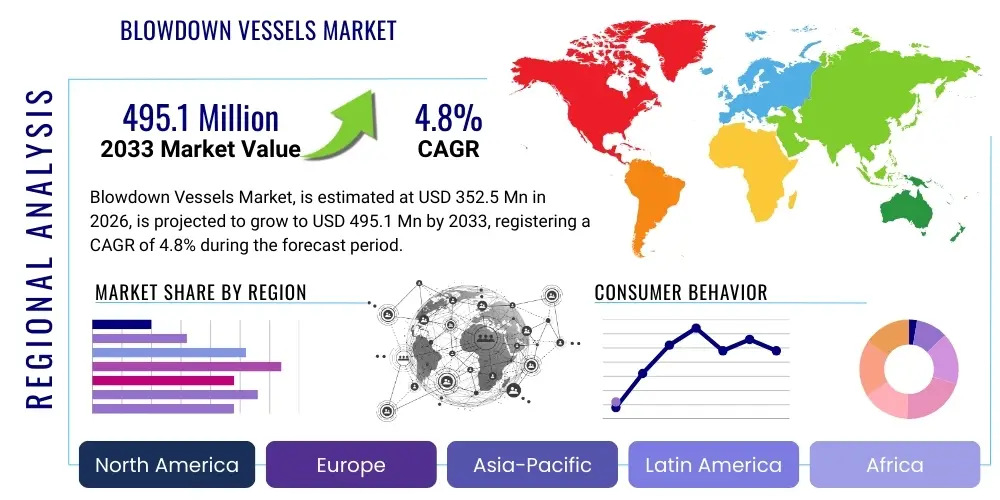

Blowdown Vessels Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435824 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Blowdown Vessels Market Size

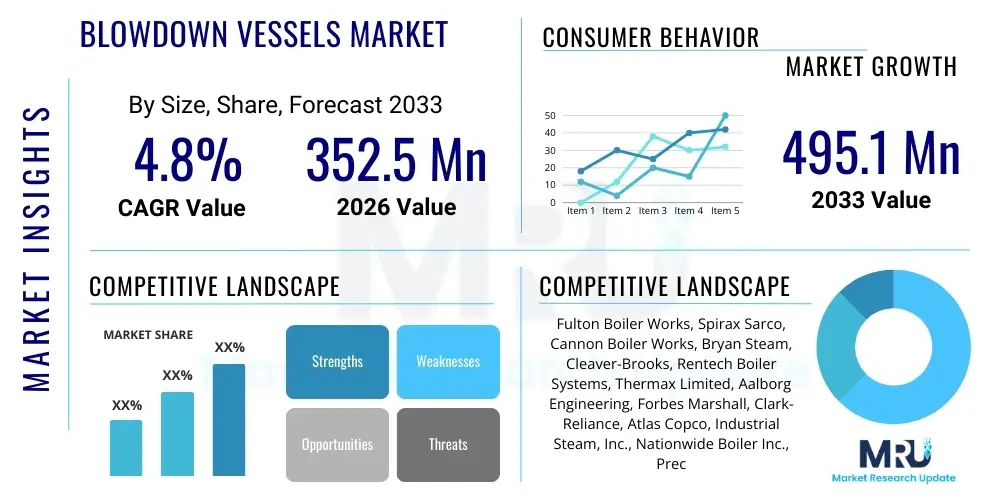

The Blowdown Vessels Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 352.5 million in 2026 and is projected to reach USD 495.1 million by the end of the forecast period in 2033. This consistent growth trajectory is primarily underpinned by stringent global safety regulations governing steam systems in heavy industrial sectors, coupled with the ongoing expansion of power generation infrastructure, particularly in developing economies.

Blowdown Vessels Market introduction

The Blowdown Vessels Market encompasses the design, manufacturing, distribution, and maintenance of specialized pressure vessels engineered to safely depressurize and cool high-temperature, high-pressure fluids, predominantly boiler water or steam. These critical components are essential safety devices that receive water and sludge discharged from boiler blowdown lines, flashing the liquid into steam and cooling the remaining water below standard drain temperatures before disposal. The primary function is to protect personnel and surrounding equipment by mitigating the risks associated with direct atmospheric release of hot fluids, ensuring adherence to stringent environmental and safety compliance mandates such as ASME Boiler and Pressure Vessel Codes (BPVC) and Pressure Equipment Directive (PED).

Major applications of blowdown vessels span critical industrial sectors including power generation (both conventional and nuclear), petrochemical refineries, chemical processing plants, pulp and paper manufacturing, and heavy utility systems. The deployment is mandatory wherever high-pressure steam boilers are operational, making their demand intrinsically linked to industrial capacity utilization and expansion projects worldwide. Blowdown vessels significantly contribute to operational efficiency by facilitating controlled maintenance routines and preventing system downtime, offering immediate benefits in terms of enhanced workplace safety and reduced thermal pollution risks associated with industrial effluent discharge.

The market is currently being driven by several macro-environmental factors, including the accelerated pace of industrialization in Asia Pacific, the necessary replacement and upgrade cycles of aging infrastructure in North America and Europe, and the continuous evolution of global occupational health and safety (OHS) standards. Furthermore, the push towards optimized energy usage and the implementation of automated boiler control systems necessitate compatible, high-integrity blowdown vessel solutions designed for maximum reliability and longevity, thereby ensuring sustained demand across established and nascent industrial landscapes.

Blowdown Vessels Market Executive Summary

The global Blowdown Vessels Market is characterized by robust resilience driven by non-negotiable safety and regulatory mandates, positioning it as a steady growth sector within the broader industrial equipment landscape. Current business trends indicate a strong shift towards modular, skid-mounted blowdown systems that reduce installation complexity and time, appealing particularly to EPC contractors handling fast-track projects. Furthermore, material innovation, specifically the increasing adoption of high-grade stainless steel and specialized alloys, is a key trend addressing corrosion resistance and extending service life, especially in harsh operational environments like chemical processing and offshore facilities. The competitive landscape remains moderately consolidated, dominated by manufacturers offering customized solutions compliant with diverse international pressure vessel standards (e.g., ASME Section VIII, TEMA).

Regional trends highlight the Asia Pacific (APAC) region as the undeniable growth engine, propelled by aggressive capital investment in new power plants (both thermal and gas-fired) and massive infrastructure development in China, India, and Southeast Asian nations. While mature markets like North America and Europe experience slower growth, their demand is primarily sustained by replacement cycles, modernization projects, and the implementation of smart monitoring technologies within existing facilities to comply with tighter environmental effluent regulations. The Middle East remains a strategic market due to extensive investments in petrochemical and desalination plants, which require high-capacity, high-pressure blowdown solutions.

Segment trends underscore the dominance of the high-pressure segment (>600 PSI) in terms of revenue, driven by the increasing deployment of high-efficiency utility boilers designed for optimal energy extraction. Simultaneously, the material segment sees rising preference for carbon steel for standard applications due to its cost-effectiveness, though the demand for stainless steel vessels is steadily increasing in sectors requiring superior chemical resistance. End-user analysis confirms that the Power Generation segment maintains the largest market share, though the Chemical and Petrochemical segments are exhibiting faster growth rates dueowing to the complex and corrosive nature of their processes, demanding highly customized vessel designs and certifications.

AI Impact Analysis on Blowdown Vessels Market

User inquiries regarding AI's influence on the Blowdown Vessels Market frequently center on predictive maintenance, operational safety enhancements, and design optimization. Key themes reflect user concerns about integrating AI with legacy control systems, the potential for autonomous monitoring to reduce manual inspections, and whether AI can enhance compliance tracking by analyzing operational data in real-time. There is significant expectation that AI algorithms, particularly machine learning models, will revolutionize the lifecycle management of these pressure vessels, shifting the industry paradigm from reactive maintenance scheduling to proactive, condition-based interventions, thus maximizing uptime and ensuring adherence to stringent safety thresholds while minimizing the likelihood of catastrophic failure associated with thermal fatigue or structural degradation.

The incorporation of Artificial Intelligence primarily impacts the Blowdown Vessels market through enhancing operational monitoring and predictive capabilities, rather than altering the core mechanical design of the vessels themselves. AI tools analyze large volumes of sensor data, including temperature, pressure fluctuations, vibration patterns, and historical blowdown cycles, to detect subtle anomalies that precursors equipment failure or reduced efficiency. This transition allows asset owners to schedule vessel cleanings, inspections, or component replacements precisely when needed, dramatically reducing unnecessary maintenance costs and extending the effective service life of the units, which is a critical factor given the high capital expenditure involved in pressure vessel manufacturing.

Furthermore, AI algorithms are being employed in the design phase (Smart Engineering) to simulate complex thermal and mechanical stresses within the vessels under various operating conditions. This digital twin approach, powered by advanced computation, helps engineers optimize material thickness, nozzle placement, and internal baffling structures, ensuring the resulting vessel is not only compliant with ASME standards but also optimally efficient and durable for its specific application. The long-term trajectory involves AI systems autonomously optimizing blowdown frequency based on real-time boiler water quality, leading to reduced water wastage and significant energy savings across large industrial complexes.

- AI-driven Predictive Maintenance: Forecasts component wear and corrosion rates using historical operational data, minimizing unplanned shutdowns.

- Enhanced Safety Monitoring: Real-time anomaly detection in pressure and temperature readings, providing early warnings of potential safety breaches.

- Digital Twin Modeling: AI-assisted simulation tools optimize vessel design for thermal stress resistance and compliance validation.

- Optimized Blowdown Cycles: Machine learning adjusts blowdown frequency based on water chemistry, improving energy efficiency and reducing water usage.

- Automated Compliance Reporting: Systems automatically log and analyze operational data against regulatory limits (e.g., ASME, PED), simplifying audit processes.

- Reduced Manual Inspection Dependency: Utilization of smart sensors and AI analysis reduces the frequency and complexity of manual, invasive inspections.

DRO & Impact Forces Of Blowdown Vessels Market

The dynamics of the Blowdown Vessels Market are shaped by a complex interplay of stringent safety regulations and the cyclical nature of industrial capital expenditure. Key drivers include the mandatory compliance with international codes like ASME BPVC, which necessitate certified pressure relief and blowdown systems for all operational steam boilers globally. Restraints primarily revolve around the significant initial capital investment required for custom-engineered vessels and the complexity associated with installation, inspection, and certification, often leading smaller operators to delay replacement or adhere to minimum regulatory requirements. Opportunities emerge from the growing trend of industrial digitalization and the necessity for retrofitting older vessels with smart monitoring capabilities, particularly within emerging markets where new industrial capacity is rapidly being added. These opposing forces dictate market penetration rates and influence manufacturer strategy regarding product standardization versus custom engineering solutions.

Drivers are heavily concentrated in the legal and safety domains. The global push for improved industrial safety and environmental stewardship forces continuous investment in reliable blowdown systems. Specifically, the expansion of the energy sector, including new combined cycle power plants and renewable energy facilities requiring auxiliary steam systems, consistently fuels demand for high-capacity, high-integrity vessels. Furthermore, rising operational standards compel industries to replace outdated or non-compliant equipment, ensuring a stable replacement market. Technological advancements in material science, offering improved resistance to corrosion and thermal fatigue, also drive adoption by promising longer operational life and reduced maintenance overheads, justifying the substantial upfront cost.

Major restraints include the highly customized nature of many high-pressure vessel projects, which prolongs lead times and increases overall costs, making the procurement process challenging. The market also faces competition from alternative water treatment technologies aimed at reducing sludge buildup (like continuous blowdown systems), which, while not eliminating the need for vessels, can reduce their size and frequency of operation. Impact forces, driven by economic fluctuations, significantly affect capital expenditure decisions in end-user industries like petrochemicals and pulp and paper, causing project deferrals during economic downturns. However, the regulatory imperative acts as a stabilizing force, ensuring that minimum safety standards are maintained regardless of economic cycles, thus preventing steep market contraction.

- Drivers: Strict adherence to ASME and PED safety codes; Global expansion of industrial boiler infrastructure, particularly in APAC; Increased focus on preventing catastrophic thermal failure and worker safety; Demand for enhanced operational efficiency and controlled effluent discharge.

- Restraints: High initial capital investment and engineering complexity for custom vessels; Long manufacturing and certification lead times; Competition from advanced continuous boiler water treatment technologies; Dependence on fluctuating raw material prices (steel and alloys).

- Opportunity: Retrofitting legacy systems with smart monitoring and automation features; Market penetration in emerging industrial clusters (e.g., Southeast Asia, Africa); Development of standardized, modular vessel designs for quicker deployment; Focus on highly corrosive applications requiring specialized materials.

- Impact Forces: Regulatory standards (High positive impact); Capital expenditure cycles of end-user industries (Moderate fluctuating impact); Technological advancements in material science (Moderate positive impact); Raw material supply chain stability (Moderate negative impact).

Segmentation Analysis

The Blowdown Vessels Market is systematically segmented based on Type, Pressure Rating, Material of Construction, and End-User Industry, allowing for a detailed analysis of demand patterns and technological requirements across various applications. Segmentation by Type differentiates between continuous blowdown tanks and intermittent (bottom) blowdown tanks, reflecting variations in boiler operation and maintenance strategy. Continuous blowdown vessels manage dissolved solids and are usually smaller, whereas intermittent vessels handle suspended solids (sludge) and are designed for high-volume, rapid discharge. This structural delineation helps manufacturers tailor design specifications and capacities to specific client needs.

The segmentation by Pressure Rating is crucial as it directly correlates with material costs, thickness requirements, and necessary safety certifications, defining product complexity and pricing. The core segments include Low Pressure (<150 PSI), Medium Pressure (150–600 PSI), and High Pressure (>600 PSI), with high-pressure vessels dominating revenue due to their mandatory use in large-scale utility and industrial power generation facilities which operate at higher thermal efficiencies. Demand within the high-pressure segment is particularly sensitive to major energy infrastructure projects globally, making it a key indicator of market health.

Further segmentation by Material and End-User reveals specific market niches. Materials range predominantly from Carbon Steel (cost-effective, standard applications) to Stainless Steel (corrosion resistance, chemical plants) and specialized alloys (extreme temperature or highly corrosive environments). The End-User analysis confirms that the Power Generation sector remains the largest consumer, but segments such as Petrochemicals, Pulp & Paper, and Pharmaceuticals represent high-growth areas due to strict regulatory oversight concerning water effluent quality and process safety, demanding high-specification and custom-engineered blowdown solutions.

- By Type:

- Continuous Blowdown Vessels (Heat Recovery Focus)

- Intermittent (Bottom) Blowdown Vessels (Sludge Removal Focus)

- By Pressure Rating:

- Low Pressure (Up to 150 PSI)

- Medium Pressure (151 PSI to 600 PSI)

- High Pressure (Above 600 PSI)

- By Material of Construction:

- Carbon Steel (CS)

- Stainless Steel (SS 304, SS 316)

- Alloy Steel (e.g., Chrome-Moly)

- Others (Fiber-Reinforced Plastic, specialized coatings for corrosive media)

- By End-User Industry:

- Power Generation (Utility and Industrial)

- Petrochemical and Refining

- Chemical Processing

- Pulp and Paper

- Pharmaceutical and Food & Beverage

- Textiles and Others Manufacturing

Value Chain Analysis For Blowdown Vessels Market

The value chain of the Blowdown Vessels Market is complex, beginning with the procurement of specialized raw materials, primarily high-grade carbon and stainless steel plates, which are subject to stringent quality verification (e.g., ASME Section II requirements). Upstream analysis reveals that raw material cost fluctuations, especially steel commodity prices, significantly impact the final product cost and manufacturer margins. Due to the high-pressure nature of the application, material quality and traceability are paramount, requiring strong, audited relationships between vessel manufacturers and certified steel suppliers, leading to limited bargaining power for the manufacturers over input costs compared to the necessity for uncompromising quality.

The manufacturing and assembly phase constitutes the highest value-add activity, involving specialized processes such as precision welding (often requiring ASME certified welders), non-destructive testing (NDT), heat treatment, and surface preparation. Blowdown vessels are typically engineered-to-order, requiring significant upfront design work utilizing Finite Element Analysis (FEA) software to ensure structural integrity and compliance. This phase also includes integrating ancillary components such as level controls, pressure gauges, safety relief valves, and necessary piping insulation, demanding sophisticated project management and adherence to tight quality assurance protocols before hydrostatic testing and final certification are issued.

Downstream analysis focuses on distribution and installation. Due to the size, weight, and customization required, the dominant distribution channel is direct sales from the manufacturer to the end-user or through large Engineering, Procurement, and Construction (EPC) firms acting as intermediaries. Indirect channels, involving smaller regional distributors, are rare, mainly restricted to replacement parts or standard, smaller-capacity vessels. Aftermarket services, including mandatory periodic inspections (e.g., ten-year internal inspections), repair, and vessel certification renewals, represent a crucial and stable revenue stream, often facilitated directly by the original equipment manufacturers (OEMs) or specialized service providers who maintain expertise in pressure vessel maintenance and regulatory compliance.

Blowdown Vessels Market Potential Customers

The primary purchasers and end-users of blowdown vessels are industrial entities operating high-pressure steam boiler systems where safety and controlled liquid discharge are mandatory regulatory requirements. These customers fall mainly into three categories: utility and captive power generators, large-scale industrial processors, and EPC firms overseeing major infrastructure projects. Utility companies, including municipal power plants and independent power producers (IPPs), are consistent, high-volume buyers, particularly for high-pressure, large-capacity vessels essential for continuous, efficient steam production required for turbine operation. Their purchasing decisions are driven by long-term operational reliability, efficiency, and compliance with strict environmental discharge limits.

The second major customer group comprises process-intensive industries such as petrochemical refineries, chemical manufacturers, and pulp and paper mills. These sectors often require vessels built from specialized materials (like stainless steel or clad vessels) to handle corrosive boiler feedwater chemistries and ensure compliance with hazardous waste disposal regulations. For these end-users, customization and material compatibility are critical decision factors, often outweighing initial cost considerations, as unexpected downtime due to corrosion or vessel failure can lead to significant production losses and environmental penalties.

The third influential customer type is global and regional Engineering, Procurement, and Construction (EPC) companies. EPC firms purchase blowdown vessels as part of integrated turnkey solutions for new plant construction or major facility expansions. Their focus is on timely delivery, adherence to project specifications, and vendor certification compatibility (ASME stamps). Given the scale of their projects, EPC contractors typically demand sophisticated logistical support and often favor manufacturers who can supply complete, skid-mounted systems that simplify on-site installation and commissioning, making them vital gatekeepers for new market penetration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 352.5 Million |

| Market Forecast in 2033 | USD 495.1 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fulton Boiler Works, Spirax Sarco, Cannon Boiler Works, Bryan Steam, Cleaver-Brooks, Rentech Boiler Systems, Thermax Limited, Aalborg Engineering, Forbes Marshall, Clark-Reliance, Atlas Copco, Industrial Steam, Inc., Nationwide Boiler Inc., Precision Tank & Equipment Co., Miura Co. Ltd., Thermon Group Holdings, Samuel Pressure Vessel Group, Highland Tank, Zep-Fenwick, Babcock & Wilcox. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blowdown Vessels Market Key Technology Landscape

The core technology landscape in the Blowdown Vessels Market is defined by advanced manufacturing processes, sophisticated computational design methods, and the integration of smart monitoring hardware. Central to the design process is the reliance on Computational Fluid Dynamics (CFD) and Finite Element Analysis (FEA) software. These tools allow engineers to accurately model the thermal shock and hydraulic stresses experienced during rapid depressurization, ensuring the vessel design meets or exceeds stringent safety factors stipulated by international codes like ASME Section VIII Division 1 and 2. The accurate simulation of multi-phase flow (steam and water) during the blowdown process is crucial for optimizing internal design elements such as baffles and tangential inlets, which minimize erosion and ensure efficient separation of steam flash from remaining liquid effluent.

Material technology remains a significant area of technological focus, particularly concerning corrosion and erosion resistance. While standard carbon steel is widely used, advancements in stainless steel alloys (such as Duplex stainless steels for higher strength and corrosion resistance) and specialized coatings are critical in extending the lifespan of vessels deployed in highly corrosive petrochemical or waste treatment environments. Furthermore, manufacturers are increasingly adopting advanced welding techniques, including automated orbital welding and specialized inspection methods like Phased Array Ultrasonic Testing (PAUT), to guarantee weld integrity—the most common point of potential failure in high-pressure containment equipment—thereby enhancing overall product safety and reliability over decades of service life.

The integration of the Industrial Internet of Things (IIoT) represents the most rapid technological shift in this sector. Modern blowdown vessels are often equipped with smart sensors that monitor parameters like fluid temperature, pressure, liquid level, and blowdown valve actuation status in real time. This data is transmitted to centralized control systems or cloud platforms, facilitating remote diagnostics and enabling the implementation of AI-driven predictive maintenance strategies discussed previously. The incorporation of certified safety instrumented systems (SIS) and fail-safe redundancy in pressure relief mechanisms ensures that the vessels maintain the highest level of functional safety, often utilizing smart valves and electronic controls that interface directly with the boiler management system to optimize operational cycles and prevent unsafe pressure build-up.

Regional Highlights

The global Blowdown Vessels Market exhibits significant regional disparities in terms of growth velocity and regulatory maturity. Asia Pacific (APAC) stands out as the highest growth potential region, driven by continuous, large-scale industrialization, particularly the massive build-out of new thermal power generation capacity, industrial parks, and chemical processing complexes in countries such as China, India, and Indonesia. This sustained capital expenditure cycle mandates the purchase of new, compliant pressure vessels, making APAC the primary focal point for market expansion and production capacity investment by global manufacturers seeking substantial volume growth opportunities. Furthermore, evolving national safety standards across major APAC economies are converging toward stricter international norms, further bolstering demand for certified equipment.

North America and Europe represent mature, stable markets characterized by high product specification demands and a focus on infrastructure modernization rather than new capacity build-out. Demand in these regions is primarily driven by regulatory compliance updates, the replacement of aging infrastructure installed several decades ago, and the necessity to retrofit existing facilities with advanced monitoring and automation features. The European market, in particular, adheres to the rigorous Pressure Equipment Directive (PED), requiring meticulous documentation and certification, which favors established OEMs known for uncompromising quality and strict adherence to codified standards and environmental performance metrics, focusing on efficiency and minimizing thermal discharge.

The Middle East and Africa (MEA), and Latin America (LATAM) offer specialized, high-value opportunities. The MEA region’s market is heavily influenced by the massive petrochemical, oil and gas, and desalination industries, which require customized, often high-pressure, vessels designed to withstand extremely harsh operating conditions and corrosive water sources. LATAM’s market growth is driven by localized industrial expansion and investments in mining and power infrastructure, though it remains sensitive to local economic stability and foreign investment influx. Overall, regional success hinges on manufacturers' ability to maintain local certification expertise, navigate complex logistical challenges, and provide comprehensive long-term servicing contracts tailored to specific regulatory environments.

- Asia Pacific (APAC): Leads in market growth due to rapid industrialization, extensive construction of new power plants (thermal and gas), and increasing regulatory enforcement in China and India.

- North America: Stable market driven by replacement cycles, facility modernization, and stringent environmental regulations demanding optimized steam system efficiency and safety certification (ASME stamps).

- Europe: Characterized by high-specification demand, mandatory PED compliance, and a strong focus on energy efficiency and integrating IIoT technologies into existing process plants and utility boilers.

- Middle East and Africa (MEA): Growth centered around massive investments in oil & gas processing, petrochemical complexes, and large-scale desalination projects requiring highly customized, corrosion-resistant vessels.

- Latin America (LATAM): Moderate growth driven by localized industrial and power infrastructure development, sensitive to commodity price volatility and localized regulatory evolution across key economies like Brazil and Mexico.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blowdown Vessels Market.- Fulton Boiler Works

- Spirax Sarco

- Cannon Boiler Works

- Bryan Steam

- Cleaver-Brooks

- Rentech Boiler Systems

- Thermax Limited

- Aalborg Engineering

- Forbes Marshall

- Clark-Reliance

- Atlas Copco

- Industrial Steam, Inc.

- Nationwide Boiler Inc.

- Precision Tank & Equipment Co.

- Miura Co. Ltd.

- Thermon Group Holdings

- Samuel Pressure Vessel Group

- Highland Tank

- Zep-Fenwick

- Babcock & Wilcox

- Viessmann Group

- Penn Separator Corp.

- Johnston Boiler Company

- Superior Boiler Works

Frequently Asked Questions

Analyze common user questions about the Blowdown Vessels market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a boiler blowdown vessel?

The primary function of a boiler blowdown vessel is to safely receive high-pressure, high-temperature discharge from boiler blowdown lines, rapidly flash the fluid into steam, and cool the remaining water to safe drain temperatures (typically below 140°F or 60°C) before disposal, ensuring compliance with plumbing codes and safety standards.

Which safety standards govern the design and operation of blowdown vessels?

The design, manufacturing, and operation of blowdown vessels are primarily governed by the ASME Boiler and Pressure Vessel Code (BPVC), specifically Section VIII for pressure vessel construction, and the European Pressure Equipment Directive (PED) in Europe. Compliance ensures structural integrity and operational safety under high stress conditions.

What factors are driving the demand for high-pressure blowdown vessels?

Demand is driven by the global trend toward high-efficiency utility boilers (>600 PSI) in the power generation sector, which require high-integrity vessels to manage severe operational pressures. Regulatory mandates for stringent safety and environmental controls further necessitate the use of certified, high-pressure equipment.

How is AI impacting the maintenance of blowdown vessels?

AI is primarily used for predictive maintenance (PdM) by analyzing sensor data (temperature, pressure) to anticipate internal corrosion or component failure. This shift from time-based to condition-based monitoring maximizes vessel uptime, extends operational lifespan, and reduces unnecessary maintenance costs.

What are the typical materials used for constructing these vessels?

The most common materials are carbon steel, used for standard, non-corrosive applications due to cost efficiency, and stainless steel (304 or 316), preferred for petrochemical, chemical, and pharmaceutical sectors due to its superior resistance to corrosion and chemical degradation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager