Blown Film Extrusion Lines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434434 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Blown Film Extrusion Lines Market Size

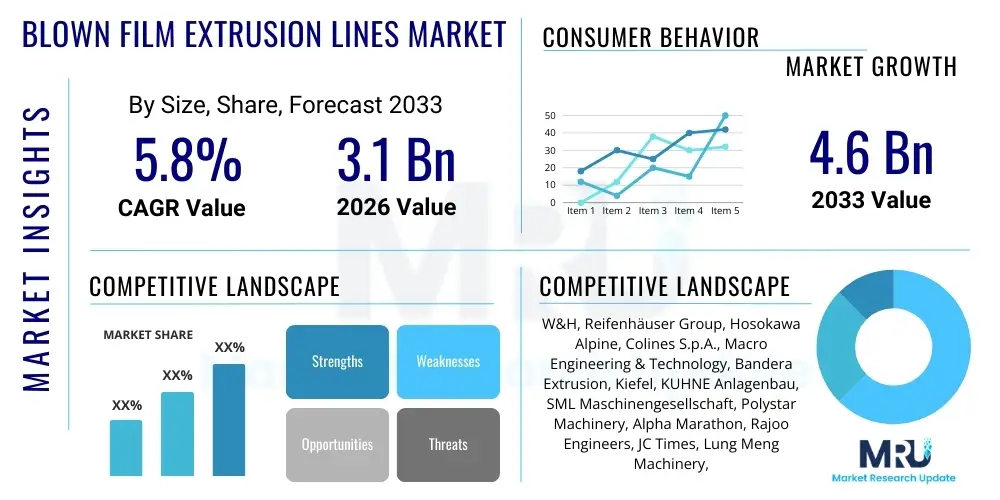

The Blown Film Extrusion Lines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.1 Billion in 2026 and is projected to reach USD 4.6 Billion by the end of the forecast period in 2033.

Blown Film Extrusion Lines Market introduction

The Blown Film Extrusion Lines Market encompasses machinery and systems utilized for producing plastic films by extruding molten polymer through an annular die and inflating the resulting tube (bubble) with air. This process is fundamental to manufacturing flexible packaging materials, agricultural films, and specific industrial liners due to its ability to create films with high mechanical strength, excellent clarity, and versatile thickness profiles. Key applications span across the food and beverage industry for primary and secondary packaging, construction for vapor barriers, and agriculture for greenhouse films and mulching. The continuous innovation in multi-layer co-extrusion technology is a primary driver, enabling manufacturers to integrate various polymer properties—such as barrier protection, sealing capability, and printability—into a single, highly functional film structure.

The core product involves integrated systems comprising extruders, dies, air rings, nip rolls, winders, and thickness control systems. Modern blown film lines are increasingly sophisticated, incorporating automation and real-time process monitoring to enhance output efficiency and film quality. The inherent benefits of blown film technology include superior film orientation, which translates to better strength in both machine and transverse directions, making the resulting films ideal for demanding applications like heavy-duty shipping sacks and stretch hood films. Furthermore, the flexibility to process a wide range of thermoplastic resins, including polyethylene (LDPE, HDPE, LLDPE), polypropylene (PP), and even specialty engineering polymers like EVOH and Nylon, ensures its continued relevance in a diversified packaging landscape.

Driving factors fueling market expansion include the global surge in demand for flexible packaging solutions owing to their cost-effectiveness and reduced material usage compared to rigid containers. The increasing focus on food preservation and waste reduction mandates high-barrier films, which are effectively produced using advanced co-extrusion lines. Additionally, robust industrialization in emerging economies, coupled with significant technological advancements in gravimetric dosing systems and automatic width control mechanisms, contributes substantially to the overall market growth trajectory. The industry is also pivoting towards lines capable of handling recycled content (PCR) and bio-based polymers to meet stringent sustainability mandates imposed globally.

Blown Film Extrusion Lines Market Executive Summary

The Blown Film Extrusion Lines Market is experiencing robust growth driven predominantly by global shifts toward sustainable and high-barrier flexible packaging. Business trends indicate a strong move toward highly automated, multi-layer co-extrusion lines (5-layer and 7+-layer) that allow for precision material stratification, optimizing film performance while minimizing raw material usage. Manufacturers are heavily investing in Industry 4.0 components, specifically focusing on integrated sensors, remote diagnostics, and data analytics to maximize uptime and operational efficiency, thereby addressing the persistent industry challenge of high operational costs and skilled labor shortages. This emphasis on efficiency and specialty film production (e.g., shrink film, lamination grade film) is redefining competitive strategies among market leaders, prompting strategic mergers and acquisitions to consolidate technological expertise and expand geographical reach.

Regional trends highlight the Asia Pacific (APAC) as the fastest-growing market segment, primarily propelled by rapid urbanization, expanding food processing industries, and significant governmental investments in agricultural infrastructure, requiring vast quantities of specialty polyethylene films. North America and Europe, while mature, are characterized by high demand for sophisticated lines capable of processing high percentages of post-consumer recycled (PCR) resin and accommodating ultra-thin gauge production to comply with strict environmental regulations. The European market, in particular, showcases a strong preference for lines optimized for material traceability and energy efficiency, often exceeding standard regulatory benchmarks. Latin America and the Middle East & Africa are emerging as pivotal growth areas due to growing manufacturing bases and increasing domestic consumption of packaged goods.

Segmentation trends reveal that multi-layer lines, particularly those designed for barrier films using Nylon and EVOH, command the largest market share in terms of value, driven by applications requiring extended shelf life, such as fresh meat, dairy, and pharmaceutical packaging. In terms of material processing, Linear Low-Density Polyethylene (LLDPE) remains the dominant polymer due to its excellent strength and puncture resistance characteristics, fueling demand for lines optimized for its specific processing temperature and pressure requirements. The application segment growth is led by the food packaging sector, followed closely by consumer goods packaging, reflecting the non-discretionary nature of these end-use sectors and the continuous necessity for advanced, cost-effective packaging solutions.

AI Impact Analysis on Blown Film Extrusion Lines Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Blown Film Extrusion Lines Market frequently revolve around how AI can enhance operational efficiency, reduce waste, and improve film quality consistency. Users are highly concerned with leveraging AI for predictive maintenance to minimize costly unplanned downtime, asking specific questions about algorithm accuracy in predicting component failure (such as screw wear or gearbox issues). Another major theme involves optimizing complex multi-layer recipes; users inquire how machine learning models can instantaneously adjust extruder temperatures, pressures, and melt flows based on real-time raw material variability to ensure target specifications (like thickness profile and barrier properties) are maintained flawlessly. Furthermore, there is strong interest in AI-driven visual inspection systems capable of detecting microscopic defects or impurities in the film web at high speeds, moving beyond traditional human-visual inspection methods and integrating seamlessly with automatic width or gauge control systems to provide a closed-loop quality assurance process. The consensus expectation is that AI will transform the traditionally empirical process of film manufacturing into a highly data-driven, autonomous operation.

- AI-driven Predictive Maintenance (PdM): Utilizes sensor data (vibration, temperature, current) to anticipate extruder, gearbox, or winder failures, drastically reducing unexpected downtime.

- Real-time Quality Control: Machine vision systems powered by deep learning detect and classify film defects (e.g., gels, contamination, streaks) instantly, ensuring high material throughput quality.

- Process Optimization and Recipe Management: Machine learning algorithms dynamically adjust processing parameters (temperatures, speeds, air flow) based on raw material batch variations and ambient conditions to maintain optimal film gauge and clarity.

- Energy Consumption Reduction: AI monitors energy usage across heating zones and motors, implementing optimized operational schedules to minimize electricity consumption without compromising melt homogeneity or quality.

- Supply Chain Forecasting: Integrating external market data with internal production metrics to predict demand fluctuations and optimize raw material procurement and inventory levels.

- Autonomous Gauge Control: Advanced AI models interpret thickness sensor data and immediately adjust die lip opening or air ring parameters in a closed-loop system, achieving superior film uniformity (low gauge variation).

- Sustainability Optimization: AI assists in determining the optimal blend of Post-Consumer Recycled (PCR) content and virgin polymer while maintaining mechanical properties, aiding sustainable manufacturing objectives.

DRO & Impact Forces Of Blown Film Extrusion Lines Market

The market dynamics are shaped by critical factors related to growing flexible packaging needs, regulatory pressures, and inherent manufacturing costs. Drivers include the rising global demand for packaged food, which necessitates high-barrier, multi-layer films for extended shelf life, and the push towards sustainable packaging lightweighting, achievable through advanced co-extrusion lines. Opportunities arise from technological advancements, specifically the integration of Industry 4.0 components like IoT sensors and analytical software, allowing for greater production efficiency and reduced waste. Conversely, major restraints impacting growth are the significant initial capital investment required for high-capacity, multi-layer lines and the persistent volatility in the prices of key petrochemical raw materials, specifically polyethylene resins (LDPE, HDPE, LLDPE). The primary impact forces are the intensity of competitive rivalry among leading machinery manufacturers, the strong bargaining power of raw material suppliers due to concentrated polymer production, and the increasing regulatory scrutiny demanding recyclability and reduced plastic usage, forcing continuous innovation in processing recycled materials and thinner gauges.

Segmentation Analysis

The Blown Film Extrusion Lines Market is comprehensively segmented based on the line type, the material processed, and the end-use application, providing a granular view of market demand and technological adoption. Segmentation by Line Type—including mono-layer, 3-layer, 5-layer, and 7+-layer systems—reflects the evolution from basic packaging films to highly specialized barrier and technical films. Material segmentation highlights the dominance of polyethylene derivatives (LDPE, LLDPE, HDPE), crucial for high-volume applications, alongside specialty polymers like Nylon and EVOH, critical for high-performance barrier film production. Application analysis underscores the market’s reliance on the Food & Beverage sector, which mandates stringent quality and barrier properties, followed by industrial and consumer goods packaging. These segments dictate the required complexity and capacity of the machinery purchased, driving technological customization and specification complexity across the industry.

- By Line Type

- Mono-layer Blown Film Lines

- Multi-layer Blown Film Lines

- 3-Layer Systems

- 5-Layer Systems

- 7+ Layer Systems (including 9-layer and 11-layer)

- By Material Processed

- Low-Density Polyethylene (LDPE)

- Linear Low-Density Polyethylene (LLDPE)

- High-Density Polyethylene (HDPE)

- Polypropylene (PP)

- Nylon (Polyamide)

- Ethylene Vinyl Alcohol (EVOH)

- Others (e.g., PLA, EVA, specialty blends)

- By Application

- Food and Beverage Packaging (e.g., frozen food, snack bags, dairy wraps)

- Industrial Packaging (e.g., stretch hood, heavy-duty sacks, protective films)

- Consumer Goods Packaging (e.g., trash bags, hygiene products)

- Agriculture (e.g., greenhouse films, mulching films, silage wraps)

- Medical and Pharmaceutical Packaging

- By Component

- Extrusion Units (Extruders and Screws)

- Die Heads and Air Rings

- Nip Rolls and Collapsing Frames

- Winders (Surface, Center, or Combination Winders)

- Automation and Control Systems

Value Chain Analysis For Blown Film Extrusion Lines Market

The value chain for the Blown Film Extrusion Lines Market begins with upstream activities involving the sourcing and processing of raw materials, primarily specialized steel and precision components (e.g., motors, sensors, gearboxes) necessary for machine construction. Polymer manufacturers (feedstock providers) represent a crucial upstream segment, as the quality and cost of polyethylene resins directly influence machinery design and operational efficiency. Midstream activities are dominated by machinery Original Equipment Manufacturers (OEMs), who design, assemble, and test the complex extrusion lines. This stage involves significant R&D investment in co-extrusion die technology, advanced cooling systems, and integrating proprietary software for process control, aiming for energy efficiency and high throughput. OEMs utilize both direct sales channels, engaging in long-term relationships and customization projects with large converters, and indirect channels through specialized regional distributors or agents, particularly in fragmented or emerging markets, which often provide essential post-sale support and local technical expertise.

The downstream segment of the value chain involves the film converters and end-users. Film converters, the immediate customers for the machinery, utilize these lines to produce various plastic films. They serve diverse sectors such as food processing, agriculture, and construction. The distribution channel is often dual-pronged: direct sales are preferred for high-value, highly customized multi-layer lines where technical consultation and installation services are paramount, often bypassing traditional distributors to ensure direct communication between the OEM and the high-volume film producer. Indirect channels are frequently used for standard or lower-capacity mono-layer lines, leveraging local distributors who manage inventory, financing, and smaller scale service requirements. The efficiency of this distribution network is crucial, as the timely delivery and installation of complex machinery are significant competitive differentiators in the market.

The final stage encompasses post-sales services, including spare parts supply, maintenance contracts, and operational training, which contribute significantly to the OEM's recurring revenue stream and customer loyalty. The entire value chain is currently emphasizing circular economy principles, leading to pressure on OEMs to design lines capable of processing recycled polymers and on converters to produce recyclable film structures. This necessitates close collaboration between raw material suppliers, machinery manufacturers, and the final converters to ensure product feasibility and adherence to stringent environmental regulations globally. Technological integration and standardization efforts within the supply chain are key to reducing lead times and ensuring the reliability of these expensive production systems.

Blown Film Extrusion Lines Market Potential Customers

Potential customers for Blown Film Extrusion Lines are primarily large-scale plastic film converters and integrated packaging companies who require high-volume, reliable production capabilities for flexible films. These buyers are capital-intensive operations that prioritize machinery lifespan, throughput capacity, energy efficiency, and the ability to produce multi-functional films, often necessitating high-layer co-extrusion technology. Key end-users include major multinational food processing corporations and large agricultural enterprises that require specialized films, driving demand for tailored equipment configurations. The purchasing decision is highly technical and usually involves extensive scrutiny of the Total Cost of Ownership (TCO), focusing on factors such as scrap rates, maximum line speed, and the precision of automatic gauge control systems, as even minor inconsistencies in film thickness can lead to significant material wastage over high production runs. Furthermore, sustainability requirements are becoming mandatory criteria, meaning customers specifically seek lines optimized for handling Post-Consumer Recycled (PCR) resins and biopolymers, aligning their capital expenditure with regulatory trends.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 4.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | W&H, Reifenhäuser Group, Hosokawa Alpine, Colines S.p.A., Macro Engineering & Technology, Bandera Extrusion, Kiefel, KUHNE Anlagenbau, SML Maschinengesellschaft, Polystar Machinery, Alpha Marathon, Rajoo Engineers, JC Times, Lung Meng Machinery, Polyrema, Parkinson Technologies, T-PLAS, Chyi Yang, Gneuss Kunststofftechnik, NGR. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blown Film Extrusion Lines Market Key Technology Landscape

The technological landscape of the Blown Film Extrusion Lines Market is defined by continuous advancements focused on achieving higher throughput, superior film quality, and improved operational sustainability. A pivotal technology is advanced multi-layer co-extrusion, where systems capable of 5, 7, 9, or 11 layers are becoming standard for producing complex barrier films that integrate layers like EVOH (Ethylene Vinyl Alcohol) or Nylon to enhance gas and moisture resistance, critical for perishable goods packaging. The implementation of oscillating haul-offs and advanced rotating dies is essential for randomizing film thickness variations (gauge variation) and ensuring uniformity, thereby improving the film's usability during subsequent printing or lamination processes. Furthermore, the development of specialized cooling technologies, such as internal bubble cooling (IBC) systems and high-efficiency air rings, allows manufacturers to significantly increase line speed without sacrificing film clarity or stability, directly translating to higher productivity and lower per-unit cost.

Another dominant technological trend is the pervasive integration of digitalization and Industry 4.0 principles. Modern extrusion lines feature highly sophisticated, integrated control systems utilizing high-resolution sensors (e.g., gravimetric dosing systems and infrared thickness gauges) that provide real-time data feedback. This data is processed through proprietary machine control software, enabling automatic adjustments to extruder output and die gap settings to maintain precise film specifications. This level of automation, often referred to as Automatic Gauge Control (AGC) and Automatic Width Control (AWC), minimizes reliance on manual intervention and significantly reduces material waste. This focus on intelligent monitoring is crucial for producing ultra-thin films accurately, which is a key requirement for lightweighting initiatives aimed at meeting sustainability targets and reducing material consumption.

Innovation is also highly concentrated around circular economy readiness. OEMs are developing specialized screw designs and extruder configurations, such as vented or cascade extruders, that are specifically optimized to process Post-Consumer Recycled (PCR) materials effectively, which often contain contaminants and moisture. This technology ensures that the mechanical properties of the film produced using recycled content remain robust and reliable. Furthermore, the adoption of modular line designs is increasing, allowing converters to easily upgrade or reconfigure their existing lines (e.g., adding a new co-extruder or changing die size) to adapt quickly to shifting market demands, such as transitioning from commodity films to high-value technical films. These technological upgrades aim to reduce energy consumption per kilogram of output and enhance the overall sustainability profile of the film production process.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the dominant and fastest-growing region, driven primarily by the rapid expansion of the food and beverage processing industry in countries like China, India, and Southeast Asia. Massive population growth, coupled with increasing disposable incomes and reliance on packaged consumer goods, fuels the demand for high-speed, cost-effective extrusion lines. Furthermore, governmental initiatives supporting agricultural modernization increase the need for specialty films such as greenhouse and silage wraps, making this region a critical hub for both volume consumption and future capacity expansion. Investment is increasingly focused on acquiring advanced 5-layer and 7-layer lines to produce high-performance barrier films.

- North America: This region is characterized by high technological maturity and a strong focus on high-performance films and sustainability. Demand centers around replacing older machinery with highly automated, energy-efficient lines capable of processing high percentages of PCR (Post-Consumer Recycled) content. The stringent regulations governing food contact materials and pharmaceutical packaging necessitate investment in precision machinery with advanced monitoring and quality assurance systems. Key customers include large flexible packaging conglomerates that demand maximum uptime and sophisticated closed-loop control systems.

- Europe: Europe is a leader in adopting circular economy principles, significantly influencing machinery requirements. The market is primarily driven by the demand for lines capable of producing ultra-thin, recyclable mono-material films (like all-polyethylene structures) that can substitute non-recyclable multi-material laminates. Innovation in this region focuses heavily on energy recovery systems, minimal scrap rates, and comprehensive digitalization (Industry 4.0) to comply with the EU’s Green Deal objectives and ambitious recycling targets. Germany, Italy, and Spain are major manufacturing hubs for both the machinery and the final film products.

- Latin America: This region presents significant growth potential, particularly in Brazil and Mexico, due to increasing foreign direct investment in manufacturing and the growing local demand for packaged food and agricultural products. The market is increasingly transitioning from mono-layer to 3-layer and 5-layer systems to improve product shelf life and compete with international quality standards. Price sensitivity remains a factor, driving demand for robust, reliable machinery with moderate automation levels and proven performance in high-humidity environments.

- Middle East and Africa (MEA): Growth in MEA is largely concentrated around industrialization efforts, particularly in Saudi Arabia and the UAE, coupled with rapidly expanding agriculture in certain African nations. The market requires heavy-duty film lines for construction, industrial applications (e.g., geomembranes), and agricultural covering films. Investments in infrastructure and packaging facilities are rising, creating new opportunities for machinery suppliers specializing in high-output, reliable systems suitable for extreme climatic conditions and basic commodity film production.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blown Film Extrusion Lines Market.- Windmöller & Hölscher (W&H)

- Reifenhäuser Group

- Hosokawa Alpine AG

- Colines S.p.A.

- Macro Engineering & Technology Inc.

- Bandera Extrusion

- Kiefel GmbH

- KUHNE Anlagenbau GmbH

- SML Maschinengesellschaft mbH

- Rajoo Engineers Ltd.

- Alpha Marathon Technologies Inc.

- Polystar Machinery Co., Ltd.

- JC Times International Business Co., Ltd.

- Lung Meng Machinery Co., Ltd.

- Polyrema GmbH

- Parkinson Technologies Inc.

- Guangdong Jinming Machinery Co., Ltd.

- Gneuss Kunststofftechnik GmbH

- NGR Next Generation Recyclingmaschinen GmbH

- Plastiflex Corporation

Frequently Asked Questions

What are the primary drivers for the increased adoption of multi-layer blown film lines?

The primary drivers are the escalating global demand for specialized flexible packaging requiring superior barrier properties and the need for material lightweighting. Multi-layer co-extrusion allows converters to combine different resins (e.g., PE, Nylon, EVOH) into a single film structure, optimizing characteristics like oxygen barrier, moisture resistance, and mechanical strength, thereby extending product shelf life and reducing overall material consumption, which aligns with sustainability goals and reduces shipping costs. This technology is critical for high-value applications in food, medical, and pharmaceutical packaging.

How is Industry 4.0 impacting the operational efficiency of blown film extrusion lines?

Industry 4.0 integration, encompassing IoT sensors, cloud computing, and AI-driven analytics, significantly enhances operational efficiency by enabling comprehensive process control and predictive maintenance. Smart lines monitor key parameters such as melt pressure, temperature uniformity, and energy consumption in real-time. This data facilitates Automatic Gauge Control (AGC) for film consistency and allows for immediate detection and prediction of equipment failures, thereby minimizing unplanned downtime, optimizing throughput, and ensuring higher material yields, leading to lower Total Cost of Ownership (TCO).

What are the key challenges associated with processing Post-Consumer Recycled (PCR) materials in blown film extrusion?

Processing PCR materials presents significant challenges related to material variability, contaminants, and moisture content, which can compromise film quality and mechanical integrity. Key issues include increased gel formation, reduced melt strength, and potential discoloration or odor in the final product. Addressing these challenges requires specialized machinery components such as high-performance filtration systems (screen changers), optimized screw geometries (vented extruders), and precise gravimetric dosing systems to ensure consistent blending and reliable output when using high percentages of recycled polymer input.

Which film segment—mono-layer or multi-layer—holds the greater market value, and why?

The multi-layer segment holds the greater market value, despite mono-layer lines still dominating volume in commodity films. Multi-layer lines are inherently higher in capital cost, require more complex controls, and process high-value, specialized resins like EVOH and Nylon. These lines produce technical films (e.g., barrier films, specialty laminating films, heavy-duty shipping sacks) that command significantly higher margins due to their superior performance, functionality, and crucial role in protecting high-value goods, particularly in the premium food and industrial sectors.

What are the critical considerations when selecting the appropriate winder technology for a blown film line?

The selection of winder technology—typically surface, center, or combination winders—is critical and depends on the specific film characteristics and final roll requirements. Surface winders are generally suitable for thicker, rigid films or larger rolls, while center winders are necessary for thinner, tension-sensitive films (like stretch wrap) to maintain tight tension control and prevent telescoping or stretching. Combination winders offer maximum flexibility but involve higher costs. Critical considerations include desired roll geometry, maximum line speed, sensitivity to tension variations, and whether the film is slippery or prone to blocking.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager