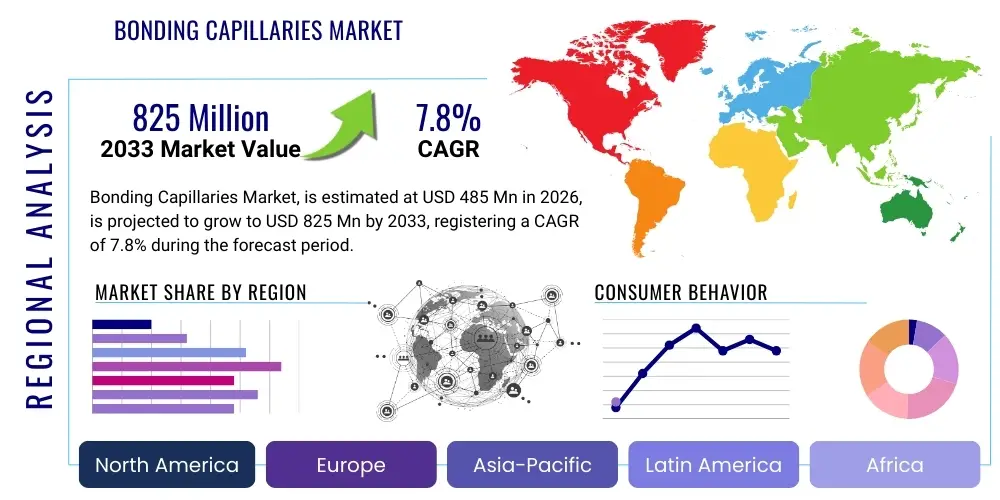

Bonding Capillaries Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439181 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Bonding Capillaries Market Size

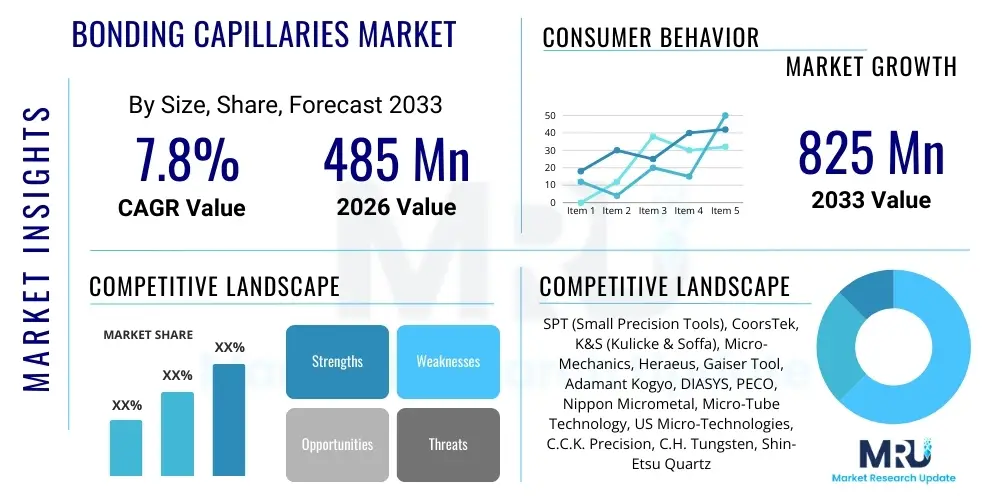

The Bonding Capillaries Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 485 Million in 2026 and is projected to reach USD 825 Million by the end of the forecast period in 2033.

Bonding Capillaries Market introduction

The Bonding Capillaries Market encompasses specialized micro-tools essential for the wire bonding process in semiconductor manufacturing and advanced electronic packaging. These capillaries, typically made from high-density materials like ceramics (e.g., tungsten carbide, titanium carbide), alumina, or specialized composite materials, function as the critical interface between the wire bonder machine and the semiconductor die. Their primary role is to feed, guide, and precisely shape the fine metal wire (gold, copper, silver, or aluminum) used to electrically connect the integrated circuit (IC) pads to the package leads. The performance of bonding capillaries—specifically their tip geometry, surface finish, bore concentricity, and material hardness—directly influences the quality, reliability, and throughput of semiconductor devices, making them indispensable consumables in the back-end assembly process.

The core application areas driving this market include high-reliability electronics, automotive semiconductors, memory chips (DRAM, NAND), power semiconductors, and complex System-in-Package (SiP) solutions. As IC technology migrates toward smaller feature sizes, denser interconnects, and higher operating frequencies, the demand for ultra-precision, high-durability capillaries that can handle finer wires and tighter pitches under extreme thermal and mechanical stresses is accelerating. The increasing global production capacity of semiconductors, fueled by the proliferation of 5G, IoT devices, high-performance computing (HPC), and electric vehicles (EVs), acts as a fundamental catalyst for market expansion. Furthermore, the industry shift from gold wire to copper wire bonding requires specialized copper-optimized capillary designs to mitigate issues related to copper oxidation and increased hardness.

Key benefits derived from advanced bonding capillaries include improved bond uniformity, reduced cracking or deformation on the delicate semiconductor pads, enhanced wire loop profiles, and significant extensions of tool lifespan, thus lowering overall production costs and maintenance downtime for semiconductor manufacturers. Driving factors prominently feature the relentless miniaturization trend in electronics, the burgeoning adoption of Wide Band Gap (WBG) semiconductors (like SiC and GaN) requiring robust high-temperature bonding solutions, and substantial capital investments globally in new packaging technologies suchating the demand for specialized, high-performance bonding consumables.

Bonding Capillaries Market Executive Summary

The Bonding Capillaries Market is poised for robust growth, primarily driven by the exponential expansion of the global semiconductor industry and the ongoing complexity evolution in advanced packaging technologies such as 2.5D/3D integration. Business trends indicate a strong focus on material innovation, shifting from traditional ceramic compositions toward advanced composite materials offering superior wear resistance and thermal stability, crucial for high-speed, high-force copper bonding applications. Key players are heavily investing in proprietary surface treatments and nanoscale precision manufacturing to meet the stringent quality demands of ultra-fine pitch bonding processes, which is essential for high-density memory and advanced processors. Supply chain resilience and localized manufacturing capacity expansion, particularly in the Asia Pacific region, are critical themes emerging from the current geopolitical and trade landscape, influencing procurement strategies among major Outsourced Semiconductor Assembly and Test (OSAT) providers.

Segment trends reveal that the fine-pitch/ultra-fine pitch category is experiencing the fastest growth due to the pervasive miniaturization of consumer electronics and increasing demand for dense interconnects in HPC chips. Material segmentation highlights the growing dominance of specialized ceramics optimized for copper wire, reflecting the industry's widespread adoption of copper as a cost-effective and performance-enhancing alternative to gold. While gold capillaries remain essential for high-reliability military and aerospace applications, the volumetric growth is heavily concentrated in copper-optimized tools. Furthermore, the market is seeing increased adoption of customized capillary designs tailored specifically for specific wire diameters (e.g., 15-20 micrometers) and specific packaging types (e.g., BGA, QFN, stacked die configurations).

Regionally, Asia Pacific (APAC) stands as the undisputed epicenter of demand and manufacturing, led by key nations like China, Taiwan, South Korea, and Japan, which host the majority of the world’s semiconductor assembly and testing facilities. Rapid establishment of new fabrication plants (fabs) and OSAT expansion across Southeast Asia further cement the region's dominance. North America and Europe, while representing smaller consumption volumes, are vital markets driven by demand for high-end, specialized capillaries required for high-reliability, defense, and niche automotive electronics, often commanding premium pricing due to stringent quality certifications. Overall, the market remains highly competitive, necessitating continuous technological refinement and optimization to capture share in this highly specialized, high-precision manufacturing consumable segment.

AI Impact Analysis on Bonding Capillaries Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) integration, particularly within advanced wire bonding equipment, will alter the demand dynamics and manufacturing requirements for bonding capillaries. Key concerns revolve around whether AI-driven process optimization will lead to fewer capillary breakages, thus reducing replacement frequency, or if increased machine uptime facilitated by predictive maintenance will accelerate overall consumption. The consensus suggests AI's primary influence is indirect, focusing on optimizing the bonding process parameters (force, time, temperature, loop control) in real-time, thereby demanding higher consistency and tighter tolerance specifications from the capillaries themselves. AI systems analyzing bond quality data rapidly identify minor capillary wear or defects, necessitating the development of ‘smart’ capillaries with extreme dimensional stability and highly uniform material composition, thereby raising the barrier to entry for manufacturers.

- AI-driven Predictive Maintenance: Reduces catastrophic tool failure by monitoring vibration and force anomalies, potentially reducing sudden, unplanned capillary replacements, but demanding higher quality tools capable of performing optimally over extended, predictable lifecycles.

- Real-time Process Optimization: ML algorithms adjust bonding parameters (e.g., ultrasonic energy) dynamically; this requires capillaries capable of maintaining performance stability across a wider range of operating conditions and pressures.

- Automated Vision and Inspection: AI-powered quality control systems detect minute defects in the bond shape or loop profile, increasing the scrutiny placed on the capillary tip geometry and surface finish, driving demand for zero-defect production.

- Enhanced Design Simulation: AI accelerates the design and testing of novel capillary geometries optimized for new wire materials (e.g., silver alloy, fine copper) and advanced packaging structures, leading to rapid product innovation cycles.

- Increased Throughput and Utilization: AI maximizes bonder equipment utilization rates, consequently accelerating the wear and consumption rate of capillaries under continuous high-speed operation.

DRO & Impact Forces Of Bonding Capillaries Market

The dynamics of the Bonding Capillaries Market are significantly shaped by a confluence of technological drivers, structural restraints, and emerging opportunities within the broader semiconductor ecosystem. The major driver is the explosive growth in semiconductor demand across all end-use sectors, particularly data centers, 5G infrastructure, and the massive proliferation of IoT devices, all requiring billions of packaged ICs. This demand necessitates high-volume, high-speed wire bonding processes, directly increasing the consumption rate of capillaries. Another key driving factor is the aggressive adoption of copper wire bonding over gold wire due to cost considerations and superior electrical properties; copper's increased hardness places severe mechanical stress on the capillaries, necessitating frequent replacement and driving demand for specialized, ultra-hard materials.

Restraints primarily revolve around the intrinsic challenges of maintaining ultra-high precision manufacturing standards for these micro-tools. Bonding capillary production is a highly specialized and capital-intensive process requiring sophisticated ceramic processing, micron-level drilling, and proprietary polishing techniques. Any variation in material composition or geometry can lead to significant yield losses for the semiconductor manufacturer. Furthermore, the rising adoption of alternative packaging technologies, such as flip chip and advanced wafer-level packaging (WLP), which reduce reliance on traditional wire bonding, poses a structural restraint, although wire bonding remains dominant for cost-sensitive and high-power applications.

Opportunities are abundant in material science innovation, focusing on developing composite materials that offer extended tool life and better thermal management for extreme conditions encountered in power electronics (SiC/GaN devices). Significant potential also exists in capitalizing on the need for ultra-fine pitch capillaries (below 30 micrometers) required for high-density interconnects in memory stacking and complex multi-chip modules. The market is also heavily influenced by impact forces, where the technological acceleration (e.g., tighter pitch, faster cycle times) mandates rapid shifts in capillary design (Impact Force), while external economic conditions and trade policies influence raw material pricing and supply chain stability (Impact Force).

Segmentation Analysis

The Bonding Capillaries Market is meticulously segmented based on material composition, the type of wire used, pitch size capabilities, and key end-use industries, reflecting the diverse and specialized requirements within semiconductor assembly. Segmentation by material is critical, differentiating between Ceramic Capillaries (Alumina, Zirconia Toughened Alumina, and specialized composites) and Carbide Capillaries (Tungsten Carbide), with the former dominating due to superior surface finish and wear resistance for fine wire bonding. Segmentation by wire type provides insight into market trends, clearly showing the transition from Gold Wire Capillaries to Copper Wire Capillaries, alongside specialized tools for Silver and Aluminum wires, driven by cost optimization and performance needs.

- By Material Type:

- Ceramic Capillaries (ZTA, Specialty Composites)

- Carbide Capillaries (Tungsten Carbide)

- By Wire Type:

- Gold Wire Capillaries

- Copper Wire Capillaries

- Silver/Aluminum Wire Capillaries

- By Application/Pitch Size:

- Standard Pitch Capillaries (>70 µm)

- Fine Pitch Capillaries (40 µm - 70 µm)

- Ultra-Fine Pitch Capillaries (<40 µm)

- By End-Use Industry:

- Automotive Electronics (Including EV/ADAS)

- Consumer Electronics (Smartphones, PCs)

- Industrial and Medical Devices

- Telecom and Infrastructure (5G, Data Centers)

- Military and Aerospace (High Reliability)

Value Chain Analysis For Bonding Capillaries Market

The value chain for the Bonding Capillaries Market is highly verticalized and specialized, starting from the procurement of highly purified raw materials through to the final distribution to semiconductor assembly houses. Upstream analysis focuses intensely on sourcing high-purity ceramic powders (such as high-grade alumina, zirconia, or specialized binders) and tungsten carbide blanks. The quality and consistency of these raw materials are paramount, as they directly dictate the mechanical strength, thermal conductivity, and wear resistance of the final capillary product. Key upstream activities involve powder preparation, sintering, and initial shaping, often requiring proprietary processes to achieve the necessary density and microstructure. The ability of capillary manufacturers to secure consistent access to high-quality raw material suppliers provides a significant competitive advantage, especially given the global constraints on specialty ceramic supply.

Midstream activities are characterized by high-precision manufacturing processes. This includes advanced grinding, micro-drilling (often using laser or micro-electro discharge machining, EDM), proprietary polishing, and tip forming. Achieving micron-level tolerances for the critical dimensions, such as the bore diameter, tip radius (TIR), and face angle, requires specialized machinery and highly skilled technicians. Manufacturers invest heavily in cleanroom facilities and advanced metrology equipment to ensure zero-defect production, which is a non-negotiable requirement for semiconductor assembly. Innovation in surface finishing, such as diamond-like carbon (DLC) coatings or nano-coatings, forms a key midstream differentiator, aimed at minimizing wire sticking and maximizing tool life.

The downstream segment primarily involves distribution channels and direct sales to end-users. Due to the technical complexity and need for application support, the distribution channel is typically direct or facilitated through highly knowledgeable, technical distributors who can provide maintenance and specialized consultation services. Direct sales dominate for major Original Equipment Manufacturers (OEMs) of wire bonding equipment and large Outsourced Semiconductor Assembly and Test (OSAT) firms, allowing for closer collaboration on custom capillary designs. Indirect channels, using regional distributors, are more common for smaller assembly houses. The downstream relationship is crucial for feedback loops, enabling manufacturers to rapidly adapt capillary designs based on real-world performance data related to specific bonder platforms and wire materials.

Bonding Capillaries Market Potential Customers

The primary customers and end-users of bonding capillaries are entities involved in the back-end manufacturing and assembly of semiconductor devices, where the wire bonding process is utilized to interconnect ICs to their lead frames or substrates. This includes major global Outsourced Semiconductor Assembly and Test (OSAT) providers who handle the majority of outsourced packaging work for fabless companies. These high-volume users require continuous supply and standardized performance across massive production lines. Furthermore, Integrated Device Manufacturers (IDMs) that maintain in-house packaging facilities, particularly those focusing on high-reliability, power, or automotive devices, represent another significant customer base, often demanding capillaries that meet proprietary and extremely high-quality specifications.

Specialized segments within the end-user market include defense and aerospace contractors who rely on wire bonding for mission-critical components where reliability far outweighs cost, driving demand for premium gold-optimized capillaries. The burgeoning electric vehicle (EV) market and power electronics sector (utilizing SiC and GaN) are rapidly expanding customers, requiring robust, high-temperature bonding capillaries capable of handling thicker wires (heavy wire bonding) to manage high currents and thermal cycling stress. Lastly, academic and industrial research labs, involved in prototyping new semiconductor devices and advanced packaging concepts, are also niche buyers, frequently demanding small batches of highly customized or experimental capillary designs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 485 Million |

| Market Forecast in 2033 | USD 825 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SPT (Small Precision Tools), CoorsTek, K&S (Kulicke & Soffa), Micro-Mechanics, Heraeus, Gaiser Tool, Adamant Kogyo, DIASYS, PECO, Nippon Micrometal, Micro-Tube Technology, US Micro-Technologies, C.C.K. Precision, C.H. Tungsten, Shin-Etsu Quartz Products |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bonding Capillaries Market Key Technology Landscape

The technological landscape of the Bonding Capillaries Market is defined by advanced material science, precision engineering, and specialized surface modification techniques aimed at optimizing tool lifespan and bond quality under increasingly stressful operating conditions. A central technological focus involves developing proprietary composite ceramic materials, such as Zirconia Toughened Alumina (ZTA) or advanced nanocrystalline ceramics, which offer significantly improved fracture toughness and wear resistance compared to standard alumina. This material innovation is critical for handling the higher forces and higher temperatures associated with modern high-speed copper wire bonding processes, mitigating cratering and ensuring consistent ball and stitch formation.

Another crucial area is micro-machining and surface finishing technology. Achieving the required micro-level geometry, especially in the Exit Cone (EC), Tip Radius (TIR), and the internal bore profile, necessitates the use of ultra-precision techniques like diamond grinding, laser ablation, and specialized chemical-mechanical planarization (CMP) polishing. The uniformity of the internal bore is vital for smooth wire feeding and preventing wire deformation, particularly for ultra-fine wires (15-20 µm). Advanced metrology, including non-contact optical inspection systems and scanning electron microscopy (SEM), is integrated into the production line to ensure every capillary meets stringent semiconductor manufacturing specifications.

Furthermore, surface treatment technology is rapidly evolving, moving toward proprietary coatings. These include thin-film deposition techniques, such as Physical Vapor Deposition (PVD) or Chemical Vapor Deposition (CVD), used to apply extremely hard, smooth coatings (e.g., specialized nitrides or diamond-like carbon, DLC) to the capillary tip. These coatings significantly reduce friction and wire sticking, enhance resistance to copper oxide buildup, and extend the functional life of the capillary, thereby improving the overall cost of ownership for semiconductor manufacturers. The integration of these materials and processes dictates market leadership, as end-users prioritize verifiable improvements in Mean Time Between Failure (MTBF) and overall bond quality yield.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant region, accounting for the largest share of both consumption and production of bonding capillaries globally. This is driven by the concentration of the world's largest OSAT providers (like ASE, Amkor, SPIL, JCET) and numerous large-scale IDMs in Taiwan, China, South Korea, Japan, and Southeast Asia. The region benefits from substantial government incentives supporting domestic semiconductor manufacturing and continuous investment in new mega-fabs, ensuring sustained high-volume demand for bonding consumables, especially those tailored for high-speed copper wire applications.

- North America: This region maintains a strong market presence, characterized by high demand for specialized, high-reliability capillaries used in defense, aerospace, and high-performance computing (HPC) applications. While manufacturing volume is lower than in APAC, North American consumers focus on premium products, demanding the absolute highest quality and consistency, often driving innovation in new materials and extreme-pitch capillary designs.

- Europe: The European market is expanding steadily, propelled by the growth of the automotive electronics sector, particularly in Germany and Italy, focusing on power semiconductors (SiC/GaN) essential for electric vehicles. This requires specialized heavy wire bonding capillaries designed to handle larger diameter wires and high thermal loads, fostering demand for durable, high-wear-resistant tungsten carbide tools and specialized ceramic composites.

- Latin America, Middle East, and Africa (LAMEA): While smaller, these regions represent emerging opportunities. Growth is typically tied to localized assembly operations focusing on consumer electronics or specific industrial applications. Demand here is often met through imports from established APAC manufacturers or focused distributors, primarily seeking cost-effective, standard-pitch capillary solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bonding Capillaries Market.- SPT (Small Precision Tools)

- CoorsTek

- K&S (Kulicke & Soffa)

- Micro-Mechanics

- Heraeus

- Gaiser Tool

- Adamant Kogyo

- DIASYS

- PECO

- Nippon Micrometal

- Micro-Tube Technology

- US Micro-Technologies

- C.C.K. Precision

- C.H. Tungsten

- Shin-Etsu Quartz Products

- Advanced Interconnect Manufacturing (AIM)

- JIDA Precision Tools

- Fuji Ceramics

- Shinkosha Co., Ltd.

- Micron Precision Tools

Frequently Asked Questions

Analyze common user questions about the Bonding Capillaries market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between ceramic and carbide bonding capillaries?

Ceramic capillaries, typically made of Zirconia Toughened Alumina (ZTA), offer superior surface finish and reduced wire sticking, making them ideal for fine-pitch gold and copper wire bonding. Carbide capillaries (Tungsten Carbide) possess higher mechanical strength and density, making them preferred for heavy wire bonding used in high-power and automotive electronics applications.

How does the shift from gold to copper wire bonding affect capillary design and lifespan?

Copper wire bonding, driven by cost efficiency, requires capillaries made of harder materials optimized for copper, often featuring specialized coatings to resist oxidation and reduce mechanical wear caused by the increased stiffness of copper wire. This shift generally leads to increased capillary wear rates and demands higher precision in tip geometry to prevent pad damage.

Which regional market dominates the global Bonding Capillaries industry?

The Asia Pacific (APAC) region dominates the market due to the high concentration of Outsourced Semiconductor Assembly and Test (OSAT) providers and large Integrated Device Manufacturers (IDMs) in countries such as China, Taiwan, and South Korea, which collectively handle the vast majority of global semiconductor packaging volumes.

What are the key technical specifications defining a high-performance bonding capillary?

High-performance capillaries are defined by ultra-precise geometric parameters including the Exit Cone (EC) angle, Tip Radius (TIR), concentricity of the internal bore, and surface roughness (measured in nanometers). Material composition (e.g., ZTA composites) and specialized non-stick coatings are also crucial for ensuring reliability and extended tool life.

Is the growth of flip chip packaging expected to eliminate the need for bonding capillaries?

While flip chip technology reduces reliance on traditional wire bonding for high-end CPU/GPU applications, it will not eliminate the need for capillaries. Wire bonding remains essential for cost-sensitive devices, memory stacking, power semiconductors (SiC/GaN), and specific automotive components, ensuring sustained and specialized demand for bonding capillaries.

What is the role of advanced metrology in capillary manufacturing?

Advanced metrology, including high-resolution optical microscopes and Scanning Electron Microscopes (SEM), is critical for quality assurance. It ensures that the manufactured capillaries meet sub-micron tolerance requirements for dimensions like the internal bore and tip geometry, preventing defects that could lead to semiconductor yield loss during the high-speed wire bonding process.

How do bonding capillary manufacturers address the challenges posed by ultra-fine pitch bonding?

For ultra-fine pitch bonding (below 40 µm), manufacturers utilize specialized materials and advanced laser micro-machining to create extremely small, durable tips with tight tolerance control. They also develop proprietary surface treatments to minimize friction and ensure the delicate wire tracks accurately without deformation in tight spacing.

What major end-use industry is driving the demand for specialized heavy wire capillaries?

The automotive electronics industry, particularly the production of Electric Vehicle (EV) inverters, charging systems, and power modules utilizing Wide Band Gap (WBG) materials like Silicon Carbide (SiC) and Gallium Nitride (GaN), is the primary driver for specialized heavy wire bonding capillaries.

What is the significance of the Exit Cone (EC) angle in capillary performance?

The Exit Cone (EC) angle is crucial as it guides the wire out of the capillary and influences the formation of the wire loop. An optimized EC angle helps control the wire trajectory and prevents wire scrubbing or bending, directly impacting bond reliability and loop shape consistency in high-speed operations.

What recent material innovations are impacting bonding capillary manufacturing?

Recent innovations focus on composite ceramics, such as materials doped with nanosized particles or specialized binders, which enhance the thermal stability and fracture toughness of the capillary. Furthermore, advanced surface coatings like nanometer-thick Diamond-Like Carbon (DLC) are being used to maximize wear resistance and minimize residue accumulation during extended use.

How does the Bonding Capillaries market respond to increasing semiconductor throughput demands?

To meet higher throughput, capillary manufacturers must enhance tool durability and consistency. They achieve this by increasing the hardness and wear resistance of the materials, allowing capillaries to withstand higher ultrasonic frequency and speed without premature erosion, thereby minimizing machine downtime and maximizing production efficiency.

What are the key restraints affecting market growth outside of technological adoption?

Key non-technological restraints include the high barrier to entry for manufacturing due to the necessity of proprietary precision machinery, the high cost and volatility of high-purity raw ceramic materials, and the stringent, specialized qualification processes required by major OSAT and IDM customers before a new capillary can be adopted.

How important is supply chain stability for Bonding Capillaries users?

Supply chain stability is highly important because bonding capillaries are high-volume, mission-critical consumables. Disruptions can immediately halt semiconductor assembly lines, leading to severe production losses. Consequently, end-users often seek dual-sourcing strategies and prioritize suppliers with robust global manufacturing and distribution networks.

What distinguishes ultra-fine pitch capillaries from standard capillaries in terms of manufacturing?

Ultra-fine pitch capillaries require significantly tighter manufacturing tolerances, especially concerning the tip radius and bore concentricity, which must be maintained across extremely small feature sizes (often less than 20 µm). This requires more sophisticated micro-machining and inspection methods, often resulting in higher unit costs.

In the value chain, where is the most significant technological investment focused?

The most significant technological investment is focused on the midstream manufacturing process, specifically in proprietary ceramic sintering techniques, micro-drilling precision, and advanced surface modification technologies (polishing and coating) necessary to achieve the demanding performance and lifespan requirements of modern wire bonding.

What is the primary role of AI in optimizing the use of bonding capillaries?

AI's primary role is process optimization and predictive maintenance. AI monitors high-speed bonding data to detect minor variations caused by capillary wear or defects in real-time, allowing operators to preemptively replace tools or adjust machine parameters, maximizing bond quality and reducing unplanned downtime.

Why are specialized capillaries required for bonding SiC and GaN power devices?

SiC and GaN devices operate at higher temperatures and handle greater power densities. This necessitates specialized heavy wire bonding (often using aluminum or copper) that requires capillaries made of materials like Tungsten Carbide with superior high-temperature stability and mechanical durability to withstand the prolonged thermal stress and high bonding forces.

How is environmental sustainability influencing the Bonding Capillaries market?

Environmental concerns drive the transition away from gold wire (due to resource scarcity and cost) toward copper and silver-alloy wires. Capillary manufacturers must innovate by developing tools specifically optimized for these alternative materials, contributing to both cost reduction and environmental sustainability efforts in semiconductor packaging.

What are the competitive advantages for local manufacturers in the APAC region?

Local APAC manufacturers benefit from close proximity to the largest consumer base (OSATs), enabling rapid feedback loops, customized design iterations, and reduced logistical costs. They also benefit from regional expertise in high-volume, high-precision semiconductor component manufacturing.

How do bonding capillaries contribute to the final semiconductor product reliability?

Bonding capillaries are critical for reliability by ensuring the accurate formation of the ball bond and stitch bond, preventing cratering on the die pad, and maintaining consistent wire loop profiles. High-quality capillaries minimize mechanical stress and thermal variance, which are key factors in determining the long-term operational lifespan of the packaged IC.

What material property is most sought after for copper bonding capillaries?

For copper bonding, the most sought-after material property is high fracture toughness combined with exceptional hardness and wear resistance. This combination is essential to resist the extreme forces and ultrasonic energy required to bond the stiffer copper wire without the capillary cracking or suffering rapid tip erosion.

Define the term 'TIR' in the context of bonding capillaries.

TIR stands for Tip Inner Radius. It is a critical geometric parameter defining the curvature of the capillary tip, where the wire exits. The TIR must be precisely controlled as it significantly influences the quality and consistency of the wire ball formation and the transfer of ultrasonic energy during bonding.

How does the Bonding Capillaries market address potential wire deformation issues?

Manufacturers address wire deformation by ensuring the internal bore of the capillary is highly polished and precisely concentric, offering minimal friction. Specialized internal geometry profiles are designed to guide the wire smoothly, particularly when handling delicate, ultra-fine diameter wires.

What influence do geopolitical factors have on the Bonding Capillaries supply chain?

Geopolitical tensions influence the supply chain by affecting the sourcing and cost of highly specialized raw materials (e.g., tungsten carbide, high-purity ceramic powders). Tariffs and trade restrictions can also accelerate regional diversification of manufacturing capacity outside major production hubs.

Which segment, based on pitch size, is anticipated to exhibit the highest growth rate?

The Ultra-Fine Pitch Capillaries (<40 µm) segment is anticipated to exhibit the highest growth rate. This accelerated growth is driven by the persistent trend of miniaturization in consumer electronics, memory stacking, and the necessity for higher density interconnects in advanced logic chips.

What are the consequences of using a low-quality bonding capillary?

Using a low-quality capillary can result in immediate yield loss due to inconsistent ball formation, poor stitch adhesion, wire breakage, pad cratering, and increased machine downtime required for frequent tool changes. These issues severely impact the overall cost of ownership and product reliability.

How do capillary suppliers support equipment OEMs?

Capillary suppliers collaborate closely with Original Equipment Manufacturers (OEMs) of wire bonding machines to ensure their tools are optimized for new bonder generations. This collaboration involves testing new capillary materials and geometries to achieve maximum speed and reliability targets set by the latest machine specifications.

What is the market relevance of aluminum wire bonding capillaries?

Aluminum wire bonding capillaries are primarily relevant for power electronics, particularly in specific automotive and industrial applications where large diameter (heavy wire) aluminum wire is used. These applications require robust, durable carbide capillaries capable of handling high forces for wedge-wedge bonding processes.

How do bonding capillaries handle the thermal requirements of semiconductor packaging?

Capillaries are exposed to high temperatures during the bonding process. Manufacturers select materials with low thermal expansion coefficients and high thermal stability (e.g., specialized ceramics) to maintain precise geometric tolerances and prevent premature wear or cracking under continuous thermal cycling.

What is the differentiation strategy employed by market leaders in this highly technical sector?

Market leaders differentiate themselves primarily through proprietary material science (advanced ceramic compositions), application-specific capillary geometries tailored for unique packaging types, superior manufacturing consistency (zero-defect output), and providing extensive technical support and consultation services to high-volume customers.

How significant is the military and aerospace segment for bonding capillaries?

The military and aerospace segment is small in volume but highly significant in value, driving demand for the highest-specification gold wire capillaries. This segment prioritizes extreme long-term reliability and traceability, often accepting higher costs for certified premium tools.

What is the typical lifespan variability in bonding capillaries?

Capillary lifespan can vary significantly, ranging from a few hours (in high-speed, demanding copper bonding environments) to hundreds of hours (in less stressful gold bonding applications), depending on wire material, bonder speed, process parameters, and the capillary's material quality and coating.

What is the core function of the internal bore surface finish?

The core function of the internal bore surface finish is to minimize friction and prevent abrasive wear on the bonding wire as it is fed through the capillary. A smooth, highly polished bore ensures consistent wire feed and minimizes wire deformation, which is crucial for uniform bond formation.

What role does specialization play in the competition landscape?

Specialization is paramount. Competition often hinges not just on price, but on the ability of manufacturers to produce specific geometries for niche or complex applications, such as specialized tooling for stacked dies, unique substrate materials, or ultra-low loop requirements, where customization is essential.

How does advanced packaging (2.5D/3D) influence bonding capillary requirements?

Advanced packaging technologies like 2.5D and 3D integration require complex interconnects, leading to demand for ultra-fine pitch capabilities and non-standard tip angles to navigate complex multi-level structures, driving capillary innovation towards extremely customized, high-precision tools.

What factors contribute to the high cost of raw materials in the capillary value chain?

The high cost stems from the need for ultra-high purity ceramic powders (like specialized ZTA) and tungsten carbide blanks, which require complex, energy-intensive synthesis and sintering processes. Any impurities at the raw material stage can compromise the final capillary performance.

Explain the process of 'sintering' in ceramic capillary production.

Sintering is a critical manufacturing step where ceramic powders are compacted and heated below their melting point. This process causes the particles to fuse, densifying the material and forming a solid, high-strength ceramic body. Proprietary sintering techniques are essential for achieving the necessary hardness and microstructure for high-performance capillaries.

What risks are associated with the heavy reliance on APAC manufacturing for bonding capillaries?

The primary risk is vulnerability to regional supply chain disruptions, including natural disasters or geopolitical trade conflicts. Furthermore, intellectual property protection risks may arise given the high level of technological specialization required for these micro-tools.

How do Bonding Capillaries aid in managing thermal stress during bonding?

Bonding capillaries, especially those made from specialized ceramics, possess favorable thermal conductivity and low thermal expansion characteristics. This helps stabilize the heat transfer during the bonding process, ensuring consistent metallurgical bond formation while minimizing thermal shock to the delicate semiconductor die.

What is the distinction between Fine Pitch and Ultra-Fine Pitch classification?

Fine Pitch generally refers to bonding pitches between 40 µm and 70 µm, common in older or less dense packaging. Ultra-Fine Pitch refers to pitches below 40 µm, which is necessary for modern high-density ICs like advanced memory and processor chips, requiring higher dimensional accuracy from the capillary.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager