BMI Calculator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438218 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

BMI Calculator Market Size

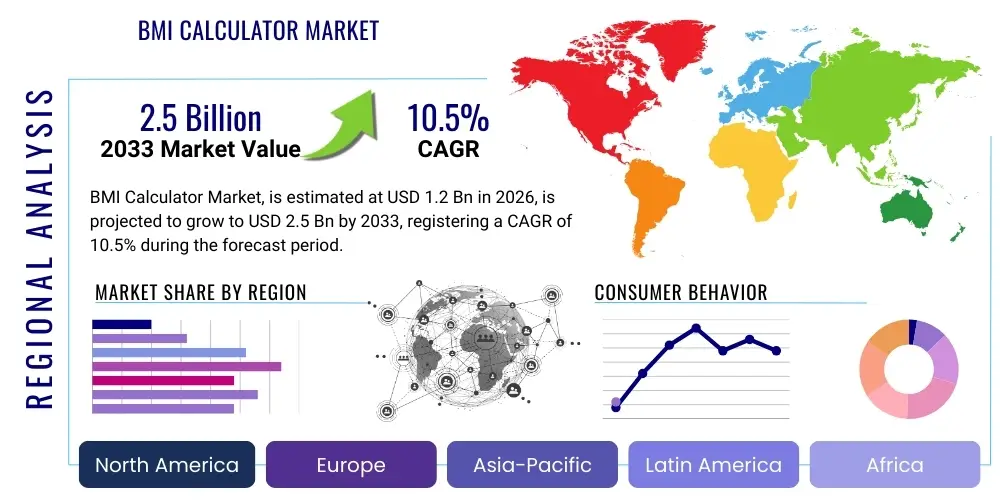

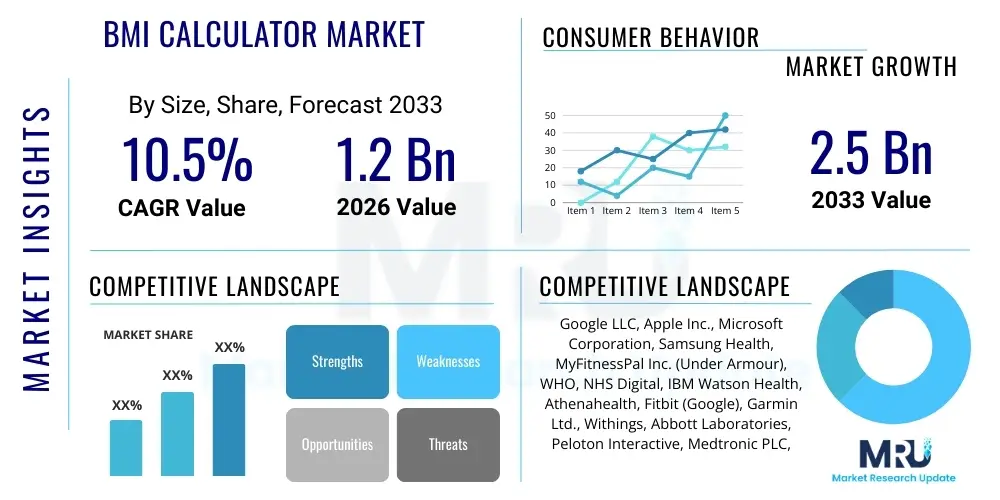

The BMI Calculator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $2.5 Billion by the end of the forecast period in 2033.

BMI Calculator Market introduction

The Body Mass Index (BMI) Calculator Market encompasses digital tools and software solutions designed to measure, track, and interpret an individual’s body weight relative to their height, providing a foundational metric for assessing potential health risks associated with weight status. These tools range from basic web-based calculators utilizing the standard mathematical formula to highly sophisticated mobile applications and integrated wearable device features that incorporate additional metrics like body fat percentage, lean muscle mass, and metabolic rate for enhanced accuracy and personalized health insights. The primary function remains the rapid and accessible determination of whether an individual falls into the underweight, normal weight, overweight, or obese category, serving as a critical first step in preventative health strategies and clinical diagnostics. The increasing global burden of chronic diseases linked to obesity, coupled with a rising consumer awareness regarding personal health management, forms the core impetus driving the adoption and evolution of these digital health instruments.

Product descriptions within this market have significantly evolved beyond simple input fields. Modern BMI calculator applications are increasingly integrating features such as historical data tracking, goal setting, customized nutritional recommendations, and seamless synchronization with electronic health records (EHRs) and other wellness platforms. Major applications span several domains, including individual health monitoring, where consumers use the tool for self-assessment and fitness progress tracking; clinical use, where healthcare providers utilize BMI data for initial screening and patient management; and corporate wellness programs, which deploy these tools to promote employee health and productivity. The simplicity of the core metric, coupled with the immediacy of digital delivery, positions the BMI calculator as an indispensable element in the broader digital health ecosystem, offering tangible benefits related to early intervention and longitudinal health data collection.

Key benefits derived from widespread use include enhanced preventative healthcare accessibility, improved patient engagement in their health journey, and the facilitation of large-scale epidemiological studies. Driving factors include the escalating global rates of obesity and associated comorbidities (such as diabetes and cardiovascular diseases), governmental initiatives promoting digital health literacy, the proliferation of smartphones and wearable technology capable of automatic data capture, and the shift toward value-based care models that emphasize proactive health management. These market dynamics necessitate continuous innovation, particularly in integrating artificial intelligence (AI) to move beyond static BMI measurement towards predictive modeling of metabolic health outcomes.

BMI Calculator Market Executive Summary

The BMI Calculator Market is experiencing robust growth driven by favorable business trends focused on personalization, integration, and regulatory compliance. Business trends indicate a strong move toward platform consolidation, where standalone BMI tools are being absorbed or integrated into larger, comprehensive digital health platforms offered by technology giants and specialized healthcare software providers. This consolidation allows for richer data analysis by combining BMI with activity tracking, sleep data, and blood markers. Furthermore, monetization strategies are shifting from purely free, ad-supported models to subscription-based premium features that offer AI-driven coaching, advanced body composition insights (beyond standard BMI limitations), and secure data sharing capabilities with clinicians. The competitive landscape is characterized by high innovation intensity, particularly concerning data privacy standards, given the sensitive nature of the health information collected, forcing developers to invest heavily in secure cloud infrastructure and compliance with regulations like HIPAA and GDPR.

Regional trends reveal distinct maturity levels and growth trajectories. North America and Europe currently dominate the market share, primarily due to high healthcare expenditure, established digital health infrastructure, and pervasive consumer adoption of wearable technology. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate. This accelerated expansion is fueled by rising disposable incomes, rapid urbanization leading to lifestyle diseases, governmental investment in smart cities and e-health projects (notably in China and India), and the vast untapped consumer base increasingly accessing health tools via low-cost mobile devices. Latin America and the Middle East & Africa (MEA) are also showing promising growth, primarily driven by corporate wellness programs targeting large enterprises and localized efforts by public health agencies to address rising obesity rates, often prioritizing mobile-first solutions tailored to limited internet bandwidth environments.

Segment trends underscore the crucial role of mobile applications, which maintain the largest market share due to unparalleled accessibility and integration with device-native sensors. However, the fastest-growing segment is expected to be Integrated Devices, particularly smart scales and advanced fitness trackers that automatically calculate and track BMI over time, offering superior accuracy and convenience compared to manual data entry. Furthermore, the application segment is witnessing a surge in clinical use, driven by healthcare providers adopting digital screening tools to streamline patient intake and remotely monitor chronic conditions. Future growth is strongly linked to the successful deployment of predictive modeling segments, which use sophisticated algorithms to estimate future health risks based on BMI trends, moving the technology from a descriptive tool to a proactive risk assessment platform.

AI Impact Analysis on BMI Calculator Market

Common user questions regarding AI in the BMI Calculator Market center around data accuracy, predictive capabilities, and ethical considerations. Users frequently ask: "How much more accurate are AI-enhanced BMI calculations compared to standard formulas?" "Can AI predict future health issues based on my BMI trend?" and "Will my personal health data be secure when processed by AI algorithms?" There is high anticipation that AI will overcome the known limitations of BMI (such as inability to distinguish muscle from fat) by integrating multimodal data streams. Conversely, concerns are raised about data transparency, potential algorithmic bias stemming from training data, and the risk of over-reliance on automated assessments without human clinical oversight. The key themes summarized are the expectation of personalized, predictive health scores beyond simple weight categories, balanced against significant privacy and algorithmic fairness concerns.

The integration of Artificial Intelligence transforms the traditional BMI calculator from a static ratio tool into a dynamic, predictive health companion. AI algorithms, particularly machine learning (ML) models, analyze vast datasets comprising BMI history, physical activity levels (via wearables), dietary intake (via linked nutrition apps), and even genetic predispositions to provide a far more nuanced assessment of body composition and metabolic risk. This advanced analysis addresses a major limitation of standard BMI by contextualizing the number; for example, distinguishing a high BMI due to muscularity from a high BMI due to excessive visceral fat. The enhanced accuracy provides clinicians and individual users with actionable insights, moving beyond simple classification to personalized intervention strategies.

Furthermore, AI facilitates highly effective personalized interventions. By analyzing usage patterns and historical health outcomes, AI can recommend optimal activity routines, caloric intake adjustments, and even lifestyle modifications that are statistically proven to be effective for individuals with similar profiles. This level of customization dramatically improves user engagement and adherence to health goals. For healthcare providers, AI-enhanced BMI data integration into EHR systems allows for automatic flagging of high-risk patients, optimizing resource allocation, and ensuring timely clinical follow-up. The technological shift driven by AI fundamentally redefines the utility and scope of BMI monitoring within both consumer wellness and professional healthcare environments.

- AI enables multimodal data fusion, integrating BMI with body fat percentage, metabolic rate, and activity levels.

- Predictive analytics use BMI trends to forecast the risk of developing type 2 diabetes, hypertension, and cardiovascular diseases.

- Machine learning algorithms enhance the accuracy of body composition estimation, overcoming standard BMI limitations.

- AI drives hyper-personalized nutritional and exercise recommendations based on individual health profiles and goals.

- Automated conversational AI chatbots provide real-time coaching and support based on BMI tracking data.

- Enhanced security and anomaly detection through AI monitoring of sensitive health data transfers.

- Algorithmic bias mitigation strategies are necessary to ensure equitable assessments across diverse populations.

DRO & Impact Forces Of BMI Calculator Market

The market for BMI calculation tools is significantly shaped by a confluence of accelerating drivers (D), persistent restraints (R), emerging opportunities (O), and pervasive impact forces (IF) that dictate strategic planning and market evolution. The primary driver is the alarming global increase in obesity prevalence, positioning BMI assessment as a foundational public health necessity for early detection and disease management. This driver is amplified by technological advancements, specifically the mainstream adoption of seamless integration capabilities between BMI platforms and IoT healthcare devices, creating comprehensive health monitoring ecosystems. However, growth is inherently restrained by the established limitations and controversies surrounding the BMI metric itself—its inability to accurately measure body fat composition, leading to potential misclassification of athletic or elderly individuals. Furthermore, concerns regarding data privacy and the lack of standardized global regulatory frameworks for digital health data pose significant hurdles, particularly in cross-border deployments, requiring complex regional compliance strategies.

Opportunities in the BMI calculator market are abundant, centered around the pivot towards holistic health metrics and specialized applications. A major opportunity lies in developing hybrid calculators that integrate BMI with other biomarkers (e.g., waist-to-hip ratio, bioelectrical impedance analysis data) to provide a Composite Health Index (CHI), offering a more medically robust assessment. Furthermore, the penetration into niche markets such as geriatric care, pediatric monitoring, and military fitness assessment presents high-value growth avenues requiring tailored solutions. The ongoing digital transformation of healthcare systems offers an institutional opportunity, enabling vendors to embed their BMI solutions directly into Electronic Health Record (EHR) systems, thereby becoming essential workflow tools for primary care physicians and specialists alike, enhancing diagnosis and monitoring efficiency dramatically.

The impact forces are predominantly societal and technological. Societal impact forces include the growing trend of consumer health empowerment and the normalization of self-quantification, where individuals actively seek out data-driven tools to manage their well-being. Technologically, the pervasive deployment of 5G networks and edge computing facilitates faster data processing and real-time feedback, making these tools more responsive and reliable. Economically, the move toward preventative health economics—where payers incentivize early intervention to reduce long-term treatment costs—strongly favors accessible and inexpensive screening tools like digital BMI calculators. The interplay between these forces necessitates continuous regulatory adaptation and technological innovation to ensure that the tools are not only accurate and accessible but also ethically sound and protective of user data.

Segmentation Analysis

The BMI Calculator Market is segmented across several dimensions, reflecting the diversity of deployment methods, end-user applications, and underlying technology used for calculation and analysis. Understanding these segments is crucial for strategic market entry and product development, as consumer expectations and clinical requirements vary significantly between platform types and end-user groups. The primary segmentation dimensions include the Platform (where the calculator is accessed), the Application (the purpose of use), the End-User (who utilizes the tool), and the underlying Technology (the complexity of the calculation mechanism). Mobile applications currently hold the largest market share due to ubiquitous smartphone ownership and ease of use, while integrated devices are projected to show the highest CAGR, signifying a shift toward automated data collection.

The diversification of segmentation highlights the market's maturity. For instance, the distinction between standard formula technology and AI-enhanced technology demonstrates the functional gap emerging in the market. Basic, free web-based calculators fulfill the need for quick assessment (Standard Formula), whereas premium clinical-grade applications rely on sophisticated machine learning to incorporate additional anthropometric data and provide predictive risk scoring (AI-Enhanced, Predictive Modeling). This technological stratification allows vendors to target specific price points and regulatory environments, ensuring compliance for clinical applications while maintaining accessibility for mass consumer markets.

Furthermore, segmentation by end-user reveals robust demand not only from individual consumers but also from institutional buyers. Corporate Wellness Programs represent a rapidly expanding segment, as companies invest in employee health monitoring as part of retention and productivity initiatives. Similarly, the Clinical Use application segment is undergoing rapid digitalization, driven by the mandate for remote patient monitoring (RPM) and the integration of basic health metrics into telehealth consultations. This comprehensive segmentation structure provides a clear roadmap for market participants to tailor their offerings, maximizing penetration across diverse operational environments.

- By Platform:

- Web-based Calculators

- Mobile Applications (iOS, Android)

- Integrated Devices (Smart Scales, Fitness Trackers)

- By Application:

- Individual Health Monitoring

- Clinical Use and Diagnostics

- Fitness and Wellness Tracking

- Research and Epidemiology

- By End-User:

- Consumers/Individuals

- Healthcare Providers (Hospitals, Clinics)

- Corporate Wellness Programs

- Public Health Organizations

- By Technology:

- Standard Formula (Basic Calculation)

- AI-Enhanced and Machine Learning Models

- Predictive Modeling and Risk Assessment

Value Chain Analysis For BMI Calculator Market

The value chain for the BMI Calculator Market is characterized by highly specialized stages, beginning with fundamental data input and culminating in integrated health delivery. The upstream segment involves the critical development of the core technology and data infrastructure. This includes R&D for calculation algorithms (both standard and advanced AI/ML), secure cloud hosting infrastructure, and the development of APIs for device integration. Key upstream players are software developers, cloud service providers (like AWS or Azure), and specialized medical informatics firms focused on biometric data processing. Success in this stage requires significant investment in data security compliance (e.g., ISO 27001 certification and regional health privacy mandates) and expertise in biostatistics to ensure algorithmic validity and reliability, forming the foundation of the final product’s credibility.

The midstream segment focuses on product manufacturing, integration, and distribution channels. For integrated devices (smart scales, wearables), this involves hardware manufacturing, quality assurance, and ensuring seamless software compatibility. For software-only solutions (web and mobile apps), this stage includes user interface/user experience (UI/UX) design, platform localization, and achieving distribution through major digital marketplaces such as the Apple App Store and Google Play Store. Distribution channels are predominantly indirect for consumer applications, leveraging these large app ecosystems. However, for clinical-grade solutions targeting hospitals and corporate wellness providers, direct sales teams and strategic partnerships with EHR vendors become the dominant and more effective distribution pathway, facilitating enterprise-level deployment and technical support.

The downstream segment revolves around market outreach, end-user utilization, and value-added services. This includes extensive marketing campaigns (often AEO-optimized content targeting health-conscious searches), providing customer support, and integrating the calculated BMI data with ancillary services like personalized coaching, nutrition planning, or remote patient monitoring platforms. The end-users—consumers, clinicians, and employers—generate crucial feedback data that closes the loop back to the upstream segment for continuous algorithm refinement and feature enhancement. The most critical value is added downstream when the BMI data transitions from a mere number into actionable intelligence that drives a positive health outcome or clinical decision.

BMI Calculator Market Potential Customers

The potential customer base for BMI calculator tools is incredibly broad, reflecting the universality of weight management as a health concern. The largest volume segment consists of individual consumers, ranging from fitness enthusiasts meticulously tracking progress to general users seeking a basic health assessment or fulfilling requirements for insurance or employment screenings. These buyers prioritize ease of use, mobile accessibility, quick data visualization, and integration with popular fitness ecosystems (e.g., Apple Health, Google Fit). Their purchasing decisions are often driven by direct-to-consumer marketing, positive app store reviews, and perceived value derived from associated premium features like personalized workout plans or specialized dietary advice.

A second, high-value customer segment comprises Healthcare Providers, including primary care physicians, bariatric specialists, cardiologists, and nutritionists. For these professional users, the BMI calculator is not merely a tool but a fundamental component of patient screening, diagnostic pathways, and longitudinal monitoring protocols, particularly in managing chronic conditions exacerbated by obesity. These institutional buyers require solutions that offer high data accuracy, stringent regulatory compliance (HIPAA, GDPR), robust integration with existing Electronic Health Records (EHRs), and clinical validation of the algorithms used. Their purchasing cycles are longer and more complex, often involving procurement departments and IT security reviews before adoption across a clinical network.

The third significant customer group involves Corporate Wellness Programs and Insurance Providers. Corporations utilize these tools as part of broader employee health initiatives aimed at reducing sick days and minimizing long-term healthcare costs. Insurers often leverage these metrics to calculate risk profiles or incentivize healthy behavior through premium adjustments. These bulk purchasers demand reliable, scalable, and customizable platforms that can handle large numbers of users while maintaining strict privacy standards. Specialized customer requirements include dashboard reporting capabilities for aggregated, anonymized group data analysis, and seamless integration with corporate human resources platforms for enrollment and incentive tracking.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $2.5 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Google LLC, Apple Inc., Microsoft Corporation, Samsung Health, MyFitnessPal Inc. (Under Armour), WHO, NHS Digital, IBM Watson Health, Athenahealth, Fitbit (Google), Garmin Ltd., Withings, Abbott Laboratories, Peloton Interactive, Medtronic PLC, Livongo Health (Teladoc), Jawbone Health, Technogym, Omron Healthcare, EufyLife. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

BMI Calculator Market Key Technology Landscape

The BMI Calculator Market is built upon a layered technological foundation that extends far beyond simple mathematical algorithms. At the core, the standard calculation utilizes basic web and mobile programming frameworks (like JavaScript, Swift, Kotlin) to execute the formula (weight in kilograms divided by height in meters squared). However, the competitive edge is found in the auxiliary technologies that enhance data collection, analysis, and presentation. Key advancements include sophisticated APIs and SDKs that enable seamless data exchange between the calculator application and IoT sensors found in wearable devices (like accelerometers and heart rate monitors) and smart scales (which often use bioelectrical impedance analysis to estimate body fat). This integration ensures automatic, friction-less data input, dramatically improving user experience and data accuracy compared to manual entry, thereby minimizing common input errors.

The deployment infrastructure heavily relies on secure, scalable cloud computing environments. Given the sensitive nature of Personal Health Information (PHI), robust encryption standards (e.g., AES-256) and compliance protocols (e.g., GDPR, HIPAA-compliant servers) are mandatory technological requirements. Furthermore, the modern landscape is dominated by the increasing utilization of Machine Learning (ML) models. These AI technologies move the calculator from a basic descriptive tool to a predictive analytical engine. ML algorithms analyze complex input variables—including demographic data, activity levels, historical weight fluctuations, and even environmental factors—to generate a Composite Health Index score that offers a more holistic risk assessment than the traditional BMI metric alone, providing clinical utility far exceeding basic consumer apps.

Advanced user-facing technologies, such as sophisticated data visualization techniques (interactive charts, graphical trend lines) and Natural Language Processing (NLP) for conversational interfaces (chatbots providing real-time feedback and encouragement), further define the technology landscape. Blockchain technology is also emerging as a niche but high-potential area, primarily explored for enhancing the security and immutability of shared health records, providing users with transparent control over who accesses their BMI and associated biometric data. The convergence of secure cloud infrastructure, advanced machine learning, and IoT connectivity defines the leading-edge technology used for sophisticated BMI assessment and tracking solutions.

Regional Highlights

Regional dynamics play a crucial role in shaping the BMI Calculator Market, reflecting variations in digital health maturity, healthcare regulatory environments, and the prevalence of obesity. North America, encompassing the United States and Canada, currently holds the largest market share. This dominance is attributable to high consumer awareness of health metrics, significant disposable income fueling the purchase of integrated wearable devices, and a well-established digital health infrastructure supported by major technology companies. Furthermore, the presence of stringent regulatory bodies, like the FDA, encourages the development of high-quality, clinical-grade applications, driving investment in AI and advanced integration capabilities necessary for remote patient monitoring (RPM) and specialized clinical use cases, thereby pushing market value higher.

Europe represents a mature market characterized by robust regulatory scrutiny (GDPR) and strong governmental focus on preventative public health initiatives. Countries in Western Europe, such as Germany, the UK, and France, exhibit high adoption rates due to universal healthcare systems that increasingly integrate digital tools to manage chronic diseases. The emphasis here is on secure, localized, and multilingual applications that seamlessly integrate into national health service portals (like NHS Digital in the UK). While the growth rate may be slower than in developing regions, the European market prioritizes high standards for data governance and clinical utility, often setting global benchmarks for privacy-compliant digital health solutions.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market. This exponential growth is spurred by rapid urbanization, which is contributing significantly to lifestyle-related health challenges, and massive investment in mobile infrastructure. Key contributors include China, India, and Southeast Asian nations, where the vast majority of the population accesses the internet and health services primarily via mobile devices. The market in APAC is driven by the need for low-cost, scalable solutions to address public health crises, often involving large-scale governmental or private corporate wellness initiatives. Adoption is high, focused heavily on mobile app solutions that are often ad-supported or freemium, emphasizing volume and accessibility over deep clinical integration found in North America.

- North America (USA, Canada): Market leader; driven by high wearable adoption, significant R&D in AI, and advanced clinical integration (HIPAA compliance).

- Europe (UK, Germany, France): Mature market; characterized by strict GDPR standards, strong public health integration, and focus on security and multilingual support.

- Asia Pacific (China, India, Japan): Fastest-growing region; powered by increasing obesity rates, mobile-first strategies, and large-scale governmental wellness programs.

- Latin America (Brazil, Mexico): Emerging market; growth driven by corporate wellness adoption and rising middle-class healthcare spending.

- Middle East & Africa (UAE, Saudi Arabia, South Africa): Niche growth; focused on addressing unique lifestyle disease burdens and leveraging digital tools in areas with limited physical healthcare infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the BMI Calculator Market.- Google LLC

- Apple Inc.

- Microsoft Corporation

- Samsung Health

- MyFitnessPal Inc. (Under Armour)

- WHO (World Health Organization - for public domain standardization)

- NHS Digital

- IBM Watson Health

- Athenahealth

- Fitbit (Google)

- Garmin Ltd.

- Withings

- Abbott Laboratories

- Peloton Interactive

- Medtronic PLC

- Livongo Health (Teladoc Health)

- Jawbone Health

- Technogym

- Omron Healthcare

- EufyLife (Anker Innovations)

Frequently Asked Questions

Analyze common user questions about the BMI Calculator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key limitations of the standard BMI formula in modern healthcare?

The standard BMI formula is limited because it calculates weight relative to height but fails to distinguish between lean muscle mass and body fat. This often leads to misclassification, where muscular individuals may be incorrectly categorized as overweight, while sedentary individuals with high body fat but low muscle mass may fall into the normal range, potentially masking genuine health risks.

How is AI transforming the accuracy and utility of digital BMI tools?

AI transforms BMI tools by integrating multimodal data (like activity, age, gender, and bioelectrical impedance data) alongside basic BMI metrics. Machine learning models use this comprehensive dataset to provide a more accurate estimation of body composition and metabolic risk, moving the tool beyond simple classification to personalized, predictive health risk assessment.

Which market segment is projected to experience the fastest growth rate?

The Integrated Devices segment, which includes smart scales and fitness trackers that automatically measure and transmit BMI data, is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This growth is driven by consumer demand for convenience, automation, and superior data accuracy compared to manual input via web or mobile apps.

What is the primary factor driving the adoption of BMI calculators in corporate settings?

Corporate adoption is primarily driven by the imperative to reduce long-term healthcare expenditure and improve employee productivity. BMI tracking is integrated into broader corporate wellness programs as a standardized, easily measurable metric for assessing general population health and encouraging preventative health behaviors among staff.

What critical regulatory compliance issues affect BMI calculator developers globally?

Developers must navigate complex, region-specific data privacy regulations, particularly the European Union's GDPR and the United States' HIPAA. Compliance requires robust data encryption, secure data handling protocols, clear consent mechanisms, and often necessitates geographically segregated data storage to legally process and manage sensitive Personal Health Information (PHI).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager