Blood Pressure Monitoring and Measurement Instruments Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432628 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Blood Pressure Monitoring and Measurement Instruments Market Size

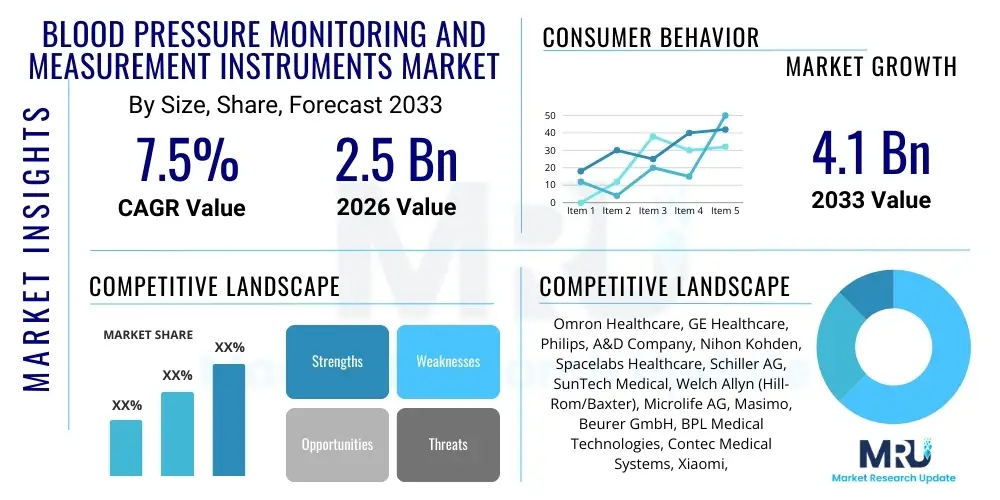

The Blood Pressure Monitoring and Measurement Instruments Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 4.1 Billion by the end of the forecast period in 2033.

Blood Pressure Monitoring and Measurement Instruments Market introduction

The Blood Pressure Monitoring and Measurement Instruments Market encompasses a diverse range of medical devices designed to accurately measure and track arterial blood pressure, crucial for the diagnosis and management of hypertension and various cardiovascular diseases. These instruments include traditional mercury sphygmomanometers, advanced aneroid devices, and sophisticated digital monitors, alongside emerging wearable technologies. The core function of these products is to provide reliable systolic and diastolic pressure readings, enabling healthcare professionals and patients alike to maintain vigilance over hemodynamic stability. Recent advancements focus heavily on non-invasive, continuous monitoring solutions that offer greater convenience and compliance, particularly in ambulatory and home care settings. The market’s evolution is strongly linked to technological innovation aimed at improving accuracy, portability, and connectivity, driven by the need for early detection and personalized treatment of chronic conditions.

Major applications for these instruments span across clinical diagnostics, patient monitoring, and personal health management. In hospital settings, multi-parameter patient monitors frequently integrate blood pressure measurement capabilities, essential during surgical procedures and intensive care. For primary care and outpatient clinics, fast and accurate measurement is vital for routine check-ups. However, the most significant growth driver in application is the shift toward remote patient monitoring (RPM) and home care. As populations age globally and chronic disease prevalence rises, self-monitoring devices empower individuals to manage their health proactively, sharing data seamlessly with providers via cloud-based platforms. This integration supports telehealth initiatives and reduces the burden on traditional healthcare infrastructure, making preventative care more accessible.

The primary benefits of effective blood pressure monitoring instruments include improved diagnostic accuracy, enhanced patient outcomes through timely intervention, and reduced healthcare costs associated with avoidable complications like stroke or myocardial infarction. Key driving factors fueling market expansion are the escalating global burden of hypertension, which affects billions of adults worldwide, increased awareness regarding the importance of cardiovascular health, and substantial technological advancements, particularly in digital and wireless capabilities. Furthermore, stringent regulatory guidelines promoting accuracy and standardization in measurement techniques, coupled with rising disposable incomes in emerging economies, contribute significantly to the robust demand for reliable blood pressure measurement solutions across all demographic segments.

Blood Pressure Monitoring and Measurement Instruments Market Executive Summary

The Blood Pressure Monitoring and Measurement Instruments Market is experiencing dynamic growth, characterized by a rapid transition from conventional clinical devices to advanced, connected, and patient-centric monitoring solutions. Key business trends indicate a strong industry focus on mergers and acquisitions among major players seeking to consolidate technological expertise, particularly in the digital health and sensor technology sectors. There is a pronounced shift in product development emphasizing miniaturization, enhanced data integration capabilities, and superior battery life to support continuous monitoring. Furthermore, strategic partnerships between medical device manufacturers and technology firms (e.g., consumer electronics companies) are becoming crucial for deploying accessible, high-volume wearable devices. Reimbursement policies favoring remote monitoring services are institutionalizing this technological pivot, ensuring sustainable revenue streams for innovative companies.

Regional trends highlight that North America and Europe currently dominate the market due to high healthcare expenditure, established clinical guidelines, and high adoption rates of advanced monitoring technologies. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth CAGR throughout the forecast period. This accelerated growth in APAC is driven by massive, underserved patient populations, improving healthcare infrastructure investment, and increasing government initiatives aimed at hypertension screening and management, particularly in large economies like China and India. Latin America and MEA are also showing steady upward trajectories, fueled by growing awareness and the increasing availability of affordable, reliable digital monitoring devices suitable for widespread primary care applications.

In terms of segment trends, the digital blood pressure monitors segment, particularly automated and upper arm cuff devices, retains the largest market share due to their ease of use and accuracy in both clinical and home settings. However, the wearable monitoring instruments segment, which includes smartwatches and specialized wrist-worn devices, is poised for the fastest expansion, capitalizing on consumer demand for seamless integration into daily life. By end-user, the home care settings segment is rapidly outpacing hospitals, supported by the global trend toward decentralization of healthcare services and the economic advantages of self-monitoring. Technology-wise, the non-invasive oscillometric method remains dominant, though continuous non-cuff technologies are attracting significant research and investment for future high-precision applications.

AI Impact Analysis on Blood Pressure Monitoring and Measurement Instruments Market

Common user questions regarding AI's impact on blood pressure monitoring revolve around the accuracy of continuous, non-invasive measurement, the potential for personalized risk stratification based on historical data, and how AI can integrate vast amounts of physiological data from multiple sources (e.g., sleep, activity, BP) to provide predictive insights. Users are particularly concerned about the reliability of algorithms in detecting subtle hemodynamic shifts that precede critical events and whether AI-driven diagnostics will reduce the necessity of frequent clinical visits. The overarching theme is the expectation that AI will transform raw blood pressure data into actionable, contextualized health intelligence, moving the paradigm from reactive measurement to proactive, continuous health management and risk prediction, thereby improving patient compliance and clinical workflow efficiency.

- AI enables real-time data analysis from continuous monitoring devices, identifying patterns and anomalies indicative of impending hypertensive crises or cardiovascular events before standard monitoring thresholds are breached.

- Predictive modeling powered by machine learning algorithms personalizes treatment plans by correlating blood pressure fluctuations with lifestyle factors, medication adherence, and environmental data.

- Improved diagnostic accuracy and reduced operator variability, as AI algorithms can process measurement signals (e.g., from PPG sensors or oscillometric data) to filter noise and enhance signal quality, ensuring reliable readings outside clinical environments.

- Enhanced remote patient monitoring (RPM) capabilities through automated risk scoring and prioritization of patients requiring immediate clinical attention, optimizing scarce healthcare resources.

- Development of non-cuff, calibration-free blood pressure estimation techniques utilizing deep learning models applied to photoplethysmography (PPG) or electrocardiogram (ECG) signals from wearable devices, improving patient comfort and adherence.

- AI integration into Electronic Health Records (EHRs) allows for longitudinal data mapping, improving research outcomes and facilitating large-scale epidemiological studies on hypertension management.

DRO & Impact Forces Of Blood Pressure Monitoring and Measurement Instruments Market

The Blood Pressure Monitoring and Measurement Instruments Market is fundamentally shaped by robust demographic drivers, restrained by regulatory complexities and pricing pressures, and poised for expansion through technological innovations. Drivers primarily include the explosive growth in the geriatric population globally, which inherently possesses a higher predisposition to cardiovascular ailments like hypertension and associated comorbidities. This demographic shift necessitates widespread, convenient monitoring tools. Concurrently, increasing public and clinical awareness campaigns globally emphasize the necessity of routine blood pressure checks for preventative health, translating directly into higher purchasing volumes for both clinical and consumer-grade devices. Furthermore, the supportive regulatory framework in several developed nations that encourages remote monitoring and digital health innovation provides a significant tailwind for the market.

Restraints, conversely, pose specific challenges to market potential. A critical concern is the high cost associated with advanced, continuous, and integrated monitoring systems, particularly impacting adoption in low- and middle-income regions where healthcare budgets are constrained. Additionally, concerns surrounding data security and privacy, especially with connected and cloud-based devices, create user hesitancy and require stringent compliance measures, increasing operational complexity for manufacturers. Technical accuracy and variability in readings, particularly among lower-cost or wrist-based consumer devices, also present a restraint, demanding continuous validation and standardization protocols to maintain clinical trust and reliability. The debate over accuracy parity between traditional mercury devices and modern digital units persists in some clinical circles, slowing complete transition.

Opportunities for disruptive growth are abundant, primarily focused on the development and mass adoption of cuffless, continuous blood pressure monitoring technologies integrated into consumer electronics like smartwatches and fitness trackers. This shift expands the market significantly beyond traditional medical device buyers to the vast consumer wellness sector. The emergence of telehealth and RPM as standardized care delivery models further opens doors for specialized service providers utilizing advanced BP monitors. Impact forces, encompassing technological advancements such as improved sensor technology (e.g., utilizing PPG, bioimpedance) and AI-driven data processing, are fundamentally reshaping the product landscape, moving measurement from episodic checks to continuous hemodynamic tracking. Competitive intensity remains high, forcing manufacturers to innovate constantly on both product features and cost efficiency to maintain market relevance.

Segmentation Analysis

The Blood Pressure Monitoring and Measurement Instruments Market is comprehensively segmented based on product type, technology, and end-user, reflecting the diverse applications and technological maturity across different healthcare settings. Analyzing these segments provides strategic insights into areas of rapid growth and stable clinical dominance. The product landscape is broadly defined by traditional manual devices (sphygmomanometers) and automated digital monitors, with the latter commanding increasing market share due to user-friendliness and integrated features like memory storage and wireless connectivity. Technological segmentation differentiates between the long-standing auscultatory method, still preferred for certain clinical validation, and the dominant oscillometric method, which forms the basis for most automated devices, alongside emerging non-invasive continuous techniques.

The segmentation by end-user illustrates the ongoing decentralization of care. While hospitals and clinics historically represented the largest market share due to high volume purchasing, the accelerated global trend toward proactive health management and chronic disease control has catapulted the home care setting segment into a leading growth category. Patients increasingly prefer monitoring devices that facilitate self-management and seamless data sharing with remote physicians. This demographic shift drives demand for compact, portable, and interconnected devices, placing significant emphasis on intuitive user interfaces and long-term device durability suitable for daily use outside professional environments.

Furthermore, within the product type, specialized segments like Ambulatory Blood Pressure Monitoring (ABPM) devices are critical, addressing white-coat hypertension and nocturnal hypertension, offering high clinical value. The increasing prevalence of complex conditions requiring continuous hemodynamic monitoring, such as in Intensive Care Units (ICUs) and operating theaters, sustains the demand for invasive blood pressure monitoring systems, although non-invasive technologies are continually eroding this niche by demonstrating comparable accuracy with lower risk profiles. Strategic analysis across all segments confirms that innovation targeting portability, connectivity (IoT), and accuracy in non-traditional settings will define future market leaders.

- Product Type:

- Sphygmomanometers (Aneroid Sphygmomanometers, Digital Sphygmomanometers, Mercury Sphygmomanometers)

- Blood Pressure Transducers

- Automated Blood Pressure Monitors

- Ambulatory Blood Pressure Monitors (ABPM)

- Wearable Blood Pressure Devices (Smartwatches, Patches)

- Blood Pressure Cuffs and Accessories

- Technology:

- Auscultatory Technology

- Oscillometric Technology

- Non-Cuff/Continuous Monitoring Technology (Emerging)

- End-User:

- Hospitals and Clinics

- Ambulatory Surgical Centers (ASCs)

- Home Care Settings

- Diagnostic Laboratories and Research Institutes

- Regions:

- North America (U.S., Canada)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Middle East and Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Blood Pressure Monitoring and Measurement Instruments Market

The value chain for the Blood Pressure Monitoring and Measurement Instruments Market is complex, beginning with raw material sourcing and culminating in patient usage, involving multiple interconnected stages focused on precision and regulatory compliance. The upstream analysis concentrates on the sourcing of critical components, including highly accurate pressure sensors, microprocessors, display screens, and durable cuff materials (nylon or synthetic polymers). Key raw material suppliers, often specialized in medical-grade plastics and advanced sensor manufacturing, heavily influence initial product quality and cost structures. Intellectual property related to advanced calibration techniques and sensor technologies constitutes a crucial competitive advantage at this stage. Manufacturers must maintain robust quality control over these components, as device accuracy is paramount to clinical utility.

The midstream involves manufacturing, assembly, and rigorous quality assurance testing. Device production requires sophisticated, clean room environments for assembly, calibration, and software integration, particularly for digital and connected monitors. Certification (such as FDA approval or CE marking) is a non-negotiable step that necessitates extensive clinical validation data. Direct and indirect distribution channels play a pivotal role in market penetration. Direct sales channels are typically employed for high-value clinical systems sold directly to large hospital networks or government procurement agencies, allowing for immediate technical support and tailored solutions. Indirect channels utilize distributors, wholesalers, and retail pharmacies (both brick-and-mortar and e-commerce platforms) to reach the vast consumer and home care market efficiently.

Downstream analysis focuses on deployment and end-user engagement. For clinical devices, servicing, maintenance, and training for healthcare personnel are essential components provided by manufacturers or authorized service partners. In the rapidly expanding home care segment, the distribution channel relies heavily on consumer electronics retail logistics and online pharmacies, prioritizing ease of purchase and consumer education regarding proper usage. The effectiveness of the value chain is increasingly measured by the quality of post-sale data management services, integration with EHR systems, and the ability to provide firmware updates or remote diagnostics for connected devices, thereby solidifying brand loyalty and ensuring long-term utility for both clinical and consumer end-users.

Blood Pressure Monitoring and Measurement Instruments Market Potential Customers

Potential customers for blood pressure monitoring and measurement instruments span the entire spectrum of healthcare, ranging from institutional entities requiring high-volume clinical accuracy to individual consumers demanding convenience and connectivity. The primary institutional buyers, or professional end-users, include large public and private hospitals, specialized cardiac and stroke centers, and tertiary care facilities, which require sophisticated, often invasive or continuous, patient monitoring systems for critical care environments and operating rooms. These facilities prioritize devices with proven clinical accuracy, reliable integration capabilities with existing patient monitoring networks, and extensive manufacturer support and maintenance contracts. Furthermore, research institutes and pharmaceutical companies represent high-value potential customers, utilizing precise BP monitoring devices in clinical trials and pharmacological efficacy studies.

The second major category encompasses community-based healthcare providers, such as general practitioners, primary care clinics, and ambulatory surgical centers (ASCs). These customers typically purchase mid-range digital and aneroid monitors that offer a balance of affordability, portability, and reliable measurement for routine patient checks and chronic condition management. The rising adoption of telehealth services makes this segment increasingly reliant on devices that can easily facilitate remote data transmission. Diagnostic laboratories also form a subset of this category, requiring certified instruments for standardized testing and screening programs aimed at early detection of cardiovascular risk factors within the general population.

The most rapidly growing customer segment is the direct consumer/end-user market (Home Care Settings). This includes individuals diagnosed with hypertension, pre-hypertension, or other chronic conditions requiring daily self-monitoring, as well as health-conscious consumers interested in preventative wellness. These buyers prioritize devices based on ease of use, comfort (especially cuff size and application), price point, and connectivity features (Bluetooth/Wi-Fi compatibility for app integration). Wearable devices, purchased through retail and e-commerce channels, specifically target this demographic, blurring the line between medical device and consumer electronics, and demonstrating the largest potential for sustained volume growth.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.1 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Omron Healthcare, GE Healthcare, Philips, A&D Company, Nihon Kohden, Spacelabs Healthcare, Schiller AG, SunTech Medical, Welch Allyn (Hill-Rom/Baxter), Microlife AG, Masimo, Beurer GmbH, BPL Medical Technologies, Contec Medical Systems, Xiaomi, Withings, iHealth Labs. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blood Pressure Monitoring and Measurement Instruments Market Key Technology Landscape

The technology landscape of the Blood Pressure Monitoring and Measurement Instruments Market is undergoing rapid transformation, moving away from purely mechanical solutions toward highly digitized and sensor-driven platforms. The established oscillometric method remains the industry standard for automated non-invasive measurement, utilizing an air-filled cuff to detect oscillations in blood flow as the pressure is gradually released. Continuous innovation within this method focuses on improving algorithms to compensate for motion artifacts and irregular heart rhythms, thereby enhancing measurement reliability in real-world scenarios. Parallelly, the auscultatory technique, relying on manual listening for Korotkoff sounds, still holds clinical significance, particularly for confirming measurements in critically ill patients, though its reliance on operator skill limits its widespread application in home settings.

The most disruptive technological frontier is the pursuit of cuffless and continuous blood pressure measurement. Researchers are heavily investing in methodologies based on Pulse Wave Velocity (PWV), Pulse Transit Time (PTT), and Photoplethysmography (PPG). PPG, in particular, is utilized by many commercial smartwatches and wearables, measuring changes in blood volume in the microvasculature. Advanced algorithms, frequently leveraging Artificial Intelligence and machine learning, correlate these optical signals with reference blood pressure, enabling discreet, frequent, and potentially continuous monitoring without the need for a bulky cuff. This technology promises to revolutionize adherence and longitudinal data collection, essential for personalized cardiovascular risk management.

Furthermore, connectivity and data handling technologies are crucial elements of the modern landscape. Bluetooth, Wi-Fi, and near-field communication (NFC) protocols are standard features, facilitating immediate data synchronization with smartphones, tablets, and cloud-based health platforms. Interoperability, driven by standardized health data protocols (like HL7 and FHIR), is key to ensuring that remote monitoring data can be seamlessly and securely integrated into Electronic Health Records (EHRs). Miniaturization in sensor design, coupled with improvements in battery technology, enables the creation of highly portable and long-lasting wearable patches and devices, further accelerating the market's trajectory towards decentralized, continuous monitoring solutions that redefine how hypertension is managed.

Regional Highlights

Regional dynamics within the Blood Pressure Monitoring and Measurement Instruments Market are diverse, driven by differences in healthcare infrastructure, chronic disease prevalence, regulatory environments, and consumer spending power. North America, specifically the United States, commands a substantial share of the global market. This dominance is attributed to high awareness levels regarding hypertension, robust reimbursement frameworks supporting Remote Patient Monitoring (RPM), and the rapid adoption of technologically advanced and premium digital devices in both clinical and home settings. The presence of major industry players and aggressive investment in digital health solutions further cements the region's leading position, focusing heavily on connected health ecosystems and AI integration.

Europe represents another mature and high-value market, characterized by strict medical device standards (MDR regulations) that ensure device reliability and quality. Key contributors like Germany, the United Kingdom, and France exhibit high per-capita healthcare spending and strong public health systems emphasizing preventative care and hypertension screening programs. While adoption rates for traditional devices are high, the region is rapidly embracing ABPM and connected digital monitors to optimize chronic disease management across national health services. Regulatory efforts promoting cross-border health data exchange are also fostering innovation in connected monitoring solutions.

Asia Pacific (APAC) is forecast to be the fastest-growing region, presenting immense market opportunities. This growth is spurred by the rapidly expanding middle-class population, escalating prevalence of cardiovascular diseases (linked to changing lifestyles), and significant governmental investments in modernizing healthcare facilities, particularly in China and India. While price sensitivity remains a factor, the sheer volume of patients requiring monitoring and the increasing penetration of affordable, yet accurate, digital devices are primary market drivers. Local manufacturing capabilities are also enhancing supply chain efficiency and product availability across diverse geographic and economic segments in the region.

Latin America and the Middle East and Africa (MEA) markets are characterized by steady but accelerating growth. In Latin America, urbanization and lifestyle changes contribute to rising hypertension rates, increasing the need for accessible monitoring tools, often fueled by public health campaigns. Brazil and Mexico are leading markets due to established healthcare economies and a growing consumer interest in self-monitoring. The MEA region, particularly the GCC countries, benefits from high healthcare spending aimed at achieving world-class medical services, driving demand for premium, high-accuracy devices in hospital settings, while South Africa acts as a key entry point for broader African market penetration, focusing on standardized, reliable digital instruments for primary care settings.

- North America: Market leader due to high healthcare expenditure, sophisticated digital infrastructure, strong regulatory support for RPM, and early adoption of AI-driven diagnostics and continuous monitoring devices.

- Europe: Mature market driven by stringent quality standards (MDR), aging population, high public health focus on preventative cardiology, and widespread use of ABPM devices for specialized diagnostics.

- Asia Pacific (APAC): Highest CAGR fueled by massive patient base, rapid healthcare infrastructure development, increasing disposable incomes, and technological leapfrogging directly to advanced digital and connected monitors.

- Latin America: Growth driven by rising chronic disease prevalence, urbanization, and government initiatives aimed at expanding access to essential medical devices for hypertension control.

- Middle East and Africa (MEA): Growth focused on high-end hospital demand in Gulf nations and increasing necessity for affordable, durable monitoring solutions in primary care across broader African countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blood Pressure Monitoring and Measurement Instruments Market.- Omron Healthcare, Inc.

- GE Healthcare

- Koninklijke Philips N.V.

- A&D Company, Limited

- Nihon Kohden Corporation

- Spacelabs Healthcare (OSI Systems)

- Schiller AG

- SunTech Medical, Inc. (Halma plc)

- Welch Allyn (Now part of Baxter International)

- Microlife AG

- Masimo Corporation

- Beurer GmbH

- BPL Medical Technologies Pvt Ltd

- Contec Medical Systems Co., Ltd.

- iHealth Labs, Inc.

- Withings S.A.

- Berrcom (Shenzhen Creative Industry Co., Ltd.)

- Hill-Rom Services, Inc. (Now part of Baxter International)

- Rossmax International Ltd.

- Citizen Systems Japan Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Blood Pressure Monitoring and Measurement Instruments market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high growth rate in the Blood Pressure Monitoring Market?

The primary driver is the accelerating global prevalence of hypertension, coupled with the rapid demographic shift towards an aging population who require frequent, often continuous, monitoring. Additionally, the technological shift toward accurate, portable, and connected devices (Remote Patient Monitoring or RPM) significantly boosts consumer adoption in home settings.

How reliable are cuffless or wearable blood pressure monitoring devices compared to traditional cuff devices?

Cuffless and wearable devices, which often rely on advanced sensor technology like PPG and AI algorithms, are showing increasing reliability but may still require periodic calibration against clinical-grade cuff devices. While traditional oscillometric cuff devices remain the clinical gold standard for accuracy, continuous monitoring offers valuable trend data, proving essential for early detection and lifestyle management in the consumer segment.

Which segment of the Blood Pressure Monitoring Instruments Market is expected to see the fastest commercial growth?

The Home Care Settings segment, supported by the Wearable Blood Pressure Devices product category, is projected to exhibit the fastest growth. This acceleration is driven by consumer demand for convenient self-monitoring, increasing acceptance of telehealth, and improved device integration with personal health records and digital wellness platforms.

What are the key technological advancements expected to shape the future of blood pressure measurement?

The future is defined by advancements in continuous, non-invasive measurement using non-cuff technologies (e.g., based on Pulse Transit Time or bioimpedance), integration of AI for predictive health analytics, and enhanced miniaturization allowing devices to be seamlessly incorporated into clothing or everyday wearables, prioritizing patient comfort and compliance over traditional episodic checks.

What are the main regulatory challenges faced by manufacturers in this market?

Manufacturers face challenges related to ensuring consistent clinical accuracy across diverse user demographics and environments, obtaining rigorous clearances (such as FDA or CE Mark) for new AI-driven diagnostic features, and complying with stringent global data privacy regulations (like GDPR and HIPAA) concerning the transmission and storage of sensitive patient monitoring data from connected devices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager