Bone Staples Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434485 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Bone Staples Market Size

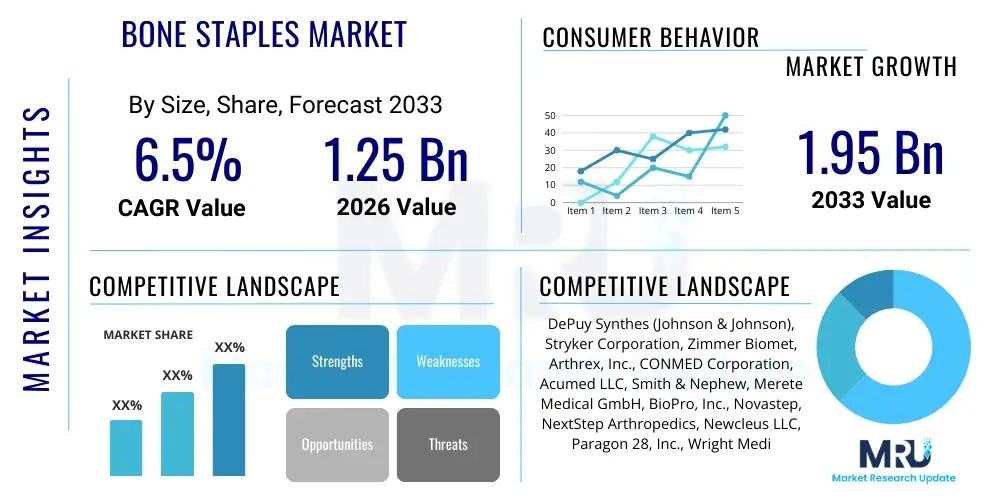

The Bone Staples Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $1.95 Billion by the end of the forecast period in 2033.

Bone Staples Market introduction

Bone staples are essential orthopedic fixation devices used primarily for temporary or permanent internal fixation of bones, soft tissues, and joints following trauma, reconstructive surgery, or corrective osteotomies. These devices are typically U-shaped or chevron-shaped, offering compression across the fracture or fusion site to promote stable healing. The fundamental utility of bone staples lies in their simplicity, ease of insertion, and the continuous dynamic compression they often provide, which is particularly beneficial in small bone fixation, such as in the foot, ankle, hand, and wrist. The effectiveness of bone staples is highly dependent on the material used, with Nitinol (nickel-titanium alloy) staples gaining significant traction due to their shape memory and superelastic properties, which maintain compressive force post-implantation, reducing the likelihood of non-union or delayed healing.

The market encompasses a wide range of product designs, including conventional staples, compression staples, and headless staples, each tailored for specific anatomical locations and clinical needs. Major applications span orthopedic, podiatric, and reconstructive surgeries, treating conditions such as bunions, hammertoes, ankle fractures, and various arthrodesis procedures. The increasing global prevalence of sports-related injuries, coupled with an aging population susceptible to degenerative joint conditions and fractures, forms a critical foundation for market expansion. Furthermore, the rising demand for minimally invasive surgical techniques, where small, precise fixation devices like staples are highly advantageous, is propelling the adoption across developed and emerging healthcare settings.

Bone Staples Market Executive Summary

The Bone Staples Market is defined by steady technological innovation focused on materials science and implant design, aimed at improving biocompatibility and enhancing compression capabilities. Key business trends include aggressive mergers and acquisitions among major orthopedic companies to consolidate specialized fixation portfolios, alongside significant investment in developing bioresorbable staples, which eliminate the need for secondary removal procedures. The market sees intense competition, driven by product differentiation based on material (Nitinol versus Titanium), insertion methodology (automated vs. manual), and application specificity (e.g., specialized staples for pediatric orthopedics). Geographically, North America currently holds the dominant market share due to sophisticated healthcare infrastructure and high surgical volumes, while the Asia Pacific region is expected to demonstrate the highest growth rate, fueled by improving access to orthopedic care and increasing healthcare expenditure across populous nations like China and India.

Segment trends highlight the growing dominance of Nitinol staples, attributed to their superior memory effect, providing consistent and dynamic compression essential for bone fusion. The Foot & Ankle application segment remains the primary revenue contributor, reflecting the high incidence of associated orthopedic pathologies requiring staple fixation. Hospitals continue to be the largest end-user segment, although the shift toward Ambulatory Surgical Centers (ASCs) is noteworthy, driven by cost-efficiency and procedural specialization. Regulatory harmonization efforts, particularly in Europe (MDR transition), pose short-term challenges but are expected to standardize quality and patient safety long-term, thereby influencing global trade dynamics and competitive strategy for market players.

AI Impact Analysis on Bone Staples Market

Common user questions regarding AI's influence on the Bone Staples Market frequently center on how artificial intelligence can improve surgical precision, personalize implant sizing, and streamline supply chain management for specialized devices. Users are concerned with the safety and validation of AI-driven surgical planning systems, seeking clarification on whether these technologies reduce operative time and improve long-term fusion outcomes. The primary thematic interest revolves around AI's ability to analyze pre-operative imaging data (CT scans, X-rays) to accurately predict optimal staple placement, trajectory, and size, thereby minimizing surgical errors and enhancing bone stability. Furthermore, interest exists in leveraging machine learning algorithms to optimize the manufacturing process of customized or patient-specific staple designs, addressing the limitations of current off-the-shelf products and reducing inventory costs for hospitals.

The integration of AI, particularly machine learning models, is primarily focused on the pre-operative and post-operative phases of bone fixation. In pre-operative planning, AI algorithms can segment bone structures, simulate various fixation techniques, and calculate the ideal dimensions and required compression force for staple implants based on individual patient anatomy and fracture patterns. This leads to reduced surgical variability and higher success rates, especially in complex reconstructive procedures involving small bones. Post-operatively, AI systems can monitor healing progression through automated radiological analysis, flagging potential complications like staple migration or non-union earlier than conventional methods, enabling timely intervention. This technological adoption positions the market for precision orthopedic procedures, shifting the focus from standardized products to customized fixation solutions guided by advanced data analytics.

- AI enhances pre-operative planning by analyzing 3D imaging data for precise staple placement.

- Machine learning algorithms optimize inventory by predicting demand for specific staple sizes and materials.

- AI-driven robotics integration improves the accuracy and consistency of staple insertion during surgery.

- Radiological analysis using AI detects staple migration or potential non-union in post-operative monitoring.

- Predictive analytics supports the design and validation of patient-specific bone staple prototypes.

DRO & Impact Forces Of Bone Staples Market

The Bone Staples Market is primarily driven by the escalating global incidence of musculoskeletal injuries, particularly those resulting from sports participation, motor vehicle accidents, and falls among the geriatric population. Furthermore, significant advancements in biomaterials technology, particularly the shift toward Nitinol and specialized absorbable polymers, have created implants offering superior biomechanical properties and reduced long-term complications, thereby encouraging their adoption by orthopedic surgeons globally. Opportunities abound in emerging markets where improving healthcare infrastructure and increasing disposable incomes are making advanced orthopedic treatments more accessible. Moreover, the transition towards outpatient settings and Ambulatory Surgical Centers (ASCs) necessitates fixation solutions that are cost-effective, easy to use, and support rapid patient recovery, positioning bone staples favorably compared to complex plating systems.

However, the market faces constraints, primarily stemming from the high costs associated with orthopedic surgical procedures and the variability in reimbursement policies across different regions, which can limit patient access in economically sensitive areas. Additionally, stringent regulatory frameworks, particularly the extensive clinical data required for novel material approvals (such as bioresorbable polymers) and the rigorous requirements of the EU Medical Device Regulation (MDR), often delay product launch and increase development expenses for manufacturers. Impact forces on the market include the threat of substitutes, particularly specialized screws, wires, and plating systems that compete directly with staples, especially in areas requiring high load-bearing capacity. Supplier bargaining power remains moderate due to the reliance on specialized alloys (like Nitinol) sourced from a few key suppliers, while buyer bargaining power is high, driven by consolidated hospital systems and Group Purchasing Organizations (GPOs) demanding volume discounts and performance guarantees.

The competitive rivalry within the Bone Staples Market is intense, characterized by continuous intellectual property development and rapid product iteration among the established multinational orthopedic companies and specialized smaller fixation firms. This rivalry forces continuous quality improvement and pricing pressure, benefiting end-users. Opportunities also lie in expanding the application scope of staples beyond traditional foot and ankle surgery into spine and large joint reconstruction, supported by research demonstrating efficacy in dynamic environments. Navigating the balance between technological innovation (drivers) and regulatory complexities (restraints) will be crucial for companies aiming to capitalize on the sustained global demand for effective internal fixation devices.

Segmentation Analysis

The Bone Staples Market is segmented based on Material, Application, and End-User, reflecting the diverse clinical needs and technological maturity across orthopedic subspecialties. The segmentation by Material is critical, as the physical properties of the staple—such as compression force, elasticity, and biodegradability—determine its clinical suitability. Nitinol and Titanium represent the current standards of care, but the rapidly emerging segment of bioresorbable staples is poised for substantial growth, promising solutions that resolve over time, negating the risk associated with permanent implants. Application segmentation highlights the dominance of the Foot & Ankle segment, where intricate procedures such as arthrodesis and fracture repair frequently utilize staple technology due to its minimally invasive nature and targeted compression capabilities in small joints.

Analyzing the End-User segmentation provides insight into consumption patterns. Hospitals remain the largest volume users due to their capacity for handling major trauma cases and complex reconstructive surgeries, necessitating large inventories of various fixation devices. However, the fastest-growing segment is Ambulatory Surgical Centers (ASCs), particularly in developed economies. This shift is driven by the increasing number of elective orthopedic procedures (e.g., bunionectomies) being moved out of expensive inpatient hospital settings, favoring the specialized, efficient, and cost-effective environment offered by ASCs. Manufacturers are therefore focusing their distribution strategies and product training efforts increasingly towards specialized outpatient orthopedic centers to capture this growth.

- By Material:

- Nitinol (Shape Memory Alloy) Staples

- Titanium Staples

- Stainless Steel Staples

- PEEK and Bioresorbable Staples

- By Application:

- Foot & Ankle Surgery

- Hand & Wrist Surgery

- Shoulder & Elbow Surgery

- Knee & Hip Reconstruction

- By End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics and Trauma Centers

Value Chain Analysis For Bone Staples Market

The value chain for the Bone Staples Market initiates with the upstream supply of specialized raw materials, predominantly medical-grade Titanium alloys, stainless steel, and high-purity Nitinol. Procurement of these materials is crucial, requiring rigorous quality control and certification to meet biocompatibility and mechanical strength standards. The manufacturing process involves specialized metallurgical techniques, including precision casting, forming, and heat treatment, especially for Nitinol staples to ensure their shape memory characteristics function reliably within the human body. Research and Development activities are heavily concentrated upstream, focusing on material science innovations, optimizing staple geometry for enhanced compression, and developing integrated insertion systems that improve surgical efficiency and reduce operative time.

Midstream activities involve the complex process of product assembly, sterilization, and packaging, adhering to strict Good Manufacturing Practices (GMP). Distribution channels are bifurcated into direct sales models, often utilized by large multinational corporations for key accounts and academic hospitals, and indirect sales through specialized medical device distributors and third-party logistics (3PL) providers. Distributors play a vital role in reaching smaller specialty clinics and ASCs, managing local inventory, and providing essential clinical support and training to surgeons. Downstream activities are dominated by the end-users—hospitals and ASCs—where the surgical procedures occur. The final link involves post-market surveillance and feedback loops, crucial for continuous product improvement and compliance with regulatory reporting requirements, ensuring long-term product safety and efficacy in various clinical settings.

Bone Staples Market Potential Customers

The primary consumers and end-users of bone staples are professional healthcare providers and institutions specializing in orthopedic care, trauma management, and reconstructive surgery. These potential customers include trauma surgeons who require rapid, reliable fixation for acute fractures, orthopedic surgeons performing elective procedures such as arthrodesis (joint fusion) or osteotomies, and specialized podiatric and hand surgeons. Hospitals, particularly large university-affiliated medical centers and trauma centers, represent the largest customer base due to the breadth of surgical services offered and the high volume of complex trauma cases requiring immediate and diverse fixation solutions. Their purchasing decisions are often centralized through GPOs, focusing heavily on long-term supplier relationships, product efficacy data, and competitive pricing for bulk procurement.

Ambulatory Surgical Centers (ASCs) constitute a rapidly expanding segment of potential customers, increasingly purchasing bone staples for smaller, elective procedures that prioritize short patient turnover times and cost-effectiveness. ASCs value products that are presented in sterile, ready-to-use kits and are compatible with minimally invasive techniques. Furthermore, specialty orthopedic clinics that perform minor surgeries and post-operative care also require a steady supply of staples, often utilizing specialized products tailored for specific anatomical sites like the foot or wrist. These customers demand strong clinical evidence, robust training programs from manufacturers, and streamlined logistics to maintain high operational efficiency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $1.95 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DePuy Synthes (Johnson & Johnson), Stryker Corporation, Zimmer Biomet, Arthrex, Inc., CONMED Corporation, Acumed LLC, Smith & Nephew, Merete Medical GmbH, BioPro, Inc., Novastep, NextStep Arthropedics, Newcleus LLC, Paragon 28, Inc., Wright Medical (Stryker), OsteoMed, Vilex, TeDan Surgical Innovations, Flower Orthopedics, In2Bones Global, Inc., Orthofix. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Bone Staples Market Key Technology Landscape

The technological landscape of the Bone Staples Market is undergoing continuous innovation focused on enhancing material performance, improving insertion mechanisms, and integrating biofunctionality. The most significant technological leap is the widespread adoption of Nitinol, a shape memory alloy, which allows staples to be compressed, inserted easily, and then return to their pre-set shape upon warming to body temperature, generating powerful and sustained compressive forces across the fusion site. Manufacturers are continuously refining Nitinol processing to optimize the transition temperature and ensure consistent performance, leading to the development of specialized thermal staples designed for specific compression needs in podiatry and hand surgery. This technology minimizes the risk of implant pull-out and enhances the stability required for primary bone healing.

Another crucial technological trend is the development of bioresorbable and bio-inductive staples, often made from polymers such as Poly-L-lactic acid (PLLA) or specialized composite materials. These staples offer temporary fixation strength comparable to metal, but gradually degrade and are absorbed by the body, eliminating the need for removal surgery and reducing the risk of long-term mechanical stress shielding. Although they currently hold a smaller market share, their growth potential is substantial as research addresses challenges related to degradation rate control and maintaining biomechanical integrity during the critical healing phase. Furthermore, advancements in specialized instrumentation, including ergonomic insertion devices and targeting guides, are simplifying surgical workflow, making staple fixation a more efficient choice for minimally invasive orthopedic procedures.

The adoption of advanced manufacturing techniques, such as 3D printing (Additive Manufacturing), is beginning to influence the bone staples sector, enabling the creation of patient-specific implants and complex staple geometries that improve bone contact and load distribution. While mass-market staples remain traditionally manufactured, 3D printing offers a path toward highly customized or porous titanium staples that may promote better osteointegration. Manufacturers are also exploring 'smart' staples, though nascent, potentially incorporating sensors or materials that change properties based on the healing environment, providing future opportunities for enhanced post-operative monitoring and personalized therapy adjustments.

Regional Highlights

The global Bone Staples Market exhibits distinct regional dynamics driven by varying levels of healthcare spending, surgical procedural volumes, regulatory environments, and the prevalence of orthopedic conditions. North America, encompassing the United States and Canada, currently leads the market in terms of revenue share. This dominance is attributed to several factors: a highly mature and technologically advanced healthcare system, high consumer awareness and acceptance of advanced surgical fixation techniques (especially Nitinol staples), robust reimbursement policies for orthopedic procedures, and the strong presence of major market players who continually introduce cutting-edge products and conduct extensive surgeon training.

Europe represents the second-largest market, characterized by stringent regulatory standards, especially under the new Medical Device Regulation (MDR). Western European countries (Germany, UK, France) are key contributors due to their aging populations and structured healthcare systems that support high volumes of elective and trauma-related orthopedic surgeries. The European market, however, places a strong emphasis on cost-effectiveness and clinical evidence, sometimes favoring established titanium or stainless steel options over the higher-cost, newer technologies unless proven significantly superior. Market players must ensure deep clinical validation to penetrate this competitive landscape successfully.

The Asia Pacific (APAC) region is projected to be the fastest-growing market during the forecast period. This accelerated growth is primarily fueled by rapid economic development, significant investments in expanding healthcare infrastructure (particularly in private hospital chains), and an increasing incidence of road traffic accidents and sports injuries due to changing lifestyles. Countries such as China, India, and South Korea are experiencing an increase in the adoption of Western orthopedic fixation standards. While pricing sensitivity is high, the immense volume potential and the rising pool of trained orthopedic specialists make APAC a critical expansion target for international manufacturers, driving localized production and strategic partnerships.

- North America: Market leader due to high adoption of advanced Nitinol technology, favorable reimbursement, and high surgical procedural volume.

- Europe: Stable market characterized by high regulatory scrutiny (MDR compliance) and strong demand driven by an aging demographic and chronic conditions.

- Asia Pacific (APAC): Highest growth rate expected, driven by infrastructure development, rising healthcare spending, and expanding access to specialized orthopedic care.

- Latin America (LATAM): Emerging market potential, constrained by economic instability but offering opportunities in countries like Brazil and Mexico seeking cost-effective, proven fixation solutions.

- Middle East and Africa (MEA): Growth driven by medical tourism and strategic investments in specialized trauma centers, particularly in the Gulf Cooperation Council (GCC) countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Bone Staples Market.- DePuy Synthes (Johnson & Johnson)

- Stryker Corporation

- Zimmer Biomet

- Arthrex, Inc.

- CONMED Corporation

- Acumed LLC

- Smith & Nephew

- Merete Medical GmbH

- BioPro, Inc.

- Novastep

- NextStep Arthropedics

- Newcleus LLC

- Paragon 28, Inc.

- Wright Medical (Stryker)

- OsteoMed

- Vilex

- TeDan Surgical Innovations

- Flower Orthopedics

- In2Bones Global, Inc.

- Orthofix

Frequently Asked Questions

Analyze common user questions about the Bone Staples market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of Nitinol bone staples over traditional metal staples?

Nitinol (Shape Memory Alloy) staples provide continuous, dynamic compression across the fusion site after implantation. Unlike traditional titanium or stainless steel staples, Nitinol utilizes thermal memory to contract and exert sustained force as it warms to body temperature, which significantly improves stability, accelerates bone fusion, and reduces the risk of non-union or staple loosening over time.

Which anatomical application segment dominates the Bone Staples Market?

The Foot and Ankle surgery application segment currently holds the largest market share. Bone staples are highly effective and widely used in podiatric procedures such as bunionectomies, hammertoe corrections, and complex hindfoot arthrodesis, where strong, localized compression in small bone structures is essential for successful patient outcomes.

Are bioresorbable bone staples expected to replace permanent metal implants in the future?

Bioresorbable staples represent a significant growth opportunity, particularly as they eliminate the need for secondary removal surgery. While they are increasingly used in low-load applications, complete replacement of permanent metal implants depends on ongoing advancements to ensure these polymer-based materials maintain necessary biomechanical strength and degradation control throughout the critical bone healing phase.

How does AI technology affect the clinical use of bone staples?

AI is primarily used for enhanced pre-operative planning and surgical simulation. Machine learning algorithms analyze patient imaging (CT, X-ray) to calculate the optimal size, placement, and insertion trajectory for bone staples, minimizing surgical error, improving precision, and helping surgeons achieve maximum compression and stability based on individual patient anatomy.

What are the key restraint factors limiting the growth of the Bone Staples Market?

Key constraints include the high overall cost of orthopedic surgical procedures, which impacts patient access in cost-sensitive regions, and the increasing stringency of regulatory requirements, particularly in Europe, which delays the market entry of novel staple designs and materials, increasing overall research and development expenses for manufacturers.

The analysis reveals a robust market dynamic influenced heavily by technological specialization and demographic shifts. The continuous search for materials that offer superior compression and long-term biocompatibility is the primary engine of innovation. Manufacturers must strategically navigate the complex global regulatory landscape, particularly concerning new implantable technologies, to maintain market competitiveness and capitalize on the growing demand for effective, minimally invasive orthopedic fixation solutions across both established and emerging markets.

The competitive environment necessitates that players not only invest in proprietary material science but also focus on improving the delivery systems accompanying the staples. Ergonomic, single-use insertion tools and customized sizing systems are becoming standard expectations, especially among Ambulatory Surgical Centers (ASCs) focused on maximizing efficiency. Furthermore, geopolitical stability and supply chain resilience concerning specialized medical-grade alloys (Nitinol, Titanium) are critical risk factors that market leaders must manage effectively to ensure consistent product availability worldwide and mitigate sudden price fluctuations.

Future growth will largely depend on penetration into high-growth areas like APAC, coupled with continued clinical evidence generation supporting the long-term superiority and cost-effectiveness of advanced staple technologies over traditional screws and plating systems in targeted applications. This dual focus on geographical expansion and clinical validation is crucial for sustaining the 6.5% CAGR projected through 2033 and achieving the targeted market valuation of $1.95 Billion.

The orthopedic fixation market is continuously evolving, and bone staples, particularly those utilizing shape memory technology, are establishing themselves as the preferred method for various specific reconstructive procedures. Investment in research and development is vital for overcoming the current limitations, such as extending the application of staples to high-load joints and enhancing the bio-absorption profile of polymer-based options. Collaboration between device manufacturers and orthopedic surgeons is essential to rapidly translate clinical needs into viable product innovations.

The shift in end-user preference toward ASCs is fundamentally reshaping distribution strategies. Manufacturers are adapting their inventory models to support smaller, more frequent deliveries and specialized kits optimized for outpatient procedures. This requires highly efficient logistics and dedicated sales teams capable of providing specialized training tailored to the focused procedural scope of ASC environments, ensuring high compliance and optimal product utilization across diverse clinical settings.

Overall market health remains strong, supported by non-discretionary medical needs related to trauma and age-related orthopedic conditions. While macroeconomic factors, such as inflation and global supply chain volatility, present challenges, the underlying demand drivers related to healthcare quality improvement and technological advancements in implant design ensure sustained growth trajectory for the global Bone Staples Market throughout the forecast period.

Regulatory harmonization efforts, especially driven by organizations like the International Organization for Standardization (ISO) and regional bodies, aim to streamline the process for introducing new staples globally. While this presents an initial hurdle, standardized clinical trial requirements and manufacturing quality protocols will ultimately benefit larger, compliant organizations, potentially consolidating the market landscape over the next decade. Success in this evolving environment requires a balance between aggressive innovation and strict adherence to global safety and efficacy standards.

Finally, emerging applications of bone staples in pediatric orthopedics and complex deformity correction offer niche growth avenues. These specialized areas demand extremely precise sizing and biocompatible materials, driving premium pricing and focusing competition on specialized small-scale manufacturers capable of meeting bespoke clinical requirements. These sub-segments, although small in volume, contribute significantly to the overall technological sophistication of the Bone Staples Market.

The market's ability to absorb the higher cost associated with advanced materials like Nitinol hinges on demonstrating clear, superior patient outcomes, especially in reducing revision rates and improving functional recovery. Health economic studies focused on the long-term cost savings derived from using advanced staples—by reducing complications and hospital stays—are critical marketing tools used by manufacturers to persuade purchasing organizations and healthcare payers regarding their value proposition.

In summary, the Bone Staples Market is experiencing a pivotal period of growth fueled by material science evolution, surgical efficiency needs, and shifting healthcare delivery models. Navigating the regulatory landscape and demonstrating clinical superiority will be the defining factors for market leadership in the coming years, cementing the role of bone staples as a primary internal fixation method in specialized orthopedic surgery.

The market analysis indicates a high degree of integration between product innovation and clinical need, particularly in the realm of minimally invasive surgery. As surgical techniques continue to trend toward smaller incisions and faster recovery times, the design of bone staples must adapt to require minimal bone dissection and offer reliable insertion through narrow channels. This focus on procedural enhancement is driving the rapid evolution of insertion instruments, moving toward automated or semi-automated systems that guarantee correct placement and compression activation, minimizing reliance on surgeon variability.

Furthermore, the competitive strategy of key players increasingly involves strategic partnerships with specialized research institutions and surgical training centers. These collaborations serve a dual purpose: gathering crucial clinical feedback for product refinement and embedding the manufacturer’s product line within the educational curriculum for future orthopedic specialists. This deep engagement ensures that market offerings remain aligned with the highest standards of surgical practice and anticipated clinical requirements. The successful marketing of bone staples is now inextricably linked to the provision of comprehensive training and educational resources, distinguishing market leaders.

The environmental impact of medical devices is also an emerging consideration, particularly regarding the disposal of metal implants and associated packaging. While not a primary driver, growing institutional focus on sustainability may influence purchasing decisions, encouraging manufacturers to explore more eco-friendly manufacturing processes and packaging solutions, adding another layer of complexity to the operational aspect of the value chain, particularly for high-volume products like bone staples.

The market structure suggests that while a few large multinational corporations dominate revenue, specialized firms often lead innovation in niche areas, such as bioresorbable or specific Nitinol designs. This necessitates a strategic balance for larger companies, requiring them to either acquire these specialized innovators or invest heavily in competing internal R&D programs. The consolidation trend seen recently highlights the criticality of acquiring specialized technology to maintain a comprehensive orthopedic portfolio.

In conclusion, the Bone Staples Market is characterized by sustained demand, high-impact technological improvements centered on materials science, and strategic geographic shifts toward high-growth emerging economies. The commitment to clinical efficacy, regulatory compliance, and surgical procedural refinement will be paramount for stakeholders aiming to maximize their market penetration and ensure long-term value generation in the dynamic orthopedic fixation sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager