrate into existing laboratory information systems, and compliant with diverging regional safety standards.

- Technology

- Gamma-Ray Irradiators (Isotopic)

- X-Ray Irradiators (Non-Isotopic)

- UV-C Irradiators (Niche/Emerging)

- Electron Beam Irradiators (Research/High-Volume Niche)

- Application

- Transfusion Medicine (Prevention of TA-GVHD)

- Research Applications (Cellular and Immunological Studies)

- End-User

- Hospitals and Clinics

- Blood Banks (Centralized and Decentralized)

- Diagnostic Centers

- Research Institutes and Academic Centers

Value Chain Analysis For Blood Irradiation Market

The value chain for the Blood Irradiation Market begins with the highly specialized Upstream Analysis, which focuses on the sourcing and manufacturing of critical components, including high-energy X-ray tubes, advanced shielding materials, automated sample handling robotics, and, for traditional systems, the complex acquisition and management of radioactive sources like Cesium-137. This phase is characterized by stringent quality control and complex regulatory oversight, particularly concerning the safety and purity of materials. Key upstream players are highly specialized component manufacturers and, for isotopic systems, nuclear material suppliers. Innovation at this stage centers on increasing the lifespan and efficiency of X-ray sources and enhancing radiation containment safety features, reducing the reliance on external maintenance and recalibration services.

Midstream activities involve the Original Equipment Manufacturers (OEMs) who assemble, integrate, and test the complex electromechanical and software systems that constitute the final irradiator unit. This phase is capital-intensive and requires substantial expertise in high-voltage physics, radiation dosimetry, and medical device manufacturing compliance (e.g., ISO 13485, FDA regulations). Distribution channels are critical, involving both direct sales teams, especially for large tenders involving government blood services or major hospital groups, and indirect distribution through specialized medical device distributors who handle installation, localized technical support, and critical service contracts. Direct channels are generally favored for high-value X-ray systems due to the complexity of installation and the necessity of specialized training provided directly by the OEM to ensure proper clinical operation and safety compliance.

Downstream analysis focuses on the end-users—primarily Blood Banks and Hospitals—who utilize the irradiators to process blood components before transfusion. This segment relies heavily on after-sales support, including mandatory annual calibration, preventative maintenance, and rapid response services, given the critical nature of the equipment in the blood supply chain. The life cycle management of the systems, especially the eventual decommissioning and disposal or replacement of radioactive sources in gamma units, forms a crucial and costly part of the downstream value proposition. Customer loyalty is driven not just by initial equipment quality but predominantly by the reliability, responsiveness, and cost-effectiveness of the long-term service agreements, making maintenance and support a major revenue driver for market players.

Blood Irradiation Market Potential Customers

Potential customers for blood irradiation equipment are fundamentally organizations that collect, process, store, and transfuse human blood components, where safety against Transfusion-Associated Graft-versus-Host Disease (TA-GVHD) is paramount. The primary customers include large, centralized national and regional blood services, such as the American Red Cross or comparable European and Asian blood banking organizations, which require high-throughput systems capable of processing thousands of blood bags daily. These organizations often drive the demand for non-radioactive X-ray technology replacements, prioritizing system longevity, minimized security risks, and operational efficiency across multiple distributed collection sites.

Secondary, yet highly significant, customers are major tertiary care hospitals, especially those with specialized units in oncology, hematology, pediatrics (neonatology), and transplantation medicine (both solid organ and hematopoietic stem cell transplants). These hospitals often purchase their own dedicated irradiators to ensure immediate, on-site availability of irradiated blood, bypassing the logistical complexities of obtaining pre-irradiated products from external blood banks, thereby ensuring quicker patient care delivery. Finally, academic research centers and pharmaceutical companies studying immunology, cell therapy, and regenerative medicine also represent a niche customer base, utilizing irradiators for controlled cell inactivation necessary for various laboratory protocols and preclinical studies, though their volume requirements are typically much lower than clinical customers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $105 Million |

| Market Forecast in 2033 | $156 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Best Theratronics, Gamma-Service Medical, Macopharma, Cegelec, Irradia, Rad Source Technologies, Hitachi, Revvity, STERIS, Nordion, Cerus Corporation, LivaNova, Mirion Technologies, Elekta, Varian Medical Systems (Siemens Healthineers), GE Healthcare, Shimadzu, Canon Medical Systems, Philips Healthcare, Fujifilm Holdings |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blood Irradiation Market Key Technology Landscape

The technology landscape of the Blood Irradiation Market is dominated by two primary modalities: Gamma Ray Irradiation and X-Ray Irradiation, with X-ray technology rapidly gaining prominence as the preferred standard due to escalating safety and regulatory concerns surrounding the handling of radioactive isotopes like Cesium-137. Gamma ray irradiators, historically the gold standard, offer proven reliability and high penetration capability but face severe logistical challenges related to sourcing, security, transportation, and ultimately, the costly and complex disposal of radioactive sources. This inherent risk profile has significantly curtailed new installations of gamma units, especially in Western markets, leading to an accelerated replacement cycle.

Conversely, X-ray irradiators, which generate radiation electrically, eliminate the need for radioactive material management, offering a safer and environmentally friendlier alternative. Modern X-ray systems feature high throughput, precise dose control, and sophisticated software for quality assurance and data logging, integrating seamlessly with modern blood bank management systems. Key technological innovations in this space focus on maximizing the energy output and lifespan of the X-ray tubes, optimizing shielding to reduce footprint, and automating the blood bag loading/unloading process to minimize staff exposure and increase overall laboratory efficiency. This non-isotopic approach is the definitive future direction of the market, driven by technological maturity and global security agendas.

While Gamma and X-ray technologies hold the bulk of the market share, niche technologies such as UV-C irradiation and low-dose Electron Beam (E-beam) systems are explored, primarily in research settings or for specialized component treatments. UV-C irradiation, often used as part of pathogen reduction strategies, is not typically sufficient alone to achieve the high dose required for effective lymphocyte inactivation necessary to prevent TA-GVHD, though it may complement the process. E-beam technology offers ultra-fast processing times suitable for extremely high-volume centralized facilities but requires highly specific infrastructure. Therefore, the core competitive landscape remains firmly focused on the continuous improvement and cost-reduction of high-performance X-ray irradiation systems to meet the rigorous demands of global transfusion medicine.

Regional Highlights

- North America: This region holds the largest market share, driven by stringent regulatory requirements (especially FDA and AABB mandates) for blood safety and widespread clinical adoption of irradiation protocols for high-risk patients. The market here is characterized by an active replacement cycle, with numerous blood centers transitioning away from aging Cesium-137 irradiators towards safer, technologically advanced X-ray units. High healthcare expenditure and the presence of major key market players and research institutions further solidify its dominance.

- Europe: The European market is mature and highly regulated, mirroring North America in its steady transition toward non-isotopic technology, largely influenced by European Union directives concerning the security of high-activity radioactive sources. Countries such as Germany, the UK, and France show high adoption rates, supported by robust blood transfusion services and established clinical guidelines. Service contracts and preventative maintenance form a critical revenue stream due to the installed base of equipment.

- Asia Pacific (APAC): APAC is projected to exhibit the highest CAGR during the forecast period. Market growth is fueled by massive investments in healthcare infrastructure, the establishment of sophisticated blood banking systems in densely populated countries (China, India), and increasing awareness and implementation of international transfusion guidelines. While price sensitivity remains a factor, the long-term trend favors the adoption of modern, secure X-ray technology as governments prioritize blood safety modernization projects.

- Latin America (LATAM): The LATAM region presents a growing, yet more fragmented, market. Adoption rates are increasing, particularly in major economies like Brazil and Mexico. Market penetration is often constrained by budget limitations and reliance on refurbished equipment. Opportunities lie in developing simplified, cost-effective irradiation solutions and leveraging government tenders focused on upgrading public health laboratory infrastructure.

- Middle East and Africa (MEA): This region is characterized by slower, localized growth, largely concentrated in the Gulf Cooperation Council (GCC) states due to high per capita healthcare spending and modernizing hospital systems. The broader African market faces significant challenges related to infrastructure and capital investment, limiting the widespread deployment of advanced irradiation technologies, although demand for safe blood products is universally high.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blood Irradiation Market.- Best Theratronics

- Gamma-Service Medical

- Macopharma

- Cegelec

- Irradia

- Rad Source Technologies

- Hitachi

- Revvity

- STERIS

- Nordion

- Cerus Corporation

- LivaNova

- Mirion Technologies

- Elekta

- Varian Medical Systems (Siemens Healthineers)

- GE Healthcare

- Shimadzu

- Canon Medical Systems

- Philips Healthcare

- Fujifilm Holdings

Frequently Asked Questions

Analyze common user questions about the Blood Irradiation market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Gamma Ray and X-Ray blood irradiators?

Gamma Ray irradiators use radioactive isotopes, typically Cesium-137, which necessitate strict security protocols and expensive disposal. X-Ray irradiators generate radiation electrically, eliminating radioactive source management, offering higher safety, and reducing long-term regulatory burden, making them the preferred modern choice.

Why is blood irradiation necessary in transfusion medicine?

Blood irradiation is essential to inactivate donor T-lymphocytes within blood components (red cells and platelets). This prevents the lymphocytes from proliferating and attacking the recipient’s tissues, thereby eliminating the risk of the fatal complication known as Transfusion-Associated Graft-versus-Host Disease (TA-GVHD) in immunocompromised patients.

Does blood irradiation affect the quality or shelf life of transfused blood?

Irradiation does not significantly impact the clinical efficacy of red blood cells or platelets. While it slightly accelerates potassium leakage and may reduce the shelf life of red blood cells by a few days (from 42 to generally 28 days post-irradiation), the clinical benefit of preventing TA-GVHD significantly outweighs this minor change in component biochemistry.

Which segments are driving the most significant growth in the market?

The X-Ray Technology segment is experiencing the highest growth rate due to the global regulatory push for non-radioactive solutions and enhanced safety features. Geographically, the Asia Pacific region is the fastest-growing market, driven by rapid healthcare infrastructure modernization and increased adherence to international blood safety guidelines.

What are the main operational challenges faced by end-users adopting new irradiator technology?

The primary challenges include the substantial initial capital investment required for purchasing modern X-ray systems, integrating new equipment with existing laboratory information management systems (LIMS), and ensuring comprehensive staff training for specialized dosimetry and quality control procedures to maintain compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager