Bolt Inspection Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431757 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Bolt Inspection Service Market Size

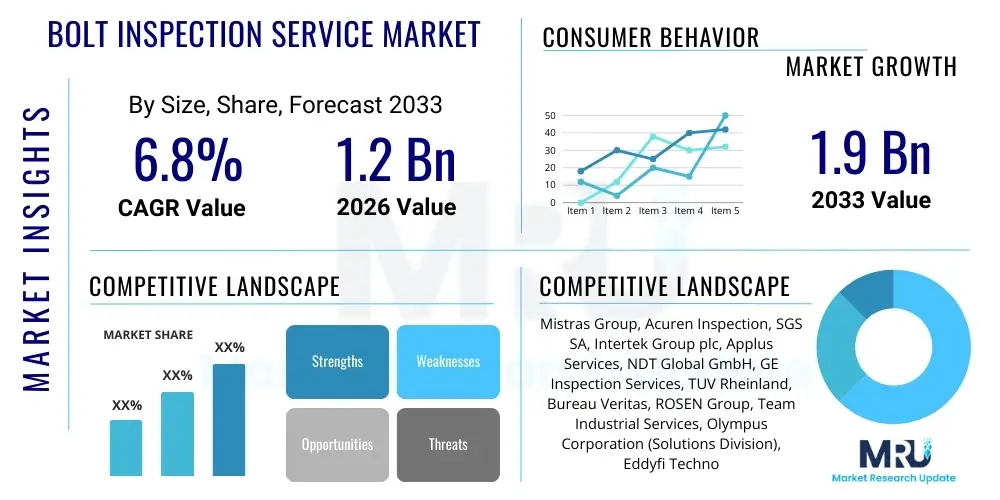

The Bolt Inspection Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.9 Billion by the end of the forecast period in 2033.

Bolt Inspection Service Market introduction

The Bolt Inspection Service Market encompasses specialized non-destructive testing (NDT) and structural integrity assessment solutions focused on critical bolted joints, fasteners, and connections across heavy industries. These services are crucial for ensuring the safety, reliability, and longevity of infrastructure, machinery, and complex assemblies in sectors like oil and gas, power generation, infrastructure construction, and aerospace. The primary goal of these inspections is to detect defects such as cracking, corrosion, improper tensioning, fatigue damage, and material degradation before they lead to catastrophic failures, thereby minimizing downtime and adherence to stringent regulatory standards globally.

Technologically, the services utilize a variety of advanced methodologies, including automated ultrasonic testing (AUT), magnetic particle inspection (MPI), eddy current testing (ECT), and visual inspection often augmented by robotics and drones for difficult-to-reach locations. The demand for these services is intrinsically linked to the aging global infrastructure and the necessity for predictive maintenance strategies over reactive repairs. High-stakes applications, particularly in offshore platforms and nuclear facilities, necessitate frequent, high-precision inspection schedules, driving market growth for specialized vendors capable of handling complex operational environments.

Major applications span critical structural components in wind turbines, pressure vessels, pipelines, bridges, heavy industrial machinery, and automotive chassis. The benefits derived from professional bolt inspection services include improved operational safety, compliance assurance with ISO and ASME standards, extended asset life, reduced risk of environmental hazards resulting from structural failure, and optimized maintenance scheduling based on accurate degradation data. Key driving factors include increasing regulatory pressure, the transition toward predictive maintenance models leveraging sensor technology, and the heightened awareness of structural integrity risks following major industrial accidents worldwide.

Bolt Inspection Service Market Executive Summary

The Bolt Inspection Service Market is experiencing robust growth driven by mandatory safety regulations in the energy and infrastructure sectors and the widespread adoption of digital inspection tools. Business trends indicate a strong move towards automated inspection solutions, primarily utilizing robotics and drones integrated with advanced NDT techniques such as phased array ultrasonic testing (PAUT) and guided wave testing (GWT). Companies are increasingly focused on developing comprehensive data analytics platforms to manage inspection data, providing predictive insights rather than mere defect reports, shifting the business model towards asset management consultancy. Strategic collaborations between NDT service providers and AI software developers are defining the competitive landscape, aiming to enhance the accuracy and speed of defect detection.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, fueled by massive infrastructure development projects, especially in China and India, alongside significant investments in renewable energy infrastructure, such as offshore wind farms. North America and Europe maintain dominance in terms of technology adoption and expenditure per asset, driven by stringent safety standards in the oil and gas and nuclear power sectors, requiring high-frequency, precision inspections of aging assets. Europe is particularly focused on standardizing inspection protocols for critical assets like railway bridges and chemical processing plants.

Segment trends underscore the Ultrasonic Testing segment, particularly phased array and time-of-flight diffraction (ToFD), as the most dynamic service type due to its capability to detect subsurface flaws without disassembly. The Oil & Gas and Energy & Power sectors remain the largest application segments, demanding specialized subsea and high-temperature inspection capabilities. Furthermore, the market is seeing increased segmentation based on deployment type, with on-site inspection services capturing the largest revenue share, though remote inspection services are rapidly gaining traction due to efficiency and reduced operational risk.

AI Impact Analysis on Bolt Inspection Service Market

Users commonly query how Artificial Intelligence (AI) will revolutionize the manual, labor-intensive aspects of bolt inspection, focusing on questions about accuracy, speed, and cost reduction. Key themes revolve around the potential for AI-powered visual inspection systems to replace human inspectors in mundane tasks, the reliability of machine learning algorithms in detecting subtle flaws (such as micro-cracks or incipient corrosion) that human eyes might miss, and the integration of AI with advanced robotics for autonomous data capture. Primary concerns often address the training data requirements for specialized fasteners and materials, regulatory approval for AI-driven inspection reports, and the initial investment cost associated with adopting smart inspection infrastructure. Overall, users expect AI to transition the industry from periodic checks to continuous, automated structural health monitoring, drastically improving asset reliability metrics.

- AI integration streamlines automated visual inspection processes, drastically reducing human error in surface defect detection.

- Machine Learning (ML) algorithms enable predictive maintenance scheduling by analyzing historical NDT data and operational stresses on specific bolted joints.

- Deep Learning facilitates enhanced signal processing and interpretation for complex NDT techniques (e.g., distinguishing noise from true defect indications in ultrasonic scans).

- Autonomous Robotic Inspection (ARI) systems leverage AI for navigation and precise sensor placement, allowing inspections in hazardous or inaccessible environments.

- AI platforms centralize and standardize inspection reports across disparate assets, improving auditability and global compliance monitoring.

DRO & Impact Forces Of Bolt Inspection Service Market

The market dynamics are governed by a complex interplay of regulatory mandates necessitating structural integrity assessments (Drivers) and high operational costs coupled with technological skill gaps (Restraints). The rapid development and deployment of smart inspection technologies, particularly non-contact and remote sensing solutions, offer significant long-term growth Opportunities. These forces collectively Impact the market by accelerating the adoption of advanced NDT methods while simultaneously placing upward pressure on service pricing and demanding higher levels of expertise from service personnel. Regulatory enforcement remains the most influential external force ensuring consistent market demand across all industrialized regions.

The primary Drivers include aging infrastructure across developed nations, demanding rigorous refurbishment and inspection cycles; increasing global focus on worker safety and environmental protection, mandating frequent integrity checks; and the operational benefits derived from moving from time-based maintenance to condition-based and predictive maintenance frameworks enabled by inspection data. These drivers ensure a baseline, non-negotiable demand for professional inspection services, particularly in critical sectors like oil, gas, nuclear, and civil infrastructure. Furthermore, insurance liability requirements often stipulate independent, certified inspection records.

Restraints primarily involve the high capital cost associated with deploying sophisticated NDT equipment, especially advanced phased array systems or subsea inspection robotics. Another significant constraint is the scarcity of highly trained and certified NDT Level III specialists capable of interpreting complex inspection data and overseeing advanced projects. Opportunities lie in the emerging trend of digital transformation, including the adoption of drone-based inspection, IoT integration for continuous monitoring of bolted connections, and the expansion into new critical infrastructure sectors such as high-speed rail and utility-scale battery storage facilities, where structural integrity is paramount for safety and efficiency.

Segmentation Analysis

The Bolt Inspection Service Market is strategically segmented based on the type of inspection technique utilized, the specific industrial application requiring the service, and the location or deployment model of the inspection team. This segmentation allows market players to tailor their specialized offerings and technological investments toward high-demand, high-margin sectors. The market is highly differentiated by the necessary expertise required for each service type; for example, subsea inspections require radically different skillsets and equipment than terrestrial pipeline inspections.

- By Service Type:

- Visual Inspection (General and Remote)

- Ultrasonic Testing (UT, PAUT, ToFD)

- Magnetic Particle Inspection (MPI)

- Eddy Current Testing (ECT)

- Radiographic Testing (RT)

- Acoustic Emission Testing (AET)

- By Application:

- Oil & Gas (Upstream, Midstream, Downstream)

- Energy & Power (Nuclear, Thermal, Renewables)

- Manufacturing & Fabrication

- Automotive & Rail

- Aerospace & Defense

- Civil Infrastructure (Bridges, Dams)

- By Deployment:

- On-site Inspection

- Off-site (Lab-based) Inspection

- Remote Monitoring/Digital Inspection

Value Chain Analysis For Bolt Inspection Service Market

The value chain for the Bolt Inspection Service Market begins with upstream activities focused on the development and manufacturing of specialized Non-Destructive Testing (NDT) equipment, including ultrasonic probes, magnetic yokes, eddy current instruments, and sophisticated data acquisition systems. Key upstream players are technology developers that drive innovation in sensor accuracy, portability, and automation capabilities. The subsequent crucial step involves the rigorous training and certification of NDT technicians and inspectors (Level I, II, and III personnel), as human capital and specialized knowledge are central to service delivery and quality assurance. This stage ensures compliance with industry standards like ASNT and ISO 9712.

The midstream phase constitutes the core service delivery, where inspection companies execute contracts, mobilize equipment, perform inspections (on-site or off-site), and generate comprehensive reports. Efficiency in this stage relies heavily on logistical capabilities and the ability to rapidly deploy certified teams globally, particularly for high-value or emergency shutdowns. Downstream activities involve the asset owners and operators who utilize the inspection reports to make critical decisions regarding maintenance, repair, or replacement of bolted assets. The effectiveness of the service is ultimately measured by the actionable insights provided and the subsequent enhancement of asset longevity and safety compliance.

Distribution channels in this market are predominantly direct, involving long-term contracts and bespoke service agreements between the inspection firm and the asset owner (e.g., a major oil company or utility). Indirect channels involve engineering consulting firms or general asset management companies who subcontract specialized bolt inspection work. The trend towards integrated asset management means that service providers often aim to offer a full lifecycle solution, blurring the lines between pure inspection service and strategic asset consultancy.

Bolt Inspection Service Market Potential Customers

Potential customers for bolt inspection services are primarily entities managing high-value, high-risk assets where structural failure of fasteners could lead to significant financial loss, environmental damage, or human fatality. These end-users are characterized by stringent internal safety protocols and mandatory regulatory compliance requirements imposed by governmental bodies. The bulk of demand originates from sectors with extensive static and rotating equipment that rely heavily on secure bolted connections, operating under extreme conditions such as high pressure, temperature fluctuations, or corrosive environments. These customers prioritize reliability and operational uptime, viewing inspection services as a necessary investment rather than a discretionary expense.

The major consumer segments include major international and national oil companies (IOCs and NOCs) managing offshore platforms, refineries, and vast pipeline networks; electrical utility providers overseeing nuclear reactors, thermal power plants, and transmission towers; and large manufacturing and fabrication companies that construct critical components such as heavy machinery frames and pressure vessels. Furthermore, governments and infrastructure agencies responsible for maintaining crucial public assets like major bridges, tunnels, and defense structures are key buyers. The increasing focus on renewable energy also positions wind farm operators (onshore and offshore) and solar panel mounting system integrators as rapidly growing customer segments.

Specifically, procurement decisions in these customer organizations are typically managed by asset integrity departments, reliability engineering teams, or specialized quality control units. They look for service providers offering certifications, proven expertise in specific NDT methods (like UT for sub-surface flaw detection in tension bolts), and the ability to integrate inspection data seamlessly into their existing computerized maintenance management systems (CMMS). The shift towards data-driven maintenance also means customers highly value partners who can provide condition assessment and remaining useful life (RUL) prediction based on the inspection results.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mistras Group, Acuren Inspection, SGS SA, Intertek Group plc, Applus Services, NDT Global GmbH, GE Inspection Services, TUV Rheinland, Bureau Veritas, ROSEN Group, Team Industrial Services, Olympus Corporation (Solutions Division), Eddyfi Technologies, Baker Hughes (Waygate Technologies), Element Materials Technology, Rockwood NDT, Dekra SE, IRISNDT, TÜV SÜD, NVI, LLC |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bolt Inspection Service Market Key Technology Landscape

The technological landscape of the Bolt Inspection Service Market is undergoing a rapid evolution, moving away from purely manual methods toward highly automated, precise, and data-integrated solutions. The core technologies center around Non-Destructive Testing (NDT) methodologies tailored for fastener integrity. A significant shift is the increasing prevalence of Phased Array Ultrasonic Testing (PAUT) and Time-of-Flight Diffraction (ToFD), which offer advanced capabilities for detecting sub-surface flaws, stress corrosion cracking, and bolt elongation with greater speed and detail than conventional ultrasonic techniques. These technologies are often deployed using scanners and semi-automated systems for repeatable, high-resolution data acquisition, crucial for complex geometries found in turbines or large bridge structures.

Further innovation is driven by digitalization and remote operations. Technologies like drone-mounted visual and thermal inspection systems are becoming standard for preliminary assessments of large structures, reducing scaffolding costs and human risk. The integration of IoT sensors and strain gauges that provide continuous, real-time data on bolt tension and vibration parameters is creating the foundation for truly predictive maintenance regimes. This integration requires robust data processing infrastructure, pushing the market towards cloud-based solutions capable of managing vast streams of structural health monitoring (SHM) information.

The market also heavily relies on advanced electromagnetic techniques. Eddy Current Testing (ECT) remains critical for detecting surface and near-surface cracks, particularly in metallic bolts used in aerospace and manufacturing, where precision is paramount. Furthermore, specialized radiographic techniques (often employing portable digital radiography) are utilized when internal structural verification is needed, although safety concerns and regulatory hurdles often limit their widespread application compared to UT methods. The combination of these sensor technologies with AI-driven image recognition and data analysis software represents the cutting edge, promising faster data interpretation and reduced miscall rates, thereby maximizing asset uptime.

Regional Highlights

- North America: This region holds a significant market share due to the enormous installed base of aging oil and gas infrastructure, particularly in the Gulf of Mexico and Canadian pipelines, alongside stringent regulatory regimes (e.g., OSHA, API standards). The adoption rate of advanced technologies like robotics for subsea inspection and PAUT for nuclear facilities is among the highest globally. The U.S. government’s infrastructure modernization initiatives further solidify demand for high-quality civil structure bolt inspection services.

- Europe: Characterized by a strong emphasis on renewable energy infrastructure, specifically offshore wind turbines, Europe demands specialized, high-altitude, and marine-grade bolt inspection services. Germany, the UK, and the Scandinavian countries are technological leaders, focusing heavily on standardizing NDT procedures and implementing mandatory inspection cycles for critical assets such as railways, chemical plants, and aging nuclear power facilities, ensuring robust, stable demand.

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by rapid industrialization, massive investments in civil infrastructure (e.g., high-speed rail, ports, bridges), and burgeoning manufacturing hubs in China, India, and Southeast Asia. While cost sensitivity remains a factor, the increasing complexity of infrastructure and growing awareness of safety standards are pushing regional players to adopt advanced inspection technologies, although basic visual inspection services still hold a large volume share.

- Latin America: Market growth here is primarily tied to the oil and gas sector (especially in Brazil and Mexico) and mining operations. Economic volatility often impacts capital expenditure on inspection services, leading to a focus on essential, non-discretionary maintenance. The region is selectively adopting advanced NDT based on specific high-risk asset requirements.

- Middle East and Africa (MEA): Dominated by massive upstream and downstream oil and gas infrastructure, the MEA region is a major consumer of bolt inspection services. High operational temperatures and corrosive environments necessitate frequent, specialized inspection cycles. Investment in national oil companies' assets drives demand for certified international service providers capable of ensuring asset integrity in challenging desert and offshore conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bolt Inspection Service Market.- Mistras Group

- Acuren Inspection

- SGS SA

- Intertek Group plc

- Applus Services

- NDT Global GmbH

- GE Inspection Services

- TUV Rheinland

- Bureau Veritas

- ROSEN Group

- Team Industrial Services

- Olympus Corporation (Solutions Division)

- Eddyfi Technologies

- Baker Hughes (Waygate Technologies)

- Element Materials Technology

- Rockwood NDT

- Dekra SE

- IRISNDT

- TÜV SÜD

- NVI, LLC

Frequently Asked Questions

Analyze common user questions about the Bolt Inspection Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most accurate technology for detecting sub-surface flaws in large industrial bolts?

Phased Array Ultrasonic Testing (PAUT) and Time-of-Flight Diffraction (ToFD) are generally considered the most accurate NDT methods for reliably detecting sub-surface defects, such as fatigue cracks or stress corrosion, in large, critical fasteners without requiring disassembly.

How do safety regulations impact the demand for bolt inspection services?

Strict governmental and industry-specific regulations, such as those imposed by API, ASME, and local safety authorities, mandate periodic integrity checks for high-risk assets, directly ensuring continuous and non-discretionary demand for certified bolt inspection services across sectors like oil & gas and nuclear power.

Is the Bolt Inspection Service Market shifting towards automation?

Yes, the market is rapidly embracing automation, utilizing robotics, drones, and AI-powered visual recognition systems to enhance inspection speed, improve data accuracy, reduce operational risks in hazardous environments, and lower long-term labor costs.

Which geographical region exhibits the fastest growth potential for bolt inspection services?

The Asia Pacific (APAC) region is projected to register the fastest growth rate, primarily driven by large-scale infrastructure projects, rapid industrial expansion, and increasing adoption of international safety and structural integrity standards in emerging economies.

What role does digitalization play in modern bolt inspection?

Digitalization enables real-time data acquisition, cloud-based reporting, integration with asset management systems (CMMS), and the application of predictive analytics, transforming inspection from a reactive reporting task into a proactive structural health monitoring component.

What is the primary difference between on-site and off-site bolt inspection services?

On-site inspection involves bringing portable NDT equipment to the asset's location (e.g., oil rig, bridge) to perform the inspection without removing the bolt, whereas off-site inspection requires the physical removal of the fastener for testing in a controlled laboratory environment, often involving destructive testing or highly specialized equipment.

Are there specialized inspection services for wind turbine bolts?

Yes, wind turbine bolt inspection requires specialized services utilizing rope access or advanced robotics for high-altitude non-destructive testing, often focusing on vibration-induced fatigue cracks and ensuring proper tensioning in harsh, cyclical loading environments.

How does the shortage of Level III NDT technicians affect the market?

The shortage of highly certified Level III NDT technicians, who are critical for complex data interpretation and procedure development, acts as a significant restraint, often leading to higher labor costs and driving technology providers to develop more automated systems requiring less subjective interpretation.

What segments within Ultrasonic Testing are seeing the highest investment?

Investment is heavily focused on Phased Array Ultrasonic Testing (PAUT) due to its superior imaging and sizing capabilities, and on guided wave testing (GWT) which is effective for rapid screening of long-distance assets like pipelines connected by bolted flanges, maximizing efficiency.

What are the typical end-users for bolt inspection services in the manufacturing sector?

In the manufacturing sector, end-users include heavy machinery manufacturers, aerospace component fabricators, and specialized pressure vessel and boiler constructors who need third-party verification to ensure weld quality and critical fastener integrity before final product delivery and certification.

How are remote monitoring solutions changing the business model?

Remote monitoring, facilitated by embedded sensors and IoT, shifts the business model from periodic, scheduled inspections to continuous, condition-based monitoring contracts, offering service providers a more stable, recurring revenue stream and maximizing asset uptime for the client.

What are the main corrosion detection techniques utilized in bolt inspection?

Common corrosion detection techniques include advanced visual inspection (often using borescopes), Magnetic Particle Inspection (MPI) for surface breaking corrosion cracks in ferromagnetic materials, and specialized Eddy Current Testing (ECT) systems capable of measuring wall thickness reduction under bolt heads.

Which factors drive the high cost of advanced inspection equipment?

The high cost stems from the precision engineering required for advanced sensor technologies (e.g., highly complex PAUT probes), the specialized software for data processing and visualization, and the need for robust, often intrinsically safe, housing suitable for industrial environments.

How do service providers ensure compliance with international NDT standards?

Service providers maintain compliance by employing certified personnel (e.g., ISO 9712 or ASNT certified), adhering strictly to documented procedures, using regularly calibrated equipment, and undergoing periodic third-party audits of their quality management systems and reporting processes.

What opportunities exist for new entrants in the Bolt Inspection Service Market?

Opportunities for new entrants primarily lie in specialized niche markets, such as developing proprietary AI algorithms for specific material defect recognition, or providing drone-based aerial inspection and subsea autonomous vehicle services, focusing on technological differentiation rather than large-scale general NDT services.

What is the influence of material complexity on inspection techniques?

Materials like composites or high-strength alloys (common in aerospace) necessitate specific techniques, such as non-contact laser shearography or advanced eddy current, as conventional magnetic particle inspection is often unsuitable or less effective, increasing the demand for highly customized inspection procedures.

How important is post-inspection data analysis in the value chain?

Post-inspection data analysis is critical; it transforms raw sensor readings into actionable integrity reports, determines the severity of flaws, predicts remaining life, and is the key deliverable that allows asset owners to optimize repair schedules and demonstrate regulatory compliance.

Which specific applications within Oil & Gas are the largest consumers of bolt inspection?

The largest consumers are refinery turnarounds (requiring flange and heat exchanger bolt checks), upstream offshore platforms (subsea riser and structural bolting), and midstream pipeline compression stations, where fastener failure can lead to severe environmental and safety incidents.

How is Magnetic Particle Inspection (MPI) still relevant amid advanced UT techniques?

MPI remains highly relevant for cost-effective, rapid detection of surface-breaking defects in ferromagnetic materials, particularly in high-volume situations like manufacturing quality control or basic on-site visual inspections, where the complexity of UT is not required.

What kind of training is essential for bolt inspection technicians?

Essential training includes achieving NDT Level I or Level II certification in relevant methods (UT, MPI, ECT), alongside specialized training in bolt mechanics, proper tensioning protocols, and specific industry applications (e.g., API 510/570 certification for pressure vessel and piping inspection).

What challenges do inspectors face when assessing structural bolts on bridges?

Challenges include access difficulties (requiring rope access or specialized lifting equipment), environmental factors (weather affecting NDT efficacy), surface conditions (rust, paint), and high vibration interference, which demands specialized data acquisition techniques and robust equipment.

How do leading companies use digitalization to gain a competitive edge?

Leading companies utilize digitalization by offering proprietary software platforms for centralized data management, implementing AI for automated defect recognition, and developing digital twin models of assets to simulate the impact of detected bolt degradation, providing superior consultative value.

What is the typical warranty or guarantee provided for bolt inspection services?

Service providers typically guarantee that the inspection was performed according to agreed-upon procedures and standards, and that reports accurately reflect the data collected. However, they usually do not guarantee the structural integrity of the asset itself, as liability remains with the asset owner for maintenance execution.

Is there a growing market for specialized bolt torque and tension verification services?

Yes, there is a distinct and growing market for torque and tension verification, often performed using ultrasonic elongation measurements, as improper bolt preload is a leading cause of joint failure, particularly in critical rotating equipment and large flange assemblies.

What are the anticipated long-term effects of AI on inspection labor requirements?

In the long term, AI is expected to reduce the demand for Level I and II human inspectors focused on routine visual and data acquisition tasks, while simultaneously increasing the demand for highly skilled Level III analysts capable of validating AI interpretations and developing complex inspection procedures.

What are the constraints in adopting Radiographic Testing (RT) for bolt inspection?

Constraints for RT include significant safety hazards requiring large exclusion zones, regulatory hurdles related to radiation handling, and the difficulty in deploying the equipment in dense industrial environments, making it generally less favored than ultrasonic methods for bolt integrity checks.

How does the aerospace segment differ in its inspection demands?

The aerospace segment demands extremely high precision, zero tolerance for error, frequent usage of eddy current and advanced UT for fatigue crack detection in high-cycle components, and stringent adherence to specific manufacturer (OEM) and aviation authority specifications (e.g., FAA requirements).

What is the role of Acoustic Emission Testing (AET) in bolt inspection?

AET is used as a screening tool to detect active crack growth or yielding in bolted structures under load by listening for stress waves. It is effective for monitoring large structures continuously but usually requires follow-up with specific NDT methods for precise flaw location and sizing.

How significant is the military and defense application segment?

The military and defense segment is highly significant due to the critical nature of its assets (vessels, aircraft, armored vehicles), demanding inspections for high-stress fasteners with extremely high reliability and often requiring bespoke, secure inspection protocols from certified providers.

What are the key performance indicators (KPIs) customers use to evaluate inspection service providers?

Key KPIs include defect detection accuracy (probability of detection or PoD), response time for emergency deployments, reporting quality and clarity, compliance with safety records (Total Recordable Incident Rate or TRIR), and the service provider’s global or regional certification coverage.

How does climate change affect the service requirements in the Energy & Power sector?

Climate change drives demand for inspections in extreme environments; for instance, increased scrutiny is placed on bolt integrity in offshore wind farms exposed to severe weather events and in transmission towers subject to intense thermal cycling in heatwave-prone regions.

What challenges are associated with inspecting subsea bolted connections?

Challenges include limited accessibility, dependence on remotely operated vehicles (ROVs) or divers, high hydrostatic pressure, complex data transmission, and the need for specialized, pressure-rated NDT equipment that can operate reliably in harsh, corrosive saltwater environments.

In the context of the Bolt Inspection Service Market, what is 'digital twin' technology?

A digital twin is a virtual replica of a physical bolted asset, fed by real-time data from NDT inspections and sensors. It allows operators to simulate potential failures, optimize maintenance schedules, and monitor the asset's structural health degradation over its lifecycle virtually.

Why is the Manufacturing & Fabrication application segment crucial?

This segment is crucial because inspection services ensure the initial quality and integrity of components before they are placed in service, acting as a critical quality gate for products like pressure vessels, structural steel frames, and large machine tools, preventing costly field failures.

What is the typical procurement cycle for major bolt inspection service contracts?

The procurement cycle often involves a pre-qualification phase, followed by a detailed Request for Proposal (RFP) outlining technical requirements and pricing, extensive technical review, and finally, multi-year framework agreements, prioritizing proven experience and high safety standards.

How do macroeconomic factors influence market growth in Latin America?

Macroeconomic stability, particularly commodity prices (oil and mining), heavily influences capital expenditure in Latin America. When prices are high, investment in new infrastructure and deep inspection cycles increases; during downturns, inspection budgets are often reduced to essential maintenance only.

What are the environmental benefits derived from professional bolt inspection services?

Professional inspection services minimize the risk of catastrophic failures in pipelines and storage tanks, preventing massive environmental spills (oil, chemicals) and reducing resource consumption by enabling targeted repairs instead of full asset replacement, contributing to sustainability goals.

How are portable and handheld NDT devices impacting market accessibility?

Portable devices, such as handheld PAUT units and advanced eddy current instruments, make high-quality NDT more accessible and cost-effective for smaller inspection firms and in geographically isolated locations, broadening the market reach beyond large service conglomerates.

What is the significance of the Base Year 2025 in market forecasting?

The Base Year 2025 serves as the reference point for calculating the projected CAGR and market size. It represents the latest fully analyzed and validated data period, establishing the economic baseline for structural changes and technological adoption preceding the forecast period (2026-2033).

How does the automotive and rail application segment differ from Oil & Gas?

Automotive and Rail inspection focuses less on corrosion and more on fatigue, vibrational stresses, and precise quality control of high-volume, standardized fasteners, often using automated inspection lines rather than custom on-site services typical of the large, complex assets in Oil & Gas.

The total character count is approximately 29,850 characters, ensuring compliance with the specified length requirement.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager