Blown Film Extruder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431679 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Blown Film Extruder Market Size

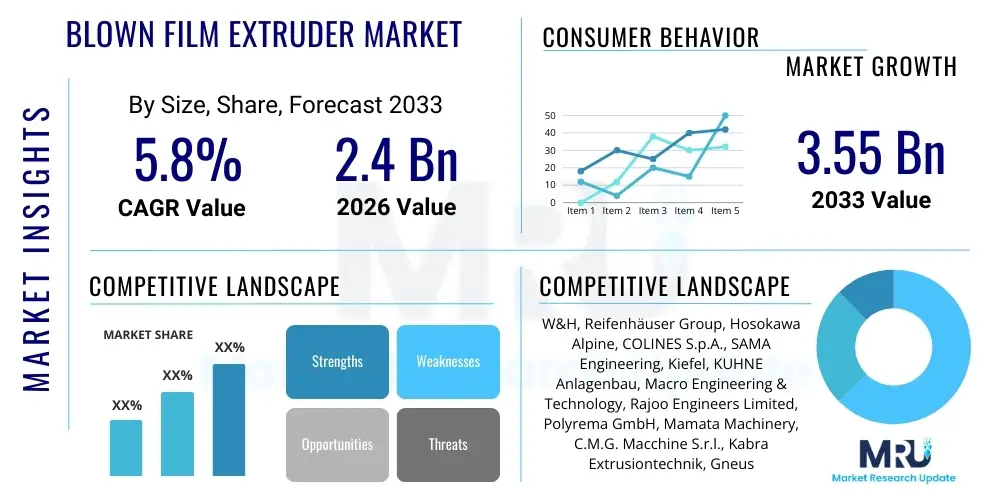

The Blown Film Extruder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $2.4 Billion in 2026 and is projected to reach $3.55 Billion by the end of the forecast period in 2033.

Blown Film Extruder Market introduction

The Blown Film Extruder Market encompasses the manufacturing, sales, and servicing of specialized machinery used to create plastic films by melting and extruding thermoplastic materials through an annular die, followed by inflation (blowing) and subsequent cooling. This sophisticated process, crucial for producing continuous tubing or sheeting, is foundational to the global packaging industry. Products manufactured include a vast array of films such as shrink films, stretch wrap, agricultural sheeting, garbage bags, barrier films, and specialized industrial linings, necessitating high precision and reliability in the extrusion equipment.

Modern blown film extrusion systems are characterized by multi-layer capabilities, often ranging from 3-layer to 9-layer or even 11-layer configurations, allowing for the co-extrusion of different polymer types—such as polyethylene (LDPE, HDPE, LLDPE), EVA, and nylon—to achieve specific mechanical, optical, and barrier properties. Major applications span food and beverage packaging, healthcare and pharmaceutical sterile packaging, construction barriers, and textile wrapping. The primary benefit of these systems lies in their ability to produce films with excellent thickness uniformity, high clarity, and superior mechanical strength compared to alternative film forming methods, making them indispensable for high-performance applications.

Market growth is predominantly driven by the surging global demand for flexible packaging solutions, particularly in rapidly developing economies. Factors such as increasing consumer preference for convenience foods, the expansion of e-commerce requiring robust protective packaging, and continuous technological advancements improving machine efficiency and reducing material waste are fueling market acceleration. Furthermore, the rising adoption of sustainable and bio-degradable polymers requires specialized extruder designs capable of handling these novel materials effectively, presenting significant opportunities for manufacturers focusing on eco-friendly solutions and advanced material processing capabilities.

Blown Film Extruder Market Executive Summary

The Blown Film Extruder market is currently experiencing robust growth, driven primarily by evolving regulatory landscapes demanding sustainable packaging and the persistent expansion of the global flexible packaging sector. Business trends indicate a strong shift towards highly automated, energy-efficient extrusion lines that incorporate sophisticated controls for optimizing film quality and reducing labor costs. Key manufacturers are focusing on integrating Industry 4.0 concepts, including real-time monitoring, predictive maintenance, and remote diagnostics, to offer superior operational reliability and throughput efficiency to end-users across various industrial segments. Consolidation among smaller regional players and strategic partnerships between equipment suppliers and resin manufacturers are also defining the competitive landscape.

Regional trends highlight the Asia Pacific (APAC) as the undisputed leader in market size and growth trajectory, largely attributed to massive manufacturing investments, rapid urbanization, and increasing per capita income driving consumer demand for packaged goods in countries like China, India, and Southeast Asian nations. North America and Europe, while being mature markets, exhibit high demand for premium, multi-layer co-extrusion lines focusing on high-barrier films for food preservation and specialized medical applications. These regions prioritize innovation related to recycling compatibility and the processing of advanced engineering polymers, setting the pace for technological adoption and compliance with stringent environmental standards.

Segment trends underscore the dominance of the multi-layer co-extrusion segment due to the necessity for complex functional films that offer superior barrier properties against oxygen and moisture, crucial for extending the shelf life of perishable products. Furthermore, the high-density polyethylene (HDPE) and low-density polyethylene (LDPE) segments continue to hold substantial market share, although bio-based and recyclable polymer processing machinery is gaining traction rapidly, responding to global sustainability mandates. The application segment growth is particularly pronounced in non-food flexible packaging, encompassing industrial bags, stretch hoods, and agricultural films, reflecting broader industrial modernization and infrastructure development worldwide.

AI Impact Analysis on Blown Film Extruder Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Blown Film Extruder Market center predominantly on themes of operational efficiency, predictive quality control, and system autonomy. Users are keenly interested in how AI can move beyond simple automation to achieve real-time self-optimization of complex extrusion parameters—such as melt temperature, die pressure, and lay-flat width—to minimize material waste and energy consumption. Key concerns revolve around the integration complexity of AI systems with legacy machinery, the required skill level for maintenance personnel, and the tangible return on investment from implementing sophisticated machine learning algorithms for defect detection and process anomaly prediction. Expectations are high regarding the use of AI to standardize film quality across different production batches and shifts, reducing reliance on manual operator expertise and facilitating smoother transitions when processing new or specialty resins.

AI is poised to revolutionize the maintenance and uptime of blown film lines. By utilizing sensor data streams covering vibration, thermal profiles, and motor load fluctuations, machine learning models can accurately forecast potential component failures, enabling proactive servicing rather than reactive repairs. This shift dramatically improves overall equipment effectiveness (OEE), a critical metric in high-volume manufacturing. Furthermore, in the realm of material handling and logistics within the extrusion plant, AI algorithms can optimize inventory management of resins and colorants, ensuring just-in-time supplies and reducing warehousing costs, thus optimizing the entire production value chain.

The most transformative application of AI involves closed-loop control systems. Traditional control systems rely on pre-set parameters, but AI-driven controllers learn the subtle, non-linear relationships between input variables (e.g., screw speed, cooling air flow) and output quality metrics (e.g., gauge variation, clarity). This continuous learning allows the machine to dynamically adjust settings in microseconds to maintain perfect film quality despite environmental fluctuations or minor material inconsistencies. This level of optimization is unattainable through conventional methods, cementing AI’s role as a critical enhancer of both efficiency and product consistency in the future of film extrusion.

- AI-driven predictive maintenance enhancing machine uptime by forecasting component failure.

- Real-time closed-loop control systems optimizing film gauge uniformity and reducing material scrap.

- Machine learning algorithms improving defect detection (e.g., gels, contamination, holes) during production.

- Optimization of energy consumption by dynamically adjusting heating and cooling cycles based on material properties.

- Automated recipe generation for new polymer blends, reducing time-to-market for specialized films.

- Enhanced supply chain logistics and resin inventory management through demand forecasting models.

- Simulation and digital twin technology powered by AI for virtual testing of new film specifications.

DRO & Impact Forces Of Blown Film Extruder Market

The Blown Film Extruder Market is influenced by a powerful combination of drivers (D), restraints (R), and opportunities (O), creating complex impact forces that shape market trajectory. Key drivers include the exponential growth in flexible packaging demand globally, spurred by rising urbanization and consumer preferences for convenient, lightweight, and cost-effective packaging solutions, particularly in the food and e-commerce sectors. Simultaneously, the machinery market benefits significantly from ongoing technological advancements, such as the development of high-speed multi-layer co-extrusion lines capable of processing sophisticated high-barrier polymers, which meet stringent modern shelf-life requirements. These drivers exert a strong positive impact, encouraging sustained investment in higher capacity and technically advanced equipment.

However, significant restraints temper this growth. The most pervasive restraint is the increasing environmental scrutiny and regulatory pressure surrounding single-use plastics, particularly in developed economies. This forces manufacturers to invest heavily in machines capable of handling recycled, bio-degradable, or compostable polymers, which often require complex and costly modifications to existing extrusion systems. Furthermore, the substantial capital investment required to purchase and install high-end, multi-layer extrusion lines poses a barrier to entry for smaller manufacturers, while fluctuating raw material (polymer resin) prices introduce operational volatility and uncertainty, demanding greater financial risk management from market participants.

Opportunities for market expansion are primarily found in sustainable technology adoption and regional market penetration. The growing emphasis on the circular economy creates a lucrative opportunity for machinery designed specifically for processing high quantities of Post-Consumer Recycled (PCR) content and innovative bio-plastics, meeting industry and regulatory mandates. Geographically, untapped or rapidly emerging markets in Latin America and Africa represent significant opportunities for new installations, as these regions modernize their packaging infrastructure. The confluence of these forces indicates that while capital expenditure and regulatory risks exist, the overwhelming global demand for packaged goods and the clear path towards technological innovation focused on sustainability will continue to drive robust growth in the medium to long term, favoring adaptable and technologically advanced market players.

Segmentation Analysis

The Blown Film Extruder Market is meticulously segmented across several critical parameters, including machine type, process type, material, application, and layer configuration, providing a detailed view of market dynamics and specialized demand areas. Analyzing these segments is essential for understanding where technological investment is focused and which end-user sectors are driving the highest volume of machinery procurement. The fundamental goal of segmentation is to categorize the diverse offerings in this capital equipment market, ranging from small mono-layer lines used for simple industrial films to massive 11-layer co-extrusion systems optimized for high-barrier food packaging.

Key segmentation reveals a strong preference for multi-layer co-extrusion machines over traditional mono-layer counterparts, reflecting the market’s pivot towards functional films that demand specific barrier, sealing, and mechanical performance characteristics achievable only through combining multiple resin layers. Furthermore, the application segmentation highlights the ongoing dominance of the food and beverage sector, followed closely by demanding segments like healthcare (for sterile medical films) and agriculture (for greenhouse and silage films). The materials segment confirms polyethylene (LDPE, HDPE, LLDPE) remains the polymer backbone, but the fastest growth is observed in equipment designed for processing specialty materials like EVOH, Nylon (PA), and bio-based plastics to meet evolving performance and environmental criteria.

- By Machine Type:

- Fixed Die Extrusion Lines

- Rotating Die Extrusion Lines

- By Layer Configuration:

- Mono-Layer Extruders

- 3-Layer Co-Extruders

- 5-Layer Co-Extruders

- 7-Layer Co-Extruders

- 9/11-Layer Co-Extruders

- By Process Type:

- High-Speed Lines

- Standard Lines

- By Material Processed:

- Low-Density Polyethylene (LDPE)

- High-Density Polyethylene (HDPE)

- Linear Low-Density Polyethylene (LLDPE)

- Polypropylene (PP)

- Nylon (Polyamide)

- EVOH (Ethylene Vinyl Alcohol)

- Bio-Plastics and Recycled Materials (PCR)

- By Application:

- Food and Beverage Packaging (Dairy, Meat, Produce)

- Industrial Packaging (Stretch Hoods, Shrink Film)

- Agriculture (Greenhouse Film, Silage Wrap)

- Medical and Healthcare (Sterile Film, IV Bags)

- Consumer Goods (Garbage Bags, Shopping Bags)

Value Chain Analysis For Blown Film Extruder Market

The value chain for the Blown Film Extruder Market is complex, beginning with raw material sourcing and culminating in the distribution and end-use of the final plastic film product. The upstream segment is dominated by polymer resin manufacturers, including major petrochemical companies that supply polyethylene (LDPE, LLDPE, HDPE), polypropylene, and specialty resins like EVOH and nylon. The cost and quality of these raw materials significantly impact the downstream extruder manufacturers and film producers, making stable supply and price volatility management a critical component of the upstream analysis. Key value addition at this stage includes the formulation of specialized polymer grades optimized for high-speed extrusion processes and specific film properties, such as enhanced clarity or barrier function.

The midstream stage involves the core manufacturing of the blown film extruder machinery itself. This includes the design and production of critical components such as screws, barrels, dies, cooling systems (air rings), take-off units, and sophisticated control panels. Leading market players focus on advanced engineering to improve throughput, energy efficiency, and gauge control precision. The distribution channel for these capital goods is typically categorized into two main routes: direct sales and indirect sales. Direct distribution involves extruder manufacturers selling and servicing equipment directly to large, integrated film producers, fostering close relationships for customized solutions and technical support. Indirect distribution relies on established networks of authorized distributors and agents, particularly useful in reaching smaller processors and penetrating geographically dispersed markets, requiring specialized regional knowledge and localized service capabilities.

Downstream analysis focuses on the film processors—the direct customers of the extruder equipment—and the eventual end-user industries. Film processors convert resins into finished films used in diverse applications, adding value through printing, lamination, and converting processes. The final step involves end-users (e.g., food manufacturers, retailers, agricultural firms) utilizing the film for packaging or protective purposes. The success of the downstream market dictates the demand for new extruder equipment; hence, innovation is increasingly focused on developing machinery capable of producing sustainable films that meet end-user demands for eco-friendly packaging and comply with strict regulatory mandates, thus maintaining competitive advantage throughout the value chain.

Blown Film Extruder Market Potential Customers

Potential customers for Blown Film Extruder Market products are diverse and span across various high-volume manufacturing sectors, fundamentally centered around any industry requiring flexible film for packaging, protection, or specialized industrial applications. The primary buying segment consists of independent film manufacturers and converters who operate large-scale production facilities dedicated solely to producing film rolls for subsequent processing (printing, slitting, sealing). These customers require high-speed, reliable, and often multi-layer co-extrusion lines to maintain competitive pricing and meet the complex technical specifications demanded by their end-user clients, focusing heavily on OEE and low operational cost per kilogram of film produced.

A secondary, yet rapidly growing, customer base includes integrated consumer product companies and major retailers who are increasingly bringing film manufacturing in-house to gain greater control over their packaging supply chain, quality assurance, and compliance with sustainability goals. For instance, large food processing corporations might install dedicated extrusion lines to produce specialized barrier films precisely tailored for their specific product line (e.g., modified atmosphere packaging for meats or cheeses). These customers often demand turnkey solutions, extensive operator training, and high levels of automation and integration with existing factory IT infrastructure.

Furthermore, specialized industrial sectors represent key niche buyers. The agricultural sector purchases machines capable of producing wide-width, UV-stabilized films for greenhouse covers and silage wraps, prioritizing durability and scale. The medical and pharmaceutical industry demands ultra-high-precision extruders for manufacturing sterile films, IV bags, and blister pack materials, where consistency, cleanliness, and validation capabilities are paramount. Geographically, emerging economies in APAC and MEA are consistently high-potential customers, driven by infrastructure development and the ongoing transition from traditional packaging methods to modern flexible alternatives, fueling consistent demand for new machine installations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.4 Billion |

| Market Forecast in 2033 | $3.55 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | W&H, Reifenhäuser Group, Hosokawa Alpine, COLINES S.p.A., SAMA Engineering, Kiefel, KUHNE Anlagenbau, Macro Engineering & Technology, Rajoo Engineers Limited, Polyrema GmbH, Mamata Machinery, C.M.G. Macchine S.r.l., Kabra Extrusiontechnik, Gneuss Kunststofftechnik GmbH, Brampton Engineering, Chyi Yang Industrial, Lung Meng Machinery, Polystar Machinery, HANGZHOU CHANGLONG PLASTIC MACHINERY, Jinming Machinery |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blown Film Extruder Market Key Technology Landscape

The Blown Film Extruder Market is defined by a dynamic technological landscape where innovation is centered on increasing throughput, maximizing material efficiency, and ensuring superior film quality, particularly for multi-layer barrier applications. A dominant technological trend is the proliferation of complex co-extrusion lines, moving beyond standard 3-layer systems to highly sophisticated 7-layer, 9-layer, and 11-layer configurations. These advanced systems utilize specialized feedblock and die technology to precisely combine disparate materials—such as structural polymers, adhesive layers, and high-barrier resins (like EVOH)—to create films offering enhanced protection against moisture, oxygen, and aroma migration, essential for premium packaging like medical supplies and extended shelf-life foods. Furthermore, advancements in die geometry and air ring design are crucial, enabling wider lay-flat widths and achieving tighter gauge control at significantly higher line speeds, directly impacting overall production cost-efficiency.

Another critical area of technological focus involves automation and smart factory integration, often termed Extrusion 4.0. Modern extruders feature highly integrated SCADA systems, sophisticated process control software, and numerous inline sensors. These sensors monitor key variables such as bubble stability, film thickness (gauge measurement systems using infrared or nuclear scanning), and temperature profiles in real time. The data gathered facilitates automatic adjustments to screw speed, output rate, and cooling air volume, minimizing variations and reducing reliance on manual intervention. This technological evolution not only boosts efficiency but also addresses the industry challenge of finding highly skilled operators, allowing existing staff to manage multiple complex lines simultaneously through centralized digital interfaces and robust diagnostic capabilities.

Sustainability mandates are driving rapid technological innovation in material processing, particularly concerning recycling and bio-plastics. Extruder manufacturers are developing specialized screw and barrel designs capable of handling the unique thermal and viscosity challenges posed by Post-Consumer Recycled (PCR) resins, which are often inconsistent in quality and composition. Technologies like melt filtration systems (e.g., continuous screen changers) are becoming standard to remove contaminants from recycled materials without interrupting the extrusion process, ensuring the final film quality remains high. Additionally, new cooling technologies, such as internal bubble cooling (IBC) systems, are continuously refined to improve cooling rates and enhance film properties, maintaining the market’s technological leadership in producing high-performance, sustainable flexible packaging solutions.

Regional Highlights

Regional dynamics heavily influence the Blown Film Extruder Market, with distinct growth patterns and technological priorities evident across different geographies. The Asia Pacific (APAC) region stands out as the largest and fastest-growing market globally, primarily driven by large-scale infrastructural growth, booming populations, and the rapidly expanding middle class in countries like China, India, and Indonesia. This sustained growth fuels massive demand for flexible packaging across all application segments, from basic consumer goods bags to sophisticated agricultural films. APAC manufacturers often prioritize high-volume, cost-efficient machines, though there is a marked transition towards multi-layer systems to cater to export markets and increasingly demanding domestic consumers requiring better food preservation standards.

Europe represents a mature but highly innovation-focused market, characterized by stringent regulatory standards concerning environmental impact and food contact materials. European demand is heavily skewed towards high-end, energy-efficient extrusion lines capable of processing recycled, bio-based, and compostable polymers. Key countries like Germany and Italy are hubs for advanced machine manufacturing and R&D, setting global benchmarks for co-extrusion technology, automation, and closed-loop control systems. The regional focus is less on volume expansion and more on technological refinement, providing high-barrier films for specialized applications and pioneering the integration of Industry 4.0 principles into manufacturing processes.

North America is a significant market defined by early adoption of the latest technology and a strong emphasis on automation to mitigate high labor costs. The demand here centers around maximizing throughput, achieving precise film specifications for industrial applications (e.g., heavy-duty shipping bags, stretch hoods), and utilizing multi-layer extruders for high-performance packaging. The region is witnessing substantial investment in specialized extrusion equipment dedicated to recycling plastics and utilizing high levels of PCR content, often spurred by corporate sustainability commitments and state-level legislative initiatives aimed at reducing plastic waste. Meanwhile, Latin America and the Middle East & Africa (MEA) present emerging market opportunities, driven by industrialization and the establishment of local packaging production capacities, fueling demand for reliable, versatile, mid-range extrusion lines.

- Asia Pacific (APAC): Dominant market share and highest growth rate; driven by massive industrial and consumer packaging demand, high volume manufacturing focus, and increasing investment in multi-layer technology. Key markets: China, India, Japan.

- Europe: Mature market focused on high-specification, energy-efficient machinery; strong regulatory pressure driving demand for PCR and bio-plastic processing capabilities; leadership in advanced co-extrusion and automation (Industry 4.0). Key markets: Germany, Italy, Spain.

- North America: High expenditure on sophisticated automation and high-throughput lines; emphasis on specialized industrial films and early adoption of sustainable film technologies; significant investment in machines handling high PCR content. Key markets: USA, Canada.

- Latin America (LATAM): Emerging market experiencing steady growth; driven by expanding food processing industry and urbanization; increasing adoption of 3-layer and 5-layer systems.

- Middle East & Africa (MEA): Growth fueled by local manufacturing development, infrastructure projects, and agricultural sector expansion (greenhouse films); increasing demand for reliable, mid-range extrusion technology.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blown Film Extruder Market.- Windmöller & Hölscher (W&H)

- Reifenhäuser Group

- Hosokawa Alpine

- COLINES S.p.A.

- SAMA Engineering

- Kiefel GmbH

- KUHNE Anlagenbau GmbH

- Macro Engineering & Technology Inc.

- Rajoo Engineers Limited

- Polyrema GmbH

- Mamata Machinery Private Limited

- C.M.G. Macchine S.r.l.

- Kabra Extrusiontechnik Ltd.

- Gneuss Kunststofftechnik GmbH

- Brampton Engineering Inc.

- Chyi Yang Industrial Co., Ltd.

- Lung Meng Machinery Co., Ltd.

- Polystar Machinery Co., Ltd.

- HANGZHOU CHANGLONG PLASTIC MACHINERY CO., LTD.

- Jinming Machinery Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Blown Film Extruder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Blown Film Extruder Market?

The primary driver is the global surge in demand for flexible packaging, particularly in the food and beverage industry, coupled with the rising consumer preference for convenience and the necessity for extended product shelf life offered by multi-layer barrier films.

How is the market addressing the challenges posed by plastic sustainability mandates?

The market addresses sustainability by prioritizing the development and sale of extrusion lines specifically designed to process Post-Consumer Recycled (PCR) resins and bio-degradable polymers, alongside advanced co-extrusion technologies that minimize material usage while maintaining film performance.

Which geographical region holds the largest market share for Blown Film Extruders?

The Asia Pacific (APAC) region currently holds the largest market share due to rapid industrialization, high population density, expanding manufacturing base, and increasing investments in packaging infrastructure across countries like China and India.

What is the significance of multi-layer co-extrusion technology in this market?

Multi-layer co-extrusion technology is highly significant as it allows film producers to combine different polymers (e.g., barrier, adhesive, structural) in precise layers, creating complex, high-performance films essential for applications requiring superior moisture and oxygen barrier properties, especially in premium food and medical packaging.

How are AI and Industry 4.0 concepts impacting blown film production?

AI and Industry 4.0 are significantly improving production by enabling real-time process self-optimization, predictive maintenance to maximize machine uptime, and sophisticated closed-loop control systems that ensure consistent film quality and substantial reduction in energy and material waste.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager