Blueberry Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432787 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Blueberry Market Size

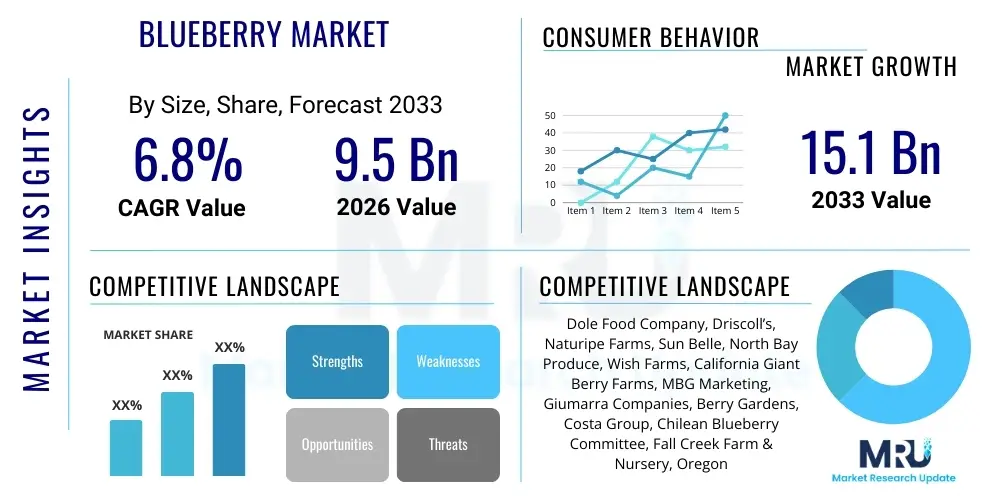

The Blueberry Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 9.5 Billion in 2026 and is projected to reach USD 15.1 Billion by the end of the forecast period in 2033.

Blueberry Market introduction

The global blueberry market encompasses the cultivation, harvesting, processing, distribution, and retail sales of various blueberry varieties, including highbush, lowbush, rabbiteye, and half-high blueberries. These small, nutrient-dense berries are primarily consumed fresh, valued for their sweet and slightly tart flavor profile, and their classification as a superfood due to high concentrations of antioxidants, particularly anthocyanins. The market exhibits significant geographical diversity, with major production hubs in North America and South America driving global supply chains to meet year-round demand in key consumption regions like Europe and Asia Pacific. Advancements in cold chain logistics and controlled atmosphere storage have been pivotal in extending the shelf life and maintaining the quality of fresh blueberries during long-distance transportation, fundamentally supporting the global expansion and accessibility of the product.

Blueberries are utilized across a wide spectrum of applications, making them a staple ingredient in both consumer and industrial segments. Major applications include the Food and Beverage industry, where they are extensively integrated into baked goods, dairy products (yogurts, ice cream), confectionery, and breakfast cereals. Beyond fresh consumption, processing segments such as frozen blueberries, dried blueberries, purees, and concentrates cater to the industrial demand for flavorings, colorings, and texture agents in manufacturing. Furthermore, the perceived health benefits of blueberries, specifically their role in cognitive function improvement, cardiovascular health maintenance, and anti-inflammatory properties, drive their incorporation into the rapidly expanding Pharmaceutical and Nutraceutical sectors, featuring prominently in dietary supplements and functional foods aimed at health-conscious consumers worldwide.

Several critical factors are currently driving the substantial expansion of the blueberry market. The rising global awareness regarding the nutritional superiority and health benefits associated with berries is the primary catalyst, fueling increased per capita consumption across developed and emerging economies. Changing dietary preferences, including the shift towards plant-based diets and the demand for natural, minimally processed snack options, further support market growth. Moreover, significant investment in research and development has led to the introduction of superior blueberry varieties characterized by improved yield, better resistance to common diseases, extended shelf life, and enhanced flavor quality, thus maximizing commercial viability for producers. The strategic expansion of blueberry cultivation into regions with optimal climatic conditions and lower labor costs also plays a crucial role in stabilizing supply and enhancing global market resilience against localized environmental fluctuations.

Blueberry Market Executive Summary

The blueberry market is characterized by robust commercial trends, driven primarily by the intensification of global trade routes and consumer-led demand for functional foods. A key business trend involves strategic investments in vertical integration across the supply chain, allowing large producers and distributors to control quality from farm to shelf, optimize logistics, and ensure consistent supply, thereby mitigating seasonal volatility. The market is witnessing a notable shift towards premium and specialty varieties that offer distinct flavor profiles or superior size, attracting higher profit margins. Furthermore, sustainable agriculture practices, including organic certification and water-efficient farming, are increasingly becoming prerequisites for market entry in environmentally conscious regions, influencing long-term investment decisions and corporate social responsibility reporting within the sector.

Regionally, the market dynamics reflect a dual scenario of established supply and emerging demand. North America remains a core market, both as a leading producer (especially in the US and Canada) and a primary consumer, driven by well-established retail channels and high consumer awareness. However, the Asia Pacific region, particularly China and India, is registering the highest growth rates, spurred by rapid urbanization, increasing disposable incomes, and the Westernization of diets, creating immense opportunities for imported premium fresh berries. Europe demonstrates consistent demand, often relying on counter-seasonal imports from South America (Chile, Peru) to maintain year-round availability, placing logistical efficiency and trade agreements at the forefront of regional supply considerations. These geographic trends highlight the dependency on stable international relations and efficient global shipping infrastructure to support market flow.

Analysis of market segmentation reveals distinct trends impacting the various product types and applications. The fresh blueberry segment dominates the market in terms of value, largely due to consumer preference for raw consumption and the associated premium pricing. Nonetheless, the processed segment, particularly frozen blueberries, is experiencing rapid volume growth, propelled by their convenience, ease of storage, and increased use in industrial applications like smoothies and frozen desserts, serving as a versatile alternative. In terms of application, the Nutraceuticals segment is emerging as the fastest-growing area, benefiting from extensive health marketing campaigns that highlight the antioxidant power of blueberries. This shift dictates that processors must enhance their capabilities to supply standardized extracts and functional ingredients tailored to the specialized requirements of the health supplement manufacturing industry.

AI Impact Analysis on Blueberry Market

User inquiries regarding the application of Artificial Intelligence (AI) in the blueberry market frequently revolve around key operational themes: precision agriculture adoption, supply chain optimization, and quality control automation. Users are highly interested in how AI-driven predictive analytics can forecast yield, manage irrigation needs based on localized microclimate data, and identify disease outbreaks early, thus minimizing crop loss and optimizing resource use. A significant concern is the cost of implementing these technologies, especially for small to medium-sized growers, and the necessary skill transfer required to operate complex AI systems. Users also express expectation for AI-powered sorting and grading systems to enhance post-harvest efficiency, ensuring standardized quality and maximizing profitability by reducing manual labor reliance and improving detection accuracy for defects before market entry.

The integration of AI technologies across the blueberry supply chain promises substantial gains in efficiency and sustainability. In the cultivation phase, machine learning algorithms analyze data collected from drone imagery, soil sensors, and weather stations to generate highly precise treatment protocols, moving away from generalized farming practices. This precision approach allows for targeted application of fertilizers and pesticides, drastically reducing environmental impact and input costs, which directly affects the final consumer price and market competitiveness. AI is crucial in scheduling harvest times to maximize sugar content and firmness, ensuring that berries are picked at their peak quality, a factor paramount to maintaining consumer satisfaction and reducing spoilage during transit, thereby strengthening the industry's focus on quality assurance.

Furthermore, AI significantly impacts the downstream segments, particularly logistics and market forecasting. Predictive models utilize historical sales data, promotional calendars, and real-time inventory levels to optimize distribution routes and warehousing strategies, minimizing transit time and cold chain breaches, which are critical for fresh produce. From a market perspective, AI analyzes complex consumer behavior patterns and macroeconomic indicators to generate accurate demand forecasts, helping producers align their supply output with actual market needs, preventing gluts or shortages. This analytical capability enhances profitability for all stakeholders by allowing dynamic pricing strategies and ensuring robust inventory management in volatile market conditions.

- AI-driven Precision Farming: Optimizing irrigation, nutrient delivery, and pest management based on real-time field data.

- Yield Prediction Models: Utilizing machine learning to forecast harvest volumes accurately, improving planning and resource allocation.

- Automated Quality Grading: Implementing AI-powered vision systems for rapid, non-destructive sorting and quality classification post-harvest.

- Supply Chain Logistics Optimization: Using algorithms to determine the most efficient cold chain routes and reduce spoilage rates during transport.

- Disease and Pest Detection: Early identification of plant health issues via image analysis, allowing for timely, localized intervention.

DRO & Impact Forces Of Blueberry Market

The blueberry market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape its trajectory and impact forces. A primary driver is the accelerating trend of consumers seeking superfoods and nutrient-rich diets globally. The established reputation of blueberries as a source of high antioxidants and beneficial phytochemicals directly translates into elevated demand, particularly within developed markets where health consciousness is high. Coupled with this is the continuous innovation in genetic breeding, resulting in cultivars that offer improved flavor, larger fruit size, and extended shelf life, enhancing product appeal and logistical resilience. These drivers exert a significant upward force on both price points and overall market volume, necessitating increased investment in sophisticated cultivation technology and marketing efforts.

Conversely, the market faces notable restraints that temper its growth potential. The most critical restraint is the extreme vulnerability of blueberries to adverse climatic conditions, including unexpected frosts, heavy rains, or prolonged droughts, which can lead to dramatic fluctuations in annual yield and subsequently destabilize global pricing. Furthermore, the high initial investment required for establishing large-scale, modern blueberry cultivation—encompassing specialized irrigation, netting, and specialized harvesting equipment—creates significant barriers to entry for smaller enterprises. Labor costs also represent a substantial restraint, as blueberry harvesting remains highly labor-intensive in many regions, despite automation attempts, posing challenges to consistent operational profitability, especially in regions with stringent labor regulations and rising minimum wages. These restraints necessitate robust risk management strategies, including comprehensive crop insurance and diversified sourcing.

Opportunities within the blueberry market are predominantly centered on geographic expansion and product diversification. Significant potential exists in untapped emerging markets in Asia and Eastern Europe, where increasing affluence and exposure to Western dietary habits are creating new consumer bases. From a product standpoint, the opportunity lies in expanding the processed applications, particularly in the functional food and beverage space—such as blueberry protein bars, specialized sports drinks, and advanced nutraceutical supplements—which leverage the health halo of the fruit. Furthermore, developing sustainable, residue-free farming methodologies presents an opportunity to capture the high-value organic segment, aligning with global consumer preference for ethically and sustainably produced food. These opportunities encourage producers to invest in novel processing technologies and explore new market entry strategies beyond traditional fresh retail sales.

Segmentation Analysis

The blueberry market segmentation provides a critical framework for understanding diverse consumer preferences and industrial applications across various product formats and end-user industries. The market is primarily segmented based on product type (Fresh and Processed), application (Food and Beverages, Nutraceuticals, Cosmetics, etc.), and geography. This multidimensional segmentation allows stakeholders to accurately target specific consumer cohorts, optimize distribution channels, and tailor their product offerings to meet heterogeneous demands, which vary significantly based on cultural dietary habits, regional economic development levels, and supply chain maturity. The inherent perishability difference between fresh and processed blueberries also dictates distinct operational strategies, cost structures, and profitability margins across these segments.

The segmentation by product type is foundational, distinguishing between the high-value, high-demand fresh market and the volume-driven, longer shelf-life processed market. While fresh blueberries command premium prices, they require complex and costly cold chain logistics and face higher risks of spoilage. Conversely, processed forms—including individually quick-frozen (IQF) berries, purees, and concentrates—offer versatility and stability, making them preferred inputs for the industrial manufacturing sector, particularly in bakery and dairy production. Analyzing the growth differential between these two segments reveals shifts in consumer behavior; a rise in demand for convenience foods often translates into higher growth for the frozen and processed segments, even as the fresh segment maintains dominance in overall market value due to consumer preference for perceived naturalness and nutrient retention.

Application-based segmentation highlights the expanding role of blueberries beyond traditional culinary uses. While Food and Beverages (F&B) remains the largest segment, the burgeoning Nutraceutical and Pharmaceutical applications are experiencing the fastest growth, driven by scientific evidence supporting the health benefits of berry phytochemicals. Manufacturers in these high-value segments require highly concentrated, standardized extracts, necessitating specialized processing techniques. The Cosmetics and Personal Care segment also represents a niche, growing area, utilizing blueberry extracts for their antioxidant properties in anti-aging creams, serums, and other topical applications. Understanding the unique quality requirements and regulatory landscapes of each application segment is crucial for market entry and sustained growth, guiding investment decisions related to processing technology and quality certification.

- Product Type:

- Fresh Blueberries (Dominant Value)

- Processed Blueberries (High Volume Growth)

- Frozen (IQF)

- Dried

- Puree and Concentrate

- Jam and Jelly

- Application:

- Food and Beverages (F&B)

- Bakery and Confectionery

- Dairy Products

- Beverages and Juices

- Nutraceuticals and Supplements

- Cosmetics and Personal Care

- Retail/Direct Consumer Sales

- Food and Beverages (F&B)

- Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LAMEA)

- Middle East and Africa (MEA)

Value Chain Analysis For Blueberry Market

The blueberry market value chain is extensive and begins with intensive upstream activities focused on cultivation and genetic selection. Upstream analysis involves research and development into new high-yield, disease-resistant cultivars, nursery operations for plant propagation, and the establishment of large-scale farms. Key upstream stakeholders include specialized plant breeders and input suppliers (fertilizers, pesticides, specialized machinery). Efficiency in this stage is determined by effective soil management, precision agriculture adoption, and access to proprietary genetics that maximize fruit quality and shelf stability. The initial investment in establishing new orchards is substantial, making long-term capital planning and risk assessment regarding climate volatility crucial for sustainability and success in this segment.

The midstream phase focuses on harvesting, sorting, grading, and initial processing. Harvesting, whether manual or mechanized, represents a high-cost component due to labor or equipment expenses. Post-harvest handling is critical, requiring rapid cooling (hydro-cooling or forced-air cooling) to maintain freshness and extend marketable life. Processing facilities convert fresh blueberries into various formats: IQF, purees, concentrates, or dried products. This stage involves sophisticated technology for quality assurance, including optical sorting machines and freezing tunnels, ensuring compliance with international food safety standards before the product enters the distribution network. Value addition in this phase determines the final use and overall profitability of the harvest.

Downstream analysis covers distribution channels and final sales to end-users. Distribution is bifurcated into direct channels, where large producers or cooperatives sell directly to major retailers or food service providers, and indirect channels, utilizing intermediaries such as wholesalers, brokers, and specialized fruit exporters. Efficient cold chain logistics are paramount for the fresh market, requiring temperature-controlled containers and rapid transport links, often involving global sea freight or air cargo for counter-seasonal supply. The final point of sale includes large supermarkets, specialized health food stores, online e-commerce platforms, and industrial buyers (e.g., bakeries, nutraceutical manufacturers). The increasing consumer preference for convenience and traceability is pushing greater transparency and digitalization throughout the downstream network.

Blueberry Market Potential Customers

The primary potential customers and end-users of blueberries span across several large, interconnected industries, reflecting the versatility of the fruit. The largest cohort comprises consumers purchasing fresh blueberries through retail channels (supermarkets, farmers’ markets, online grocery delivery) for direct consumption, snacking, or home cooking. These consumers are typically health-conscious individuals, families seeking nutritious options, and demographics focused on weight management and proactive wellness. Marketing efforts targeting this group emphasize the fruit’s antioxidant content, ease of use, and convenience, capitalizing on the "superfood" image to drive impulse purchases and routine inclusion in daily diets.

A second major customer group consists of industrial buyers within the Food and Beverage manufacturing sector. This includes large multinational companies producing baked goods (muffins, pies), dairy products (yogurt, fruit fillings), breakfast cereals, and juice/smoothie blends. These buyers predominantly utilize processed blueberries (frozen, purees, or concentrates) as they require consistent quality, standardized sweetness, and year-round availability that processed formats reliably provide, often under bulk purchase agreements. Their purchasing decisions are heavily influenced by cost-effectiveness, contract reliability, and the need for certified traceability and adherence to strict manufacturing specifications concerning sugar levels and microbial safety.

Furthermore, specialized industries like Nutraceuticals and Pharmaceuticals represent high-growth potential customers. Manufacturers in this segment acquire blueberry extracts, freeze-dried powder, or specialized concentrates rich in anthocyanins for inclusion in dietary supplements, functional beverages, and health-focused formulations aimed at cognitive and cardiovascular health. These buyers demand premium, highly purified, and standardized ingredients, necessitating stringent quality control and third-party certifications regarding potency and purity. The expansion of clinical research validating the health benefits of blueberries is critical for securing and expanding contracts within this highly lucrative, regulatory-intensive segment, driving demand for specialized, high-specification raw material input.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.5 Billion |

| Market Forecast in 2033 | USD 15.1 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dole Food Company, Driscoll’s, Naturipe Farms, Sun Belle, North Bay Produce, Wish Farms, California Giant Berry Farms, MBG Marketing, Giumarra Companies, Berry Gardens, Costa Group, Chilean Blueberry Committee, Fall Creek Farm & Nursery, Oregon Berry Packing, True Blue Farms, United Exports, Blue Hand Growers, Global Berry. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blueberry Market Key Technology Landscape

The blueberry market’s technological landscape is rapidly evolving, moving towards advanced automation and data-driven farming practices to enhance productivity, mitigate labor dependency, and improve post-harvest quality. A critical technology is the adoption of advanced sensor technology combined with Internet of Things (IoT) devices, deployed in the field to monitor crucial environmental parameters such as soil moisture, nutrient levels, and localized temperature variations in real-time. This granular data enables growers to implement variable rate irrigation and fertilization, optimizing resource utilization and minimizing waste, which is essential for sustainability and operational efficiency. Furthermore, controlled environment agriculture (CEA) techniques, although currently niche for blueberries, are being explored to mitigate climate risks, particularly in regions prone to extreme weather events, ensuring predictable yield and consistent quality throughout the growing season.

Automation in harvesting and post-harvest handling represents another cornerstone of technological advancement. While mechanical harvesters have been utilized for processed berries for decades, recent innovations are focusing on developing selective harvesting machines capable of picking fresh-market quality fruit with minimal damage, often utilizing advanced computer vision systems and gentle handling mechanisms. Post-harvest technology is equally crucial; this includes optical sorters equipped with high-resolution cameras and spectroscopic analysis to grade fruit based on color, size, shape, and internal defects invisible to the human eye. These automated grading systems significantly increase throughput, maintain quality consistency, and reduce the high costs associated with manual sorting labor, thereby improving global competitiveness and meeting stringent import standards imposed by major consuming nations.

Beyond the physical handling, advancements in cold chain management and packaging technology are vital for extending the global reach of fresh blueberries. Modified Atmosphere Packaging (MAP) and Controlled Atmosphere (CA) storage techniques are widely employed to slow the respiration rate of the berries, inhibiting fungal growth and preserving firmness and flavor during long-distance shipping across continents. Furthermore, blockchain technology is emerging as an essential tool for enhancing traceability and transparency throughout the supply chain. By digitally tracking every batch from the farm to the retail shelf, growers and distributors can offer verifiable information to consumers regarding origin, handling conditions, and quality certifications, building trust and meeting the growing consumer demand for food safety and ethical sourcing practices in the fresh produce segment.

Regional Highlights

Regional dynamics within the blueberry market are defined by distinct patterns of production, consumption, and trade flows, necessitating region-specific strategic approaches. North America, encompassing the United States and Canada, represents both the largest consumption market and a critical production hub, particularly for highbush varieties. This region is characterized by high consumer awareness regarding health benefits, robust established retail distribution networks, and a strong preference for domestically sourced berries during the local season. However, North America heavily relies on counter-seasonal imports, predominantly from Latin America, between October and March to ensure year-round supply continuity, placing immense logistical pressure on efficient cross-continental cold chain management and necessitating stable trade policies for seamless import operations.

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate, driven by significant demographic shifts, rapid economic growth, and an expanding middle class willing to pay a premium for imported 'superfoods.' While domestic production is growing in countries like China and Japan, current supply remains insufficient to meet the surging urban demand. This creates massive opportunities for exporters from the Americas and Oceania, making APAC a high-priority target market. European demand is consistent and high, driven by sophisticated consumers and stringent food quality standards. Europe primarily sources from North Africa and Eastern Europe during its domestic season, relying on Chile and Peru during the winter months, making the region highly sensitive to global pricing fluctuations and currency exchange rates impacting import affordability.

Latin America, particularly Chile and Peru, holds unparalleled significance as the primary global supplier during the Northern Hemisphere’s winter. Peru has emerged as a major disruptive force, leveraging ideal climate conditions, aggressive investment in modern high-density farming, and strategic access to Asian trade routes, leading to rapid expansion of its export capabilities. Chile, while facing competition, maintains its position through established trade agreements and deep-rooted industry expertise. The Middle East and Africa (MEA) region remains a smaller but increasingly important market, particularly the Gulf Cooperation Council (GCC) countries, characterized by high-income expatriate populations and reliance on high-quality air-freighted imports, driven by modern retail infrastructure and a growing interest in specialty fruit imports.

- North America: Dominant consumer market and key producer; focus on established retail channels and increasing organic segment demand.

- Europe: Consistent high demand; highly reliant on complex counter-seasonal imports from South America and Mediterranean regions; emphasis on certified food safety.

- Asia Pacific (APAC): Fastest growing region; massive opportunity for exports due to surging urban demand and increasing purchasing power, led by China and Southeast Asian markets.

- Latin America (LAMEA): Global production powerhouse (Chile, Peru); major focus on export efficiency, logistics, and counter-seasonal supply to North America and Europe.

- Middle East and Africa (MEA): Emerging market characterized by high-value, niche demand for premium, imported fresh berries, concentrated in urban economic hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blueberry Market.- Dole Food Company

- Driscoll’s

- Naturipe Farms

- Sun Belle

- North Bay Produce

- Wish Farms

- California Giant Berry Farms

- MBG Marketing (Michigan Blueberry Growers)

- Giumarra Companies

- Berry Gardens

- Costa Group

- Chilean Blueberry Committee (Association/Key Stakeholder)

- Fall Creek Farm & Nursery (Genetic Provider)

- Oregon Berry Packing

- True Blue Farms

- United Exports

- Blue Hand Growers

- Global Berry (Cooperative)

- Hortifrut

- Mazzoni Group

Frequently Asked Questions

Analyze common user questions about the Blueberry market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Blueberry Market?

The Blueberry Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 6.8% between the forecast years of 2026 and 2033, driven by sustained global demand for health-oriented foods.

Which geographic region dominates the consumption of blueberries?

North America currently dominates the consumption segment of the blueberry market, characterized by high per capita consumption rates, established retail infrastructure, and strong consumer awareness regarding the health benefits of berries.

What are the primary factors restraining growth in the blueberry market?

The major restraints include the extreme vulnerability of crops to unpredictable climatic conditions, which leads to volatile yields, and the high initial investment required for modern, specialized farming technologies and significant labor costs associated with manual harvesting.

How is the adoption of Artificial Intelligence (AI) impacting blueberry farming?

AI is significantly impacting blueberry farming by enabling precision agriculture through yield prediction, automated quality grading post-harvest, and optimizing resource use via real-time data analysis of environmental factors and soil conditions, leading to greater efficiency and reduced waste.

Which segment of the processed blueberry market is experiencing the fastest volume growth?

The Individually Quick Frozen (IQF) blueberry segment is experiencing the fastest volume growth within the processed category, primarily due to high consumer demand for convenient frozen fruits used in smoothies, baked goods, and industrial food manufacturing applications.

What is the most significant technological challenge in distributing fresh blueberries globally?

The most significant technological challenge is maintaining the integrity of the cold chain logistics over long distances, which requires advanced techniques like Modified Atmosphere Packaging (MAP) and rapid, efficient transport links to prevent spoilage and maintain fruit firmness during cross-continental shipment.

Which application segment provides the highest growth opportunity for blueberry extracts?

The Nutraceutical and Functional Food application segment provides the highest growth opportunity, driven by increasing consumer preference for supplements and health products that utilize high-purity blueberry extracts rich in antioxidants for cognitive and cardiovascular support.

Why is Peru becoming a major competitor to Chile in the global blueberry export market?

Peru is challenging Chile's dominance by leveraging optimal year-round growing conditions in coastal areas, significant private investment in advanced horticulture, and strategically timed harvests that align perfectly with peak demand periods in Northern Hemisphere markets, ensuring a competitive year-round supply.

How do trade agreements influence the price stability in the European blueberry market?

Trade agreements significantly influence European price stability by ensuring predictable and reduced tariff rates for counter-seasonal imports, particularly from Latin American suppliers, thereby stabilizing the overall supply and mitigating extreme price volatility that could arise from domestic crop failures or supply chain disruptions.

What role does blockchain technology play in the blueberry supply chain?

Blockchain technology is used to provide immutable, decentralized records for enhanced traceability, allowing consumers and regulators to verify the origin, handling conditions, and quality certifications of each batch of blueberries from the farm gate to the final point of retail sale, fostering trust and transparency.

What types of blueberries are commercially dominant in the market?

The Highbush variety (Vaccinium corymbosum) is the commercially dominant type globally, prized for its large size, firmness, and high yields suitable for both fresh market consumption and mechanized harvesting for processed goods.

How important are organic certifications for market access?

Organic certifications are increasingly important, particularly in high-value North American and European markets, as they cater to a growing segment of health-conscious consumers willing to pay a premium for sustainably and residue-free produced fruit, thereby dictating market access for major retailers.

What is the difference in profitability between the fresh and processed blueberry segments?

The fresh segment typically offers higher revenue per unit due to premium pricing, but the processed segment (like IQF) offers more stable profitability and lower logistical risks due to extended shelf life, lower handling costs, and bulk industrial contracts, mitigating losses from rapid perishability.

How does water scarcity affect blueberry production planning?

Water scarcity forces producers to invest heavily in water-efficient technologies, such as drip irrigation and advanced weather monitoring, impacting long-term planning and favoring cultivation in regions with predictable water resources, thereby influencing global production shifts and costs.

Who are the main upstream stakeholders in the blueberry value chain?

The main upstream stakeholders are specialized plant nurseries and breeders, who develop and supply superior cultivars, and input suppliers providing customized fertilizers, pest control solutions, and highly specialized agricultural machinery essential for large-scale, efficient production.

Which application segment requires the most standardized raw material inputs?

The Nutraceutical and Pharmaceutical segments require the most standardized raw material inputs, demanding high levels of purity, specific concentration of active compounds (like anthocyanins), and rigorous certifications to meet strict regulatory and formulation requirements.

What role do brokers and wholesalers play in the distribution of blueberries?

Brokers and wholesalers play a crucial role in the indirect distribution channel by aggregating supply from numerous smaller growers and managing the complex logistics necessary to deliver specific volumes and quality grades to large industrial buyers or international retail chains.

How do changing consumer diets affect the demand for processed blueberries?

Changing consumer diets, particularly the rising popularity of at-home food preparation like smoothies and healthy bowls, boost the demand for processed blueberries, especially frozen formats, which offer convenience, controlled portion sizes, and reduced food waste compared to fresh options.

What are the investment trends among key players in the market?

Key players are increasingly investing in strategic vertical integration to control quality and supply consistency, expanding global cultivation footprints into counter-seasonal regions, and adopting advanced technologies for sorting, handling, and logistics optimization.

How is climate change influencing cultivar development?

Climate change is driving cultivar development towards varieties with enhanced resilience to temperature extremes, greater tolerance to drought or excessive moisture, and reduced chilling requirement hours, ensuring viability in rapidly shifting global climatic zones and securing reliable yields.

What is the significance of the Chilean Blueberry Committee?

The Chilean Blueberry Committee is highly significant as it represents the interests of Chilean exporters, facilitating market access, conducting quality control programs, and coordinating large-scale promotional campaigns to ensure Chile remains a dominant supplier during the off-season in major markets.

What is the projected value of the Blueberry Market by 2033?

The Blueberry Market is projected to reach an estimated value of USD 15.1 Billion by the conclusion of the forecast period in 2033, reflecting substantial compounded growth across all major geographical segments and application sectors globally.

Why are post-harvest cooling techniques critical for fresh market blueberries?

Post-harvest cooling techniques, such as forced-air cooling, are critical because rapid temperature reduction immediately after picking slows the berry's metabolic rate and inhibits microbial growth, which is essential for maximizing shelf life and preserving the quality required for premium fresh market sales.

How does urbanization in the Asia Pacific region affect blueberry consumption?

Urbanization in the Asia Pacific region significantly boosts blueberry consumption by increasing access to modern retail chains and promoting exposure to Western dietary habits, coupled with higher disposable incomes that enable consumers to afford premium imported fresh fruit.

What are the key components of the technological landscape in post-harvest handling?

Key technological components in post-harvest handling include advanced optical sorting and grading machines, sophisticated Modified Atmosphere Packaging systems, and integrated cold storage facilities designed to maintain precise temperature and humidity controls throughout the handling process.

In which specific sub-segment of Food and Beverages are blueberries most commonly used?

Blueberries are most commonly used in the Bakery and Confectionery sub-segment within Food and Beverages, particularly in muffins, pies, and tarts, leveraging both fresh and frozen berries for flavor, texture, and visual appeal.

What distinguishes the rabbiteye blueberry variety in commercial terms?

The Rabbiteye variety is distinguished by its tolerance to heat and drought and its adaptability to lower-chill environments, making it commercially viable for cultivation in warmer regions that are unsuitable for traditional highbush varieties, thereby diversifying global production sources.

How do tariffs and non-tariff barriers influence global blueberry trade?

Tariffs and non-tariff barriers, such as phytosanitary regulations and specific quality standards, impose significant constraints on global blueberry trade, requiring exporters to invest in compliance measures and influencing the overall cost and feasibility of accessing major international markets.

Which metric is primarily used to determine the quality of blueberries for the nutraceutical segment?

The primary metric used for the nutraceutical segment is the concentration and standardization of anthocyanins, the powerful antioxidant compounds, ensuring the extracts deliver the desired biological activity and meet product specification requirements for health supplements.

How are environmental concerns driving innovation in blueberry packaging?

Environmental concerns are driving innovation towards sustainable packaging, focusing on recyclable and biodegradable materials, and lighter weight designs to reduce the carbon footprint associated with transport, while still maintaining the protective qualities necessary for preserving freshness.

What is the role of cooperatives like MBG Marketing in the blueberry market structure?

Cooperatives like MBG Marketing play a vital role by consolidating the production, marketing, and distribution efforts of numerous smaller member growers, providing them with economies of scale, access to premium markets, and unified brand visibility that individual growers could not achieve alone.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager