Bone Glues Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434497 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Bone Glues Market Size

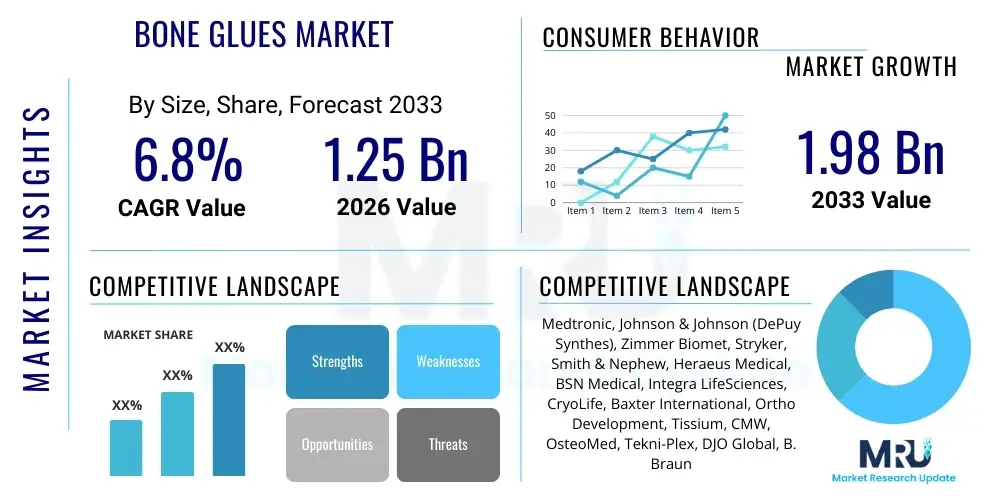

The Bone Glues Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.98 Billion by the end of the forecast period in 2033.

Bone Glues Market introduction

The Bone Glues Market, encompassing specialized medical adhesives and cements used for orthopedic, trauma, and dental applications, represents a crucial segment within the broader biomaterials industry. These products are engineered to provide mechanical stability, structural support, and aid in the fixation of bone fragments, filling bony voids, and stabilizing prosthetic devices. The primary types of bone glues include traditional polymethyl methacrylate (PMMA) cements, which offer high compressive strength for joint replacement procedures, and advanced bio-resorbable or injectable adhesives based on calcium phosphate, collagen, or synthetic polymers, designed to promote natural healing and eventual replacement by native bone tissue.

Major applications driving market demand include complex trauma surgery, spinal fusion procedures, joint arthroplasty (knee, hip, and shoulder replacement), and vertebroplasty/kyphoplasty for vertebral compression fractures. The utility of bone glues lies in their ability to offer rapid setting times, localized drug delivery capabilities (e.g., antibiotic-loaded cements), and minimally invasive application techniques. This versatility makes them indispensable tools for orthopedic surgeons aiming to improve patient outcomes, reduce operative time, and enhance the longevity of implant fixation.

Key driving factors propelling the market growth include the global demographic shift toward an aging population, which inherently increases the incidence of osteoporosis and fragility fractures, particularly hip fractures requiring immediate surgical stabilization. Furthermore, continuous technological advancements focused on developing biodegradable, osteoinductive, and stronger adhesive formulations that minimize exothermic reactions and improve biocompatibility are expanding the scope of their clinical use. The increasing adoption of minimally invasive surgical approaches, where injectable bone glues facilitate precise placement and immediate stability, further reinforces the market’s positive trajectory.

Bone Glues Market Executive Summary

The Bone Glues Market is characterized by robust growth, primarily fueled by the accelerating rate of orthopedic surgeries globally and significant investment in next-generation biomaterials. Business trends indicate a strong focus on merging adhesive technology with regenerative capabilities, shifting market preference from non-resorbable cements toward bio-active, injectable glues that enhance bone integration and reduce long-term complications. Leading players are concentrating on strategic acquisitions and partnerships to integrate specialized adhesive formulations into their existing orthopedic portfolios, focusing specifically on trauma and spinal applications where rapid fixation is paramount for functional recovery.

Regionally, North America currently holds the largest market share, driven by high healthcare expenditure, sophisticated surgical infrastructure, and favorable reimbursement policies for complex orthopedic procedures. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth over the forecast period, attributed to expanding medical tourism, rapid development of healthcare facilities, and a large, underserved patient base requiring trauma and age-related orthopedic interventions. European markets remain steady, driven by high adoption rates of advanced arthroplasty techniques and stringent quality standards promoting the use of established, high-performance PMMA cements.

Segment trends highlight the dominance of PMMA in terms of revenue due to its established efficacy and widespread use in load-bearing joint replacements, although calcium phosphate-based cements are gaining traction due to their osteoconductive properties and suitability for filling bone voids without significant thermal damage. The application segment sees trauma and arthroplasty dominating the market, while the end-user segment is heavily weighted towards hospitals, although ambulatory surgical centers (ASCs) are emerging as significant growth centers, especially for less complex, elective orthopedic procedures that utilize injectable bone glues for quick outpatient interventions.

AI Impact Analysis on Bone Glues Market

User queries regarding AI's impact on the Bone Glues Market often revolve around optimizing surgical planning, enhancing material performance prediction, and improving quality control in manufacturing. Users are keenly interested in how Artificial Intelligence and Machine Learning (ML) can be applied to personalize adhesive deployment based on patient-specific bone density and defect geometry, thereby reducing the risk of cement mantle failure or improper fixation. Key themes include the use of AI for predictive modeling of long-term cement wear and tear in arthroplasty, and the automation of precise glue mixing and dispensing systems in operating theaters to ensure optimal material consistency and reduce human error, addressing concerns about consistency and durability.

AI is beginning to integrate into the entire orthopedic product lifecycle, from R&D to clinical application. In the research phase, ML algorithms can analyze vast datasets of biomaterial properties, mechanical stresses, and biological responses to accelerate the identification of novel, high-performance adhesive compositions that offer superior biocompatibility and osteointegration. Clinically, AI-driven image analysis tools (using CT or MRI scans) can accurately map bone defects and recommend the precise volume, viscosity, and setting time required for the bone glue formulation, thereby optimizing surgical outcomes and reducing the necessity for revision surgeries related to cement failure or suboptimal filling.

Furthermore, the manufacturing processes for specialized bone cements and glues, which require extremely precise component ratios and controlled curing environments, benefit immensely from AI-powered process optimization. Predictive maintenance fueled by sensors and ML models ensures consistent product quality and minimizes batch variation, which is crucial for high-stakes medical devices. This enhanced manufacturing reliability, coupled with AI-assisted post-operative monitoring—using patient data to predict the longevity and effectiveness of the glued fixation—promises a step change in the reliability and clinical acceptance of advanced bone adhesive solutions.

- AI-driven optimization of bone glue formulation R&D for enhanced biocompatibility.

- Machine learning models predicting patient-specific outcomes and cement failure rates in arthroplasty.

- Automation and precision control in bone glue mixing and dispensing during surgery (Robotic-Assisted).

- Integration of AI image analysis for precise volumetric assessment of bone defects requiring adhesive filling.

- Predictive maintenance and quality control in biomaterials manufacturing processes.

DRO & Impact Forces Of Bone Glues Market

The Bone Glues Market is significantly influenced by a confluence of driving factors, primarily the rising global burden of orthopedic conditions and the consequent increase in surgical procedures. This demand is counterbalanced by significant regulatory hurdles and the inherent limitations associated with existing materials, such as potential thermal necrosis during curing. Opportunities lie primarily in the development of next-generation bioactive and injectable adhesives suitable for minimally invasive techniques. These factors collectively exert complex impact forces on market dynamics, compelling manufacturers to innovate while navigating stringent safety requirements and material complexity.

Drivers: A primary driver is the rapid aging population worldwide, particularly in developed nations, leading to a surge in degenerative bone diseases, osteoporosis-related fractures, and joint replacement surgeries. Additionally, advancements in surgical technology, including the shift towards less invasive procedures (MIS), favor injectable and moldable bone glues that can be delivered efficiently. The rising incidence of road traffic accidents and sports injuries requiring trauma fixation also substantially contributes to the consistent demand for high-strength bone adhesives and cements in emergency settings.

Restraints: Significant restraints include the high cost associated with advanced bio-adhesives and related surgical tools, which can limit adoption in emerging economies. Moreover, clinical concerns regarding material performance, such as the potential for cement-related complications including exothermic reactions (thermal necrosis) during PMMA curing, residual monomer toxicity, and the risk of infection when using non-resorbable materials, continue to restrict broader clinical application. Strict and lengthy regulatory approval processes for new biomaterials also pose a considerable barrier to entry and rapid product commercialization.

Opportunities: Key opportunities are centered on innovation in biodegradable and injectable materials. The demand for materials that can provide temporary structural support while promoting natural bone healing (osteoinductivity) is high. Expanding applications in specialized areas like craniofacial surgery, dental bone grafting, and personalized 3D-printed bone defect filling using customized adhesive formulations represent high-growth avenues. Furthermore, integrating antimicrobial agents into bone glues to mitigate post-operative infection risks offers a major market differentiator and commercial opportunity.

Segmentation Analysis

The Bone Glues Market is comprehensively segmented based on material type, clinical application, and end-user, providing a granular view of market dynamics and adoption trends. The categorization by material type—encompassing polymeric cements (PMMA), calcium-based adhesives (calcium phosphate, calcium sulfate), and natural/hybrid options (collagen, fibrin)—reflects the technical evolution within the orthopedic biomaterials sector. This segmentation highlights the trade-off between established mechanical performance (PMMA) and advanced biological integration capabilities (calcium-based and hybrid materials).

Application-wise, the market is defined by procedures requiring high-strength fixation (arthroplasty and trauma) versus procedures focused on bone void filling and fusion (spinal fusion, vertebroplasty, and dental). This dictates the specific properties required of the bone glue, such as handling characteristics, radio-opacity, and resorbability. Understanding these segmented needs allows companies to tailor product development to critical surgical demands, for instance, high viscosity for pressurized cementation in hip replacement versus low viscosity for injectable spinal procedures.

Finally, the end-user segmentation separates the primary high-volume consumers of bone glues. Hospitals remain the dominant user due to the volume of complex procedures requiring PMMA cements and extensive trauma surgeries. However, the rapidly growing adoption of less complex, trauma-related orthopedic interventions and pain management procedures in specialized ambulatory surgical centers (ASCs) is repositioning them as a key, fast-growing end-user segment for injectable and quick-setting adhesive solutions.

- By Material Type:

- Polymethyl Methacrylate (PMMA) Cements

- Calcium Phosphate Cements (CPC)

- Calcium Sulfate Cements

- Bio-resorbable Adhesives (e.g., Fibrin, Collagen-based, Polyurethane)

- By Application:

- Arthroplasty (Hip, Knee, Shoulder)

- Trauma Fixation

- Spinal Procedures (Vertebroplasty, Kyphoplasty, Fusion)

- Dental/Craniofacial Applications

- Bone Void Filling

- By End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Orthopedic Clinics

Value Chain Analysis For Bone Glues Market

The value chain for the Bone Glues Market begins with complex upstream activities involving the sourcing and refinement of specialized raw materials, primarily high-purity monomers (for PMMA), calcium compounds, polymers, and biological agents. Suppliers in this segment focus heavily on maintaining rigorous quality control and sterility standards, as the performance of the final adhesive product is critically dependent on the purity and consistency of these foundational components. Research and development activities, which involve material science specialists and orthopedic surgeons, form a crucial part of the upstream segment, dictating intellectual property and technological superiority in final product offerings.

The midstream phase involves the manufacturing and formulation of the bone glues, often requiring specialized cleanroom facilities and controlled processes for mixing, packaging (e.g., pre-dosed kits), and sterilization. This is where proprietary technology for optimizing setting time, viscosity, and thermal stability is implemented. Quality assurance protocols, including mechanical testing and biocompatibility assessments, are paramount before the products enter the downstream distribution network. Manufacturers often engage in direct interaction with Key Opinion Leaders (KOLs) and regulatory bodies during this phase to ensure compliance and clinical relevance.

Downstream activities center on distribution channels, which include a mix of direct sales teams targeting large hospital networks and specialized medical device distributors who handle logistics, inventory, and clinical training. Direct channels are preferred for high-volume, premium products where close surgeon relationships and technical support are essential, especially for new, complex bio-adhesives. Indirect channels leverage regional distributors to penetrate smaller orthopedic clinics and emerging markets. The final stage involves the end-user—hospitals and ASCs—where product procurement, inventory management, and surgeon training ensure the appropriate and effective clinical utilization of the bone glues.

Bone Glues Market Potential Customers

Potential customers for bone glues are concentrated within the institutional healthcare sector, primarily driven by specialized surgical units that perform high volumes of musculoskeletal and trauma interventions. The largest end-users are large tertiary and quaternary care hospitals that house dedicated orthopedic departments, trauma centers, and specialized spinal surgery units. These institutions require a wide range of bone glue types, from high-strength PMMA for complex revision arthroplasty to resorbable pastes for minor bone defect fillings, and they often purchase through centralized procurement contracts due to scale.

A rapidly growing segment of potential customers includes Ambulatory Surgical Centers (ASCs), particularly those focusing on orthopedic and pain management procedures. As healthcare shifts towards outpatient settings for cost efficiency, ASCs are increasing their demand for quick-setting, minimally invasive injectable bone glues used in procedures like vertebroplasty, kyphoplasty, and minor fracture stabilization. These centers prioritize ease of use, predictable curing times, and cost-effectiveness in their procurement decisions.

Beyond traditional orthopedics, specialized customers include dental and craniofacial surgeons who utilize bone glues and cements for complex reconstructive procedures, particularly those involving maxillofacial trauma or required pre-implant bone augmentation. Additionally, specialized research centers and academic institutions are consistent purchasers for experimental procedures and advanced training, demonstrating a diverse but highly technical customer base demanding clinically proven, reliable, and innovative adhesive solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.98 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, Johnson & Johnson (DePuy Synthes), Zimmer Biomet, Stryker, Smith & Nephew, Heraeus Medical, BSN Medical, Integra LifeSciences, CryoLife, Baxter International, Ortho Development, Tissium, CMW, OsteoMed, Tekni-Plex, DJO Global, B. Braun Melsungen. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bone Glues Market Key Technology Landscape

The technology landscape of the Bone Glues Market is dynamic, marked by an intense focus on enhancing material biocompatibility, structural integration, and application efficiency. Traditional technology revolves around PMMA cementation systems, which rely on the reliable polymerization process for high mechanical strength, often incorporating antibiotic loading (e.g., Gentamicin, Vancomycin) to prevent local infection, a standard practice in cement use for joint replacement. Recent innovations in this established sector focus on lowering the exothermic peak temperature during curing and optimizing monomer release profiles to improve clinical safety and reduce tissue damage.

A significant technological shift is observed in the adoption of injectable, self-setting calcium-based cements (Calcium Phosphate and Calcium Sulfate). These technologies are attractive because they are osteoconductive—meaning they provide a scaffold for new bone growth—and they eliminate the thermal concerns associated with PMMA. Advanced CPC formulations are engineered to mimic the mineral composition of natural bone and achieve controlled resorption rates, aligning with the body's natural healing process. Key technological advancements here include developing injectable pastes that maintain structural integrity while allowing minimally invasive delivery through small-gauge needles, essential for spinal procedures like kyphoplasty.

Further cutting-edge technology includes the development of entirely synthetic, high-strength biological glues, often based on proprietary polyurethane or cyanoacrylate chemistries designed for non-load-bearing applications or stabilizing complex fractures before internal fixation. Researchers are also exploring smart, responsive bio-adhesives that can be activated on demand (e.g., using light or temperature) and those capable of delivering therapeutic payloads (growth factors or anti-inflammatory drugs) directly to the surgical site, accelerating tissue regeneration and improving long-term fusion rates, which represents the frontier of bone glue technology.

Regional Highlights

- North America: This region maintains its position as the market leader, primarily driven by the United States. High adoption rates of advanced surgical techniques, robust healthcare infrastructure, and significant expenditure on R&D for biomaterials contribute to its dominance. The presence of major market players and favorable reimbursement policies for complex orthopedic procedures, including total joint replacements and spinal fusions, ensure high consumption of both PMMA and advanced injectable bone glues. Innovation, particularly in trauma and spinal fixation adhesives, is centered here.

- Europe: The European market is mature and characterized by high procedural volumes in countries like Germany, France, and the UK. Strict medical device regulations (e.g., MDR) necessitate high-quality, clinically proven products, favoring established PMMA and calcium phosphate formulations. The market demonstrates steady growth, driven by an aging demographic and government initiatives aimed at improving orthopedic care access, with a strong focus on antimicrobial cement formulations to combat infection rates.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing regional market. This explosive growth is attributed to rapid improvements in healthcare access, rising disposable incomes facilitating private healthcare utilization, and the enormous, previously underserved patient population in countries like China and India. While price sensitivity remains a factor, the increasing prevalence of trauma and the expansion of orthopedic specialty hospitals are fueling the demand for reliable, cost-effective bone glues, often through local manufacturing partnerships and technology transfer.

- Latin America (LATAM): The LATAM market, including Brazil and Mexico, presents significant untapped potential. Market expansion is driven by increasing investment in public and private health facilities and efforts to standardize trauma care. Economic volatility and varied regulatory environments pose challenges, yet the necessity for affordable, high-quality bone cements in trauma settings ensures consistent, moderate growth.

- Middle East and Africa (MEA): Growth in the MEA region is segmented, with high growth observed in the Gulf Cooperation Council (GCC) countries due to high healthcare investments and medical tourism initiatives. Demand is concentrated on modern surgical consumables, including advanced bone glues for elective orthopedic procedures. In contrast, the African continent experiences slower adoption, primarily constrained by infrastructure limitations and resource scarcity, where basic, cost-effective PMMA remains the core product utilized in major regional trauma centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bone Glues Market.- Medtronic

- Johnson & Johnson (DePuy Synthes)

- Zimmer Biomet

- Stryker

- Smith & Nephew

- Heraeus Medical

- BSN Medical (Essity)

- Integra LifeSciences

- CryoLife

- Baxter International

- Ortho Development

- Tissium

- CMW Bone Cement

- OsteoMed (Stryker subsidiary)

- Tekni-Plex

- DJO Global

- B. Braun Melsungen

- Surgical Specialties Corporation

- Biocomposites Ltd

- Master Bond Inc.

Frequently Asked Questions

Analyze common user questions about the Bone Glues market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between PMMA bone cement and Calcium Phosphate Cements (CPC)?

PMMA (Polymethyl Methacrylate) cement offers high mechanical strength, making it ideal for load-bearing joints like hips and knees, but its polymerization is exothermic and it is not resorbable. CPCs, conversely, are osteoconductive, biocompatible, and resorbable, meaning they convert into native bone over time, making them preferred for bone void filling and non-load-bearing applications, though they offer lower initial mechanical strength.

How does the use of bone glues impact revision rates in total joint arthroplasty?

High-quality bone glues (cements) are critical for secure fixation of prosthetic implants. Proper cementation technique and material selection minimize micromotion and failure at the bone-implant interface, significantly reducing the risk of aseptic loosening, which is a major cause of revision surgery. Innovations in low-viscosity cements aim to further enhance penetration and fixation reliability.

What are the major regulatory hurdles facing manufacturers in the Bone Glues Market?

Manufacturers face stringent regulatory requirements, particularly concerning biocompatibility, sterilization, and long-term in vivo performance data. The transition to new regulations, such as the EU MDR, requires extensive clinical evidence and post-market surveillance for biomaterials, lengthening time-to-market for innovative adhesive formulations, especially those incorporating biological or resorbable components.

Which application segment drives the highest demand for bone glues globally?

The Arthroplasty segment, encompassing total hip and knee replacement surgeries, currently drives the highest revenue demand for bone glues, largely due to the widespread and long-established use of high-volume PMMA cements necessary for durable fixation in these load-bearing procedures, particularly in North America and Europe.

What is the market outlook for injectable bone glues in minimally invasive spinal procedures?

The outlook for injectable bone glues (primarily CPCs and high-viscosity PMMA) is highly positive, driven by the increasing adoption of minimally invasive spinal procedures like vertebroplasty and kyphoplasty. Injectable formulations facilitate precise delivery and rapid stabilization of vertebral compression fractures with reduced patient recovery time, positioning this segment for rapid growth, particularly in outpatient settings.

The Bone Glues Market, spanning orthopedic trauma, elective arthroplasty, and specialized craniofacial repair, is experiencing a transformative phase, driven by technological advancements that prioritize bioactivity and minimally invasive surgical solutions. The evolution from traditional PMMA cements, known for their exceptional mechanical load-bearing capacity, to sophisticated bio-resorbable and osteoconductive formulations like Calcium Phosphate Cements (CPCs), highlights a major industry shift towards promoting natural healing and reducing long-term material dependence. This transition is not only redefining clinical standards but also expanding the application scope of bone adhesives into areas such as controlled drug delivery and personalized medicine, where the glue acts as a temporary scaffold and therapeutic agent carrier.

Market segmentation analysis confirms that while arthroplasty remains the largest revenue generator due to the established high volume of joint replacement surgeries globally, the fastest growth is anticipated in the spinal and trauma segments, which highly utilize injectable and quick-setting adhesives tailored for high-pressure, time-sensitive surgical environments. Geographically, while established markets like North America and Europe provide stable demand driven by aging demographics and advanced surgical capacity, the Asia Pacific region is strategically positioned for exponential expansion. This growth is fueled by increasing investments in healthcare infrastructure, improved access to specialized surgical care, and a rising prevalence of traffic-related trauma and age-related orthopedic conditions across populous emerging economies.

The competitive landscape is dominated by large medical device multinational corporations (MNCs) such as Medtronic, Johnson & Johnson, and Stryker, who leverage vast distribution networks and integrated orthopedic portfolios to maintain market leadership. However, niche players focusing on novel material science, particularly those developing bioactive polymers and antimicrobial-loaded glues, are rapidly gaining ground. Future success in this market will depend heavily on the ability of manufacturers to navigate complex global regulatory frameworks, demonstrate superior long-term clinical outcomes through rigorous testing, and efficiently scale production of highly specialized, sterile biomaterials, ensuring consistent quality and performance across all surgical applications.

Technological innovation is consistently addressing the historical constraints associated with bone glues, specifically the concerns surrounding thermal necrosis and residual monomer toxicity inherent to PMMA. Modern PMMA formulations incorporate specific additives to control the curing process, while CPCs inherently bypass these thermal risks. The emerging focus on 3D-printable or moldable adhesives customized for specific bone defects represents the next horizon. These materials, often hybrid composites, are designed not just to fill voids but actively participate in the osseointegration process. This technological evolution underscores the industry's commitment to materials that serve dual functions: immediate mechanical stability coupled with long-term biological repair, making the bone glue a functional implant rather than just a sealant.

The critical impact forces on the market extend beyond clinical demand to macroeconomic and infrastructural developments. Economic growth in developing regions, coupled with the expansion of insurance coverage, directly translates into increased patient access to elective orthopedic surgeries and necessary trauma care, thereby boosting the consumption of bone glues. Furthermore, the global drive towards antibiotic stewardship places immense pressure on manufacturers to develop and clinically validate antibiotic-loaded bone cements that offer targeted local drug delivery to reduce systemic antibiotic use and combat antibiotic resistance, a factor that is increasingly influencing purchasing decisions in major hospital systems globally.

Effective value chain management is indispensable for profitability, given the high fixed costs associated with medical device manufacturing and stringent regulatory oversight. Upstream supply chain resilience is crucial, particularly for securing high-purity specialized chemicals and bio-components that are sourced globally. Manufacturers are increasingly implementing digital tracing and quality control mechanisms across the value chain, utilizing AI and advanced sensors to ensure end-to-end product integrity. This focus on traceability and quality is essential for mitigating risks associated with material failure, protecting patient safety, and maintaining regulatory compliance in highly sensitive clinical domains like trauma and spinal surgery.

The Bone Glues Market’s future is intrinsically linked to advancements in personalized medicine. As diagnostic imaging and surgical planning become more detailed, the demand for bone glues with customizable properties (viscosity, setting time, and bioactive components) will increase. Surgeons require materials that can be precisely modulated to match the biomechanical environment of an individual patient's bone structure and defect profile. This trend necessitates closer collaboration between biomaterials scientists, software developers (for AI planning tools), and orthopedic clinicians, driving the market toward a high-mix, low-volume manufacturing model for specialized, patient-specific adhesive solutions, signaling a shift away from standardized, off-the-shelf products for complex cases.

In conclusion, the Bone Glues Market is evolving rapidly from a foundational component in orthopedic surgery to a high-technology sector focused on regenerative and personalized biomaterials. While established PMMA cements maintain their stronghold in high-load applications, innovation in CPCs and bio-adhesives is capturing emerging opportunities in minimally invasive and biological repair fields. Strategic success hinges on continuous material science breakthroughs, adherence to strict clinical validation standards, and effective penetration of high-growth APAC and ASC markets, ensuring sustainable expansion across the forecast period.

The substantial growth anticipated in the Bone Glues Market is a direct reflection of the indispensable role these materials play in restoring function and stability across the spectrum of orthopedic interventions. The market's dynamism is further evidenced by continuous refinement aimed at biological superiority. Specifically, the development pipeline includes advanced polymer chemistries that offer superior adhesion to both bone and metal implants, addressing the perennial clinical challenge of interface failure, which often necessitates costly and invasive revision surgeries. These innovations are often protected by robust intellectual property, forming competitive moats for key industry players.

Focusing specifically on the application segment of spinal fusion, the rise of injectable synthetic bone glues, often augmented with cellular components or growth factors, represents a paradigm shift. These products enable better load sharing and accelerated fusion rates compared to traditional bone grafts or simpler bone void fillers. The clinical advantage of immediate stabilization coupled with long-term biological integration drives premium pricing and high adoption rates in specialized spinal centers globally, contributing significantly to the market's overall valuation trajectory.

From an end-user perspective, the strategic importance of Ambulatory Surgical Centers (ASCs) cannot be overstated. As healthcare systems globally prioritize outpatient care to manage costs and improve efficiency, the volume of less complex orthopedic procedures performed in ASCs—such as minor fracture stabilizations, certain types of kyphoplasty, and minor joint repairs—is soaring. This shift mandates the supply of highly efficient, low-inventory, ready-to-use bone glue kits that minimize preparation time and maximize procedural throughput, differentiating the product needs of ASCs from the centralized, high-volume demands of major hospital trauma centers.

Furthermore, the regulatory environment acts as a dual-edged sword. While strict regulations restrain quick market entry, they also solidify the competitive position of established manufacturers who possess the necessary resources and long-standing data required for compliance. This creates a high barrier to entry, ensuring that products reaching the market are subject to rigorous safety and efficacy verification, which ultimately benefits patient outcomes and reinforces clinical trust in advanced bone adhesive solutions. The complexity of testing bio-resorbable materials, which must prove predictable degradation rates without harmful byproducts, is a central focus of current regulatory scrutiny.

The Bone Glues Market is therefore best understood as a highly specialized, technically demanding segment of the medical device industry, where clinical efficacy, material science innovation, and strict regulatory adherence determine market success. The sustained growth forecasts are justified by persistent demographic pressures (aging) and continuous technological breakthroughs that address existing clinical limitations, making bone glues an indispensable component of modern musculoskeletal health care delivery.

The integration of digital technology is further influencing procurement and use patterns. Hospitals are increasingly utilizing centralized Enterprise Resource Planning (ERP) systems to manage inventory and standardize the bone glue products used across surgical suites. This trend favors manufacturers capable of offering a comprehensive portfolio that meets diverse needs—from high-strength PMMA for orthopedics to specialized injectable glues for trauma—all while ensuring seamless integration with hospital logistical systems. Digital tools are also being used for advanced surgeon training and virtual simulation to optimize complex cement mixing and injection techniques, improving standardization of care globally.

In summary, the market's trajectory is characterized by simultaneous demand for high-performance conventional products and rapid investment in innovative, biologically active materials. The convergence of an aging, fracture-prone population, the continuous evolution of surgical techniques towards minimal invasiveness, and breakthroughs in biomaterials engineering provides a robust foundation for the projected market expansion through 2033. Maintaining supply chain integrity and focusing R&D efforts on reducing adverse events (like infection and thermal damage) will be critical competitive factors for long-term growth and leadership in this vital medical niche.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager