Bluetooth Car Adapter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434465 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Bluetooth Car Adapter Market Size

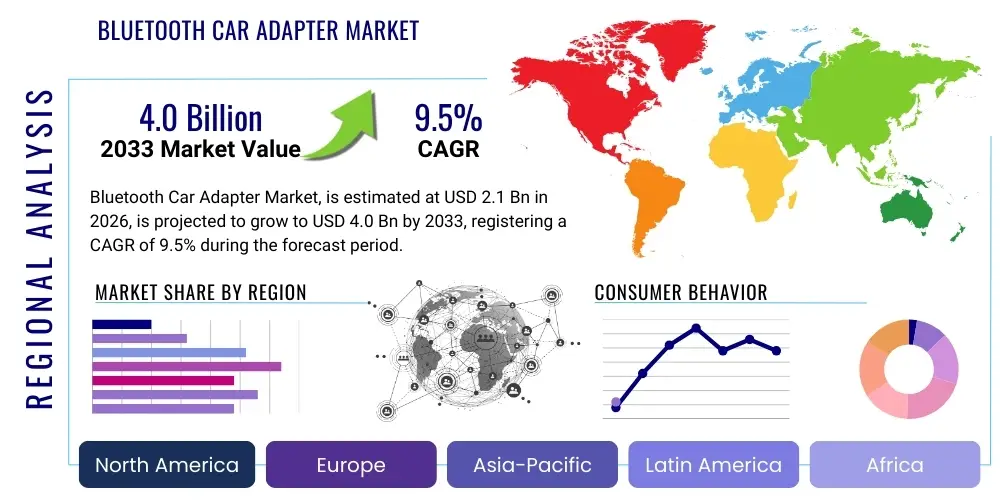

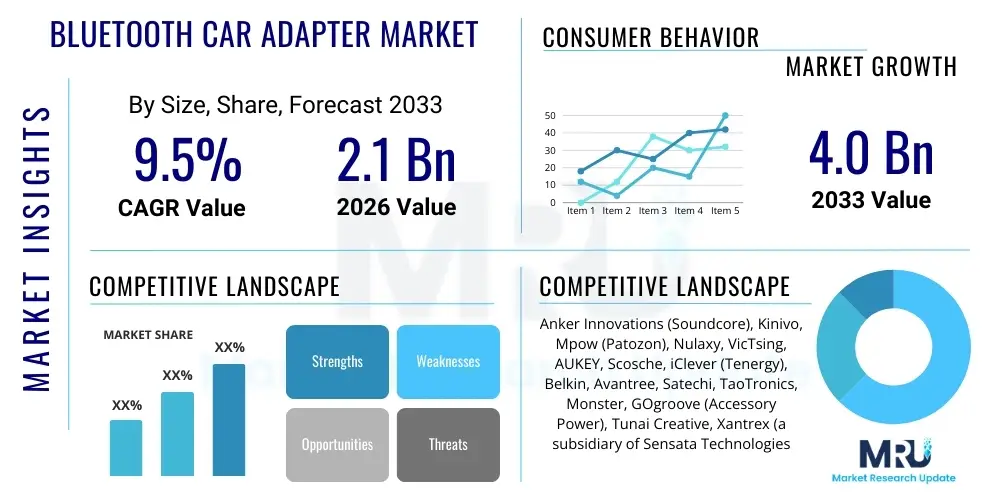

The Bluetooth Car Adapter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $2.1 Billion in 2026 and is projected to reach $4.0 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the continuous global retention of older vehicle models that lack factory-installed Bluetooth connectivity, coupled with the ubiquitous presence of personal smart devices requiring seamless integration for hands-free operation and high-fidelity audio streaming. The market size reflects the increasing consumer prioritization of in-car infotainment and communication safety standards.

Bluetooth Car Adapter Market introduction

The Bluetooth Car Adapter Market encompasses devices designed to bridge the connectivity gap between modern smartphones and older vehicle audio systems, enabling wireless transmission of audio and voice data. These adapters essentially retrofit legacy cars with contemporary connectivity features, transforming passive audio units into interactive infotainment systems capable of supporting hands-free calling, GPS voice navigation, and music streaming. The core product categories include simple receivers that plug into auxiliary ports, advanced transmitters that broadcast signals over FM frequencies, and comprehensive transceiver solutions offering both input and output capabilities, often powered by the vehicle's USB port or 12V socket.

Major applications of these adapters span personal vehicle use, commercial fleets, and ride-sharing services, where reliable, low-latency wireless communication is paramount. Key benefits include enhanced driver safety through mandated hands-free calling compliance, significant improvement in user convenience, and the ability to utilize digital media libraries without physical connections. These devices extend the usable life of vehicles by providing modern technological parity, delaying the need for costly head unit replacements or new vehicle purchases, thereby representing a highly cost-effective connectivity solution.

The market’s strong growth trajectory is primarily fueled by several critical driving factors, including the surging global adoption of smartphones, which necessitate continuous, reliable connectivity; evolving governmental regulations globally mandating hands-free operation while driving; and rapid advancements in Bluetooth technology standards (such as Bluetooth 5.0 and newer versions) that offer enhanced power efficiency, greater range, and superior audio fidelity. Furthermore, the burgeoning popularity of music streaming services like Spotify and Apple Music necessitates seamless in-car integration, positioning Bluetooth adapters as essential peripherals for the modern driver.

Bluetooth Car Adapter Market Executive Summary

The Bluetooth Car Adapter Market is characterized by intense innovation centered on improving audio quality and reducing latency, reflecting a broader shift towards premium wireless experiences. Current business trends indicate a strong focus on high-fidelity audio codecs (like aptX and LDAC) and the integration of smart charging features within the adapter unit to enhance utility. The competitive landscape is fragmented, with key players concentrating on brand differentiation through superior noise cancellation technologies, enhanced voice assistant activation reliability, and the development of multi-device pairing capabilities, effectively transforming simple accessories into sophisticated connectivity hubs.

Regionally, the market exhibits varied dynamics. North America and Europe represent mature markets defined by stringent hands-free regulations and high consumer disposable income, driving demand for premium, feature-rich adapters. Conversely, the Asia Pacific (APAC) region is emerging as the fastest-growing market, propelled by rapid growth in the used car sector, increasing urbanization, and a swelling middle class demanding affordable technological upgrades for their vehicles. Regulatory bodies in these emerging economies are also gradually tightening safety standards, further stimulating adapter adoption.

Segment trends highlight the dominance of the Receiver Type segment due to its reliability and superior audio output compared to FM transmitters, although transceiver models are gaining traction by offering comprehensive solutions for older vehicles lacking auxiliary input ports. Technology trends emphasize the rapid transition towards Bluetooth 5.0 and subsequent standards, which promise enhanced data transfer speeds and broader operating range, positioning these advanced adapters as the new industry benchmark for robust and future-proof in-car connectivity solutions. The aftermarket distribution channel maintains significant market share, driven by consumer preference for easy installation and readily available products across e-commerce platforms and specialized electronics retail.

AI Impact Analysis on Bluetooth Car Adapter Market

Common user questions regarding AI’s influence on the Bluetooth Car Adapter Market frequently revolve around improved voice command processing, personalized in-car experiences, and enhanced noise isolation algorithms. Users are keenly interested in whether AI can solve longstanding issues related to voice assistant reliability in noisy vehicle environments, and how machine learning might enable the adapter to dynamically adjust audio settings based on the type of media being consumed or the specific acoustic profile of the car cabin. Furthermore, there is anticipation regarding AI-driven predictive capabilities, such as pre-emptively managing connectivity based on habitual routes or learning preferred communication styles, thereby maximizing safety and convenience without manual input.

The integration of artificial intelligence is fundamentally transforming the value proposition of modern Bluetooth car adapters, shifting them from simple connectivity conduits to intelligent vehicular interfaces. AI algorithms are increasingly being embedded to execute sophisticated noise cancellation and echo reduction in real-time, leveraging machine learning to differentiate between human speech and ambient road noise, leading to significantly clearer hands-free calls. This enhanced processing power is vital for maintaining high standards of communication clarity, especially in older vehicles that may lack comprehensive factory soundproofing, directly addressing a core consumer pain point.

Beyond acoustic enhancements, AI contributes to advanced user experience personalization. Future adapters are expected to incorporate adaptive learning models that track user habits—such as preferred streaming apps, typical call patterns, and specific volume settings linked to different driving scenarios (e.g., highway versus city). This allows the device to proactively optimize connections and settings upon entry into the vehicle, creating a seamless and customized environment that minimizes driver distraction. This focus on adaptive intelligence represents a crucial pathway for product differentiation and market growth, ensuring that car adapters remain relevant even as OEM systems become smarter.

- Enhanced Voice Command Reliability: AI-powered natural language processing (NLP) improves the accuracy and speed of voice assistant activation (Siri, Google Assistant) under high ambient noise conditions.

- Adaptive Audio Equalization: Machine learning algorithms dynamically adjust sound profiles based on vehicle acoustics and content type (music, podcast, navigation prompts).

- Predictive Connectivity Management: AI learns user commuting patterns and preferred connections, optimizing Bluetooth pairing sequences and reducing latency upon vehicle startup.

- Intelligent Noise and Echo Cancellation: Sophisticated neural networks isolate driver speech from background noise for superior hands-free call quality.

- Firmware Optimization: AI assists in analyzing usage data to guide Over-The-Air (OTA) updates, improving battery life and connection stability specific to the user's vehicle model.

DRO & Impact Forces Of Bluetooth Car Adapter Market

The Bluetooth Car Adapter Market dynamics are governed by a complex interplay of facilitating drivers, market limitations, and substantial growth opportunities, all influenced by powerful external impact forces such as technology cycles and regulatory changes. Key drivers include the massive global installed base of non-Bluetooth-enabled vehicles, coupled with the rising consumer dependency on smartphones for navigation and entertainment. This persistent demand for connectivity retrofits ensures a stable market foundation. However, restraints such primarily stem from increasing OEM integration of advanced infotainment systems in new vehicles, potentially capping the demand in the new car segment, alongside technical challenges related to signal interference (FM transmitters) and potential latency issues affecting user experience.

Opportunities for market growth are abundant, particularly in the realm of smart functionality integration. These include the development of multi-functional adapters that incorporate features like Quick Charge (QC) or Power Delivery (PD) protocols, enabling simultaneous high-speed charging and connectivity. Furthermore, the integration with emerging Vehicle-to-Everything (V2X) communication standards and the growing ecosystem of car IoT devices presents significant avenues for technological synergy and product diversification. The adapter is evolving into a central hub for various vehicular smart services, offering developers scope for value addition beyond simple audio streaming.

Impact forces exert profound influence on the market structure. Regulatory mandates enforcing hands-free device usage (Safety Regulations) act as a primary external driver, compelling vehicle owners to adopt connectivity solutions. Technological inertia, specifically the slow adoption of advanced connectivity features in budget vehicle segments across developing nations, sustains the long-term necessity for aftermarket solutions. Economic forces, particularly the increasing average age of vehicles on the road globally, directly correlate with sustained demand for cost-effective upgrade solutions, counteracting the displacement pressure exerted by advanced OEM systems.

Segmentation Analysis

The Bluetooth Car Adapter Market is comprehensively segmented based on Device Type, Technology Standard, Distribution Channel, and End-Use Application, providing a granular view of market dynamics and consumer preferences. Device Type segmentation differentiates between receivers (which require an AUX input), transmitters (which utilize FM radio frequencies), and transceivers (offering bidirectional communication flexibility). The segmentation by Technology Standard is crucial, separating devices based on their Bluetooth version compatibility, where the migration from Bluetooth 4.x to 5.x defines performance metrics like range and data throughput. Analyzing these segments helps stakeholders tailor product development and marketing strategies to specific consumer needs, addressing varying levels of legacy vehicle compatibility and desired features.

- By Device Type:

- Receiver

- Transmitter (FM)

- Transceiver

- By Technology Standard:

- Bluetooth 4.x

- Bluetooth 5.0 and above

- By Distribution Channel:

- Online (E-commerce platforms)

- Offline (Retail stores, Specialty auto shops)

- By End-Use Application:

- Personal Vehicles

- Commercial Vehicles (Fleet, Ride-Sharing)

Value Chain Analysis For Bluetooth Car Adapter Market

The value chain of the Bluetooth Car Adapter Market commences with upstream activities focused heavily on the procurement of critical components, primarily semiconductors, specialized Bluetooth chips (often sourced from companies like Qualcomm or Realtek), and electronic circuit boards. High efficiency and low latency are determined at this stage, requiring close collaboration between adapter manufacturers and component suppliers to integrate the latest Bluetooth Low Energy (BLE) standards and high-fidelity audio codecs. Manufacturing and assembly follow, often concentrated in cost-effective regions in Asia, where efficiency and scalable production capacity dictate final product pricing and quality control mechanisms.

Midstream activities involve core manufacturing, including rigorous testing for electromagnetic compatibility (EMC) and radio frequency (RF) compliance, ensuring the adapters function reliably within the confined metallic environment of a vehicle cabin. The subsequent distribution phase is multifaceted, encompassing both direct and indirect channels. Direct sales often occur via dedicated brand e-commerce sites, allowing for greater control over pricing and customer feedback collection. Indirect channels, however, dominate the market, utilizing large global e-commerce platforms (Amazon, eBay) and vast networks of traditional brick-and-mortar electronics retailers and specialized automotive parts stores.

Downstream analysis focuses on reaching the end-user. E-commerce platforms provide extensive reach, price transparency, and rapid fulfillment, aligning perfectly with the aftermarket nature of the product. Specialized auto parts stores offer the benefit of expert installation advice and immediate access. The market structure is highly dependent on effective logistics and marketing that highlights compatibility and ease of installation, as the product is frequently purchased as an immediate solution to a connectivity deficit in an existing asset. The prominence of online reviews and user-generated content strongly influences purchasing decisions in this highly competitive consumer electronics segment.

Bluetooth Car Adapter Market Potential Customers

The primary potential customers for Bluetooth Car Adapters consist of vehicle owners whose automobiles were manufactured before the widespread integration of OEM Bluetooth technology, typically models from the early 2000s up to approximately 2016, depending on the manufacturer and vehicle class. This demographic often seeks cost-effective methods to modernize their existing vehicle's functionality without investing in expensive head unit replacements. These customers prioritize ease of use, stability of connection, and reliable hands-free calling functionality, viewing the adapter as an essential safety and convenience upgrade.

A second significant customer segment includes commercial fleet operators and professional drivers (e.g., ride-sharing services like Uber and Lyft, and delivery drivers). For these users, reliable and consistent communication is directly linked to operational efficiency and regulatory compliance. They often require adapters with advanced features such as robust noise cancellation for constant calling, multi-device support for various driver shifts, and durable, rugged designs capable of handling continuous use within a high-stress environment. Fleet managers view these adapters as crucial tools for ensuring driver safety and compliance with regional traffic laws regarding mobile device use.

The emerging customer base includes classic car enthusiasts and users of niche, specialty vehicles who value maintaining the original aesthetics and components of their car but still demand modern connectivity. For this group, discreet, low-profile adapters that seamlessly integrate without visible modification are highly valued. Finally, technology early adopters who seek the latest audio standards (e.g., LE Audio support) also represent a high-value niche segment, driving demand for premium products that offer superior audio fidelity and future-proof connectivity features, even if their existing vehicle already possesses basic Bluetooth capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.1 Billion |

| Market Forecast in 2033 | $4.0 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Anker Innovations (Soundcore), Kinivo, Mpow (Patozon), Nulaxy, VicTsing, AUKEY, Scosche, iClever (Tenergy), Belkin, Avantree, Satechi, TaoTronics, Monster, GOgroove (Accessory Power), Tunai Creative, Xantrex (a subsidiary of Sensata Technologies), Sony, JVCKenwood, Pioneer Corporation, Rocketek. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bluetooth Car Adapter Market Key Technology Landscape

The technological evolution within the Bluetooth Car Adapter Market is primarily focused on enhancing audio transmission quality, optimizing power consumption, and improving overall connection stability and interoperability. The shift from older standards (like Bluetooth 3.0 and 4.0) to Bluetooth 5.0 and subsequent standards (5.2, 5.3) is the most critical technical driver. Bluetooth 5.0 offers four times the range and eight times the broadcast message capacity compared to its predecessors, significantly improving connection resilience, which is crucial in dense urban environments where signal interference is common. Furthermore, the enhanced data throughput supports higher quality audio codecs, minimizing compression artifacts.

Crucial advancements in audio processing technologies define the premium segment. High-definition audio codecs such as Qualcomm’s aptX Adaptive and Sony’s LDAC are being integrated into advanced receivers to deliver near-lossless audio quality over wireless connections, meeting the demands of audiophile consumers. Equally important is the introduction of Bluetooth LE Audio, enabled by the new Low Complexity Communication Codec (LC3). LE Audio promises to reduce power consumption dramatically while maintaining or even improving audio quality, which is vital for adapters powered by small internal batteries or drawing minimal power from the vehicle’s electrical system, potentially enabling new, smaller form factors.

Furthermore, technology development is heavily centered on usability and multi-tasking. Features like multipoint connectivity, which allows an adapter to simultaneously pair with two source devices (e.g., a personal phone for music and a work phone for calls), are becoming standard in mid-to-high-tier products. There is also increasing integration of noise reduction software, hardware dedicated to suppressing feedback loops, and advanced FM stabilization mechanisms (for transmitter types) that actively scan the radio spectrum for clear frequencies, ensuring minimal audio disruption. Firmware Over-The-Air (FOTA) update capabilities are also being adopted by leading brands to facilitate feature improvements and bug fixes post-purchase, extending the product lifecycle and perceived value.

Regional Highlights

The market dynamics for Bluetooth Car Adapters vary significantly across global regions, reflecting differences in vehicle fleet age, regulatory environments, and consumer technology adoption rates. North America maintains a dominant position, characterized by high consumer willingness to adopt new technology and strict regulations enforcing hands-free device usage. The U.S. and Canada possess a large inventory of older vehicles, particularly light trucks and SUVs, driving robust demand for high-quality, reliable aftermarket connectivity solutions. The market here is mature, favoring brands that offer premium features like noise cancellation and advanced audio codecs.

Europe represents a highly competitive market, characterized by stringent EU safety standards and a strong focus on design integration. Countries such as Germany, the UK, and France show high adoption, particularly of receiver types due to the prevalence of AUX ports in many European vehicle models. The region emphasizes compliance with regional radio frequency guidelines and expects products to offer seamless integration with mandated European eCall systems, though indirectly. Demand is sustained by the prolonged lifespan of vehicles and the high penetration of technology-savvy younger demographics.

Asia Pacific (APAC) is projected to be the fastest-growing region, driven by explosive growth in automotive sales, especially second-hand vehicles, and rapidly increasing middle-class income across nations like China, India, and Southeast Asia. The necessity for affordable in-car connectivity upgrades in a vast and growing vehicle fleet underpins this demand. While FM transmitter types initially dominated the budget segment, the increasing availability of AUX and USB ports in newer entry-level vehicles is shifting demand towards reliable receiver and transceiver models. Infrastructure development and increasing awareness of traffic safety regulations are further catalyzing market expansion.

- North America: Market leader due to large installed base of legacy vehicles, high disposable income, and strong regulatory pressure for hands-free operation. Focus on premium, feature-rich adapters.

- Europe: Strong demand driven by safety regulations and high technological awareness; emphasis on design integration and compliance with stringent technical standards.

- Asia Pacific (APAC): Fastest-growing region, fueled by rising vehicle ownership, large used car market, and increasing consumer desire for technological modernization at competitive prices.

- Latin America (LATAM): Growth stimulated by improving digital infrastructure and increasing adoption of smartphones, leading to steady demand for budget-friendly connectivity solutions, primarily through online channels.

- Middle East and Africa (MEA): Emerging market with potential derived from urbanization trends and increasing fleet utilization, requiring basic, durable connectivity solutions for commercial transport applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bluetooth Car Adapter Market.- Anker Innovations (Soundcore)

- Kinivo

- Nulaxy

- Mpow (Patozon)

- Scosche

- VicTsing

- AUKEY

- iClever (Tenergy)

- Belkin International

- Avantree

- Satechi

- TaoTronics (Sunvalleytek)

- Monster

- GOgroove (Accessory Power)

- Tunai Creative

- JVCKenwood Corporation

- Pioneer Corporation

- Sony Corporation

- Rocketek

- LDesign

Frequently Asked Questions

Analyze common user questions about the Bluetooth Car Adapter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a Bluetooth Car Receiver and a Transmitter?

A Bluetooth Car Receiver connects via the vehicle's Auxiliary (AUX) input or USB to receive audio digitally, offering superior sound quality and stability. A Transmitter utilizes FM radio frequencies to broadcast the audio signal, relying on finding a clear, unused radio station, which can lead to interference and reduced clarity, though transmitters are compatible with vehicles lacking an AUX port.

Why is Bluetooth 5.0 technology crucial for modern car adapters?

Bluetooth 5.0 offers significant advantages over previous versions, including increased data throughput for supporting high-fidelity audio codecs (reducing compression loss), four times the range (improving connection stability), and enhanced power efficiency. These features combine to provide a more reliable, robust, and higher-quality wireless audio experience crucial for uninterrupted driving.

How do I ensure the adapter I purchase provides reliable hands-free calling?

Reliable hands-free calling depends on the adapter's integrated microphone quality, its physical placement, and the sophistication of its Noise and Echo Cancellation (NEC) technology. Look for models explicitly stating CVC (Clear Voice Capture) or utilizing advanced AI-driven noise reduction algorithms, which isolate the driver's voice from road and engine noise for clearer communication.

Is the Bluetooth Car Adapter Market being threatened by built-in OEM infotainment systems?

While new vehicles increasingly feature OEM Bluetooth integration, the market for aftermarket adapters remains highly robust. This resilience is due to the enormous global inventory of older vehicles (often 10+ years old) that require retrofitting, coupled with the affordability and rapid innovation cycle of adapters, which often adopt new features (like LE Audio) faster than OEM systems.

What role does the integration of Quick Charge (QC) or Power Delivery (PD) play in adapter functionality?

Many modern car adapters are integrated with QC or PD charging ports, transforming them into multi-functional hubs. This feature addresses the common user need to charge power-intensive smartphones rapidly while simultaneously using them for navigation and streaming, maximizing the utility of the single accessory port within the vehicle cabin.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager