Blowout Preventer (BOP) Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432252 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Blowout Preventer (BOP) Equipment Market Size

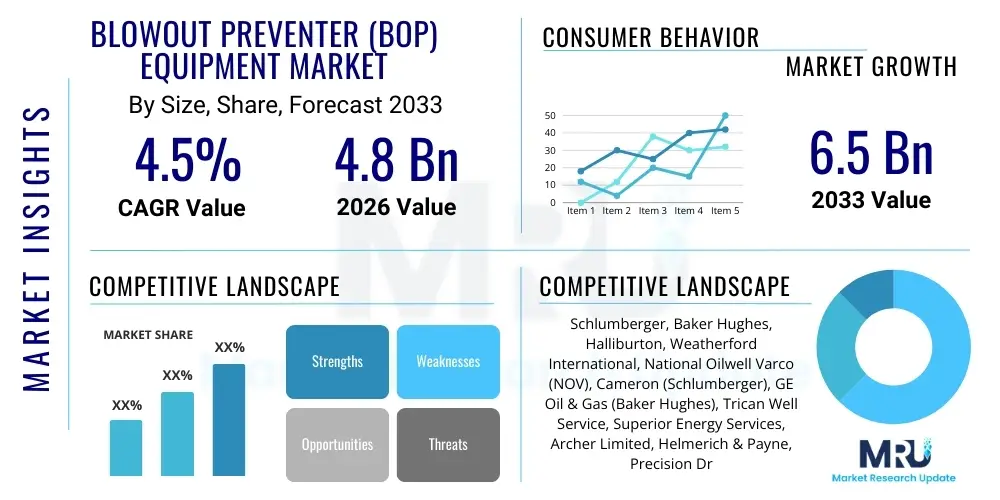

The Blowout Preventer (BOP) Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 6.5 Billion by the end of the forecast period in 2033.

Blowout Preventer (BOP) Equipment Market introduction

The Blowout Preventer (BOP) Equipment Market encompasses specialized mechanical devices crucial for maintaining well control during drilling and completion operations in the oil and gas industry. These systems are designed as large, high-pressure valves installed at the wellhead, serving as a primary safety mechanism to seal, control, and monitor oil and gas wells, thereby preventing uncontrolled releases of formation fluids, known as blowouts. The necessity for reliable BOP equipment has intensified following major catastrophic incidents, driving stringent regulatory enforcement globally, particularly in deepwater and ultra-deepwater environments where pressure gradients are extreme and operational risks are magnified.

Product descriptions for BOP equipment typically categorize them into two main types: Ram BOPs, which use opposing steel rams to seal the wellbore, and Annular BOPs, which utilize a flexible packing element to seal around the drill pipe or completely close the well. Major applications span across onshore drilling, shallow water offshore operations, and critical deepwater and subsea drilling activities. The intrinsic benefit of these systems lies in their ability to protect personnel, assets, and the environment from catastrophic well control loss, ensuring operational continuity and compliance with international safety standards like API (American Petroleum Institute) specifications.

Driving factors for market expansion include the increasing focus on complex drilling activities in unconventional reserves and deeper offshore fields, where higher pressures and temperatures necessitate advanced BOP designs, such as high-pressure/high-temperature (HPHT) rated systems. Furthermore, the global push towards digitalization of drilling operations, incorporating sensor technology and remote monitoring for predictive maintenance of BOP stacks, is fundamentally enhancing the reliability and operational lifespan of this critical safety infrastructure.

Blowout Preventer (BOP) Equipment Market Executive Summary

The Blowout Preventer (BOP) Equipment Market is characterized by robust investment driven by essential safety mandates and the global pursuit of hydrocarbon resources in technically challenging environments. Business trends indicate a shift towards leasing and servicing models rather than outright purchase, driven by the high capital expenditure required for modern BOP stacks, particularly those rated for ultra-deepwater use. Key players are focusing heavily on integrating advanced monitoring technologies, remote diagnostics, and standardized maintenance protocols to minimize downtime and ensure compliance, thereby influencing competitive differentiation based on reliability and total cost of ownership rather than initial acquisition cost.

Regional trends highlight North America, particularly the Gulf of Mexico, as a dominant market due to extensive deepwater exploration and stringent regulatory frameworks established by bodies like the Bureau of Ocean Energy Management (BOEM). Asia Pacific is emerging as the fastest-growing region, fueled by increasing exploration and production (E&P) activities in countries like China, India, and Malaysia, which are expanding their offshore capabilities. Conversely, the market in Europe is showing resilience, anchored by ongoing maintenance and upgrade cycles in the North Sea, demanding highly specialized, cold-weather-resistant BOP systems.

Segment trends underscore the increasing dominance of the Offshore application segment, particularly subsea BOP systems, which command higher price points due to their complexity, redundant controls, and necessity for remote operability. Within the type segmentation, Ram BOPs, specifically those featuring blind shear rams (BSRs) capable of cutting through the drill pipe and sealing the well, remain technologically critical. The hydraulic operation segment is universal, though there is a growing interest in incorporating electric actuators and acoustic backup systems to enhance reliability and communication in severe subsea conditions, reflecting a constant industry prioritization of fail-safe mechanisms.

AI Impact Analysis on Blowout Preventer (BOP) Equipment Market

User queries regarding AI's influence on the BOP Equipment Market frequently revolve around how artificial intelligence can enhance safety, reduce unscheduled downtime, and optimize maintenance schedules for these critical devices. Common user concerns center on the reliability of AI algorithms in high-stakes operational environments, the required data infrastructure for effective deployment, and the potential reduction of human intervention roles. Users seek definitive answers on predictive maintenance accuracy, the integration of machine learning for identifying subtle component failures (especially in sealing elements and hydraulic systems), and the capacity of AI to simulate worst-case scenarios for training and certification purposes, aiming to move beyond traditional time-based maintenance models.

The analysis confirms that AI's primary immediate impact is transforming BOP maintenance from reactive or time-based scheduling to highly accurate condition-based monitoring. Machine learning algorithms analyze continuous sensor data—including pressure, temperature, fluid flow, and actuator response times—to predict the remaining useful life (RUL) of critical components, such as seals and shear rams. This predictive capability significantly reduces the risk of equipment failure during critical drilling phases, improving overall well safety and reducing the substantial costs associated with non-productive time (NPT) caused by unexpected BOP failures and subsequent retrieval operations.

Furthermore, AI-driven systems are being utilized to optimize the operational performance of the BOP stack itself. Algorithms can analyze historical data from various wells and environmental conditions to recommend optimal closing sequences, pressure application rates, and testing procedures. This not only standardizes operations but also ensures that the BOP is operated within its safest and most efficient parameters. The long-term expectation is that AI will be foundational in developing autonomous BOP systems, allowing for faster, more reliable response to incipient well control events, potentially automating the activation of shear functions based on rapid analysis of downhole data that exceeds human reaction time capabilities.

- AI-driven Predictive Maintenance: Utilizing machine learning on sensor data (vibration, acoustics, pressure) to forecast component failure, drastically reducing unscheduled downtime and optimizing maintenance intervals.

- Automated Diagnostics and Anomaly Detection: Implementing algorithms that continuously monitor BOP system health, instantaneously detecting minor deviations in hydraulic pressure or valve response indicative of impending operational issues.

- Operational Optimization: Employing AI to analyze drilling parameters and environmental conditions to recommend ideal BOP testing frequency, closure sequence, and ram application force for maximized efficiency and safety.

- Simulation and Training: Using AI and digital twin technology to create highly realistic simulation environments for training operators in complex well control scenarios, enhancing procedural familiarity and rapid decision-making.

- Subsea Data Interpretation: Leveraging AI to process large volumes of subsea sensor data transmitted via acoustic or wired links, turning raw data into actionable insights for remote operational teams.

DRO & Impact Forces Of Blowout Preventer (BOP) Equipment Market

The Blowout Preventer (BOP) Equipment Market is fundamentally shaped by external safety regulations and the evolving complexities of oil and gas extraction environments. The primary driver remains the imperative for safety and strict global regulatory oversight, especially post-Deepwater Horizon, which mandated redundant systems and enhanced testing protocols, compelling operators to invest in newer, higher-specification equipment. However, the market faces significant restraints, chiefly volatile crude oil prices, which directly impact E&P capital expenditure, leading to deferred maintenance and reduced orders for new equipment. Opportunities are abundant in the development of modular BOP systems, remote operability features, and the growing market for BOP refurbishment and recertification services, especially in mature oil provinces. These forces collectively dictate capital deployment, technological innovation pathways, and competitive strategies within the highly specialized BOP sector.

Drivers are rooted in the technical necessity of deep and ultra-deepwater drilling, which operates under extreme pressure (up to 20,000 psi) and temperature (HPHT) conditions, demanding specialized BOPs with higher material integrity and sophisticated control systems. This is compounded by the global energy security focus, pushing exploration into previously inaccessible high-risk areas. Furthermore, the mandatory requirement for third-party inspection and certification bodies to sign off on BOP operational readiness ensures a continuous demand cycle for upgrades, service, and replacement parts, sustaining the aftermarket sector.

Restraints are dominated by the significant financial outlay required to purchase, install, and maintain modern BOP stacks, which can account for a substantial portion of the overall drilling rig cost. Economic volatility in the oil market often leads operators to maximize the operational lifespan of existing equipment through extensive refurbishment, thereby suppressing demand for new unit sales. The complexity and sheer size of subsea BOP systems also introduce logistical and maintenance challenges, contributing to high operational expenditure and potential non-productive time, further restraining growth by increasing the economic burden on operators.

Opportunities lie in technological advancement, specifically the shift toward smaller, more reliable electric BOPs (eBOPs) that simplify hydraulic complexity and improve reaction time. The necessity for remote operation and condition monitoring, facilitated by 5G connectivity and IoT, offers significant growth potential for specialized software and sensor providers. Moreover, the aging fleet of drilling rigs globally provides a consistent, high-value opportunity for companies specializing in the comprehensive overhaul, recertification, and upgrade of legacy BOP systems to meet contemporary safety standards, extending the profitable life cycle of drilling assets.

Segmentation Analysis

The Blowout Preventer (BOP) Equipment Market is comprehensively segmented based on the mechanism type, operational method, and application environment, reflecting the diverse and stringent requirements across the global oil and gas industry. Understanding these segments is crucial as the demand characteristics, technological complexity, and pricing structures vary drastically between an onshore ram BOP system and an ultra-deepwater subsea annular BOP. The market is increasingly driven by the offshore segment, which mandates complex, redundant, and often custom-engineered equipment, contrasting sharply with the standardized equipment typically used in conventional onshore drilling. This segmentation dictates manufacturing focus and strategic resource allocation among key market participants.

The primary classifications involve distinguishing between Ram BOPs, which provide maximum sealing capacity against high pressures, and Annular BOPs, which offer flexible sealing around varied downhole equipment. Further stratification occurs based on the method of activation, where hydraulic systems currently dominate due to their proven reliability and power, though electric and acoustic alternatives are gaining traction for niche, high-redundancy subsea controls. The application environment—onshore versus offshore—is the most influential differentiator regarding component complexity and price, with subsea BOP stacks featuring specialized materials and control pods designed to withstand crushing hydrostatic pressures and operate reliably far beneath the surface.

The growing complexity of well profiles, including multilateral and extended-reach wells, necessitates specialized BOP components such as variable bore rams (VBRs) that can seal around multiple sizes of drill pipe. The integration of advanced sensor packages and remote monitoring capabilities is blurring the lines between the equipment segment and the services segment, emphasizing a total well control solution approach. Future segmentation focus is likely to heavily emphasize the pressure rating (e.g., 10K, 15K, 20K psi) and the environmental rating (standard service versus HPHT service), as these factors directly correlate with the technological sophistication and market value of the BOP equipment.

- By Type:

- Ram BOP (Blind Rams, Pipe Rams, Shear Rams, Variable Bore Rams)

- Annular BOP

- Combination BOP

- By Operation:

- Hydraulic

- Manual

- Acoustic/Electric Backup

- By Application:

- Onshore

- Offshore (Shallow Water, Deepwater, Ultra-Deepwater)

- By Component:

- Hydraulic Control Systems (Accumulators, Control Pods)

- Ram Blocks and Sealing Elements

- Spools and Connectors

Value Chain Analysis For Blowout Preventer (BOP) Equipment Market

The value chain for the BOP Equipment Market is complex, starting with the sourcing of specialized, high-grade materials required to withstand extreme pressures and corrosive environments, moving through highly proprietary and precision manufacturing processes, and culminating in intricate distribution and critical post-sale service loops. Upstream activities involve securing materials like high-strength alloy steels and specialized elastomers capable of handling high temperatures and pressures (HPHT). The manufacturing stage is capital-intensive, requiring advanced machining centers, stringent quality control, and extensive testing facilities to meet API and ISO standards. This phase adds the most value, transforming raw materials into sophisticated, certified safety systems.

Downstream activities are dominated by sales and service. Due to the custom, high-value nature of BOP stacks, the distribution channel is predominantly direct, involving close collaboration between manufacturers and major drilling contractors or integrated oil companies (IOCs/NOCs). This direct channel facilitates customization, technical support, and long-term service agreements. Post-sale service—including installation, commissioning, required recertification, refurbishment, and spare parts supply—is critical and often represents the most stable revenue stream for BOP manufacturers, given the mandatory safety regulations requiring frequent inspection and overhaul.

The structure of the distribution channel emphasizes indirect influence through certification bodies and regulatory compliance advisors. While sales are direct, the purchasing decision is heavily influenced by third-party technical requirements and regulatory updates, meaning successful market penetration relies not just on product quality but on robust compliance history and certification status. The indirect market influence also includes financing institutions that assess the safety profile and reliability of assets, which inherently favors BOP equipment from established, reputable manufacturers known for low failure rates and superior aftermarket support.

Blowout Preventer (BOP) Equipment Market Potential Customers

Potential customers for Blowout Preventer (BOP) Equipment primarily comprise entities engaged in high-risk drilling and well intervention activities, where operational safety and regulatory compliance are paramount. The main buyers are major International Oil Companies (IOCs) and National Oil Companies (NOCs) that operate their own drilling programs, along with specialized drilling contractors who own and operate the mobile offshore drilling units (MODUs) and land drilling rigs. These customers are driven by the necessity to maintain operational integrity, protect massive capital investments in drilling assets, and ensure strict adherence to governmental and international safety mandates.

The buying process is characterized by long sales cycles and detailed technical vetting, as BOPs are critical safety assets. Drilling contractors represent a significant segment, purchasing or leasing BOP systems as part of the overall rig package. Their primary concern is total reliability and minimal non-productive time (NPT), prioritizing BOP systems with proven track records, superior remote diagnostics, and established global service networks. Other crucial buyers include well intervention specialists and specialized service companies that require smaller, modular BOP systems for workover and completion activities on existing wells.

Ultimately, the end-users—the rig operators and drill crews—are the ones who rely on the performance of the equipment. Therefore, customer satisfaction is highly dependent on the ease of maintenance, system redundancy, and rapid availability of certified replacement parts and specialized technicians. The market effectively targets capital investment departments (for new builds) and maintenance/operations departments (for servicing and refurbishment) across the global E&P supply chain.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 6.5 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schlumberger, Baker Hughes, Halliburton, Weatherford International, National Oilwell Varco (NOV), Cameron (Schlumberger), GE Oil & Gas (Baker Hughes), Trican Well Service, Superior Energy Services, Archer Limited, Helmerich & Payne, Precision Drilling Corporation, Abraj Energy Services, Transocean, Diamond Offshore Drilling, Ensign Energy Services, C&J Energy Services, Farris Engineering, Uztel S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blowout Preventer (BOP) Equipment Market Key Technology Landscape

The technological landscape of the Blowout Preventer (BOP) market is characterized by a relentless drive for redundancy, reliability, and capability to handle extreme drilling conditions, particularly in deepwater and HPHT (High-Pressure/High-Temperature) environments. The introduction of 20K psi BOP stacks represents a significant technological leap, requiring entirely new materials science and machining tolerances to manage extremely high pressures previously deemed unreachable. This advancement mandates complex control systems, often utilizing redundant subsea control pods and multiplexed electro-hydraulic systems to ensure instantaneous and reliable activation, even hundreds of meters below the sea floor. Furthermore, the integration of advanced sensors and real-time monitoring technology is now standard, allowing operators to assess the operational health of rams, seals, and hydraulic lines continuously, facilitating condition-based monitoring.

A major focus area is the enhancement of shear capabilities. Modern BOP stacks are often equipped with Blind Shear Rams (BSRs) designed to cut through thick-walled drill pipe, tool joints, and various downhole obstacles, and then seal the wellbore completely. Technological evolution here focuses on increased shearing force, reliability under extreme load, and the capacity to shear newer, stronger materials such as titanium or specialized steel alloys used in deep drilling. The adoption of acoustic signaling as a last-resort backup system for subsea BOP activation represents another layer of technological redundancy, circumventing potential failures in primary hydraulic or electronic umbilical lines, thereby significantly increasing safety margins in critical offshore operations.

The future technology trajectory is heavily invested in digitalization and remote operation. Digital twin technology is increasingly used to simulate BOP performance under various stress conditions and to aid in predictive maintenance modeling, while electric BOPs (eBOPs) are being commercialized. eBOPs reduce the complexity and footprint associated with massive hydraulic accumulators and piping, offering faster, more precise ram movement and requiring less subsea maintenance. This digitalization effort aligns with the broader industry trend towards autonomous drilling systems, positioning the BOP stack as an integrated, intelligent safety node within the overall well control architecture.

Regional Highlights

The global Blowout Preventer (BOP) Equipment Market exhibits distinct regional dynamics, primarily dictated by the concentration of E&P activities, regulatory stringency, and the geological complexity of hydrocarbon reserves.

- North America (Dominant Market):

- North America, particularly the Gulf of Mexico (GOM), holds the largest market share due to extensive ultra-deepwater drilling activities and the presence of the most stringent safety regulations globally (post-Deepwater Horizon).

- The U.S. shale industry also generates demand for specialized, smaller, and highly mobile BOP systems for land rigs, ensuring a diverse demand profile from high-pressure offshore to fast-moving onshore operations.

- High investment in advanced technology, including 20K psi BOPs and digitally integrated control systems, defines this region.

- Asia Pacific (Fastest Growing Market):

- APAC is driven by increasing offshore exploration activities in countries such as China, India, Australia, and Malaysia, seeking to bolster domestic energy security.

- Significant infrastructure development and governmental support for deepwater drilling programs are fueling new BOP installation and refurbishment cycles.

- The region is characterized by a growing appetite for standardized, yet reliable, equipment as new local drilling contractors enter the market.

- Middle East and Africa (MEA) (Major Investment Hub):

- MEA is witnessing sustained investment, particularly from major National Oil Companies (NOCs) in Saudi Arabia, UAE, and Qatar, focused on expanding offshore capacity and accessing complex deep gas reservoirs.

- Demand is high for robust, heavy-duty BOP systems capable of handling high production pressures and desert operational conditions (for onshore).

- The need for upgrades and maintenance services is continuous due to the large, aging fleet of rigs operating in the region.

- Europe (Mature and Highly Regulated):

- The European market is mature, primarily focused on the North Sea, emphasizing maintenance, repair, and overhaul (MRO) of existing equipment rather than new builds.

- Extremely strict environmental and safety standards necessitate specialized BOPs resistant to harsh, cold-water conditions and compliance with high integrity standards set by regional bodies.

- Latin America (Recovery Potential):

- Market growth is tied to the successful development of pre-salt deepwater fields in Brazil and offshore exploration in Mexico (Gulf of Mexico).

- Political and economic stability factors significantly influence the pace of exploration, but large-scale deepwater projects ensure steady, though volatile, demand for high-specification BOP equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blowout Preventer (BOP) Equipment Market.- Schlumberger

- Baker Hughes

- Halliburton

- Weatherford International

- National Oilwell Varco (NOV)

- Cameron (Schlumberger)

- GE Oil & Gas (Baker Hughes)

- Trican Well Service

- Superior Energy Services

- Archer Limited

- Helmerich & Payne

- Precision Drilling Corporation

- Abraj Energy Services

- Transocean

- Diamond Offshore Drilling

- Ensign Energy Services

- C&J Energy Services

- Farris Engineering

- Uztel S.A.

- Oil States International

Frequently Asked Questions

Analyze common user questions about the Blowout Preventer (BOP) Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Blowout Preventer (BOP)?

The primary function of a BOP is to serve as a safety device, controlling and sealing the wellbore during drilling operations to prevent the uncontrolled release of formation fluids (oil, gas, water) to the surface, thereby averting a catastrophic well blowout.

How do Ram BOPs and Annular BOPs differ in operation?

Ram BOPs utilize powerful opposing steel rams (blind, pipe, or shear) to seal the wellbore, offering maximum pressure containment. Annular BOPs use a flexible elastomer packing element that contracts hydraulically to seal around various shapes and sizes of drill pipe or to achieve a total seal when no pipe is present.

What is the significance of the High-Pressure/High-Temperature (HPHT) segment?

The HPHT segment is significant because it addresses the challenges of drilling in deep, complex reservoirs where pressures exceed 15,000 psi and temperatures exceed 350°F. BOP equipment in this segment requires specialized, durable materials and control systems to ensure reliability under extreme operating conditions.

How is digitalization impacting BOP maintenance and reliability?

Digitalization impacts BOP reliability primarily through predictive maintenance. By utilizing continuous sensor data and AI-driven analytics, operators can accurately forecast component failure, optimize maintenance schedules (condition-based), minimize non-productive time (NPT), and significantly reduce operational risks associated with equipment failure.

Which geographical region dominates the demand for advanced BOP equipment?

North America, specifically the U.S. Gulf of Mexico, dominates the demand for advanced BOP equipment due to extensive ultra-deepwater exploration, high investment in 20K psi systems, and the region's highly regulated operational environment necessitating the use of the most technologically sophisticated, redundant safety systems available.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager