Body Armor and Personal Protection Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433379 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Body Armor and Personal Protection Market Size

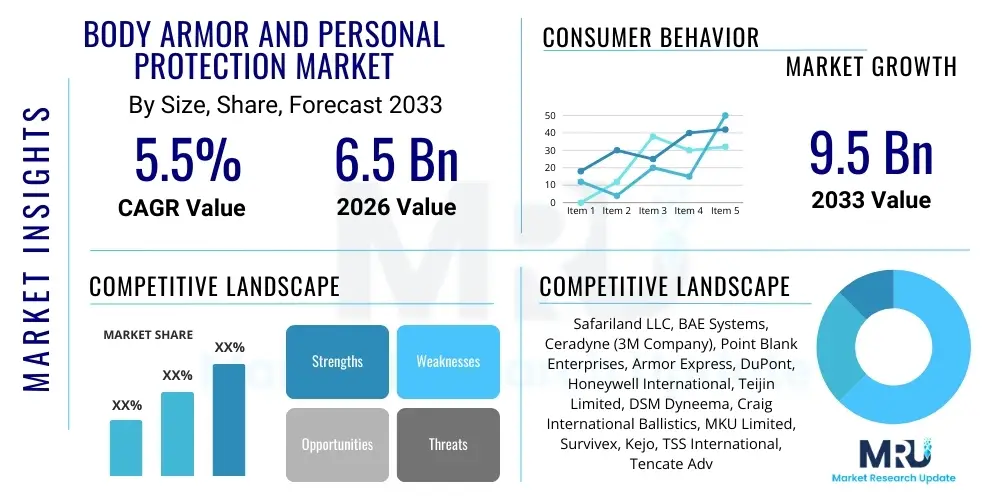

The Body Armor and Personal Protection Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 9.5 Billion by the end of the forecast period in 2033.

Body Armor and Personal Protection Market introduction

The Body Armor and Personal Protection Market encompasses the manufacturing, distribution, and sale of advanced protective equipment designed to mitigate ballistic, stab, and impact threats for military personnel, law enforcement officers, and private security contractors. This equipment includes hard armor plates, soft armor vests, helmets, and tactical gear, utilizing cutting-edge materials such as ultra-high-molecular-weight polyethylene (UHMWPE), aramid fibers (like Kevlar and Twaron), and ceramic composites. The primary applications span defense operations, counter-terrorism, civil disorder management, and critical infrastructure protection. The continuous evolution of threat landscapes, including the proliferation of high-velocity ammunition and sophisticated improvised explosive devices (IEDs), necessitates continuous innovation in protective technology, driving market expansion globally.

The core benefit provided by this market is enhanced survivability and operational effectiveness for personnel operating in high-risk environments. Modern body armor is characterized not only by superior ballistic resistance but also by reduced weight and improved ergonomic design, ensuring user mobility is not significantly compromised. The shift toward lighter, more flexible protection solutions is particularly evident in soft armor, which is increasingly integrated into uniforms and specialized tactical carriers. Furthermore, the market is benefiting from rising defense budgets in major economies, particularly in Asia Pacific and North America, aimed at modernizing aging equipment inventories and ensuring compliance with updated national protection standards (such as NIJ standards in the US and equivalent European protocols).

Key driving factors include escalating geopolitical tensions and ongoing regional conflicts, which accelerate procurement cycles for advanced armor systems. The growing demand for advanced tactical helmets with integrated communication systems and sensor arrays also plays a crucial role. Moreover, the increasing visibility and professionalism of private security services, particularly in resource-rich but unstable regions, contribute significantly to the commercial segment. Technological breakthroughs in material science, focusing on hybrid armor systems that optimize weight-to-protection ratios, represent the fundamental catalysts for long-term sustainable market growth, ensuring continuous product refresh cycles for both government and commercial end-users.

Body Armor and Personal Protection Market Executive Summary

The global Body Armor and Personal Protection Market exhibits robust growth, primarily fueled by sustained governmental investment in defense modernization and the expansion of internal security apparatuses worldwide. Key business trends include the vertical integration of specialized material manufacturers (e.g., UHMWPE and aramid fiber producers) into armor plate assembly, aiming to control supply chains and reduce production costs. Furthermore, there is a pronounced focus on modular protection systems that can be rapidly customized for specific mission profiles, ranging from high-threat kinetic environments to routine patrol duties. Strategic partnerships between Western defense contractors and local manufacturers in emerging markets are critical for navigating complex regulatory frameworks and securing large-scale government contracts, emphasizing technology transfer and localized production.

Regional trends indicate that North America maintains market dominance due to substantial R&D expenditure, stringent safety mandates, and the significant procurement volumes from the U.S. Department of Defense (DoD) and various federal and state law enforcement agencies. However, the Asia Pacific region is demonstrating the highest growth trajectory, propelled by military upgrades in countries like China, India, and South Korea, responding to regional security threats and border disputes. European market growth is stable, driven by the need to counter terrorism threats and manage border security challenges, leading to increased demand for high-protection, concealable armor solutions for specialized police forces. The Middle East and Africa continue to be volatile markets, heavily influenced by localized conflicts and the frequent acquisition of personal protection equipment by military organizations and international humanitarian agencies.

Segmentation trends highlight the increasing prominence of soft armor solutions, owing to their comfort and suitability for daily wear by law enforcement and private security personnel. Within hard armor, ceramic plates, particularly those incorporating Silicon Carbide and Boron Carbide, are favored for their superior multi-hit capabilities and reduced weight compared to steel alternatives. By end-user, the defense segment remains the largest purchaser, driven by large military contracts, but the law enforcement segment is expected to show accelerated growth due to urbanization and the increasing frequency of active shooter incidents, requiring advanced protection for first responders. Innovation in tactical helmets, integrating advanced head trauma protection alongside sophisticated communications gear, represents a high-value, rapidly evolving segment.

AI Impact Analysis on Body Armor and Personal Protection Market

User inquiries regarding AI's influence in the Body Armor and Personal Protection Market frequently revolve around predictive threat assessment, optimization of material composition, and the integration of AI-powered health monitoring within wearable systems. Users are keen to understand how AI can move armor from being a passive defense mechanism to an active, intelligent protective suite. Key themes include the use of machine learning to analyze battlefield data and inform ergonomic design changes, the potential for AI-driven material fabrication processes (e.g., generative design of complex ceramic matrices), and the expectation that future armor systems will incorporate real-time physiological and situational awareness data processing. Concerns often center on data privacy, system reliability in harsh environments, and the economic accessibility of these advanced, AI-integrated solutions for smaller agencies or emerging nations.

The impact of Artificial Intelligence is manifesting primarily in the R&D and manufacturing phases of body armor. Machine learning algorithms are being utilized to simulate thousands of ballistic impact scenarios, allowing researchers to rapidly test and iterate on novel material combinations—such as complex ceramic geometries or heterogeneous polymer layers—without extensive, costly physical testing. This generative design approach significantly shortens the product development lifecycle and leads to optimization of armor weight and thickness while maintaining stringent protection levels. For example, AI can predict the shear thickening behavior of non-Newtonian fluids used in flexible armor components under various stress conditions, leading to more resilient designs.

Furthermore, AI is crucial for enhancing the "smart" components of personal protection equipment. Future armor systems will likely incorporate embedded sensors connected to an AI core that monitors the wearer's physical condition (heart rate, temperature, fatigue) and external threat levels (proximity alerts, friendly fire warnings). This data is processed locally and transmitted through encrypted networks, providing command centers with real-time health and position data, enabling proactive response and resource allocation. AI-driven predictive maintenance for armor, analyzing wear and tear patterns based on usage intensity, ensures that protective gear remains compliant and effective throughout its service life, contributing to long-term cost efficiency for large organizations.

- AI-driven generative design for optimizing complex ceramic and composite armor structures.

- Machine learning algorithms simulate ballistic impacts to accelerate material R&D and testing cycles.

- Integration of AI in smart textiles for real-time physiological monitoring and situational awareness.

- Predictive analytics used for threat modeling to inform dynamic protection needs and load-bearing adjustments.

- Automated quality control (QC) in manufacturing utilizing computer vision for defect detection in plate pressing and textile weaving.

DRO & Impact Forces Of Body Armor and Personal Protection Market

The market is predominantly driven by increasing global instability and the pervasive threat of asymmetric warfare, compelling nations to upgrade their protective gear inventories (Drivers). Restraints include the high cost associated with advanced material procurement (e.g., military-grade Boron Carbide), strict government regulations regarding export and domestic use of protective equipment, and the constant design challenge of minimizing weight while maximizing protection. Opportunities arise from technological advancements in nano-materials and smart textiles, enabling the development of lighter, more functional armor systems, and the untapped potential in the civilian market for low-profile, anti-stab, and anti-trauma protection. The collective impact forces reflect significant influence from geopolitical dynamics, stringent regulatory standardization (like NIJ 0101.06), and rapid material science innovation, forcing manufacturers to continuously adapt products to counter evolving threats and regulatory updates.

Drivers are specifically magnified by the increasing operational tempo of peacekeeping and counter-insurgency forces worldwide, necessitating durable and reliable protective solutions. The mandatory replacement cycles for aging soft armor (which degrades over time due to UV exposure and laundering) also ensure continuous baseline demand. Furthermore, the rising awareness of cumulative trauma injuries, particularly in the law enforcement sector, has spurred demand for specialized trauma plates and enhanced fragmentation protection features, driving innovation beyond standard ballistic resistance. These factors collectively push governments and agencies towards larger, multi-year procurement contracts to ensure supply stability.

Restraints, particularly regulatory hurdles, pose significant barriers to entry, especially for new market entrants needing to navigate complex certification processes (e.g., establishing efficacy against specific NATO or non-standard ammunition types). The environmental impact of disposing of composite armor materials is also becoming an increasing concern, pushing the industry toward developing more sustainable, degradable, or recyclable components. Opportunities lie particularly in the emerging markets of Latin America and Africa, where rapid militarization and the expansion of private security require basic yet reliable Level III and Level IV protection solutions. The commercial sector also offers an avenue for growth through specialized products for high-net-worth individuals and journalists operating in conflict zones.

Segmentation Analysis

The Body Armor and Personal Protection Market is extensively segmented across multiple dimensions, including product type, material utilized, protection level, and end-user application. Segmentation allows manufacturers to tailor solutions precisely to mission requirements, whether focusing on maximum ballistic resistance for military special forces (Hard Armor segment) or prioritizing concealability and flexibility for plainclothes police officers (Soft Armor segment). The diversity of threats, ranging from knives and needles to high-powered rifle rounds, necessitates this granular classification, ensuring appropriate gear selection and compliance with international protection standards such as NIJ (National Institute of Justice) and NATO STANAG protocols.

- By Product Type:

- Soft Armor (Vests, Inserts)

- Hard Armor (Plates, Shields)

- Protective Headwear (Helmets)

- Full Body Suits (EOD Suits, Riot Gear)

- Ballistic and Tactical Eyewear

- By Material Type:

- Aramid Fibers (Kevlar, Twaron)

- Ultra-High-Molecular-Weight Polyethylene (UHMWPE)

- Ceramic (Boron Carbide, Silicon Carbide, Alumina)

- Steel/Metallic Alloys

- Hybrid Composites

- By Protection Level (NIJ Standard):

- Level IIA

- Level II

- Level IIIA

- Level III

- Level IV

- By End User:

- Defense/Military

- Law Enforcement (Police, Border Patrol)

- Private Security and VIP Protection

- Civilian/Commercial

Value Chain Analysis For Body Armor and Personal Protection Market

The value chain for the body armor market begins upstream with the highly specialized manufacturing of key raw materials, predominantly advanced synthetic fibers (like aramid and UHMWPE) and high-performance ceramic powders. This upstream segment is dominated by a few global chemical and material science giants due to the high capital and R&D investment required to produce materials that meet military-grade specifications. Control over the purity and consistency of these materials is crucial, as even minor variations can drastically impact ballistic performance. Key upstream activities include polymerization, fiber spinning, and the sintering of ceramic components, establishing the foundational cost and performance characteristics of the final product.

Midstream activities involve the transformation of raw materials into finished protective components. This includes the weaving and lamination of soft armor textiles, the pressing and molding of composite panels, and the assembly of hard armor plates. Manufacturers often operate highly regulated and quality-controlled facilities where ballistic testing is integral to the production process. Distribution channels are highly bifurcated: Direct sales are common for major defense and law enforcement contracts, where security clearances and customized requirements necessitate close producer-to-buyer interaction. Indirect channels, utilizing specialized defense distributors and tactical gear retailers, cater primarily to smaller agencies, private security firms, and the civilian market.

Downstream analysis focuses on deployment, maintenance, and end-of-life management. End-users require robust training on the proper wearing and care of armor to maintain its protective integrity. The lifespan of body armor is governed by strict expiration dates, creating consistent replacement demand. The complexities of disposal (especially composite and ceramic materials) present a logistical challenge and a nascent business opportunity for specialized recycling or destruction services. The formal and professional nature of the market necessitates extensive post-sale support, including ongoing ballistic assessment updates and adherence to warranties, cementing the long-term relationship between manufacturers and institutional clients.

Body Armor and Personal Protection Market Potential Customers

The primary customers for the Body Armor and Personal Protection Market are institutional buyers driven by statutory requirements and mission-critical objectives. The largest segment remains global military forces, including conventional army units, naval infantry, and air force security details, which require large volumes of standardized Level IV hard armor and ballistic helmets for deployed personnel. These customers prioritize proven multi-hit capability, low weight, and interoperability with existing tactical equipment and vehicle platforms. Procurement decisions are often centralized, involve lengthy competitive bidding processes, and are heavily influenced by national defense budgets and geopolitical alignment.

A rapidly expanding customer base is the law enforcement sector, encompassing municipal police departments, federal agencies (like the FBI, DEA, and Marshals Service), and specialized SWAT teams. These buyers exhibit a strong demand for concealable Level IIIA soft armor for daily use and specialized hard armor shields and plates for high-risk entry operations. Their purchasing decisions are often decentralized, budget-constrained, and focused on solutions that balance protection with officer comfort and agility, given the extensive time spent wearing the gear. The increasing demand for anti-stab protection in urban environments further customizes their requirements.

Beyond government entities, significant potential customers include private military contractors (PMCs) and private security companies (PSCs) operating in hostile or high-risk commercial zones, such as maritime security, critical infrastructure protection, and executive protection details. These customers seek commercially available, high-performance protection that often mirrors military specifications but with less restrictive procurement processes. Additionally, humanitarian aid organizations, journalists, and specialized industrial workers (e.g., bomb disposal technicians who require Explosive Ordnance Disposal or EOD suits) form smaller but highly specialized customer niches, demanding gear tailored to extreme, specific threat environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 9.5 Billion |

| Growth Rate | CAGR 5.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Safariland LLC, BAE Systems, Ceradyne (3M Company), Point Blank Enterprises, Armor Express, DuPont, Honeywell International, Teijin Limited, DSM Dyneema, Craig International Ballistics, MKU Limited, Survivex, Kejo, TSS International, Tencate Advanced Composites, Revision Military, Elmon, U.S. Armor Corporation, CoorsTek, Armorskin |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Body Armor and Personal Protection Market Key Technology Landscape

The technology landscape of the body armor market is highly focused on materials science, aiming to achieve ballistic resistance with minimum weight and bulk. A central technological thrust involves the refinement of ceramic composite materials, moving beyond monolithic Alumina to advanced, lighter combinations of Boron Carbide (B4C) and Silicon Carbide (SiC) set in complex matrix structures. The use of advanced sintering techniques and nano-scale engineering is critical to enhancing the hardness and fracture resistance of these ceramics, allowing them to effectively defeat modern, high-velocity armor-piercing rounds. Furthermore, the development of hybrid armor systems—combining ceramic strike faces with backed layers of UHMWPE—is now standard, optimizing energy absorption characteristics across multiple impact events.

In the soft armor segment, the primary technological advancements center on fiber enhancement and fabric construction. High-performance polyethylene (UHMWPE) fibers, marketed under brands like Dyneema and Spectra, continue to see performance improvements in terms of tensile strength and energy dissipation efficiency. A major focus is the development of non-Newtonian, shear-thickening fluids (STFs) that can be integrated into fabric layers or used as coatings. These fluids remain liquid and flexible under normal conditions but instantly solidify upon high-speed impact (such as a bullet or knife thrust), offering enhanced stab and ballistic protection in extremely thin and flexible configurations, thereby addressing the long-standing challenge of creating truly concealable and comfortable high-protection soft armor.

Beyond material composition, technology is also focused on integration and survivability systems. This includes the development of modular plate carriers (like those standardized under the MOLLE system) designed for optimal load distribution and quick release mechanisms. Helmet technology is moving toward advanced pad systems (e.g., proprietary foam compositions) that mitigate blunt force trauma and rotational forces, addressing traumatic brain injury (TBI) concerns, which are paramount in modern warfare. Furthermore, the embedding of RFID tags and sensor arrays directly into the armor allows for sophisticated inventory management, automatic tracking of use conditions, and verification of armor authenticity, a crucial feature given the prevalence of counterfeit protective equipment.

Regional Highlights

- North America: Dominates the global market, primarily driven by the colossal defense spending of the United States (DoD and DHS). The region is a hub for innovation, especially in advanced composite materials and smart body armor integration, supported by robust regulatory standards (NIJ) and consistent demand from law enforcement agencies facing high-risk scenarios.

- Europe: Characterized by stable growth, fueled by increased anti-terrorism budgets and the modernization of police and paramilitary forces in the UK, France, and Germany. Demand is strong for lightweight, flexible armor suitable for urban counter-terrorism operations and specialized EOD (Explosive Ordnance Disposal) suits.

- Asia Pacific (APAC): Exhibits the highest CAGR due to significant military modernization programs in India and China, alongside heightened border security concerns. Procurement is driven by the need for advanced Level IV protection and domestic manufacturing initiatives aimed at reducing reliance on Western suppliers.

- Latin America: Growing steadily, propelled by high levels of organized crime and the need to equip militarized police and anti-drug enforcement units. The focus is often on cost-effective, durable protection, including steel and basic ceramic solutions, alongside Level III concealable armor for security details.

- Middle East and Africa (MEA): Highly volatile but critical market, driven by ongoing internal conflicts and regional arms races. Demand is focused on high-specification military armor systems, often procured through international defense aid or large government defense contracts, emphasizing proven performance in desert and high-temperature environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Body Armor and Personal Protection Market.- Safariland LLC

- BAE Systems

- Ceradyne (3M Company)

- Point Blank Enterprises

- Armor Express

- DuPont

- Honeywell International

- Teijin Limited

- DSM Dyneema

- Craig International Ballistics

- MKU Limited

- Survivex

- Kejo

- TSS International

- Tencate Advanced Composites

- Revision Military

- Elmon

- U.S. Armor Corporation

- CoorsTek

- Armorskin

Frequently Asked Questions

Analyze common user questions about the Body Armor and Personal Protection market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Level IV body armor?

The primary driver for Level IV armor demand is the increase in sophisticated, high-velocity threats, particularly armor-piercing rifle ammunition, necessitating gear that provides maximum ballistic resistance for frontline military and specialized tactical law enforcement units.

How are new materials like UHMWPE impacting traditional aramid fiber armor?

UHMWPE (Ultra-High-Molecular-Weight Polyethylene) is displacing traditional aramid fibers by offering superior strength-to-weight ratios, resulting in lighter, more comfortable soft armor solutions while often meeting equivalent or better ballistic protection standards, especially against fragmentation.

Which segment of the body armor market is expected to experience the fastest growth rate?

The hard armor plates segment, particularly those utilizing advanced ceramic and hybrid composites (Boron Carbide and Silicon Carbide), is projected to experience the fastest growth due to ongoing military modernization and the increasing operational requirements for multi-hit capability at lower weight profiles.

What are the main regulatory standards governing body armor production globally?

The primary global regulatory standard is the NIJ (National Institute of Justice) 0101.06 standard in the United States. Many international manufacturers also adhere to NATO STANAG 4569 and equivalent standards set by bodies like the HOSDB (Home Office Scientific Development Branch) in the UK.

How is the integration of 'smart' technology changing the design of tactical helmets?

Smart technology integration is transforming tactical helmets by incorporating advanced communication systems, night vision integration interfaces, sensor arrays for situational awareness, and improved padding designs focused on mitigating Traumatic Brain Injury (TBI) from rotational forces and blunt impact.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager