Boat Radar Reflectors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431849 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Boat Radar Reflectors Market Size

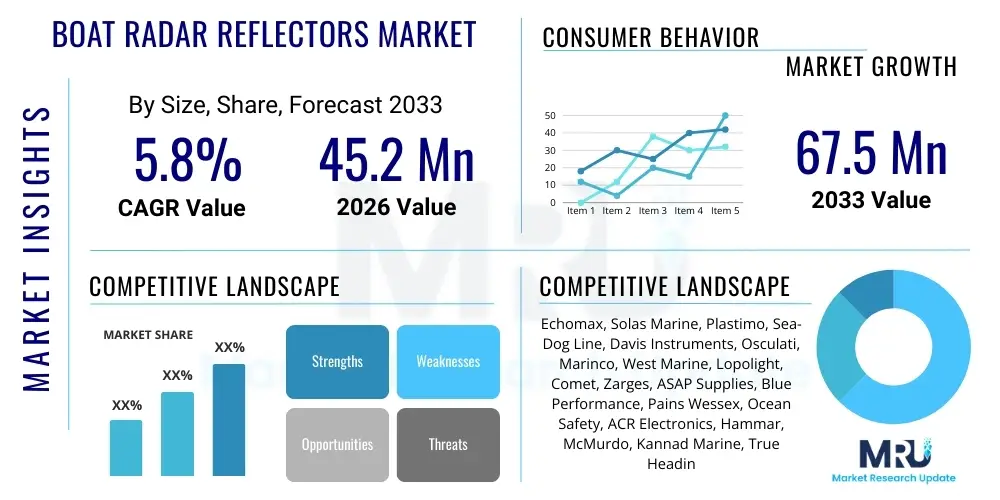

The Boat Radar Reflectors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $45.2 Million in 2026 and is projected to reach $67.5 Million by the end of the forecast period in 2033.

Boat Radar Reflectors Market introduction

The Boat Radar Reflectors Market encompasses devices designed to enhance the radar visibility of vessels, particularly smaller craft, to ensure collision avoidance and improve overall maritime safety. These critical safety components, mandated by various international maritime regulations (such as IMO and SOLAS requirements for certain vessel types), operate by reflecting radar signals back to the transmitting radar unit, thereby increasing the apparent size and detectability of the boat. The primary products include passive corner reflectors, stack arrays, and increasingly, active radar enhancers (transponders) which offer superior performance in complex environments.

The major applications for radar reflectors span across recreational boating, commercial fishing vessels, sailboats, and search and rescue operations. Their fundamental benefit lies in mitigating collision risk, especially in low visibility conditions, congested waterways, or during night navigation. The continuous rise in global recreational boating activity, coupled with stringent safety standards imposed by regulatory bodies worldwide, acts as a primary driving factor for market expansion. Furthermore, technological advancements leading to more efficient, lighter, and high-performance active reflectors are accelerating adoption across high-value commercial fleets.

Key driving factors include the global focus on marine safety, the proliferation of smaller, non-mandated vessels entering heavy traffic areas, and continuous innovation in material science that allows for the production of durable and highly effective passive reflectors. Market growth is also influenced by replacement cycles, as older, less effective reflectors are phased out in favor of modern, standardized designs that comply with rigorous performance standards, such as ISO 8729-1 or RORC guidelines. The market remains sensitive to fluctuations in new boat construction rates and general economic health affecting discretionary spending on recreational marine accessories.

Boat Radar Reflectors Market Executive Summary

The Boat Radar Reflectors Market is characterized by steady, regulation-driven growth, emphasizing the shift towards high-performance active reflector systems while maintaining a large installed base for cost-effective passive reflectors. Business trends indicate a focus on material optimization, with manufacturers increasingly utilizing lightweight, corrosion-resistant polymers and specialized metals to improve efficiency without adding significant weight or bulk, appealing particularly to the sailing and high-speed vessel segments. Strategic partnerships between manufacturers and boat builders are becoming crucial for integrating reflection solutions seamlessly into new vessel designs, driving enhanced product visibility and market penetration.

Regionally, Europe and North America currently dominate the market due to high rates of recreational boating participation, established maritime safety cultures, and strict national and international regulations mandating the use of radar reflectors on specified vessels. However, the Asia Pacific region is demonstrating the highest growth trajectory, fueled by rapid expansion in commercial fishing fleets, significant naval investments, and the burgeoning leisure marine sector in countries like China and Australia. Regulatory harmonization across different trade blocks is also influencing product design and distribution efficiency globally.

Segment-wise, passive reflectors maintain market share volume due to their low cost and reliability, but the active reflector segment is leading in terms of revenue growth rate (CAGR), driven by increasing awareness among vessel owners regarding the performance gap between passive and active systems. Within materials, the metal-based corner reflector subsegment remains the benchmark for performance, although the use of advanced plastics and composites in smaller, easily mountable designs is gaining traction. The leisure segment remains the largest end-user, though the commercial segment provides more stable, high-volume demand due to regulatory compliance requirements for vessels over a certain size.

AI Impact Analysis on Boat Radar Reflectors Market

User inquiries regarding AI's impact on boat radar reflectors primarily center on the potential for AI-driven maritime traffic management systems to utilize or potentially supersede traditional reflector technology. Common questions involve whether AI-powered collision avoidance systems on large vessels will render passive reflectors obsolete, and how machine learning (ML) can be integrated into next-generation active radar enhancers to optimize signal recognition and filtering. Users are keenly interested in predictive analytics capabilities—specifically, if AI can process reflector performance data in real-time, factoring in atmospheric conditions and sea state, to offer predictive safety alerts far beyond current capabilities. There is an expectation that AI will standardize detection thresholds and potentially lead to smarter, regulatory-compliant systems that dynamically adjust their reflection characteristics based on situational awareness data.

The integration of artificial intelligence and machine learning is not directly altering the physical design of basic passive radar reflectors, but it is profoundly influencing the associated ecosystem, particularly in the realm of active radar enhancers and overall maritime surveillance systems. AI algorithms are being deployed in advanced radar processing units on large commercial vessels and naval craft to filter noise, classify detected targets based on their reflection signature (including recognizing specific reflector types), and significantly reduce false positives. This improved radar processing necessitates higher standards for reflector performance, encouraging manufacturers to focus on highly reliable and consistent radar cross-section (RCS) output, thereby accelerating the shift towards standardized, performance-certified devices.

Furthermore, AI is instrumental in the development of autonomous and semi-autonomous maritime vessels. These vessels rely heavily on sophisticated sensor fusion, where radar data (enhanced by effective radar reflectors on other vessels) is merged with AIS, GPS, and optical data. AI algorithms manage the complex task of collision prediction and path planning. For the Boat Radar Reflector market, this means future regulatory frameworks might increasingly differentiate between vessels based on their compliance with systems designed to interact optimally with AI-driven navigation stacks. The ability of a reflector to provide a clean, discernible signature is therefore becoming a key performance metric driven by AI-enabled detection technology.

- AI-driven radar processing enhances target discrimination, requiring higher fidelity from reflectors.

- Machine Learning improves active radar enhancer efficiency by optimizing signal gain and filtering environmental noise.

- Autonomous vessel navigation relies on robust radar data, increasing demand for standardized, high-RCS reflectors.

- Predictive analytics tools leverage historical reflector performance data to inform regulatory updates and safety protocols.

- AI systems may eventually lead to dynamic regulatory enforcement based on real-time reflector performance assessment.

DRO & Impact Forces Of Boat Radar Reflectors Market

The Boat Radar Reflectors Market is primarily driven by strict international and regional safety regulations (Drivers), faces limitations due to the high cost of advanced active systems and installation complexity (Restraints), and presents substantial growth opportunities in the expanding autonomous shipping sector and emerging markets (Opportunities). The key impact forces dictating market trajectory include the continuous regulatory pressure exerted by organizations like the International Maritime Organization (IMO) and national coast guard agencies, technological advancements in material science improving performance-to-weight ratios, and persistent price sensitivity among recreational vessel owners.

Key drivers center on the global focus on mitigating marine accidents. The implementation and enforcement of SOLAS (Safety of Life at Sea) requirements, even extending applicability to non-convention vessels in many jurisdictions, forces boat owners to install certified reflectors. The rapid growth in leisure boating activities globally, particularly post-pandemic, has increased the density of small craft in coastal waters, making reliable detection crucial for safety. Additionally, the development of standardized performance benchmarks, such as those published by the RORC (Royal Ocean Racing Club) and ISO 8729, drives replacement demand for reflectors that meet superior specifications, supporting market value growth.

However, the market is restrained by several factors. The initial high cost and complexity associated with active radar enhancers (requiring electrical power and careful installation) deter many cost-sensitive recreational users who opt for cheaper, lower-performing passive solutions. Furthermore, educating end-users about proper mounting height and location—which significantly affects performance—remains a persistent challenge, leading to dissatisfaction with passive systems that are improperly installed. Opportunities lie primarily in the convergence of radar reflector technology with other digital safety tools, such as AIS (Automatic Identification System) transponders. Furthermore, the burgeoning market for unmanned surface vehicles (USVs) and autonomous ships represents a crucial new application area where superior, certified reflection capabilities are paramount for safe integration into mixed-traffic waterways.

Segmentation Analysis

The Boat Radar Reflectors Market is segmented primarily based on Product Type, Material, Application, and End-User. Analyzing these segments reveals diverse demand patterns influenced heavily by compliance requirements, vessel size, and operational environment. The segmentation allows manufacturers to tailor solutions, ranging from cost-effective passive reflectors for small dayboats to sophisticated, integrated active systems for large commercial yachts or naval patrol craft. Understanding the dynamics across these segments is critical for forecasting, particularly recognizing the accelerating adoption of active systems despite their higher price point, driven by performance mandates in heavy traffic zones.

- Product Type:

- Passive Radar Reflectors (Corner Reflectors, Plate Reflectors, Lens Reflectors)

- Active Radar Reflectors (Radar Target Enhancers)

- Material:

- Metal-based (Aluminum, Stainless Steel)

- Plastic/Composite-based

- Application:

- Sailboats

- Motorboats and Trawlers

- Life Rafts and Emergency Signaling

- End-User:

- Recreational/Leisure Marine

- Commercial Vessels (Fishing, Ferries, Cargo)

- Military and Defense

Value Chain Analysis For Boat Radar Reflectors Market

The value chain for the Boat Radar Reflectors Market begins with the upstream procurement of specialized materials, primarily high-grade aluminum alloys or stainless steel for maximum reflection efficiency, and advanced polymers for housing and mounting structures. Manufacturers specializing in maritime safety equipment convert these raw materials into finished passive or active reflector units. For active systems, the upstream supply chain also involves securing sophisticated electronic components, including signal processing chipsets, antennae, and power management modules. Efficiency at this stage is critical, as material costs directly influence the competitiveness of passive reflectors, while electronic component reliability is paramount for active enhancers.

The downstream analysis focuses heavily on the robust distribution network, which is bifurcated into direct channels serving large commercial fleet operators and Original Equipment Manufacturers (OEMs), and indirect channels crucial for the leisure market. Direct distribution involves supplying products to major shipyards during the new build process or directly to marine safety equipment wholesalers serving commercial operations. Indirect distribution leverages a complex network of marine retail stores, specialized chandleries, and increasingly, major e-commerce platforms focused on the recreational boating sector. The complexity of installation, especially for active systems, also means certified marine electricians and maintenance providers play a crucial role in the downstream value addition.

Direct sales are prevalent for high-volume commercial contracts and military procurement, ensuring regulatory adherence and technical specification compliance. However, indirect channels, particularly through established marine distributors like West Marine or ASAP Supplies, dominate the lucrative leisure marine replacement and upgrade market. Marketing efforts across the distribution channels focus heavily on safety certifications (CE marking, RORC ratings) and highlighting the superior Radar Cross Section (RCS) performance of the products. Efficient logistics, minimizing warehousing costs for bulky passive reflectors, and providing robust technical support for sophisticated active systems are key competitive differentiators within the value chain.

Boat Radar Reflectors Market Potential Customers

The primary potential customers and end-users of boat radar reflectors are broadly categorized into three major groups: the vast Recreational/Leisure Marine sector, the highly regulated Commercial Vessels sector, and specialized Government/Military organizations. The recreational segment represents the largest volume of sales, driven by owners of small to medium-sized sailboats, cruisers, and fishing boats who are seeking compliance with local regulations or simply wishing to enhance safety while navigating busy coastal waters. These buyers are often price-sensitive but increasingly prioritize ease of installation and reliable performance ratings, making them key targets for highly visible passive and basic active reflectors marketed through retail channels.

The Commercial Vessels sector comprises buyers responsible for larger fishing trawlers, cargo carriers, ferries, and tugboats. For this segment, the purchase decision is fundamentally driven by strict international maritime law (SOLAS) and flag state requirements, which often mandate the installation of high-specification reflectors or equivalent safety equipment. These buyers prioritize durability, long-term reliability, and certified performance data, often procuring products directly from manufacturers or through specialized maritime procurement agencies. Replacement cycles in this sector are predictable, tied to vessel maintenance schedules and regulatory updates, ensuring stable, high-value demand for robust, often metal-based, reflectors.

A growing segment of potential customers includes operators of emerging vessel technologies, such as Unmanned Surface Vehicles (USVs) and autonomous research platforms. These vehicles require specialized, highly efficient, and sometimes custom-designed radar reflectors to ensure they are detected reliably by conventional shipping radar systems, fulfilling the safety requirement for operating in mixed-traffic maritime environments. Furthermore, search and rescue organizations, including coast guards and voluntary rescue services, represent consistent buyers of compact, high-performance reflectors for deployment on rescue vessels and, critically, for inclusion in life raft emergency kits, where maximizing visibility under challenging conditions is paramount to survival.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $45.2 Million |

| Market Forecast in 2033 | $67.5 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Echomax, Solas Marine, Plastimo, Sea-Dog Line, Davis Instruments, Osculati, Marinco, West Marine, Lopolight, Comet, Zarges, ASAP Supplies, Blue Performance, Pains Wessex, Ocean Safety, ACR Electronics, Hammar, McMurdo, Kannad Marine, True Heading |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Boat Radar Reflectors Market Key Technology Landscape

The technology landscape for boat radar reflectors is bifurcated into two major categories: passive and active systems, with ongoing innovation focusing on optimizing Radar Cross Section (RCS) performance and enhancing integration capabilities. Passive reflectors, which rely solely on the physical geometry and conductive materials (typically aluminum or specialized metals) to reflect incident radar energy, are dominated by the corner reflector and the less common lens reflector designs. Technological advancements in this area focus on optimizing the orientation and shape of the reflective surfaces (dihedral or trihedral corners) to maximize effective reflecting area across a wider range of vessel heel angles, crucial for sailboats. Manufacturers are also using advanced computer modeling (e.g., Finite Difference Time Domain analysis) to predict and optimize RCS performance before physical prototyping, ensuring compliance with standards like ISO 8729-1.

Active radar reflectors, often marketed as Radar Target Enhancers (RTEs), represent the leading edge of technology, utilizing electronic circuits to detect an incoming radar pulse, amplify the signal, and transmit a much stronger, distinct signal back to the transmitting vessel. This active technology provides a significantly enhanced effective RCS, often making a small boat appear on radar screens like a much larger vessel, vastly improving detection range and reliability. Key technological features in active systems include microprocessors for pulse recognition and filtering, low-power consumption circuitry suitable for small craft, and sophisticated antennae design to ensure omni-directional performance. Modern active reflectors often operate across X-band and S-band frequencies, providing comprehensive coverage against commercial and recreational radar units.

A critical trend is the merging of radar reflector technology with digital communication systems. The next generation of active reflectors is being designed not just to reflect, but potentially to communicate status or position data, leveraging low-power embedded processors and integration points with NMEA 2000 marine networks. Material science continues to play a vital role, particularly in reducing the weight and size of passive reflectors while maintaining robustness against harsh marine environments, driving the adoption of specialized thermoplastic housings and high-strength, lightweight aluminum alloys. Future technology is expected to focus on smart reflectors capable of adapting their reflection profile based on the surrounding traffic density or predetermined safety zones, although widespread commercialization of fully adaptive systems remains dependent on regulatory acceptance and cost reduction.

Regional Highlights

North America: North America, particularly the coastal regions of the United States and Canada, represents a mature and high-value market segment characterized by a vast and affluent recreational boating population and well-enforced maritime regulations. The U.S. Coast Guard enforces safety equipment requirements which, while not always strictly mandating reflectors for all small recreational vessels, strongly encourage their use in offshore or heavy traffic zones. Market dynamics here are driven by consumer willingness to invest in high-performance safety equipment, leading to strong sales of advanced active radar reflectors, especially among owners of sailing yachts and high-speed motor yachts. The concentration of marine electronics manufacturers and distributors further supports market growth and technological adoption. Demand is consistently high for products meeting stringent reliability and performance standards, often exceeding the minimum international requirements. Furthermore, commercial fishing fleets and specialized coastal research vessels provide stable demand for certified, durable passive reflectors.

The regulatory environment in North America, while fragmented across states, generally aligns with international safety norms, pushing for certified safety devices. There is a notable preference for systems that offer easy integration with existing onboard electronics, which fuels the active reflector subsegment. Replacement demand is steady, driven by regular maintenance and the short life cycle of some polymer-based products exposed to intense UV radiation. Key distribution channels include major marine retail chains and specialized installers, making brand recognition and retail presence crucial for market success. The Great Lakes region and the Gulf Coast also contribute significantly to localized market demand, driven by unique environmental conditions requiring reliable visibility solutions.

Europe: Europe holds a dominant position in the Boat Radar Reflectors Market, largely due to its extensive coastline, dense maritime traffic, and the rigorous enforcement of safety standards across the European Union, particularly under the Maritime Equipment Directive (MED). European regulatory bodies, including the UK’s Maritime and Coastguard Agency (MCA) and various national bodies, place strong emphasis on ISO and RORC standards for reflector performance. This regulatory stringency drives consistent demand for high-quality, certified passive, and active reflectors for both commercial and leisure vessels operating in busy areas like the English Channel, the Mediterranean, and the Baltic Sea.

The European market is highly segmented, with northern European countries like the UK, Germany, and the Netherlands exhibiting high demand for passive reflectors on sailboats due to the prevalence of competitive racing (where low wind resistance is valued) and active reflectors on fishing and commercial vessels. Southern Europe, with its substantial luxury yachting sector (France, Italy, Spain), shows a growing appetite for aesthetically pleasing, integrated active systems that combine high performance with discrete installation. Competition among manufacturers is fierce, often focused on price-to-RCS ratios for passive systems and technological features, such as minimal power draw, for active systems. Furthermore, Europe serves as a major hub for R&D in marine safety electronics, pushing innovation in compact and lightweight reflector designs.

Asia Pacific (APAC): The Asia Pacific region is rapidly emerging as the fastest-growing market globally, primarily fueled by the massive expansion of commercial fleets, including fishing, cargo, and resource exploration vessels, alongside significant naval modernization efforts by key nations such as China, India, South Korea, and Australia. While safety regulations in some developing nations remain less strictly enforced compared to North America or Europe, the sheer volume of new vessel construction, particularly in shipbuilding hubs like South Korea and China, drives substantial OEM demand for standard, cost-effective passive reflectors.

Market growth is also supported by the increasing affluence in coastal cities, leading to a burgeoning, though currently smaller, recreational boating sector. Australia, in particular, maintains strong regulatory alignment with Western standards, exhibiting high demand for certified, durable reflectors. The challenges in this region include addressing diverse regulatory environments and adapting product distribution to extensive geographic distances and varied economic capacities. There is a strong long-term opportunity for active reflector sales as governments continue to invest in modernizing maritime surveillance and traffic management, requiring enhanced visibility from all vessels operating in increasingly congested ports and international shipping lanes.

Latin America: The Latin American market for boat radar reflectors is characterized by moderate but consistent growth, primarily driven by the needs of local commercial fishing industries and coastal transport services. Economic volatility in certain countries and lower enforcement of international safety standards compared to developed regions often limit the widespread adoption of higher-end active radar systems. However, countries with significant maritime traffic and oil and gas interests, such as Brazil and Mexico, show stable demand for robust, reliable passive reflectors for regulatory compliance and operational safety.

The recreational market remains niche but is expanding, particularly in wealthier coastal resort areas. Distribution often relies on local maritime agencies and importers who manage the complex regulatory requirements for importing certified marine safety equipment. The market potential is strongly linked to infrastructure development and governmental commitment to improving maritime safety oversight. Standardization and simplification of product offerings are key to successful market entry and penetration in this region, prioritizing durability over sophisticated electronic features.

Middle East and Africa (MEA): The MEA region presents a diverse market landscape. The Middle East segment, driven by high-value maritime trade, substantial naval activity, and significant yachting sectors in the UAE and Qatar, exhibits demand for premium, high-performance active reflectors and certified safety solutions. Regulatory compliance is often strictly enforced in major international ports, supporting steady demand for certified equipment. Oil and gas exploration and support vessels form a crucial end-user group, prioritizing reliable, durable, and highly detectable systems.

The African market is highly varied, with significant demand originating from commercial fishing operations, particularly off the West African coast, and essential coastal transport. While the leisure sector is minimal, the need for basic, reliable passive reflection on smaller, traditional vessels is recognized, though often constrained by budget limitations and inconsistent regulatory enforcement. Opportunities for growth are tied to infrastructure investment, modernization of local fishing fleets, and international aid programs focused on enhancing marine safety across high-risk shipping routes. The overall MEA region requires tailored distribution strategies to address differing economic capacities and regulatory requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Boat Radar Reflectors Market.- Echomax

- Solas Marine

- Plastimo

- Sea-Dog Line

- Davis Instruments

- Osculati

- Marinco

- West Marine

- Lopolight

- Comet

- Zarges

- ASAP Supplies

- Blue Performance

- Pains Wessex

- Ocean Safety

- ACR Electronics

- Hammar

- McMurdo

- Kannad Marine

- True Heading

- IOR Advisory

- Global Marine Safety

- Sailor Systems

- Orolia Maritime

Frequently Asked Questions

Analyze common user questions about the Boat Radar Reflectors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between passive and active boat radar reflectors?

Passive radar reflectors rely on physical shape and metal surfaces (like corner arrays) to bounce radar energy back to the source, maximizing the Radar Cross Section (RCS) based on geometry. Active radar reflectors (or Radar Target Enhancers, RTEs) detect incoming radar signals, electronically amplify them, and transmit a much stronger, enhanced return signal, offering superior detection range and reliability, especially for small, low-profile vessels.

Are boat radar reflectors legally mandated for all recreational vessels?

The mandate for radar reflectors varies significantly by region and vessel size. Internationally, organizations like IMO set requirements for certain commercial vessels. For recreational craft, many jurisdictions (especially in Europe and parts of North America) strongly recommend or require them for vessels over a certain length or when sailing in heavy traffic areas, particularly if the vessel lacks an operational AIS transponder.

How crucial is the mounting height and location for a radar reflector’s performance?

Mounting height is extremely crucial. The reflector must be mounted as high as possible, preferably above the highest structures (like the cabin top or masts), to ensure an unobstructed line of sight with the approaching vessel’s radar antenna. Improper or low mounting severely diminishes the effective Radar Cross Section (RCS), making the vessel far less detectable and potentially rendering the safety device ineffective.

Which radar frequency band is most important for reflector performance?

Most maritime search and navigation radars operate primarily in the X-band (3 cm wavelength) and S-band (10 cm wavelength). While passive reflectors are generally effective across both, active reflectors are typically optimized to detect and enhance X-band radar signals, as X-band radars are the most common type used for short-range detection and collision avoidance on smaller commercial and recreational vessels.

What performance standard should I look for when purchasing a new radar reflector?

When purchasing, look for certification compliance with ISO 8729-1 for passive reflectors, or equivalent certifications for active enhancers, often designated by national maritime authorities or industry bodies like the RORC. These standards ensure the reflector meets minimum operational requirements for effective detection in a maritime environment, providing confidence in its safety function.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager