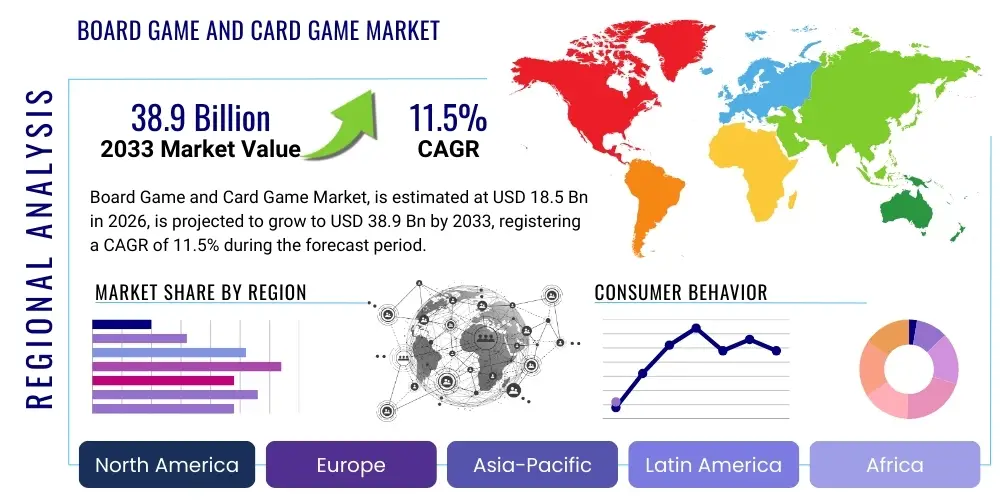

Board Game and Card Game Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438752 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Board Game and Card Game Market Size

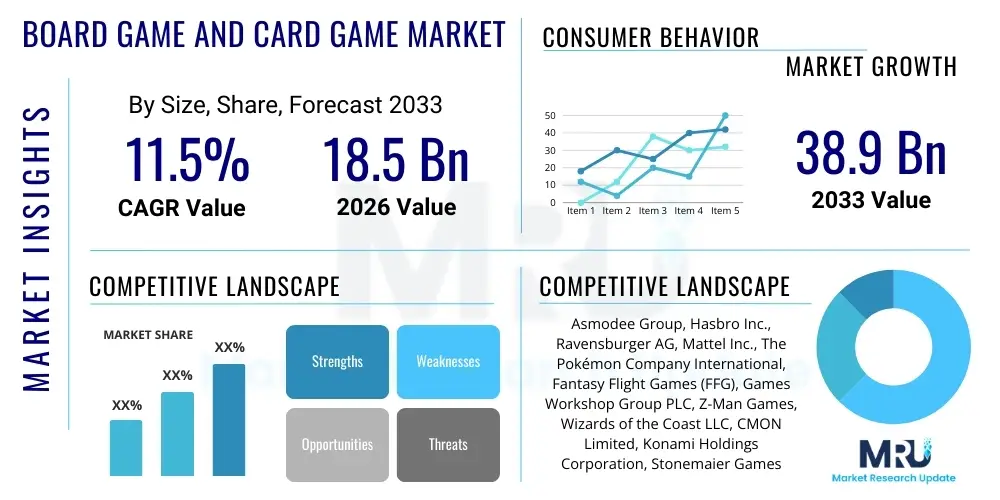

The Board Game and Card Game Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $18.5 Billion in 2026 and is projected to reach $38.9 Billion by the end of the forecast period in 2033. This robust expansion is fueled by a confluence of factors, including increasing consumer disposable income, a strong cultural shift towards communal leisure activities, and technological advancements that enhance the physical gameplay experience. The market demonstrates significant resilience against purely digital entertainment alternatives by offering tangible, high-quality social interactions.

The valuation reflects sustained consumer interest across core segments, particularly strategy-based board games and collectible card games (CCGs). While traditional games maintain a stable base, modern, complex, and narrative-driven games (often categorized as hobby games) are the primary growth engine. These premium products command higher average selling prices and benefit from strong repeat purchases driven by expansion packs and accessory sales. Geographic expansion into emerging economies, especially in Asia Pacific, further solidifies the long-term upward trajectory of market valuation and volume growth, positioning tabletop gaming as a globally recognized and valued form of entertainment.

Board Game and Card Game Market introduction

The Board Game and Card Game Market encompasses the development, manufacturing, distribution, and sale of physical, non-electronic games primarily played on a tabletop. Products range from traditional classics (e.g., Chess, Monopoly) to complex modern strategy games (Eurogames, Ameritrash), role-playing game systems, and collectible card games (CCGs). Major applications center around entertainment, social interaction, educational tools, and intellectual stimulation. The core benefit derived by consumers is the fostering of real-world community building and the cognitive engagement necessary for strategic planning and problem-solving. This sector thrives on high-quality component design, immersive thematic content, and mechanics that encourage repeated playability and engagement.

Key drivers propelling the market include a powerful resurgence of interest in analog entertainment as a counterpoint to pervasive digital screen time, often termed the "digital detox" phenomenon. Furthermore, the effectiveness of crowdfunding platforms (like Kickstarter) has lowered entry barriers for independent designers, leading to a proliferation of innovative game titles and genres that cater to highly specific niche demographics. Social trends supporting community gatherings, family game nights, and organized play events further institutionalize board and card games as central elements of modern leisure culture. The COVID-19 pandemic, paradoxically, accelerated market penetration as consumers sought at-home, high-engagement entertainment, leading to sustained demand post-lockdown.

The fundamental product categories within this market segmentation include strategy board games characterized by complex rules and low reliance on luck; party games designed for large groups with simple mechanics; educational games focused on learning outcomes; and CCGs, which rely on the continuous release of new content to drive sustained sales and competitive play. The successful market strategy often involves sophisticated intellectual property (IP) management, high-fidelity components (e.g., custom miniatures, durable card stock), and robust distribution networks capable of handling both mass-market retail and specialized hobby stores. This continuous innovation in mechanics and components keeps the consumer base engaged and willing to invest in new releases, ensuring market vitality.

Board Game and Card Game Market Executive Summary

The Board Game and Card Game Market is defined by dynamic business trends emphasizing premiumization, community-driven marketing, and the strategic integration of digital elements. Business trends show a strong shift towards direct-to-consumer (D2C) models, often leveraged via successful crowdfunding campaigns that serve not only as funding sources but also as highly effective pre-order and community-building platforms. Licensing of established intellectual properties (IPs) from film, television, and video games remains a critical factor in mitigating launch risk and ensuring rapid market adoption. Furthermore, sustainability in manufacturing, utilizing recycled or responsibly sourced materials, is emerging as a critical competitive differentiator, aligning with evolving consumer ethical preferences. This focus on premium quality and ethical production underscores the market's maturity and sophisticated consumer base.

Regionally, North America and Europe maintain dominance due to established hobbyist cultures, high disposable incomes, and the presence of major global publishers and specialized retail chains. However, Asia Pacific (APAC) is projected to exhibit the fastest growth trajectory, driven by massive untapped populations, increasing urbanization, and the rapid adoption of Western-style leisure activities, particularly in China and India. The regional landscape is characterized by tailored content localization and distribution strategies to overcome linguistic and cultural barriers. Segment trends highlight the consistent strength of Collectible Card Games (CCGs) fueled by competitive organized play circuits, while the board game sector sees robust growth in the "Legacy" format—games that permanently change based on player decisions across multiple sessions, offering deep narrative depth and unique replay value. Strategy games targeting adult players continue to outperform simple, mass-market offerings in terms of revenue per unit.

The overall market trajectory is highly positive, driven by the inherent social value of tabletop gaming. Key challenges relate to inventory management, combating piracy (especially for high-value component games), and navigating increasingly complex global logistics chains. Successful companies are those that master omnichannel sales strategies, balancing specialized hobby store loyalty with the broad reach of e-commerce platforms. The emphasis on component quality and unique gameplay mechanics ensures that the barrier to entry remains relatively high for manufacturers, reinforcing the market position of established publishers who possess the necessary capital and operational expertise for large-scale production runs and global fulfillment.

AI Impact Analysis on Board Game and Card Game Market

User inquiries regarding AI's influence in the tabletop sector primarily focus on four key areas: how AI can accelerate or optimize the game design and testing process; the potential for AI integration to enhance digital companion apps or hybrid games; the use of AI in personalizing consumer recommendations and inventory forecasting; and concerns about whether AI-generated content (art, mechanics) might dilute the creative value of human designers. Users are generally curious about efficiency gains but remain highly protective of the traditional, human-centric nature of tabletop creativity, viewing AI as a tool for optimization rather than a replacement for core design intuition. The overriding sentiment is the expectation that AI should enhance the player experience without sacrificing the tangible, non-digital appeal of the physical product, particularly in complex strategy games where perfect information or algorithmic predictability could undermine the fun of human-to-human rivalry.

AI's role in product development is becoming increasingly sophisticated. Machine learning algorithms are being employed to analyze extensive playtesting data, identifying mechanical imbalances, dominant strategies, and potential exploit loops far more rapidly than traditional manual testing. This allows designers to iterate on rulesets and balance components with unprecedented efficiency, drastically reducing the time-to-market for complex titles. Furthermore, AI can generate vast amounts of scenario, puzzle, or card text variants, serving as a powerful brainstorming partner for human designers. While the final creative touch remains manual, AI accelerates the prototyping phase, especially in procedural content generation for narrative or randomization-heavy games, thus democratizing the creation of intricate tabletop experiences.

In the consumer-facing sphere, AI is crucial for optimizing the commercial aspects of the market. Sophisticated recommendation engines analyze player preferences, ownership history, and community discussions to deliver hyper-personalized suggestions, driving both new game purchases and sales of expansion content. For retailers and publishers, AI-driven demand forecasting optimizes supply chain management, minimizing stockouts of popular items and reducing obsolete inventory, a major operational challenge in this high-SKU, low-volume segment. Although the physical game remains the core product, AI integration through companion apps can manage complex rule tracking, provide dynamic opponent behavior (in solo play modes), or offer lore depth, enhancing engagement without requiring the game itself to become digital.

- Accelerated Playtesting and Balancing: AI algorithms rapidly simulate millions of gameplay sessions to identify mechanical flaws and optimal strategies.

- Personalized Recommendation Engines: Machine learning models analyze player profiles and purchasing habits to suggest niche game titles and accessories.

- Dynamic Content Generation: AI assists in generating randomized components, narrative prompts, and card text variants for rapid prototyping.

- Optimized Supply Chain Logistics: Utilizing predictive analytics to forecast demand for specific expansions and core sets, minimizing inventory risk.

- Enhanced Companion Applications: AI manages complex rule lookups, score tracking, or acts as a scalable, adaptive solo-player opponent.

- Anti-Counterfeiting Measures: AI vision systems aid in validating component authenticity during quality control processes.

DRO & Impact Forces Of Board Game and Card Game Market

The Board Game and Card Game Market is primarily driven by a powerful desire for authentic, face-to-face social engagement and the rising consumer recognition of the cognitive benefits associated with strategic play. Key restraints include the inherent challenges of physical product manufacturing, such as high tooling costs, reliance on volatile raw material pricing (paper, plastic), and the significant logistics costs associated with shipping bulky items globally. Opportunities abound in the educational sector, leveraging games for structured learning environments, and in the hybridization of physical and digital products through integrated applications. The principal impact forces center on cultural acceptance of tabletop gaming as a mainstream hobby and the economic viability of crowdfunding as a disruptive model for product launch and distribution.

Drivers include the widespread recognition of board games as a mechanism for reducing screen fatigue, offering a tangible, tactile experience that contrasts sharply with digital consumption. The growth of specialized hobby communities and dedicated gaming conventions further supports persistent demand, fostering a strong culture of collecting and repeat purchases. Economically, the relatively high perceived value and lifespan of a high-quality board game compared to other forms of entertainment make it an attractive consumer investment. Furthermore, successful integration of themes appealing to adult demographics, such as complex historical simulations or deep fantasy narratives, has expanded the addressable market well beyond traditional family-based entertainment.

Restraints are often operational and cost-related. The physical nature of the product necessitates large storage facilities and complex global freight management, which are susceptible to geopolitical and logistical disruptions. Component complexity, particularly the inclusion of custom miniatures or intricate wooden pieces, mandates stringent quality control and high minimum order quantities (MOQs), posing financial risks, especially for smaller publishers. Opportunities exist in diversifying revenue streams through digital extensions (online rulebooks, virtual tabletops), expanding intellectual property licensing for ancillary products (merchandise, apparel), and penetrating untapped demographic segments such as older adults seeking cognitive engagement and therapeutic activities. The primary impact forces shaping the market involve rapid changes in crowdfunding platform policies and the rising influence of social media channels in driving immediate market adoption or failure for new titles, placing high pressure on initial marketing efforts.

Segmentation Analysis

The Board Game and Card Game Market is comprehensively segmented based on product type, theme, distribution channel, and end-user demography, allowing for granular analysis of market penetration and growth vectors. The product type segmentation typically divides the market into Board Games (further sub-categorized by type: strategy, party, educational, etc.), Collectible Card Games (CCGs), Trading Card Games (TCGs), and Puzzle Games. Theme segmentation includes Fantasy, Sci-Fi, Historical, Educational, and Abstract, reflecting diverse consumer preferences. Distribution is bifurcated between online retail, specialized hobby shops, mass-market retail, and direct-to-consumer models, each offering unique margins and reach. End-users are generally classified by age group (children, adults, families) and player commitment level (casual, hobbyist, competitive).

- By Product Type:

- Board Games (Strategy, Party, Educational, Abstract, War Games)

- Collectible Card Games (CCGs) / Trading Card Games (TCGs)

- Miniature Games

- Dice Games and Role-Playing Games (RPGs)

- By Theme:

- Fantasy and Adventure

- Science Fiction

- Historical and Military

- Educational and STEM

- Abstract and Logic

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Publisher D2C)

- Offline Retail (Specialty Stores, Mass-Market Retailers, Department Stores)

- Crowdfunding Platforms

- By End-User:

- Children (Ages 5-12)

- Teenagers and Young Adults (Ages 13-25)

- Adults and Families (Ages 26+)

Value Chain Analysis For Board Game and Card Game Market

The value chain for the Board Game and Card Game Market is complex, beginning with raw material sourcing and intellectual property conceptualization, moving through specialized manufacturing, and culminating in multi-channel distribution. Upstream analysis focuses on securing raw materials, primarily high-grade paperboard, card stock, plastics (for miniatures and dice), and often wood or metal components. Key upstream activities also involve professional graphic design and meticulous rule development, followed by securing intellectual property rights or original content creation. Downstream analysis emphasizes warehousing, sophisticated logistics, and managing inventory across diverse retail environments, which range from small, independent hobby stores requiring personalized service to large e-commerce fulfillment centers demanding scale and efficiency. The highly specialized nature of the components requires reliable relationships with niche suppliers capable of high-fidelity printing and bespoke tooling.

Distribution channels are critical determinants of profitability and market reach. The channel structure is typically split into direct and indirect methods. Direct channels involve publishers selling straight to consumers via their websites or highly successful crowdfunding campaigns, allowing for maximum margin capture and direct customer feedback. Indirect channels rely on a network of international and regional distributors, who manage inventory risk and logistics for specialized retailers and mass-market outlets. The choice of channel significantly impacts pricing; specialty shops often rely on distributors for smaller, specialized stock orders, while mass retailers demand bulk, discounted pricing directly from the publisher. Maintaining balanced inventory across these diverse channels is a perennial challenge.

The value added at each stage is substantial. Designers and artists add crucial IP value, while manufacturers contribute quality and scale. However, the most significant value addition in the contemporary market often occurs at the marketing and community engagement stages, where publishers transform a physical product into a recognized brand through social media influence, organized play support, and convention presence. The success of a game hinges not just on its mechanics, but on the publisher's ability to cultivate a loyal, engaged community that drives word-of-mouth promotion and sustained purchasing of expansions and related products. This community engagement is a vital differentiator against generic, low-cost competition.

Board Game and Card Game Market Potential Customers

Potential customers for the Board Game and Card Game Market span a wide demographic range, segmented primarily by interest level, age, and socioeconomic profile. The core buyer base consists of dedicated hobbyists and competitive players (often young adults and professionals aged 18-45) who seek complex strategy games, high-value collectible card products, and immersive narrative experiences. These consumers are typically willing to pay premium prices for custom components, deep rule systems, and ongoing content releases, driven by a passion for the genre and participation in local and national organized play circuits. Their purchasing decisions are heavily influenced by online reviews, designer reputation, and community buzz.

A second major segment comprises families and casual players who prioritize easy-to-learn mechanics, high replayability, and accessibility for mixed-age groups. These end-users, often purchasing through mass-market retail channels, seek established brands, party games, or titles with strong educational merit. The purchasing drivers here include the need for family bonding activities, easy setup, and universally appealing themes. This segment is less sensitive to component exclusivity but highly sensitive to price and immediate availability, representing the largest volume but lower average value per transaction.

A burgeoning third segment includes educational institutions, corporate training programs, and therapeutic practices. These institutional buyers leverage the inherent benefits of strategic games for teaching complex concepts, fostering team-building, and enhancing cognitive resilience. Specific products are often tailored or modified for didactic purposes, focusing on subjects like history, resource management, or critical thinking. This segment requires robust, durable components and clear learning outcomes, presenting a strong opportunity for specialized B2B offerings and long-term contracts outside traditional retail cycles. These diverse buyer profiles necessitate multi-faceted product development and distribution strategies to maximize market penetration across all key demographics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $18.5 Billion |

| Market Forecast in 2033 | $38.9 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Asmodee Group, Hasbro Inc., Ravensburger AG, Mattel Inc., The Pokémon Company International, Fantasy Flight Games (FFG), Games Workshop Group PLC, Z-Man Games, Wizards of the Coast LLC, CMON Limited, Konami Holdings Corporation, Stonemaier Games, Renegade Game Studios, Czech Games Edition, Rio Grande Games, Capstone Games, Japanime Games, IELLO, Portal Games, GMT Games |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Board Game and Card Game Market Key Technology Landscape

While fundamentally an analog market, technology plays a crucial supporting role, primarily through enhancing the physical experience, streamlining production, and facilitating community interaction. The key technology landscape involves the adoption of companion applications for complex rule management, scorekeeping, and dynamic solo modes, effectively bridging the gap between physical components and digital efficiency. This hybridization, often through QR codes or near-field communication (NFC) chips embedded in components, allows games to offer more immersive, variable, and complex narratives without adding prohibitive complexity to the physical rulebook. Furthermore, advanced digital printing and 3D prototyping technologies are revolutionizing the manufacturing pipeline, enabling faster iteration cycles and the production of highly detailed custom miniatures and game components that were previously cost-prohibitive.

Advanced manufacturing technologies, specifically precision tooling and injection molding, are essential for maintaining the high quality expected by hobbyist consumers, particularly in the miniature and custom dice segments. Innovations in material science are also being applied, leading to the development of more sustainable and durable components, such as recycled plastics and laminated, spill-resistant card stock. On the consumer interaction front, augmented reality (AR) technology is slowly being incorporated, allowing players to overlay digital graphics or animations onto the physical board via smart devices, adding visual spectacle and depth to the gameplay experience. This technological integration aims to enhance the tactile nature of the game rather than replace it, preserving the core appeal of tabletop interaction while benefiting from digital capabilities.

The reliance on robust e-commerce and logistics platforms represents another significant technological requirement. Publishers utilize sophisticated Inventory Management Systems (IMS) and Customer Relationship Management (CRM) tools to manage the global supply chain, coordinate crowdfunding fulfillment, and handle localized sales tax and shipping complexity. The strategic use of data analytics derived from online sales and community forums helps publishers identify emerging trends, forecast demand spikes for expansion packs, and optimize print runs. Technology is thus utilized not just in the product itself, but across the entire lifecycle, from design optimization to personalized post-sale customer engagement, ensuring operational efficiency and market responsiveness.

Regional Highlights

The global Board Game and Card Game Market exhibits distinct regional dynamics, driven by cultural acceptance, disposable income levels, and the maturity of distribution infrastructure.

- North America (NA): This region holds the largest market share, characterized by a highly established hobby gaming culture, the dominance of major publishers, and a sophisticated network of specialty retailers. Growth is driven by premium, high-value strategy games and the persistent popularity of major Trading Card Games (TCGs). Crowdfunding success rates are highest here, indicating a strong consumer appetite for new, innovative concepts and high-component complexity.

- Europe: Europe represents the second-largest market, historically anchored by German-style board games (Eurogames) focused on strategy and resource management. The market is fragmented but highly engaged, with strong growth observed in Central and Eastern European countries. Consumer preference leans towards well-tested, high-quality, and often aesthetically subtle designs. Key growth drivers include the prevalence of board game cafés and strong community support for localized versions of global hits.

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by economic development, urbanization, and the adoption of Western entertainment trends in countries like China, Japan, and South Korea. While Japan has a historically strong TCG and RPG presence, China is rapidly emerging as a massive potential market for Western-style strategy games. The region presents significant opportunities for localized content, particularly fantasy and historical themes relevant to regional myths and history. Challenges include diverse language requirements and regulatory complexities.

- Latin America: This region is a developing market with high potential, constrained currently by lower average disposable income and less mature specialized retail infrastructure. Growth is focused primarily on mass-market, affordable games, though an increasing middle class is beginning to drive demand for mid-range strategy titles. E-commerce penetration is key to bypassing traditional distribution hurdles.

- Middle East and Africa (MEA): MEA represents the smallest market share but shows nascent growth, particularly in urban centers of the GCC nations. Demand is highly dependent on cultural factors and leisure trends. The adoption of tabletop gaming here is largely linked to the presence of multinational retail chains and the growing influence of global media trends.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Board Game and Card Game Market.- Asmodee Group

- Hasbro Inc.

- Ravensburger AG

- Mattel Inc.

- The Pokémon Company International

- Fantasy Flight Games (FFG)

- Games Workshop Group PLC

- Z-Man Games

- Wizards of the Coast LLC

- CMON Limited

- Konami Holdings Corporation

- Stonemaier Games

- Renegade Game Studios

- Czech Games Edition

- Rio Grande Games

- Capstone Games

- Japanime Games

- IELLO

- Portal Games

- GMT Games

Frequently Asked Questions

Analyze common user questions about the Board Game and Card Game market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current growth surge in the Board Game Market?

The primary driver is the widespread consumer desire for "digital detox"—seeking authentic, face-to-face social interaction and tangible, analog entertainment as an alternative to screen-based activities. Additionally, sophisticated game design, high production quality, and the success of direct-to-consumer crowdfunding models fuel expansion.

How significant is the role of Collectible Card Games (CCGs) versus standard board games?

CCGs, particularly flagship franchises like Pokémon and Magic: The Gathering, represent a crucial, high-value segment characterized by robust competitive play and recurring revenue through content expansion. While board games (especially strategy titles) drive unit volume, CCGs contribute significantly to overall market revenue and long-term player engagement.

Which geographic region exhibits the highest growth potential for tabletop games?

The Asia Pacific (APAC) region, driven by rapidly increasing disposable incomes, urbanization, and growing cultural acceptance of Western leisure activities in China and India, is projected to achieve the highest Compound Annual Growth Rate (CAGR) in the forecast period.

What major challenges constrain the expansion of the Board Game and Card Game Market?

Key constraints include the volatility and high cost of raw materials (paper, plastic), coupled with complex, expensive global logistics for shipping bulky physical products. Intense competition for limited retail shelf space and the difficulty in inventory management for hundreds of unique SKUs also pose significant challenges.

How are technology and AI integrating with traditional board and card games?

Technology enhances the analog experience through companion apps that manage complex rules, automate scoring, and facilitate solo play. AI is primarily used upstream for accelerating playtesting, balancing game mechanics, and optimizing consumer personalization and supply chain forecasting, rather than replacing the physical core product.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager