Bluetooth Headphone Battery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435935 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Bluetooth Headphone Battery Market Size

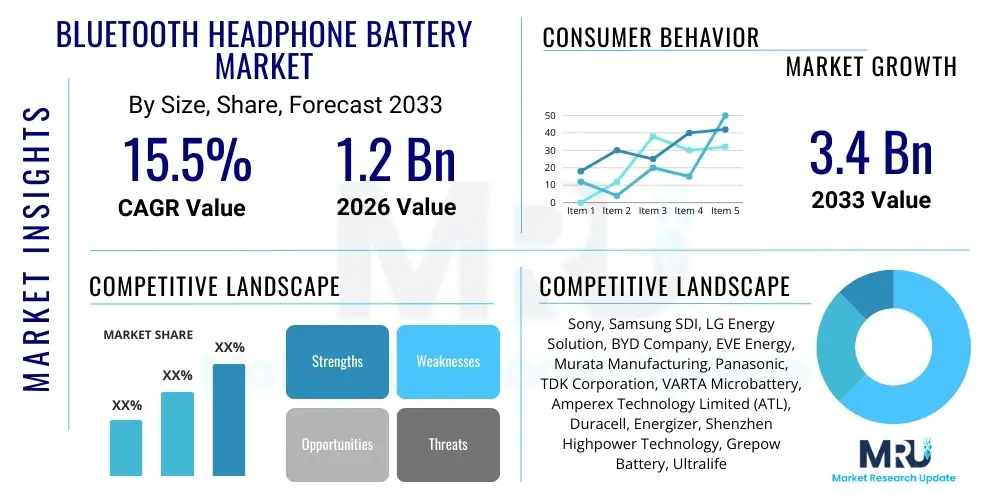

The Bluetooth Headphone Battery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 3.4 Billion by the end of the forecast period in 2033.

Bluetooth Headphone Battery Market introduction

The Bluetooth Headphone Battery Market encompasses the production, distribution, and utilization of rechargeable batteries specifically designed to power wireless audio devices such as True Wireless Stereo (TWS) earbuds, neckband headphones, and over-ear Bluetooth headsets. These specialized batteries, predominantly lithium-ion (Li-ion) and lithium polymer (Li-Po) cells, must meet stringent requirements for miniaturization, high energy density, rapid charging capability, and extended cycle life to support the demanding usage profiles of modern consumer electronics. The core value proposition of these batteries lies in enabling completely untethered audio experiences, which is a fundamental shift in consumer preferences globally.

Major applications driving this market include personal audio consumption, professional use (such as remote conferencing and high-fidelity monitoring), gaming, and fitness tracking. The integration of Bluetooth technology has made seamless connectivity a standard expectation, necessitating corresponding improvements in battery technology. Benefits derived from advanced headphone batteries include longer listening times, smaller form factors for earbuds, enhanced safety features, and reduced overall product weight. Furthermore, the push towards fast charging standards is a critical performance metric, directly influencing consumer satisfaction and adoption rates across various price points.

Driving factors propelling the market expansion include the exponential growth in the global TWS segment, increasing smartphone penetration in emerging economies, and the continuous innovation in audio codecs requiring more stable and robust power supply. The shift away from wired audio interfaces by major smartphone manufacturers has fundamentally accelerated the demand for wireless alternatives. Additionally, the replacement market for batteries in existing devices, coupled with technological advancements increasing energy density in smaller packages, ensures sustained growth throughout the forecast period. Consumers increasingly prioritize battery life as a key purchasing criterion, forcing manufacturers to continually seek higher performance battery solutions.

Bluetooth Headphone Battery Market Executive Summary

The Bluetooth Headphone Battery Market is characterized by robust growth driven primarily by the global proliferation of TWS devices and significant advancements in battery chemistry focused on miniaturization and extended endurance. Business trends highlight intense competition among Asian manufacturers specializing in Li-Po technology, emphasizing vertical integration to control material costs and accelerate innovation cycles. Original Equipment Manufacturers (OEMs) are increasingly partnering with specialized micro-battery suppliers to meet strict performance metrics related to charging speed and safety protocols, making supply chain resilience a critical success factor in this segment. The increasing adoption of smart features, such as active noise cancellation (ANC) and spatial audio, places higher energy demands on these miniature power sources, fueling research into next-generation solid-state battery alternatives.

Regional trends indicate that Asia Pacific (APAC) currently dominates the market, largely due to its concentrated manufacturing base for both batteries and consumer electronics, along with being the primary market for high-volume, budget-friendly TWS products. North America and Europe, while smaller in volume, represent premium markets focused on high-end over-ear headphones and specialized gaming headsets, demanding batteries with extreme longevity and high discharge rates. Latin America and MEA are emerging markets, witnessing rapid growth in basic and mid-range Bluetooth headphone adoption, creating substantial future potential for standard Li-ion variants. Regulatory efforts, particularly in the EU concerning product longevity and mandatory battery replacement, are beginning to influence design choices across all geographical markets.

Segmentation trends show that the Lithium Polymer (Li-Po) segment maintains the largest market share due to its superior flexibility and safety characteristics suitable for compact electronics. However, the development of solid-state batteries represents a crucial disruptive trend, promising higher energy density and improved safety, though commercialization remains limited to niche applications currently. Based on product type, the TWS segment is the undeniable primary growth driver, outpacing on-ear and over-ear categories in unit shipments globally. Manufacturers are shifting R&D focus toward optimizing batteries in the 50mAh to 150mAh range, which is the sweet spot for premium TWS cases and medium-sized headsets, balancing power requirements with physical constraints.

AI Impact Analysis on Bluetooth Headphone Battery Market

User inquiries concerning the impact of Artificial Intelligence on Bluetooth Headphone Battery Market revolve primarily around four key areas: optimization of battery management systems (BMS), predictive maintenance for extending battery life, enhanced charging efficiency, and the energy demands imposed by AI-enabled audio features (like real-time translation or sophisticated noise cancellation). Users are keen to understand if AI can effectively mitigate the inherent degradation issues of lithium batteries and if sophisticated algorithms can dynamically manage power consumption to deliver advertised endurance times consistently. The consensus expectation is that AI will transform battery usage from a fixed performance metric to a dynamic, user-adaptive system, requiring closer integration between the battery and the headphone's primary processing unit for real-time power modulation based on ambient conditions and user activity.

AI's primary influence is moving beyond simple charge/discharge management into highly optimized predictive modeling. AI algorithms can analyze historical charge cycles, temperature variations, and specific usage patterns (e.g., call duration vs. music streaming) to tailor charging profiles, thereby slowing down capacity loss over the battery’s lifespan. This optimization extends the usable life of the product, addressing a significant consumer concern regarding electronic waste and device longevity. Furthermore, AI-driven fault detection systems are enhancing safety, identifying potential cell imbalances or thermal runaways faster than traditional, hardware-based monitoring systems, making the entire ecosystem safer for compact consumer devices.

The secondary, yet equally significant, impact of AI is related to increasing power demand. Features like advanced ambient sound processing, deep learning-based noise reduction, and on-device voice assistant processing consume considerable power. AI algorithms are thus employed not only for battery management but also for system-level power allocation, prioritizing essential audio functions while temporarily throttling less critical processes. This intelligent balancing act ensures performance stability while maximizing battery runtime, effectively mitigating the increased energy requirements necessitated by the integration of more powerful AI chips and sensors within the headphones themselves. This dynamic consumption management is key to maintaining market competitiveness.

- AI-driven Predictive Battery Management Systems (BMS) reduce degradation.

- Optimized charging algorithms accelerate charge times without compromising cycle life.

- Real-time power allocation based on user activity maximizes operational uptime.

- Enhanced thermal management and fault detection using machine learning models improve safety.

- Increased energy demand from complex AI audio processing features drives battery innovation.

- AI assists in battery material discovery and manufacturing process optimization.

DRO & Impact Forces Of Bluetooth Headphone Battery Market

The Bluetooth Headphone Battery Market is propelled by strong demand for wireless audio and restrained by limitations in current battery chemistry, while substantial opportunities exist in the emerging solid-state segment and recycling initiatives. Key drivers include the massive unit sales volume of TWS devices and regulatory pressures demanding longer product lifecycles, pushing manufacturers toward high-quality, durable battery solutions. Conversely, the physical limits of current lithium-ion energy density and persistent safety concerns related to overheating and swelling pose significant restraints, requiring substantial R&D investment to overcome. The impact forces are characterized by high substitution threats from alternative charging technologies (like kinetic energy harvesting) and intense competitive rivalry centered on miniaturization and fast charging capabilities.

Opportunities are predominantly centered around the transition to next-generation battery technologies. Solid-state electrolytes promise higher safety margins and potentially double the energy density in the same footprint, offering a pathway to significantly increased runtime without increasing device size. Furthermore, the growing global focus on environmental sustainability presents opportunities for developing easily removable and replaceable battery units, along with advanced recycling processes for cobalt and lithium. Strategic partnerships between battery producers and leading audio tech firms to co-develop customized power solutions for specific high-performance headphones also represent a lucrative avenue for market penetration and establishing technological leadership.

The overall impact of these forces maintains a high growth trajectory for the market, albeit one characterized by continuous technological disruption. Regulatory changes, particularly concerning safety certifications and import restrictions on certain battery types, exert a medium to high external influence. Internally, the ability of manufacturers to scale production while maintaining zero-defect quality control for highly compact cells remains the primary factor determining market share. The need for specialized battery solutions that can withstand frequent charging and deep cycling, common in TWS usage, ensures that demand remains robust for high-performance, quality-certified batteries, offsetting minor economic fluctuations.

Segmentation Analysis

The Bluetooth Headphone Battery Market is segmented comprehensively based on battery technology (Type), capacity range, the specific type of headphone device utilizing the battery, and the end-use application. This multidimensional segmentation allows for precise market sizing and identification of high-growth niches. The market structure reveals a clear differentiation between the high-volume TWS segment, which prioritizes extremely small capacities and rapid charging, and the premium over-ear segment, which demands higher capacity for noise cancellation features and extended travel use. Lithium Polymer technology remains dominant due to its adaptability to curved and irregular headphone designs, which is crucial for ergonomic considerations in compact devices.

- By Type

- Lithium-ion (Li-ion)

- Lithium Polymer (Li-Po)

- Solid State Batteries (Emerging)

- Other chemistries (e.g., Zinc-air, Nickel-Metal Hydride)

- By Capacity (mAh)

- Under 50mAh (Primary TWS cell size)

- 50mAh – 150mAh (TWS Charging Cases and Neckbands)

- Above 150mAh (On-ear/Over-ear Headphones)

- By Headphone Type

- True Wireless Stereo (TWS) Earbuds

- On-ear and Over-ear Headphones

- Neckband/Collar Headphones

- By Application

- Consumer Electronics and Personal Audio

- Fitness, Sports, and Outdoor Use

- Professional and Enterprise (Studio, Gaming, Conference)

Value Chain Analysis For Bluetooth Headphone Battery Market

The value chain for Bluetooth Headphone Batteries is highly integrated and complex, starting from the extraction and processing of raw materials (lithium, cobalt, nickel, manganese) and extending through highly specialized manufacturing processes to final integration into consumer products. Upstream activities involve material sourcing, which is highly sensitive to geopolitical factors and commodity price volatility. Key players in this stage are raw material miners and chemical producers, whose technological purity directly impacts battery performance and safety. Midstream activities, involving cell manufacturing (electrode production, electrolyte preparation, cell assembly), require cleanroom environments and precision engineering, where companies like LG, Samsung SDI, and specialized Chinese micro-battery producers hold significant technological advantages due to economies of scale and expertise in thin-film technologies.

Downstream activities include battery pack assembly, which often incorporates proprietary Battery Management Systems (BMS) chips, followed by distribution. The distribution channel is bifurcated: direct sales occur when major OEMs (like Apple or Sony) procure batteries directly from tier-one suppliers, often involving highly customized specifications and exclusive contracts. Indirect channels involve battery distributors or electronics component wholesalers supplying smaller headphone manufacturers, specialized accessory companies, or the aftermarket repair sector. The critical success factor in the downstream segment is the efficiency of logistics and the ability to comply with diverse global safety and shipping regulations for lithium batteries, which are classified as dangerous goods.

The primary profit pools are concentrated in the midstream (cell manufacturing) due to the intellectual property surrounding cell chemistry and design, and in the highly specialized upstream material processing sector. The relationship between battery manufacturers and headphone OEMs is pivotal; the push for smaller, faster-charging batteries often involves co-development, leading to tightly coupled supply chains. The aftermarket and repair sector, though smaller, is gaining importance due to regulatory pressure to enhance product reparability. The overall value chain emphasizes quality assurance, as a single battery failure can severely damage a headphone manufacturer's brand reputation, leading to stringent testing protocols throughout production.

Bluetooth Headphone Battery Market Potential Customers

The primary customers and end-users of Bluetooth Headphone Batteries are the Original Equipment Manufacturers (OEMs) specializing in audio electronics, who procure these components in large volumes for integration into their product lines. This includes global giants producing TWS earbuds and premium over-ear headphones, mid-tier consumer electronics brands focusing on mass-market penetration, and niche manufacturers specializing in high-fidelity or professional audio gear. These customers prioritize consistency, minimum defect rates, high energy density, and competitive pricing, often requiring batteries customized for unique physical dimensions or specific charging profiles to differentiate their final products in the competitive consumer market.

A significant and rapidly growing segment of potential customers includes manufacturers of charging cases for TWS devices, as the case batteries often hold 3 to 5 times the capacity of the earbud batteries themselves and require different capacity specifications, often in the 300mAh to 800mAh range. Furthermore, the aftermarket and independent repair shops represent a persistent demand source for replacement batteries, driven by the inherent degradation of lithium batteries over time, especially in frequently used TWS units. Finally, specialized application manufacturers, such as those creating hearing aids with Bluetooth connectivity or communication systems for industrial use, also form a lucrative, albeit smaller, customer base demanding extremely reliable, low self-discharge batteries.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 3.4 Billion |

| Growth Rate | CAGR 15.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sony, Samsung SDI, LG Energy Solution, BYD Company, EVE Energy, Murata Manufacturing, Panasonic, TDK Corporation, VARTA Microbattery, Amperex Technology Limited (ATL), Duracell, Energizer, Shenzhen Highpower Technology, Grepow Battery, Ultralife Corporation, Contemporary Amperex Technology Co. Ltd (CATL), ProLogium Technology, Maxell Holdings, FDK Corporation, Tianjin Lishen Battery. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bluetooth Headphone Battery Market Key Technology Landscape

The technology landscape of the Bluetooth Headphone Battery market is highly dynamic, centered on enhancing energy density, improving charging efficiency, and ensuring intrinsic safety in extremely small form factors. Current technology is dominated by Lithium Polymer (Li-Po) due to its flexible packaging capabilities (pouch cells), allowing it to fit into the ergonomic contours of modern earbuds and headsets. Key technological breakthroughs focus on optimizing cathode and anode materials, particularly using silicon-based anodes and nickel-rich cathodes, to increase the amount of energy stored per unit volume without compromising cycle life. The integration of advanced Battery Management Systems (BMS) with dedicated protection circuits is mandatory, utilizing microcontrollers and fuel gauge algorithms to accurately track State of Charge (SoC) and State of Health (SoH).

A crucial technological development is the implementation of ultra-fast charging capabilities, often achieved by utilizing higher C-rates (charge current rate) and optimizing electrolyte pathways to reduce internal resistance and thermal build-up during rapid charging cycles. Many premium headphones now require a battery capable of gaining several hours of playtime from just a 5 to 10-minute charge. This necessitates specialized charging integrated circuits (ICs) within the headphone case and the earbuds themselves that can manage high current inputs safely. Furthermore, the physical manufacturing process for micro-batteries, specifically lamination and packaging, requires micron-level precision to maximize cell efficiency and minimize the risk of internal short circuits, distinguishing specialized suppliers from general battery producers.

Looking ahead, the most transformative technology is the research and limited commercial deployment of solid-state batteries (SSBs). SSBs replace the flammable liquid electrolyte with a solid counterpart, offering the potential for significantly higher energy density (by utilizing pure lithium metal anodes) and dramatically improved safety, as they are non-flammable. While still facing hurdles related to cost, mass production scaling, and achieving high power density for rapid discharge, SSBs are expected to revolutionize the high-end Bluetooth headphone segment in the later stages of the forecast period. Other relevant technologies include flexible batteries for wearables integration and improved cold-weather performance characteristics essential for outdoor sports applications.

Regional Highlights

The global Bluetooth Headphone Battery Market exhibits distinct regional dynamics influenced by manufacturing hubs, consumer spending power, and varying adoption rates of wireless audio technology.

- Asia Pacific (APAC): APAC is the epicenter of the Bluetooth Headphone Battery market, dominating both supply and demand. China, South Korea, and Japan host the majority of the world's leading battery cell manufacturers and the largest consumer electronics assembly plants. The region is driven by high-volume sales of TWS devices, propelled by robust smartphone penetration and a massive population of young, tech-savvy consumers in countries like India and Southeast Asia. The focus is on cost-competitive, high-performance Li-Po batteries, making it the fastest-growing market by volume.

- North America: Characterized by high Average Selling Prices (ASPs) and a preference for premium, feature-rich audio products, North America is a crucial market for innovative and high-capacity batteries used in professional and high-end over-ear headphones (demanding over 500mAh in some cases). The region's consumers prioritize brand reputation, longevity, and advanced features like superior Active Noise Cancellation (ANC), which translates to higher power demands and a focus on cutting-edge battery technology, including early adoption of novel chemistries.

- Europe: Europe mirrors North America's focus on quality and premiumization but is increasingly influenced by stringent environmental and recycling regulations (like the EU Battery Regulation). This regulatory environment is driving demand for batteries that are easily replaceable, manufactured sustainably, and highly durable. Western Europe represents a mature market for over-ear devices, while Eastern Europe is seeing accelerating adoption of TWS, driving balanced demand across the capacity spectrum.

- Latin America (LATAM): LATAM is an emerging market with rapid growth, primarily driven by the affordability of mid-range and budget-friendly TWS units. Market demand focuses on reliable, standard Li-ion and Li-Po cells that offer a good balance between cost and performance. The growth trajectory here is directly tied to improving disposable incomes and increasing access to mobile internet services, positioning it as a high-potential market for mass-market battery manufacturers.

- Middle East and Africa (MEA): This region is highly fragmented, with the UAE and Saudi Arabia acting as major hubs for premium imports, mirroring European consumption patterns. In contrast, many African nations are rapidly adopting affordable wireless solutions, driving demand for basic, reliable battery components. The region is highly sensitive to logistics costs and relies heavily on imported batteries and finished goods from APAC.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bluetooth Headphone Battery Market.- Sony

- Samsung SDI

- LG Energy Solution

- BYD Company

- EVE Energy

- Murata Manufacturing

- Panasonic

- TDK Corporation

- VARTA Microbattery

- Amperex Technology Limited (ATL)

- Duracell

- Energizer

- Shenzhen Highpower Technology

- Grepow Battery

- Ultralife Corporation

- Contemporary Amperex Technology Co. Ltd (CATL)

- ProLogium Technology

- Maxell Holdings

- FDK Corporation

- Tianjin Lishen Battery

Frequently Asked Questions

Analyze common user questions about the Bluetooth Headphone Battery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected CAGR for the Bluetooth Headphone Battery Market?

The Bluetooth Headphone Battery Market is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033, driven primarily by the sustained global demand for TWS devices and miniaturization technology.

Which battery type dominates the Bluetooth Headphone Battery segment?

Lithium Polymer (Li-Po) batteries currently dominate the market due to their flexible form factor, lightweight design, and high energy density, which are essential for fitting into the ergonomic and space-constrained designs of modern earbuds and compact headsets.

How is AI influencing the longevity of headphone batteries?

AI is positively influencing battery longevity by utilizing sophisticated algorithms within the Battery Management System (BMS) to optimize charging cycles, manage thermal output, and perform predictive maintenance, thereby reducing cell degradation and extending the overall life of the battery pack.

What is the most significant technological opportunity in this market?

The most significant technological opportunity lies in the commercialization and mass adoption of Solid-State Batteries (SSBs), which promise dramatically higher energy density and improved intrinsic safety compared to current liquid-electrolyte lithium-ion chemistries, leading to significantly longer headphone runtime.

Which region holds the largest market share for Bluetooth Headphone Batteries?

Asia Pacific (APAC) holds the largest market share, serving as both the global manufacturing hub for consumer electronics and battery cells, and a primary consumer market, especially for high-volume True Wireless Stereo (TWS) products.

What distinguishes battery requirements for TWS earbuds versus over-ear headphones?

TWS earbuds require extremely small capacity batteries (under 50mAh) that emphasize rapid charging (high C-rate) and safety in highly confined spaces. Over-ear headphones utilize larger capacity batteries (often >150mAh) to support features like Active Noise Cancellation (ANC) and demand longer total runtime, prioritizing sustained energy delivery over minimal size.

What are the primary restraints affecting market growth?

Primary restraints include the intrinsic safety risks associated with lithium-based chemistries (swelling, thermal runaway), which mandate expensive protection circuits, and the physical limits on further increasing energy density using conventional materials without expanding the battery footprint.

How do global regulations impact the battery design process?

Global regulations, particularly those established by the European Union, are increasingly focused on environmental sustainability, mandating stricter requirements for recyclability, material sourcing, and product reparability, which forces manufacturers to design batteries that are easier to remove and replace.

Which application segment is driving the highest volume demand?

The Consumer Electronics and Personal Audio application segment, specifically driven by the explosive demand for True Wireless Stereo (TWS) devices, is generating the highest volume demand for micro-batteries globally.

What is the role of silicon-based anodes in new battery technology?

Silicon-based anodes are crucial for next-generation batteries as they have a theoretical capacity significantly higher than traditional graphite anodes, enabling battery manufacturers to achieve substantial increases in energy density (Wh/L or Wh/kg) required for extended headphone usage.

What is the estimated market size in 2033?

The market is projected to reach an estimated value of USD 3.4 Billion by the end of the forecast period in 2033, reflecting consistent double-digit growth spurred by technological upgrades and increasing global adoption of wireless audio.

Who are the key upstream suppliers in the value chain?

Key upstream suppliers include chemical processing companies and miners specializing in raw materials such as lithium, cobalt, nickel, and manganese, which are essential components for producing high-performance battery cathodes and electrolytes.

How important is the rapid charging feature to consumers?

Rapid charging is critically important to consumers, particularly for TWS devices. Batteries capable of reaching usable charge levels (e.g., 50% capacity) within 5 to 15 minutes are highly favored, making high C-rate performance a crucial competitive metric for battery suppliers.

What capacity range is most competitive for TWS charging cases?

The capacity range of 50mAh to 150mAh is highly competitive for individual TWS charging cases, as this capacity range balances portability with the ability to provide multiple full charges to the earbuds themselves, maximizing convenience for the user.

Why is safety a major concern in this market?

Safety is a major concern because these batteries are small, frequently charged and discharged, and operate in close proximity to the user's body. Defects can lead to thermal events, requiring advanced protection circuits and rigorous quality control (QC) during manufacturing to prevent catastrophic failures.

What role do gaming applications play in the market?

Gaming applications require high-power density batteries that can sustain peak discharge rates for features like low-latency audio transmission and haptic feedback, demanding specialized, high-performance battery cells that maintain stability under extreme load conditions.

Are alternative battery chemistries gaining traction?

While Lithium-based chemistries dominate, Zinc-air and small Nickel-Metal Hydride batteries are used in niche applications, but Solid-State Batteries represent the primary focus for alternative future chemistries due to their potential for disruptive performance gains.

What is the definition of a micro-battery in this context?

In the Bluetooth headphone context, a micro-battery generally refers to small, highly specialized rechargeable cells with capacities typically below 150mAh, optimized for size, weight, and high volumetric energy density, necessary for insertion into earbuds.

How does intense market competition affect battery prices?

Intense market competition, particularly among Asian manufacturers, consistently drives down the price per Wh (Watt-hour) of standard Li-Po batteries, forcing producers to focus on economies of scale and automation to maintain profit margins while investing in premium, customized solutions.

What is the significance of the base year 2025?

The base year 2025 serves as the reference point for market estimation and analysis, reflecting the most recent established market size data and trends immediately preceding the forecast period (2026-2033), accounting for immediate post-pandemic technology adoption shifts.

How is the fitness and sports segment impacting battery design?

The fitness and sports segment requires batteries with enhanced durability against sweat and moisture, reliable performance in fluctuating temperatures, and the ability to maintain power during high-vibration activities, pushing the development of more robust cell packaging and sealing techniques.

Which company is a key player in solid-state battery development for consumer electronics?

ProLogium Technology is recognized as a key player actively developing and prototyping solid-state battery technology, positioning them as a potential future leader in supplying next-generation power sources for high-performance consumer devices like premium headphones.

What is the primary factor driving demand in the North American market?

The primary factor driving demand in North America is the high consumer purchasing power focused on premium features such as advanced Active Noise Cancellation (ANC) and personalized audio experiences, which necessitate high-capacity, long-lasting battery solutions in over-ear headphones.

What metric defines battery performance in TWS devices?

For TWS devices, battery performance is often defined by volumetric energy density (Wh/L), as the physical size constraint is extremely tight, and the fast-charging rate (C-rate) required for quick power replenishment.

What is downstream analysis in the value chain?

Downstream analysis focuses on the final stages of the value chain, including battery pack integration into the headphone (often performed by the OEM), distribution logistics, retail sales channels, and the post-sale aftermarket for replacements and repair components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager