Boiler Feedwater Pump Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434289 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Boiler Feedwater Pump Market Size

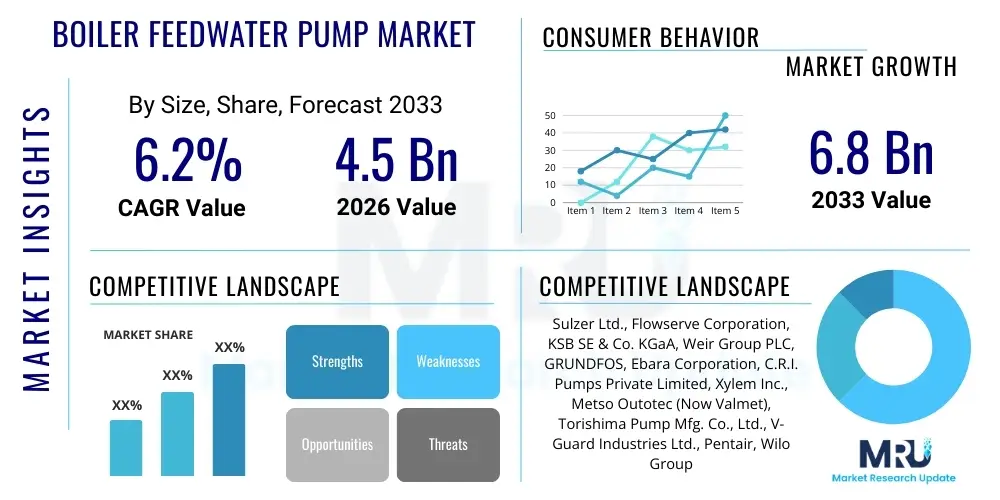

The Boiler Feedwater Pump Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.8 Billion by the end of the forecast period in 2033.

Boiler Feedwater Pump Market introduction

The Boiler Feedwater Pump Market encompasses specialized high-pressure pumps designed to deliver heated water into a steam boiler system, ensuring the constant and efficient operation of power plants, industrial facilities, and large-scale heating systems. These pumps are critical components in the steam cycle, requiring exceptional reliability, energy efficiency, and capability to handle high temperatures and pressures, often exceeding 300 bar in modern ultra-supercritical power applications. The design complexity stems from the need to manage thermal expansion, maintain tight clearances, and prevent catastrophic failure, making material selection and precision engineering paramount. The operating environment demands resistance to corrosion from boiler water treatment chemicals and resistance to erosion caused by high-velocity flow, necessitating the use of specialized alloys such as high-chrome steel and duplex stainless steel in vital components like impellers and diffusers. Furthermore, the modern market places a high premium on pumps integrated with advanced monitoring systems to ensure operational visibility.

Major applications of boiler feedwater pumps span across thermal power generation, including traditional coal-fired plants, highly efficient gas turbine combined cycle (CCGT) systems, and crucial operations within the nuclear power sector where feedwater pumps must meet rigorous safety and reliability standards. Beyond power, significant utilization occurs in heavy industries such as chemical processing, petroleum refining, the pulp and paper sector, and extensive municipal district heating networks. The fundamental benefits derived from utilizing modern, high-performance feedwater pump systems include dramatically enhanced thermal efficiency of the overall steam cycle, which directly translates to reduced fuel consumption and lower operational costs. Additionally, the incorporation of sophisticated hydraulic designs and Variable Speed Drives (VSDs) allows for precise flow control, mitigating system fluctuations and extending the operational lifespan of the entire boiler unit by reducing stress and water hammer effects.

Key driving factors accelerating market expansion include the substantial, continued global investment in new conventional and nuclear power generation infrastructure, particularly concentrated within emerging Asian economies striving to meet skyrocketing electricity demand. Concurrently, in mature markets of North America and Europe, the primary driver is the necessity of replacing aging pump infrastructure installed decades ago with modern, highly efficient models that comply with stricter environmental and energy consumption standards. The inherent demand for high-reliability components in mission-critical applications ensures sustained market viability. Furthermore, technological innovation focused on improving efficiency by reducing internal recirculation losses and optimizing Net Positive Suction Head (NPSH) requirements is compelling industries to upgrade to the latest pump technologies, thereby enhancing system stability even under transient load conditions characteristic of modern grid operations.

Boiler Feedwater Pump Market Executive Summary

The Boiler Feedwater Pump Market is characterized by a strong convergence of industrial necessity and technological advancement, positioning it for stable growth throughout the forecast period. Business trends prominently feature a shift toward smart pumping solutions, integrating sophisticated sensor arrays for real-time vibration analysis, temperature monitoring, and performance diagnostics. This technological pivot facilitates the widespread adoption of predictive maintenance contracts, representing a significant revenue stream for OEMs beyond initial equipment sales. Furthermore, the competitive landscape is increasingly defined by firms capable of offering highly customized, modular pump packages, particularly essential for the constraints of retrofit projects or highly specific requirements of ultra-supercritical power plants that require bespoke hydraulic performance tailored to specific thermodynamic cycles. Strategic mergers and acquisitions are frequently utilized by key players to consolidate technological niches and expand global service networks, thus strengthening their competitive position in both the aftermarket and new installations.

Regionally, the market dynamic is starkly bifurcated. The Asia Pacific region retains its leadership position, underpinned by massive infrastructural development and the realization of major power projects in nations such as China, India, and Indonesia. This sustained growth in APAC involves both greenfield investments and expansion of existing industrial complexes. Conversely, North America and Europe represent highly mature, service-intensive markets, where market penetration relies heavily on capital replacement cycles, regulatory mandates for energy efficiency, and the increasing incorporation of digital services. These regions prioritize sophisticated maintenance solutions, aiming to maximize the operational uptime of existing assets. The Middle East and Africa (MEA) shows focused growth tied to petrochemical expansion and water desalination projects, demanding pumps engineered specifically for harsh environments and requiring robust sealing systems.

Segmentation analysis underscores the enduring dominance of multi-stage centrifugal pumps, specifically the barrel casing configuration, due to its inherent structural integrity and suitability for the extreme pressures encountered in large power stations, often exceeding 300 bar. In terms of end-use, the Power Generation segment remains the bedrock of demand; however, the Industrial sector, covering refining, chemical processing, and general manufacturing, is exhibiting accelerated growth fueled by global industrial modernization programs and increasing emphasis on energy recovery systems. A noticeable trend within the product segment is the growing adoption of boiler circulating pumps (often integrated into the broader feedwater system) utilizing advanced magnetic coupling technology to eliminate seal leakage and reduce the need for complex cooling systems, contributing to overall operational simplicity and reliability.

AI Impact Analysis on Boiler Feedwater Pump Market

Analysis of common user questions reveals a widespread focus on how Artificial Intelligence (AI) can transcend traditional preventative maintenance schedules to deliver genuine operational foresight for boiler feedwater pumps. Users are deeply interested in the capability of AI to analyze multivariate datasets—including acoustic signatures, transient pressure surges, shaft alignment, and fluid dynamics—to isolate specific, incipient faults in components such as thrust bearings, mechanical seals, and highly stressed diffusers. A major concern is the practicality and cost-effectiveness of retrofitting older, high-capital pumps with the necessary sensing technology required for effective AI deployment, alongside the integration challenges presented when connecting proprietary OEM AI platforms with diverse plant-wide control systems (DCS). Ultimately, users expect AI to provide a tangible Return on Investment (ROI) by maximizing uptime, minimizing maintenance labor, and ensuring pumps consistently operate at peak hydraulic efficiency regardless of varying boiler loads.

- Enhanced Predictive Maintenance: AI leverages deep learning algorithms to process vibration and temperature data, predicting bearing and seal failures up to three months in advance, facilitating scheduled, rather than reactive, maintenance interventions.

- Optimized Energy Consumption: Machine learning models continuously analyze boiler load requirements and external thermodynamic conditions to modulate Variable Speed Drives (VSDs), ensuring the pump operates along the highest efficiency curve, reducing power draw by typically 3-5%.

- Advanced Fault Diagnosis: AI systems perform immediate root cause analysis for performance deviations, distinguishing between hydraulic imbalances (e.g., cavitation) and mechanical wear, thereby guiding maintenance teams directly to the core issue and minimizing investigative downtime.

- Digital Twin Implementation: Creation of high-fidelity digital models allows operators to simulate the pump’s response to transient conditions (like rapid cycling or pressure spikes), optimizing control parameters before deployment and extending equipment design life.

- Automated Logistical Planning: AI integrates maintenance predictions with Enterprise Resource Planning (ERP) systems to automatically forecast spare parts demand (e.g., impellers, gaskets, couplings), ensuring inventory is available precisely when needed, reducing carrying costs and wait times.

DRO & Impact Forces Of Boiler Feedwater Pump Market

The market trajectory for Boiler Feedwater Pumps is intricately balanced between powerful expansion drivers and significant technological hurdles acting as restraints. A primary driver is the accelerating global electrification, particularly evident in Asia and parts of Africa, necessitating massive capital expenditure on power infrastructure. Furthermore, the stringent global regulatory push towards improved industrial energy efficiency, often mandated through national efficiency standards and carbon reduction commitments, compels plant operators worldwide to replace older, inefficient pumps with modern, high-efficiency centrifugal and barrel pumps. Technological advancements, specifically the maturation of high-pressure, high-speed designs and integrated condition monitoring systems, further fuel replacement demand by offering compelling lifecycle cost savings (LCC) compared to legacy equipment.

Significant restraints include the extremely high initial capital cost associated with custom-engineered, multi-stage, high-pressure pumps, which require specialized fabrication techniques, exotic materials (to prevent erosion and corrosion), and extensive factory testing. This high entry barrier can slow down purchasing cycles, especially in price-sensitive industrial segments. Operationally, boiler feedwater pumps face constant threats from severe cavitation, particularly under low-NPSH conditions or during transient operations, and water chemistry fluctuations, which can rapidly degrade internal components, leading to expensive and lengthy unplanned outages. Furthermore, the market remains dependent on the volatility of raw material prices—notably nickel, chromium, and specialized steel alloys—which directly impacts manufacturing costs and profit margins for OEMs.

Opportunities for market players are vast, stemming primarily from the growing adoption of combined cycle gas turbine (CCGT) technology, which demands highly flexible and fast-responding feedwater systems capable of rapid cycling. The expanding implementation of Industry 4.0 solutions, integrating IoT, cloud computing, and AI-driven diagnostics, represents a high-value opportunity, enabling OEMs to transition from equipment providers to providers of comprehensive reliability and performance service contracts. Additionally, the widespread need for energy recovery and waste heat utilization across diverse industrial processes (e.g., cement, steel manufacturing) is creating new, albeit smaller, pockets of demand for customized industrial boiler and associated feedwater pump systems, demanding tailored solutions for different steam pressures and flow rates.

Segmentation Analysis

Segmentation provides a detailed view of the Boiler Feedwater Pump Market landscape, categorizing demand based on hydraulic design, operational capacity, and application focus. The division by product type highlights the supremacy of centrifugal pumps, which are favored for their ability to handle massive flow rates and achieve high heads required for modern power generation. Within centrifugal pumps, the barrel casing design stands out as the premium segment for supercritical thermal power plants due to its robust pressure containment structure. Segmentation by stage type distinctly separates the market between high-volume utility applications utilizing complex multi-stage pumps and less demanding industrial applications served by single-stage pumps. The end-user segment is crucial, illustrating the market's heavy reliance on the capital expenditure cycles of global Power Utilities, while the Industrial sector provides a more diversified and consistently expanding stream of revenue through various manufacturing and processing needs.

- By Product Type:

- Centrifugal Pumps: The dominant segment due to high efficiency at large flow rates.

- Multi-Stage Pumps: Necessary for achieving the extremely high pressure heads (up to 4,500 psi) required by supercritical boilers.

- Barrel Case Pumps: Used exclusively in ultra-high pressure power generation applications, offering superior structural integrity.

- Horizontal Split Case Pumps: Common in lower-pressure industrial and auxiliary power applications due to easier maintenance access.

- Positive Displacement Pumps (Reciprocating Pumps): Used in small boiler systems or for precise, low-flow chemical injection (dosing) into the feedwater line.

- By Stage Type:

- Single Stage: Lower pressure applications; primarily industrial or small auxiliary use.

- Multi Stage: High-pressure applications; mandatory for mainline power generation facilities where pressure requirements are extreme.

- By End-User:

- Power Generation: Includes traditional coal, gas, and nuclear plants; largest market segment in terms of volume and revenue.

- Industrial: Encompasses refineries, chemical plants, pulp and paper mills, and F&B processing, focusing on reliable process steam supply.

- Other Applications: District heating systems, marine propulsion boilers, and specialized commercial boiler systems.

- By Operational Pressure:

- Ultra-High Pressure (Above 300 Bar): Specialized for ultra-supercritical power plants.

- High Pressure (200–300 Bar): Typical for supercritical and large combined cycle power plants.

- Medium Pressure (50–200 Bar): Common in medium-sized industrial and conventional thermal power facilities.

- Low Pressure (Below 50 Bar): Used for smaller industrial or auxiliary boiler systems.

Value Chain Analysis For Boiler Feedwater Pump Market

The upstream segment of the Boiler Feedwater Pump value chain is highly dependent on specialized material inputs, particularly the sourcing and processing of high-nickel and high-chromium alloys. Suppliers of specialized castings, forgings, and high-precision bearing components operate under stringent quality controls, often required to meet API 610 or similar standards, certifying their materials for high-pressure, high-temperature service. Expertise in metallurgy and heat treatment is a non-negotiable requirement for these upstream providers, as material integrity directly dictates the pump’s resistance to thermal stress, corrosion, and erosion. Manufacturers maintain tight relationships with a limited number of certified suppliers to ensure component traceability and quality consistency across complex product lines, especially for nuclear-grade applications.

The midstream phase, dominated by major OEMs, involves extensive R&D, sophisticated machining, and final assembly. Core activities include hydraulic design optimization using advanced simulation tools (CFD), structural analysis (FEA), and the integration of electrical components like high-efficiency motors and VSDs. For customized projects, this phase culminates in mandatory, expensive Factory Acceptance Testing (FAT) under simulated operational conditions to verify performance parameters like efficiency, head, and NPSH requirements. Distribution channels exhibit a dual strategy: direct sales, engineering, procurement, and construction (EPC) firms are preferred for large power plant projects requiring tailored solutions and complex contractual negotiation. Conversely, standardized pumps for smaller industrial applications are often distributed through a network of specialized, technically proficient industrial distributors capable of local assembly, stocking critical spare parts, and providing localized technical troubleshooting.

Downstream activities center entirely on service, support, and asset lifecycle management. Given the mission-critical nature and high cost of feedwater pumps, robust after-market services, including spare parts supply, field service engineering, and long-term maintenance contracts, constitute a major competitive field. The rise of digitalization means that OEMs are increasingly offering value-added services such as remote monitoring and AI-driven performance diagnostics, ensuring the pump operates at peak efficiency throughout its 20-30 year lifespan. End-users prioritize vendors who can guarantee rapid response times and hold extensive regional inventories of critical spares, minimizing the financial impact of unscheduled downtime in power generation facilities.

Boiler Feedwater Pump Market Potential Customers

The ecosystem of potential customers is dominated by large infrastructure operators and heavy industrial entities requiring reliable, continuous steam generation. Foremost among these are the global Power Utilities and Independent Power Producers (IPPs) managing massive centralized power complexes. These customers are the primary buyers of the largest, most technologically complex multi-stage barrel pumps required for supercritical (250+ bar) and ultra-supercritical (300+ bar) boilers. Their purchasing criteria focus on guaranteed efficiency curves, mean time between failures (MTBF), adherence to global standards (e.g., ISO, API), and the OEM's capacity for long-term service agreements and emergency response.

A second, highly diversified customer segment is the Industrial sector, encompassing entities whose core processes require significant amounts of steam for heating, chemical reactions, or drying. This includes major integrated refineries and petrochemical complexes utilizing steam for distillation and feedstock processing; large-scale fertilizer and ammonia production plants; and the entirety of the pulp and paper industry. These customers typically require a variety of medium to high-pressure pumps suitable for diverse flow rates. Their decisions often hinge on minimizing total lifecycle costs, prioritizing energy efficiency, ease of maintenance, and compatibility with existing plant automation and safety systems.

Emerging and specialized customer segments include operators of large Marine vessels (cruise ships, container ships, naval vessels) that utilize specialized, compact boiler systems, and municipal authorities managing extensive District Heating networks in colder climates, such as parts of Europe and North Asia. For these segments, constraints like space, weight, and the ability to handle rapid system cycling are paramount. Overall, while the power generation sector provides the largest singular contracts, the industrial segment offers a consistent, recurring revenue stream driven by modernization and continuous process expansion globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.8 Billion |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sulzer Ltd., Flowserve Corporation, KSB SE & Co. KGaA, Weir Group PLC, GRUNDFOS, Ebara Corporation, C.R.I. Pumps Private Limited, Xylem Inc., Metso Outotec (Now Valmet), Torishima Pump Mfg. Co., Ltd., V-Guard Industries Ltd., Pentair, Wilo Group, ITT Inc., Atlas Copco AB, SPP Pumps, Ruhrpumpen Group, Trillium Flow Technologies, Baker Hughes Company, ANDRITZ Group, CNP Pump Co., Ltd., Nikkiso Co., Ltd., Kirloskar Brothers Limited, Pumpline Pumps, Tsurumi Manufacturing Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Boiler Feedwater Pump Market Key Technology Landscape

The technological evolution within the Boiler Feedwater Pump Market is fundamentally focused on enhancing hydraulic performance, maximizing component life, and seamlessly integrating digital intelligence. A primary technological cornerstone is the continuous refinement of multi-stage pump design, particularly the hydraulic components (impellers, diffusers). Utilizing sophisticated Computational Fluid Dynamics (CFD) simulation allows engineers to optimize flow paths, significantly reducing hydraulic friction losses and improving the pump's overall efficiency, often pushing efficiency ratings above 85% for high-capacity units. This optimization is crucial for minimizing energy expenditure, which often accounts for a significant portion of a power plant’s auxiliary load. Furthermore, addressing the critical challenge of Net Positive Suction Head (NPSH) remains paramount, driving innovations in first-stage impeller design and the integration of booster pumps to prevent damaging cavitation under transient load changes.

Material science innovation is equally vital, particularly in mitigating the extreme conditions of high-pressure, high-temperature operation. The shift towards proprietary high-strength, corrosion-resistant alloys, such as specific grades of duplex and super-duplex stainless steel, is standard practice for components exposed to aggressive boiler water chemistries. Advanced wear-resistant coatings, including specialized ceramics or surface treatments, are being increasingly applied to prevent abrasive wear and erosion in throttling areas. Concurrently, the mechanical seals and bearing systems are seeing advancements, with cartridge seal designs becoming more common for ease of replacement, and magnetic bearings being explored in niche, high-speed applications to eliminate friction losses and lubrication complexities, enhancing overall reliability and reducing routine maintenance costs.

The current frontier of innovation lies in the deployment of digital technologies under the umbrella of Industry 4.0. Modern feedwater pumps are often supplied with embedded sensor packages monitoring vibration (using FFT analysis), temperature, flow, and pressure. This data stream is processed by sophisticated Condition Monitoring Systems (CMS), frequently leveraging cloud-based platforms and AI algorithms to predict machine degradation. The implementation of Variable Speed Drives (VSDs), synchronized with the boiler’s Distributed Control System (DCS), is now standard, enabling precise flow regulation and yielding substantial energy savings compared to traditional fixed-speed throttling methods. This convergence of mechanical engineering excellence with robust digital monitoring facilitates the transition towards highly reliable, predictive maintenance schedules, guaranteeing maximum asset utilization throughout the pump’s lifecycle.

Regional Highlights

Market growth and operational characteristics differ markedly across global regions, reflecting diverse energy policies, industrial maturity, and investment priorities.

- Asia Pacific (APAC): Dominating the market, APAC’s growth is fueled by massive capacity additions in power generation, driven primarily by China’s infrastructure strategy and India’s burgeoning electricity demand. The market is characterized by high volume procurement of ultra-supercritical and supercritical feedwater pumps. Regional competitive dynamics are intensifying, with local manufacturers rapidly gaining market share against established global OEMs through aggressive pricing and government support for domestic sourcing, particularly in the medium and low-pressure industrial segments. The region faces challenges related to ensuring consistent quality control and service support across a vast geographical area.

- North America: This mature market is characterized by moderate, value-driven growth focused almost entirely on replacement cycles and efficiency mandates. Regulatory compliance, driven by emissions standards and energy conservation targets, necessitates upgrades to VSD-equipped, highly reliable pump systems. End-users prioritize total lifecycle cost (LCC) and are early adopters of AI-enabled predictive maintenance platforms, seeking to maximize the operational longevity of aging infrastructure. The industrial segment, particularly oil and gas, demands robust pumps adhering strictly to API standards for reliable process steam generation.

- Europe: Highly regulated by EU energy efficiency directives, Europe's market is primarily replacement-focused, with significant opportunities in retrofitting and modernizing existing district heating systems and industrial plants (e.g., Germany, UK, and Nordic countries). Sustainability is a key driver, pushing demand for the highest efficiency class of pumps and integrated smart control systems. The shift away from coal power limits growth in large thermal units but fuels demand for flexible, fast-ramping pumps in gas-fired combined cycle plants crucial for grid stability as renewable penetration increases.

- Middle East and Africa (MEA): Growth is erratic but potentially explosive, highly correlated with investments in the oil & gas (upstream and refining) and large-scale water desalination sectors, particularly in the Gulf Cooperation Council (GCC) countries. These applications require customized pumps engineered to handle high saline environments, high ambient temperatures, and demand stringent material specifications (often specialized alloys) for critical service. Political stability and commodity price trends significantly influence the timing and scale of major pump procurement cycles in this region.

- Latin America: This region exhibits gradual recovery and growth, tied primarily to key industries such as mining (requiring large power generation capacity) and petrochemicals in Brazil and Mexico. Price sensitivity is higher here compared to North America or Europe, often favoring durable, standardized designs over the latest high-cost technological innovations. Market entry often requires strong local partnerships to navigate complex regulatory environments and provide adequate regional support and service infrastructure, which remains critical for long-term customer retention.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Boiler Feedwater Pump Market.- Sulzer Ltd.

- Flowserve Corporation

- KSB SE & Co. KGaA

- Weir Group PLC

- GRUNDFOS

- Ebara Corporation

- C.R.I. Pumps Private Limited

- Xylem Inc.

- Metso Outotec (Now Valmet)

- Torishima Pump Mfg. Co., Ltd.

- V-Guard Industries Ltd.

- Pentair

- Wilo Group

- ITT Inc.

- Atlas Copco AB

- SPP Pumps

- Ruhrpumpen Group

- Trillium Flow Technologies

- Baker Hughes Company

- ANDRITZ Group

- CNP Pump Co., Ltd.

- Nikkiso Co., Ltd.

- Kirloskar Brothers Limited

- Pumpline Pumps

- Tsurumi Manufacturing Co., Ltd.

- Doosan Heavy Industries & Construction

- Hitachi Industrial Equipment Systems Co., Ltd.

- Dresser-Rand (A Siemens Business)

- Shih Hsiang Machinery Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Boiler Feedwater Pump market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a boiler feedwater pump in a power plant?

The primary function is to deliver treated, deaerated, and heated water (feedwater) into the boiler drum or steam generator at a pressure significantly higher than the boiler operating pressure, ensuring a continuous supply for steam production necessary for turbine operation. This process is crucial for maintaining the plant's thermal efficiency and stability.

How does the type of boiler affect the selection of a feedwater pump?

Boiler pressure dictates the pump type and materials; high-pressure supercritical and ultra-supercritical boilers require extremely high-head, multi-stage barrel casing centrifugal pumps (e.g., 300+ bar), while lower-pressure industrial boilers may use simpler horizontal split-case pumps or positive displacement units tailored for medium pressure ranges.

What are the key maintenance challenges associated with high-pressure feedwater pumps?

The main challenges involve combating severe cavitation, which rapidly damages impellers; mitigating erosion and corrosion, demanding specialized metallurgy; and managing mechanical seal and bearing wear caused by the constant exposure to high temperatures and pressures, necessitating sophisticated monitoring systems.

How is digitalization impacting the longevity and efficiency of boiler feedwater pumps?

Digitalization, through integrated IoT sensors and AI-driven Condition Monitoring Systems (CMS), allows for predictive maintenance, real-time performance optimization using Variable Speed Drives (VSDs), and early fault detection, thereby drastically extending the pump’s operational lifespan, reducing maintenance costs, and maximizing energy efficiency by ensuring operation at optimal hydraulic points.

Which region currently drives the highest demand and growth for boiler feedwater pumps?

Asia Pacific (APAC) currently holds the highest demand, primarily driven by massive infrastructure and power capacity expansions in developing economies like China, India, and Southeast Asia, resulting in significant volume sales of both new installations and crucial industrial replacements across various sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager