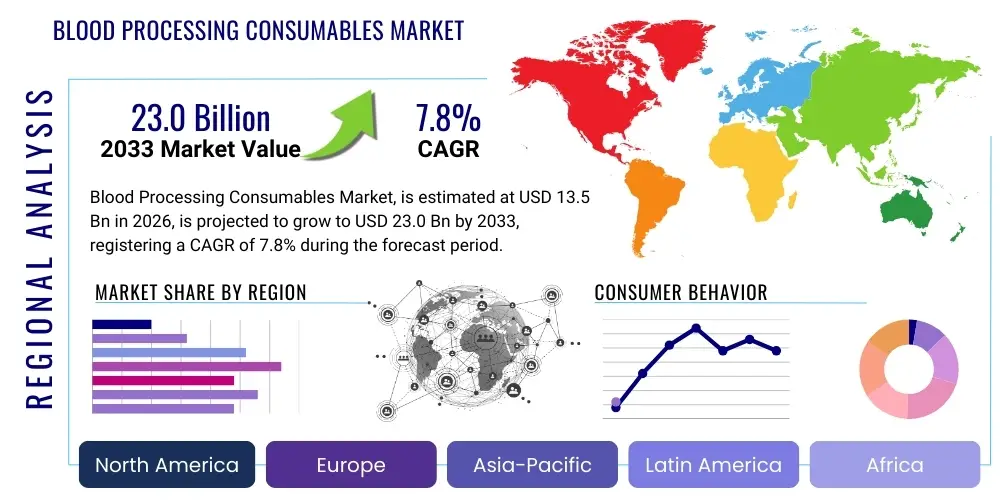

Blood Processing Consumables Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436372 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Blood Processing Consumables Market Size

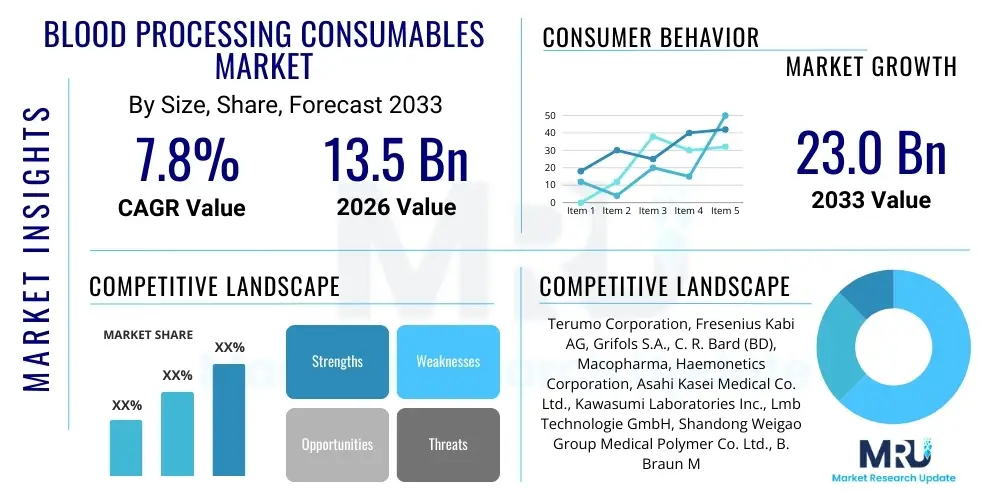

The Blood Processing Consumables Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 13.5 Billion in 2026 and is projected to reach USD 23.0 Billion by the end of the forecast period in 2033.

Blood Processing Consumables Market introduction

The Blood Processing Consumables Market encompasses specialized products essential for the collection, separation, storage, and transfusion of blood and its components. These consumables include blood bags, syringes, filtration systems, separation media, tubes, and related devices designed for single-use to maintain sterility and prevent cross-contamination. This market is fundamentally driven by the critical need for safe blood products in various medical settings, including surgical procedures, trauma care, and the management of chronic blood disorders like hemophilia and sickle cell anemia. The primary application sectors are blood banks, hospitals, diagnostic laboratories, and pharmaceutical companies involved in plasma fractionation, where meticulous processing of biological samples is mandatory for patient safety and regulatory compliance.

Key products within this segment facilitate the effective separation of whole blood into its therapeutic components, such as red blood cells, platelets, fresh frozen plasma, and cryoprecipitate. The inherent benefits of utilizing modern blood processing consumables include enhanced quality control, standardization of procedures, minimization of operational risks, and extension of the shelf life of labile blood components. Furthermore, the shift towards advanced processing techniques, such as apheresis and leukocyte reduction, necessitates high-quality, specialized consumables that are chemically inert and biologically safe, driving continuous innovation in material science and manufacturing precision across the supply chain.

Major driving factors fueling the market expansion include the increasing volume of surgical operations globally, a rising incidence of chronic diseases requiring frequent blood transfusions, and significant advancements in transfusion medicine protocols. Additionally, stringent regulatory mandates emphasizing blood safety and the growing public awareness regarding voluntary blood donation campaigns contribute substantially to the demand curve. Demographic trends, particularly the aging global population, which is more susceptible to conditions requiring blood products, further solidify the stable growth trajectory of the blood processing consumables sector over the forecast period.

Blood Processing Consumables Market Executive Summary

The Blood Processing Consumables Market is poised for robust expansion, primarily steered by accelerating advancements in automated blood collection and component separation technologies. Current business trends indicate a strong focus on developing 'smart' consumables integrated with RFID or barcoding systems to enhance traceability and reduce manual errors in blood banks. There is an increasing adoption of closed-system blood collection kits and highly efficient pathogen reduction technologies (PRTs), reflecting a dominant industry push towards achieving zero-risk blood transfusion environments. Furthermore, strategic partnerships and mergers among key manufacturers and technology developers are intensifying the competitive landscape, aiming to capture market share in high-growth regions through localized production and expanded distribution networks.

Regionally, North America and Europe maintain dominance, owing to well-established healthcare infrastructure, high awareness regarding advanced blood therapies, and significant government funding directed toward transfusion safety research. However, the Asia Pacific (APAC) region is projected to register the fastest growth, fueled by rapidly improving healthcare access, increasing investments in modernizing public blood centers, and a vast population base leading to high volumes of potential donors and recipients. Emerging markets in Latin America and the Middle East and Africa (MEA) are also showing promising growth, primarily driven by international aid programs and domestic efforts to curb infectious disease transmission through safer blood practices, necessitating a higher supply of high-grade processing consumables.

Segment trends highlight the dominance of blood bags and storage containers due to their universal necessity across all processing stages. Nonetheless, the apheresis consumables segment is expected to show the highest CAGR, driven by the increasing application of specialized component collection (e.g., concentrated platelet donation) and therapeutic apheresis procedures. Manufacturers are increasingly focusing R&D efforts on producing specialized, biocompatible plastics and polymeric materials that ensure optimal preservation of blood integrity. The institutional end-user segment, comprising hospitals and independent blood centers, remains the largest consumer, but demand from diagnostic labs and biotechnology firms for clinical trials and specialized processing is growing rapidly.

AI Impact Analysis on Blood Processing Consumables Market

User queries regarding the impact of Artificial Intelligence (AI) on the Blood Processing Consumables Market center around three key themes: efficiency in inventory management, integration with automated processing hardware, and predictive analytics for demand forecasting. Users are concerned about whether AI-driven optimization will reduce the overall consumption volume of consumables through improved operational precision, or if it will spur demand for specialized, sensor-enabled consumables. Key expectations include AI optimizing blood component matching, reducing wastage due to expiration or procedural errors, and streamlining the complex logistics of the blood supply chain from donor to patient. Essentially, users expect AI to transition the market from reactive supply ordering to proactive, data-driven inventory management, thus influencing the required volume and type of standardized, traceable consumables.

- AI integration optimizes complex blood fractionation protocols, potentially reducing errors and standardizing the usage of specific consumables.

- Machine learning algorithms enhance demand forecasting for blood components, leading to optimized stocking levels of corresponding collection and processing kits, minimizing expiry waste.

- AI-powered image analysis and quality control systems require highly uniform and traceable consumables (e.g., standardized tubing size, clear bag materials) for accurate performance assessment.

- Predictive maintenance for automated apheresis and component separation equipment ensures timely replacement of necessary consumables, improving operational uptime.

- AI contributes to personalized medicine by identifying optimal blood component preparation techniques, potentially driving demand for specialized, low-volume processing consumables.

DRO & Impact Forces Of Blood Processing Consumables Market

The market for Blood Processing Consumables is shaped by dynamic interactions between essential drivers, persistent restraints, compelling opportunities, and overarching impact forces. The primary drivers include the mandatory increase in blood screening and safety standards globally, the high demand generated by trauma and surgical centers, and the growing incidence of chronic diseases requiring regular transfusions. These factors create sustained, non-negotiable demand for sterile, single-use products. Conversely, the market faces restraints such as stringent regulatory approval processes for new materials and devices, the constant pressure to reduce healthcare costs globally, and challenges related to maintaining a stable donor base and ensuring efficient supply chain logistics, particularly in developing economies.

Significant opportunities arise from the ongoing shift towards advanced component separation techniques, specifically therapeutic apheresis, which requires specialized, high-margin disposable kits. Moreover, the integration of automation and digitalization in blood banks presents an opportunity for manufacturers to develop 'smart' consumables equipped with traceability features. Furthermore, developing pathogen reduction technologies (PRT) and the need for corresponding consumables that maintain product efficacy while ensuring viral inactivation represent a key area for high-value growth. This pivot toward sophisticated processing methodologies ensures that innovation in consumables remains a critical component of market strategy.

The impact forces influencing the market trajectory are primarily regulatory harmonization, technological obsolescence, and global health crises. Regulatory bodies like the FDA and EMA continually update guidelines regarding blood product quality and safety, forcing manufacturers to adopt new standards swiftly, which impacts product design and material selection. Technological progress in non-invasive diagnostic alternatives could potentially reduce the reliance on certain blood products, serving as a limiting force. However, the recurring threat of pandemics or major public health crises consistently reinforces the strategic necessity and demand for robust, reliable blood supply chain infrastructure and associated processing consumables, acting as a profound demand accelerator.

Segmentation Analysis

The Blood Processing Consumables Market is comprehensively segmented based on product type, processing technology, material, and end-user, allowing for detailed analysis of market dynamics and targeted strategic development. The product segmentation details the various disposable items required throughout the blood handling lifecycle, from collection to transfusion. Technology segmentation reflects the shift towards highly specialized and automated methods of blood component preparation, such as apheresis and filtration, which necessitate unique consumable interfaces. Material analysis focuses on the chemical composition of blood-contacting surfaces, emphasizing biocompatibility and integrity. End-user classification helps identify primary consumption hubs and their specific requirements for volume and specialization, enabling manufacturers to tailor their production and distribution efforts accordingly.

- By Product Type:

- Blood Bags (Single, Double, Triple, Quadruple)

- Anticoagulants and Additive Solutions (CPD, CPDA-1, AS-1, AS-3)

- Apheresis Consumables (Disposable kits, Centrifuge bowls)

- Blood Filtration Systems (Leukoreduction filters, Removal filters)

- Plasma Fractionation Consumables

- Others (Tubes, Needles, Sampling kits, Sealing devices)

- By Technology:

- Whole Blood Processing

- Apheresis Technology

- Blood Component Separation

- Pathogen Reduction Technology (PRT)

- By Material:

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Others (Ethylene Vinyl Acetate, Biocompatible polymers)

- By End User:

- Blood Banks

- Hospitals and Clinics (Transfusion Centers)

- Diagnostic Laboratories

- Pharmaceutical and Biotechnology Companies (Plasma Fractionation Centers)

Value Chain Analysis For Blood Processing Consumables Market

The value chain for Blood Processing Consumables begins with upstream activities centered on raw material procurement, primarily specialized polymers, plastics, and proprietary anti-coagulant chemicals. Manufacturers must secure high-quality, medical-grade components that meet strict biocompatibility standards, often sourcing from specialized chemical or polymer processing firms. Critical upstream activities include the synthesis of non-toxic plastics suitable for blood contact and the preparation of additive solutions necessary for component preservation. Supply stability and quality control at this stage are paramount, as they directly influence the safety and efficacy of the final blood product.

The core manufacturing stage involves cleanroom assembly, sterilization, and packaging of the complex consumable kits, such as multi-bag systems and apheresis disposables. Efficiency and precision in manufacturing are crucial to minimize defect rates, given the critical nature of the product application. The distribution channel is bifurcated: direct distribution often targets large, centralized blood banks and major hospital systems, allowing for customized inventory solutions and direct technical support. Indirect distribution, leveraging regional distributors and medical supply resellers, services smaller hospitals, clinics, and remote diagnostic laboratories, ensuring widespread market penetration.

Downstream activities focus on the end-users—blood banks and hospitals—where the consumables are utilized for collection, component separation, and storage. The final consumption point requires reliable inventory management and adherence to strict usage protocols. Post-consumption, the value chain often incorporates specialized medical waste disposal, though this is managed by the end-user. The integration of digital tracking systems (barcodes/RFID) throughout the chain connects manufacturing traceability directly to patient transfusion records, enhancing overall market efficiency and regulatory compliance, thereby adding significant value to the final consumable product.

Blood Processing Consumables Market Potential Customers

The primary customers for Blood Processing Consumables are institutions that manage the complex process of blood collection, component preparation, testing, and storage. Centralized public and private blood banks represent the largest purchasing segment globally. These institutions operate high-volume processing centers and require large quantities of standardized consumables, including blood collection bags, storage solutions, and basic filtration units. Their procurement decisions are heavily influenced by cost-efficiency, regulatory approval, and the ability of the consumables to integrate seamlessly with their automated processing machinery. Since blood banks are mandated to ensure the highest safety standards, they prioritize products offering advanced features like pathogen reduction compatibility and enhanced component yields.

Hospitals and clinics, particularly those with dedicated transfusion medicine departments and high surgical caseloads, form the second significant customer base. While some large hospitals operate internal blood processing units, most rely on consumables for immediate bedside testing, rapid filtration, and final administration (transfusion kits). Trauma centers and specialized surgical units, which require immediate access to various blood components, drive demand for specialized, ready-to-use kits. The purchasing patterns in this segment are often decentralized and influenced by group purchasing organizations (GPOs), focusing on reliability, timely delivery, and ease of use in critical settings.

A growing niche segment comprises pharmaceutical and biotechnology companies, specifically those involved in plasma fractionation to produce life-saving therapeutic proteins (e.g., albumin, immunoglobulins). These organizations require highly specialized, industrial-scale consumables, including large-volume collection systems and specific filtration and separation media designed for plasma purification processes. Similarly, contract research organizations (CROs) and advanced diagnostic laboratories that handle clinical trial samples or conduct complex blood component analysis also represent a high-value customer segment, often demanding small volumes of highly specialized, research-grade consumables.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 13.5 Billion |

| Market Forecast in 2033 | USD 23.0 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Terumo Corporation, Fresenius Kabi AG, Grifols S.A., C. R. Bard (BD), Macopharma, Haemonetics Corporation, Asahi Kasei Medical Co. Ltd., Kawasumi Laboratories Inc., Lmb Technologie GmbH, Shandong Weigao Group Medical Polymer Co. Ltd., B. Braun Melsungen AG, Abbott Laboratories, Thermo Fisher Scientific, General Electric Healthcare, Danaher Corporation, Octapharma AG, Medtronic plc, Nikkiso Co. Ltd., Teleflex Incorporated, Sarstedt AG & Co. KG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blood Processing Consumables Market Key Technology Landscape

The Blood Processing Consumables Market is heavily influenced by continuous technological advancements aimed at improving blood product safety, quality, and processing efficiency. A crucial technological shift involves the transition from manual whole blood processing to highly automated, closed-system component separation, primarily driven by advanced centrifugal and filtration technologies. These automated systems require bespoke, integrated consumable kits that interface perfectly with the equipment, ensuring sterile transfer and minimal operator intervention. Key technological focuses include developing advanced polymers that enhance gas exchange properties for platelet storage and novel additive solutions that extend the viability and shelf life of red blood cells.

Another significant area of technological innovation is in Pathogen Reduction Technology (PRT). PRT relies on specific consumable systems designed to introduce photoactive compounds and expose blood components to UV light, neutralizing residual pathogens without compromising the therapeutic efficacy of the blood product. The consumables used in PRT systems must be optically clear, highly stable under UV exposure, and compatible with the chemical agents utilized. The market is seeing an increasing demand for integrated leukoreduction filters, which are essential for removing white blood cells to prevent transfusion reactions and minimize immunomodulation, thereby increasing the overall safety profile of transfused components.

Furthermore, the rise of therapeutic and collection apheresis technology demands specialized disposable sets that facilitate selective harvesting of specific blood components (e.g., plasma, platelets) from donors or patients, while returning the remaining components. These apheresis kits are complex, featuring multiple tubing segments, collection chambers, and precision-engineered centrifuge bowls. Future technological developments are likely to focus on miniaturization and improved material robustness, enabling point-of-care processing and enhancing compatibility with emerging digital technologies for real-time monitoring and quality assurance throughout the blood handling process.

Regional Highlights

- North America: This region holds the largest market share due to its sophisticated healthcare infrastructure, high adoption rate of advanced blood screening and processing technologies, and stringent regulatory environment (FDA). The presence of major market players and substantial investment in R&D, particularly in apheresis and plasma-derived therapies, solidifies its leading position. The U.S. remains the central hub for innovation and high-volume consumption of specialized processing consumables.

- Europe: Characterized by mandatory blood safety regulations enforced by centralized bodies like the European Medicines Agency (EMA) and national blood services, Europe is a mature and highly regulated market. The focus here is strongly on standardization, universal adoption of leukoreduction, and integration of automated blood processing equipment, driving steady demand for high-quality, certified consumables. Germany, France, and the UK are key contributors to market revenue.

- Asia Pacific (APAC): APAC is anticipated to experience the highest growth rate driven by expanding healthcare budgets, increasing awareness regarding transfusion safety, and the rapid establishment of modern blood banking facilities, particularly in China and India. The immense population size translates to a massive potential donor and patient base, while government initiatives to combat infectious diseases accelerate the demand for advanced, single-use processing kits.

- Latin America (LATAM): Growth in LATAM is characterized by infrastructural improvements and efforts to standardize blood processing protocols across countries like Brazil and Mexico. While pricing sensitivity is higher, there is a consistent increase in demand for basic blood bags and anticoagulant solutions, supplemented by rising adoption of filtration technologies supported by international organizations.

- Middle East and Africa (MEA): This region exhibits mixed maturity. The Gulf Cooperation Council (GCC) countries show high adoption of advanced consumables due to high per capita healthcare spending. However, the African continent is focused on basic blood processing needs and controlling infectious disease transmission, creating stable, though often price-sensitive, demand for essential collection and storage consumables.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blood Processing Consumables Market.- Terumo Corporation

- Fresenius Kabi AG

- Grifols S.A.

- C. R. Bard (BD)

- Macopharma

- Haemonetics Corporation

- Asahi Kasei Medical Co. Ltd.

- Kawasumi Laboratories Inc.

- Lmb Technologie GmbH

- Shandong Weigao Group Medical Polymer Co. Ltd.

- B. Braun Melsungen AG

- Abbott Laboratories

- Thermo Fisher Scientific

- General Electric Healthcare

- Danaher Corporation

- Octapharma AG

- Medtronic plc

- Nikkiso Co. Ltd.

- Teleflex Incorporated

- Sarstedt AG & Co. KG

Frequently Asked Questions

Analyze common user questions about the Blood Processing Consumables market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving force behind the growth of the Blood Processing Consumables Market?

The primary driving force is the increasing global demand for blood and its components, fueled by a rising volume of complex surgical procedures, a high prevalence of chronic blood disorders, and continuously tightening regulatory mandates focused on enhancing blood safety and reducing transfusion-related risks worldwide.

Which product segment dominates the Blood Processing Consumables Market?

The Blood Bags and Storage Containers segment currently dominates the market by revenue, as these products are universally required across all stages of blood collection, component preparation, and storage activities in every blood bank and transfusion facility globally.

How is Pathogen Reduction Technology (PRT) influencing consumable demand?

PRT technology is significantly increasing demand for highly specialized, chemically compatible consumables that are integral to the viral inactivation process. These proprietary consumables ensure the efficacy of pathogen reduction while maintaining the quality and therapeutic properties of the treated blood products.

Which geographical region is projected to exhibit the fastest growth rate?

The Asia Pacific (APAC) region is projected to demonstrate the fastest Compound Annual Growth Rate (CAGR). This acceleration is attributed to rapidly developing healthcare infrastructure, growing public and private investment in modern blood banking, and the enormous patient base in countries like China and India.

What role does material science play in the Blood Processing Consumables Market?

Material science is critical, focusing on developing advanced, biocompatible polymers (like specialized PVC or novel polyolefins) that ensure optimal preservation, reduce leaching, and extend the viability and storage life of sensitive blood components, such as platelets and red blood cells.

The extensive demand for blood components across diverse medical fields—ranging from oncology and hematology to trauma and surgical interventions—mandates the sustained evolution of the consumables market. The sector's stability is underpinned by the essential nature of its products, which are non-negotiable for maintaining global blood safety standards. As healthcare systems globally prioritize patient safety and traceability, the integration of smart features into consumables will become standard practice. This includes incorporating micro-sensors or advanced material science to monitor temperature and component integrity in real time. The geopolitical landscape, particularly regarding manufacturing capacity and supply chain resilience, plays a critical role. Manufacturers are increasingly looking to diversify production bases to mitigate risks associated with regional disruptions, ensuring continuous supply of these life-saving products. Further market penetration relies heavily on successful collaboration between regulatory bodies, technology developers, and end-users to standardize protocols and facilitate the widespread adoption of next-generation processing kits across varied economic landscapes. The transition toward high-throughput, automated processing platforms, particularly in emerging economies, will be a defining trend in the latter half of the forecast period, emphasizing the need for robust, cost-effective disposable solutions capable of handling massive sample volumes while maintaining stringent quality control.

The emphasis on personalized medicine and tailored transfusion strategies is subtly reshaping the consumable profile. Instead of large, multi-purpose kits, there is a nascent trend toward smaller, more targeted processing consumables suitable for pediatric transfusions or highly specific patient requirements. This shift requires manufacturers to manage complex inventory portfolios and ensure scalability in niche production lines. Furthermore, sustainability is emerging as a long-term factor. Given the single-use nature of these products, there is increasing scrutiny regarding the environmental impact of disposal. While sterility remains paramount, future R&D efforts may focus on developing medical-grade polymers that offer a better environmental footprint without compromising biocompatibility or regulatory compliance. This duality—the need for absolute safety coupled with environmental responsibility—will drive innovation in raw material selection and manufacturing processes over the next decade. Continuous training and education for blood bank personnel are also crucial, as the effectiveness of the consumables is directly tied to the proper use of the associated technology. Companies that offer comprehensive training packages alongside their products will gain a competitive edge, especially in markets transitioning to advanced processing techniques.

The long-term outlook for the Blood Processing Consumables Market remains exceptionally positive, driven by the inelastic demand for blood products and the perpetual need for enhanced safety measures. The convergence of biotechnology, automation, and material science suggests a future where blood processing is faster, safer, and highly tailored. Investment in high-growth segments like apheresis and specialized filtration systems, coupled with strategic expansion into high-potential APAC markets, will be the central pillars of competitive strategy. Manufacturers must continuously innovate to meet evolving regulatory landscapes, particularly those addressing emerging infectious threats that necessitate rapid adaptation of processing and screening protocols. The market’s resilience is guaranteed by its role at the core of emergency medicine and chronic disease management, making consumables a fundamental component of global healthcare infrastructure.

The competitive environment is characterized by a mix of large, diversified healthcare conglomerates and specialized niche players focusing solely on blood safety or collection. This dynamic structure fosters both price competition in commodity segments (like basic blood bags) and intense R&D competition in high-value areas (like PRT and apheresis kits). The development cycle for new consumables is often extended due to rigorous regulatory testing to prove non-toxicity and efficacy. This barrier to entry favors established players with substantial resources and long-standing relationships with regulatory bodies. However, smaller innovators often introduce disruptive technologies, particularly in material science or automation interface design, forcing larger companies to acquire or strategically partner to maintain technological leadership. Intellectual property rights surrounding proprietary anticoagulant formulations and unique bag designs are crucial assets, shaping market dynamics and preventing rapid commoditization of specialized products. Companies that successfully navigate this complexity, offering scalable, safe, and technologically integrated consumable solutions, are best positioned to capture substantial market share growth over the forecast period and beyond.

Global standardization efforts, led by international organizations like the World Health Organization (WHO), push for universal adoption of best practices, inadvertently favoring manufacturers whose products meet these highest standards. This trend supports the global export capabilities of companies based in highly regulated zones (North America and Europe). Furthermore, the rising awareness and deployment of sophisticated cold chain logistics for blood component transport also influences consumable design, requiring materials capable of withstanding extreme temperature variations and minimizing risks of component degradation during shipment. The interface between the consumable and the cold chain environment is a growing design consideration, driving demand for specialized packaging and insulation components, often integrated into the primary consumable kit itself. This holistic approach, from collection bag material to transportation stability, ensures the integrity of the blood product until the moment of transfusion.

The market faces ethical and logistical challenges related to sourcing and disposal. Ethical debates surrounding voluntary versus compensated donation models indirectly impact the volume of blood collected, thus affecting the necessary volume of consumables. Logistically, ensuring sterile disposal of millions of contaminated single-use units is a significant environmental and operational cost for end-users. Manufacturers addressing these issues through bio-degradable or more easily recyclable materials, while adhering to stringent medical waste protocols, will secure a competitive advantage in environmentally conscious markets. Lastly, the increasing prevalence of diagnostic point-of-care testing utilizing microfluidic blood analysis could potentially siphon off some demand from traditional centralized laboratory consumables, particularly for rapid screening tests. However, core life-saving transfusions and high-volume component processing will remain firmly reliant on traditional, high-capacity consumables for the foreseeable future, ensuring sustained market stability and growth.

The adoption of advanced techniques such as flow cytometry and mass spectrometry for quality control of blood components also necessitates high-purity consumables that do not interfere with sensitive analytical processes. Contaminants leaching from plastics can significantly skew diagnostic results, driving demand for ultra-low extractable and inert materials. This focus on purity extends the competitive scope beyond mere functionality to include stringent chemical profiling of all blood-contacting surfaces. Furthermore, the global shift towards component separation, rather than whole blood transfusion, is fundamentally changing the procurement landscape. Hospitals are increasingly ordering specific component kits (e.g., platelet kits or plasma kits) rather than just general collection bags, demanding greater precision in inventory management both from the supplier and the end-user. This specialization drives higher average selling prices for consumables and encourages continuous innovation in component-specific preservation solutions.

In developing nations, the primary market growth driver remains the expansion of access to basic, safe blood collection and processing infrastructure. International aid and NGO investments often target providing subsidized or donated essential consumables (like standard triple blood bags) to replace outdated or high-risk collection practices. While advanced technologies like apheresis are gradually penetrating these markets, the immediate, high-volume requirement is for affordable, highly reliable standard kits. Localized manufacturing, supported by foreign direct investment, is a growing trend aimed at reducing import dependency and addressing price sensitivity in these regions. Successful market entry in these regions requires robust supply chains capable of handling challenging logistical environments and effective localization of product specifications to meet national health guidelines and operational constraints.

Finally, the growing threat of bioterrorism or highly contagious infectious disease outbreaks (as evidenced by recent global events) necessitates rapid scalability and flexibility in the consumables supply chain. Manufacturers are often required to maintain surge capacity or rapidly retool production lines to meet emergency demands for specialized collection or decontamination kits. This requirement for readiness adds complexity and cost to the manufacturing process but is a vital component of the sector's strategic importance to national security and public health preparedness. The market is thus driven not only by steady medical demand but also by unpredictable, high-impact public health risks, cementing the crucial role of reliable and adaptable blood processing consumables.

The increasing automation across the entire transfusion chain—from donor registration to component storage—is leading to a requirement for consumables that are intrinsically compatible with robotic handling systems. This necessitates precise dimensional tolerances, consistent material properties, and specific geometric features on blood bags and tubing to ensure flawless interaction with automated sealers, sorters, and storage carousels. Quality control in manufacturing must therefore be exceptionally rigorous to support this automation wave, reducing the tolerance for defects that could cause system failures in high-throughput environments. This technological pressure is driving smaller players to invest heavily in modernizing their production facilities or face being excluded from contracts with large, automated blood centers. The future manufacturing landscape for consumables will prioritize factories utilizing Industry 4.0 principles, including high-precision machining, integrated sensor monitoring, and data-driven process optimization to achieve the requisite quality standards for automated blood processing environments.

Moreover, the utilization of big data and advanced analytics in transfusion medicine is influencing product design. Consumables that facilitate easy, error-free capture of critical processing data—such as kits with integrated passive sensors or advanced QR codes—are becoming increasingly valuable. This digital integration supports improved patient traceability, enhances auditing processes, and provides manufacturers with valuable insights into real-world product performance. For instance, monitoring the physical stress on a blood bag during centrifugation can inform future design iterations aimed at improving durability and component yield. The convergence of physical product and digital data streams elevates the role of the consumable beyond a simple container to an integral part of the data management ecosystem in modern blood banking.

The specialized area of cell and gene therapy (CGT) is creating a distinct, high-value sub-segment within the consumables market. CGT procedures, such as CAR T-cell therapy, rely on highly purified, patient-derived cells, often requiring specialized, closed-system collection and processing kits that minimize external contamination risks. These consumables are typically sterile-dockable and tailored for use with specific bioreactors and cell processing platforms. While the volume of CGT-related consumables is currently lower than traditional transfusion products, their significantly higher unit cost and requirement for cutting-edge materials make them a powerful growth driver for manufacturers focused on high-specification, niche markets. This segment demands consumables with extremely low particle counts and verified chemical inertness, pushing the boundaries of medical device material science and manufacturing precision.

Lastly, the dynamic regulatory landscape surrounding donor screening and testing methodologies influences the design of the entire collection kit. For example, changes in mandated testing protocols may require specialized sampling ports or tubes to accommodate different diagnostic instruments, often requiring rapid redesign and re-certification of the base consumable product. Manufacturers must maintain agile regulatory teams capable of quickly interpreting and implementing these changes globally. The continued pressure to reduce donor infectious risk, coupled with the emergence of new viral threats, ensures that the market for consumables related to pre-transfusion testing and viral inactivation will see sustained innovation and investment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager