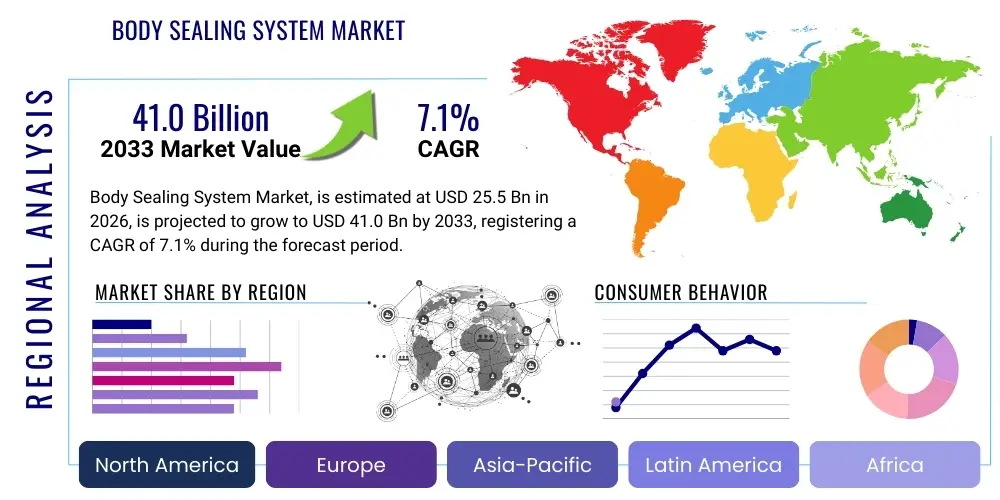

Body Sealing System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436358 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Body Sealing System Market Size

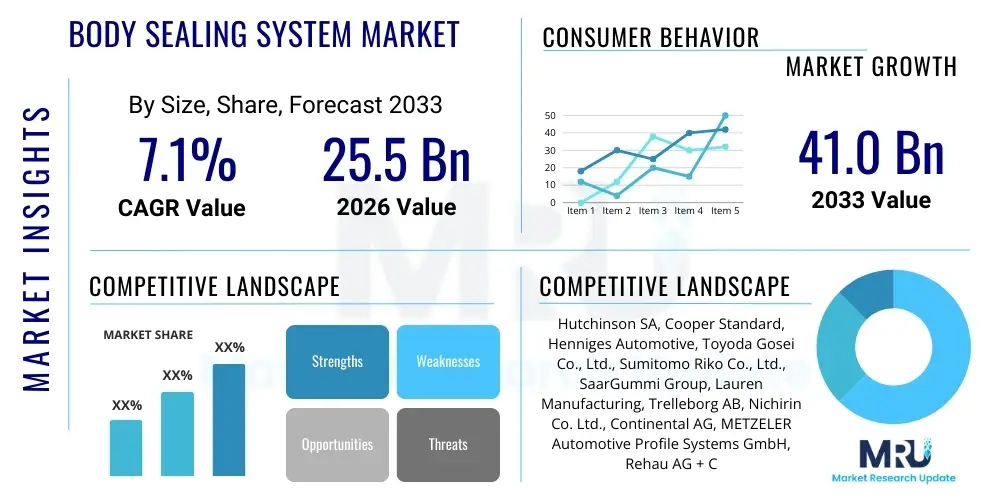

The Body Sealing System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.1% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 41.0 Billion by the end of the forecast period in 2033.

Body Sealing System Market introduction

The Body Sealing System Market encompasses the design, manufacturing, and integration of various rubber and thermoplastic components critical for protecting vehicle interiors and ensuring operational safety and occupant comfort. These systems, primarily including weather-strips, dynamic seals, static seals, and glass run channels, are essential for establishing a barrier against environmental factors such as water, dust, air, and noise. The primary function of body sealing systems is to optimize Noise, Vibration, and Harshness (NVH) levels, enhance vehicle aerodynamics, and improve climate control efficiency by minimizing air leakage across doors, windows, trunk lids, and sunroofs. The reliability and durability of these seals directly influence the perceived quality and longevity of the vehicle, making them a crucial component in modern automotive engineering.

Body sealing components utilize a variety of advanced materials, predominantly Ethylene Propylene Diene Monomer (EPDM) rubber, due to its excellent resistance to ozone, UV radiation, and temperature fluctuations, alongside Thermoplastic Vulcanizates (TPV) and other engineered thermoplastics. The shift toward lightweight vehicle architectures, driven by stringent emission regulations and the proliferation of electric vehicles (EVs), is fundamentally altering material demands within this market. Manufacturers are increasingly prioritizing materials that offer reduced weight without compromising sealing efficacy or durability, necessitating innovation in extrusion and molding techniques.

The major applications of these systems span passenger cars, commercial vehicles, and extend into non-automotive sectors such as rail, aerospace, and construction machinery. Key driving factors include the global expansion of automotive production, particularly in Asia Pacific; the rising consumer expectation for silent and comfortable cabin environments; and the necessity for enhanced passive safety measures. Furthermore, the complexity introduced by large glass surfaces and panoramic roofs in contemporary vehicle designs demands more sophisticated and often encapsulated sealing solutions, bolstering market growth and technological investment.

Body Sealing System Market Executive Summary

The Body Sealing System Market is characterized by intense pressure to innovate materials and manufacturing processes to support the automotive industry's pivot towards lightweight and electric mobility. Current business trends indicate a strong move away from traditional heavier EPDM compounds towards advanced Thermoplastic Elastomers (TPEs) and TPVs, which facilitate lighter, recyclable components and simplified manufacturing processes, notably through injection molding and co-extrusion. Strategic collaborations between Tier 1 sealing manufacturers and chemical suppliers are defining the competitive landscape, focusing on proprietary compounds that address specific NVH and aerodynamic challenges unique to EV platforms, which are inherently quieter and thus more sensitive to external noise ingress. Efficiency in material usage and complexity reduction through part consolidation are central to profitability.

Regionally, the Asia Pacific (APAC) market, spearheaded by China and India, maintains dominance due to high volume automotive manufacturing and escalating regulatory standards regarding passenger comfort and safety. Europe and North America, while having mature markets, are driving innovation primarily through high-end vehicle segments and strict adherence to environmental standards, accelerating the adoption of sustainable and high-performance sealing materials. These regions exhibit higher average selling prices due to the prevalence of complex encapsulated components and customized modular sealing solutions designed for luxury and performance vehicles. Meanwhile, emerging markets in Latin America and MEA are seeing steady growth driven by general urbanization and increasing vehicle fleet size.

Segment trends reveal that the Product Type segment is heavily dominated by weather-strips and door seals, forming the foundational revenue stream, while the Material segment shows the fastest growth in Thermoplastic Vulcanizates (TPVs), reflecting the industry's lightweighting imperatives. The Vehicle Type segmentation highlights the significant opportunity within the Electric Vehicle (EV) category, where sealing systems must manage battery compartment cooling, ingress protection for sensitive electronics, and exceptionally demanding NVH characteristics, requiring specialized sealing architectures. The market structure emphasizes the critical role of Tier 1 suppliers who manage the complex supply chain from raw material processing to delivering integrated sealing modules directly to OEMs.

AI Impact Analysis on Body Sealing System Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Body Sealing System Market predominantly center on three core themes: improving quality assurance through automated inspection, optimizing complex seal designs for performance metrics (aerodynamics and NVH), and enabling predictive maintenance functionalities. Users are concerned about how AI-driven quality control, utilizing machine vision and deep learning models, can detect minute defects in extruded profiles that human inspectors might miss, thereby reducing warranty claims and scrap rates. Furthermore, there is significant interest in AI's role in computational fluid dynamics (CFD) and structural analysis to rapidly iterate complex seal geometry, especially for challenging areas like panoramic roof interfaces and frameless windows, ensuring optimal performance under various operating conditions.

The implementation of AI algorithms in manufacturing aims to revolutionize extrusion and molding processes by utilizing real-time sensor data from machinery. This allows for immediate, fine-tuned adjustments to parameters such as temperature, pressure, and cure time, dramatically enhancing process stability and reducing material wastage. Predictive quality models, based on machine learning, analyze historical production data to forecast potential defects before they occur, shifting manufacturing from reactive correction to proactive optimization. This level of precision is critical given the tight tolerances required for effective body sealing.

Beyond manufacturing, AI is expected to play a crucial role in the development cycle. Generative design tools, powered by AI, can explore hundreds of topological optimization options for seals based on inputs like material properties, required compression force, and NVH targets, significantly accelerating the R&D timeline. Additionally, in the future of autonomous vehicles and connected cars, embedded sensors within "smart seals" coupled with AI could monitor the integrity and wear of the sealing system throughout the vehicle's lifespan, providing crucial data for predictive maintenance schedules and ensuring ongoing passenger safety and acoustic performance.

- AI-driven machine vision systems for 100% inline quality inspection of seals, detecting micro-cracks and dimensional inconsistencies.

- Generative design for topological optimization of complex gaskets and weather-strips to minimize weight and improve aerodynamic efficiency.

- Predictive maintenance analytics utilizing integrated sensors in smart seals to forecast material degradation and replacement cycles.

- Optimization of extrusion and molding parameters using machine learning to reduce material scrap and energy consumption during production.

- Enhanced simulation capabilities (CFD/NVH) for faster virtual prototyping of sealing systems in new vehicle platforms.

DRO & Impact Forces Of Body Sealing System Market

The market dynamics of body sealing systems are influenced by a convergence of technological mandates and macroeconomic pressures. The primary drivers (D) include the rapid expansion of the Electric Vehicle (EV) sector, which requires specialized sealing to protect battery compartments and electronic controls from moisture and thermal variability, alongside the pervasive industry push for lightweighting initiatives to enhance fuel efficiency and EV range. Conversely, significant restraints (R) exist, particularly the volatility and high cost of petrochemical raw materials (synthetic rubber and plastics), which exert continuous pressure on manufacturer margins. Furthermore, the inherent complexity in designing sealing systems that must accommodate increasingly diverse vehicle geometries, such as frameless windows and unconventional door mechanisms, presents an ongoing engineering challenge.

Opportunities (O) for market expansion are substantial, driven by the emergence of smart sealing solutions incorporating sensors for monitoring door closure status and internal cabin pressure, contributing to enhanced safety and NVH performance. Furthermore, the increasing adoption of automated and robotics-based manufacturing techniques, coupled with advancements in Thermoplastic Elastomers (TPEs) and recyclable materials, allows manufacturers to meet sustainability goals while improving production flexibility. The expansion into non-automotive high-specification applications, such as high-speed rail and specialized construction equipment, also represents a profitable diversification route for key players.

These internal and external factors culminate in significant Impact Forces. The regulatory environment, particularly stringent safety and environmental mandates (e.g., EU regulations on material recycling and NVH limits), acts as a pervasive force, compelling continuous R&D investment. Technological disruption, led by material science breakthroughs and AI integration in design and quality control, accelerates product obsolescence and favors technologically advanced suppliers. Lastly, the concentrated buyer power of major global Automotive OEMs dictates pricing strategies and demanding quality standards, making supplier performance and cost efficiency paramount for long-term viability in this competitive sector.

Segmentation Analysis

The Body Sealing System Market is systematically segmented across Material Type, Product Type, Application, and Vehicle Type, providing a granular view of market trends and investment priorities. This comprehensive segmentation allows market participants to tailor their strategies based on specific technological requirements and end-user needs. The transition toward lighter materials like TPV and the robust demand for specialized dynamic seals underscore the evolving technological landscape. Market growth is heavily driven by performance requirements, particularly within the passenger vehicle and electric vehicle segments where advanced sealing integrity is non-negotiable for comfort and operational efficiency. Understanding the interplay between material advancements and product complexity is key to unlocking growth within these segments.

Material segmentation remains the cornerstone, defining durability, cost structure, and performance characteristics. EPDM still holds the largest share due to its established performance profile and cost-effectiveness, but TPVs are rapidly gaining ground due to their superior lightweight properties and easier recyclability, aligning perfectly with circular economy initiatives. Product type segmentation highlights the diverse functional roles of sealing systems, ranging from primary door seals that manage critical ingress protection and cabin pressure to highly engineered encapsulated glass systems that integrate multiple functions, including trim and mounting features, simplifying vehicle assembly for OEMs.

The segmentation by Vehicle Type vividly illustrates the disparity in sealing requirements between Internal Combustion Engine (ICE) vehicles and Electric Vehicles (EVs). EVs require specialized thermal management seals and superior acoustic insulation seals to manage the distinct NVH profile (where wind and road noise become more prominent without engine noise masking them). Furthermore, the application segmentation differentiates between original equipment manufacturers (OEMs), which constitute the vast majority of demand based on new vehicle production volumes, and the aftermarket sector, which primarily focuses on replacement parts due to wear and damage over the vehicle's lifecycle. OEM sales drive technological innovation, while aftermarket stability ensures a baseline revenue flow.

- Material Type:

- Ethylene Propylene Diene Monomer (EPDM)

- Thermoplastic Vulcanizates (TPV)

- Thermoplastic Elastomers (TPE)

- Silicone

- Others (PVC, Polyurethane)

- Product Type:

- Weather-strips

- Gaskets & Seals (Engine, Chassis, Body)

- Glass Run Channels

- Encapsulated Glass Seals

- Hose and Tubing Seals

- Application:

- Original Equipment Manufacturer (OEM)

- Aftermarket

- Vehicle Type:

- Passenger Cars (PC)

- Commercial Vehicles (CV)

- Electric Vehicles (EV)

- Heavy Duty Vehicles (HDV)

Value Chain Analysis For Body Sealing System Market

The value chain for the Body Sealing System Market is characterized by a high degree of integration between specialized raw material providers and large-scale Tier 1 manufacturers, positioning the latter as crucial intermediaries between material science and final vehicle assembly. The upstream segment involves the production of base polymers such as specialized synthetic rubbers (e.g., EPDM, HNBR) and engineering plastics (e.g., TPV, TPE). These petrochemical and chemical manufacturers supply raw compounds that dictate the final seal properties (flexibility, heat resistance, compression set). Efficiency in this phase hinges on optimizing polymerization processes and ensuring supply chain resilience against fluctuating oil and gas prices, which directly impact material costs.

The midstream phase is dominated by Tier 1 automotive suppliers who specialize in converting raw polymers into final sealing components through complex manufacturing processes like extrusion, injection molding, and vulcanization. This phase adds significant value through proprietary compounding, design optimization (tooling and die creation), and the integration of metal or plastic carriers (co-extrusion). Quality control in this stage is paramount, utilizing sophisticated measurement and inspection systems to meet the extremely tight tolerances required by OEM assembly lines. Innovation in manufacturing techniques, such as continuous vulcanization and specialized coating application for friction reduction, dictates competitive advantage.

Downstream distribution channels are predominantly direct, linking Tier 1 suppliers immediately to OEM assembly plants globally, establishing a just-in-time delivery system necessary for synchronized vehicle production. Tier 1 suppliers often operate facilities geographically close to major automotive manufacturing hubs to minimize logistics costs and improve response times for design changes. The indirect channel serves the aftermarket, where seals are distributed through established networks of replacement parts vendors, independent repair shops, and authorized dealerships. The efficiency and quality of the direct distribution channel are critical for maintaining continuous OEM relationships, while the indirect channel, though smaller, provides stability and brand exposure over the vehicle lifespan.

Body Sealing System Market Potential Customers

The primary customers and end-users of body sealing systems are concentrated within the global automotive manufacturing sector, encompassing a diverse range of vehicle types that require superior protection against environmental factors and optimized NVH performance. Major Original Equipment Manufacturers (OEMs), including global giants producing passenger cars (sedans, SUVs, crossovers) and commercial vehicles (light, medium, and heavy-duty trucks), represent the largest volume of purchasers. These customers demand highly customized, durable, and lightweight sealing solutions that integrate seamlessly with specific platform architectures, often engaging in multi-year contracts with preferred Tier 1 suppliers based on strict performance criteria and cost competitiveness.

Beyond the core automotive sector, the market extends to specialized transportation industries that require high-specification sealing for demanding operating environments. Rail car manufacturers, particularly those involved in high-speed and metro systems, are significant buyers, requiring seals that withstand high wear, pressure differentials, and stringent fire safety standards (flame retardancy). Similarly, aerospace manufacturers utilize specialized sealing components for cabin pressurization, door seals, and engine nacelle protection, prioritizing materials with extreme temperature stability and chemical resistance, leading to demand for silicone and high-performance fluoroelastomers.

The aftermarket sector, consisting of authorized dealerships, independent maintenance repair shops, and direct consumer replacement part channels, constitutes another vital customer base. Although purchases in this segment are driven by replacement needs rather than new vehicle production volume, the demand is constant and influenced by the average age of the global vehicle fleet. For suppliers, maintaining robust aftermarket inventory and quality ensures comprehensive market coverage and extends the lifecycle revenue derived from initial product development and manufacturing investments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 41.0 Billion |

| Growth Rate | 7.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hutchinson SA, Cooper Standard, Henniges Automotive, Toyoda Gosei Co., Ltd., Sumitomo Riko Co., Ltd., SaarGummi Group, Lauren Manufacturing, Trelleborg AB, Nichirin Co. Ltd., Continental AG, METZELER Automotive Profile Systems GmbH, Rehau AG + Co, Zhongding Group, Parker Hannifin Corporation, SKF Group, Kismet Rubber Products, Minth Group, Standard Profiles, Freudenberg Sealing Technologies, Saint-Gobain S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Body Sealing System Market Key Technology Landscape

The technological landscape of the Body Sealing System Market is rapidly evolving, driven primarily by the need for superior NVH performance in electric vehicles and continuous pressure for component weight reduction. The primary technological advancements are centered around advanced material science, specifically the accelerated adoption of Thermoplastic Elastomers (TPEs) and Thermoplastic Vulcanizates (TPVs) as replacements for traditional EPDM. These TPV-based solutions allow for complex co-extrusion profiles that integrate hard and soft elements, enabling the consolidation of multiple parts into a single, lighter component. Furthermore, TPVs are easily recyclable and can be processed using injection molding, leading to shorter cycle times and lower energy consumption compared to the vulcanization required for EPDM.

Manufacturing techniques are also undergoing significant transformation. Continuous vulcanization (CV) lines are being enhanced with advanced sensor technology and process control to ensure dimensional accuracy and consistent material quality throughout long-run profiles. Furthermore, the use of advanced coating technologies, such as flocking or anti-friction surface treatments, is essential for minimizing contact friction in dynamic seals like glass run channels, improving both durability and user experience. For highly customized, low-volume applications or prototyping, additive manufacturing (3D printing) is beginning to play a role, allowing for rapid iteration of complex seal geometries before committing to expensive tooling for mass production.

A burgeoning technological segment involves "smart seals" or integrated sealing systems. These systems incorporate micro-sensors, often utilizing MEMS technology, to monitor critical parameters such as door closure status, seal compression, and interior cabin pressure in real-time. This data integration supports advanced vehicle diagnostics, enhances safety features by confirming proper door sealing, and allows for predictive maintenance algorithms. Encapsulation technology, particularly for fixed glass panels and panoramic roofs, continues to advance, utilizing liquid injection molding (LIM) processes to create highly aesthetic, structurally rigid modules that simplify vehicle assembly and improve long-term weather resistance, cementing the shift towards pre-assembled modules supplied by Tier 1 partners.

Regional Highlights

The global Body Sealing System Market exhibits diverse growth trajectories across major geographical regions, influenced by localized automotive production volumes, regulatory frameworks, and technological adoption rates. Asia Pacific (APAC) dominates the market, accounting for the largest share in terms of volume and experiencing the fastest growth rate. This dominance is attributed to the presence of high-volume automotive manufacturing hubs, particularly in China, Japan, South Korea, and India, coupled with increasing domestic demand for vehicles that comply with increasingly stringent local quality and comfort standards. The region is witnessing massive investment in EV manufacturing capacity, which necessitates specialized sealing solutions, further bolstering market expansion.

Europe represents a mature yet highly innovative market. Growth here is driven not by volume but by the premium segment and strict environmental regulations. European OEMs demand high-performance, aesthetically integrated sealing systems, especially encapsulated glass units and TPE-based materials that meet rigorous recycling mandates. The focus is heavily on optimizing NVH performance to support the robust regulatory environment and consumer preference for high-quality driving experiences. Innovation in manufacturing precision and lightweighting materials is concentrated within this region.

North America maintains a strong position, characterized by significant R&D investment, particularly in advanced material testing and validation for rugged conditions. The market is fueled by consistent light truck and SUV production, requiring heavy-duty, highly durable sealing solutions. Furthermore, the substantial domestic investment in EV manufacturing, catalyzed by government incentives, ensures sustained demand for sophisticated battery seals and lightweight body sealing components, driving the regional market towards higher technology integration and automation in manufacturing processes.

- Asia Pacific (APAC): Market leader by volume, driven by high automotive production in China and India, rapid EV adoption, and demand for cost-effective, durable EPDM and TPV solutions.

- Europe: Focus on premium vehicles, stringent environmental regulations necessitating advanced TPE/TPV materials, and technological leadership in encapsulation and acoustic seals.

- North America: Stable demand from light truck and SUV segments, strong investment in localized EV supply chains, and focus on high-durability and corrosion-resistant sealing materials.

- Latin America: Emerging market growth tied to regional economic stability and vehicle fleet modernization; characterized by demand for affordable, standard sealing components.

- Middle East and Africa (MEA): Growth driven by infrastructure projects and increasing vehicle imports; focus on seals offering superior heat and dust resistance crucial for desert environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Body Sealing System Market.- Hutchinson SA

- Cooper Standard

- Henniges Automotive

- Toyoda Gosei Co., Ltd.

- Sumitomo Riko Co., Ltd.

- SaarGummi Group

- Lauren Manufacturing

- Trelleborg AB

- Nichirin Co. Ltd.

- Continental AG

- METZELER Automotive Profile Systems GmbH

- Rehau AG + Co

- Zhongding Group

- Parker Hannifin Corporation

- SKF Group

- Kismet Rubber Products

- Minth Group

- Standard Profiles

- Freudenberg Sealing Technologies

- Saint-Gobain S.A.

Frequently Asked Questions

Analyze common user questions about the Body Sealing System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most critical material trend impacting the Body Sealing System Market?

The most critical material trend is the transition from conventional EPDM rubber to Thermoplastic Vulcanizates (TPVs) and advanced Thermoplastic Elastomers (TPEs). This shift is driven by the mandate for lightweighting in both traditional and electric vehicles, as TPVs offer comparable performance to EPDM but are significantly lighter and easier to recycle, optimizing both vehicle efficiency and manufacturing processes.

How is the rise of Electric Vehicles (EVs) changing body sealing requirements?

EVs impose strict demands, primarily needing highly effective seals for enhanced Noise, Vibration, and Harshness (NVH) mitigation, as the absence of engine noise makes wind and road noise more noticeable. Additionally, specialized high-integrity seals are required for protecting sensitive battery packs and electronics from moisture ingress, thermal runaway, and dust contamination, necessitating specialized material compounds.

Which geographical region is currently leading the market growth?

Asia Pacific (APAC), particularly driven by manufacturing output in China and India, is leading the market growth in terms of volume and expansion rate. This is due to massive investments in new vehicle production capacity, the localized growth of the EV sector, and increasing demand for higher quality vehicle components across emerging economies in the region.

What are the primary functions of a Body Sealing System in a modern vehicle?

The primary functions are manifold: ensuring optimal cabin acoustics and reducing Noise, Vibration, and Harshness (NVH); preventing the ingress of water, dust, and external air; maintaining cabin climate control efficiency by reducing air leakage; and supporting the structural integrity and aesthetic finishing of doors, windows, and movable panels.

What role does Artificial Intelligence (AI) play in the manufacturing of body seals?

AI is increasingly applied in manufacturing primarily for quality control and process optimization. Machine vision systems powered by AI perform instantaneous, high-precision inspections of extruded profiles, detecting microscopic defects. Furthermore, AI algorithms are used to stabilize complex extrusion parameters in real-time, improving material consistency and reducing overall scrap rates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager