Blown Film Extrusion Machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438533 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Blown Film Extrusion Machines Market Size

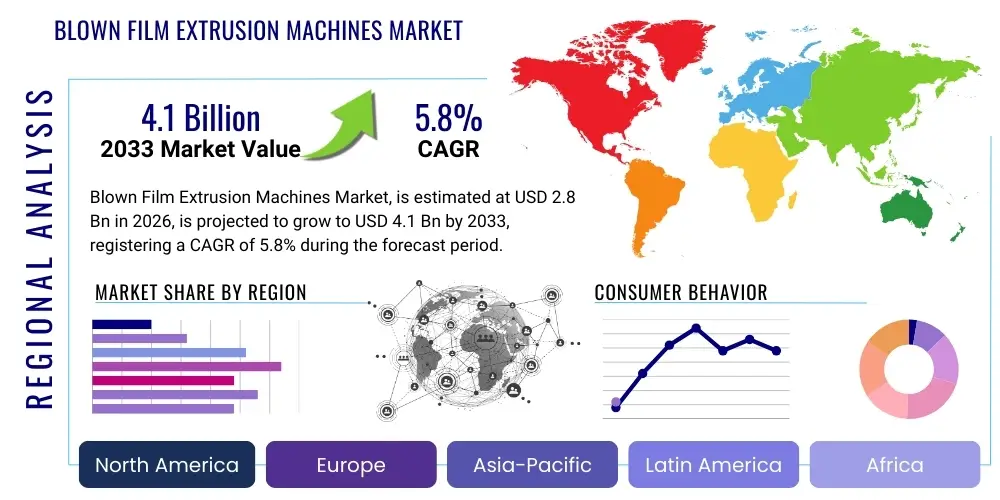

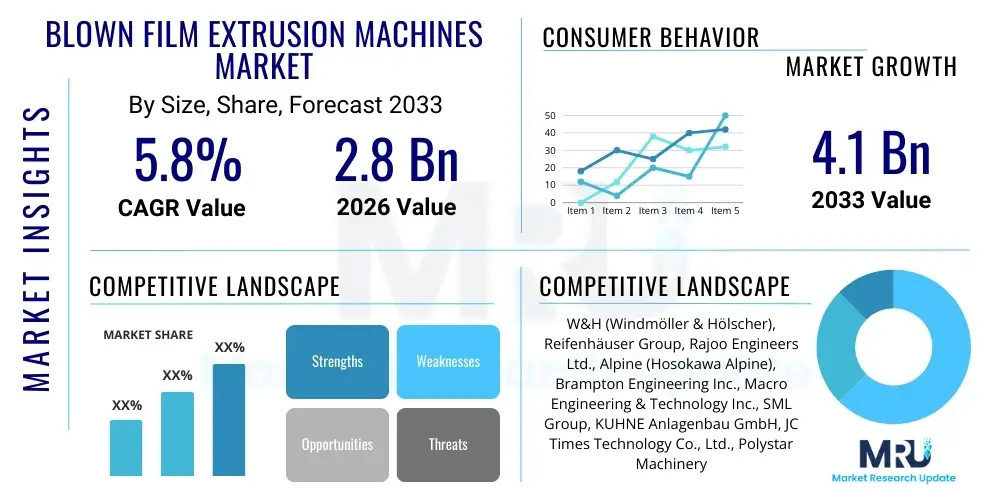

The Blown Film Extrusion Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 2.8 Billion in 2026 and is projected to reach USD 4.1 Billion by the end of the forecast period in 2033.

Blown Film Extrusion Machines Market introduction

The Blown Film Extrusion Machines Market encompasses the manufacturing, distribution, and utilization of specialized industrial equipment designed to produce thermoplastic films by extruding molten polymer through an annular die and inflating it with air. This process yields continuous tubing, which can be subsequently slit and treated for various flexible packaging and industrial applications. These machines are pivotal in transforming raw polymer resins, such as Low-Density Polyethylene (LDPE), High-Density Polyethylene (HDPE), and Linear Low-Density Polyethylene (LLDPE), into finished goods like shrink wrap, heavy-duty sacks, agricultural films, and multilayer barrier films essential for food preservation. The continuous demand from the thriving e-commerce sector and the sustained need for protective packaging across FMCG and pharmaceutical industries are primary growth pillars supporting market expansion globally.

Product sophistication within this domain has accelerated, driven by the need for enhanced film properties, including increased barrier protection, improved puncture resistance, and greater optical clarity. Modern blown film lines often incorporate multi-layer co-extrusion capabilities, enabling manufacturers to combine different polymers to achieve customized performance characteristics previously unattainable with mono-layer systems. The adoption of advanced components, such as automatic thickness control systems, gravimetric dosing units, and high-efficiency cooling rings, significantly enhances operational consistency, reduces material waste, and lowers energy consumption, making newer machines highly attractive investments for large-scale packaging converters aiming for superior productivity and sustainability compliance.

Major applications driving the demand for these machines include food packaging (pouches, wrappers), industrial packaging (stretch films, liners), consumer goods (shopping bags, protective coverings), and specialized applications like medical films and agricultural mulch films. The inherent benefits of films produced via blown extrusion, such as excellent heat seal strength, superior tensile properties, and the flexibility to adjust film width and gauge instantly, cement the machine’s foundational role in the flexible packaging supply chain. The overriding driving factors include rapid industrialization in developing economies, regulatory pressure favoring recyclable materials stimulating investment in specialized machine types, and the global shift toward flexible packaging solutions dueishing logistics efficiency and reducing overall material weight.

Blown Film Extrusion Machines Market Executive Summary

The Blown Film Extrusion Machines Market is characterized by robust business trends centered on automation, efficiency, and sustainability. Key business drivers involve fierce competition among machinery manufacturers focusing on integrating Industry 4.0 standards, including predictive maintenance capabilities and real-time operational diagnostics, to minimize downtime. Companies are strategically pivoting towards offering turnkey solutions and modular systems that allow converters flexibility in scaling production lines and quickly adapting to shifts in polymer trends, particularly the increasing reliance on bio-plastics and recycled content (PCR). Furthermore, mergers and acquisitions remain a consistent strategy among leading players to consolidate technological expertise, particularly in high-precision co-extrusion and large-format machine segments, thereby expanding geographic reach and enhancing competitive product portfolios.

Regionally, the Asia Pacific (APAC) market maintains undeniable leadership, primarily due to the expansive growth of the domestic manufacturing sector, rapidly escalating consumer demand for packaged goods, and significant governmental investment in infrastructure and industrial zones, particularly in China and India. While North America and Europe represent mature markets, growth here is dominated by stringent environmental regulations mandating the transition to machinery capable of handling sustainable and post-consumer recycled resins (PCR). This regulatory environment necessitates substantial capital expenditure for upgrading existing equipment or investing in sophisticated lines that meet circular economy objectives. Latin America and the Middle East and Africa (MEA) are emerging as high-potential markets, driven by favorable demographics, urbanization, and the nascent establishment of sophisticated local packaging industries, creating strong demand for mid-range and high-output machinery.

Segment trends indicate a pronounced shift towards multi-layer co-extrusion technology, specifically 5-layer and 7-layer systems, as converters prioritize barrier properties crucial for extending the shelf life of perishable goods. HDPE and LLDPE machine types are experiencing high volume sales, reflecting their utility in heavy-duty applications and stretch films, respectively. In terms of application, food and beverage packaging remains the most dominant segment, though specialty film production, including high-strength agricultural and medical films, is forecast to achieve the highest compounded annual growth rate. The market is also seeing polarization, with demand strong for both high-speed, high-output lines necessary for bulk packaging and compact, energy-efficient lines suitable for specialized, smaller volume production runs, underscoring the diversification of end-user needs.

AI Impact Analysis on Blown Film Extrusion Machines Market

User inquiries regarding AI's influence in the Blown Film Extrusion Machines Market primarily revolve around operational efficiency, material optimization, and predictive maintenance. Common questions include: "How can AI reduce material waste in the extrusion process?", "What role does machine learning play in optimizing film gauge uniformity?", and "Can AI predict equipment failure in complex multi-layer lines?" These themes reveal a strong market expectation for AI to solve persistent operational challenges related to throughput variability, quality control, and the costly downtime associated with unscheduled maintenance. Users are focused on leveraging AI for real-time prescriptive analytics, moving beyond mere descriptive monitoring to achieve genuine optimization of energy consumption and raw material usage, thereby enhancing competitiveness and sustainability credentials within a highly capitalized industry. The integration of sophisticated algorithms with existing industrial internet of things (IIoT) sensors is seen as the next frontier for achieving previously unattainable levels of precision in film production.

- AI-Powered Process Optimization: Utilizing machine learning algorithms to adjust extrusion parameters (temperature, pressure, screw speed, air ring settings) dynamically and instantaneously, minimizing deviation in film thickness and maximizing output quality.

- Predictive Maintenance (PdM): Analysis of vibration, heat, and energy consumption data from critical components (gearboxes, dies, screws) to anticipate potential failures, scheduling maintenance proactively and dramatically reducing catastrophic unplanned downtime.

- Material Recipe Optimization: AI models determine the optimal blend ratio of virgin polymers, recycled resins (PCR), and additives to meet specific film characteristics while minimizing material cost and waste generation.

- Quality Control Automation: Integration of high-speed vision systems powered by deep learning to detect microscopic defects, holes, or inconsistencies in the film web in real-time, providing immediate feedback for process correction.

- Energy Consumption Reduction: Machine learning systems analyze production schedules and historical data to optimize machine startup and shutdown sequences and maintain ideal operational temperature set points, leading to measurable reductions in utility costs.

- Supply Chain Resilience: AI analyzing raw material inventory levels and predicting demand fluctuations to optimize procurement strategies for polymer resins, insulating manufacturers against volatile commodity markets.

- Digital Twin Simulation: Creating virtual replicas of the physical extrusion line to simulate various polymer formulations and process adjustments before implementing them on the actual machine, accelerating new product development cycles.

DRO & Impact Forces Of Blown Film Extrusion Machines Market

The market is predominantly influenced by robust drivers, counterbalanced by inherent operational restraints, while significant opportunities remain available for technologically agile firms, all of which are interconnected by fundamental impact forces defining market dynamics. The primary driver is the pervasive, sustained expansion of the global flexible packaging industry, fueled by evolving consumer lifestyles favoring convenience, portability, and single-serve packaging formats, which necessitates high-volume film production. Simultaneously, strict international and regional environmental regulations demanding circular economy practices are forcing manufacturers to invest in new extrusion technology capable of processing high percentages of recycled content (PCR) and bio-based plastics, effectively creating a replacement cycle for older, inefficient machinery. Furthermore, technological advancements in co-extrusion, allowing for production of films with superior barrier properties essential for sophisticated applications like medical and aseptic packaging, substantially push the demand envelope.

However, significant restraints temper the market’s growth trajectory. High initial capital investment required for state-of-the-art multi-layer extrusion lines poses a substantial barrier to entry for smaller and mid-sized enterprises, particularly in emerging markets, leading to market consolidation among well-capitalized players. Volatility in the price and supply of key raw materials, primarily crude oil derivatives such as polyethylene and polypropylene resins, creates instability in operational costs and profit margins for film producers, indirectly affecting machinery procurement cycles. Moreover, the increasing demand for sustainable packaging, while driving innovation, also introduces complexity in machine design and operational management, requiring specialized expertise and significant retooling efforts to achieve acceptable output quality with non-virgin materials.

Opportunities for expansion lie predominantly in developing customized machinery solutions tailored for highly specialized niche applications, such as high-strength agricultural silage films and technical films for construction. The rapid proliferation of e-commerce necessitates continuous innovation in protective and shipping films, offering a vast, untapped potential for high-speed stretch and shrink film lines. Furthermore, manufacturers who successfully integrate IIoT, AI, and comprehensive digital services into their machinery offerings, providing remote diagnostics and prescriptive maintenance solutions, stand to capture premium segments of the market. The impact forces acting upon this equilibrium are characterized by high substitution threat from alternative packaging forms (e.g., rigid plastics, glass) and strong bargaining power exerted by large film converters who dictate specifications and price points, requiring machine manufacturers to maintain relentless focus on cost reduction and technical superiority.

Segmentation Analysis

The Blown Film Extrusion Machines Market is meticulously segmented based on key structural and functional criteria, allowing for granular analysis of demand patterns and technological adoption across various end-user industries. The segmentation is primarily driven by the complexity of the film required (measured by the number of layers), the type of material processed, the output rate (size/capacity), and the ultimate application of the extruded film. The complexity of machinery ranges from simple mono-layer units used for commodity packaging to highly sophisticated nine-layer or ten-layer systems engineered for complex barrier films required in high-end food and pharmaceutical applications. Understanding these segments is crucial for strategic business planning, as it dictates the required investment level, the target customer base, and the regional suitability of the machinery offered.

- By Product Type:

- Mono-layer Blown Film Extrusion Machines

- Multi-layer Blown Film Co-Extrusion Machines

- 3-Layer Co-Extrusion

- 5-Layer Co-Extrusion

- 7-Layer Co-Extrusion

- 9/10-Layer and Above Co-Extrusion

- By Output Capacity:

- Low Capacity (Up to 200 kg/hr)

- Medium Capacity (200 kg/hr to 500 kg/hr)

- High Capacity (Above 500 kg/hr)

- By Material Type:

- Low-Density Polyethylene (LDPE)

- High-Density Polyethylene (HDPE)

- Linear Low-Density Polyethylene (LLDPE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Bio-Plastics and Sustainable Resins (e.g., PLA, PCR blends)

- By Application:

- Food & Beverage Packaging

- Dairy and Meat Packaging

- Snacks and Confectionery

- Aseptic Packaging

- Industrial Packaging

- Stretch and Shrink Films

- Heavy Duty Sacks

- Laminating Films

- Consumer Goods Packaging (e.g., Shopping Bags, Trash Bags)

- Agricultural Films (e.g., Mulch Films, Greenhouse Covers)

- Medical and Pharmaceutical Films

- Construction and Technical Films

Value Chain Analysis For Blown Film Extrusion Machines Market

The value chain for the Blown Film Extrusion Machines Market is complex, beginning with upstream analysis focused on the procurement of specialized components and raw materials necessary for machine construction. Upstream activities are dominated by specialized suppliers providing highly engineered components such as high-precision gearboxes, large-format screws and barrels made from specialized alloys, sophisticated annular dies, and advanced control systems (PLCs, motors, drives). The core competitive advantage for machine manufacturers often hinges on their ability to source these components reliably and integrate them efficiently. Price fluctuations in metals and sophisticated electronic components can significantly influence the final cost of the extrusion machine. Machine builders must manage complex supplier relationships to ensure component quality and availability, as a single component failure can render an entire production line inoperable.

Midstream activities involve the core manufacturing process, where leading machine builders focus on proprietary designs, precision machining, and rigorous assembly and testing protocols. Manufacturers differentiate themselves through technological innovation, such as developing specialized cooling systems (e.g., internal bubble cooling, high-efficiency air rings) and advanced automation features crucial for energy savings and operational consistency. The distribution channel is bifurcated into direct sales and indirect representation. Direct sales are typically favored for high-value, customized, multi-layer extrusion lines sold to large multinational packaging converters, ensuring close consultation and after-sales service. Indirect channels, utilizing specialized distributors or agents, are common for standard mono-layer or lower-capacity machines, particularly in regions where the manufacturer does not maintain a large local presence. These distributors provide essential local support, installation, and spare parts inventory.

Downstream analysis focuses on the end-users and the final applications of the produced film. The immediate downstream users are film converters and plastic packaging companies who utilize the machines to produce various primary and secondary packaging materials. These converters then sell their film products to diverse sectors, including Food & Beverage, Consumer Goods, and Agriculture. Direct sales ensure manufacturers maintain greater control over service quality and glean direct feedback for product improvement, which is critical in this high-technology market. Indirect channels broaden market access but require robust training and support for the channel partners to maintain the brand’s technical reputation. The success of the machine builder is intrinsically linked to the profitability and growth of these downstream film converters, necessitating partnerships that include technical training, financing solutions, and ongoing application support to optimize film formulation and production efficiency.

Blown Film Extrusion Machines Market Potential Customers

Potential customers in the Blown Film Extrusion Machines Market are primarily concentrated among companies involved in flexible packaging manufacturing and specialized polymer processing, forming a critical link between raw material suppliers and consumer goods companies. The dominant customer base includes multinational packaging corporations that operate numerous high-output production lines globally, such as Amcor, Berry Global, and Sealed Air. These large entities demand highly customized, multi-layer co-extrusion lines capable of high speeds, precise gauge control, and flexibility in handling complex resin blends, often prioritizing energy efficiency and sophisticated automation features to minimize labor costs and environmental impact across massive scales of operation. Their procurement decisions are driven by total cost of ownership (TCO) and long-term service agreements rather than just the initial capital expenditure.

A second substantial segment comprises medium-sized regional film converters who service local and national markets. These businesses typically seek robust, reliable three-layer or five-layer machines with moderate output capacities (200-500 kg/hr). Their purchasing criteria emphasize quick return on investment, ease of maintenance, and the versatility to switch between different film applications (e.g., from trash bags to agricultural film). In rapidly developing economies, this segment is characterized by high growth potential as industrialization accelerates, demanding cost-effective, durable machinery. Furthermore, niche potential customers include companies focused exclusively on specialized films, such as medical-grade sterile films or advanced photovoltaic encapsulation films, which require ultra-high precision extrusion systems and specialized cleanroom compatibility, representing a high-margin but low-volume sales opportunity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.8 Billion |

| Market Forecast in 2033 | USD 4.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | W&H (Windmöller & Hölscher), Reifenhäuser Group, Rajoo Engineers Ltd., Alpine (Hosokawa Alpine), Brampton Engineering Inc., Macro Engineering & Technology Inc., SML Group, KUHNE Anlagenbau GmbH, JC Times Technology Co., Ltd., Polystar Machinery Co., Ltd., Fong Kee Iron Works Co., Ltd., JINMING Machinery Co., Ltd., COLINES S.p.A., Carer Makina, BOCO Technologies Inc., and Atlas Converting Equipment Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blown Film Extrusion Machines Market Key Technology Landscape

The technology landscape of the Blown Film Extrusion Machines Market is undergoing continuous evolution, primarily focusing on enhancing co-extrusion capabilities, improving operational efficiency, and addressing sustainability requirements. Multi-layer co-extrusion technology is arguably the most critical advancement, enabling manufacturers to produce films containing up to 11 layers or more. This sophisticated layering allows for the strategic placement of different polymer resins (e.g., barrier resins like EVOH, adhesive layers, and structural resins) to achieve optimal performance characteristics, such as oxygen and moisture barrier protection crucial for shelf-stable food products. Modern lines incorporate highly advanced melt pumps and specialized feedblocks that ensure precise layer distribution and uniformity, which is vital for high-speed winding and subsequent converting operations. The drive towards high-output lines necessitates highly efficient cooling systems, including advanced Internal Bubble Cooling (IBC) systems and sophisticated air rings, which accelerate the cooling process to increase production speeds without compromising film clarity or mechanical strength.

A secondary, but rapidly accelerating, technological trend involves the integration of advanced process control and automation systems, moving towards the paradigm of smart manufacturing or Industry 4.0. Key components include gravimetric dosing systems that accurately measure and blend multiple raw materials in real-time, coupled with automated gauge control (AGC) systems using non-contact sensors (e.g., infrared or nuclear sources) to maintain tight film thickness tolerances across the entire width. These systems minimize material usage, which is the single largest cost component in film production. Furthermore, the incorporation of sophisticated Human-Machine Interfaces (HMIs) and connectivity tools allows operators to manage complex recipes, monitor energy consumption, and interface with centralized plant management software, thereby optimizing the entire factory floor performance and facilitating remote diagnostics and service support.

Finally, technology related to material handling and recycling is increasingly prominent. Machine designers are actively developing screws and barrels specifically optimized for processing resins derived from Post-Consumer Recycled (PCR) waste. Processing PCR is inherently challenging due to material heterogeneity and varying melt indexes, necessitating specialized venting and filtering systems (screen changers) to remove contaminants without disrupting the extrusion process. The development of extrusion lines that can seamlessly switch between virgin resins, PCR content, and biodegradable polymers demonstrates the market’s commitment to regulatory compliance and circular economy principles. This flexibility is essential for converters who must rapidly adapt their product mix to meet fluctuating customer demands and regulatory mandates regarding recyclable content.

Regional Highlights

The global Blown Film Extrusion Machines market exhibits significant disparity in growth rates and technological maturity across different geographic regions, heavily influenced by local economic growth, packaging regulations, and industrial production output.

- Asia Pacific (APAC): Dominates the market share due to the explosive growth in manufacturing output, rapid urbanization, and a burgeoning middle class driving demand for packaged consumer goods. Countries like China, India, and Southeast Asian nations are massive consumers and producers of flexible packaging, leading to consistent, high-volume demand for both high-capacity, cost-efficient machines and advanced multi-layer systems. The presence of numerous local manufacturers also intensifies competition and drives price sensitivity in the region.

- North America: Characterized by a mature, replacement-driven market focused intensely on automation, high efficiency, and sustainability. Demand is high for specialized co-extrusion lines capable of processing high percentages of Post-Consumer Recycled (PCR) resins, often driven by brand owner commitments to circular packaging. Investment priorities center on IIoT integration, advanced process control, and high operational uptime.

- Europe: Exhibits strong demand driven by some of the world's most stringent environmental directives, notably the Plastic Strategy and related recycling targets. This necessitates significant investment in new machinery capable of handling biodegradable and recycled plastics efficiently while maintaining high quality standards. Germany, Italy, and Spain are key manufacturing hubs for both machine production and flexible packaging conversion, prioritizing technical excellence and energy efficiency.

- Latin America (LATAM): Emerging market experiencing steady growth, driven by expanding food processing sectors and increasing consumer preference for packaged goods, particularly in Brazil and Mexico. The market currently favors robust, reliable mid-capacity machines, though growing international investment is starting to introduce more sophisticated multi-layer technology for high-barrier applications.

- Middle East and Africa (MEA): A nascent, high-potential region showing strong momentum, particularly in the GCC countries and South Africa, supported by government diversification initiatives, infrastructural development, and growth in the domestic agricultural and food security sectors. Demand is often project-based, focusing on acquiring reliable machinery for large-scale industrial films and standard packaging applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blown Film Extrusion Machines Market.- W&H (Windmöller & Hölscher)

- Reifenhäuser Group

- Hosokawa Alpine AG (Alpine)

- Brampton Engineering Inc.

- Macro Engineering & Technology Inc.

- SML Group

- KUHNE Anlagenbau GmbH

- Rajoo Engineers Ltd.

- JINMING Machinery Co., Ltd.

- COLINES S.p.A.

- Polystar Machinery Co., Ltd.

- Fong Kee Iron Works Co., Ltd.

- JC Times Technology Co., Ltd.

- Penta-Tech Co., Ltd.

- Atlas Converting Equipment Ltd.

- Carer Makina

- BOCO Technologies Inc.

- Gneuss Kunststofftechnik GmbH

Frequently Asked Questions

Analyze common user questions about the Blown Film Extrusion Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for multi-layer blown film machines?

The primary driver is the increasing regulatory and consumer demand for superior barrier packaging, particularly in the food and pharmaceutical sectors, which requires films with specific protection against oxygen and moisture to extend shelf life. Multi-layer co-extrusion allows converters to combine structural, adhesive, and barrier resins effectively to achieve these complex film properties, making them essential for high-end flexible packaging applications.

How is sustainability impacting the investment cycle for new extrusion equipment?

Sustainability mandates are significantly accelerating the investment cycle, forcing manufacturers to purchase or upgrade machinery capable of efficiently processing Post-Consumer Recycled (PCR) resins and bio-plastics. New machines must feature advanced filtration and specialized screw designs to handle variable quality recycled materials while maintaining high output and film quality, meeting brand owners' circular economy commitments.

Which geographical region holds the largest market share for Blown Film Extrusion Machines?

Asia Pacific (APAC), particularly driven by China and India, holds the largest market share. This dominance is due to rapid industrialization, massive growth in the domestic consumer goods and flexible packaging industries, and the continuous expansion of the manufacturing base across the region, generating sustained high volume demand for both low-cost and technologically advanced extrusion lines.

What is the role of Industry 4.0 technology in modern blown film lines?

Industry 4.0 technologies, including IIoT sensors and AI-driven control systems, are critical for achieving operational excellence. They enable predictive maintenance, real-time automated gauge control (AGC), precise material dosing, and energy usage optimization. This integration minimizes downtime, reduces material waste, and enhances the overall profitability of high-speed production lines.

What are the key differences between mono-layer and co-extrusion machines?

Mono-layer machines produce films from a single type of polymer, suitable for commodity applications like trash bags or simple industrial liners. Co-extrusion machines use multiple extruders feeding a single die to merge several distinct layers of different polymers, essential for producing high-performance barrier films, stretch films, and customized food packaging requiring specific mechanical and protective attributes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager