Blood Product Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435330 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Blood Product Market Size

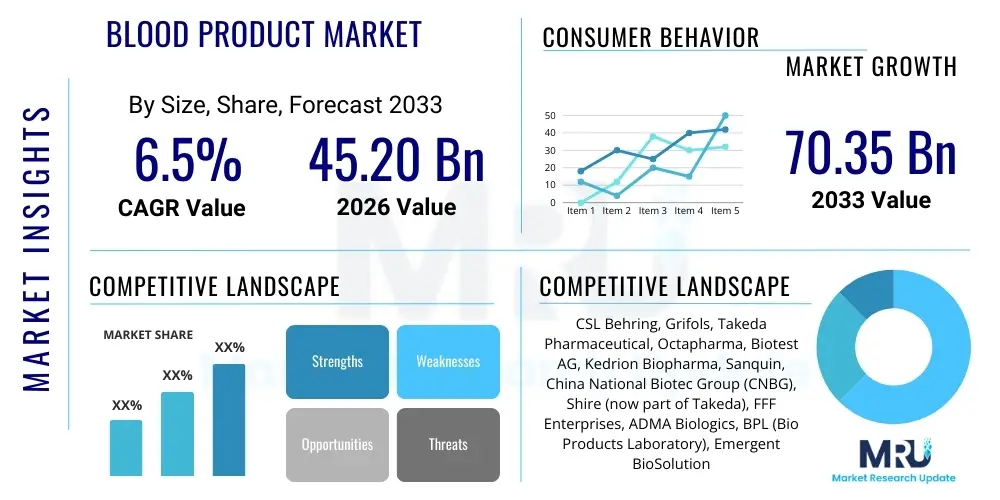

The Blood Product Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 45.20 Billion in 2026 and is projected to reach USD 70.35 Billion by the end of the forecast period in 2033.

Blood Product Market introduction

The Blood Product Market encompasses a wide range of therapeutic and diagnostic materials derived from human blood, including whole blood, red blood cell concentrates, platelets, and crucially, plasma derivatives such as immunoglobulins (Ig), albumin, and coagulation factors. These products are indispensable components of modern healthcare, utilized extensively across critical medical disciplines including transfusion medicine, hematology, oncology, and immunology. The demand for blood products is intrinsically linked to global demographics, particularly the aging population, which requires more complex surgical interventions and suffers from higher incidences of chronic diseases like hemophilia, primary immune deficiencies (PID), and alpha-1 antitrypsin deficiency (AATD). The safety and efficacy of these products are paramount, necessitating stringent regulatory frameworks and continuous technological advancements in donor screening, collection, and processing, particularly concerning viral inactivation and pathogen reduction techniques. The essential, non-substitutable nature of many plasma derivatives drives sustained market stability and growth.

Blood products serve vital roles, ranging from life-saving trauma care, where rapid transfusion is necessary to restore volume and clotting capacity, to long-term management of genetic disorders. Plasma derivatives, which constitute the most lucrative segment, are essential for patients with inherited bleeding disorders, such as Hemophilia A and B, who rely on factor concentrates for prophylactic and on-demand treatment. Furthermore, the increasing off-label and approved uses of intravenous immunoglobulin (IVIg) for neurological and autoimmune conditions are significantly bolstering market expansion. The complexity of manufacturing plasma derivatives, which involves intricate fractionation processes to separate therapeutic proteins, limits competition and necessitates significant capital investment, further characterizing this specialized market space.

The fundamental driving factors sustaining the market include rising surgical volumes worldwide, often requiring blood transfusions; growing diagnosis rates for PID and other conditions treatable with Ig therapies; and robust public and private investments in blood banking infrastructure and research. However, the market faces persistent challenges related to donor availability and the ethical sourcing of plasma, alongside high manufacturing costs and intense regulatory scrutiny. Technological innovations focused on enhancing product safety, extending shelf life, and developing synthetic alternatives (though still nascent) represent key areas for future market evolution and disruption. The geopolitical landscape also plays a role, as many countries rely on imported plasma for their derivative supply, creating supply chain vulnerabilities that stakeholders are actively working to mitigate through domestic investment.

Blood Product Market Executive Summary

The global Blood Product Market demonstrates robust resilience driven primarily by increasing demand for plasma derivatives, especially high-purity immunoglobulins and specialty factor concentrates, essential for managing chronic, life-threatening conditions. Business trends indicate a significant push toward vertical integration among major players, aiming to secure plasma supply through expanded collection center networks, particularly in the United States, which is a major source of source plasma. Furthermore, the industry is witnessing strategic alliances and mergers focused on leveraging proprietary fractionation technologies and expanding geographic reach, particularly into high-growth emerging economies. The overarching business objective remains balancing the urgent need for supply expansion with maintaining impeccable product safety standards, driven by stringent pharmacovigilance requirements.

Regionally, North America maintains market dominance due to established healthcare systems, high awareness, extensive reimbursement policies, and a highly centralized plasma collection infrastructure. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by improving healthcare access, rising disposable incomes leading to better disease diagnosis, and significant governmental investments in public health and blood banking capacity building. European markets continue steady growth, marked by strong regulatory harmonization and emphasis on non-remunerated voluntary donation models, presenting unique challenges for plasma sourcing compared to the remunerated system prevalent in North America. These regional dynamics necessitate tailored market entry and regulatory strategies for global manufacturers.

Segment trends highlight the dominance of the plasma derivatives segment, consistently outpacing whole blood and other components in value growth, attributed to the premium pricing and chronic usage nature of products like IVIg and Factor VIII. Within the derivatives segment, innovation is focused on improving administration methods (e.g., transitioning from intravenous to subcutaneous immunoglobulin products—SCIg) to enhance patient quality of life and reduce healthcare burden. The segment targeting Hemophilia treatment is witnessing a shift toward longer-acting factor concentrates and potentially curative gene therapies, which, while not immediately displacing current products, signal a long-term transformative trend requiring manufacturers to diversify their therapeutic portfolios and adapt their commercial strategies.

AI Impact Analysis on Blood Product Market

Common user inquiries regarding the integration of Artificial Intelligence (AI) and Machine Learning (ML) in the Blood Product Market primarily center on enhancing operational efficiency, minimizing risks, and optimizing scarce resource allocation. Users are keenly interested in how AI can streamline donor recruitment and retention campaigns, moving beyond traditional methods to predictive analytics for identifying high-potential donors and reducing attrition. A significant concern is the application of AI in supply chain logistics—specifically, improving inventory management of short-shelf-life products like platelets and optimizing the complex global transportation of plasma concentrates, ensuring temperature stability and traceability. Furthermore, users question AI's role in accelerating the discovery of novel plasma protein therapeutics and improving the throughput and purity of the computationally intensive plasma fractionation process, which traditionally relies heavily on complex chemical engineering.

AI's influence is expected to dramatically enhance the security and efficacy of the blood supply chain from phlebotomy to patient bedside. By utilizing predictive modeling based on historical donation patterns, local disease outbreaks, seasonal demands, and demographic shifts, AI algorithms can dynamically adjust blood collection targets, thereby minimizing wastage from over-collection and preventing critical shortages during unforeseen events. In the realm of quality control, sophisticated image recognition and pattern analysis algorithms are being developed to assist in the automated inspection of blood bags and testing results, offering an additional layer of precision over manual or semi-automated screening processes, thereby improving the detection of subtle contaminants or deviations in manufacturing standards before final product release.

The highest leverage point for AI implementation lies in optimizing the highly capital-intensive and time-consuming process of plasma derivative manufacturing. AI-driven simulation tools can model various fractionation parameters (pH, temperature, concentration) to predict optimal yields and product purity, leading to reduced batch variations and lower operational costs. Moreover, in clinical decision support, AI tools are emerging that can integrate patient data (genetics, disease severity, prior treatments) to suggest the most appropriate blood product or derivative dosage, personalizing treatment plans and potentially reducing adverse reactions. This transition from standardized protocols to data-driven, personalized transfusion and infusion medicine represents a pivotal shift catalyzed by advanced analytics.

- Optimization of donor recruitment and retention via predictive behavioral modeling.

- Enhanced supply chain management using ML algorithms for inventory forecasting and cold chain logistics.

- Automation of quality control and diagnostic screening for pathogens and contaminants.

- Accelerated research and development of novel plasma proteins and synthetic blood components.

- AI-assisted clinical decision support for precise product selection and dosage in transfusion medicine.

- Improved efficiency and yield optimization in complex plasma fractionation processes.

DRO & Impact Forces Of Blood Product Market

The Blood Product Market is subject to a unique set of Drivers, Restraints, and Opportunities (DRO), collectively forming the Impact Forces that shape its trajectory. Key drivers include the global demographic shift toward an aging population, which necessitates increased surgical procedures and treatments for age-related chronic conditions, alongside the successful global efforts in diagnosing and treating chronic immunodeficiencies and hematological disorders. Simultaneously, advancements in regulatory standards, ironically, act as both a driver (by boosting public trust and market quality) and a restraint (by increasing compliance costs and time-to-market). The fundamental restraint remains the reliance on human donors for sourcing, which introduces volatility related to collection logistics, ethical concerns over compensation, and the persistent, albeit low, risk of transfusion-transmitted infections (TTIs), necessitating extremely costly testing and inactivation procedures. The opportunities largely revolve around technological breakthroughs, particularly the development of recombinant factors, novel derivative purification methods, and the promising, yet distant, potential of synthetic blood substitutes that could alleviate donor dependency.

The demand side is strongly influenced by increasing awareness among clinicians and patients regarding the efficacy of IVIg therapies for a widening spectrum of neurological and autoimmune conditions, driving robust volume growth, often exceeding plasma collection capacity. Furthermore, improving economic conditions and healthcare infrastructure in emerging economies are turning previously untapped patient populations into active consumers of essential blood products. This robust demand creates strong upward pricing pressure, particularly for niche products. Impact forces related to manufacturing include the extreme concentration of the plasma fractionation industry; only a handful of global manufacturers possess the requisite technical expertise, scale, and regulatory approval to produce these complex therapeutics, leading to high barriers to entry and intense competition within the established oligopoly.

Restraints are continually challenging market growth, primarily stemming from the significant capital expenditure required to establish and maintain compliant collection and manufacturing facilities, alongside the complex and lengthy regulatory approval processes mandated by agencies like the FDA and EMA to ensure product safety. Donor management remains critical; any global event (like a pandemic) that restricts human mobility directly impacts source plasma availability, causing critical supply chain stress. Opportunities, however, are focused on innovation, particularly in gene therapies that aim to provide functional cures for conditions like hemophilia, potentially reducing or eliminating the need for chronic factor concentrate infusions. While this represents a long-term threat to certain derivative segments, it simultaneously creates new high-value markets for advanced therapeutic manufacturers. The development of pathogen reduction technologies (PRT) also offers a pivotal opportunity to further enhance safety and simplify storage logistics for various blood components.

Segmentation Analysis

The Blood Product Market segmentation provides a critical view of product portfolio dynamics, applications, and end-user consumption patterns. The market is primarily segmented based on the type of product derived from the blood, which includes highly specialized plasma derivatives, whole blood, and specific cellular components (red blood cells, platelets, fresh frozen plasma). The product segmentation reflects the varying complexity of manufacturing and the distinct therapeutic uses, with plasma derivatives commanding the largest market share by value due to their chronic usage and high manufacturing overheads. Further analysis of the application segment reveals that hematology and immunology are the core therapeutic areas driving demand, particularly for factor concentrates and immunoglobulins, respectively, while trauma and surgical centers remain the steady consumers of whole blood and red cell concentrates.

The segmentation by end-user illustrates the primary consumption channels for these products. Hospitals, encompassing both general acute care facilities and specialized trauma centers, represent the dominant end-user category, purchasing large volumes for immediate and critical patient care. Blood banks, while often acting as intermediaries responsible for collection and initial processing, are also critical end-users in terms of internal usage for quality control and distribution management. Understanding the purchasing power and inventory management requirements of these distinct end-users is crucial for effective market penetration and distribution strategy, particularly given the short shelf-life and stringent storage requirements of non-derivative blood components.

Geographic segmentation is essential, highlighting the established regulatory landscapes and infrastructure capacities across major regions. The high concentration of plasma fractionation capacity in North America and Europe dictates global supply patterns, whereas rapid market expansion in Asia Pacific signals shifts in future growth centers. This multi-dimensional segmentation facilitates precise forecasting and strategic resource allocation for manufacturers, allowing them to focus R&D and commercial efforts on high-growth product categories like SCIg, or high-potential regions like China and India, where growing populations and improving access to specialized care are driving up consumption of sophisticated blood products.

- By Product Type:

- Plasma Derivatives (Immunoglobulin, Albumin, Coagulation Factors, Others)

- Whole Blood

- Blood Components (Red Blood Cells, Platelets, Fresh Frozen Plasma)

- By Application:

- Hematology

- Immunology

- Trauma and Surgery

- Neurology

- Others (e.g., Critical Care, Pulmonology)

- By End-User:

- Hospitals and Clinics

- Blood Banks and Transfusion Centers

- Ambulatory Surgical Centers

Value Chain Analysis For Blood Product Market

The value chain for the Blood Product Market is unique, highly regulated, and intrinsically sensitive, beginning with the critical upstream activity of human donor recruitment and screening. Upstream analysis focuses on securing the source material—whole blood or plasma—which involves extensive marketing, donor health evaluation, phlebotomy, and initial anti-coagulation and storage. This stage is heavily scrutinized for ethical compliance and safety, as it dictates the quality of the raw material. Ensuring a stable and compliant donor base is the most significant competitive advantage in the upstream segment, leading major fractionation companies to invest heavily in proprietary plasma collection networks. Strict regulatory compliance (e.g., FDA requirements for donor deferral and testing) dictates operational parameters and costs at this foundational level.

The midstream phase involves rigorous testing, processing, and manufacturing. For whole blood, this means separation into components (red cells, platelets, plasma) and viral inactivation using technologies like solvent/detergent treatment. For plasma derivatives, the process involves complex industrial-scale fractionation, primarily using the Cohn cold ethanol fractionation method, followed by multiple purification steps (chromatography, filtration) to isolate high-purity therapeutic proteins like IVIg, Factor VIII, and Albumin. This manufacturing phase is capital-intensive, technologically sophisticated, and subject to GMP (Good Manufacturing Practice) standards, requiring specialized infrastructure and highly skilled personnel. Yield optimization and viral safety validation are the key performance indicators in this complex midstream operation.

The downstream segment encompasses the distribution channel, storage, and eventual administration to the patient. Distribution is bifurcated into direct channels (major fractionators selling directly to hospital systems or national blood services) and indirect channels (distribution through specialized pharmaceutical wholesalers and logistics providers). Due to the temperature sensitivity of many components (especially fresh frozen plasma and platelets) and the high value of derivatives, distribution requires a specialized cold chain logistics network. Direct sales often facilitate stronger customer relationships and inventory management control, while indirect channels provide wider geographic reach. Ultimately, the successful delivery of a blood product relies on seamless integration across the entire chain, from donor arm to patient infusion, underpinned by robust regulatory oversight and traceability systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.20 Billion |

| Market Forecast in 2033 | USD 70.35 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CSL Behring, Grifols, Takeda Pharmaceutical, Octapharma, Biotest AG, Kedrion Biopharma, Sanquin, China National Biotec Group (CNBG), Shire (now part of Takeda), FFF Enterprises, ADMA Biologics, BPL (Bio Products Laboratory), Emergent BioSolutions, Prothya Biosolutions, Merck KGaA, Pfizer Inc., Novo Nordisk, Baxalta (now part of Shire/Takeda), HemaCare, Precision BioSciences |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blood Product Market Potential Customers

The primary potential customers and end-users of blood products are institutional healthcare providers that require these specialized therapeutics for critical care, surgical procedures, and managing chronic conditions. Hospitals, particularly large academic medical centers, specialized oncology and hematology units, and high-volume trauma centers, constitute the largest customer segment. These institutions possess the infrastructure for immediate storage, cross-matching, and administration of both labile blood components and stable plasma derivatives. Their purchasing decisions are highly influenced by product availability, established supply chain reliability, and the reimbursement policies tied to therapeutic administration, making them critical targets for both plasma fractionators and regional blood services.

Another crucial customer group includes regional and national blood banks and transfusion centers. While these entities are often producers or processors of whole blood and components, they are also significant purchasers of certain processed materials, reagents, and equipment required for screening, separation, and storage. In many jurisdictions, national blood services operate as centralized purchasing bodies for plasma derivatives, dictating the procurement volumes and competitive landscape for major global manufacturers. Their purchasing criteria prioritize long-term contractual stability, adherence to stringent national safety protocols, and capacity to handle sudden fluctuations in demand, such as during seasonal peaks or public health emergencies.

Emerging potential customers include specialized outpatient clinics and Ambulatory Surgical Centers (ASCs), particularly those focused on administering chronic immunoglobulin therapies (IVIg and SCIg) for patients with immune deficiencies or certain autoimmune disorders. As healthcare delivery shifts toward decentralized, cost-effective settings, the consumption patterns in these outpatient settings are growing rapidly. Furthermore, research institutes and biopharmaceutical companies represent a niche but high-value customer base, purchasing specific blood components or specialty plasma fractions for use in drug discovery, clinical trials, and manufacturing processes, requiring ultra-high purity and customized specifications.

Blood Product Market Key Technology Landscape

The technological landscape of the Blood Product Market is characterized by intense focus on safety, efficiency, and the development of substitutes to address persistent supply limitations. A pivotal technological area is Pathogen Reduction Technology (PRT), such as the INTERCEPT Blood System, which utilizes chemical treatments combined with UV light exposure to neutralize a broad spectrum of viruses, bacteria, and parasites in plasma and platelet components. The widespread adoption of PRT is fundamentally shifting component preparation protocols globally, enhancing product safety profiles and potentially extending component shelf-life, which significantly impacts distribution logistics. Continuous innovation in PRT remains a key strategic area for technology providers and blood collection organizations striving to achieve zero-risk transfusion products.

Further advancements are seen in automated apheresis systems and novel plasma fractionation techniques. Automated apheresis devices are increasingly sophisticated, allowing for higher efficiency and greater donor comfort during the collection of specific components (e.g., platelets or source plasma), thereby improving collection center throughput. In fractionation, manufacturers are moving beyond classical Cohn methodology toward advanced chromatography and ultrafiltration techniques, which offer higher purity and yield of therapeutic proteins, particularly specialized factors or novel IgG subclasses. These technological improvements are crucial for meeting the rising global demand for high-quality immunoglobulins and reducing manufacturing costs in a highly competitive derivative market.

Looking forward, the technology landscape is being shaped by digital integration and cutting-edge biotechnology. The implementation of digital traceability systems, including the potential application of blockchain technology, is enhancing the transparency and integrity of the supply chain, ensuring that every unit of blood or derivative can be tracked from donor to recipient. Simultaneously, research into recombinant technologies and gene therapies poses a revolutionary challenge to the reliance on human plasma sources for certain products, especially Factor VIII and IX. While synthetic blood oxygen carriers are still in the early stages of commercial viability, ongoing R&D in cellular engineering and tissue culture promises future non-donor dependent blood components, representing the ultimate technological opportunity and long-term market disruption force.

Regional Highlights

- North America: North America, led by the United States, is the undisputed market leader in terms of market size and revenue share within the Blood Product Market. This dominance is attributed to several critical factors, including a highly developed healthcare infrastructure, universal access to advanced diagnostic and therapeutic services, and robust, well-established reimbursement schemes that cover expensive plasma derivative therapies. Furthermore, the region is home to the largest network of commercial plasma collection centers globally, making it the primary source of raw material for the world’s fractionation industry. The market is characterized by intense competition among the few large fractionators and a high degree of regulatory maturity under the stringent oversight of the FDA.

- The North American market demonstrates high rates of innovation adoption, particularly concerning high-end, long-acting recombinant coagulation factors and advanced intravenous and subcutaneous immunoglobulin formulations. The focus here is not only on volume but also on specialty, high-value products. Investment in automation within blood banks and the early adoption of advanced pathogen reduction technologies further solidify the region's premium market position. Demand growth is driven primarily by the rising prevalence of chronic conditions requiring long-term treatment, such as Primary Immune Deficiency (PID) and autoimmune disorders, ensuring a predictable and sustained revenue stream for derivative manufacturers. The regulatory environment strongly influences pricing and market entry strategies, requiring significant compliance investment.

- The stability of the North American market, however, is increasingly challenged by operational costs, particularly labor expenses in plasma collection centers, and ongoing debates regarding the ethics and compensation models for plasma donation. Manufacturers must continually navigate complex state and federal regulations while simultaneously investing in expanding collection capacity to meet the growing global appetite for plasma derivatives. Despite these operational complexities, the sheer volume of plasma collected and processed, coupled with favorable pricing for proprietary specialty therapeutics, ensures that North America remains the critical benchmark and profitability core of the global blood product industry.

- Europe: The European market constitutes the second-largest regional segment, distinguished by its unique reliance on voluntary, non-remunerated blood donation systems across many member states, contrasting sharply with the US model. This structure often necessitates robust cooperation between centralized national blood services and commercial fractionators for meeting plasma supply needs, leading to varying degrees of self-sufficiency across the continent. Key markets like Germany, France, and the UK drive significant demand due to their advanced healthcare systems and high patient awareness regarding rare diseases and immunotherapies. Regulatory harmonization through the European Medicines Agency (EMA) and related directives ensures standardized safety and quality across borders.

- Demand in Europe is strong, particularly for IVIg and Albumin, reflecting the high incidence of neurological and autoimmune conditions and the standard use of albumin in critical care settings. The regional focus on patient quality of life is fueling the rapid adoption of subcutaneous immunoglobulin (SCIg) therapies, which allow for home administration and reduce hospital burden. European R&D efforts are also focused on developing novel fractionation methods that increase yield from limited source plasma, acknowledging the difficulties in scaling up non-remunerated donation volumes. The interplay between national policies favoring voluntary donation and the commercial necessity of sourcing high volumes of plasma shapes the strategic landscape in Europe.

- Furthermore, technological investments in Europe are concentrating on optimizing blood component management, including extended storage solutions for red cells and platelets, and implementation of cutting-edge donor screening technologies. The market experiences steady, predictable growth, underpinned by universal healthcare coverage that ensures patient access to necessary therapies, irrespective of cost. However, ongoing pressure from public health systems to control pharmaceutical expenditure means that price negotiation and demonstrating cost-effectiveness are crucial determinants of commercial success for blood product suppliers operating within the European Union and associated countries.

- Asia Pacific (APAC): The APAC region is recognized as the fastest-growing market globally for blood products, characterized by immense geographic diversity and rapid economic development. The growth trajectory is powered by two main factors: vast, underserved populations gaining access to standardized healthcare and significant government investment in upgrading clinical infrastructure, including blood banking and transfusion capacity. Countries like China and India, with their enormous patient bases and rising prevalence of trauma and infectious diseases, are the primary drivers of this expansion. The market here is still fragmented, with many local players operating alongside global giants.

- The shift from infectious disease focus toward chronic disease management in emerging APAC economies is substantially increasing the demand for plasma derivatives, particularly factor concentrates and IVIg, as diagnosis rates for conditions like hemophilia and PID improve. Challenges remain, including disparities in regulatory enforcement, limited infrastructure for centralized blood collection and testing in rural areas, and cultural hesitations toward blood donation. Overcoming these hurdles requires localized strategies, including developing robust cold chain logistics tailored to regional climate variations and investing in public awareness campaigns to boost voluntary donation rates.

- Foreign direct investment from major global players (CSL, Grifols, Takeda) is accelerating the establishment of advanced fractionation facilities and distribution hubs in key APAC countries, aiming to capture the burgeoning middle-class consumer segment. The growth in surgical volumes, driven by increased urbanization and better access to specialized care, also significantly boosts the demand for whole blood and cellular components. Consequently, APAC represents the critical future growth engine for the global Blood Product Market, albeit one requiring patience, significant capital outlay, and navigation of highly localized regulatory environments.

- Latin America & MEA (LAMEA): The LAMEA regions present unique market dynamics characterized by resource constraints, varying degrees of political stability, and often high reliance on imported blood products, especially complex plasma derivatives. Latin America shows localized growth driven by large economies like Brazil and Mexico, where improved public health policies and rising diagnosis rates increase demand for essential factor concentrates. However, currency fluctuations and economic instability pose significant procurement challenges for public healthcare systems.

- In the Middle East, high per capita income in countries like Saudi Arabia and UAE allows for the adoption of premium, advanced therapies, leading to sustained demand for high-quality imported IVIg and recombinant factors. Africa, however, faces the most significant challenges, primarily related to inadequate collection infrastructure, prevalence of transfusion-transmitted infections (TTIs) despite screening efforts, and limited availability of specialized derivatives. Efforts in these regions are focused on enhancing regional self-sufficiency in blood component production and improving basic collection safety protocols.

- Overall, growth in LAMEA is heavily dependent on governmental prioritization of healthcare, stability of import/export logistics, and successful implementation of global health initiatives that often subsidize access to critical therapies. For global manufacturers, these regions represent long-term strategic markets where brand trust and regulatory compliance are essential for securing high-value government contracts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blood Product Market.- CSL Behring

- Grifols, S.A.

- Takeda Pharmaceutical Company Limited

- Octapharma AG

- Biotest AG

- Kedrion Biopharma

- Sanquin

- China National Biotec Group (CNBG)

- F. Hoffmann-La Roche Ltd.

- Novo Nordisk A/S

- ADMA Biologics, Inc.

- Bio Products Laboratory (BPL)

- Emergent BioSolutions Inc.

- Prothya Biosolutions

- Precision BioSciences

- HemaCare Corporation

- CSL Limited

- Baxter International Inc. (formerly significant in fractionation)

- Merck KGaA

- Pfizer Inc.

Frequently Asked Questions

Analyze common user questions about the Blood Product market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Blood Product Market?

The market growth is primarily driven by the increasing global geriatric population, leading to higher surgical volumes and chronic disease prevalence (e.g., cardiovascular and immune deficiencies). Furthermore, improved diagnostic capabilities, especially in emerging economies, are increasing the recognized patient pool requiring long-term plasma derivative therapies, such as immunoglobulins and coagulation factors.

How does plasma derivative sourcing impact market stability and global supply?

Market stability is intrinsically linked to the supply of source plasma, which is highly geographically concentrated (largely in the U.S.). Regulatory and logistical hurdles related to plasma collection, donor compliance, and ethical concerns create perpetual supply constraints. Any disruption to the collection network, such as regulatory changes or public health crises, significantly impacts the global supply of essential derivatives like IVIg and albumin.

What role do recombinant products play in the future of the Blood Product Market?

Recombinant products, particularly recombinant Factor VIII and IX for hemophilia treatment, reduce reliance on human plasma sources for specific coagulation factors. While they present high-value alternatives, their penetration varies by region and they currently do not replace the need for non-substitutable polyclonal products like immunoglobulins, meaning they complement, rather than fully displace, the plasma derivative market.

Which technological advancements are most critical for blood component safety?

Pathogen Reduction Technologies (PRT) are the most critical safety innovation, utilizing methods like solvent/detergent or UV light to inactivate viruses and bacteria in blood components (plasma and platelets). Alongside advanced nucleic acid testing (NAT) for rapid detection of emerging pathogens, PRT dramatically reduces the risk of transfusion-transmitted infections (TTIs), ensuring higher standards of patient safety.

Which region currently dominates the consumption of high-value blood products?

North America is the dominant region for the consumption of high-value blood products, specifically plasma derivatives. This dominance is due to established and comprehensive healthcare systems, highly centralized commercial plasma collection networks, and favorable reimbursement policies for costly, long-term therapeutic regimens, ensuring robust and sustained patient access.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager